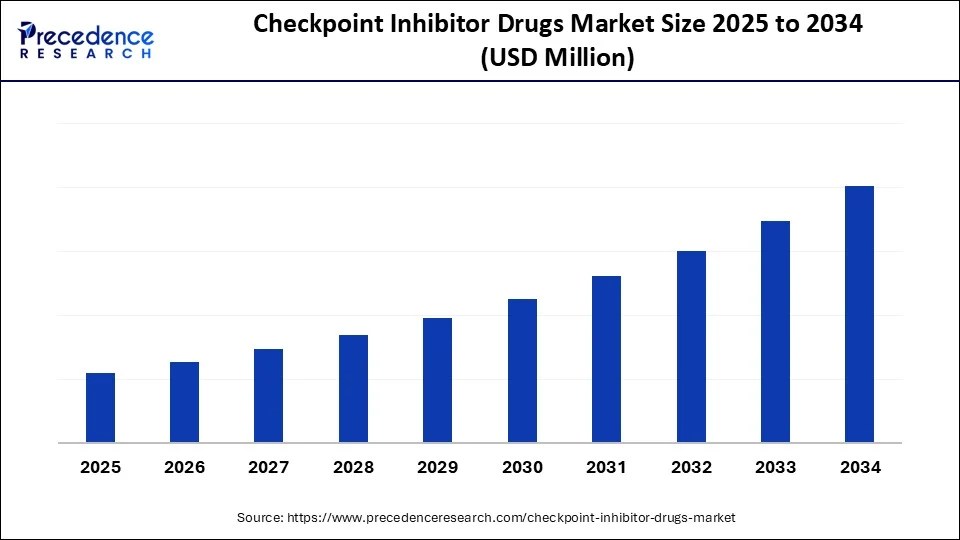

Checkpoint Inhibitor Drugs Market Size and Forecast 2025 to 2034

The Checkpoint Inhibitor Drugs Market is expanding with growing adoption of immunotherapies that target immune checkpoints like PD-1, PD-L1, and CTLA-4, offering improved survival outcomes in oncology.The checkpoint inhibitor drugs market is growing at a fast rate since cancer cases are increasing, new regimens are emerging, and further approvals and increased use in varied treatment frameworks.

Checkpoint Inhibitor Drugs Market Key Takeaways

- North America accounted for the largest share of the checkpoint inhibitor drugs market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By drug class, the PD-1 inhibitors segment led the market with largest market share of 41% in 2024.

- By drug class, the dual checkpoint inhibitors (pd-1/ctla-4, etc.) segment is anticipated to show considerable growth over the forecast period.

- By cancer type, the non-small cell lung cancer (NSCLC) segment held a significant share in 2024.

- By cancer type, the hematologic cancers (e.g., Hodgkin's lymphoma) segment is anticipated to show considerable growth over the forecast period.

- By route of administration, the intravenous segment contributed the biggest market share in 2024.

- By route of administration, the subcutaneous segment is anticipated to show considerable growth over the forecast period.

- By end-user, the hospitals and specialty clinics segment captured the highest market share in 2024.

- By end-user, the homecare and ambulatory infusion centers segment is anticipated to show considerable growth over the forecast period.

- By distribution channel, the hospital pharmacies segment accounted for a biggest market share in 2024.

- By distribution channel, the specialty pharmacies segment is anticipated to show considerable growth in the market over the forecast period.

How Is AI Transforming the Checkpoint Inhibitor Drugs Market?

The use of artificial intelligence (AI) is shifting the checkpoint inhibitor drugs market to a transformative role in terms of the quantification of drug discovery, clinical development, and personalizing cancer treatment. AIs allow identifying potentially useful drug candidates much faster, analyzing huge amounts of data, such as genomic, tumor characteristics, and immune responses. This speeds up the process of new checkpoint inhibitors and combination therapies and cuts research time and expenses.

During patient enrollment, AI can improve the time-consuming process of matching and enrolling the right patient, and receiving a real-time result on patient response to treatment, increasing the success rate of a clinical trial. Since healthcare systems are becoming increasingly data-driven, AI will help to improve the accuracy and access of checkpoint blocker treatments.

Market Overview

The checkpoint inhibitor drugs market refers to the segment of immuno-oncology therapies that block immune checkpoint proteins, such as PD-1, PD-L1, and CTLA-4, to enhance the immune system's ability to recognize and attack cancer cells. These drugs work by inhibiting the inhibitory pathways that cancers use to evade immune detection, thus restoring T-cell function and enhancing anti-tumor immunity. They are widely used across various cancer types and represent one of the fastest-growing classes of cancer therapies globally.

The driver of the checkpoint inhibitor drug market is the fact that diseases like cancer are increasing in the world, and this is fueling the need to have more and better-targeted cancer medication with fewer side effects. A breakthrough in cancer immunotherapy has been the checkpoint inhibitors that provide patients with enhanced survival and long-term responses across several malignancies, including non-small cell lung cancer, melanoma, and Hodgkin lymphoma. Moreover, the efficiency of treatments and personalization is being improved due to higher investment rates in research and development, higher rates of combination therapy, and biomarker testing.

What Factors Are Fueling the Rapid Expansion of the Checkpoint Inhibitor Drugs Market?

- Increase in cancer: The escalating cancer worldwide, especially lung cancer, breast cancer, colorectal cancer, and prostate cancer, is motivating the demand for checkpoint inhibitors. With these drugs coming as first-line-treatment, the growth in the number of patients needing to receive a good immunotherapy is a big contributor to the market and the adoption across a variety of healthcare environments around the globe.

- Regulatory Approvals: The growth of approvals of checkpoint inhibitors across various cancer types across the world provides more treatment accessibility. These therapies are receiving a fast-tracking approval process due to their effective clinical performance, expansive indications, and enablers to reimbursement, which combined drive the market development by allowing more patients to get access to immunotherapy.

- Outpatient and Homecare: The site of care for the administration of checkpoint inhibitors is shifting outside of hospitals into ambulatory infusion centers and homecare, leading to decreased cost and enhanced convenience for the patients. The trend aids in the better adherence to treatment and new areas of business, and this is a boost to the growing market of checkpoint inhibitor drugs.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Cancer Type, Route of Administration, End-User Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Occurrences of Cancer

Increasing instances of cancer around the world are one of the major factors boosting the global market. Breast cancer, lung cancer, colorectal cancer, and prostate cancer are the most prevalent forms of cancer whose outcomes in treatment have improved tremendously following the introduction of checkpoint inhibitors. These types of immunotherapies, specifically those that impair PD-1/PD-L1 and CTLA-4 pathways, have transformed cancer treatment by allowing the patient's immune system to have better cancer recognition and destruction abilities. The current use of checkpoint inhibitors as first-line therapy against a variety of cancers is widespread, whether used as monotherapies or in novel combinations with other forms of treatment, including chemotherapy and targeted therapies.

Restraint

High Cost of Inhibitors

The expensive nature of the checkpoint inhibitor drug sits as a major barrier to the market growth. Such new immunotherapies as PD-1 and PD-L1 blockers are one of the costliest cancer therapies in the market, putting a huge strain on both the health providers and the health insurance companies, as well as the patients. This is a very sharp economic problem faced, especially in poor as well as middle-income nations, where the treatment facilities to administer higher levels of oncology intervention. Moreover, high checkpoint inhibitor cost and the increasing trend of patients and clinicians to shift to other modes of treatment, e.g., surgery, radiation therapy, or conventional chemotherapy.

Opportunity

Expanding Clinical Applications and Unmet Medical Needs

The checkpoint inhibitor drugs market is potentially huge because of an increase in the area of clinical trials and the unmet need in a few types of cancer. Advancements in drugs like the use of dual checkpoint inhibitors, including PD-1/PD-L1 combined with CTLA-4 or other immune checkpoints, such as LAG-3 and TIGIT, are some of the innovations that provide alternative treatment opportunities in refractory and hard-to-treat malignancies. These newer treatment modalities will help to increase patient outcomes and serve a greater population of patients. Also coming, as an area of continuing innovation and market development, are bispecific antibodies and fusion proteins, which concurrently act on immune pathways. Moreover, the acceptance and expansion of clinical trials of these segments will lead to a broader market penetration.

Drug Class Insights

How Did the PD-1 Inhibitors Segment Dominate the Checkpoint Inhibitor Drugs Market with a 41% Share in 2024?

The PD-1 inhibitors segment led the market while holding a 41% share in 2024, due to the novel approaches that have encompassed the PD-1 combination with checkpoint targets (A2AR, IDO-1, STING, and TLR7/9), to create greater effects and less resistant therapeutic outcomes through the generation of bispecific antibodies and fusion proteins.

PD-1 inhibitors, the nivolumab and pembrolizumab ones, have turned out to be key interventions in cancer immunotherapy, being clinically versatile and effective in a wide variety of cancer types, e.g., melanoma, non-small cell lung cancer, head and neck cancers, etc. The process of further investment and innovation in research shows that PD-1 inhibitors will continue to occupy a dominant position in terms of the immunotherapy environment.

The dual checkpoint inhibitors (pd-1/ctla-4, etc.) segment is expected to grow at a significant CAGR over the forecast period. They are propelled by mounting clinical data of their improved efficacy in the treatment of complex or resistant cancers. The mechanism of such combination strategies is the simultaneous inhibition of more than one immune checkpoint, therefore enhancing the immune response against the tumors.

Although dual checkpoint inhibitors have greater and longer-lasting depression of tumor response, the likelihood of immune-related adverse effects increases as the volume of immune activation increases. With increasing insights into tumor immunology, dual checkpoint blockade is emerging as the decisive role in immuno-oncology, with an increasing list of indications and clinician comfort.

Cancer Type Insights

Why Did Non-Small Cell Lung Cancer Contribute the Most Revenue in 2024?

The non-small cell lung cancer contributed the most revenue in 2024 and is expected to dominate throughout the projected period owing to the increased usage of biomarker testing, expanded regulatory options, and the mounting clinical evidence are the factors that help prompt their further use in NSCLC.

The NSCLC is a very common type of lung cancer all over the world, and the combination of checkpoint inhibitors in the management of cancer patients has greatly changed the outcomes associated with cancer care. Immunotherapy drugs include PD-1/PD-L1 and CTLA-4 pathway inhibitors, including nivolumab, pembrolizumab, atezolizumab, durvalumab, ipilimumab, and cemiplimab, which have become standard drugs in the treatment of NSCLC.

The hematologic cancers (e.g., Hodgkin's lymphoma) segment is expected to grow substantially in the checkpoint inhibitor drugs market. Nivolumab and pembrolizumab, which belong to the group of checkpoint inhibitors, have shown impressive results in the therapy of relapsed or refractory cases of Hodgkin lymphoma, within which cancerous cells take advantage of the PD-1/PD-L1 pathway to escape the immune system.

The efficacy of the checkpoint inhibitors in Hodgkin lymphoma has prompted their approval in several countries and even their inclusion in treatment guidelines, especially after the stem cell transplant or other therapy has failed. In addition to Hodgkin lymphoma, other checkpoint inhibitors are under investigation in a variety of other hematologic malignancies, including non-Hodgkin lymphoma, multiple myeloma, and some leukemias.

Route of Administration Insights

How Did the Intravenous Segment Lead the Checkpoint Inhibitor Drugs Market?

The intravenous segment led the checkpoint inhibitor drugs market and accounted for the largest revenue share in 2024 due to the reliability and regulation of IV infusion have aided it in being the preferred approach in the administration of drugs such as nivolumab, pembrolizumab, and ipilimumab. The most common route in the administration of checkpoint inhibitors is intravenous because it allows taking the drug with high precision, and the bioavailability is also fast.

The drugs normally infused right into the bloodstream are of the kind that assist in stimulating the immune system to attack and kill cancer cells. The most suitable places to transfer patients with an IV are hospitals, specialty clinics, and infusion centers, which are fully equipped to handle them.

The subcutaneous segment is expected to grow at a significant CAGR over the forecast period. Such an approach decreases the administration time and can be administered in a wider range of settings, such as outpatient clinics and even at home. Subcutaneous checkpoint inhibitors present unique benefits as the healthcare sector transitions to less resource-intensive, more flexible models of care delivery, as a result of enhanced patient comfort, decreased strain on hospital resources, and, by extension, possible healthcare cost savings. Products such as atezolizumab, nivolumab, and pembrolizumab have already received or advanced towards late-stage development in the subcutaneous segment and reflect that the segment will also have high momentum.

End-User Insights

Why Did Hospitals & Specialty Clinics Generate the Highest Revenue in 2024?

The hospitals & specialty clinics contributed the most revenue in 2024 and are expected to dominate throughout the projected period. The hospitals and specialty clinics are also armed with the infrastructure, medical staff, and supporting systems to provide administration of these drugs through the intravenous route, monitoring of patient effects, and handling side effects. The patient is usually administered these treatments on schedule and is often administered in outpatient oncology departments. Such facilities provide extensive cancer care, i.e., diagnostics, imaging, and multi-disciplinary treatment planning, and thus oncologists as well as patients are willing to choose these facilities.

The homecare & ambulatory infusion centers segment is expected to grow substantially in the Checkpoint inhibitor drugs market. Ambulatory infusion centers provide safe administration of immunotherapy drugs in a cost-effective outpatient setting that is considered to be less intensive and more accessible compared to hospitals. These facilities are frequently nearer patients' residences and often permit quicker schedules and cut down waiting time, which makes patient adherence and satisfaction better. The homecare services allow patients to obtain their infusions at home, reducing the overall level of such exposure as well as enhancing their living conditions.

Distribution Channel Insights

Why Are Hospital Pharmacies Leading the Checkpoint Inhibitor Drugs Market in 2024?

The hospital pharmacies contributed the most revenue in 2024 and are expected to dominate throughout the projected period. Hospital pharmacies, made up of the comprehensive cancer treatment centers, are one of the facilities that have infrastructure and trained staff to deliver the drugs safely and manage adverse events in real-time. The majority of the checkpoint inhibitors are being used in inpatient or infusion center systems where multidisciplinary care teams can supervise the patients during and after administration. Moreover, hospitals usually participate in clinical trials that enhance their role in the distribution system and allow them to have early access to new inhibitors.

The specialty pharmacies segment is expected to grow substantially in the checkpoint inhibitor drugs market. Specialty drug stores are coming into the position in the checkpoint medicines drug distributor demographic, especially as oral and subcutaneous types are entering the market. Specialty pharmacies are also poised to participate in patient-centric care as checkpoint inhibitors are developed, where they can be taken through patient self-administration. They provide a full range of support services such as reminder medications, side effects solution guidance, and programs to continually monitor patients, which have the advantage of facilitating treatment compliance and outcomes.

Region Insights

Why Did North America Dominate the Checkpoint Inhibitor Drugs Market in 2024?

North America held the dominating share of the checkpoint inhibitor drugs market in 2024, as the regulatory bodies, like the FDA, have also fast-tracked regulatory initiatives to approve the new immunotherapies, such as the checkpoint inhibitors, to bring advanced technologies to people faster. The modern healthcare infrastructure of the region, large levels of healthcare spending, and extensive implementation of innovative methods of treatment all contribute to the growth of the market. The rising incidences of cancer and aging populations have continued to stimulate the need to develop effective treatment, thus resulting in the growth of the checkpoint inhibitor refractory cancer market in North America.

The United States has a number of chronic diseases, like lung cancer, urothelial carcinomas, melanoma, and even complications like diabetes are increasing rapidly in the country. The increased burden of this disease requires the use of the most selective and effective treatment methods, like immune checkpoint inhibitors. In addition, the U.S. hosts a significant number of well-established pharmaceutical and biotechnology companies, research centers, and clinical trial centers that are willing to invest in the production and experimentation of the next generation of cancer treatments.

Why is Asia Pacific undergoing the Fastest Growth in the Checkpoint inhibitor drugs market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. The prevalence of cancer is very high, and there has been a rising awareness about early diagnosis, and there is an ever-growing governmental support towards the detection and treatment of cancer. Also, there is an increase in strategic measures like mergers, acquisitions, and alliances by large pharmaceutical and biotechnology corporations in the area. A rising rate of aging is another force that is causing increased demand for effective treatment options, as most of the aged population in countries such as India is more prone to the development of cancer due to their aging demographic.

In 2024, China became one of the highest-potential markets in the checkpoint inhibitor drugs market, as the burden of cancers, favorable regulations, and investments in healthcare prices continued to rise. Indigenous pharma firms have raced ahead of the R&D on immuno-oncology, and multiple indigenous PD-1/PD-L1 blockers have entered clinical trials and have been approved by the regulatory agencies. Patient access has been greatly enhanced by the efforts of the Chinese government, including revision of the composition of the National Reimbursement Drug List (NRDL).

What are the Key Trends Driving the Europe Checkpoint inhibitor drugs market?

The European checkpoint inhibitor drugs market is expected to account for a substantial market share in 2024. Market growth is due to growing awareness among healthcare workers, positive regulatory assistance on the part of the European Medicines Agency (EMA), and the growth of clinical trial activities on the continent. Also, the aging population and an increase in the number of patients seeking specific cancer chemotherapies are driving the demand for effective immunotherapies. Development and accessibility of checkpoint inhibitors are further bolstered by Europe putting an emphasis on research into innovative oncology.

Germany can be considered a central country for the checkpoint inhibitor drugs in the region. An advanced healthcare system, robust reimbursement, and a focus on the early implementation of innovative treatment make the country a strategic center of immuno-oncology development. Its involvement in multinational clinical tests and cooperation with large drug manufacturing companies also led to the earlier introduction and use of checkpoint inhibitors.

Checkpoint Inhibitor Drugs Market Companies

- Bristol Myers Squibb

- Merck & Co., Inc. (Keytruda)

- Roche Holding AG (Genentech)

- AstraZeneca plc

- Pfizer Inc.

- Novartis AG

- Eli Lilly and Company

- Sanofi S.A.

- BeiGene, Ltd.

- Regeneron Pharmaceuticals, Inc.

- Innovent Biologics

- GlaxoSmithKline plc (GSK)

- Exelixis, Inc.

- Hoffmann-La Roche Ltd.

- Incyte Corporation

- MacroGenics, Inc.

- Arcus Biosciences, Inc.

- Shanghai Junshi Biosciences Co., Ltd.

- Checkpoint Therapeutics, Inc.

- IO Biotech

Recent Developments

- In June 2025, Pembrolizumab, a drug that inhibits immune checkpoints, was granted approval by the U.S. Food and Drug Administration (FDA) for patients with resectable locally advanced head and neck squamous cell carcinoma who have PD-L1 expression (Combined Positive Score (CPS) ≥1) determined by an FDA-approved test.

- In August 2024, the Food and Drug Administration, has approved three new immunotherapy options for people with advanced endometrial cancer. The approvals are for drugs called immune checkpoint inhibitors.

- In January 2023, Merck & Co. entered into a clinical trial collaboration with Teon Therapeutics to assess the efficiency of TT-816 with KEYTRUDA (pembrolizumab), which is indicated for patients with advanced solid tumors.

Market segment Covered in the report

By Drug Class / Mechanism

- PD-1 Inhibitors (Largest, 41%)

- e.g., Nivolumab, Pembrolizumab

- PD-L1 Inhibitors

- e.g., Atezolizumab, Durvalumab

- CTLA-4 Inhibitors

- e.g., Ipilimumab

- Dual Checkpoint Inhibitors (PD-1/CTLA-4, etc.)

- Emerging Checkpoints (e.g., LAG-3, TIM-3)

By Cancer Type

- Non-Small Cell Lung Cancer (NSCLC)

- Melanoma

- Renal Cell Carcinoma

- Head and Neck Cancers

- Urothelial Carcinoma

- Hepatocellular Carcinoma

- Triple-Negative Breast Cancer (TNBC)

- Hematologic Cancers (e.g., Hodgkin's lymphoma)

By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

By End-User

- Hospitals & Specialty Clinics

- Cancer Research Centers

- Homecare & Ambulatory Infusion Centers

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Specialty Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting