What is the HVDC Transmission System Market Size?

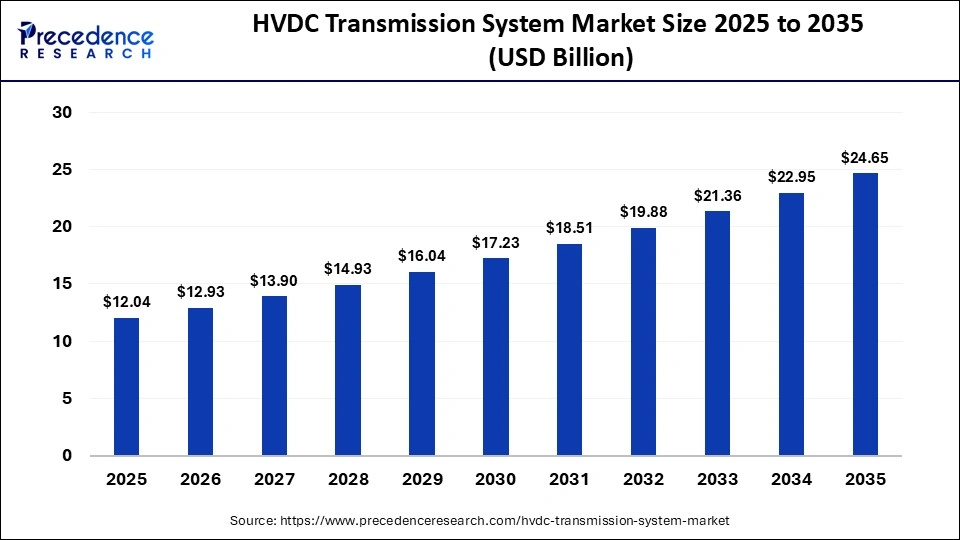

The global HVDC transmission system market size was calculated at USD 12.04 billion in 2025 and is predicted to increase from USD 12.93 billion in 2026 to approximately USD 24.65 billion by 2035, expanding at a CAGR of 7.43% from 2026 to 2035.It is fueled by the rising urgent need to combine large volume renewable projects with urban demand centers.

Market Highlights

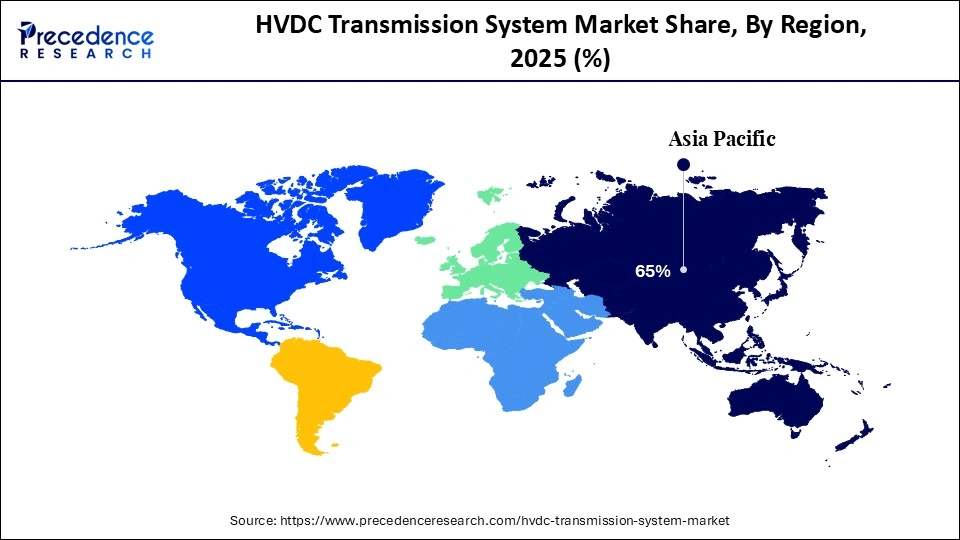

- Asia Pacific accounted for the biggest market share of 65% in 2025.

- By transmission type, the overhead HVDC transmission system segment dominated the market in 2025.

- By transmission type, the submarine HVDC transmission system segment is expected to grow rapidly during 2026-2035.

- By component, the converter stations segment registered dominance in the market in 2025.

- By component, the others (control & protection systems, reactive power equipment, accessories) segment is expected to witness rapid expansion in the coming years.

- By voltage rating, the 400 to 800 kV segment led the market in 2025.

- By voltage rating, the above 800 kV segment is expected to grow at a rapid CAGR during the forecast period.

What are the Significant Drivers in the HVDC Transmission System Market?

A prominent catalyst in the market is the growing need to integrate remote, large-scale renewable projects to urban demand centers, where HVDC is prioritized for its ability to transmit large amounts of energy over long distances with minimal losses. Alongside, the globe is fostering investments in interconnecting regional power grids to boost reliability, energy security, & cross-border trading.

Trends in the HVDC Transmission System Market

- Promotion of Offshore Wind Integration:HVDC systems are stepping towards greater capacity to manage the vast power output from offshore wind farms, like 2 GW, using symmetric bipolar topologies for extensive reliability.

- Unveiling Modular & Compact Designs:The market is widely employing prefabricated, containerized modular HVDC systems to lower footprint and installation time, which raises versatility in construction.

- Bolstering Grid Forming Converters:Immersive VSC-HVDC systems highly employ grid-forming, which supports stabilising onshore AC grids by offering inertia, similar to traditional synchronous generators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.04Billion |

| Market Size in 2026 | USD 12.93 Billion |

| Market Size by 2035 | USD 24.65Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.43% |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Transmission Type, Component, Voltage Rating, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Transmission Type Insights

Which Transmission Type Led the HVDC Transmission System Market in 2025?

In 2025, the overhead HVDC transmission system segment captured a major share of the market. This kind provides minimal transmission losses over very long distances as compared to HVAC systems, and it is also affordable to develop per kilometre & faster to repair than underground or subsea cables. The Western Hemisphere is known as the giant renewable energy project, which uses HVDC to transmit 3,000 MW of wind power from New Mexico to Arizona & California.

Moreover, the submarine HVDC transmission system segment is estimated to show the fastest growth. Specifically, spurring projects in Europe, China, and India, which need long-distance, high-capacity subsea cables to transfer energy from sea to shore. Recently, the Tyrrhenian Link (Italy) initiated installing 500 kV HVDC subsea cables, which will set a new record for deep-water installation in early 2026.

Component Insights

Why did the Converter Stations Segment Dominate the Market in 2025?

The converter stations segment held the largest share of the market in 2025. These stations enable the interconnection of non-synchronous AC networks, such as those with various frequencies, like 50 Hz to 60 Hz. The latest Sea Link project preferred Siemens Energy to establish two HVDC converter stations for this subsea link in the UK. Recently, Hitachi Energy was awarded a contract to deliver modular, high-capacity VSC converter stations to connect U.S. offshore wind to the grid.

However, the others (control & protection systems, reactive power equipment, accessories) segment will expand rapidly. The global market is moving from traditional Line Commutated Converters (LCC) to Voltage Source Converters (VSC), which need sophisticated, high-speed control and protection systems. The first 1,100 kV Gas-Insulated Switchgear (GIS) orders for UHVDC substations in China are shifting towards greater voltage and more compact equipment.

Voltage Rating Insights

Which Voltage Rating Led the HVDC Transmission System Market in 2025?

In 2025, the 400 to 800 kV segment registered dominance in the market. It is mainly driven by the use of ±525 kV VSC in offshore wind farms and remote solar parks, which requires HVDC for robust, reliable, and low-loss transmission. Currently, State Grid Corporation of China (SGCC) is expanding several projects, like the Ningxia–Hunan ±800 kV UHVDC project, which links the northwest desert to central China.

Whereas the above 800 kV segment is anticipated to witness rapid expansion. Its demand is propelled by operating systems at 800kV, ±800 kV, and above 1,100 kV to transfer over 10,000 MW per corridor, crucial for meeting greater energy demand. Particularly, the Jinshang–Hubei ±800 kV UHVDC transmission project explored the world's highest-altitude UHVDC line, which transmits 40 billion kWh of clean energy per year from the upper reaches of the Jinsha River to Hubei Province.

Regional Insights

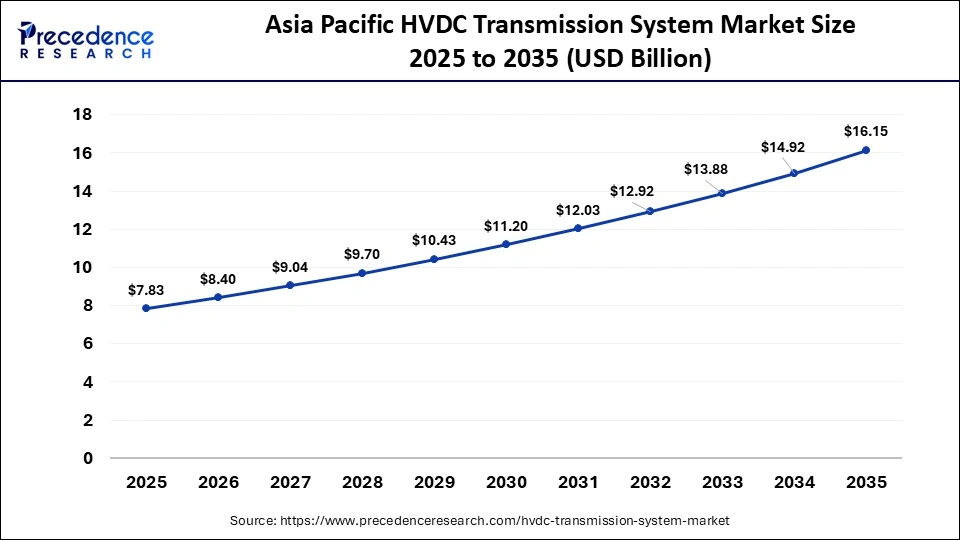

What is the Asia Pacific HVDC Transmission System Market Size?

The Asia Pacific HVDC transmission system market size is expected to be worth USD 7.53 billion by 2035, increasing from USD 16.15 billion by 2025, growing at a CAGR of 7.51% from 2026 to 2035.

Why did the Asia Pacific Dominate the Market in 2025?

In 2025, the Asia Pacific captured the dominating share & will expand fastest in the HVDC transmission system market. The region is experiencing expedited industrialization and urbanization in China, India, & Southeast Asia, which raises electricity consumption, requiring grid upgrades & advancement. Nowadays, Adani Energy Solutions Ltd (AESL) is bolstering with a vital HVDC-based, VSC-technology-enabled (Voltage Source Converter) project for Mumbai, which will be explored by late 2025 or early 2026.

China is extensively fostering High-Voltage Direct Current (HVDC) & Ultra-High-Voltage Direct Current (UHVDC) transmission, and emphasizing vast, long-distance "clean energy highways" to link western renewable energy bases to eastern industrial load centers. Alongside, the Longdong-Shandong ±800 kV project includes "wind-solar-thermal-storage" integration, with a capacity of 36 billion kWh per year.

How will Europe Expand Notably in the Market in the Upcoming years?

In the HVDC transmission system market, Europe is broadening policies to target net-zero emissions, which mandate high-capacity, effective transmission to substitute fossil fuel p

Who are the Major Players in the Global HVDC Transmission System Market?

The major players in the HVDC transmission system market include ABB Ltd (Hitachi Energy), Siemens Energy AG, GE Vernova, Inc., Mitsubishi Electric Corporation, Toshiba Corporation, Prysmian Group, Nexans S.A., NKT A/S, Sumitomo Electric Industries, LS Cable & System, TBEA Co., Ltd., State Grid Corporation of China, NR Electric Co., Ltd., Bharat Heavy Electricals Ltd., CHINT Group, Trench Group, Schneider Electric SE, Hyosung Heavy Industries, ZTT Group.

Recent Developments

- In February 2026, Chile began construction of the Kimal–Lo Aguirre high-voltage direct current (HVDC) transmission line.(Source- https://strategicenergy.eu)

- In July 2025, National Grid rolled out a revolutionary novel approach with Britain's supply chain to escalate the delivery of £8 billion worth of crucial substation infrastructure across England and Wales.(Source- https://www.nationalgrid.com)

- In June 2025, TBEA launched zero-carbon, digital-intelligent energy solutions at SNEC 2025.Source- https://www.solarbeglobal.com)

Segments Covered in the Report

By Transmission Type

- Submarine HVDC Transmission System

- Overhead HVDC Transmission System

- Underground HVDC Transmission System

By Component

- Converter Stations

- Transmission Medium (Cables)

- Others (Control & Protection Systems, Reactive Power Equipment, Accessories)

By Voltage Rating

- Up to 400 kV

- 400 to 800 kV

- Above 800 kV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting