Immune Checkpoint Inhibitors Market Size and Forecast 2025 to 2034

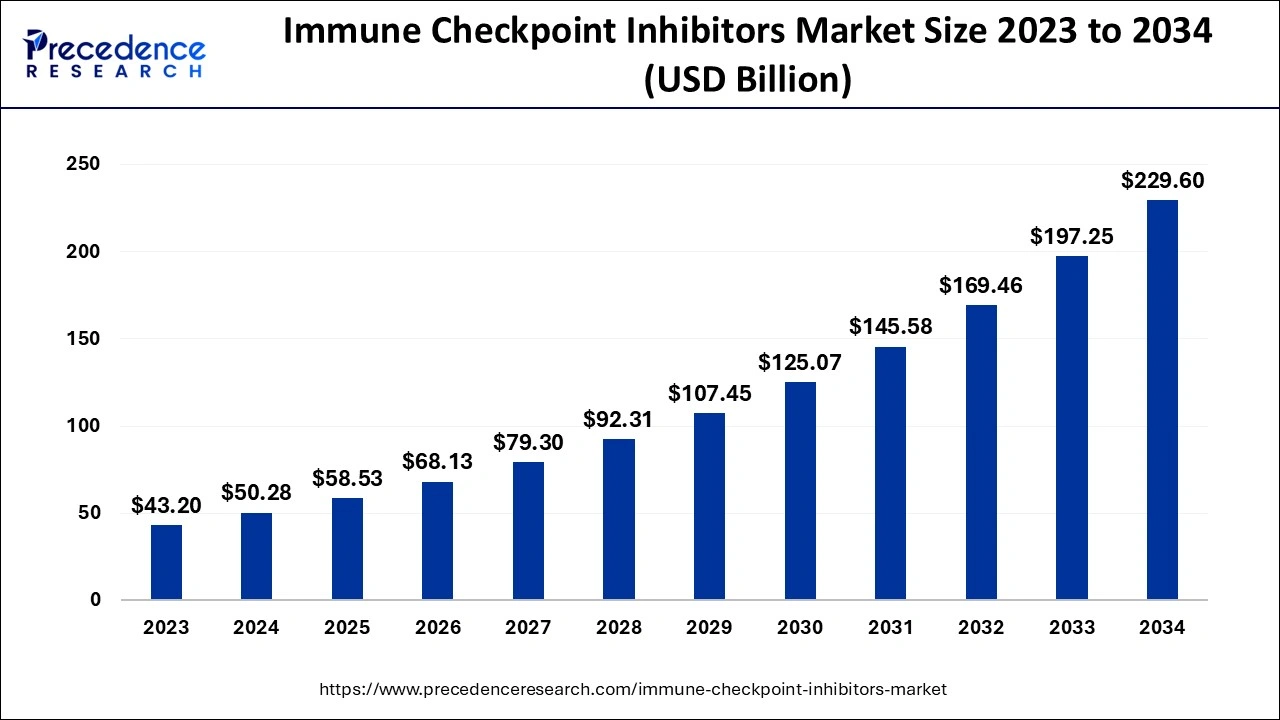

The global immune checkpoint inhibitors market size was estimated at USD 50.28 billion in 2024 and is anticipated to reach around USD 229.60 billion by 2034, expanding at a CAGR of 16.40% from 2025 to 2034.

Immune Checkpoint Inhibitors Market Key Takeaways

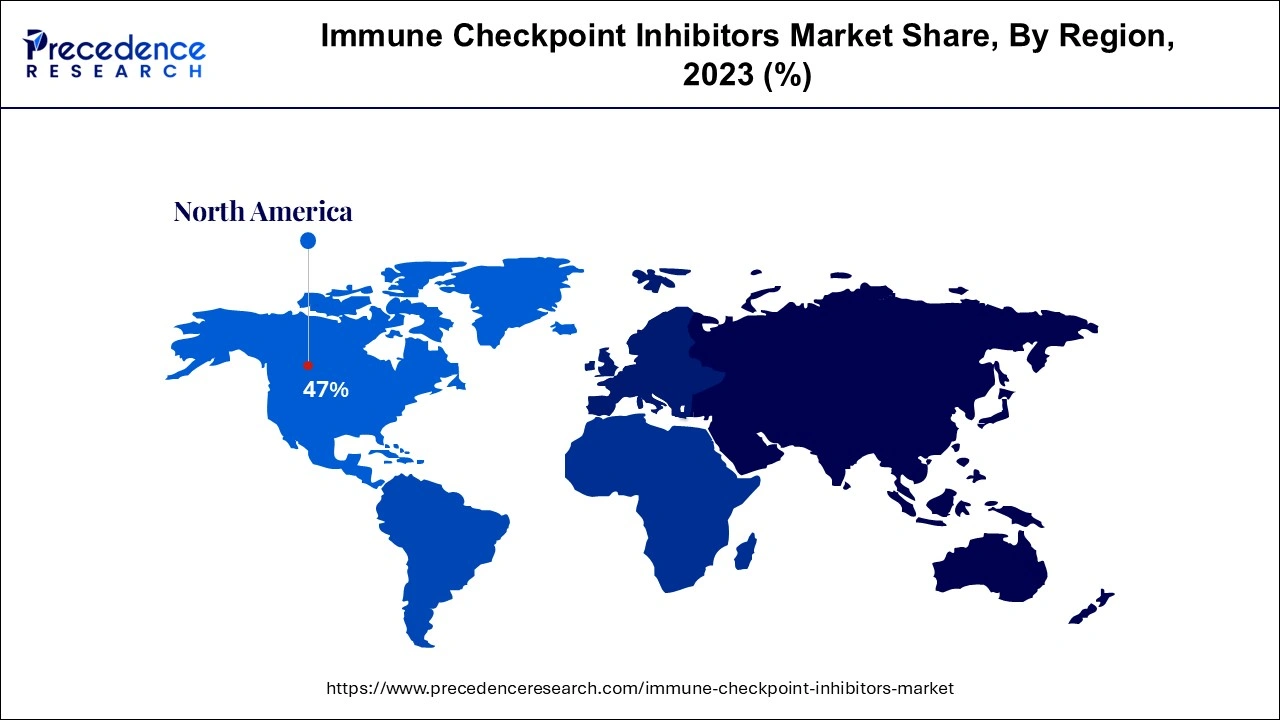

- North America accounted for 47% revenue share in 2024.

- By type, the PD-L1 inhibitor segment accounted for 64% of revenue share in 2022 and is expected to grow at a CAGR of 16.8% from 2025 to 2034.

- By application, the lung cancer segment held a 37.5% revenue share in 2024.

- By region, the Asia-Pacific region is expected to reach a CAGR of 18.4% from 2025 to 2034.

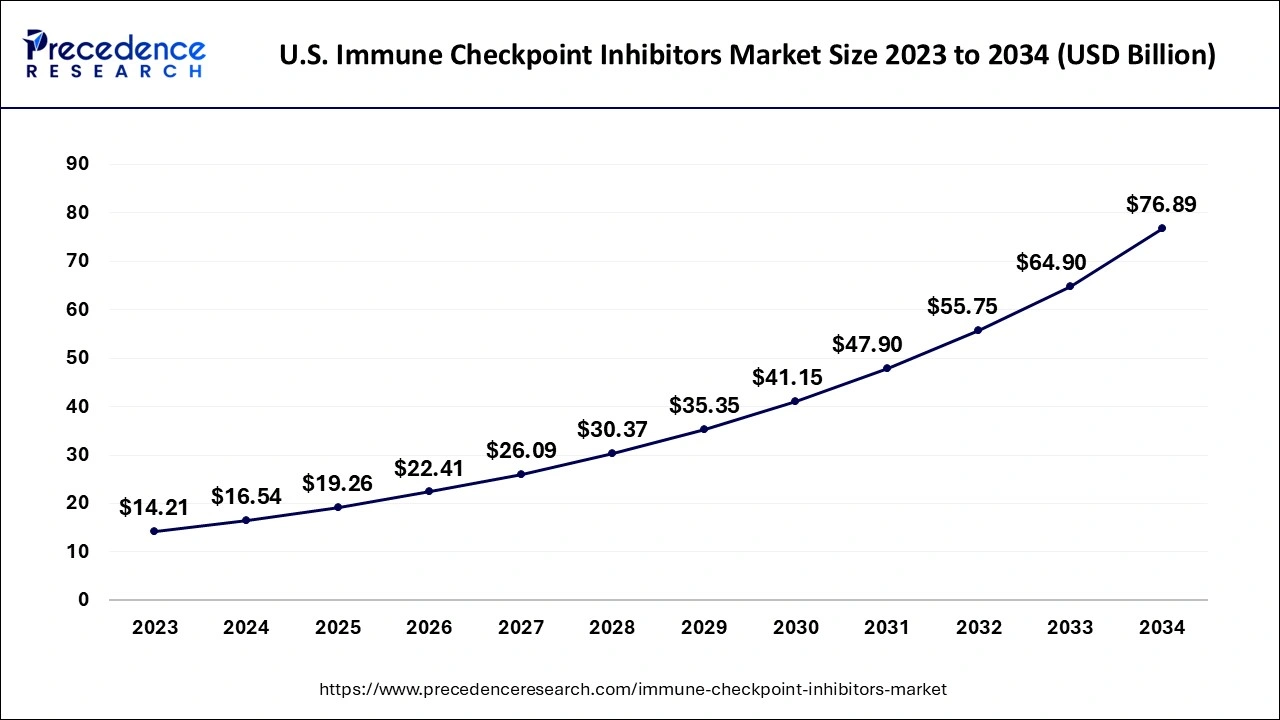

U.S. Immune Checkpoint Inhibitors Market Size and Growth 2025 to 2034

The U.S. immune checkpoint inhibitors market size was evaluated at USD 16.54 billion in 2024 and is predicted to be worth around USD 76.89 billion by 2034, rising at a CAGR of 16.61% from 2025 to 2034.

The North American region dominated the market in 2024 due to the owing rising number of oncology patients. The increasing government funding and support for the expansion of new drug development for cancer treatment. Moreover, boost in research and development for new and novel drugs in the market is also supporting the regional growth. The government's help through funding for new drug development for the treatment of cancer is driving the growth of the immune checkpoint inhibitors market.

Asia Pacific is the fastest growing market for the immune checkpoint inhibitors market with a significant CAGR during the forecast period due to the rising incidence of cancer, enhanced healthcare awareness, and increased availability of innovative therapies. Nations such as China, Japan, and South Korea are improving cancer treatment through local drug innovation, expedited regulatory processes, and investment in oncology infrastructure. Collaborative efforts between governments and private entities are advancing clinical trials, while the heightened demand for targeted immunotherapy is propelling market growth. The area's large population and focus on personalized medicine are drawing interest from global pharmaceutical companies, positioning Asia Pacific as a vibrant center for immunotherapy advancements and implementation.

China

In the Asia Pacific immune checkpoint inhibitors market, China is a significant contributor, driven by high cancer rates and strong investment in biotech advancements. The government's initiative for faster drug approvals and a focus on self-sufficiency in oncology has led to the development of domestic checkpoint inhibitors. Firms such as Akeso are creating innovative therapies, while public-private collaborations are enhancing clinical research efforts and increasing access to immunotherapy throughout the country.

Europe Market Trends

Europe is observed to grow at a considerable growth rate in the upcoming period, backed by robust healthcare systems, prestigious research institutions, and a commitment to advanced cancer therapies. There is a notable increase in clinical trial activities and strategic partnerships involving biotech firms and academic organizations. As the aging population grows and cancer diagnoses rise, the appetite for innovative immuno-oncology solutions is expanding. European regulatory bodies are striving to streamline approval processes, with numerous countries incorporating immunotherapy into their standard cancer treatment protocols. These developments are fueling consistent market growth and enhancing access to checkpoint inhibitor therapies.

Germany

Germany is at the leading edge of Europe's immune checkpoint inhibitors market, because of its sophisticated healthcare system and a strong pharmaceutical industry. The country actively supports cancer research and nurtures collaborations between academic institutions and biotech companies. Immunotherapy is being progressively incorporated into standard cancer treatments, with German entities playing a crucial role in the creation and assessment of next-generation checkpoint inhibitors through both local and global clinical trials.

Market Overview

The immune system's role is to avoid foreign particles (such as germs and cancer cells) to destroy healthy cells in the body. Checkpoint inhibitors are a type of immunotherapy as well as this is useful in the treatment of cancer like melanoma skin cancer and lung cancer. In the immune checkpoints, they are engaged when proteins on the surface of immune cells are known as T cells(recognizers). Additionally, these checkpoints bind to partner proteins on other cells like tumor cells. Therefore, these cells help to prevent the immune system from destroying cancer.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 |

USD 50.28 Billion |

| Market Size in 2025 |

USD 58.53Billion |

| Market Size by 2034 |

USD 229.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Disease Indication, End-Users, and Geography |

MarketDynamics

Radiation and surgery are used to treat areas of cancer and the area ofoncologyis wide-ranging including diverse types of application areas. Chemotherapy generally travels over the bloodstream to treat the entire body of patients and treating the entire body is also known as systemic treatment. Treatment of cancer cells supports the immune cells of patients' bodies to fight cancer more effectively. Cancer is the leading reasons of death worldwide. Therefore, Immune checkpoint inhibitors drugs block cancer cells and help the immune system or cells to find them so they can be stopped. Immune checkpoint inhibitors drugs on some immune cells that need to be triggered and deactivated to start an immune reaction and stop the immune system from being damaged.

Moreover, several prominent vendors are investing in research and development under clinical development. The checkpoint inhibitor pembrolizumab for the treatment of MSI-H and dMMR tumors was the first FDA approval based exclusively on the presence of a genetic feature in a tumor. There is continuing competition in the immune checkpoint inhibitors market that result in the growth of the market. Additionally, rising technological advancements in the treatment of cancer and increasing awareness among the population regarding immune system disease are restraining the growth of the immune checkpoint inhibitors market.

The adoption of an unhealthy lifestyle, increasing cases of cancer, and genetic modification and alteration affects the country's healthcare cost, therefore it helps to drive the growth of the immune checkpoint inhibitor market. Moreover, the technological advancement in the screening or broadcast method for cancer and increasing healthcare expenditures in this market, the increase in the adoption of immune checkpoint inhibitor drugs in emerging markets, are factors propelling the growth of the immune checkpoint inhibitors market. Furthermore, severe FDA guidelines for the drug approval of new drugs & adverse effects, challenge the growth of the immune checkpoint inhibitors market.

In the immune checkpoint inhibitors market, there are several research collaborations of international players with companies that are combining their main competencies to fasten their research programs. For example, Merck recognized as MSD outside the U.S. and Canada along with the Dynavax Technologies Corporation is examining the possible synergistic properties by combining Dynavax's SD-101 with two of Merck's immune therapies Keytruda and MK-1966. An increase in demand for cancer therapeutics, and enlarge in R&D studies, and rising reimbursement policies offered by manufacturers and insurance companies in some countries are key factors boosting the global market growth.

End-Users Insights

By end-users, the global immune checkpoint inhibitors market is segmented into hospitals, specialty clinics, and academic & research institutions. The hospitals & specialty clinics segment is estimated to largest market share in the global immune checkpoint inhibitors market over the forecast period, due to the large customer base, rising healthcare expenditure, and increasing cases of cancer such as lung cancer and bladder cancer, melanoma, hodgkin lymphoma, and others.

Disease Indication Insights

By disease indication, the lung cancer held a substantial share in disease indication segment. Immune checkpoint inhibitors drugs are used for targeted cancer treatments in advanced forms of lung cancer. FDA-approved Immune checkpoint inhibitors drugs for the treatment of lung cancer such as Ipilimumab, nivolumab, atezolizumab, and durvalumab, which are driving the growth of the market. Moreover, the bladder cancer segment is estimated to fastest growth during the forecast period, owing to the rise in cases of bladder cancer.

Medical oncologists and immunologists have aided many clinical trials to show that checkpoint inhibitors can be an effective counter to melanoma and lung cancer. The several formal discussions have been made about the finest treatment for patients with respect to immune checkpoint inhibitors in terms of combination therapy, monotherapy, and predictive biomarkers. Immune checkpoint inhibitors are the main treatment to cure patients of several cancers such as breast, bladder, stomach, colon, liver, cervical, lung, skin, and rectal cancer.

Immune Checkpoint Inhibitors Market Top Companies

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company (ARMO Biosciences.)

- GlaxoSmithKline PLC

- Roche Holding AG

- Incyte Corporation

- Novartis AG

- F. Hoffmann-La Roche Ltd. (Genentech Inc.,)

- Sanofi, Merck & Co., Inc.

- Merck KGaA (EMD Serono Inc.)

- BeiGene Ltd

- Shanghai Jhunsi Biosciences Ltd.

Recent Developments

- In March 2025, India's Sun Pharmaceutical Industries revealed its acquisition of U.S.-based Checkpoint Therapeutics for USD 355 million. This strategic acquisition is designed to enhance Sun Pharma's oncology portfolio by incorporating Checkpoint's FDA-approved skin cancer medication, Unloxcyt, into its offerings. The acquisition highlights Sun Pharma's determination to grow its footprint in the immunotherapy domain.

- In December 2024, the FDA granted approval for tislelizumab (Tevimbra) in combination with chemotherapy as a first-line treatment for adults with unresectable or metastatic HER2-negative gastric or gastroesophageal junction adenocarcinoma that expresses PD-L1. This approval introduces a new immunotherapy alternative for patients suffering from advanced gastric cancers.

- In December 2024, the FDA assigned fast-track designation to IMM-1-104 for the treatment of patients with unresectable or metastatic NRAS-mutant melanoma who have either shown progression on or are unable to tolerate PD-1/PD-L1 immune checkpoint inhibitors. This designation seeks to accelerate the development and evaluation of this promising therapy.

Segments Covered in the Report

By Drug Type

- CTLA-4 Inhibitor

- PD-1 Inhibitor

- PD-L1 Inhibitor

By Disease Indication

- Lung Cancer

- Bladder Cancer

- Melanoma

- Hodgkin lymphoma

- Others

By End-Users

- Hospitals

- Specialty Clinics

- Academic & Research Institutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting