What is the Immune Health Supplements Market Size?

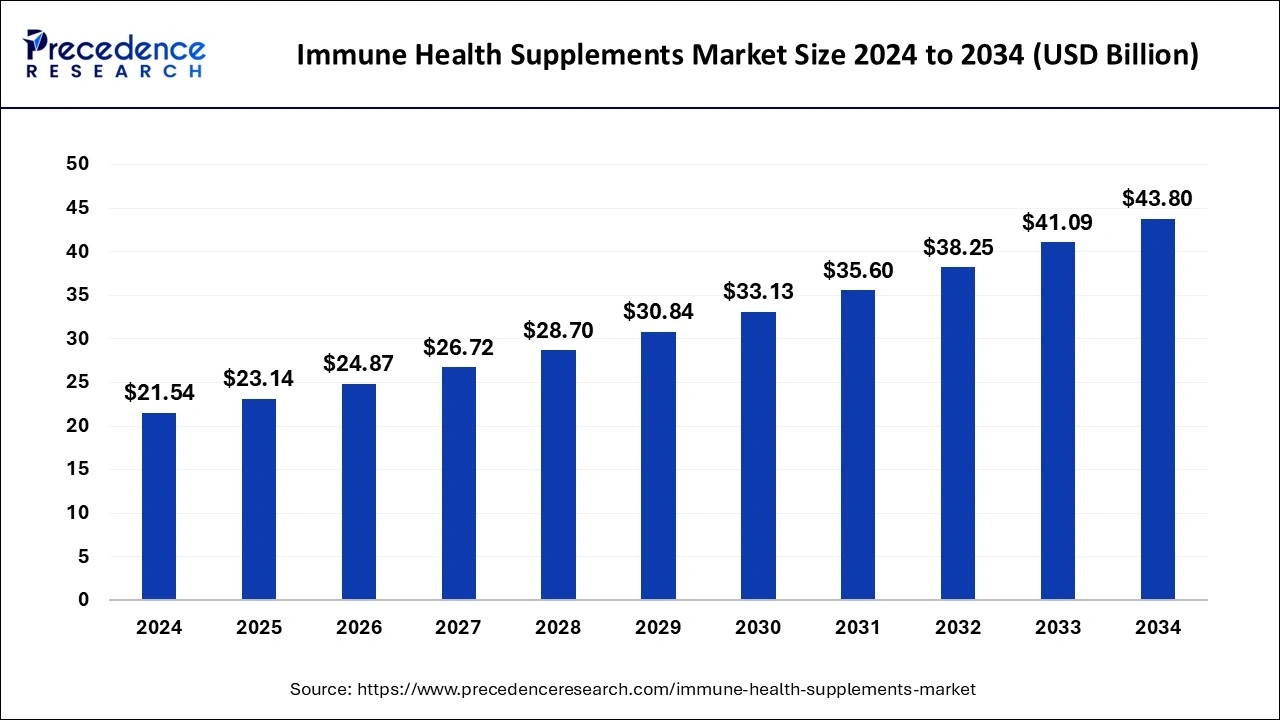

The global immune health supplements market size was estimated at USD 23.14 billion in 2025 and is predicted to increase from USD 24.87 billion in 2026 to approximately USD 46.60 billion by 2035, expanding at a CAGR of 7.25% from 2026 to 2035. Rising lifestyle disorders, fatigue and insufficient absorption of vital nutrition due to the synthetic pesticides causes oxidative stress in the human system has led the dynamics of immune health supplement market further and expand its horizon globally.

Immune Health Supplements Market Key Takeaways

- The global immune health supplements market was valued at USD 23.14billion in 2025.

- It is projected to reach USD 46.60 billion by 2035.

- The market is expected to grow at a CAGR of 7.25% from 2026 to 2035.

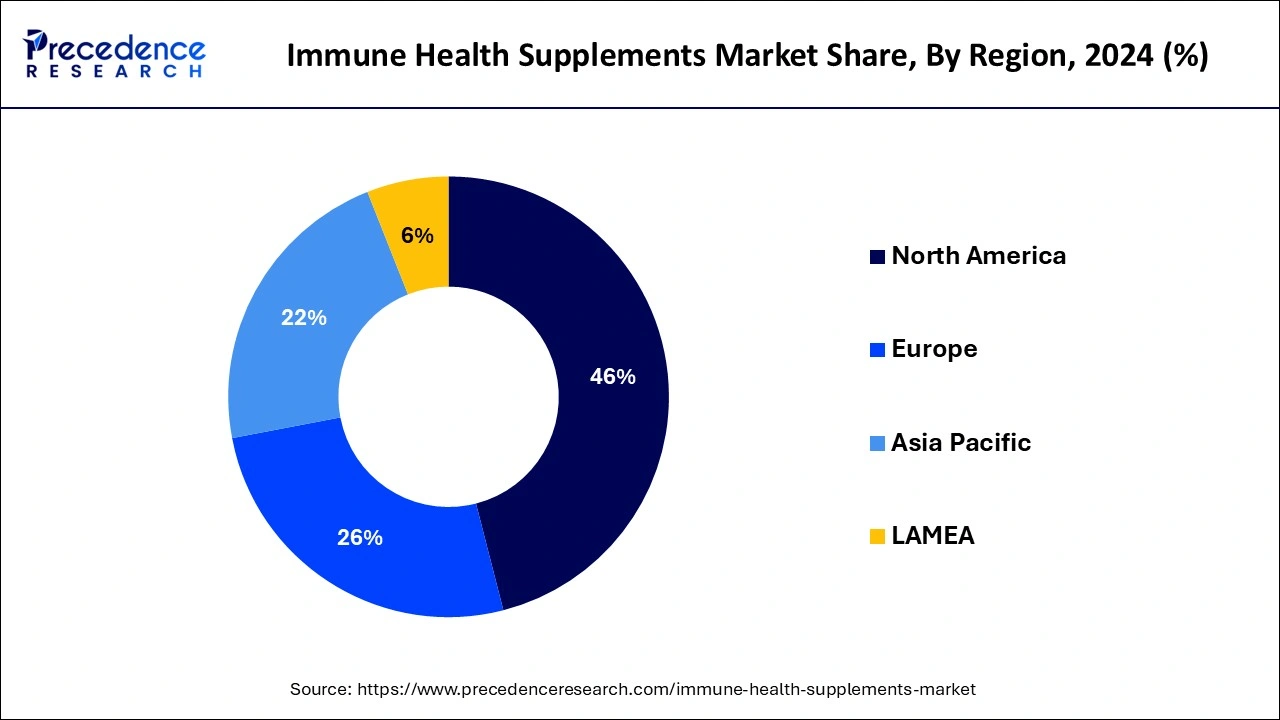

- North America dominated the global market with the largest market share of 46% in 2025.

- Asia Pacific is recognized as one of the fastest-growing regions in the global immune health supplements market.

- By product type, the vitamins and minerals segment held the largest share of the market in 2025.

- By product type, the herbal supplement segment is anticipated to register rising CAGR during the forecasted periods.

- By form, the tablets segment held the largest share of the market in 2025.

- By form, the softgel segment is observed to witness a significant rate of growth during the forecast period.

- By the application, the respiratory tract infection segment has emerged as the dominant force in 2025.

- The gut health segment is poised to become the fastest growing segment during the forecast period.

- By mode of medication, the self-medication segment has captured the largest share in 2025.

- By distribution channel, the pharmacies and drug store segment has emerged as the dominant force in the immune health supplements market.

- The e-commerce segment is expected to experience a notable rate of growth in the immune health supplements market during the forecast period.

What are Immune Health Supplements?

The immune health supplements market continues its upward trajectory, driven by growing consumer awareness of preventive healthcare and a desire for overall wellness. With recent global health concerns, there's heightened interest in bolstering immune systems. The market sees a surge in demand for supplements containing key ingredients like vitamin C, zinc, elderberry, and probiotics, known for their immune-boosting properties.

Companies are innovating with new formulations and delivery methods, catering to diverse consumer preferences, including capsules, gummies, and powders. E-commerce platforms play a pivotal role in expanding market reach, offering convenience and accessibility to a wider audience. Additionally, consumers are increasingly prioritizing transparency and quality, favoring products with natural, science-backed ingredients and third-party certifications.

How is AI contributing to the Immune Health Supplements Industry?

Artificial intelligence allows tailored immune support based on biomarkers, microbiome, genetics, and lifestyle information. It maximizes ingredient interactions, forecasts immune response profiles, tailors suggestions based on time, speeds up formulation studies, and directs companies to specific, data-driven, customized immune nutrition solutions to consumers.

Immune Health Supplements Market Growth Factors

- Increasing consumer awareness of preventive healthcare creates a supportive factor for the market to grow.

- Heightened interest in overall wellness and immune system support.

- Growing concerns about global health issues.

- Surge in demand for immune-boosting ingredients like vitamin C and zinc create a significant driver for the market.

- Innovation in formulations and delivery methods to cater to diverse preferences.

- Expansion of market reach through e-commerce platforms.

- Emphasis on transparency and quality, favouring products with natural, science-backed ingredients.

- Rising adoption of third-party certifications for supplements creates a sustained potential for the market.

- Shift towards personalized nutrition and tailored immune support solutions promotes the expansion of the market.

- Influence of healthcare professionals recommending immune health supplements.

- Growing investment in research and development for novel ingredients and formulations.

Market Outlook

- Industry Growth Overview: The immune health supplements market is empowered by growth supported by preventive healthcare awareness and increased demands of vitamins, botanicals, and functional nutrition.

- Global Expansion: Europe is emerging as a significant player as a result of lifestyle changes and the adoption of traditional medicine.

- Major Investors: Sequoia Capital India, Blume Ventures, Nestle Health Science, and Unilever Ventures are active participants in creating investments and acquisitions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.25% |

| Market Size in 2025 | USD 23.14Billion |

| Market Size by 2035 | USD 46.60Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Form, By Application, By Mode Of Medication, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing emphasis on health and wellness

The increasing awareness towards health stands as a major driver propelling the immune health supplements market forward. In recent years, there has been a significant shift in consumer behaviour towards proactive health management, driven by a heightened awareness of the importance of preventive healthcare measures. Individuals are increasingly seeking ways to bolster their immune systems and overall well-being, spurred by a desire to lead healthier lifestyles and reduce the risk of illness.

This heightened awareness has been further fuelled by various factors, including widespread access to health information through the internet and social media, as well as a growing emphasis on wellness in mainstream media and popular culture. Moreover, recent global health crises have underscored the importance of maintaining a robust immune system to protect against infectious diseases, driving home the message of preventive health measures.

- For instance, according to the research article published in 2022 showed a direct relation between the daily consumption of antioxidant supplements and physical wellbeing. It concluded that, length of illness found shorter and sleep deprivation lower in the group of people had a daily consumption of supplements.

As a result, consumers are actively seeking out immune health supplements as a convenient and effective means of supporting their immune systems. Key ingredients such as vitamin C, zinc, and probiotics are in high demand, as consumers prioritize products that offer tangible health benefits and peace of mind. This trend is expected to continue driving growth in the immune health supplements market, as individuals increasingly prioritize their health and well-being in an ever-changing world.

Restraint

Elevated cost

Although, the immune health supplements market is experiencing robust growth, the high cost associated with these products stands as a significant restraint. Many high-quality supplements containing key immune-boosting ingredients can come with a higher price tag, deterring price-sensitive consumers from purchasing them regularly.

The production and sourcing of premium ingredients, coupled with stringent quality control measures, contribute to the elevated cost of immune health supplements. Additionally, the incorporation of innovative formulations and delivery methods often adds to the overall expenses incurred by manufacturers, further driving up retail prices.

For many consumers, the perceived value of immune health supplements may not always justify the expense, leading them to opt for more affordable alternatives or supplementation altogether. This can pose a challenge for market penetration and growth, particularly in regions where disposable income is limited or where healthcare costs are a concern.

Opportunity

R&D investment

Research and development (R&D) innovation presents a significant opportunity in the immune health supplements market, driving growth, differentiation, and consumer trust. As scientific understanding of immune health evolves there's a growing demand for innovative products that deliver enhanced efficacy, safety, and convenience.

One key aspect of R&D innovation involves the discovery and validation of novel ingredients with potent immune-boosting properties. Researchers are continually exploring botanicals, compounds, and bioactive derived from natural sources that exhibit promising immunomodulatory effects. By identifying and leveraging these ingredients, supplement manufacturers can develop unique formulations that offer distinct advantages over conventional products.

- For instance, in January 2024 Nutriwell launches a new line of immune booster supplement called” ImmunoBoost,” formulated with bioactive compounds which is naturally derived and antioxidants.

Moreover, R&D efforts focus on optimizing delivery systems to enhance the bioavailability and stability of active compounds. Advanced encapsulation technologies, microencapsulation, and nano-emulsion techniques enable targeted delivery of immune-supporting nutrients, ensuring optimal absorption and utilization within the body. This enhances the effectiveness of supplements and improves consumer satisfaction.

Furthermore, R&D drives innovation in formulation design, allowing for the creation of multifunctional products that address diverse aspects of immune health. Therefore, innovation not only fosters product differentiation and competitive advantage but also foster confidence among consumers by demonstrating a commitment to scientific efficacy. As the immune health supplements market continues to evolve, companies that prioritize R&D investment are poised to capitalize on emerging opportunities and drive sustained growth.

Segment Insights

Product Insights

The vitamins and minerals segment dominated the immune health supplements market due to their essential role in supporting the immune system. They include vitamins such as vitamin C, vitamin D, vitamin E, and vitamin A, which are known to boost immune function and help the body fight off infections. For instance, in May 2024, VitalityLife have introduces, a diverse range of flexible dose of personalized vitamins known as, VitaFlex, to make up vitamin deficiencies.

These vitamins and minerals are widely recognized for their ability to enhance immune response, making them popular choices for consumers looking to support their immune health. Additionally, minerals such as zinc and selenium are the building blocks for immune system and they're relatively easy to incorporate into various supplement formulations, making them accessible to a wide range of consumers seeking to bolster their immune defences.

The herbal supplement segment is anticipated to register rising CAGR during the forecasted period. The herbal supplement segment within the immune health market is poised for substantial growth, driven by a surge in demand for natural, plant-based solutions. Consumers are increasingly turning to herbal remedies due to their perceived safety, efficacy, and minimal side effects compared to synthetic alternatives.

Key herbs like mulethi, turmeric and ginger are gaining traction for their immune-boosting properties supported by scientific research. Moreover, traditional herbal remedies from various cultures are being rediscovered and incorporated into modern supplements. With a growing emphasis on holistic health and wellness, the herbal supplement segment is expected to flourish as consumers seek natural ways to support their immune systems.

Form Insights

The tablets segment dominated the global market due to convenience they provide. Tablets are easy to consume, making them a popular choice for consumers who prefer simplicity and portability in their supplements. They can be taken with water anytime, anywhere, without the need for measuring or mixing, which enhances their appeal and accessibility. tablets offer precise dosing, ensuring consistent intake of nutrients with each serving. This reliability is valued by consumers who seek standardized and convenient supplementation.

Additionally, tablets have a longer shelf life compared to some other forms, making them suitable for mass production and distribution, thus contributing to their widespread availability and dominance in the market. for instance, in august 2023, an innovative chewable tablet has been introduced by healthcare company VitaChew. Hence, the convenience, reliability, and versatility of tablets position them as the leading form in the global immune health supplement market.

The softgel segment is emerging as a rapid growth area within the immune health supplements market, driven by several factors. Softgel capsules offer several advantages over traditional pill forms, including easier swallowing, faster absorption, and enhanced bioavailability of nutrients. Consumers are increasingly drawn to softgels for their convenience and perceived effectiveness, in turn dominating the global immune health supplements market.

Application Insights

The respiratory tract infection segment has emerged as the dominant force. This prominence is fuelled by the increasing prevalence of respiratory illnesses worldwide, including colds, flu, and other infections. Consumers are prioritizing proactive measures to support respiratory health, especially in light of recent global health concerns. Supplements targeting this segment often contain a blend of herbs, vitamins, and minerals known for their immune-boosting and respiratory support properties.

The gut health segment is poised to become the fastest growing in the immune health supplements market. This projection stems from growing awareness of the gut-immune connection and the crucial role of gut health in overall immune function. Consumers are increasingly seeking supplements formulated with probiotics, prebiotics, and other gut-supporting ingredients to optimize their immune systems. Additionally, research highlighting the link between gut health and various health conditions has spurred interest in gut-supporting supplements. With a rising focus on the gut health this, segment is anticipated to experience significant growth in the immune health supplement market.

Mode of Medication Insights

The self-medication segment has captured the highest share, and its trend is expected to continue over the forecast years, reflecting a shift towards proactive wellness management among consumers. This trend is driving demand for over-the-counter immune health supplements, allowing people to address their health needs independently. Self-medication offers convenience, flexibility, and empowerment especially for preventive measures like immune support. As a result, this segment is expected to maintain its significant share in the immune health supplement market, reflecting the evolving healthcare landscape and consumer preferences towards self-care.

Distribution Channel Insights

The pharmacies and drug store segment has emerged as the dominant force in the immune health supplements market. This dominance is attributed to several factors, including the widespread availability of these outlets, trusted healthcare professional recommendations, and consumer preference for purchasing health products from reputable sources. Pharmacies and drug stores offer a wide range of immune health supplements, making them easily accessible to consumers seeking to support their immune systems. Additionally, these outlets often provide personalized guidance and advice, further enhancing consumer trust and loyalty. As a result, the pharmacies and drug store segment continue to command a significant share of the market, playing a crucial role in meeting the growing demand for immune health products.

the supermarkets/hypermarkets segment is expected to witness fastest growth globally in the distribution of supplements market due to availability of various supplements at same place. supermarkets and hypermarkets have extensive reach and presence, making them easily accessible to a wide range of consumers. These retail outlets are often conveniently located in urban and suburban areas, offering consumers the convenience of one-stop shopping for their groceries and health needs.

The e-commerce segment is expected to experience a notable growth rate in the immune health supplements market. This surge is fuelled by the increasing adoption of online shopping channels, convenience, and the expanding digital marketplace. Consumers are turning to e-commerce platforms to purchase a wide variety of immune health supplements from the comfort of their homes, eliminating the need for physical store visits. Furthermore, e-commerce offers a vast selection of products, competitive pricing, and the convenience of doorstep delivery, making it an attractive option for busy individuals.

Regional Insights

What is the U.S. Immune Health Supplements Market Size?

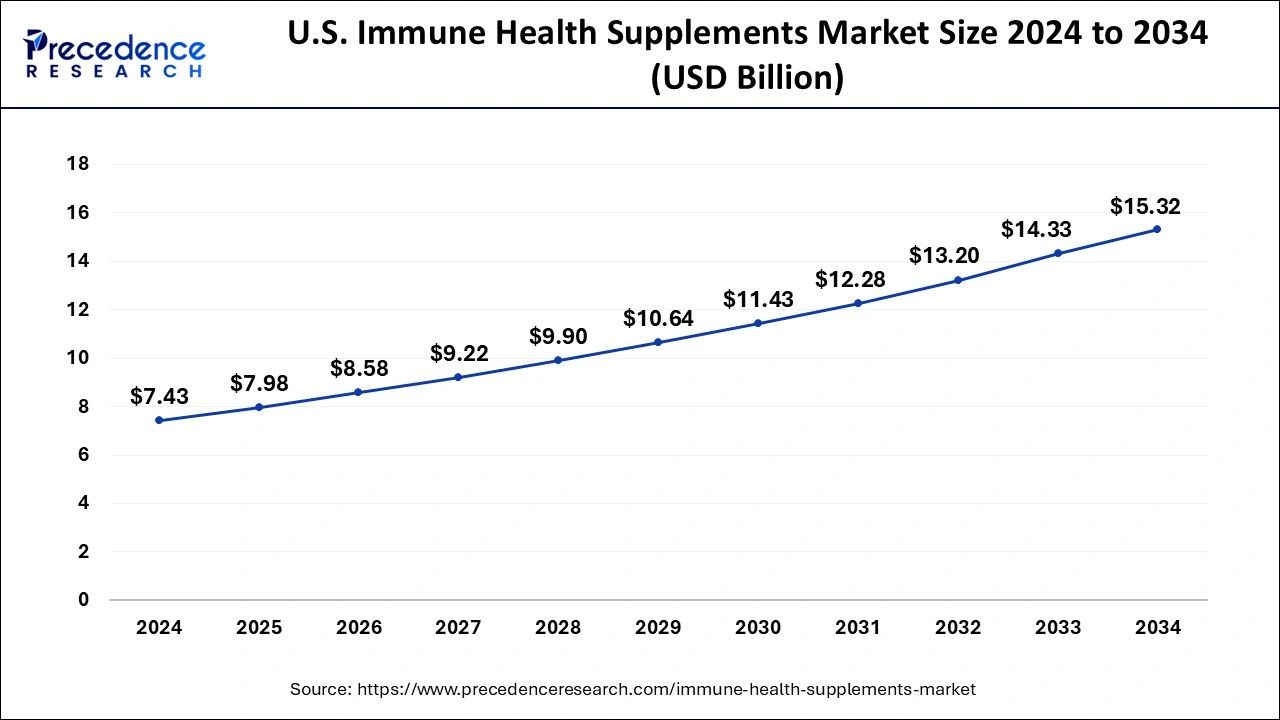

The U.S. immune health supplements market size was estimated at USD 7.98 billion in 2025 and is predicted to be worth around USD 15.40 billion by 2035 at a CAGR of 7.47% from 2026 to 2035.

North America led the immune health supplements market in 2025. The region is observed to due to rising cases of lifestyle fatigue and disorders. the region has a large and health-conscious population that places a high value on preventive healthcare and wellness. With increasing awareness of theimportance of dietary supplements in maintaining overall health and wellbeing, the demand for supplements in North America continues to grow steadily.

Moreover, North America is home to a highly developed healthcare infrastructure, including advanced research facilities, regulatory bodies, and distribution networks. This infrastructure supports the development, manufacturing, and distribution of supplements, facilitating market growth and dominance in the region. The dietary supplement industry in North America benefits from robust regulatory frameworks that ensure product safety, quality, and efficacy.

Furthermore, North America's diverse retail landscape, including pharmacies, health food stores, supermarkets, and online retailers, provides consumers with a wide range of options for purchasing supplements. This accessibility and availability contribute to the region's dominance in the global immune health supplement market.

Asia Pacific is recognized as one of the fastest-growing regions in the global immune health supplements market. Several factors contribute to this growth. Countries in the Asia Pacific region is experiencing a surge in health awareness and a growing interest in preventive healthcare. As lifestyles become more sedentary and dietary habits shift towards processed foods, there is increasing recognition of the need for dietary supplements to fill nutritional gaps and support overall health and wellbeing.

The expanding middle class in countries like China, India, and Southeast Asian nations has led to increased spending power and a greater focus on health and wellness products, including dietary supplements. Rising disposable incomes allow consumers to invest in their health, driving demand for immune health supplements.

Many countries in Asia Pacific, such as Japan and South Korea, are experiencing rapid aging populations. As people age, there is a heightened awareness of health issues and a greater emphasis on proactive health management, including the use of dietary supplements to address age-related concerns.

Urbanization and changing lifestyles have led to dietary imbalances and an increased prevalence of chronic health conditions. As a result, there is growing interest in supplements to support immune health, manage stress, and address nutritional deficiencies associated with modern diets.

Also, developing E-commerce platforms has played a significant role in driving supplement sales, offering convenience and a vast selection of products to consumers across the region. These countries have large populations, rapidly growing economies, and increasing health consciousness, making them lucrative markets for supplement manufacturers and retailers.

Hence, the combination of shifting demographics, rising disposable incomes, increasing health awareness, and expanding retail infrastructure positions Asia Pacific as a dynamic and fast-growing region in the global immune health supplements market.

What Are the Driving Factors of the Immune Health Supplements Market in Europe?

Europe is expected to grow at a remarkable rate during the forecast period. Europe exhibits consistent demand for immune supplements due to the ageing populations and the preventive health awareness. Consumers prefer clean-label, natural, and science-supported formulations. The dominant positioning is premium, and there is a high level of trust in regulatory supervision and growing interest in probiotics, intestinal immunity connections, and open ingredient sourcing procedures.

Germany Immune Health Supplements Market Trends

Germany focuses more stress on quality, regulation, and scientific validation of immune supplements. The consumers are more sensitive to organic and clean-label formulations that have proven efficacy. Among the elderly, preventive immune management leads to a rise in micronutrient and probiotics demand. Pharmacies are still the channels of purchase that are trusted, which builds credibility and steady adoption.

Value Chain Analysis of the Immune Health Supplements Market

- R&D: involves finding and obtaining bioactive substances that researchers will test to evaluate their effectiveness.

Key Players: Amway (Nutrilite), Bayer AG, Pfizer, Nestle Health Science, Glanbia plc - Clinical Trials and Regulatory Approvals: The clinical trials process tests product effectiveness and safety while maintaining the required standards established by food supplement regulatory bodies.

Key players: Abbott Laboratories, FDA (USA), CDSCO (India), FSSAI - Formulation and Final Dosage Preparation: involves creating capsules and gummies, and powders from approved ingredients, which scientists will measure in exact amounts.

Key players: Akums Drugs & Pharmaceuticals, Himalaya Wellness - Packaging and Serialization: involves using secure packaging systems that contain distinct identification codes to guarantee product tracking and protection against counterfeit products.

Key Players: Amcor, Constantia Flexibles, CCL Industries, Huhtamaki, WestRock - Distribution to Hospitals, Pharmacies of Immune Health Supplements: The organization oversees all aspects of distribution operations while maintaining the quality of the health supplements.

Key players: Zuellig Pharma, McKesson Corporation, AmerisourceBergen

Immune Health Supplements Market Companies

- Bayer AG: Promotes multivitamin preparations of Redoxon and Supradyn that contain vitamin C, D, and zinc in a daily dose of immune support.

- Pfizer Inc.: Offers Centrum multivitamins and Emergen-C drink mixes that offer combined vitamins and antioxidants that help in building immune resilience.

- Sun Pharmaceutical Industries Limited.: Markets Revital is a collection of supplements rich in vitamins, minerals, and ginseng as a way to boost immunity, vitality, and energy requirement through out the day.

Other Major Key Players

- Swisse Wellness Pty Ltd.

- GlaxoSmithKline Inc.

- Abbott Laboratories

- Amway Corp.

- The Nature's Bounty Co.

- Herbalife Nutrition of America, Inc.

- Himalaya Global Holdings Ltd.

- American Health

- Unilever

- Sanofi

- Novartis

- Boehringer Ingelheim

- Nestlè

- Danone

Recent Developments

- In January 2026, Kirin is enhancing immune health research with FANCL and Blackmores by developing a urine-immune test and launching a new supplement. The test, measuring immunoglobulin A levels, will debut in Q3 2026, assessing plasmacytoid dendritic cell activity in urine. (Source: https://www.nutraingredients.com )

- In June 2025, PT Ionaya Optima Natura introduced Vitera, a daily powder supplement containing Nutrileads' prebiotic Benicaros and Tetraselmis chuii microalgae. It aims to enhance gut health, strengthen immune resilience, and promote beneficial gut bacteria through the use of upcycled carrot pomace extract.

(Source: https://nutraceuticalbusinessreview.com ) - In August 2024, a “mind -body balance” is a well-known supplement was launched by wellnessMax to support cognitive functions of human brain and mind which may deter due to insufficient nutrients so that to cater mental clarity and reduce overthinking fog that eventually led to emotional well-being and stability.

- In October 2023, HealthBlend made a partnership with renowned nutritionist Dr.Wellness to customize and develop individual supplement plans.

Segments Covered in the Report

By Product

- Vitamin and Mineral Supplements

- Vitamin C Supplements

- Vitamin D Supplements

- Vitamin B complex Supplements

- Multivitamins

- Selenium Supplements

- Zinc Supplements

- Herbal Supplements

- Probiotic Supplements

- Others

By Form

- Capsules

- Tablets

- Powder

- Liquid

- Gel

- Soft Gels

- Others

By Application

- Hair Growth

- Gut Health

- Respiratory Tract Infection

- Others

By Mode of Medication

- Prescription Based

- Self-medication

By Distribution Channel

- Pharmacies/Drug Stores

- Supermarkets and Hypermarkets

- E-commerce

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting