What is the Hepatology Market Size?

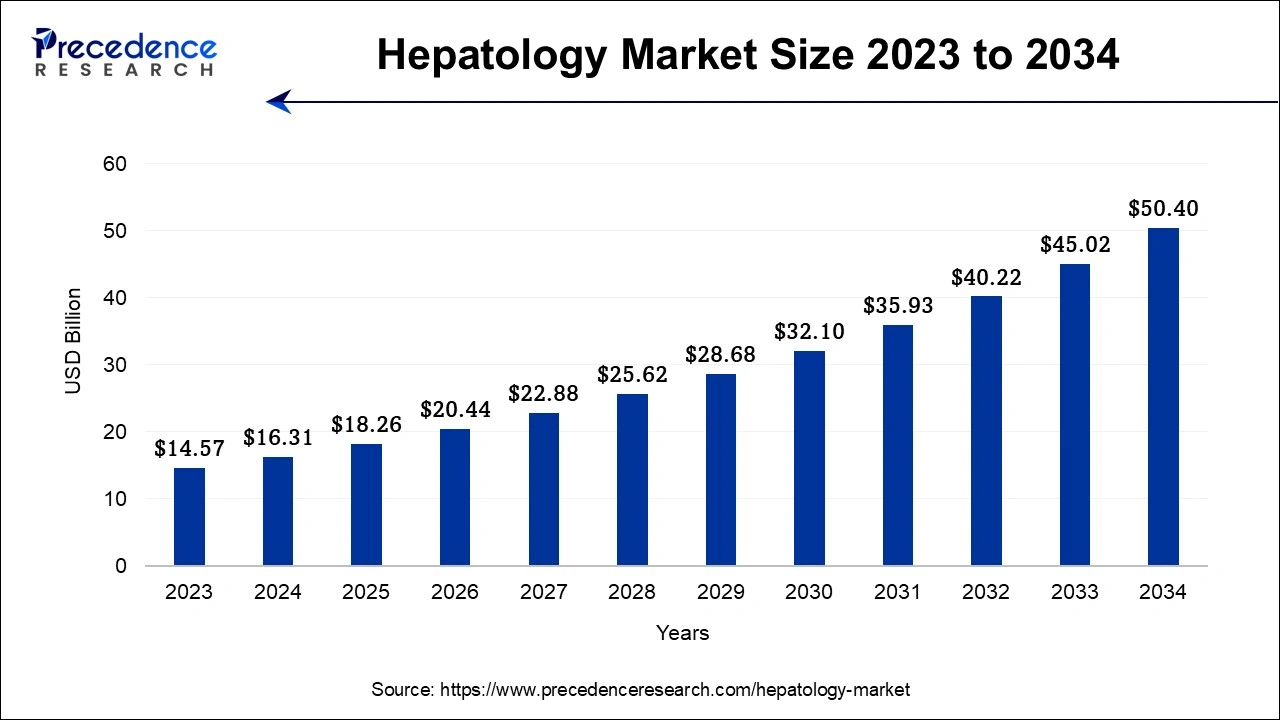

The global hepatology market size is accounted at USD 18.26 billion in 2025 and predicted to increase from USD 20.44 billion in 2026 to approximately USD 55.78 billion by 2035, representing a CAGR of 11.81% from 2026 to 2035.

Market Highlights

- North America is expected to dominate the hepatology market during the forecast period.

- By treatment type, the antiviral drugs segment is expected to be the dominating segment throughout the forecast period.

- By disease type, the hepatitis segment is expected to be the leading segment of the market. On the other hand, the liver cancer segment will grow at a significant rate during the forecast period.

Market Overview

The hepatology market focuses on diseases and conditions related to the liver. It encompasses various areas such as hepatitis, liver cirrhosis, fatty liver disease and liver cancer. The global market has been witnessing a significant growth due to factors such as increasing prevalence of liver disorders, rising awareness about liver health and improved diagnostic methods. Chronic liver diseases are generally caused by excessive alcohol consumption, exposure to aflatoxins and certain genetic conditions. Key players involved in the global hepatology market are investing in research and development to develop innovative treatments and therapies for liver related ailments.

Hepatology Market Growth Factors

Complications relating to the liver are caused by an increase in the prevalence of liver diseases such as hepatitis, fatty liver disease, and liver cancer, improvements in medical technology, diagnostics, and therapies for liver disorders, and changing lifestyles such as poor diets and alcohol consumption. The aging population and increased vulnerability to liver illnesses along with the growing knowledge of the necessity of early identification and treatment of liver health are a few other factors for the growth of the market. The market expansion is fueled by advancements in healthcare infrastructure, accessibility to healthcare in underdeveloped areas, and investments in pharmaceutical and therapeutic research & development for the liver.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.26 Billion |

| Market Size in 2026 | USD 20.44 Billion |

| Market Size by 2035 | USD 55.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.81% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Treatment Type, Disease Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of liver diseases

The hepatology market is expanding due to the rising prevalence of liver illnesses like liver cirrhosis, hepatitis, and fatty liver disease. There is an increased need for hepatology diagnostic procedures, drugs, and cutting-edge therapies as these disorders become more common. As a result, more investments are being made in research and development, which has prompted the market launch of novel therapies and technologies to meet the expanding needs of patients. The hepatology market has also grown due to the increased awareness of liver health and the value of early diagnosis.

Restraint

High cost of production

The probability that patients with financial constraints would receive the essential therapy is decreased when drugs and treatments are expensive due to high production costs. As some patients may require assistance to continuously afford their prescribed prescriptions, expensive medications may cause poor patient adherence to therapies, which could compromise treatment outcomes. Pharmaceutical corporations may refrain from investing in hepatology research and development due to high production costs, limiting the possible innovation.

The high cost of production may lead to discrepancies in the availability of cutting-edge treatments, depriving some areas or populations of the most recent developments in hepatology. The high cost of manufacturing may deter prospective rivals from accessing the hepatology industry, which would restrict the development of substitute, potentially less expensive treatments. Healthcare systems, insurance companies, and patients may need help to afford these specific therapies due to high production costs that can result in increased prescription prices.

Opportunity

Liver transplantation solutions

Advancements in liver transplantation techniques, including organ preservation methods, transplant immunosuppression, and post-transplant care, can improve patient outcomes and create opportunities for related products and services. The hepatology industry has a substantial possibility for liver transplantation treatments since they may effectively treat end-stage liver illnesses. The need for liver transplants has increased due to improvements in medical technology and organ transplantation methods, as well as conditions such as liver failure, cirrhosis, and hepatitis. This presents a profitable opportunity for medical enterprises to create novel approaches to enhance transplant success rates and patient outcomes, such as organ preservation technology, transplant diagnostics, and immunosuppressive medications.

Segment Insights

Treatment Type Insights

The antiviral drugs segment is expected to be dominant in the hepatology market during the predicted period. Antivirals support the body in fighting off certain viruses that can cause disease and are also preventive. It can protect from obtaining viral infections or spreading a virus to others because disease risk progress is closely associated with a patient's serum HBV DNA level. Antiviral therapy for liver diseases or conditions may subdue viral replication, stabilize liver function, improve survival rate, enhance the severity of the hepatic disorder, improve clinical symptoms and lifestyle, and extend patient survival.

The vaccines segment is expected to register a notable growth rate during the forecast period. The hepatitis B vaccine prevents the harsh liver disease that can grow when adults or children are infected with the hepatitis B virus. Individuals who have other liver disorders such as hepatitis C, Wilson disease, hemochromatosis, autoimmune hepatitis, fatty liver, primary biliary cirrhosis and cirrhosis should all receive vaccination for hepatitis A and B.

On the other hand, the chemotherapy segment is expected to show significant growth in the hepatology market during the forecast period. Chemotherapy is a cancer treatment that operates one or more anti-cancer drugs as part of a regulated chemotherapy regimen. It can be used at any stage of cancer, from IA/IB to IV. The rising prevalence of liver cancer is observed to promote the segment's growth during the forecast period.

Disease Type Insights

The hepatitis segment is expected to be the leading segment of the market. Hepatitis B is a viral infection that attacks the liver and generally spreads through contact with infected fluids such as semen, blood, vaginal fluids, and saliva. Numerous blood tests are available to detect and check people with hepatitis B. Few laboratory examinations can differentiate acute and chronic infections and tailor the severity of liver disease. Ultrasound, fibro scan, and physical examination can also be carried out to determine the level of liver fibrosis and scarring and monitor liver disease growth. It is preventable after injecting a vaccine. All these factors collectively promote the segment's growth.

Moreover, the potential of drug development for hepatitis in the global pharmaceutical industry supports the segment's growth. For instance, Bepirovirsen is a drug used to cure chronic hepatitis B, and researchers are currently focused on developing a new formula by combining Bepirovirsen with other therapies to raise the drug treatment's efficacy. Therefore, the future is hopeful for curing chronic hepatitis with new drugs entirely.

On the other hand, the liver cancer segment will grow at a significant rate during the forecast period. The ongoing research and development activities for the therapy development for liver cancer promotes the segment's growth. Chronic infection with hepatitis B or hepatitis C elevates the risk of liver cancer with the changes. The American Cancer Society stated that about 41,210 new patients would be diagnosed for primary liver and intrahepatic bile duct cancer in the United States in 2023. This rising number of liver cancer cases is expected to force researchers and the overall healthcare industry to develop and adopt advanced liver cancer treatment of therapies in upcoming years.

Regional Insights

What Made North America the Dominant Region in the Market in 2025?

North America has its largest revenue share in 2025 and is expected to sustain its dominance in the hepatology market throughout the predicted timeframe. The presence of a strong diagnosis system that maintains the accuracy of illness identification and treatment outcomes have improved the overall position of North America in the global market. In addition, the availability of diagnostic techniques, hepatic imaging techniques, and therapeutic approaches have supplemented the market's growth in North America.

U.S. Market Trends

The U.S. is a major contributor to the North American hepatology market, fueled by rising cases of liver diseases, particularly metabolic dysfunction associated steatotic liver disease (MASLD/NAFLD) and alcohol-associated liver disease (ALD). Studies indicate that by 2050, over 121 million U.S. adults (41.4%) are expected to be affected by MASLD, highlighting the growing treatment demand.

Moreover, available healthcare policies for treatments along with healthcare insurance and government initiatives for better access to treatments in the region support the market's expansion. Campaigns for health awareness, educational activities, and developments in medical research have all contributed to raising public awareness of liver illnesses and enabling early diagnosis and treatment in the region. Additionally, the strong pharmaceutical and biotechnology industries promise the innovation of novel therapeutic development for liver conditions.

The burden of chronic liver illnesses has increased in North America due to the aging population, fueling demand for hepatology treatments. The hepatology industry has significantly impacted North America, where healthcare providers, pharmaceutical firms, and academic institutions always seek to enhance the standards of diagnostic methods and therapeutic options available for liver illnesses.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to witness the fastest rate of growth during the forecast period. In Asia-Pacific, the prevalence of liver illnesses such as alcoholic liver disease, viral hepatitis, and non-alcoholic fatty liver disease (NAFLD) has increased, increasing the need for hepatology treatments and pharmaceuticals. The industry has been pushed by improvements in medical technology and therapies for liver disease. The emergence of cutting-edge remedies, such as hepatitis C direct-acting antivirals, has improved treatment outcomes and given patients access to powerful drugs. The region has seen an increase in liver disease screens and diagnostics due to a better understanding of liver health and the value of early detection and treatment.

India Market Trends

India is poised for rapid growth in the hepatology market due to a rising burden of alcohol-associated liver disease (ALD), a leading cause of cirrhosis and liver-related deaths in the country. The expansion of liver transplantation programs, with around 4,500 transplants conducted by 2024, is further driving the demand for advanced hepatology care. Additionally, innovative research, such as the use of VEGF-C nanocarriers by the Institute of Liver and Biliary Sciences (ILBS) for treating advanced cirrhosis and reducing ascites in preclinical studies, highlights India's growing role in developing cutting-edge therapies.

How is the Opportunistic Rise of Europe in the Hepatology Market?

Europe is experiencing an opportunistic rise in the market due to the increasing prevalence of liver diseases such as NAFLD/NASH, hepatitis, cirrhosis, and liver cancer, which is driving demand for advanced diagnostics and therapeutics across well-established healthcare systems. Strong public health initiatives, comprehensive national screening and treatment programs, and robust pharmaceutical R&D in countries like Germany, France, and the UK are accelerating early diagnosis, clinical trial activity, and adoption of innovative therapies.

Germany Market Trends

The hepatology market in Germany is expanding, driven by its status as a hub for advanced medical research and world-class clinics. Leading institutions such as Charité – Universitätsmedizin Berlin, University Hospital Heidelberg, and Hannover Medical School are advancing cutting-edge research and clinical trials while following EASL guidelines. Notably, researchers at Heidelberg University and University Hospital Tübingen are developing HRX-215, an MKK4 inhibitor, aimed at enhancing the liver's regenerative capacity, highlighting Germany's focus on innovative hepatology therapies.

Hepatology Market Companies

- Astellas Pharma Inc.

- Merck & Co. Inc.

- Abbott Laboratories

- Bristol- Myers Squibb

- AbbVie Inc.

- Emergent BioSolutions Inc.

- F. Hoffmann- La Roche AG

- Eli Lilly and Company

- Viatris Inc.

- Gilead Sciences, Inc.

Recent Developments

- In October 2025, Siemens Healthineers and the National University Hospital (NUH) Singapore tied up to strengthen diagnostic solutions for Metabolically Dysregulated-Associated Steatotic Liver Disease (MASLD).

https://www.prnewswire.com - In September 2025, Roche agreed to buy U.S. biotech firm 89bio (ETNB.O), initiated for up to $3.5 billion, to develop new liver disease treatments & also a major push into weight-loss drugs.

https://www.reuters.com - In October 2025, Ipsen launched Bylvay in Korea with national coverage for a rare childhood liver disease.

https://www.koreabiomed.com - In October 2025, Hoth Therapeutics, Inc. announced the launch of a VA-backed U.S. study evaluating GDNF as a potential therapy for obesity and fatty liver disease (hepatic steatosis).

https://www.prnewswire.com

Segments Covered in the Report

By Treatment Type

- Antiviral Drugs

- Vaccines

- Immunosuppressants

- Targeted Therapy

- Chemotherapy

- Corticosteroids

- Immunoglobulins

By Disease Type

- Hepatitis

- Liver Cancer

- Genetic Disorders

- Autoimmune Diseases

- Non- Alcoholic Fatty Liver Diseases

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting