What is the Hydrochloric Acid Market Size?

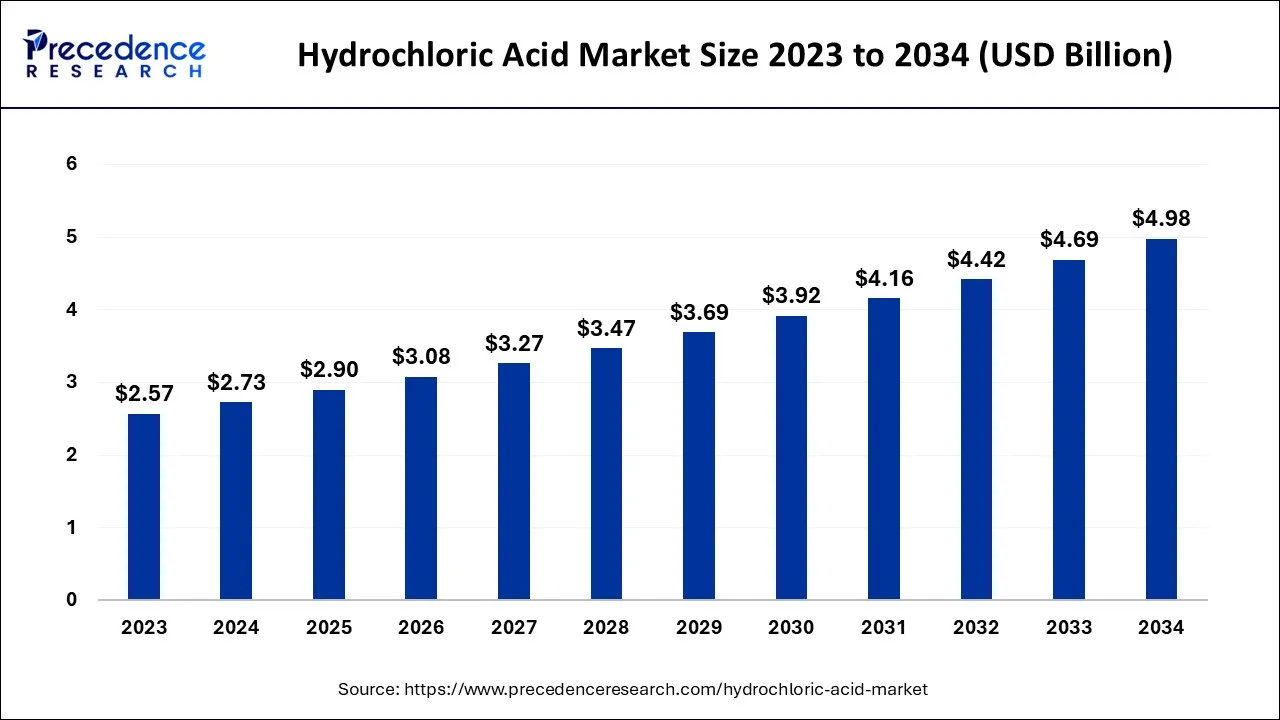

The global hydrochloric acid market size is calculated at USD 2.90 billion in 2025 and is predicted to increase from USD 3.08 billion in 2026 to approximately USD 5.26 billion by 2035, expanding at a CAGR of6.14% from 2026 to 2035.

Hydrochloric Acid Market Key Takeaways

- North America is predicted to capture the largest market share from 2026 to 2035.

- Asia Pacific region is expected to expand at the fastest CAGR from 2026 to 2035.

- By Grade, the synthetic grade segment held the largest market share in 2025.

- By Application, the steel pickling segment is projected to capture the biggest revenue share from 2026 to 2035.

What is Hydrochloric Acid?

A strong, colorless mineral acid with various industrial applications, hydrochloric acid (HCl, also known as muriatic acid) interacts with an organic base to generate a hydrochloride salt. Historically, rock salt and green vitriol were used to make hydrochloric acid. Later, common salt (NaCl) and sulfuric acid, which have a similar chemical makeup, were used. In the large-scale production of vinyl chloride for PVC plastic and polyurethane, the chemical industry uses hydrochloric acid as a chemical reagent. Acid hydrochloride is a multifunctional chemical.

Other industrial uses for hydrometallurgical processing of metals include the creation of alumina and/or titanium dioxide, the creation of hydrogen, the activation of petroleum wells, various cleaning/etching processes, including metal cleaning (such as steel pickling), and the cleaning of finished brickwork by masons. HCL is widely used as a bleaching agent to neutralize alkaline substance in various industries including metal, food, textile and others. The hydrochloric acid market is driven by the increasing demand from various end-use industries such as food & beverages, textile, water and wastewater and others, increasing technological advancements, the increasing demand for HCL in steel production and the growing collaboration among the key players operating in these industries.

According to the European Steel Association AISBL (EUROFER), 153 million tonnes of finished steel are produced annually on average by the EU steel sector. Additionally, this industry supports up to 2.27 million indirect jobs in addition to 310,000 direct jobs.

The value of all pharmaceutical sales in Canada from 2011 to 2019 (including non-patented over-the-counter drugs) climbed by 35.3% to $29.9 billion, with 86.7% going to retail pharmacy shops and 13.3% going to hospitals, according to the 2019 PMPRB Annual Report. Governments pay for 37.2% of the cost of drugs, with private payers covering theremaining 62.8%.

How is AI contributing to the Hydrochloric Acid Industry?

AI has a big role in the hydrochloric acid industry because it makes drug discovery for stomach acid disorders faster, predicts compound effectiveness and toxicity, optimizes industrial absorption and recovery processes, recycles from waste streams, and improves quality control systems. Moreover, AI remains a partner for the safe and environmentally responsible operations of the pharmaceutical and industrial chemical processing sectors.

Market Outlook

- Industry Growth Overview: There are still strong demands from steel manufacturing, chemical processing, and water treatment applications around the world.

- Sustainability Trends: Acid recycling, energy efficiency, and emissions reduction have become the principal aspects around which manufacturers design their production processes.

- Global Expansion: The Asia-Pacific region is the fastest-growing market because the industrial expansion taking place in the manufacturing and infrastructure sectors drives the growth.

- Major Investors: The main global players are Olin Corporation, Westlake Chemical, BASF SE, Solvay, OxyChem, and INEOS Group, among others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.90 Billion |

| Market Size in 2026 | USD 3.08 Billion |

| Market Size by 2035 | USD 5.26 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.14% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Grade, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing demand for HCL from water and wastewater treatment

The market for hydrochloric acid is anticipated to develop in the future due to the rising demand for water and wastewater treatment. The process of enhancing water quality for final usage is referred to as water and wastewater treatment. Because of its capacity to neutralize, hydrochloric acid is an excellent choice for applications involving water treatment, and as a result, demand for this chemical is rising.

According to the United Nations, an intergovernmental body with headquarters in New York, 56% of home wastewater flows were safely treated globally in 2020 as of August. By 2030, it is anticipated that wastewater treatment and acceleration will meet a goal.

The objective is to monitor the percentage of entire industrial and domestic wastewater flows that have been safely treated by local or national regulations. As a result of the rising need for water and wastewater treatment, the hydrochloric acid industry is growing.

Restraints

Adverse impact on health

HCl denatures proteins and alters the pH in the immediate area. This causes tissue necrosis and the production of edema. Coagulation necrosis caused by HCl is characterized by the development of an eschar. The esophagus and stomach may become damaged as a result of ingested HCl. Pylorospasm-induced pooling of HCl in the antrum has been linked to subsequent gastric injury. Patients who survive HCl ingestions could develop strictures, gastric atony, and obstruction of the gastric outlet. HCl usually builds up and harms the upper respiratory tract when it is breathed. Concentrated HCl can reach the alveoli and bronchioles and harm them from there. Thus, the adverse impact on health might hamper the market growth over the forecast period.

Opportunities

Increasing demand from various end-use industry

The increasing demand for hydrochloric acid from various end-use industries including food & beverages, pharmaceutical and others is expected to provide a potential opportunity for market growth over the forecast period. The symbol E507 is used to identify hydrochloric acid in the food sector. It is an acidity regulator, which implies that adjusting or maintaining pH is its main function. Breweries and confectioneries utilize hydrochloric acid primarily, but it is also frequently present in baby food, homogenized and cottage cheese, spice blends, and syrup. In the pharmaceutical sector, it is employed in the chemical production of numerous medicines' active components, including ascorbic acid and para-aminobenzoic acid. Hydrochloric acid also regulates the pH of eye moisturizing drops. Thus, these type of application in the food and pharmaceutical sector is expected to offer an attractive opportunity for market expansion.

Segment Insights

Grade Insights

Based on the grade, the global hydrochloric acid market is segmented into synthetic grade and by-product grade. The synthetic grade segment held a substantial market share and is expected to continue the same pattern during the forecast period. Aqueous hydrogen chloride solutions make up synthetic hydrochloric acid. Synthetic grade HCL is widely used in various applications including pH adjustment and neutralization as a base of food and industrial chemicals. As a result, demand for this particular variety of hydrochloric acid is increasing. These are used in a variety of sectors because it is readily available and less expensive, in turn, driving the segment growth during the forecast period.

The by-product grade segment is expected to grow exponentially during the forecast period. The growth in the segment is primarily attributed to the several application in various sectors including oils, and lubricants, mining (ore extraction) as well as refinement procedures.

Application Insights

Based on the application, the global hydrochloric acid market is divided into steel pickling, oil well acidizing, ore processing, food processing, pool sanitation, calcium chloride, biodiesel, and others. Steel pickling is expected to capture the largest revenue share over the forecast period. Steel demand is being influenced by the building sector's rapid expansion worldwide. Hydrochloric acid is usually included in the pickling solution. Large-scale continuous treatment techniques including wire pickling, metal stripping, and the regeneration of depleted pickling solutions are advantages of using hydrochloric acid. These factors, which are anticipated to fuel this segment's revenue growth, lead to an increase in the use of hydrochloric acid due to the increased demand for steel globally. Another factor supporting the expansion of the steel industry is the increased demand for steel-based products in the construction sector, which also raises the need for hydrochloric acid for pickling steel.

Regional Insights

How is the Opportunistic Growth of Asia Pacific in the Hydrochloric Acid Market?

Asia Pacific is expected to grow at the fastest CAGR in the market, due to rapid industrialization, expanding steel and chemical manufacturing, and rising infrastructure development. Increasing pharmaceutical production, water treatment activities, and strong demand from food processing industries, supported by cost-efficient manufacturing and growing investments in China, India, and Southeast Asia, are further accelerating market expansion. Additionally, the region benefits from low production costs, abundant raw material availability, and a strong manufacturing base, positioning Asia Pacific as a key hub for hydrochloric acid production and consumption.

India Market Analysis

India's hydrochloric acid market is expanding, as the chemical, textile, and metal-processing industries increase production. Rising domestic capacity, adoption of efficient recovery technologies, and growth in specialty chemicals, along with higher demand from laboratories and industrial applications, are driving market growth. Additionally, increasing exports of HCl-dependent products and investment in modern industrial facilities support expansion.

North America is expected to capture the largest market share during the forecast period. The growth of hydrochloric acid in the region is derived from the increasing pharmaceutical business. It is used in the pharmaceutical industry to produce a variety of medicines' active ingredients, such as ascorbic acid and para-aminobenzoic acid, chemically. Additionally, hydrochloric acid controls the pH of ocular lubricant drops. Moreover, the growing food and processing industry in the countries like Canada and US is expected to provide lucrative opportunities for market expansion in the region.

U.S. Hydrochloric Acid Market Trends

The U.S. is the main consumer of hydrochloric acid due to its massive steel production, oil and gas exploration, and chemical manufacturing activities. Besides, the market is supported by the expansion of domestic capacity, technological advancements, and investments from major producers focusing on efficiency, safety, and sustainable industrial chemical processing.

What Are the Driving Factors of The Hydrochloric Acid Market in Europe?

Europe's hydrochloric acid market is significant and is characterized by stringent environmental regulations and sustainability issues. Demand comes from sectors such as chemical processing, metallurgical treatment, and high-purity applications, which are increasingly emphasizing acid recovery systems, eco-friendly production methods, and compliance with evolving environmental standards.

Germany Hydrochloric Acid Market Trends

Germany is the largest market for hydrochloric acid in Europe owing to its sophisticated chemical, metal processing, and industrial manufacturing sectors. Its focus on innovative production technologies, efficient recovery systems, and strict environmental compliance ensures a stable demand across industrial, pharmaceutical, and specialty chemical applications.

Hydrochloric Acid Market-Value Chain Analysis

- Quality Testing and Certification: After the completion of the market release, products are analyzed to check if they are safe, pure, and in compliance with strict quality standards.

Key Players: SGS, Bureau Veritas - Packaging and Labelling: The packaging of hydrochloric acid is done in such a way that the acid is completely safe, and the handling, safety, and regulatory information is put on it for transportation.

Key Players: Greif, Mauser Packaging Solutions - Distribution to Industrial Users: A full range of activities is involved in the movement of hydrochloric acid from the factory to industrial customers and hospitals, including storage, transportation, and delivery.

Key Players: Univar Solutions (now part of Brenntag), Brenntag SE - Compound Formulation and Blending: Hydrochloric acid is produced by dissolving hydrogen chloride gas in water, with blending for tailored industrial and commercial applications.

Key Players: BASF, Occidental Petroleum, Olin Corporation, Gujarat Alkalies & Chemicals, Solvay, Shriram Alkali Chemicals, Dow Chemicals. - Waste Management and Recycling: Hydrochloric acid waste is managed via neutralization, recycling, or advanced recovery methods, ensuring safe handling, storage, and regulatory compliance.

Key Players: Solvay, Gujarat Alkalies & Chemicals, Shriram Alkali Chemicals, Nouryon, Occidental Petroleum, Olin Corporation

Hydrochloric Acid MarketCompanies

- BASF SE: The company is a global producer of hydrochloric acid that not only supplies it to various industries but also invests in the modernization of its facilities to increase its production capacity.

- AGC Chemicals: The company is a worldwide producer of hydrochloric acid, which is a major product within the integrated chlor-alkali value chains.

- Coogee Chemicals: The company sells acid from chlor-alkali plants for mining, water treatment, and other industrial uses.

- Olin Corporation – Major producer of industrial HCl via chlor alkali operations, offering burner-grade hydrochloric acid for steel pickling, oil well acidizing, water treatment, and chemical synthesis globally.

- Detrex Corporation – Supplies ultra pure and high purity hydrochloric acid grades for pharmaceutical, food & beverage, semiconductor, lab reagent, and industrial applications, meeting strict regulatory and quality standards.

- Dongyue Group – Manufactures hydrochloric acid as part of its diversified chemical portfolio, serving water treatment, industrial processing, and chemical production needs worldwide.

- Ercros SA – Produces hydrochloric acid alongside other chlor-alkali products, supplying industrial chemicals for metal processing, water treatment, and diverse manufacturing sectors.

- ERCO Worldwide – Offers industrial-grade hydrochloric acid with reliable specifications and safety standards for water treatment, food processing, oil & gas, and steel picking applications.

- Inovyn (INEOS) – Supplies hydrochloric acid through its integrated chlor-alkali and PVC value chain, ensuring consistent industrial supply and supporting chemical and polymer manufacturing.

- Nouryon Industrial Chemicals – Provides essential hydrochloric acid and related chlor-alkali chemicals as part of broad specialty chemical solutions for industrial and processing applications.

- Occidental Petroleum Corporation (OxyChem) – Produces hydrochloric acid via its chemical division, supporting industrial markets like metal cleaning, chemical synthesis, and oil well acidizing with a comprehensive supply.

Other Major Key Players

- Covestro AG

- Vynova Group

- Shin-Etsu Chemical Co., Ltd

- Solvay

- Tessenderlo Group

- TOAGOSEI CO. LTD

- PCC Group

- Westlake Chemical Corporation

- Merck KGaA

Recent Developments

- In May 2025, Iraq's Minister of Industry, Khalid Battal Al-Najm, initiated two major industrial projects in Basra, including the largest chlorine and caustic soda plant. Utilizing eco-friendly technology, it will produce significant chemical quantities daily, supporting water treatment, oil, and industry, while creating local job opportunities. (Source:www.iraqinews.com )

- In October 2020, PVS Chloralkali Inc., a fully owned subsidiary of PVS Chemicals Inc., and Univar Solutions Inc., a global distributor of chemicals and ingredients and provider of value-added services, announced a new agreement under which PVS will transfer railcars in Ohio, Illinois, and Virginia as well as sourcing contracts for Hydrochloric Acid (HCL) to Univar Solutions. Through this partnership, Univar Solution extensive and reliable network for its HCL business in North America would be further expanded.

- In January 2022,the Ludwigshafen Verbund Sites infrastructure, including the facilities for producing acid chlorides and chloroformates, will undergo a significant modernization by BASF. For this, the corporation is investing a low-thirty million euro sum. The measures, which are scheduled to be finished in 2025, will roughly triple the company production capacity at this location. With a current annual capacity of 60,000 metric tons and manufacturing facilities at its locations in manufacturing facilities at its location in Ludwigshafen, Germany, and Yeosu, Korea. BASF is one of the top producers of chloroformates, acid chlorides, and alkali chlorides in the world.

- In February 2022,Hexion Inc. was purchased by Westlake Chemical Corporation, a US-based producer and supplier of petrochemicals, polymers, and building products. Westlake is anticipated to gain from this collaboration by obtaining access to a top downstream range of coatings and composite products, significantly expanding its integrated business. Chemical manufacturer Hexion Inc., with headquarter in the US, creates specialized products, associated technology, and thermosetting polymers that work in hydrochloric acids.

Segments Covered in the Report

By Grade

- Synthetic Grade

- By-Product Grade

By Application

- Steel Pickling

- Oil Well Acidizing

- Ore Processing

- Food Processing

- Pool Sanitation

- Calcium Chloride

- Biodiesel

- Others

By End-use

- Food & Beverages

- Pharmaceuticals

- Textile

- Steel

- Oil & Gas

- Chemical

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting