Smart Fabrics Market Size and Forecast 2025 to 2034

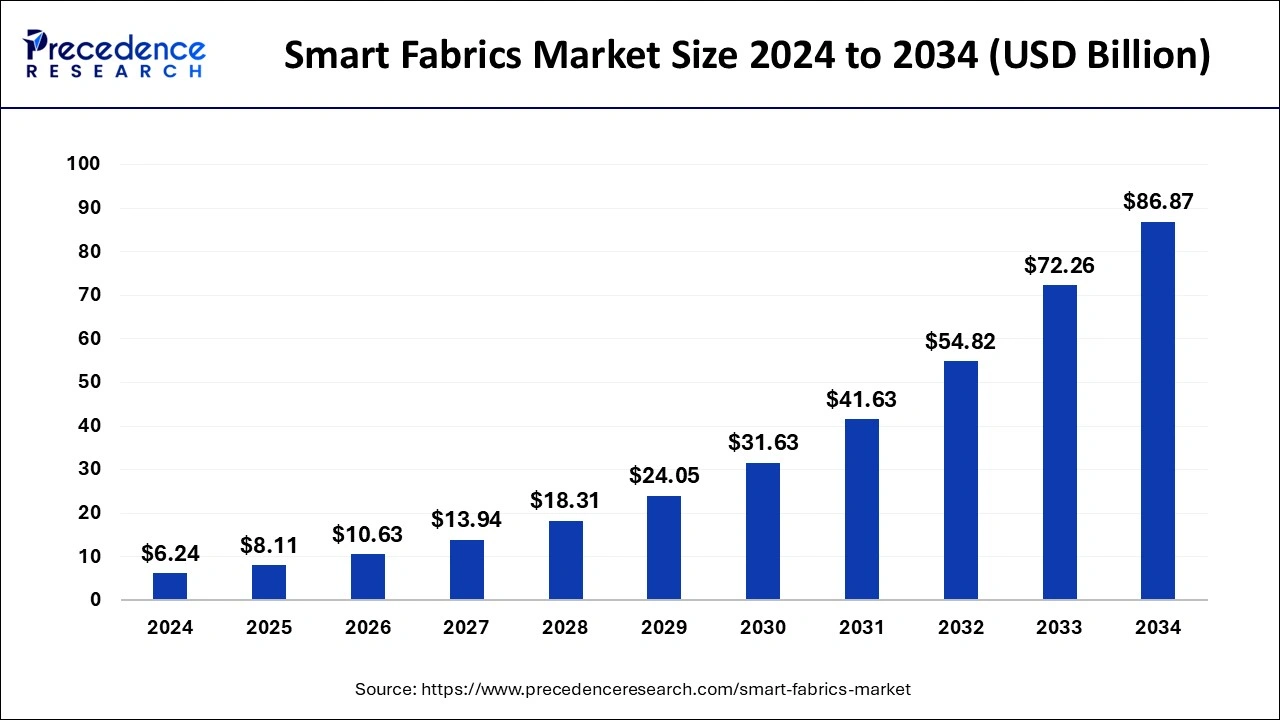

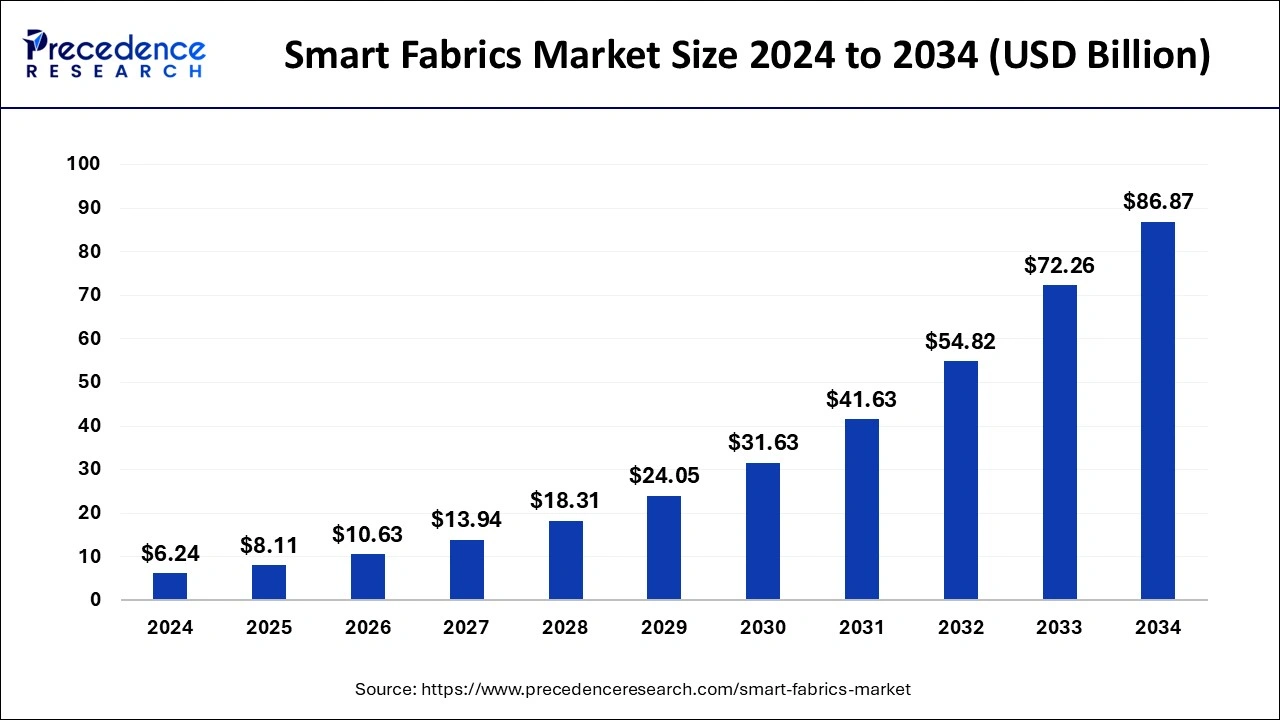

The global smart fabrics market size is accounted at USD 8.11 billion in 2025 and predicted to increase from USD 10.63 billion in 2026 to approximately USD 86.87 billion by 2034, expanding at a CAGR of 30.13% from 2025 to 2034.

Smart Fabrics MarketKey Takeaways

- In terms of revenue, the global smart fabrics market was valued at USD 6.24 billion in 2024.

- It is projected to reach USD 86.87 billion by 2034.

- The market is expected to grow at a CAGR of 30.13% from 2025 to 2034.

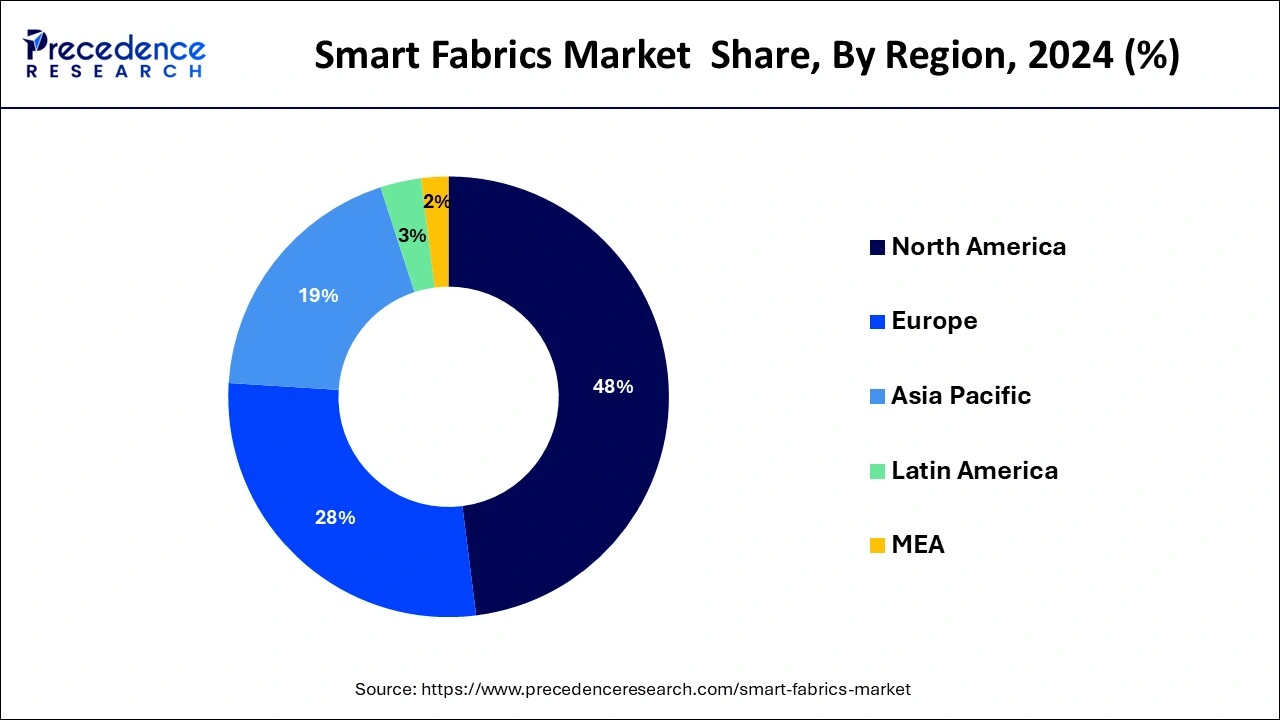

- North America held the dominating share of the market while contributing 48% of the market share in 2024.

- Asia Pacific is observed to grow at a CAGR of 38.4% during the forecast period of 2025-2034.

- By product, the active segment held the largest share of the market while contributing 44% market share in 2024.

- By product, the very smart product segment is expected to witness the fastest growth at a CAGR of 38.2% during the forecast period.

- By function, the sensing segment held the largest share of 38% in 2024 for the smart fabrics market.

- By function, the energy harvesting segment is expected to witness the fastest growth at a CAGR of 32.9% during the forecast period.

- By end user, the defense & military segment held the largest share of 29% in 2024.

- On the other hand, the sports & fitness segment is expected to witness rapid growth at a CAGR of 34.8% during the forecast period of 2025-2034.

Market Overview

A textile is traditionally defined as an object created through the weaving of threads or yarns into fabric, typically made from natural fibers derived from plants or animals. However, with advancements in technology, textiles have evolved beyond traditional forms. Laboratory manufacturing has led to the production of textiles that are stronger and more versatile than their natural counterparts.

In contemporary times, textiles are not limited to conventional materials, as innovative technologies have introduced new possibilities. Modern textiles incorporate thin fibers that can transmit data, creating a seamless integration with digital communication devices. This technological integration has given rise to the smart fabrics market, where computer-based technology is woven into the fabric itself. As a result, textiles are no longer just passive materials but have become dynamic, interactive components that can serve various functions beyond their conventional roles.

Smart Fabrics Market Data and Statistics

- In July 2022, researchers at MIT achieved a breakthrough in smart fabric technology by developing fabrics that dynamically adapt to the wearer's body, sensing their position and actions. This innovation was made possible through an advanced production process. The team improved the precision of pressure sensors integrated into multilayered knit textiles, known as 3DKnITS, by incorporating a specific type of plastic yarn and applying a technique called thermoforming. This methodology was employed to create "smart" footwear and mats. Subsequently, a comprehensive hardware and software system was devised to capture and analyze real-time data from the pressure sensors. Impressively, the machine-learning algorithm achieved an accuracy rate of approximately 95%, successfully predicting the movements and yoga positions of individuals standing on the smart fabric mat.

- Several prominent brands, including Under Armour, Levi's, and Tommy Hilfiger, as well as smaller companies like Sensora, Loomia, Hexoskin, and CuteCircuit, are at the forefront of offering smart clothing that incorporates smart fabrics, setting their collections apart. For instance, CuteCircuit utilizes smart fabrics in its haute couture collections and special projects. The 'Hug Shirt' by CuteCircuit enables users to send electronic hugs through sensors embedded in the garment. Additionally, the French startup Spinali Design specializes in high-end beachwear with integrated ultraviolet light sensors that notify wearers when it's time to apply sunscreen. Their designs also feature distance trackers, alerting parents when their kids have ventured too close to the water. These innovations showcase the diverse applications of smart fabrics in the fashion industry.

Smart Fabrics MarketGrowth Factors

- The smart fabrics market is propelled by the increased adoption of semiconductors for broadband-enabled devices and applications. The growing demand for consumer electronics devices, coupled with the expansion of the wearable electronics industry, contributes significantly to market growth.

- Continuous technological advancements in smart fabrics, characterized by lower power consumption, serve as a catalyst for market expansion. The technology's rising popularity, driven by added convenience, increased productivity, and enhanced reliability and quality, positively impacts the market.

- The applications of the Internet of Things (IoT), encompassing smart homes, smart cities, Machine-to-Machine (M2M) communications, and Industrial IoT (IIoT), among others, further drive market growth. The integration of smart fabrics into IoT ecosystems enhances their capabilities and widens their range of applications across various sectors.

Recent Trends

Rise of Wearable Health Monitoring:

Smart textiles with sensors to track movement, body temperature, and heart rate are becoming increasingly popular in the sports and healthcare industries. Through real-time feedback, these fabrics are assisting users in identifying early indicators of health problems and enhancing athletic performance. Growing consumer interest in wellness technologies and preventive healthcare supports this trend.

Integration of IoT and AI:

Smart fabrics are increasingly connected to mobile and cloud platforms for real-time data processing and analytics. This integration allows for personalized insights and remote monitoring, making smart clothing more interactive and functional. It also opens opportunities for AI-driven predictive health and fitness management. Machine learning algorithms analyze continuous data streams from embedded sensors to identify health risks earlier and provide tailored recommendations. This convergence of technologies transforms clothing from a passive necessity into an active participant in managing overall well-being.

Focus on Sustainability:

To support green initiatives, manufacturers are creating smart textiles that are recyclable, eco-friendly, and energy-efficient. Low-impact dyeing techniques, solar-powered sensors, and biodegradable fibers are all becoming more and more popular. Brands and consumers who care about the environment are drawn to this move toward sustainable innovation. The integration of closed-loop supply chains minimizes waste from production, ensuring that materials are repurposed effectively. This focus on circularity not only meets consumer demand but also addresses regulatory pressures concerning environmental impact within the textiles industry.

Market Outlook

- Industry Growth Overview: As textiles and electronics combine to create clothing and materials that can sense, react, or communicate, the market for smart fabrics is growing quickly. Additional uses are developing, ranging from fashion and military equipment to sportswear and healthcare. Demand for wearable technology smart apparel for biometric surveillance and textiles that improve user performance or comfort are the driving forces.

- Sustainability Trends: Smart fabric manufacturers are incorporating recycled materials bio bio-based fibers, and low-impact coatings in addition to embracing supply chain transparency to achieve sustainability that goes beyond standard textile eco-efforts. Simultaneously, smart fabric features like temperature control, energy harvesting, or embedded sensing help minimize waste and resource consumption by using materials more wisely, requiring fewer replacements and producing goods more effectively.

- Startups Ecosystem: Fabric sensors, energy harvesting textiles, fabrics with embedded electronics for health tracking, and adaptive clothing for sports or defense are all being developed by new companies and technology partners in the thriving startup and innovation ecosystem surrounding smart fabrics. To get a solution closer to production, these companies frequently collaborate with electronic experts or textile producers. Adoption still depends on scaling economically, guaranteeing durability, and conforming to safer or regulatory requirements.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 30.13% |

| Market Size in 2025 | USD 8.11 Billion |

| Market Size in 2026 | USD 10.63 Billion |

| Market Size by 2034 | USD 86.87 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Function, and By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advance technologies in smart fabrics

The textile industry has undergone a transformation with the advent of new technologies, particularly artificial intelligence (AI) and the Internet of Things (IoT). Smart apparel is now being manufactured, incorporating AI, Bluetooth Low Energy (BLE), edge computing, and cloud data, enabling the monitoring and communication of the wearer's vital information such as blood pressure, heart rate, perspiration, and temperature. AI plays a crucial role in accessing and collecting historical and real-time operational data, providing insights that enhance the wearer's efficiency.

In textile manufacturing, AI applications include defect detection, pattern inspection, and color matching. The integration of AI enables the production of smart apparel that leverages IoT and electronic sensors, creating an enhanced user experience. This technological integration not only ensures comfort but also focuses on health-related features. Smart fabrics, covering a significant portion of the body, can potentially provide various types of physiological information. Additionally, smart fabrics rely on BLE and IoT technologies for a durable energy source from embedded batteries.

Additionally, the development of clothes and fabrics equipped with groundbreaking technology, capable of monitoring every movement and facilitating the recycling and reuse of textiles, is anticipated to be a key driver for the market in the forecast period. Technological advancements in the wireless and electronics segment have led to the miniaturization and integration of electronic components into conductive textiles, fostering market growth.

The increasing integration of Bluetooth Low Energy (BLE) technology, offering features like low power consumption and multi-vendor interoperability, will also contribute to market expansion. Attires equipped with BLE technology have the ability to sense, feel, and transmit data, provided the device is connected to the internet. The growing popularity of sophisticated gadgets with advanced functionalities, including sensing and reacting to the surroundings, is expected to propel the market. These fabrics incorporate components such as actuators, controllers, and sensor units for effective operation, making them valuable for protection and safety in applications like consumer wear and military attire.

Restraint

Lack of standards and regulations

The lack of standardized regulations poses a significant obstacle to market growth, making it challenging for smart fabric manufacturers to scale up and commercialize new technologies. The production processes involved in smart fabrics can result in environmental and health hazards. Operations such as de-sizing, bleaching, dyeing, neutralizing, scouring, mercerizing, printing, and finishing in the textile industry generate high-level toxic effluents, contributing to soil contamination and air, groundwater, and surface water pollution. Establishing environmental standards becomes crucial to control and mitigate the pollution caused by the textile and leather industries. The implementation of robust standards and regulations is essential to ensure the sustainable and responsible production of smart fabrics.

Opportunity

Growing demand for soundproof transportation

The contemporary trend of individuals owning multiple mobile devices, including smartphones and tablets, has spurred the demand for compact devices that can integrate computing and monitoring functions into a single device. This trend creates opportunities for the development of multi-function and hybrid smart fabrics, providing users with convenience and convergence in wearable devices. Researchers from the National University of Singapore (NUS) exemplify this by incorporating conductive textiles into clothing, establishing a wireless body sensor network. This network enables several wearable devices to dynamically connect at once, transmitting data with signals 1,000 times stronger than conventional technologies. The application of such smart fabrics extends to human-machine interfaces, health monitoring, and medical interventions.

The development of multi-featured and hybrid smart fabrics is a notable trend in the smart fabrics market. With the increasing prevalence of individuals owning multiple mobile devices such as smartphones and tablets, there is a growing demand for compact and integrated solutions that can consolidate various computing and monitoring functions into a single device. Hybrid smart fabrics leverage advanced technologies to seamlessly integrate multiple functions, providing users with convenience and versatility.

- For instance, researchers from institutions like the National University of Singapore (NUS) are incorporating conductive textiles into clothing to create a wireless body sensor network. This innovation enables dynamic connectivity between several wearable devices simultaneously, resulting in more efficient data transmission.

The applications of multi-featured and hybrid smart fabrics span various sectors, including human-machine interfaces, health monitoring, and medical interventions. This trend reflects the industry's efforts to meet the evolving needs of consumers for integrated and technologically advanced wearable solutions.

Product Insights

The active segment led the market with a 44% market share in 2024. The smart fabrics market exhibits distinct segments, each catering to specific applications and functionalities. The active segment, encompassing sports and fitness-related fabrics, such as workout clothing, sports bras, fitness bands, and running shoes, commands the largest market share. Smart fabrics in this category provide performance-enhancing features such as moisture-wicking, temperature regulation, and compression, contributing to improved athletic performance and comfort during physical activities.

The very smart product segment is poised to experience the fastest CAGR of 38.2% in the forecast period of 2025-2034. This growth is attributed to continuous advancements in sensor technology, conductive materials, and the miniaturization of electronic components integrated into smart fabrics.

While, passive smart fabrics, which can sense the user's movement and environment, are expected to undergo significant expansion. These fabrics offer functionalities at a lower price point and are less complex than other variants. The very smart fabric, characterized by its ability to sense, react, and adapt based on given circumstances, aligns with principles of artificial intelligence (AI). Its capability to effectively respond to life-threatening situations or maintain high comfort levels during extreme environmental changes is anticipated to drive its growth.

Function Insights

The sensing segment dominated the smart fabrics market with a 38% share in 2024, underlining its crucial role as the primary attribute of smart garments. Sensing fabrics are equipped with sensors capable of detecting and measuring various physical attributes like temperature, pressure, moisture, and movement. These fabrics find applications in sports and fitness monitoring, healthcare, and military sectors.

The energy harvesting segment is anticipated to exhibit the fastest CAGR of 32.9% during the forecast period. Fabrics in this category are designed to capture and store energy from the surrounding environment, such as solar or kinetic energy. The stored energy can then be utilized to power electronic devices or sensors integrated into the fabric, enhancing the fabric's functional capabilities.

End Users Insights

The defense & military segment dominated the smart fabrics market with a 29% market share in 2024. This sector is actively exploring the use of smart fabrics for various applications, including soldier protection systems, body monitoring, and communication. The lightweight and flexible nature of smart fabrics makes them well-suited for defense and military applications, where mobility and comfort are critical. Integrating these fabrics with electronic components provides a lightweight alternative to traditional garments with heavy batteries. Warrior systems are expected to incorporate wireless weapons, chemical and biological threat detectors, heads-up displays, global positioning systems (GPS), and battery power to enhance safety.

The sports & fitness segment is projected to witness substantial growth at a CAGR of 34.8% during the forecast period. Smart fabrics, capable of reacting to mechanical, thermal, magnetic, chemical, and electrical stimuli, are employed in advanced electronic devices like fitness watches and belts for real-time health and body vitals monitoring. Additionally, smart fabrics are utilized in medical applications to accelerate recovery times. The increasing global population's demand for improved healthcare and medical facilities contributes to the market's growth in this segment.

Regional Insights

U.S.Smart Fabrics Market Size and Growth 2025 to 2034

The U.S. smart fabrics market size is valued at USD 2.74 billion in 2025 and is anticipated to reach around USD 30.17 billion by 2034, poised to grow at a CAGR of 30.54% from 2025 to 2034.

North America dominated the smart fabrics market, holding the largest share of 48% in 2024, and is projected to be the fastest-growing region market. The region is home to several prominent companies operating in the smart fabric industry, which contribute to the market's growth by developing, manufacturing, and marketing smart fabric-based products. The presence of established players fosters product innovation and market competitiveness. North America boasts a robust technological infrastructure and expertise, facilitating advancements in smart fabric technologies.

Asia Pacific is also expected to witness steady growth at a CAGR of 38.4% during the forecast period. The region benefits from the availability of low-cost raw materials and labor in countries like China, Japan, and India, establishing it as a manufacturing hub for smart fabric technology. This trend has resulted in a decline in overall smart fabric production in the European region. However, the European Union's sponsorship of an increasing number of R&D activities for intelligent fabrics within programs like EU FP6 and FP7 is revitalizing the industry in European countries.

Smart Fabrics Market Companies

- AiQ Smart Clothing (Taiwan)

- Clothing Plus Ltd. (U.K.)

- DuPont (U.S.)

- Google (U.S.)

- GENTHERM (U.S.)

- Interactive Wear (Germany)

- schoeller Switzerland (Switzerland)

- Sensoria (U.S.)

- Textronics (U.S.)

- Company Check Ltd (U.K.)

- International Fashion Machines (U.S.)

- Vista Medical (U.S.)

- Nike, Inc (U.S.)

- O'NEILL (U.S.)

- Wearable Technologies Limited (U.K.)

- Thermosoft International Corporation (U.S.)

- Fibretronics Sales (Pty) Ltd (South Africa)

- Peratech Holdco Limited (U.K.)

- Bonfiglioli (Italy)

- APEX MILLS (U.S.)

- H.B. Fuller Company (U.S.)

Recent Developments

- In April 2023, a groundbreaking development took place in the UK as researchers achieved the creation of the world's first smart fabric that can change its shape and color in response to two specific stimuli: heat and electricity. This innovative fabric utilizes stimuli-responsive materials (SRMs) that react to external factors such as light, temperature, magnetic fields, or electricity, leading to alterations in molecular composition, mechanical properties, or shape. This breakthrough opens up possibilities in various domains, including virtual reality and robotics, showcasing the potential for advancements in responsive textiles.

- In February 2023 when researchers at Finland's Aalto University and the University of Cambridge collaborated to develop responsive smart fabrics that can change their shape in response to temperature fluctuations. These textiles offer customizable aesthetics and hold promise for applications such as monitoring health, improving thermal insulation, and providing tools for controlling room acoustics and design.

- In July 2022, Adidas collaborated with Spinnova to launch the Adidas TERREX HS, the first knitted item incorporating Spinnova technology. This mid-layer hiking hoodie utilizes a fabric composition with at least 30% wood-based SPINNOVA fibers and 70% organic cotton. SPINNOVA fibers are derived from wood pulp, providing a sustainable and innovative approach to manufacturing textiles. This collaboration reflects Adidas' commitment to using sustainable materials and advancing manufacturing processes.

-

In April 2024, DuPont announced a breakthrough in conductive fiber technology and a new line of durable, flexible smart fabrics designed to withstand industrial washing processes.

https://www.globenewswire.com

Segments Covered in the Report

By Product

- Passive Smart

- Active Smart

- Very Smart

By Function

- Sensing

- Energy Harvesting

- Luminescence and Aesthetics

- Thermo-Electricity

- Others

By End Users

- Fashion & Entertainment

- Sports & Fitness

- Medical

- Transportation

- Defense & Military

- Architecture

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting