Hybrid Valves Market Size and Forecast 2025 to 2034

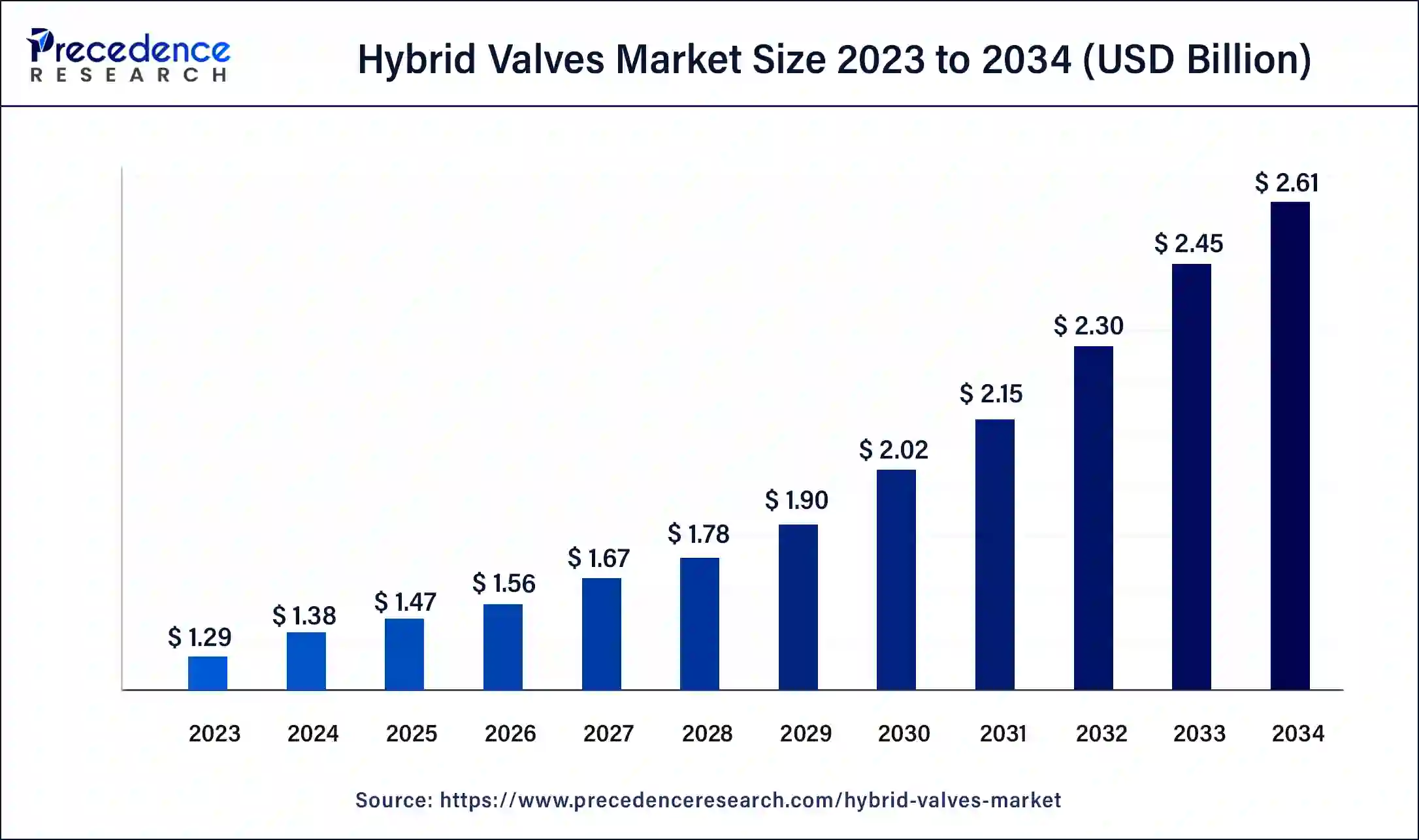

The global hybrid valves market size was estimated at USD 1.38 billion in 2024 and is predicted to increase from USD 1.47 billion in 2025 to approximately USD 2.61 billion by 2034, expanding at a CAGR of 6.58% from 2025 to 2034. The rise in the use of products in different industries is the key factor driving the hybrid valves market growth.

Hybrid Valves Market Key Takeaways

- In terms of revenue, the global hybrid valves market was valued at USD 1.38 billion in 2024.

- It is projected to reach USD 2.61 billion by 2034.

- The market is expected to grow at a CAGR of 6.58% from 2025 to 2034.

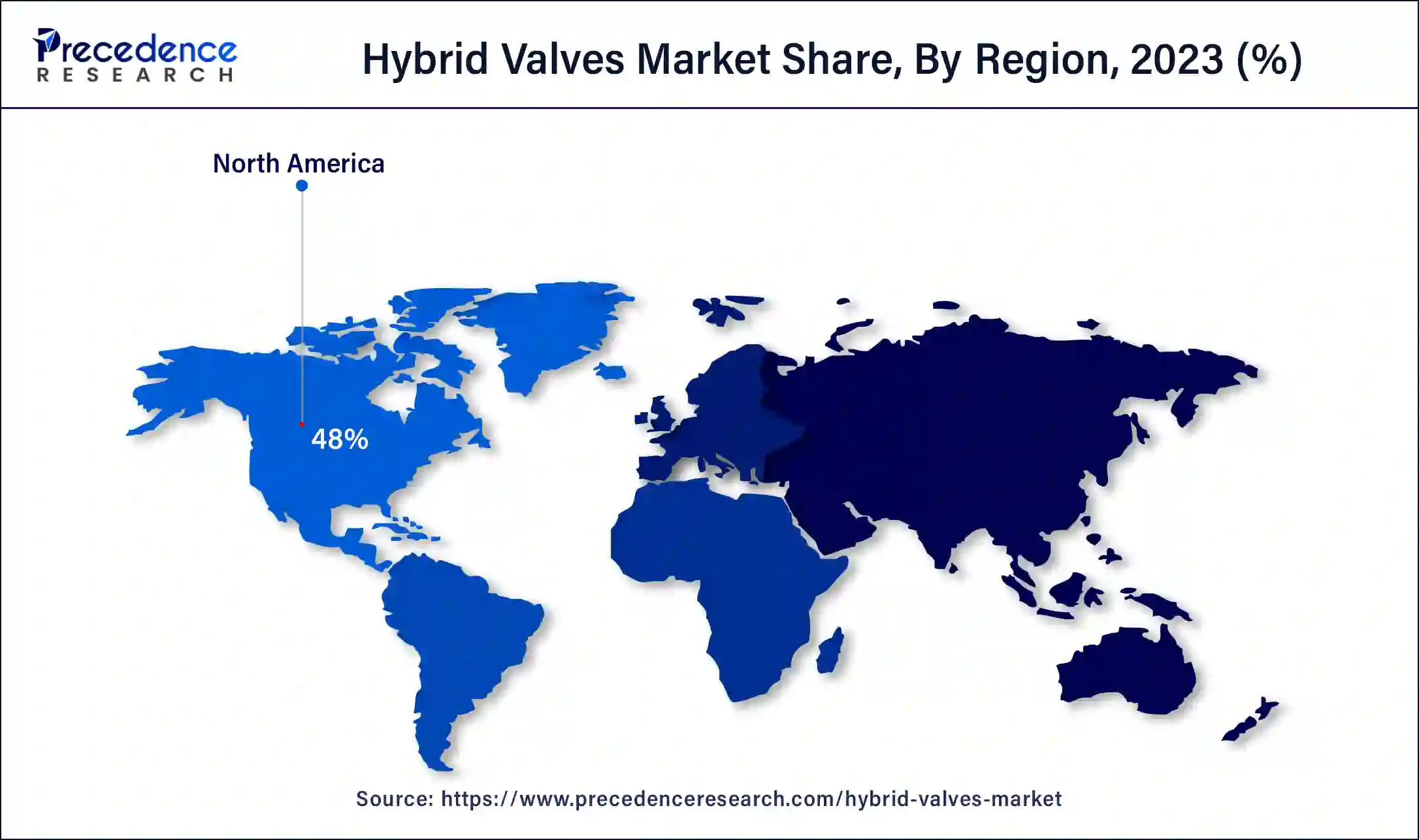

- North America dominated the global hybrid valves market with the largest market share of 48% in 2024.

- By material, the steel segment dominated the market in 2024.

- By material, the alloy segment is expected to show significant growth in the market over the forecast period.

- By industry, the chemical segment led the market in 2024.

- By industry, the oil & gas segment will show the fastest growth in the market over the studied period.

- By valve size, in 2023, the 6" to 25", segment held a significant share of the global market.

U.S. Hybrid Valves Market Size and Growth 2025 to 2034

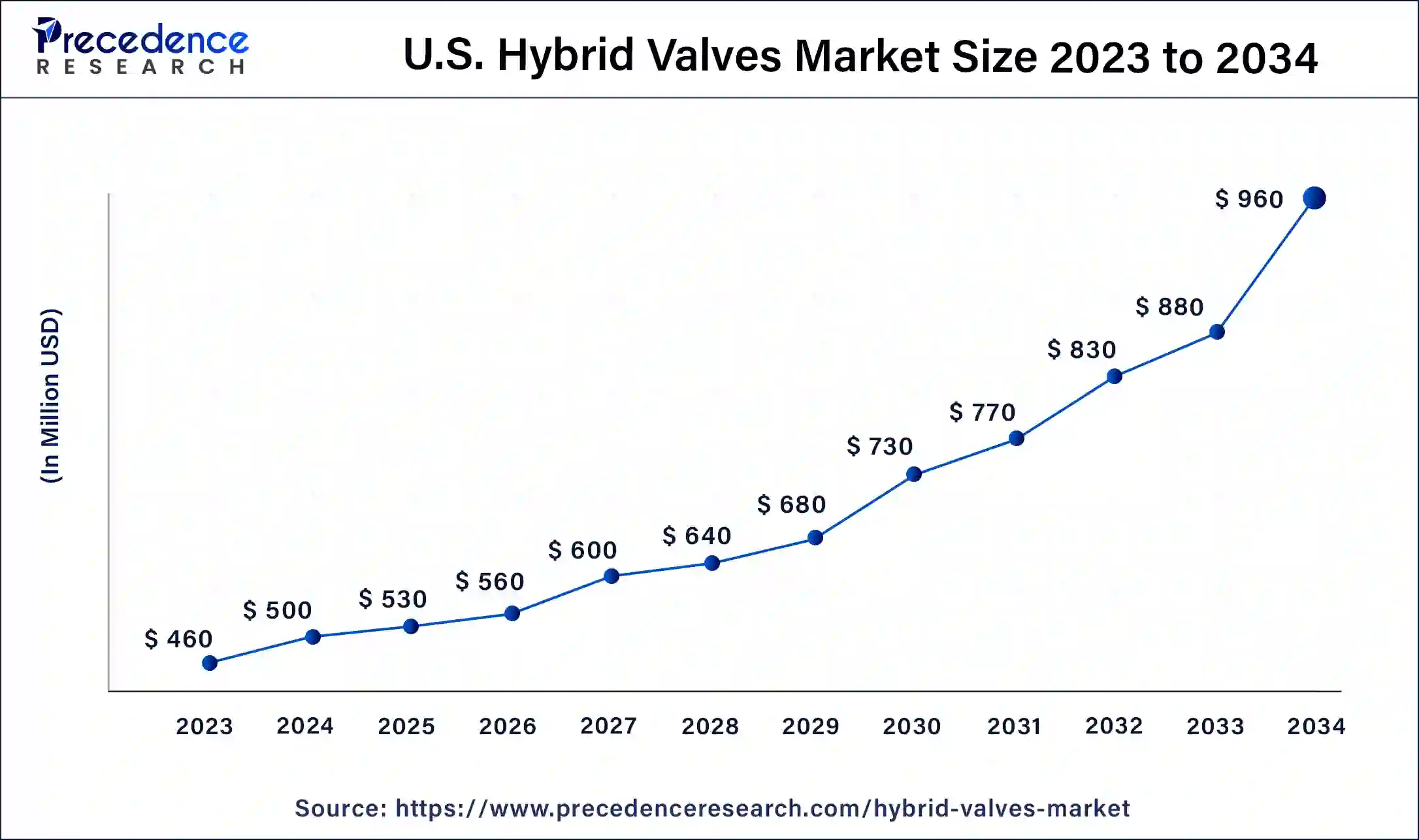

The U.S. hybrid valves market size was exhibited at USD 500 million in 2024 and is projected to be worth around USD 960 million by 2034, poised to grow at a CAGR of 6.74% from 2024 to 2034.

North America dominated the global hybrid valves market in 2024. The growth of the region is driven by rising industrial automation and the need for efficient fluid control systems. Moreover, factors such as the increasing adoption of innovative manufacturing techniques along with strict environmental regulations are further boosting market growth. Market players are also emphasizing the design of innovative hybrid valve solutions to fulfill diverse industry requirements from end-users across various sectors.

- In August 2022, Aegis Flow Technologies LLC announced its merger with Richter Pumps and Valves Inc. The strategic move is expected to strengthen and expand the company's product offering. This merger also enabled the company to update its product offerings in the valves market for the water and wastewater industry.

Nuclear Share of Electricity Generation in 2023

| Country | Total net capacity [MW] | Nuclear Share (%) |

| ARGENTINA | 1641 | 6.3 |

| ARMENIA | 416 | 31.1 |

| BELARUS | 2220 | 28.6 |

| BELGIUM | 4916 | 41.2 |

| BRAZIL | 1884 | 2.2 |

| BULGARIA | 2006 | 40.4 |

| CANADA | 13699 | 13.7 |

| CHINA | 53152 | 4.9 |

| CZECH REPUBLIC | 3934 | 40.0 |

| FINLAND | 4394 | 42.0 |

Asia Pacific is expected to witness the fastest growth in the hybrid valves market over the forecast period. The region can be attributed to the ongoing economic growth in developing countries like China and India. The requirement for hybrid valves has risen substantially as a result of the need to decrease greenhouse gas emissions in the various industrial sectors. Furthermore, the region is a base of many manufacturing firms such as pharmaceutical, chemical, and automotive sectors. Whose work relies on high-performance valves. Also, there is a growth in infrastructure development investments coupled with government initiatives in water harvesting.

Market Overview

Hybrid valves are utilized in a variety of industries, such as chemical, oil and gas, water treatment, and power generation. Because they provide reliability, better performance, and control than traditional valves, hybrid valves can also optimize pressure and fluid flow, which can lower costs and improve energy efficiency. There is a growing need for safety and dependability in crucial applications like oil and gas pipelines, nuclear power plants, and chemical facilities, as well as industries like water treatment and power production.

Hybrid Valves Market Growth Factors

- The growing need to control excessive noise, vibration, and cavitation is expected to fuel market growth soon.

- The hybrid valves market players' increasing investments and networking capability can boost market growth further.

- The increase in demand for energy and power generation can fuel market growth shortly.

- The rise in the number of refineries and petrochemical plants will likely contribute to market expansion shortly.

- Growing demand for hybrid valves in GCC countries is expected to drive market growth further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.61 Billion |

| Market Size in 2025 | USD 1.47 Billion |

| Market Size in 2024 | USD 1.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Industry, Valve Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing usage of hybrid valves in manufacturing facilities

The hybrid valves market is growing because of the rise in the application of hybrid valves in industries like chemicals, metals and mining, oil and gas, and pharmaceuticals to reduce pressure, vibration, and noise. Additionally, hybrid valves are increasingly used by oil and gas industries to stop corrosion and maintain excessive pressure during production.

- In March 2024, Eaton launched its next-generation fuel tank isolation valve (FTIV) for hybrid vehicles. The gasoline engine in a hybrid vehicle does not operate continuously. As a result, hybrid fuel systems require special measures to address evaporative emissions that accumulate when the gas engine is not in operation.

Restraints

Limited awareness and adoption

The hybrid valves market faces a significant constraint due to less adoption and awareness among industry players about hybrid valves. This lack of awareness can slow the adoption rates, by hampering the overall market growth. Moreover, addressing this challenge needs specific educational efforts to highlight the benefits of hybrid valves which showcase their ability to improve performance and decrease operational costs across different industries.

Opportunity

Rising focus on automation and wireless monitoring

By using advanced technologies, valves can now be controlled from any remote location, which allows real-time adjustments and smooth management of fluid flow. Furthermore, this automation can improve precision and reduce operational costs and manual labor. The wireless monitoring systems can offer continuous data on valve performance by minimizing downtime and enabling proactive maintenance. These advancements signify a substantial leap forward in strengthening industrial processes by ensuring swift operations in the hybrid valves market .

- In December 2023, Ukrainian smart home specialist Uhome launched a crowdfunding campaign for a wire-free valve system designed to automatically switch off a water supply line in the event of a leak or other incident, integrating nicely into existing smart home platforms like Home Assistant.

Material Insights

The steel segment dominated the hybrid valves market in 2024. The dominance of the segment can be linked to the increasing demand forsteel material in applications including high temperature and steam because of the need for greater flow control and handling of a corrosive media application in water & wastewater treatment and chemicals industries during the projected period.

The alloy segment is expected to show significant growth in the hybrid valves market over the forecast period. Alloy hybrid valves are a special type of valve that combines the qualities of different alloys to enhance their performance in specific applications. Moreover, alloys can offer improved performance strength and durability by improving resistance to corrosive and abrasive environments.

- In August 2022, Hitachi developed Scanning Acoustic Tomography. This technology provides a one-time examination and increased image quality for 300 mm wafer defect detection.

Industry Insights

The chemical segment led the hybrid valves market in 2024. The growth of the segment can be credited to the increasing use of hybrid valves in chemical plants for controlling complex & distinctive noises coupled with acoustical difficulties. Additionally, the growth of consent decrees on noise, air, and water contamination implemented in refineries are key factors driving the demand for hybrid valves in the chemical sector.

The oil & gas segment will show the fastest growth in the hybrid valves market over the studied period. The growth of the segment can be attributed to the increasing use of hybrid valves in the oil and gas industry to maintain the flow of oil and gas in pipelines, storage tanks, and other upstream and downstream processes. Furthermore, Hybrid valves help to control the flow of liquids, gases, and steam during treatment procedures.

- In May 2024, China achieved a breakthrough in nuclear valve technology. Such valves are used in the reactor primary loop system and play a vital role in the safe operation of the nuclear power plant. China is becoming one of the few countries in the world that has mastered this technology.

Valve Size Insights

The 6" to 25", segment held a significant share of the global hybrid valves market in 2024. This is due to the fact that 6-inch to 25-inch hybrid valves provide efficient control over the flow of fluids, gases, and steam. These valves are also utilized to maintain the flow of oil and gas in pipelines. Hybrid valves of this size are also employed to control the flow of steam and other fluids.

Hybrid Valves Market Companies

- Emerson Electric Company

- Flowserve Corporation

- IMI plc

- CIRCOR International, Inc.

- Carter Process Control GmbH

Recent Developments

- In May 2023, Dymet Alloys attended AlSTech 2023, an iron and steel technology conference. The symposium offered insight into the engineering and technological know-how required by steel producers, suppliers, and consultants.

- In April 2022, Emerson added a new three-way Series 090 valve design to its ASCOTM Series 090 range of micro solenoid valves, enabling lighter, better space-efficient alternatives for gas regulation in oxygen treatment, pressure therapy, and gas meter devices.

- In May 2022, Emerson introduced the TopWorxTM DX PST with HART 7. The units provided valuable valve data and diagnostic information, enabling the digital transformation of process applications. The new DX PST integrated seamlessly with existing valves and control systems, giving operators access to critical valve data, trends, and diagnostics used to predict and schedule maintenance.

- In April 2022, Eaton Corporation expanded its business categories across Europe, including vehicle groups and e-mobility. The purpose of this expansion was to establish a new research facility and office in Karlsruhe, Germany. This development will expand the existing engineering and production capabilities in Tczew, Poland, and Montrottier, France.

Segments Covered in the Report

By Material

- Steel

- Tungsten Carbide

- Duplex Nickel

- Titanium

- Alloy

- Others

By Valve Size

- Up to 1”

- 1” to 6”

- 6” to 25”

- 25” to 50”

- 50” and Larger

By Industry

- Oil & gas

- Energy & Power

- Water & Wastewater

- Building & Construction

- Chemicals

- Pharmaceuticals

- Agriculture

- Metal & Mining

- Paper & Pulp

- Food & Beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting