Ball Valves Market Size and Forecast 2025 to 2034

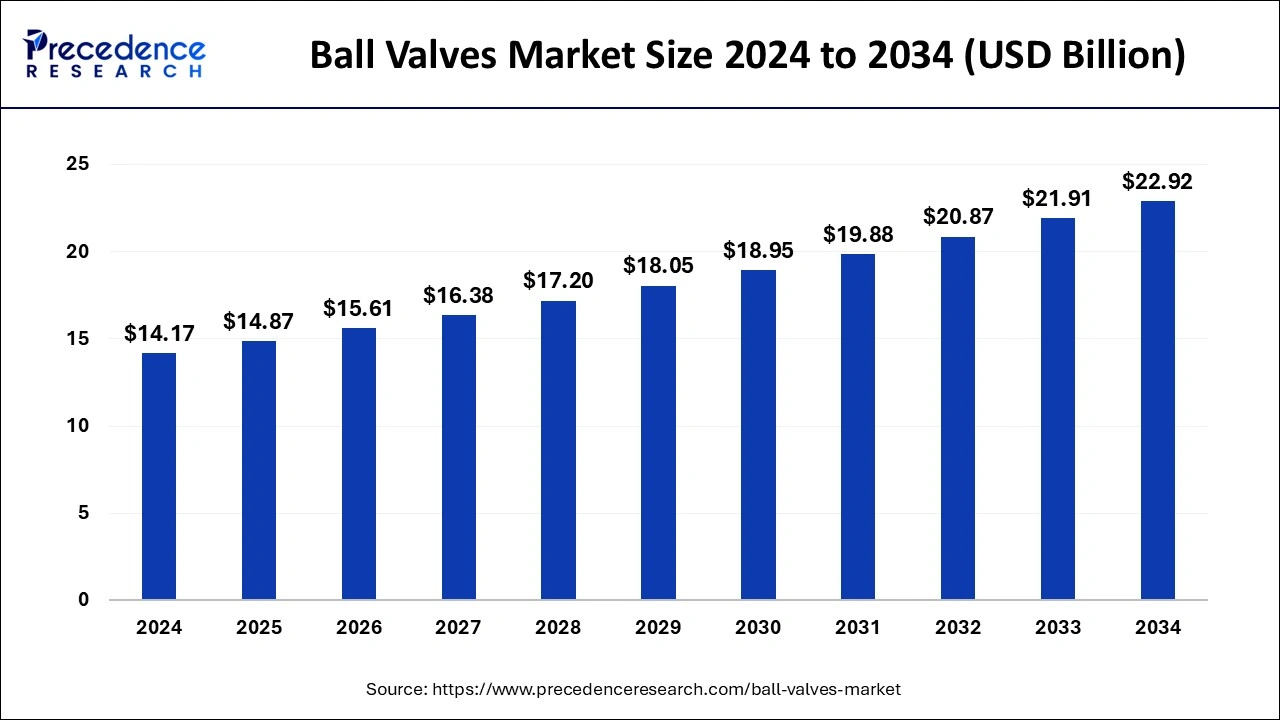

The global ball valves market size was calculated at USD 14.17 billion in 2024 and is predicted to reach around USD 22.92 billion by 2034, expanding at a CAGR of 4.93% from 2025 to 2034. The ball valves market is driven by the increasing demand for reliable flow control systems in industries such as oil & gas, water treatment, and chemical processing.

Ball Valves Market Key Takeaways

- The global ball valves market was valued at USD 14.17 billion in 2024.

- It is projected to reach USD 22.92 billion by 2034.

- The ball valves market is expected to grow at a CAGR of 4.93% from 2025 to 2034.

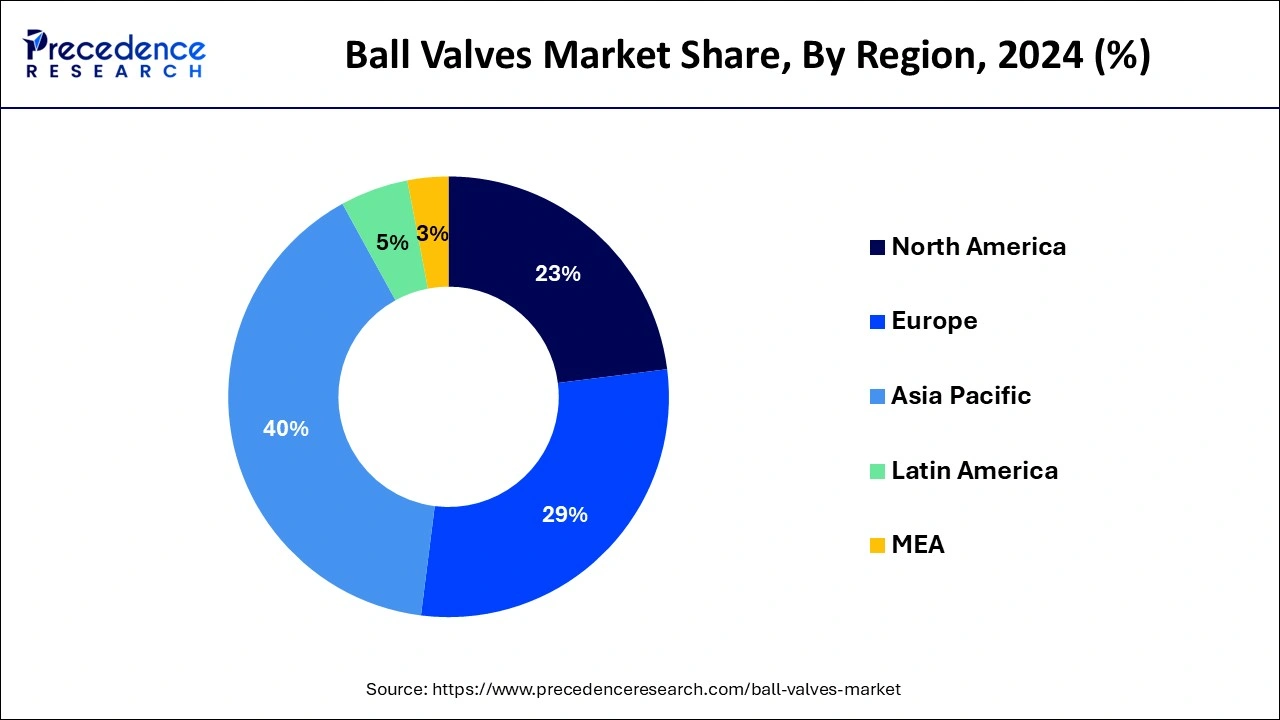

- Asia Pacific has held the largest share of 40% in 2024.

- Europe region is projected to grow at the fastest CAGR of 5.70% between 2025 and 2034.

- By material, the stainless steel segment has contributed the highest market share of 38% in 2024.

- By material, the alloy-based segment is anticipated to grow at a significant CAGR of 5.80% during the projected period.

- By type, the floating segment has held the major market share of 49% in 2024.

- By type, the trunnion mounted segment is projected to expand at a significant CAGR of 5.54% over the projected period.

- By size, the 1"–5" segment has accounted more than 32% of market share in 2024.

- By industry, the pharmaceutical segment has recorded the highest market share of 29% in 2024.

- By industry, the pulp & paper segment is expected to expand at the fastest CAGR of 6.88% during the projected period.

Integration of AI in the ball valves industry

Artificial intelligence can offer valuable assistance in selecting the right valve and features for specific applications using expert systems trained by experts (SMEs) from various backgrounds in the valve industry, including contractors, subcontractors, manufacturers, and users. This ensures that customers receive informed recommendations tailored to their needs and that deviations are properly justified.

Asia Pacific Ball Valves MarketSize and Growth 2025 to 2034

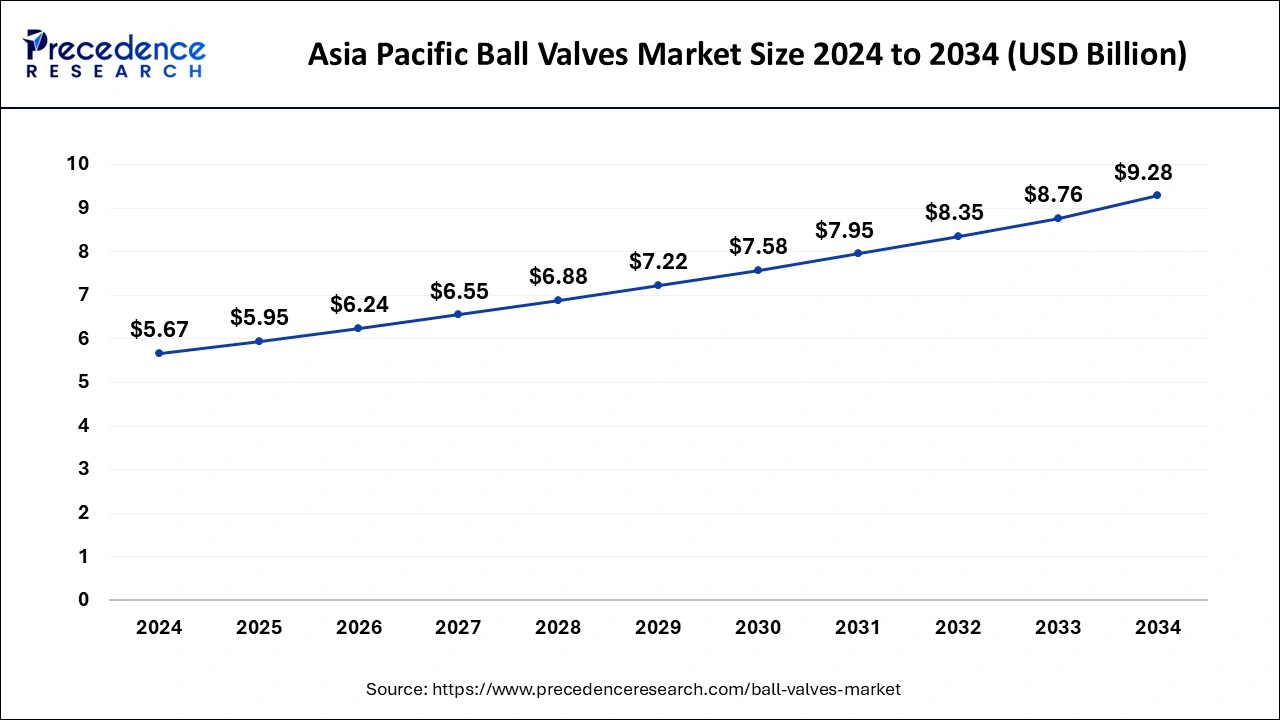

The Asia Pacific ball valves market size was evaluated at USD 5.67 billion in 2024 and is projected to be worth around USD 9.28 billion by 2034, growing at a CAGR of 5.05% from 2025 to 2034.

Asia Pacific emerged as the dominating region in the ball valves market share of 40% in 2024, capturing the largest market share of 40%. Rapid urbanization and population growth, particularly in countries like India and China, have fueled the demand for ball valves across various industries such as oil and gas, chemical, water treatment, and power generation. The need for reliable and efficient flow control solutions in these industries has led to a significant uptake of ball valves. Moreover, favorable government policies aimed at promoting industrial growth have further boosted the demand for these valves. Additionally, the presence of major players in the ball valves market and increasing investment in infrastructure development projects have contributed to the market's growth in the region.

Europe region is estimated to expand the fastest CAGR of 5.70% between 2025 and 2034 in the ball valves market. There has been a notable expansion in long-term nuclear and fusion research programs, leading to a surge in demand for specialized components like ball valves used in high-precision fluid control applications. The construction of new particle accelerator projects has also bolstered the demand for these valves. Europe's strong presence of leading research institutions and a highly skilled workforce in the field of physics further drives the demand for ball valves. Moreover, the region's growing investment in research and development, coupled with a focus on innovation and technological advancement, continues to propel the market for ball valves in Europe.

Market Overview

The ball valves market revolves around the production and distribution of components used in various industries to regulate the flow of fluids such as gases, liquids, fluidized solids, or slurries. Its operation involves opening, closing, or partially obstructing passages to control the flow of fluids through a pipeline or system. While formally categorized as valve fittings, ball valves are commonly referred to simply as valves.

The design of a ball valve typically consists of a spherical closure element with a bore through its center. This sphere, often made of metal, plastic, or ceramic material, rotates within a housing to either allow or block the flow of fluid. When the valve is open, the fluid flows freely through the bore, and when closed, the sphere obstructs the passage, preventing the flow of fluid. Ball valves find applications across a wide spectrum of industries and processes.

In industrial settings, they are used for regulating fluid flow in pipelines, controlling processes, and managing pressure levels. They are also commonly employed in household appliances such as dishwashers, laundry washers, and faucets to control water flow.

Moreover, ball valves play a crucial role in irrigation systems, allowing precise control over the distribution of water to fields and crops. In the transportation industry, they are utilized in pipelines for the transportation of oil, gas, and other fluids. Additionally, ball valves are integral components in defense applications, ensuring the efficient operation of various systems and processes. Their versatility, reliability, and durability make ball valves indispensable in numerous industrial, commercial, and residential settings, offering efficient fluid control and management solutions across diverse applications. Whether in controlling the flow of liquids in a household faucet or managing critical processes in industrial plants, ball valves play a vital role in ensuring smooth and efficient operations.

Ball Valves Market Growth Factors

- The global push toward industrialization, particularly in emerging economies, is fueling the demand for ball valves. These valves are integral components in industrial processes across sectors such as oil and gas, chemical, water and wastewater treatment, pharmaceuticals, and power generation.

- With growing concerns about water scarcity and pollution, there's a heightened focus on efficient water and wastewater management. Ball valves play a crucial role in regulating and controlling the flow of water and wastewater in treatment plants, pipelines, and distribution systems.

- The expansion of oil and gas exploration and production activities worldwide is driving the demand for ball valves used in drilling operations, pipelines, refineries, and petrochemical plants. Ball valves are preferred for their reliability, durability, and ability to handle high-pressure and high-temperature conditions. These factors promote the expansion of the ball valves market.

- Stringent regulatory standards related to industrial safety, environmental protection, and product quality are driving the adoption of high-quality ball valves that meet industry standards and certifications. This includes compliance with standards set by organizations such as the American Petroleum Institute (API), American Society of Mechanical Engineers (ASME), and International Organization for Standardization (ISO).

- Ongoing technological advancements, including the development of smart valves and automation technologies, are enhancing the efficiency, reliability, and performance of ball valves. These innovations enable remote monitoring, predictive maintenance, and optimization of valve operations, leading to increased adoption in various industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.87 Billion |

| Market Size by 2034 | USD 22.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.93% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Type, Size, and Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing industry demands for safety and improved product quality

The aging infrastructure in key industries, such as oil & gas and water and wastewater treatment, poses significant challenges, particularly in countries like the United States with extensive networks of outdated pipelines. Many valves, including ball valves, utilized in this aging infrastructure, have exceeded their operational lifespan. Consequently, the replacement of these outdated valves becomes imperative for enhancing performance, ensuring safety, and addressing maintenance concerns. This demand for the replacement or upgrade of old infrastructure is a driving force behind the increasing need for new and technologically advanced ball valves.

End-users in these industries are increasingly prioritizing the adoption of highly reliable, integrated, and cutting-edge solutions to overcome maintenance issues associated with aging infrastructure. With a history of over 40 years in process industries, ball valves, being subject to wear and tear, are being systematically replaced with new, customized valves that meet specific requirements such as material, size, and other critical factors for applications in these industries.

Moreover, the ball valves market is incorporating advanced technologies into its offerings, with a significant focus on the development of smart valves. Smart valves offer numerous advantages to end-users, particularly in scenarios where the manual operation of a large number of valves across extensive utility networks is impractical and costly. Traditional manual operation is not only inefficient but also prone to inaccuracies. Hence, smart valves empower operators to have precise control over the flow of a pipe network remotely. This capability holds substantial value for utility companies, factories, housing estates, mining operations, and irrigation systems, providing efficient and accurate control over processes.

Recognizing the potential of smart valves, various valve manufacturers are actively investing in research and development activities to enhance and integrate smart technologies into their valve offerings, thereby contributing to the modernization and efficiency of critical industrial and residential applications. The trend toward smart valves is set to revolutionize how industries manage and control fluid flow within their systems, ushering in a new era of reliability, efficiency, and remote operability.

Restraint

High costs associated with raw materials

The manufacturing cost of ball valves is intricately linked to a multitude of factors, foremost among them being the cost of raw materials. The selection of materials, which often includes stainless steel, brass, and exotic alloys, significantly influences manufacturing expenses. The fluctuating prices of these materials are subject to global supply and demand dynamics, geopolitical events, and changes in energy costs.

Moreover, stringent quality standards and environmental regulations further add to manufacturing costs as compliance necessitates additional investments in quality control processes and environmentally friendly production methods. Labor costs, which vary based on geographical location and prevailing wage rates, also contribute to the overall manufacturing expenses. Additionally, transportation expenses incurred during the procurement of raw materials and distribution of finished products further impact the cost structure. Thereby, the cost factor acts as a restraint for the ball valves market.

Customization requirements, particularly in industrial settings where unique specifications are common, can also drive up manufacturing costs. In response to these cost pressures, manufacturers often explore various cost-saving measures such as optimizing production processes, adopting lean manufacturing principles, and leveraging economies of scale through bulk purchasing agreements. Strategic sourcing practices and supply chain optimization efforts are also employed to mitigate the impact of volatile raw material prices and fluctuating market conditions. Overall, a comprehensive understanding of these cost drivers is essential for manufacturers to remain competitive in the global ball valve market.

Opportunity

Utilizing 3D printing technology in the production of valves

The integration of 3D printing technology into research and development (R&D) activities and production processes has revolutionized the manufacturing landscape, offering numerous advantages that traditional methods struggle to match. One of the most significant benefits of 3D printing is its ability to expedite the design iteration and prototyping phases of product development. Traditional prototyping methods often involve lengthy lead times and high costs associated with tooling and setup. In contrast, 3D printing enables manufacturers to quickly produce prototypes directly from digital designs, reducing time-to-market and overall development costs. This rapid prototyping capability allows for faster response to customer inquiries and facilitates iterative testing and refinement of product designs.

Moreover, 3D printing offers unparalleled design flexibility, allowing manufacturers to create complex geometries and intricate structures that would be challenging or impossible to produce using conventional manufacturing techniques. This capability enhances product performance and functionality, particularly in applications where precision and customization are critical.

A notable example of the application of 3D printing in valve manufacturing is Metso's development of valves with 3D-printed parts at its Helsinki plant. By leveraging 3D printing technology to fabricate metal components, Metso was able to enhance the performance of its valves, enabling them to withstand demanding applications that require frequent open-close cycles without maintenance.

As 3D printing continues to advance and become more widely adopted across industries, manufacturers can expect to see further innovations in valve design and production, ultimately driving improvements in performance, efficiency, and overall product quality.

Material Insights

The stainless steel segment held the highest market share of 38% based on the material in 2024. Stainless steel ball valves dominated the ball valves market due to their exceptional durability, corrosion resistance, and versatility. These qualities make them indispensable across a wide range of industries including oil & gas, chemicals, and water treatment. The reliability and consistent performance of stainless steel ball valves have led to a surge in demand worldwide, solidifying their position as essential components in critical applications across diverse sectors. Their ability to withstand harsh operating conditions and maintain performance over extended periods has cemented their status as the preferred choice for fluid control solutions globally.

The alloy-based segment is anticipated to witness rapid growth at a significant CAGR of 5.80% during the projected period. The growth of alloy-based ball valves in the ball valves market is driven by their superior mechanical properties, including high strength, corrosion resistance, and temperature tolerance. These valves offer enhanced performance and reliability in demanding applications across industries such as oil & gas, petrochemicals, and pharmaceuticals. With the increasing focus on operational efficiency and durability, alloy-based ball valves are gaining traction as preferred solutions for critical fluid control systems. Their ability to withstand extreme conditions and provide long-term performance makes them increasingly sought after, driving their adoption and contributing to the overall growth of the ball valves market.

Type Insights

The floating segment has held a 49% market share in 2024. Floating ball valves are widely preferred in the ball valves market due to their versatility and effectiveness in controlling fluid flow across various industries. Their design, featuring a floating ball between two seats within the valve body, enables precise regulation of fluid flow by rotating the ball to either allow or block the passage of fluids. With applications ranging from oil and gas to petrochemicals, water treatment, and HVAC systems, floating ball valves offer reliable performance and efficient fluid control solutions. Their robust construction and ability to withstand high-pressure environments make them indispensable components in modern industrial processes, driving their significant market share.

The trunnion mounted segment is anticipated to witness significant growth of 5.54% over the projected period. Trunnion mounted ball valves have witnessed significant growth owing to their robust construction and exceptional performance in high-pressure environments prevalent in industries like oil and gas, petrochemicals, and power generation. Their design features a trunnion mechanism that supports the ball, ensuring stable operation even under extreme pressure conditions. With superior sealing capabilities and resilience, these valves provide efficient fluid control while minimizing the risk of leaks, making them ideal for critical applications. As a result, trunnion mounted ball valves have become increasingly favored across various sectors where reliable performance and safety are paramount concerns, driving their substantial market growth.

Size Insights

The 1"–5" segment has held a 32% market share in 2024 and is expected to witness highest CAGR in the forecast period. The 1"–5" segment remains at the forefront of the ball valves industry, a trend expected to persist in the forecast period. This segment is preferred due to the widespread manufacture of ball valves falling within this size range. The selection of valves within this diameter range is driven by several factors, including flow pressure, noise considerations, type of media being handled, and vibration levels in the application environment. Given the versatility and adaptability of ball valves within this size range, they continue to be the preferred choice across various industries, further solidifying the dominance of the 1"–5" segment in the market.

Industry Insights

The pharmaceutical segment held the highest market share at 29%. The pharmaceutical industry relies heavily on the ball valves market for precise fluid flow control, essential for critical operations. Ball valves play integral roles in processes like mixing, blending, and transferring liquids and gases within pharmaceutical facilities. Stainless steel ball valves are favored due to their corrosion resistance and ability to uphold product purity. Moreover, sanitary ball valves, meeting rigorous industry standards, ensure adherence to strict hygiene and cleanliness requirements. These valves are indispensable for maintaining the integrity of pharmaceutical products, safeguarding against contamination, and facilitating efficient operations essential for the production of high-quality pharmaceuticals.

The pulp & paper segment is anticipated to witness rapid growth at a significant CAGR of 6.88% during the projected period. In the Pulp & Paper sector, ball valves are indispensable components known for their robustness and resistance to corrosive environments inherent in pulp processing. These valves play a pivotal role in ensuring reliable and uninterrupted production by withstanding the harsh chemicals and high pressures involved in pulp manufacturing processes. Their ability to prevent leaks and maintain operational efficiency is critical for minimizing downtime and optimizing productivity. As the industry focuses on enhancing efficiency and embracing innovation, ball valves continue to be integral, facilitating sustainable growth and enabling the sector to adapt to evolving operational requirements effectively.

Recent Developments

- In December 2024, Salvalco declared it would extend its Eco-Valve family further with its Eco-Inverted ball valve. Designed specifically for use with inert gas propellants such as nitrogen, the new valve will deliver all the great benefits of Eco-Valve, including superior performance while minimizing environmental impact.

- In February 2024, The Neles XH metal seated ball valve is designed for safety, high cycle shut off, and throttling services with high-pressure differentials. It aims at various industries, like chemical and petrochemical plants, power plants, natural gas, hydrocarbons, oil and gas refining, polymers, catalyst handling, high-temperature services, and more.

Ball Valves Market Companies

- Emerson Electric Co. (United States)

- Cameron, a Schlumberger company (United States)

- Flowserve Corporation (United States)

- Kitz Corporation (Japan)

- Crane Co. (United States)

- KSB SE & Co. KGaA (Germany)

- Velan Inc. (Canada)

- Swagelok Company (United States)

- IMI plc (United Kingdom)

- Spirax-Sarco Engineering plc (United Kingdom)

- Watts Water Technologies, Inc. (United States)

- Parker Hannifin Corporation (United States)

- Bonney Forge Corporation (United States)

- AVK Holding A/S (Denmark)

- Apollo Valves (United States)

Segments Covered in the Report

By Material

- Cast Iron

- Stainless Steel

- Alloy-based

- Others

By Type

- Trunnion-mounted

- Floating

- Rising Stem

By Size

- <1”

- 1” − 5”

- 6” – 24"

- 25” – 50”

- >50”

By Industry

- Oil & Gas

- Energy & Power

- Water & Wastewater Treatment

- Chemicals

- Pharmaceuticals

- Building & Construction

- Food & Beverages

- Metals & Mining

- Pulp & Paper

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting