What is the Glutamic Acid Market Size?

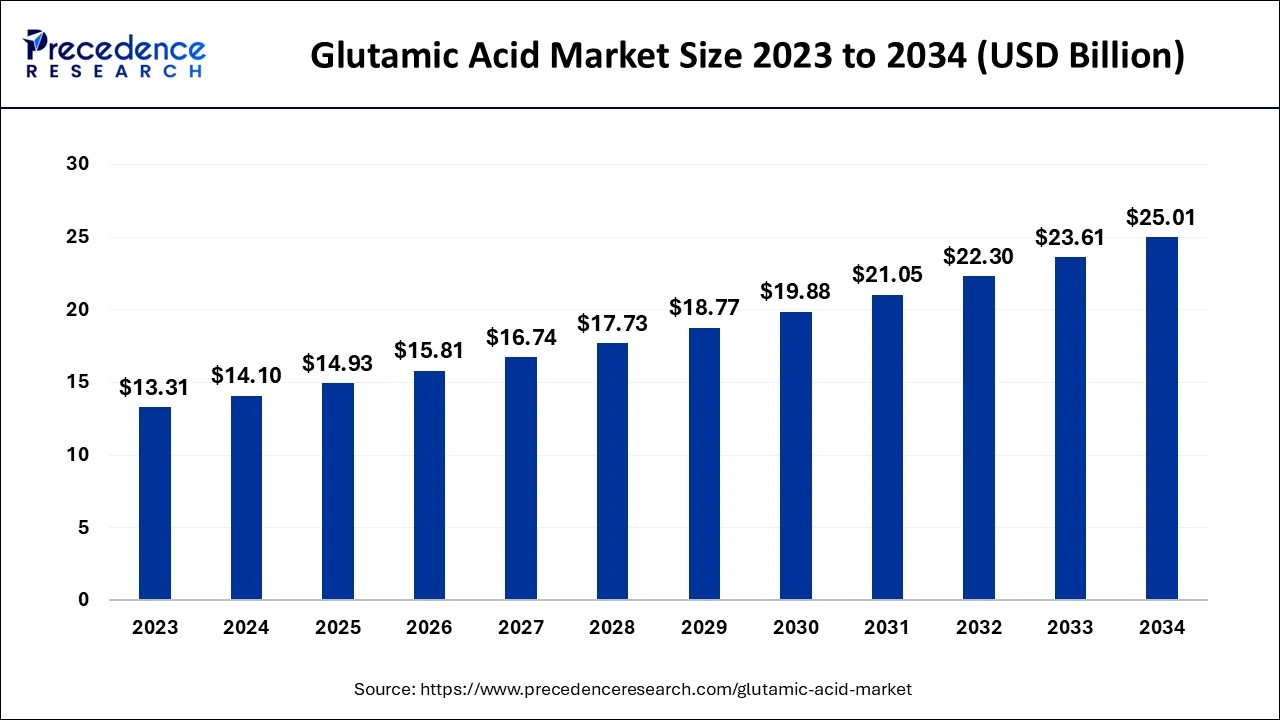

The global glutamic acid market size is estimated at USD 14.93 billion in 2025and is predicted to increase from USD 15.81 billion in 2026 to approximately USD 26.35 billion by 2035, expanding at a CAGR of 5.85% from 2026 to 2035.

Glutamic Acid Market Key Takeaways

- North America dominated glutamic acid market in 2025.

- By application, food and beverage segment led the market in 2025.

Market Overview

In the near future, it is predicted that the rising demand for animal feed will be accompanied by an increase in the use of food enhancers and additives in the food and beverage sector. A number of economies have been devastated by the COVID-19 virus's proliferation, and supply networks in several industries have been seriously damaged.

Therefore, it is expected that any changes in the demand from the end-use industries would have a direct effect on the demand for glutamic acid. The demand for glutamic acid in the food and beverage and pharmaceutical industries has been positively affected by people's growing knowledge of the need of consuming nutritious goods.

The product is produced through the fermentation process, which includes the phases of fermentation, evaporation, carbon adsorption, centrifugation, crystallization, and ion exchange, utilizing the necessary raw ingredients. Because the goods produced by the fermentation process are of such high quality and purity, it has become more popular among producers. However, the procedure requires a lot of cash and uses a lot of water and energy.

The non-essential amino acid glutamic acid usually referred to as glutamate, is vital for the efficient operation of cells. The amino acid is necessary for eliminating extra nitrogen from the human body as well. Glutamic acid is a key excitatory neurotransmitter in the neurological system. The amino acid participates in a variety of cognitive processes in the brain, including memory and learning, and is essential for synaptic plasticity. The precursor glutamic acid is used to create inhibitory GABA. Overstimulating glutamic acid has been associated with conditions including lathyrism, amyotrophic lateral sclerosis, and Alzheimer's. Additionally, the amino acid has been linked to epileptic convulsions. Glutamate helps ulcers heal more quickly, fights weariness, and boosts cognitive function.

Glutamic Acid Market Growth Factors

The glutamic acid industry is still expanding strongly thanks to its many benefits. The food and beverage industry's growing need for food enhancers, food additives, and animal feed are some of the key drivers of this product's rising demand. The pharmaceutical, beverage, and food industries have seen a growth in glutamic acid demand as consumer knowledge of the benefits of eating healthful goods has grown. Due to the rising global population, rising consumption of meat and dairy products, rising disposable income, and rising demand for healthier, more nutritious, tastier, and higher quality meat food products, the processed food and animal feed industries stand out and will experience significant growth.

This pattern would support the market expansion for glutamic acid. Because glutamic acid is employed as a flavor enhancer in ready-to-eat and processed foods as well as in food additives, glutamic acid market growth is anticipated to be boosted throughout the projected period. Furthermore, more and more people who care about their health are choosing natural food additives over synthetic food additives. Manufacturers are exploring a number of strategies to offer cutting-edge food items in order to adapt to the changes in the eating habits of today's customers. The glutamic acid market is anticipated to expand faster as a result of these changing customer preferences.

Since there won't be any travel restrictions following the epidemic, it will be simple to provide the products, which has led to a surge in demand for nutritional supplements and nutritious food items. The longer-term persistence of COVID-19 had an impact on the supply chain since it was disrupted and it was harder to get food products to customers, who at first reduced demand for goods. However, after COVID, there has been a marked increase in demand for dietary items that promote health and well-being as a result of growing knowledge of the long-term advantages of amino acids in balanced diets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.93 Billion |

| Market Size in 2026 | USD 15.81Billion |

| Market Size by 2035 | USD 26.35 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.85% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

Market Dynamics

Key Market Drivers

Steady growth in industries

- An amino acid necessary for the synthesis of proteins is glutamic acid. The demand for animal feed as a result of the rising consumption of poultry products like chicken, pork, beef, turkeys, and geese, as well as the rising demand for aquatic products like fish and shrimp, is expected to fuel market growth over the forecast period. These factors together with the rising consumption of such acids as food additives and enhancers in the food and beverage industry are also expected to contribute to the market growth.

- To maintain their manufacturing capacity, buyers want long-term contracts at market-competitive prices. It is anticipated that rising demand from producers of functional foods and pharmaceutical businesses would have an impact on product pricing. As a result, during the anticipated timeframe, buyer power is anticipated to remain high.

Consumer awareness toward healthy and nutritious foods

- Future glutamic acid market expansion is anticipated to be fuelled by consumer awareness of wholesome meals. Growing public knowledge of health concerns aids in preventing the onset of some diseases. Due to its qualities, food containing glutamic acid is advantageous to memory as well as general physical well-being. Thus, as consumer interest in eating wholesome foods grows and health-related awareness among the general population rises so does demand glutamic acid.

- For instance, the market for healthy eating, nutrition, and weight reduction increased from $912 billion in 2019 to $946 billion in 2020, according to the Global Wellness Institute, a non-profit organization with headquarters in the US. Additionally, the sub-sector for foods and beverages with a healthy label had the most revenue in 2020 ($680 billion), followed by the sub-sectors for vitamins & supplements ($137 billion), and weight loss goods & services ($128 billion). As a result, rising consumer awareness of the benefits of eating wholesome foods is fueling the glutamic acid market's expansion.

Key Market Challenges

- The excessive intake of glutamic acid can lead to fatigue problems - Some problems are preventing market expansion. Overconsumption of glutamic acid can cause headaches and weariness, which might impede market expansion.

Key Market Opportunities

Increase in the number of initiatives taken by amino acid manufacturers

- The producers of amino acids will have more opportunities to develop the worldwide amino acids market as they debut new products, expand their operations, make investments, and take other efforts. Due to their numerous health benefits, including their ability to build muscle, support body tissue repair, and maintain healthy skin, hair, and nails, amino acids are becoming more and more in demand across a range of industries, including food and beverage, cosmetics, pharmaceuticals, and dietary supplements.

- As consumer knowledge of the health advantages of amino acids grows, so will the market's need for them, allowing producers to introduce new goods, boost production capacity, and raise capital to produce a range of amino acid-based products for diverse end users.

Segment Insights

Application Insights

In 2023, the market was led by the food and beverage application sector, which had a revenue share of approximately 81%. This is explained by glutamic acid's expanding use as a taste enhancer in the food and beverage sector. Generally speaking, canned vegetables, processed meat, salad dressings, carbohydrate-based snacks, soups, and dairy items like ice cream, bread, and cheese employ monosodium glutamate (MSG), a component of glutamic acid, as a taste enhancer. The demand for glutamic acid in the food and beverage industry is anticipated to rise due to convenience foods and ready-to-drink drinks' rising popularity throughout the world.

Over the projected period, the category for pharmaceuticals is expected to grow at the highest revenue-based CAGR of 8.2%. Glutamic acid is used in pharmaceutical applications to treat a number of illnesses, including epilepsy, muscular dystrophy, neurotransmission imbalances, and cognitive and behavioral issues in people, as well as to avoid nerve damage during chemotherapy. Favorable government policies supporting the pharmaceutical business and expanding private company investment are anticipated to stimulate the pharmaceutical industry, which is anticipated to increase glutamic acid usage in the upcoming years.

Glutamic acid is used in the personal care and cosmetics sector to modify the pH levels in cosmetics and personal care items. It is utilized in a variety of items, including anti-aging creams, infant products, eye cosmetics, hair care products, skincare products, and bath products. Due to its ability to promote skin health, prevent free radical damage, and retain moisture, it is utilized in anti-aging and acne lotions.

Regional Insights

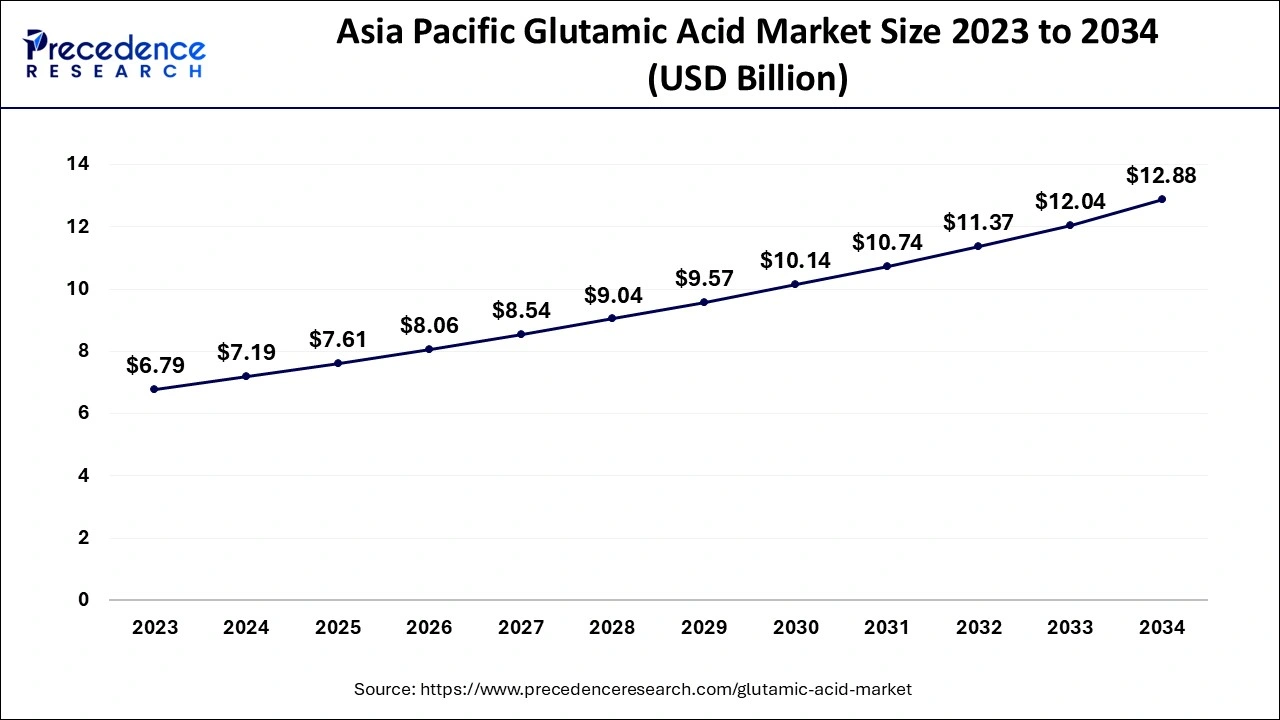

What is the Asia Pacific Glutamic Acid Market Size?

The Asia Pacific glutamic acid market size is evaluated at USD 7.61 billion in 2025 and is predicted to be worth around USD 13.61 billion by 2035, rising at a CAGR of 5.99% from 2026 to 2035.

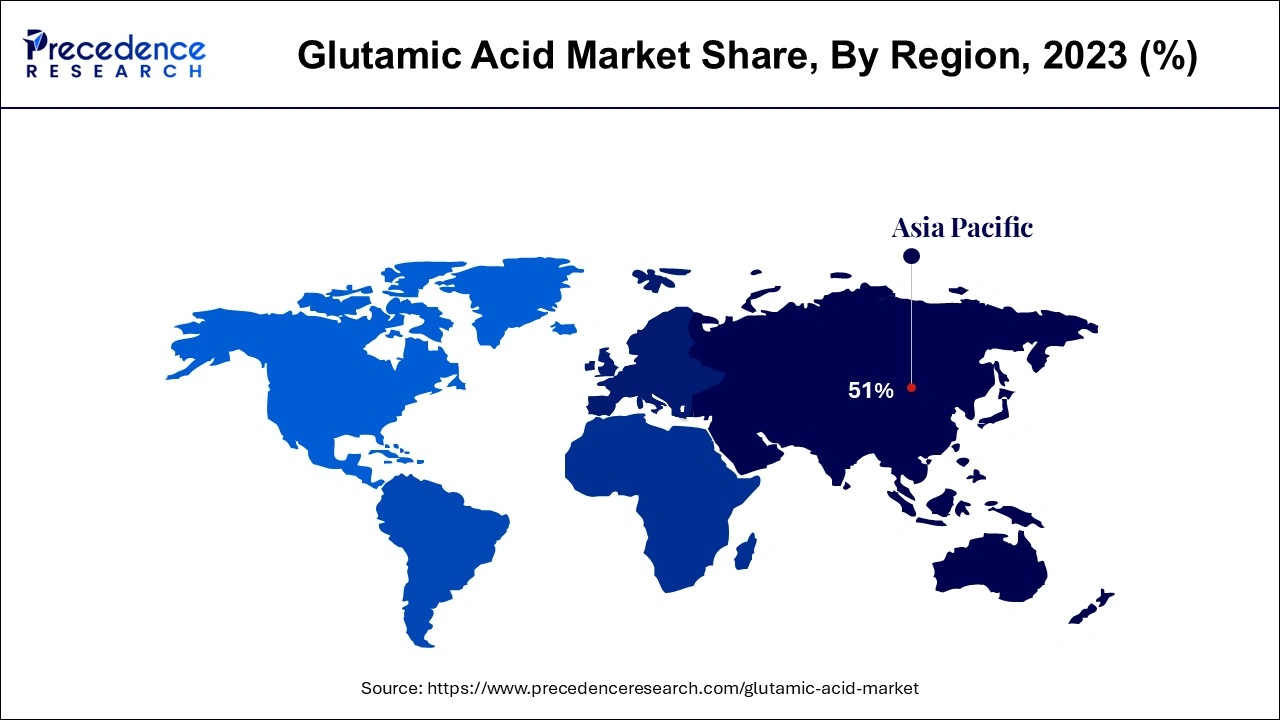

With a revenue share of over 51% in 2023, Asia Pacific led the market and is anticipated to expand at the highest rate during the forecast period. This is attributable to the growth of end-use businesses in the region's rising economies, including animal feed, pharmaceuticals, cosmetics, personal care, and food and beverage. With a capacity of more than 187 million metric tonnes yearly, China is one of the leading feed producers in the area.

China Market Trends

China accounts for nearly 80% or more of the total global glutamic acid production, making its production capacity along with operational status a vital factor in global supply and price stability. China is mainly focused on microbial fermentation to improve production efficiency and sustainability. This aim on greener, more efficient production processes works with global requirements for eco-friendly products and pushes a few international players to innovate to remain competitive.

Due to the large population of livestock, the need for animal feed is expected to increase in nations like China and India. As a result of the increasing demand for meat in regional cuisines, pork and poultry has become the most popular animal types in the Asia Pacific region. Due to extensive cow farming operations, Vietnam and Thailand are two of the region's most important markets for animal feed.

In 2023, North America held the second-largest market share. The rising demand for medicines and animal feed is expected to be a major factor in driving glutamic acid consumption in North America. The substance is used in the pharmaceutical industry to create a range of medications for the management of various illnesses, including epilepsy and cognitive issues. The pharmaceutical industry in North America is anticipated to reach USD 633 billion by 2024, achieving a CAGR of 3.8% during the projected period, according to research released by a U.K. based pharmaceutical firm in 2020.

U.S. Market Trends

The large U.S. food processing sector utilizes glutamic acid as a vital flavor enhancer, mainly in convenience foods and snacks, driving remarkable market share. There is a need for high-quality meat and poultry, which boosts its use as a feed additive to enhance animal growth, immunity, and protein synthesis.

The Organization for Economic Co-operation and Development (OECD) ranks North America's consumption of dairy goods like cheese as second only to that of Europe. According to a Dairy Food article from April 2019, the average amount of cheese consumed per person in North America grew from 11.7 pounds in 1995 to 15 pounds in 2017. Thus, it is predicted that over the course of the forecast period, the market in the area would be driven by the rising demand for a variety of food and beverage items in North America.

European Market Trends

Europe shows a significant growth during the forecast period. It is driven by need for natural, clean-label ingredients, with strong expansion in the food & beverage, pharmaceutical, and animal feed sectors. Germany, France, along with the UK are key markets, focusing on sustainable production methods such as fermentation.

Latin America Market Trends

Latin America's market shows notable growth during the forecast period. It is driven mainly by its extensive usage as a flavor enhancer in the food and beverage industry and even a fast-growing application in the pharmaceutical sector.

Argentina

There is increasing need for glutamic acid as an animal feed additive, mainly in the poultry and aquaculture sectors, to improve animal performance and immunity. Argentina is a major producer and exporter of agricultural commodities such as soybeans, maize, and wheat, which thus, underpins the local animal feed industry.

MEA Market Trends

The MEA market shows a rapid growth during the forecast period. It is driven by rising demand in the food and beverage, animal feed, and also pharmaceutical industries.

Kuwait

There is an increasing knowledge in Kuwait about the advantages of amino acids in healthy and nutritious food, which has led to a growth in demand for dietary supplements. Glutamic acid is the fastest-growing segment in the Kuwait market in the dietary supplements market, used in products perceived as effective solutions for improving overall health and well-being.

Value Chain Analysis of Glutamic Acid Market

- Feedstock Procurement

It includes sourcing abundant, inexpensive, renewable carbon sources for microbial fermentation, thus, the dominant production method.

Key Players: Ajinomoto Co., Inc., Global Bio-chem Technology Group Company Limited, Fufeng Group - Chemical Synthesis and Processing

By microbial fermentation, due to its lower expenses, higher purity of the desired L-isomer, and also environmental advantages.

Key Players: Evonik Industries AG, Bachem AG, Merck KGaA, Tokyo Chemical Industry Co., Ltd. (TCI) - Compound Formulation and Blending

It includes mixing purified glutamic acid with a few ingredients to create final commercial goods with specific functional properties for numerous applications, like food, cosmetics, pharmaceuticals, and biodegradable materials.

Key Players: Ajinomoto Co., Inc., Evonik Industries AG, Fufeng Group

Glutamic Acid Market Companies

- Ajinomoto Co., Inc.

- Akzo Nobel N.V.

- Evonik Industries AG

- Sichuan Tongsheng Amino acid Co., Ltd.

- KYOWA HAKKO BIO CO., LTD.

- Ottokemi

- Hefei TNJ Chemical Industry Co., Ltd.

- Suzhou Yuanfang Chemical Co., Ltd.

- Global Bio-chem Technology Group Company Limited

- Ningxia Yipin Biological Technology Co., Ltd.

Recent Developments

- In November 2025, Akzo Nobel N.V. and Axalta Coating Systems Ltd. declared they had entered into a definitive agreement to merge in an all-stock merger of equals, creating a premier global coatings firm with an enterprise value of nearly $25 billion. (Source: https://www.akzonobel.com )

- October 2020 - The Agrinos Group of enterprises was purchased by American Vanguard Corporation (AVC), a US-based agrochemical firm, for an unknown sum. Through this purchase, AVC's Green Plant liquid nutrition solutions, which have shown great development in the Central American market, are anticipated to be complemented by Agrinos's range. Agrinos is a full-service producer of biological inputs with headquarters in the US.

Market Segmentation

By Application

- Food & Beverages

- Pharmaceuticals

- Animal Feed

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content