What is the Gynecological Devices Market Size?

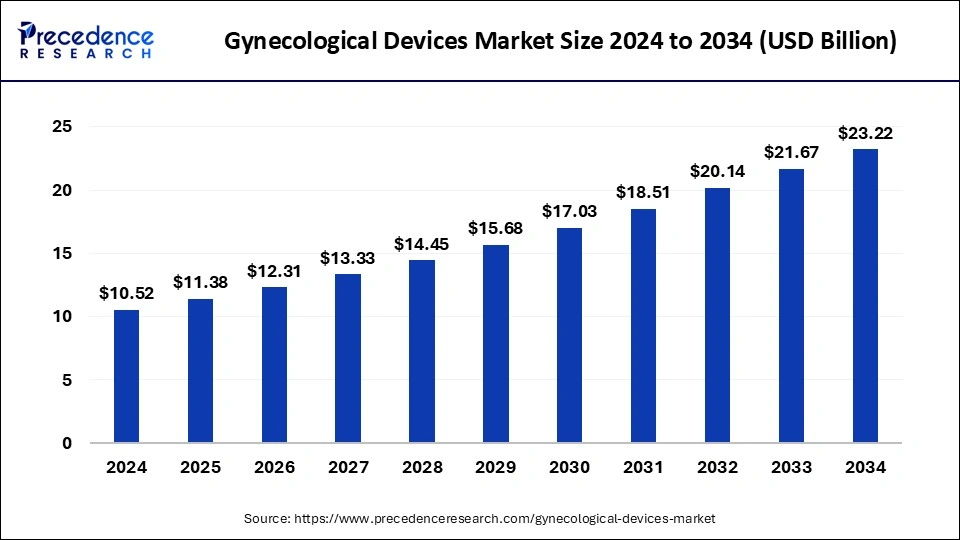

The global gynecological devices market size is accounted at USD 11.38 billion in 2025 and predicted to increase from USD 12.31 billion in 2026 to approximately USD 24.75 billion by 2035, expanding at a CAGR of 8.08% from 2026 to 2035

Gynecological devices are the instruments that are only used in gynecological procedures include assisted reproduction, uterine fibroid remobilization, colposcopy, hysteroscopy, pelvic floor electrical stimulation, female sterilization, pelvic organ prolapsed repair, endometrial resection, fluid management, and many others. A gynecological device is a piece of apparatus used at the time of surgery or an operation to perform certain tasks or attain some outcomes, such as altering biological tissue or providing access to monitor it.

Market Highlights

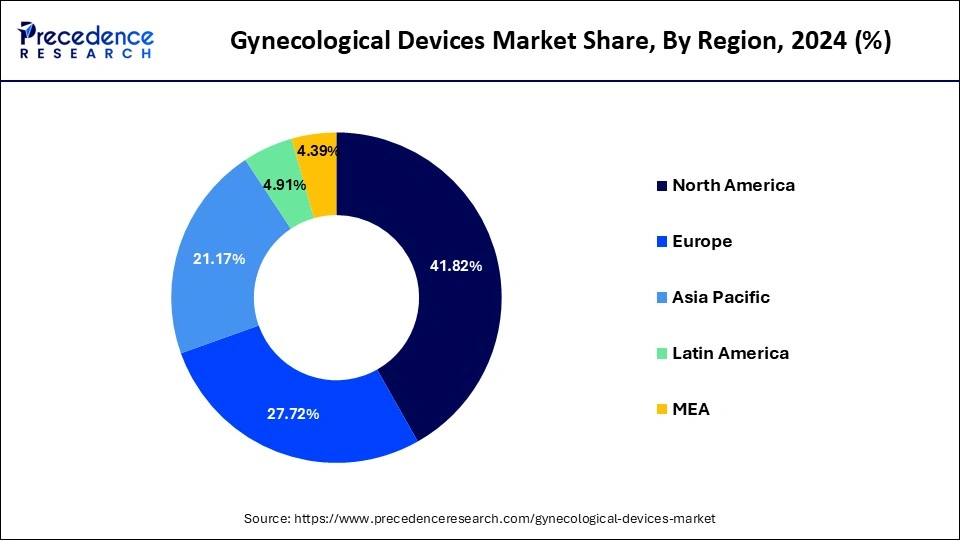

- North America led the global market with the highest market share of 41.82% in 2025.

- Asia Pacific is estimated to expand at the fastest CAGR of 8.64% between 2026 to 2035

- By Product, the surgical devices segment has generated more than 53.20% of revenue share in 2025.

- By Product, the handheld instruments segment is projected to grow at a remarkable CAGR of 8.4% from 2026 to 2035.

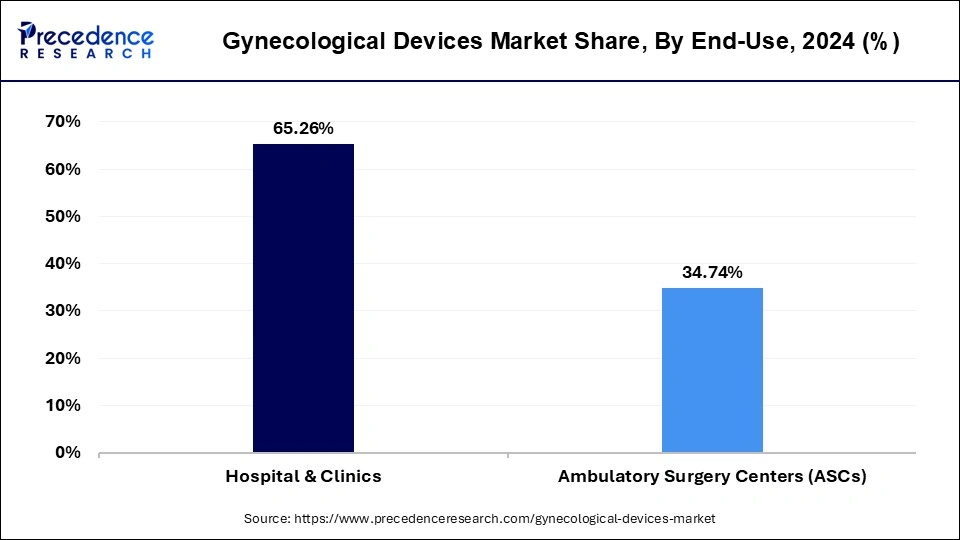

- By End-Use, the hospital & clinics segment has captured around 65.26% in 2025.

- By End-Use, the ambulatory surgery centers (ASCs) is expected to expand at the fastest CAGR of 8.1% between 2026 to 2035

Role of Artificial Intelligence in the Gynecological Devices Market

Artificial Intelligence (AI) is transforming the gynecological devices market by improving the accuracy, precision, and outcomes for patients through improved diagnostics and treatment. Due to technological advancements, AI-enabled imaging and diagnostic tools are allowing for the earlier and more accurate detection of gynecological disorders including cervical cancer, endometriosis, and ovarian cysts.

Robotic-assisted surgeries are more successful, meaning there is less risk of complications and significantly reduced recovery time. AI algorithms also assist in personalized care pathways by analyzing patient data and then recommending personalized treatment plans. Wearable gynecological devices with AI allow women to track fertility cycles, hormonal changes, and reproductive health in real-time. As the healthcare ecosystem shifts more towards information, data-driven models, AI continues to improve innovation, decision-making, and shape women's reproductive health technology.

Gynecological Devices Market Overview

The gynecological devices market spans surgical systems, diagnostic instruments, minimally invasive tools, imaging aids, fertility devices, endometrial and cervical care tools, and digital/connected solutions supporting reproductive and pelvic health. This domain has evolved from traditional mechanical tools into a highly sophisticated category underpinned by robotics, miniaturized endoscopy, sensor-driven diagnostics, and patient-centric design. As awareness of women's health rises globally and care delivery shifts toward comfort, precision, and preventive screening, gynaecological devices are becoming central to modern clinical practice.

Gynecological Devices Market Growth Factors

- The rising prevalence of gynecological diseases like PCOS, uterine fibroids and cervical cancer, resulting in increased demand and adoption for innovative and advanced diagnostic devices.

- The increasing awareness of women's health and reproductive care, especially in developing parts of the world resulting in earlier diagnosis and treatment.

- The technology advancements in the field of minimally invasive procedures, robotic-assisted procedures or imaging systems, all resulting in improved accuracy and better patient outcomes.

- The increasing aging female population leading to increased demand for pelvic organ prolapse and menopause-related treatments.

- Government initiatives and investment made to improve access and uptake of gynecological treatment around the world.

- The increase in healthcare complexness with new health facilities and trained professionals in developing economies speeding historical levels of adoption and penetration of existing products.

Market Outlook

- Industry Outlook: The industry is transitioning from hardware-centric innovation to integrated ecosystems combining devices, diagnostics, imaging, and software. Companies are emphasizing ergonomics, safety, and real-time feedback mechanisms; large medtech firms are expanding through acquisitions in robotics, laparoscopic systems, and fertility technologies. Startups and mid-tier players are driving breakthroughs in portable diagnostics, single use minimally invasive instruments, and digitized reproductive-health monitoring.

- Major Investment Areas: Minimally invasive surgical technologies include laparoscopic, hysteroscopic, and laser/energy-based systems. Robotic-assisted gynecological surgery is customized for pelvic operations. Devices for cervical cancer screening feature AI-enhanced colposcopy and portable screening solutions. Fertility and reproductive technologies consist of ovarian stimulation monitoring tools, embryo-handling instruments, and laboratory equipment. Pelvic-floor therapy devices are equipped with sensors and biofeedback capabilities. Single-use sterile instruments allow for safer outpatient procedures. Investors favor companies that combine device innovation with digital solutions and scalable, clinic-friendly approaches.

- Startups: Startups are reshaping women's health through high-impact innovations: portable, AI-assisted diagnostics for cervical screening and pelvic imaging. Smart fertility trackers, ovulation sensors, and hormone-monitoring devices with app integration for menstrual and pelvic pain using neuromodulation. Micro-robotic tools for minimally invasive interventions. Their emphasis on accessibility and comfort pushes the industry toward more patient-aligned solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.38 Billion |

| Market Size in 2026 | USD 12.31 Billion |

| Market Size by 2035 | USD 24.75Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.08% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | By Product and By End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase in Gynecological Disease Incidence

The need for healthcare payer services is being driven by the expanding insurance coverage of the world's population. It is also anticipated that emerging countries like India would experience an increase in health insurance coverage as a result of beneficial government initiatives. For instance, the Union Budget of 2021 increased the FDI threshold in insurance from 49 to 74%, and state-owned general insurance companies received a boost of USD 413.13 million to assist them become more solid financially. The significant losses brought on by the rise in healthcare fraud also increase the need for healthcare payer services, which propels the worldwide market's growth. The global market for gynecology devices is benefiting from a discernible rise in health insurance enrollment.

Opportunity

Government Initiatives in Gynecological Devices Market:

Government initiatives are a critical factor in stimulating the growth of the gynecological devices market by increasing access to women's healthcare and advancing technology. Governments and regulatory agencies worldwide are investing in technology and modernizing medical infrastructure by focusing on early diagnosis and subsidizing gynecological care programs to provide women with gynecological screenings.

In the U.S. the FDA's Health of Women Program, is enabling innovation in women's health and regulatory clarity in devices directed to women. In India, the Pradhan Mantri Surakshit Matritva Abhiyan government program, provides free antenatal care for women, resulting in an increase in demand for new diagnostic gynecological devices. In Europe, the European Commission continues to fund med-tech innovations that include minimally invasive devices and AI integrated devices.

At the same time, a valuable Marketplace is created when national health missions in developing countries contribute to upgrading healthcare resources, including rural healthcare. Not only do these initiatives improve patient outcomes, they also continue to drive growth in the global gynecological devices market.

Government programs

Government programs to manage the region's expanding population are projected to raise knowledge of birth control and family planning, which will in turn fuel regional product demand. The demand for modern contraception among women of reproductive age was around 90.1% in 2019 and is anticipated to stay constant through 2030, according to UN Population Facts. China is also one of the nation's having birth control laws. The region's market is anticipated to develop as a result of the increased incidence of gynecological problems and the rise in surgical procedures. A research that appeared in the journal Gynecology and Pelvic Medicine estimates that at China's Department of Gynecology in 2019, 13,934 gynecological procedures were carried out.

Use of robotics in gynecological equipment

One type of computer system that facilitates surgery is robotics. The demand for a wide variety of surgical devices rises as a result of skilled gynecologists using robots. Modern robotic technology can be used to successfully treat cancer and other gynecological conditions. Additionally, in order to boost profits, manufacturers of medical devices are committed to utilizing robotic operations. As a result, the market for gynecological devices is anticipated to grow due to the quick adoption of automation technologies like robotics in the treatment of gynecological diseases.

Technological Advancements in the Gynecological Devices Market:

Considerable changes in the gynecological devices market are being driven by technological progressions that achieve enhanced diagnostics, safer procedures, and improved patient care. Innovative developments of minimally invasive surgical tools with laparoscopic and hysteroscopic technologies result in shorter recovery times, decreased surgical risks and reduced length of hospital stays.

Newer imaging technologies deliver clearer visuals - for example, high-definition ultrasound and state-of-the-art 3D colposcopy systems allow for early detection of gynecological conditions. Next-generation technological developments in endometrial ablation devices and new energy-based devices focused on radio-frequency ablation and cryoablation provide more efficacy for the treatment of uterine disorders with more precision and comfort.

Wireless monitoring and smart instrumentation enhance real-time diagnostics and improve surgical navigation. As manufacturers continue to innovate, these new and emerging technologies are revolutionizing the standards in the care of women's healthcare and stimulating the global growth of the gynecological devices market.

Challenges

The expansion of the market would be hampered by worries regarding pelvic organ safety

Over the course of the projected period, worries regarding the safety of pelvic organ prolapse are anticipated to restrain market expansion. The vaginal mesh should only be used in difficult instances where there are no other effective therapies available in Europe. The growth of pelvic organ prolapses and the market as a whole may be constrained by the generally bad reputation surrounding litigation, regulatory scrutiny, and the use of meshes.

Segment Insights

Product Insights

The surgical devices segment is the market leader in the global gynecological devices market segment because it holds the greatest share in the market. Surgical devices play a significant role in advanced surgical procedures, like hysterectomy, laparoscopy, and endometrial ablation. Surgical devices are the surgical tools that we are used to thinking about, which include: trocars, scissors, endoscopes, as well as energy-based devices. Surgical devices are also utilized in both open and minimally invasive surgeries. These devices are becoming more utilized as patients demand less surgery trauma and inpatient time, and the improved clinical outcome with minimally invasive techniques. Technological advancement in surgical visualization, cutting precision and robotic guided devices have increased the efficiency and accuracy of surgical instruments as well. Established players in the gynecological market have developed new products by investing development into surgical. This is good growth for this segment across developed and developing environments.

Meanwhile, the handheld instruments segment is quickly becoming the fastest growing product category, due to the necessity of the instruments being easy to use, cost effective and portable for routine gynecological exams or minor outpatient or inpatient procedures. Instruments such as forceps, dilators, vaginal speculums, and curettes, are being utilized in great demand by clinic settings, community clinics and the ever-increasing number of rural healthcare settings today. That being said, the recent demand in awareness of early diagnosis, preventative care, and female reproductive health, has crystallized the next phase in the potential for handheld instruments.

Gynecological Devices Market, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Surgical Devices | 4,794.93 | 5,178.60 | 5,598.2 |

| Handheld Instruments | 1,299.72 | 1,404.02 | 1,518.1 |

| Diagnostic Imaging Systems | 2,935.35 | 3,160.75 | 3,406.6 |

In 2025, the surgical devices market segment led the sector and captured more than 53% of the total revenue. Throughout the projected period, it is predicted that widespread use of endoscopic devices and female contraceptives will sustain the segment's leadership. To give one example, CooperSurgical had a 26% rise in net sales for surgical equipment used by obstetricians or gynecologists in hospitals. Additionally, as surgical procedures increase internationally, there is a growing demand for surgical tools that are simple to autoclave and extremely durable. Growing public knowledge of birth control procedures and technologies is predicted to boost sector expansion. Additionally, the market's expansion is being significantly influenced by the rise in female sterilization operations. According to the United Nations' 2019 report on contraceptive usage by technique, around 840 million women worldwide out of 1.99 million women of reproductive age use contemporary methods of contraception. Female sterilization and intrauterine devices are the two contraceptive techniques most often used by women of reproductive age, at rates of 11.5% and 8.4%, respectively.

During the projection period, the diagnostic imaging systems sector is expected to grow at a profitable CAGR. The rise is due to an increase in both planned and unplanned pregnancies throughout the world. The United Nations Population Fund estimates that about half of all pregnancies worldwide or around 100 million conceptions annually are unintended. Imaging techniques such as magnetic resonance imaging, ultrasound, computed tomography, or even plain radiography are used to explore and diagnose pregnancy-related issues.

End-Use Insights

Hospitals and clinics currently represent the largest market segment for gynecological devices globally because they have the most medical infrastructure, the highest number of trained professionals, and comprehensive gynecological care services. Hospitals are where advanced surgical procedures take place, such as hysterectomies, laparoscopies, and fibroid removals, and it requires the most complex surgical and diagnostic devices. Hospitals improve patient outcomes with cutting-edge technology, such as 3D imaging, robotic-assisted surgery and energy-based ablation systems. This quality care defines patient outcome and increases demand for gynecological devices.

Ambulatory Surgery Centers (ASCs) are growing faster than any other end use, due to towards minimally-invasive procedures and same-day surgical care. ASCs have virtues such as faster turnover time, lower costs of procedures, and convenience for patients that have encouraged outpatient gynecological appointments such as abnormal uterine bleeding, endometrial ablation, hysteroscopy, sterilization, etc. With patient preference shifting towards more customized and less invasive care methods, ASCs are rapidly developing a bigger role with women's health. Improved regulatory support, increased investments and technology built around outpatient environments are pushing gynecological devices out the door and into patients, all from within these nimble and patient-centric surgical environments.

Gynecological Devices Market, By End-Use, 2022-2024 (USD Million)

| By End-Use | 2022 | 2023 | 2024 |

| Hospital & Clinics | 5,883.95 | 6,353.65 | 6,867.2 |

| Ambulatory Surgery Centers (ASCs) | 3,146.05 | 3,389.72 | 3,655.6 |

The hospitals & clinics segment has generated around 65.16% of the total revenue share in 2025.In hospitals and clinics, the use of cutting-edge medical equipment and the growth in demand for gynecological surgery are mostly to blame for the high proportion. Modern surgical substitutes are efficient and offer a superior experience.

For instance, in January 2024, the Hominis Surgical System, a robotic surgical system created by Memic Innovative Surgery, was put to use at The Women's Hospital at Jackson Memorial, Kendall Region Medical Center of HCA Florida Healthcare, and AdventHealth Celebration.

The device, which is FDA-approved, provides less invasive therapy options for gynecological surgeries. Throughout the forecast period, the end-use sector for ASC is predicted to grow at the fastest rate. The segment's growth may be attributed to the fact that these institutions are less costly than some other healthcare facilities like clinics and hospitals. Gynecological treatments, such as laparoscopic procedures, hysterectomy, oophorectomy, and others, were among the most commonly performed major ambulatory procedures among younger females in the U.S., according to the Nationwide Ambulatory Surgery Sample database. In the United States, about 420,000 major ambulatory gynecological operations were performed in 2019.

Regional Insights

U.S. Gynecological Devices Market Size and Growth 2026 to 2035

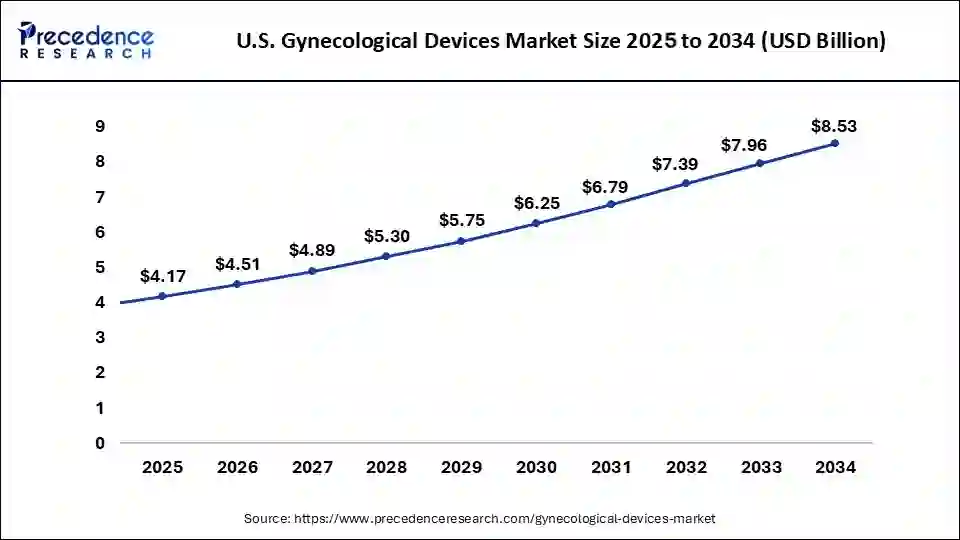

The U.S. gynecological devices market size is evaluated at USD 4.17 billion in 2025 and is projected to be worth around USD 9.1 billion by 2035, growing at a CAGR of 8.12% from 2026 to 2035

The greatest market share in 2025 belonged to North America, which generated around 41.82% of the global industry's revenue. It is predicted to maintain its dominance throughout the project due to the presence of established healthcare infrastructure, increased levels of knowledge regarding the accessibility of diagnostic tests & treatments, and improved reimbursement coverage.

Asia Pacific, on the other hand, is predicted to see the fastest growth rate over the forecast period. As a result of government initiatives to curb population growth, it is projected that increasing understanding of birth control and family planning will raise regional product demand. According to the United Nations Population Facts, the demand for modern contraception among women of reproductive age was approximately 90% in 2019 and is predicted to remain stable through 2035. China is also one of the countries having birth control legislation. The market in the area is expected to rise as a result of the increased number of surgical procedures and gynecological disorders. For instance, the Department of Gynecology in China performed 14,000 gynecological treatments, according to a report published in the journal of Gynecology and Pelvic Medicine.

North America:

The North America gynecological devices market leads the world based on advanced medical infrastructure, increased awareness of women's reproductive health, as well as the higher assimilation of the most recent technologies. The United States is the primary country in the region, with governmental support averting reimbursement issues and ongoing innovations in minimally invasive surgical instruments, devices, and diagnostic tools.

The increasing number of gynecological interventions, combined with the persistent rise of conditions like endometriosis, uterine fibroids, and cervical cancer, continue to fuel demand. With many leading manufacturers of medical devices, as well as clinical research, the market continues to expand.

The physician drive construct is also actively engaged within the community and validated by healthcare investors who continue the commitment to the advancements in women's health. Consequently, North America continues to be a key growth area in the global marketplace for gynecological devices.

Asia-Pacific:

Rapid growth is taking place in the Asia-Pacific gynecological devices market with surrounding prospects such as increased awareness of women's health, increase in healthcare spending and greater access to modern medical technologies. The development of the Asia-Pacific gynecological devices market can be explained by a few key countries, China, India, and Japan, which have large patient populations and greater integrated diagnostics and are increasingly focusing on the early detection of gynecological issues.

Government-sponsored health schemes and increased healthcare infrastructure in rural and semi-urban areas will spur demand for advanced gynecological devices. Add to that, the increased access to skilled humanitarian, and the interest in the adoption of minimally invasive surgical devices, and we see rapid deployment of gynecological devices as penetration grows. With the region's improving economy and continued emphasis on women's health, Asia-Pacific represents a high-priority market for gynecological devices.

Europe:

The gynecological devices market in Europe is continuing to grow at a steady pace as a result of the strong healthcare system, growing awareness of women's healthcare and medical innovation supported by the government. Advanced gynecological instruments like minimally invasive surgical devices and precise diagnostic devices are being onboarded by leading countries in gynecological technology including Germany, France, and the UK. As the female population in Europe ages, and the growing incidence of gynecological disorders like uterine fibroids and ovarian cysts increases, there will be championing of an array of treatment solutions.

Because reimbursement policies are generally supportive and, clinical research investment continues to progress compared to the current innovation timeline and regulatory approvals, there will allow for the continued growth of this market. With a focus on quality care and preventive health, Europe is an attractive region of the growing gynecological device market globally.

Latin America Gynecological Devices Market Trends:

Latin America presents a market with uneven but rising demand. Urban centres in Brazil, Mexico, Chile, and Colombia have advanced fertility clinics, early adoption of minimally invasive gynecological tools, and growing private healthcare spending. Public healthcare systems often prioritize essential surgical instruments and resource-efficient equipment, while NGOs support cervical cancer screening and maternal health technologies.

Challenges include procurement fragmentation, budget constraints, and variable access to training for complex devices. Nonetheless, rising awareness, expanding women's health advocacy, and gradual modernization of hospital infrastructure create strong long-term opportunities for both cost-effective and premium gynaecological devices.

| Regulatory Bodies | Market Focus reason | Key Regulations and Standards | Notable Insights |

| BfArm | Strict MDR compliance, rigorous biocompatibility. | Minimally invasive surgery devices, robotic systems, endoscopy. | Strong engineering base; high adoption of advanced surgical tech |

| MHRA | Device safety, usability testing and evidence. | Cervical screening tools, fertility devices and surgical instruments. | NHS procurement shapes market; strong demand for inclusive design. |

| ANSM | Compliance with EU MDR and strict device. | Diagnostic tools and screening designs. | Early adoption of AI enhanced screening in select centers. |

| AFIA | MDR implementation | Laproscopy systems and pelvic floor devices. | Regional variations in purchasing. |

Market Value Chain Analysis

- Raw Material Sourcing: Raw materials for gynecological devices must meet strict biocompatibility, sterility, and durability requirements. Manufacturers source medical-grade polymers, stainless steel, titanium, silicone elastomers, optical fibers, and specialized coatings designed to resist corrosion and ensure smooth insertion or navigation.

- Technological Advancements: Technological innovation is reshaping the capabilities of gynecological devices. Miniaturization of optics and instrumentation enables precision procedures with minimal patient discomfort.

Gynecological Devices MarketCompanies

- Cooper Surgical Inc.: A company focused on women's health, fertility, and surgical products.

- Hologic Inc.: A company with a focus on women's health, which has launched new products like the NovaSure V5 endometrial ablation device.

- Medtronic plc: A large medical technology company that designs, develops, manufactures, and markets medical devices and solutions.

- Olympus Corporation: A Japan-based manufacturer of optical and digital precision technology that has introduced products like the Guardenia Contained Extraction System.

- Stryker Corporation: A medical technology company that is a major player in the gynecological devices market.

- Richard Wolf GmbH: A company that partners with others to provide solutions in gynecology, urology, and general surgery.

- MedGyn Product Inc.: Another company identified as a key player in the gynecological devices market.

Other Gynecological Devices Market Companies

- Boston Scientific Corporation

- Ethicon Inc.

- Karl Storz Gmbh & Co. KG

Recent Developments

- In May 2025, the FDA approved the Teal?Wand, marking the first-ever at-home cervical cancer screening kit in the U.S. This prescription-based device allows individuals aged 25–65 to self collect vaginal samples with 96% clinical accuracy, supported by the robust SELF-CERV trial—and is expected to launch regionally in California in June, with a nationwide rollout planned. (Source :https://www.getteal.com )

- On October 14,2024, Hologic announced its definitive $350 million acquisition of Gynesonics, incorporating the Sonata System, an incisionless, radiofrequency-based intrauterine fibroid solution, into its women's health portfolio.( Source :https://investors.hologic.com )

Segments Covered in the Report

By Product

- Surgical Devices

- Gynecological Imaging Devices

- Portable Tools

By End Use

- Hospital & Clinics

- Ambulatory Surgery Centers (ASCs)

ByRegion

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content