What is the Glutinous Rice Flour Market Size in 2026?

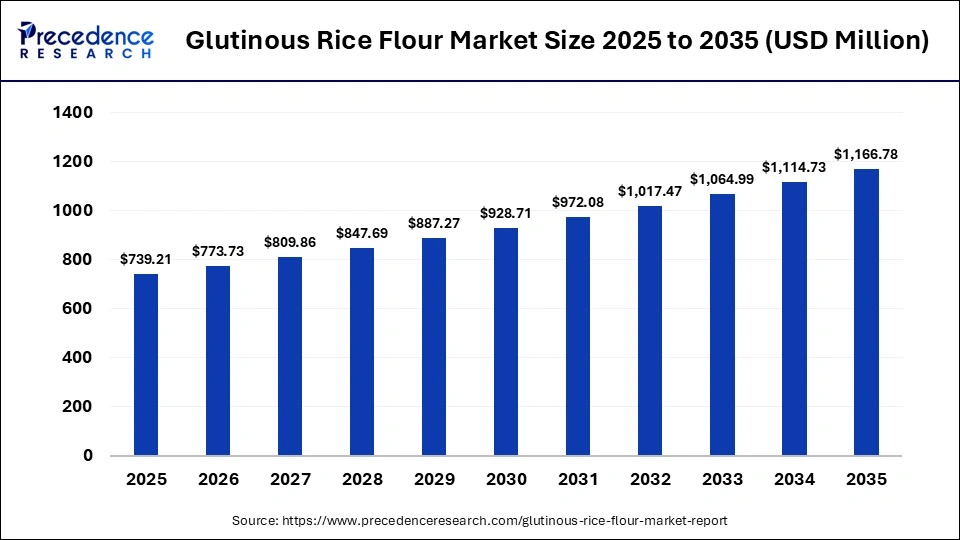

The global glutinous rice flour market size was calculated at USD 739.21 million in 2025 and is predicted to increase from USD 773.73 million in 2026 to approximately USD 1,166.78 million by 2035, expanding at a CAGR of 4.67% from 2026 to 2035. The glutinous rice flour market is expanding at a rapid pace in the confectionery industry. It is popular due to its unique, chewy, and highly elastic texture. Growth factors include an increase in health awareness and the management of chronic diseases, advancements in alternative flour innovations, a rise in the diagnosis of celiac disease, a growing preference for gluten-free options, the expansion of retail channels, and trends towards plant-based foods.

Key Takeaways

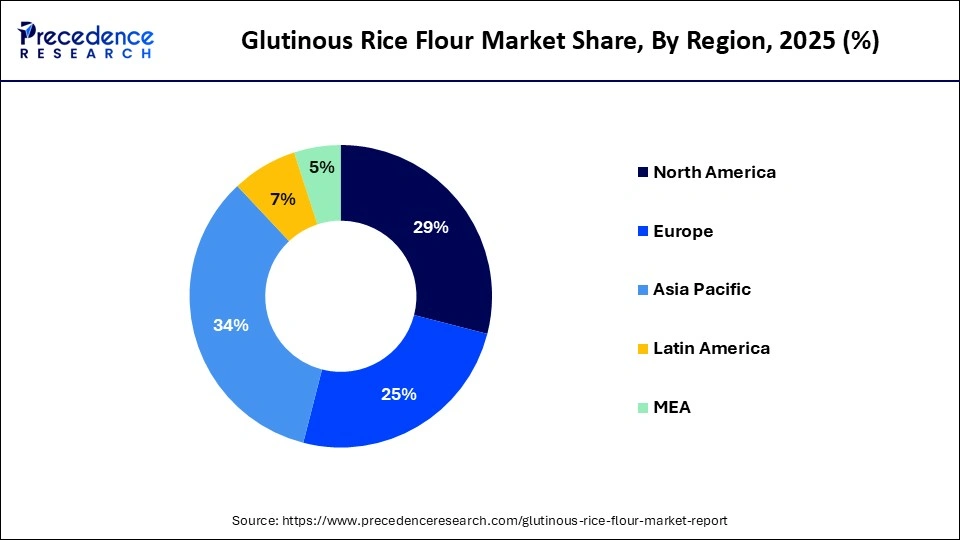

- Asia-Pacific dominated the glutinous rice flour market in 2025.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the white rice segment contributed the biggest revenue share in the market in 2025.

- By type, the brown rice segment is expected to witness the fastest growth in the market over the forecast period.

- By size, the medium grain segment registered its dominance over the global market in 2025.

- By size, the long grain segment is expected to witness the fastest growth in the market over the forecast period.

- By nature, the organic segment held a dominant position in the market in 2025.

- By nature, the conventional segment is expected to expand rapidly in the market in the coming years.

What is the Glutinous Rice Flour Market?

Glutinous rice flour is refined from glutinous rice and contains a compound called amylopectin, which creates attention, flexibility, and toughness in the flour. Due to its highly elastic and chewy texture, it is essentially used in traditional Asian snacks such as dumplings and mochi. Additionally, as it contains no gluten, it is a safer and popular alternative for the population with gluten intolerance or with celiac disease. With its high starch content, it is excellent for binding ingredients in recipes to create stable and flexible dough.

Due to its ability to thicken sauces and soups, it is highly used in a variety of dishes, including Korean tteokbokki, cakes, noodles, Japanese mochi, and dumplings. Other growth factors encompass high moisture retention, which inhibits the drying of frozen fruit, and effective yeast immobilization. To improve external production and in applications within the food and industry sectors, it also functions as a fermentative, textural, and binding agent, thereby further promoting market growth.

What is the Role of AI in the Glutinous Rice Flour market?

Artificial intelligence (AI) is transforming the glutinous rice flour industry by enhancing safety, optimizing supply chains, and personalizing consumer experience through data-driven insights. AI facilitates quality control and inspection, production optimization, product development and personalization, supply chain management, and advanced analysis of functional properties.

AI algorithms help analyze the physical properties of grains, such as hardness or size, optimize milling efficiency, and enhance yield. Machine learning (ML) and AI are also used to inspect rice for its color, shape, and size defects. They can detect impurities, mold, and broken green in real time, helping maintain the high purity required for various food production, such as Asian cuisines, baked goods, and sauces. Additionally, it monitors and manages the high amylopectin content, ensuring consistent high-quality untraceable production.

What Are the Trends in the Glutinous Rice Flour Market?

- Increasing Popularity in Asian Cuisine: Asian cuisines are immensely popular due to their complex, bold, and varied flavor profiles. Key reasons for their popularity include dietary adaptability, cultural influence, bold and complex flavors, nutrient-dense appeal, and diverse regional options, making them a timeless cuisine. The trend is further fueled by the global spread of authentic dishes such as mochi, rice cake, and dumplings, which rely on rice flour due to its unique texture. The demand is further accelerated by the preference for gluten-free products and flour's functionality as a thickener and binder in processed foods.

- Sustainable and Clean Label: Sustainable and clean label trends are major drivers in the market. Clean label emphasizes natural non-GMO and recognizable ingredients, leading to significant adoption of rice flour as a substitute for wheat, mainly in bakery and processed snacks. The market is further driven by consumers' demand for gluten free allergy friendly and natural ingredients, along with organic options. Manufacturers are also leveraging this trend to develop new products like functional native rice starches and flowers, which replace additives in food.

- Rise in Gluten-Free and Healthy Diet: A gluten-free and healthy diet is important for managing celiac disease and non-celiac gluten sensitivity. The fundamental reasons also include a reduction in chronic inflammation, improving digestive health, boosting energy and cognitive functions, encouraging nutrient-dense choices, and improving energy levels. Due to the safe, versatile, and nutritious wheat alternative, gluten free option is driving significant growth in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 739.21 Million |

| Market Size in 2026 | USD 773.73 Million |

| Market Size by 2035 | USD 1,166.78 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.67% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Size, Nature, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Which Type Segment Dominated the Glutinous Rice Flour Market?

The white rice segment held the largest revenue share in the market in 2025, because white rice serves as a crucial global staple due to its quick preparation, being an easily digestible source of energy, and for individuals requiring rapid fuel. White rice ensures that flour remains refined, neutral in flavor, and brightly white, maintaining high-quality production. As white rice has excellent adhesion, flexibility, a sticky texture, and high viscosity, it is highly functional for making soft, chewy, and sticky traditional foods.

The brown rice segment is expected to expand rapidly in the market in the coming years, as it enhances nutritional profile, improves flavor, and alters the texture characteristics of traditional white rice. It also improved glycemic control in consumers due to its high fiber content and lower amylose content. They are also used to enhance the fermentation process and provide higher antioxidant capacity than traditional rice. Due to its slightly nutty, deeper, and earthy flavor, consumers considered it more appetizing, further fueling the segment's growth.

Size Insights

Why Did the Medium Grain Segment Dominate the Glutinous Rice Flour Market?

The medium grain segment contributed the biggest revenue share in the market in 2025, as it is shorter and wider and contains almost 100% amylopectin, which provides maximum stickiness, viscosity, chewy and soft texture, essential for rice flour. It is highly used in Asian delicacies such as mochi rice cake dumplings, which need a soft and chewy texture. Additionally, medium-sized grain mimics the elasticity and structure of gluten in dough while serving as a gluten-free alternative, keeping the floor soft for a longer period, making it a preferred choice in the market.

The long grain segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, as it offers better processing efficiency, high amylopectin content, reduced retrogradation, and optimal gelatin and textural quality. It is highly used in the food industry as it delays hardening, making it ideal for frozen packaged and stored foods, which need to maintain a fresh texture over time. It also allows for effective handling during the milling process, producing high-quality, fine, and white flour, making it a suitable choice for premium, shelf-stable, and high viscosity food products.

Nature Insights

How the Organic Segment Dominated the Glutinous Rice Flour Market?

The organic segment contributed the biggest revenue share in the market in 2025, due to a combination of environmental, health, and quality benefits driven by consumers' growing preference and awareness regarding food safety and sustainable practices. Organic rice is grown using natural methods, reducing exposure to toxins, pesticides, and genetically modified organisms (GMOs). It is also more nutrient-dense and has higher levels of antioxidants, vitamins, and minerals in the grain. It is also linked to reducing the risk of certain diseases, making it a safer and cleaner alternative to conventional rice.

The conventional segment is expected to grow with the highest CAGR in the market during the studied years, as they enhance natural aroma, has a distinct texture, and improves flavor absorption. They are also preferred due to high nutritional retention, rich in fiber and antioxidants, and have medicinal properties. Traditional rice is often minimally processed, which retains its bran and germ, making it rich in antioxidant vitamins and minerals. Certain varieties of rice are also believed to detoxify the body an improved digestion, making it the premier choice in the market.

Regional Insights

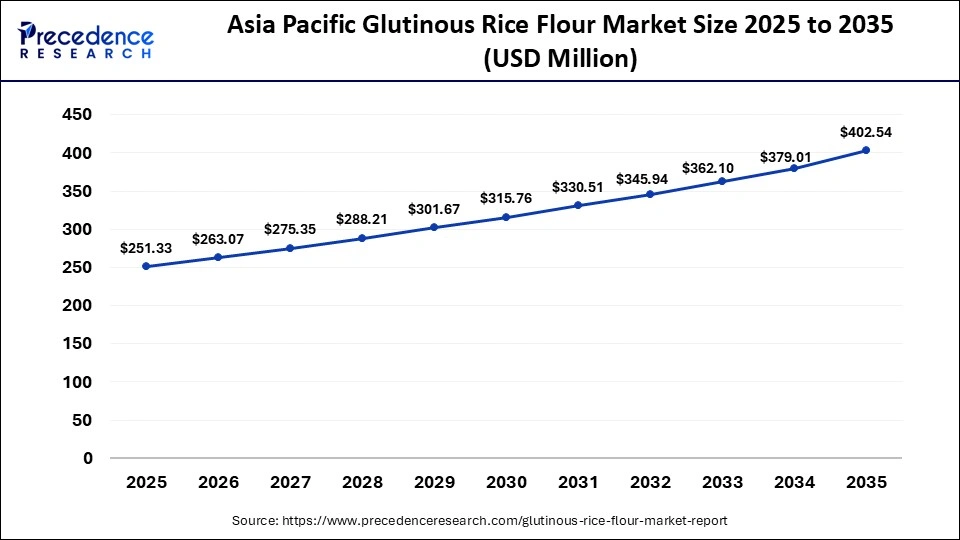

Asia Pacific Glutinous Rice Flour Market Size and Growth 2026 to 2035

The Asia Pacific glutinous rice flour market size is expected to be worth USD 402.54 million by 2035, increasing from USD251.33 million by 2025, growing at a CAGR of 4.82% from 2026 to 2035.

Which Factors Drive the Glutinous Rice Flour Market in Asia-Pacific?

Asia-Pacific held a major revenue share of the market in 2025, as glutinous rice flour serves as the main staple food in the area due to its adaptability to the region's hot, humid, and monsoon-influenced climate. It is a vital source of essential nutrients and a key element of the daily diet, leading to its high consumption in the region. Furthermore, its cultural and historical relevance make it an integral part of Asian culture, traditions, and dietary practices. The rapid urbanization and the increasing demand for convenient, ready-to-use food products reflect the busy lifestyles of the population. Additionally, the region stands as the world's leading rice producer, which guarantees a stable supply chain and lower production costs, thereby reinforcing its strong market position.

Thailand Market Trends

Rice holds a significant place in Thai culture, economy, and everyday life, with more than 80% of the population consuming it on a daily basis. Its preference stems from its profound cultural importance. The growth factors also include agricultural abundance, economic importance, nutrition, versatility, taste, and cultural significance. It is also one of the top rice producers and exporters, making it significantly important in the national economy. Furthermore, due to increased demand influenced by food factories, particularly for Japanese frozen food exports, it is a critical and high-value market in Thailand.

How Will the North America Region Grow in the Glutinous Rice Flour Market?

North America is expected to be the fastest-growing region in the market in the predicted timeframe. Key drivers include increasing preference for health and lifestyle, ready-to-eat foods, multiculturalism and cuisine, sustainable domestic production, and versatility. Consumer preference towards healthier, plant-based, and gluten-free diets, combined with the increasing popularity of diverse ethnic cuisines, such as Asian and Mexican, is fueling the market growth further.

U. S. Market Trends

The U.S. market is experiencing high growth driven by rising demand for gluten-free and allergy-friendly alternatives, a rapid increase in Asian cuisine, and a shift towards plant-based and clean-label products. Consumer awareness regarding the nutritional value of flour is rising, as it is a beneficial source of protein and fiber, along with a lower glycemic index that aligns with health-conscious dietary practices, accelerating market growth.

Glutinous Rice Flour Market Value Chain Analysis

Glutinous Rice Flour Market Companies

- Burapa Prosper Co. Ltd.

- Thai Flour Industry Co. Ltd.

- Erawan Marketing Co. Ltd.

- Cho Heng Rice Vermicelli Factory Co., Ltd.

- Wonnapob Company Ltd.

- Pornkamon Rice Flour Mills

- Koda Farms

- Bob's Red Mill Natural Foods

- Starch Asia

- Lieng Tong

- Grain Vietnam Co. Ltd

- Haprosimex JSC

- Nanapan Group

- Western Foods LLC

- To Your Health Sprouted Flour Co.

Recent Developments

- In September 2025, Mee Mochi Donuts & Soft Serve announced the launch of Asian-inspired desserts to Waukee with fish-shaped waffle cones, chewy doughnuts, Korean corn dogs, and Vietnamese coffee. These products are available in its dessert shop on the western edge of Waukee.(Source: https://www.desmoinesregister.com)

- In February 2024, MyMochi launched its Waffle Bites, the first-ever frozen waffles made with the sweet rice flour used in traditional mochi. This ready-to-eat snack can be thawed or briefly heated in the microwave. These bites are available in three flavors, including Original, Blueberry, and Cinnamon.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Type

- White

- Brown

- Black

- Others

By Size

- Short Grain

- Medium Grain

- Long Grain

By Nature

- Organic

- Conventional

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting