Hybrid Fabrics Market Size adn Forecast 2025 to 2034

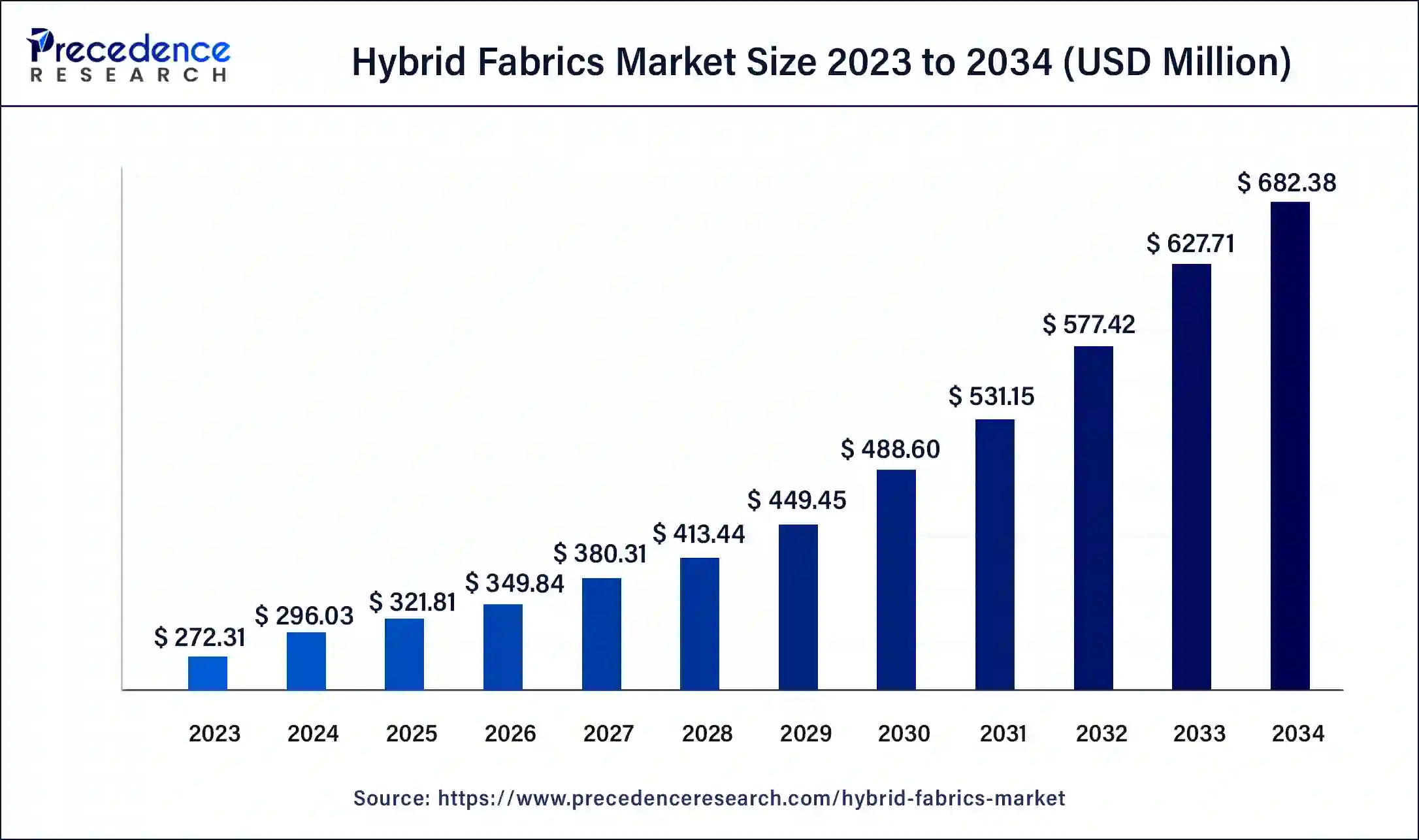

The global hybrid fabrics market size was evaluated at USD 296.03 million in 2024 and is anticipated to reach around USD 682.38 million by 2034, growing at a solid CAGR of 8.71% over the forecast period 2025 to 2034. The rise in inclination toward hybrid fabrics due to stringent Government regulations is the key factor driving the hybrid fabrics market growth.

Hybrid Fabrics Market Key Takeaways

- The global hybrid fabrics market was valued at USD 296.03 million in 2024.

- It is projected to reach USD 682.38 million by 2034.

- The hybrid fabrics market is expected to grow at a CAGR of 8.71% from 2025 to 2034.

- Europe dominated the global hybrid fabrics market in 2024.

- North America is expected to show the fastest growth in the market throughout the projected period.

- By fiber type, the glass/carbon segment dominated the market in 2024.

- By fiber type, the glass/aramid segment is expected to grow at the fastest rate in the market over the forecast period.

- By application, the aerospace & defense segment led the market in 2024.

- By application, the automotive segment is anticipated to grow at the fastest rate in the market during the forecast period.

How is AI Changing the Hybrid Fabrics Market?

AI significantly impacts the hybrid fabrics market through the innovative discovery and design of new materials. Unlike traditional methods, which often involve slow and labor-intensive trial-and-error processes, machine learning algorithms can expedite material development. These algorithms enable rapid exploration of wide material design spaces, efficiently identifying promising candidates based on specific performance criteria and desired properties. High-throughput virtual screening involves evaluating millions of potential material compositions and structures quickly through computational models. By utilizing advanced algorithms and powerful computing capabilities, researchers can simulate and predict material properties before physical synthesis.

Market Overview

Hybrid fabrics are created by blending various types of fibers to achieve unique properties and performance benefits. These fabrics find applications in diverse sectors such as automotive, aerospace, military, marine, and other industrial fields. Known for their ability to reduce overall product weight while surpassing the strength of metals and conventional fabrics, hybrid fabrics are distinguished by their exceptional technical features. The hybrid fabrics market offers high strength, durability, and outstanding resistance to heat, flames, and chemicals. Additionally, their lightweight nature and improved toughness make them highly versatile, leading to their widespread use in industries like wind energy, aerospace, defense, and sports.

Hybrid Fabrics Market Growth Factors

- Rising demand for lightweight materials is expected to fuel the hybrid fabrics market growth soon.

- Increasing demand for high-performance products can drive market growth further.

- Innovation in product design, along with the cost-effectiveness of materials, can boost the hybrid fabrics market growth shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 682.38 Million |

| Market Size in 2025 | USD 321.81 Million |

| Market Size in 2024 | USD 296.03 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.71% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rise in applications in automotive and aircraft

In the automotive and aerospace sectors, hybrid fabrics are employed to enhance fuel efficiency and speed. The hybrid fabrics market contributes to a reduction in vehicle weight by 40-60% and bolsters compressive strength. In aerospace and defense applications, hybrid fabrics often include combinations of carbon, glass, aramid, and epoxy fibers. Moreover, these materials are particularly effective for high-temperature environments, helping to decrease the weight of aircraft and hence improve fuel efficiency.

- In November 2023, Manjushree Spntek Introduced the Hightex Hybrid Spunmelt Nonwoven. Designed with the world's first Reicofil smart composite line from Reifenhäuser Reicofil and A.Celli's advanced resin-treatment technology (SFT), these multi-layer composite nonwovens offer the protection and ultimate comfort that surgeons and nurses seek.

Restraint

Supply chain problems

Complex supply chains can lead to shortages, price volatility, and production delays, all of which may impede the hybrid fabrics market growth. This issue is particularly relevant for advanced polymers and specialized fibers utilized in hybrid fabrics. Additionally, ensuring consistent performance and quality across different batches of hybrid fabrics can be challenging. Variations in performance could lead to concerns among end users, which potentially decreases the adoption rates and undermines confidence in the products.

Opportunity

Rising focus on sustainability

A key trend in the hybrid fabrics market is the growing focus on sustainability. As environmental concerns become more prevalent, both consumers and businesses are increasingly favoring eco-friendly materials. Hybrid fabrics present an opportunity to integrate recycled fibers, organic cotton, and other sustainable components into their production. This trend supports the global shift toward more sustainable industry practices and appeals to consumers who prioritize products with a minimal ecological footprint. Additionally, recent advancements in textile technology have led to the creation of hybrid fabrics with improved properties.

- In July 2023, Epson launched the SureColor F2270 Textile Printer for DTG, DTFilm Market. The SureColor F2270 is a hybrid printer that allows transfer to a wider variety of materials, including uniquely shaped items.

Fiber Type Insights

The glass/carbon segment dominated the hybrid fabrics market in 2024. Carbon-glass hybrid fabrics combine carbon fiber, known for its high tensile strength and stiffness, with glass fiber to lower overall costs and reduce fabric density. These fabrics exhibit superior tensile and compressive strength compared to other carbon/epoxy hybrids. The inclusion of glass fiber, which is less prone to failure than carbon fiber, enhances the strain resistance of hybrid fabric. Moreover, Increased glass fiber content allows the fabric to endure higher strain levels before the low-elongation carbon fibers fail, making these hybrid materials ideal for use in the automotive and aerospace sectors.

The glass/aramid segment is expected to grow at the fastest rate in the hybrid fabrics market over the forecast period. Aramid fibers, composed of aromatic polyamide with over 85% amide bonds directly linked to two aryl groups, offer several key benefits. These fibers are lightweight, high-strength, and high-modulus, and they exhibit impressive resistance to high temperatures and corrosion. The growing preference for lightweight materials in transportation and marine applications is anticipated to boost the demand for glass-aramid hybrid fabrics.

- In December 2022, Saertex will expand global production network capacities for technical textile manufacture. Saertex reorganizes and invests in its 12 global facilities for producing multiaxial NCFs made of glass, carbon, aramid, and natural fibers to supply wind power, mobility, and industrial markets.

Application Insight

The aerospace & defense segment led the hybrid fabrics market in 2024. The aerospace and defense sectors are major consumers of hybrid fabrics due to their need for materials that combine high strength, durability, and lightweight properties. Hybrid textiles are commonly used in the construction of aircraft components such as wings, fuselage, and engine parts. These materials offer several advantages, including enhanced fuel efficiency, reduced emissions, and improved safety. Furthermore, hybrid fabrics are designed to endure corrosion, abrasion, and impact, which makes them ideal for challenging Environments.

The automotive segment is anticipated to grow at the fastest rate in the hybrid fabrics market during the forecast period. This can be attributed to the growing demand for electric vehicles, the emphasis on utilizing lightweight materials for enhanced fuel efficiency, and the increasing implementation of advanced safety features are all expected to drive revenue growth. Hybrid fabrics are used in the manufacturing of body panels and chassis components and in the production of interior elements such as automobile seats, door panels, and other upholstered items. These materials offer numerous benefits, including a superior strength-to-weight ratio, improved impact resistance, and greater design versatility.

Regional Insights

Europe dominated the global hybrid fabrics market in 2024. The European market includes countries such as the UK, Germany, France, Spain, Italy, and other European nations. The demand for hybrid fabrics in Europe is largely fueled by the presence of major global players like Gurit Holding AG DSM, Solvay SA, SGL Group, and Kordcarbon AS. The substantial number of hybrid fabric manufacturers providing a diverse array of products significantly impacts market demand. Furthermore, the European Commission's increasing focus on reducing greenhouse gas emissions is expected to drive growth in the market for lightweight hybrid fabrics used in the automotive industry.

- In January 2022, Solvay announced the acquisition of European Carbon Fiber GmbH, a German-based company specializing in the production of high-quality carbon fiber products. This acquisition is aimed at expanding Solvay's carbon fiber Composites portfolio and strengthening its position in the global hybrid fabrics market.

North America is expected to show the fastest growth in the hybrid fabrics market throughout the projected period. The demand for hybrid textiles in this region is projected to grow due to the presence of leading industry players and the increasing need for advanced, high-performance materials across various sectors. Specifically, the aerospace and defense industries are expected to drive demand due to their requirement for durable, lightweight materials. The automotive sector's rising demand for fuel-efficient and eco-friendly vehicles is likely to contribute to the increased need for hybrid fabrics. The construction industry is also experiencing a boost in activity, which is stimulating the demand for hybrid fabrics in this region.

India fabric export 2021-22 the percentages and shares

| Fabric Type | Exports 2021-22 | Share (%) |

| Cotton Woven | 2,453 | 49% |

| Synthetic Woven | 1,582 | 31% |

| Other Woven | 1,015 | 20% |

| Woven Fabric | 5,050 | 86% |

| Knitted Fabric | 850 | 14% |

| Total Fabric | 5,900 |

Hybrid Fabrics Market Companies

- Hexcel Corporation

- Toray Industries, Inc.

- Solvay SA

- Huntsman Corporation

- SGL Carbon SE

- Teijin Limited

- Owens Corning

- Mitsubishi Chemical Corporation

- Kolon Industries, Inc.

- Kermel

Recent Developments

- In January 2024, as part of its growing company-wide sustainability goals, McDonald's announced its investment in new sustainable team uniforms. The new crew uniforms will be made with CiClo technology, which allows synthetic materials like polyester to biodegrade at similar rates to natural fibers, such as wool.

- In January 2024, Lenzing, the Tencel lyocell manufacturer, unveiled a new process that allows wood-based fiber to create fabrics with stretch and recovery properties. The fossil-free process involves re-engineering woven fabric composed of Tencel fiber and a fabric pre-treatment while maintaining its closed-loop production and traceability.

- In December 2023, researchers made an advancement in textile technology, drawing inspiration from the structure of polar bear fur. The team, led by Mingrui Wu, developed a novel aerogel fiber characterized by its exceptional thermal and mechanical properties.

- In November 2022, to maintain its position as a world leader, Solvay announced plans to restart work on its 600 kT soda ash capacity expansion in Green River, Wyoming, USA. The start of production is anticipated for the end of 2024, just in time to meet the expanding demand from customers for a reliable source of supply that is also affordable.

Segments Covered in the Report

By Fiber Type

- Glass/Carbon

- Carbon/UHMWPE

- Glass/Aramid

- Carbon/Aramid

- Others

By Application

- Automotive

- Aerospace & Defense

- Wind energy

- Sports & Recreational Equipment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting