Enzyme Inhibitor Market Size and Forecast 2025 to 2034

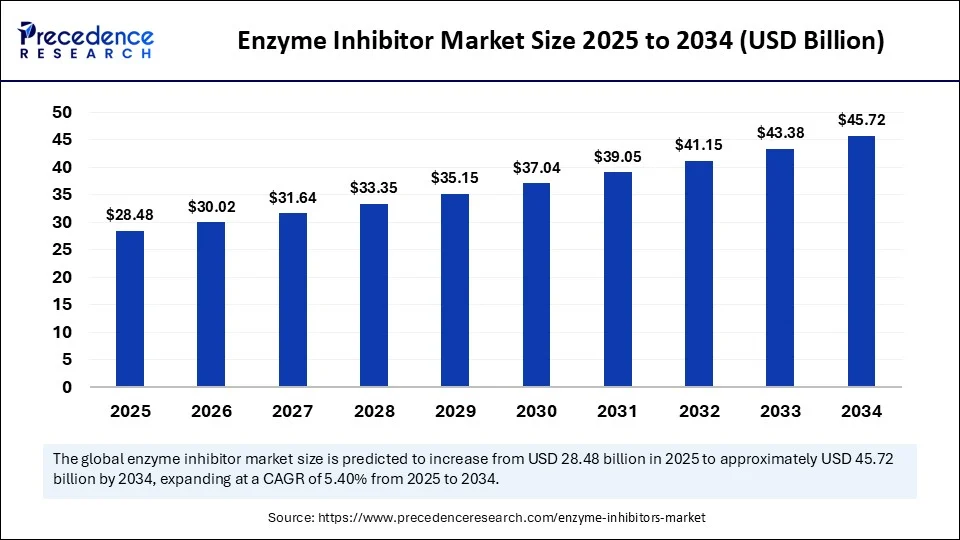

The global enzyme inhibitor market size accounted for USD 27.02 billion in 2024 and is predicted to increase from USD 28.48 billion in 2025 to approximately USD 45.72 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. The market is witnessing substantial growth because of the rising demand for effective and targeted treatments, driven by the increasing rates of chronic and metabolic disorders. The rising focus on precision medicine and advancements in drug discovery technologies are likely to support market growth.

Enzyme Inhibitor Market Key Takeaways

- In terms of revenue, the global enzyme inhibitor market was valued at USD 27.02 billion in 2024.

- It is projected to reach USD 45.72 billion by 2034.

- The market is expected to grow at a CAGR of 5.40% from 2025 to 2034.

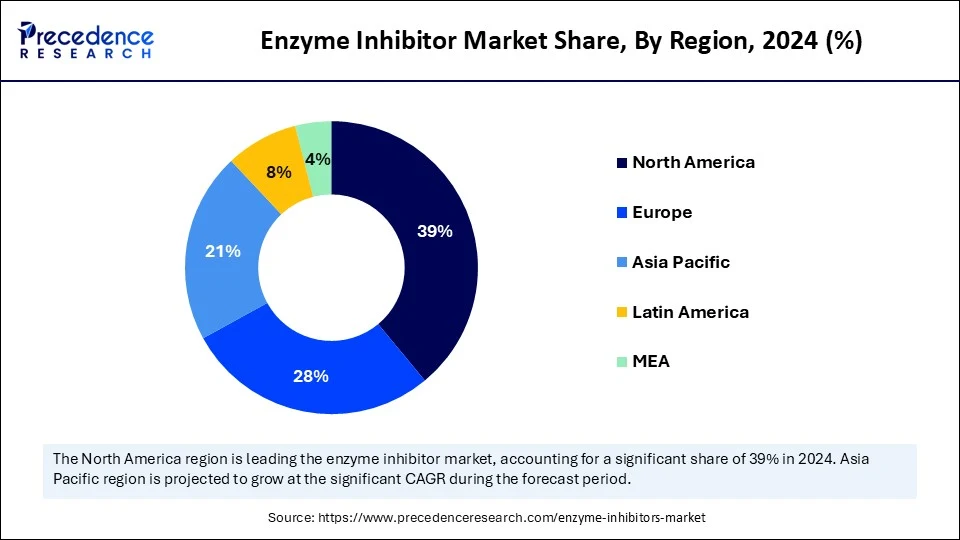

- North America dominated the global enzyme inhibitor market with the largest share of 39% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2034.

- By type, the kinase inhibitors segment contributed the biggest market share of 27% in 2024.

- By type, the protease inhibitors segment is expanding at a significant CAGR during the forecast period.

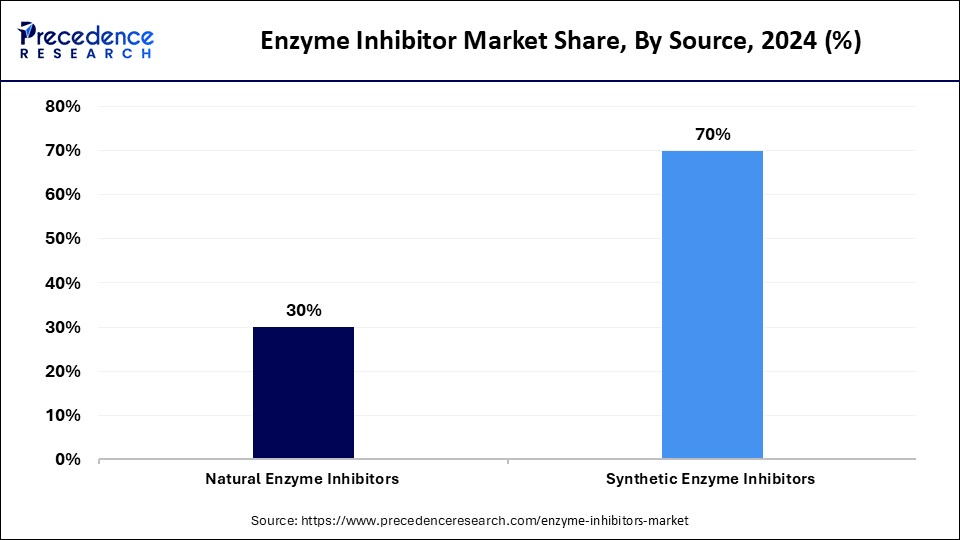

- By source, the synthetic enzyme inhibitors segment led the market share of 70% in 2024.

- By source, the natural enzyme inhibitors segment is expected to grow at a significant CAGR over the projected period.

- By therapeutic area, the oncology segment held the major market share of 33% in 2024.

- By therapeutic area, the neurological disorders segment is projected to grow at a CAGR between 2025 and 2034.

- By mechanism of action, the competitive inhibitors segment held the highest market share of 40% in 2024.

- By mechanism of action, the allosteric inhibitor segment is expanding at a significant CAGR from 2025 to 2034.

- By end use, the pharmaceutical and biotech companies segment captured the largest market share of 58% in 2024.

- By end use, the Contract Research Organizations (CROs) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By route of administration, the oral segment held the major market share of 61% in 2024.

- By route of administration, the injectable segment is expected to grow at a significant CAGR over the projected period.

How Does AI Impact the Enzyme Inhibitor Market?

Artificial intelligence (AI) is revolutionizing the enzyme inhibitor market by speeding up drug discovery and development. AI algorithms can predict enzyme-inhibitor interactions, optimize lead compounds, and even help in designing novel inhibitors. This is especially useful for targeting enzymes that are difficult to inhibit with traditional methods. Additionally, AI can predict how a drug will be metabolized and excreted, which is crucial for assessing its safety and effectiveness. This leads to more efficient and cost-effective development of enzyme-targeted therapies, especially for diseases where enzyme malfunction plays a key role.

U.S. Enzyme Inhibitor Market Size and Growth 2025 to 2034

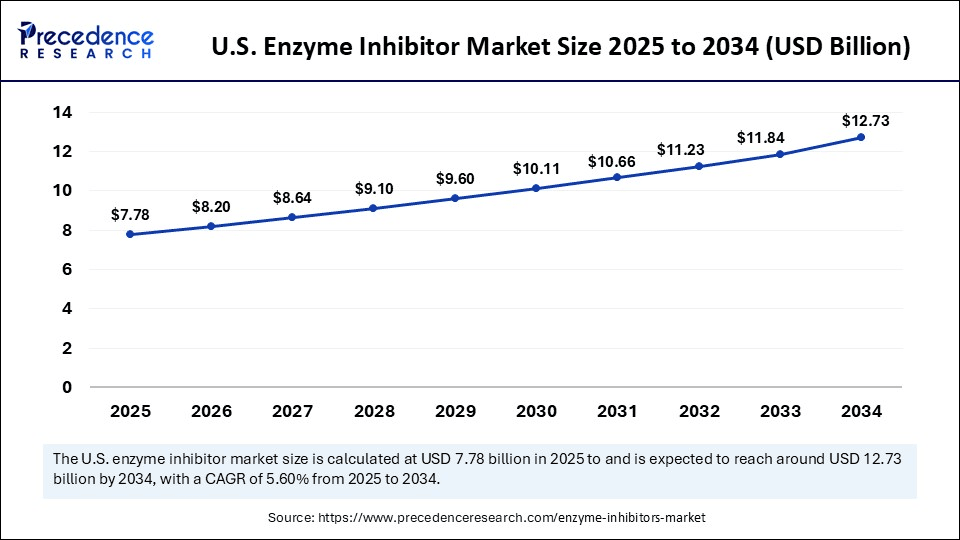

The U.S. enzyme inhibitor market size was exhibited at USD 7.38 billion in 2024 and is projected to be worth around USD 12.73 billion by 2034, growing at a CAGR of 5.60% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Enzyme Inhibitor Market in 2024?

North America dominated the global market with the largest share of 39% in 2024. This is mainly due to its well-developed healthcare system, modern facilities, advanced technologies, and high healthcare spending per capita, leading to the early adoption of enzyme inhibitor therapies. The strong presence of pharmaceutical and biotech giants such as Amgen, AbbVie, Bristol Myers Squibb, Eli Lilly, and Gilead Sciences drives innovation and the development of new enzyme inhibitor drugs. Government initiatives, including favorable reimbursement policies and investments in R&D, further support market growth. Moreover, there is a high demand for personalized medicine, contributing to regional market growth.

U.S. Enzyme Inhibitor Market Trends

The U.S. plays a major role in the regional market. The country is at the forefront of research and development and drug discovery, boosting the development of novel enzyme inhibitor therapies. The U.S. market is large, driven by the high prevalence of diseases treated with enzyme inhibitors, a well-established healthcare system, and significant R&D investments. Major companies like Novartis, Roche, AstraZeneca, and Pfizer are active in the U.S. market. The U.S. FDA significantly influences the market by approving enzyme inhibitor drugs and fostering growth by enabling innovative therapies.

What Are the Major Factors Contributing to the Asia Pacific Enzyme Inhibitor Market?

Asia Pacific is expected to grow at the fastest rate in the coming years. This is mainly due to the rising improvements in healthcare infrastructure, increasing investments in pharmaceutical R&D, and rising awareness of the benefits of enzyme inhibitors in fields such as oncology and cardiovascular health. A growing aging population, along with higher disposable incomes, is increasing demand for better healthcare products and services, including enzyme inhibitors. Government initiatives, such as Sri Lanka's National Innovation Bill and collaborations between academia and the private sector in India, are fostering innovation and technology transfer, which are vital for translating research into commercial products.

In April 2022, Daewon Pharmaceutical launched Escorten, its first proton-pump inhibitor drug. The Escorten Tablet, containing esomeprazole magnesium trihydrate, is a low-dose PPI that improves access to PPIs across various treatment settings, from hospitals to clinics. It offers effective therapy at affordable prices, making it a satisfactory treatment option.

(Source: https://www.koreabiomed.com)

China Enzyme Inhibitor Market Trends

China plays a vital role in the global market, acting both as a consumer and a producer. It is a major market for enzyme inhibitors, and it aims to expand its presence in pharmaceutical applications like cancer treatment and cardiovascular diseases. China is increasing its enzyme production capacity, including enzyme inhibitors, to meet rising domestic and international demand. For example, Douchi, a traditional Chinese soybean product, contains angiotensin I-converting enzyme (ACE) inhibitors, which help lower blood pressure. Additionally, the biotechnology sector is growing in research and development, particularly in creating enzyme inhibitors for various uses.

Why is Europe Considered a Notable Region in the Enzyme Inhibitor Market?

Europe is expected to grow at a notable rate in the coming years. This growth is driven by its strong pharmaceutical industry, robust R&D capabilities, and high healthcare expenditure. Key countries like Germany, France, and the UK contribute significantly to the market. Advances in developing new enzyme inhibitors for cancer and enzyme-based solutions in the food and beverage industry, along with efforts to combat antimicrobial resistance, also contribute to improvements in healthcare access and quality.

What Opportunities Exist in the Latin America Enzyme Inhibitor Market?

The Latin American market is growing due to rising chronic disease rates, increasing healthcare budgets, and greater awareness of the benefits of enzyme inhibitors. The region is experiencing a growing burden of conditions like diabetes and cardiovascular diseases, which drives demand for corresponding enzyme inhibitors. Both public and private healthcare expenditures are rising, improving access to medications, including enzyme inhibitors.

Middle East and Africa Enzyme Inhibitor Market Trends

The Middle East and Africa are also experiencing considerable growth, driven by the prevalence of chronic diseases, rising healthcare spending, and government initiatives that support public health. Investments in healthcare and life sciences, particularly in countries such as Saudi Arabia and the UAE, are driving demand for diagnostic enzymes and enzyme inhibitor-based therapies by enhancing healthcare infrastructure and promoting modern treatment options.

Market Overview

The enzyme inhibitor market refers to the global industry focused on developing, manufacturing, and commercializing chemical substances that reduce or block the activity of specific enzymes by changing the shape of enzymes and preventing them from binding to their substrate or catalyzing the reaction. These inhibitors are widely used in various fields, especially in medicine and pharmaceuticals, to develop new therapeutic drugs and understand disease mechanisms for treating conditions such as cancer, cardiovascular diseases, and metabolic disorders. They are also used in agriculture as pesticides or herbicides and in biotechnology for research and diagnostic applications. This market is driven by factors such as the increasing prevalence of chronic diseases, advancements in drug discovery, and the growing aging population.

What are the Key Trends in the Enzyme Inhibitor Market?

- Advancements in Drug Discovery and Development: Ongoing research and development efforts are resulting in the discovery of new and more effective enzyme inhibitors for various diseases.

- Increasing Geriatric Population: An aging global population is more susceptible to chronic diseases, as the rising incidence of cancer, cardiovascular diseases, and neurological disorders generates a strong and increasing geriatric population

- Expansion of the Biopharmaceutical Industry: The growth of the biopharmaceutical sector is contributing to the increased development and production of enzyme inhibitors.

- Applications in Other Industries: Enzyme inhibitors are also used in food and beverages, cosmetics, and personal care products to enhance quality and shelf life.

Markket Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 45 .72 Billion |

| Market Size in 2025 | USD 45.72 Billion |

| Market Size in 2024 | USD 27.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Inhibitor, Source, Therapeutic Area, Mechanism of Action,End Use, Route of Administration and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Chronic Diseases

The major factor boosting the growth of the enzyme inhibitor market is the increasing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and infectious diseases. These diseases often involve specific enzymes that can be targeted by inhibitors to slow down or stop their progression, thereby boosting research into enzyme inhibitors as potential treatments. Inhibitors play a crucial role in therapeutic intervention. This strategy is more effective and produces fewer side effects compared to broad-spectrum treatments. Moreover, the rising demand for targeted therapies and combination therapies propels the growth of the market. Enzyme inhibitors are used in conjunction with other therapies to enhance treatment outcomes.

Restraint

Patent Expiration and Side Effects

The primary challenge in the enzyme inhibitor market is patent expiration, which lead to the entry of generic drugs, intensifying competition. Pharmaceutical companies develop enzyme inhibitors and secure patents to protect their investments during development and marketing. However, when these patents expire, other companies can produce and sell generic versions at lower prices. This significantly impacts the market share and profitability of branded enzyme inhibitors, as they face competition from cheaper generics, which can slow down overall market growth. Moreover, some inhibitors exhibit adverse side effects, such as dizziness, headaches, and gastrointestinal issues, which limits their clinical application and hampers the market growth.

Opportunity

Rising Demand for Personalized Medicine and the Development of Selective Enzyme Inhibitors

A key future opportunity for the enzyme inhibitor market lies in the rising demand for personalized medicine and the development of selective enzyme inhibitors. This involves customizing treatments based on an individual's unique genetic makeup and disease characteristics, leading to more effective and targeted therapies. This approach aims to improve treatment efficacy and reduce side effects. The focus of selective enzyme inhibitors is shifting toward developing compounds that precisely target enzymes involved in specific disease processes, minimizing off-target effects and maximizing therapeutic benefits.

Type Insights

How Did the Kinase Inhibitors Segment Dominate the Enzyme Inhibitor Market in 2024?

The kinase inhibitors segment dominated the market, accounting for 27% of the market share in 2024. This is due to their proven effectiveness in treating various diseases, especially cancer, and their ability to be designed with high specificity, particularly those targeting ATP-binding sites. Many kinase inhibitors have been approved for cancer treatment, demonstrating their ability to disrupt cancer cell growth and survival while offering higher selectivity and fewer off-target effects. Advances in the development of allosteric and reversible covalent inhibitors also address issues like drug resistance and off-target activity.

The protease inhibitors segment is expected to grow at the fastest CAGR in the upcoming period, driven by their widespread use in treating viral infections such as HIV and COVID-19, as well as other diseases like cancer. They work by blocking specific proteases, enzymes essential for viral replication, and other cellular functions, with minimal harm to healthy cells. This targeted approach makes them valuable in drug development. Continued research and development of new protease inhibitors, advancements in drug discovery technology, and increased awareness of their therapeutic benefits contribute to this growth.

Source Insights

How Does the Synthetic Enzyme Inhibitors Segment Dominate the Market in 2024?

The synthetic enzyme inhibitors segment dominated the enzyme inhibitor market with a 70% share in 2024 due to their advantages in cost, scalability, and tunability compared to natural or biological inhibitors. They can isolate and purify natural compounds from biological sources, achieve greater specificity, and reduce off-target effects. Medicinal chemistry and structure-based drug design enable fine-tuning of these inhibitors, optimizing affinity and selectivity for target enzymes. They are generally easier and cheaper to produce on a large scale, and their structures can be modified to improve efficacy, specificity, and bioavailability.

The natural enzyme inhibitors segment is experiencing the fastest growth, mainly because they are increasingly used in drug discovery for cancer and other diseases. They are perceived as safer and more effective than synthetic inhibitors to modulate enzyme activity. The rising incidence of chronic diseases, such as cancer and cardiovascular diseases, where enzyme activity plays a crucial role, is driving the demand for enzyme inhibitors, including those derived from natural sources. Natural inhibitors can be highly specific, targeting enzymes involved in disease pathways, leading to more targeted therapies. They are also being explored as potential candidates for pest control and crop protection, broadening their market potential.

Therapeutic Area Insights

What Made Oncology the Dominant Segment in the Enzyme Inhibitor Market in 2024?

The oncology segment led the market with the biggest share of 33% in 2024. This is driven by the effectiveness of enzyme inhibitors in targeting cancer cell growth and proliferation. These inhibitors not only block certain enzymes but can also disrupt disease processes, making them valuable in cancer treatment. Often used in combination with other therapies like chemotherapy or immunotherapy, enzyme inhibitors can enhance treatment outcomes. Additionally, since cancer cells can develop resistance to traditional treatments, enzyme inhibitors provide an alternative approach by targeting different pathways or mechanisms to overcome resistance.

The neurological disorders segment is expected to grow at the fastest rate during the forecast period. This is owing to the ideal role enzymes play in the development and progression of various neurological diseases like Alzheimer's and Parkinson's. Enzymes are involved in various neurological processes, including neurotransmitter metabolism, protein aggregation, and neuroinflammation. Dysregulation of these enzymes can contribute to the pathology of neurodegenerative diseases. Enzyme inhibitors offer a targeted approach to modulate enzyme activity, potentially slowing disease progression or alleviating symptoms with fewer side effects compared to broad-spectrum treatments.

Mechanism of Action Insights

How Did the Competitive Inhibitors Segment Dominate the Market in 2024?

The competitive inhibitors segment captured the largest market share of 40% in 2024. This is mainly due to their targeted mechanism of action, which involves competing with the substrate for binding to the enzyme's active site, with a powerful strategy for drug development. This mechanism is well-understood and allows for the design of specific inhibitors with predictable effects. This inhibition is often reversible and can be displaced by high concentrations of the substrate. This property allows for some degree of control over the inhibitory effect by mimicking the substrate's structure by allowing it to bind to the enzyme's active site and preventing the substrate from interacting with the enzyme and inhibiting the enzyme's activity.

The allosteric inhibitors segment is expected to grow at the fastest CAGR during the forecast period. This is due to their high specificity and ability to modulate enzyme activity, resulting in fewer off-target effects compared to traditional inhibitors. This type of inhibition binds to sites on the enzyme distinct from the active site, allowing for more selective targeting of specific enzymes and reducing the likelihood of affecting other cellular processes. This targeted approach is particularly advantageous in drug discovery, as it allows for more precise control over enzyme function while potentially overcoming resistance mechanisms.

End Use Insights

What Made Pharmaceutical & Biotech Companies the Dominant Segment in the Enzyme Inhibitor Market in 2024?

The pharmaceutical & biotech companies segment dominated the market with a major revenue share of 58% in 2024. This is primarily due to their extensive research and development efforts, which focus on creating enzyme inhibitors for various therapeutic uses, including cancer, infectious diseases, and metabolic disorders. Increased R&D spending, strategic partnerships, and outsourcing to Contract Research Organizations further support this dominance. Biotechnology plays a crucial role in the development of enzyme inhibitors, particularly in the production of biological drugs and the utilization of enzymes as active pharmaceutical ingredients.

The contract research organizations (CROs) segment is experiencing the fastest growth during the forecast period. This is because of the rising prevalence of chronic diseases, which boosts demand for targeted therapies. CROs specializing in specific disease areas offer tailored services and expertise, making them attractive to pharmaceutical and biotech companies. This focus enables CROs to optimize clinical trial designs, navigate regulatory requirements, and expedite drug development for specific conditions, ultimately leading to faster market entry for new treatments.

Route of Administration Insights

Why Did the Oral Segment Dominate the Enzyme Inhibitor Market in 2024?

The oral segment accounted for the largest market share of 61% in 2024. This is due to its convenience, cost-effectiveness, and high patient adherence. Oral administration is the most user-friendly route, requiring no specialized equipment or medical professionals. This simplicity increases patient compliance with treatment plans. Additionally, oral formulations, especially controlled-release options, are generally cheaper to produce and distribute compared to injectables or other specialized routes, with improved efficacy and patient adherence.

The injectable segment, particularly intravenous administration, is seeing significant growth. This is driven by the rapid onset of action and high bioavailability associated with intravenous injections, making them preferred for delivering enzyme inhibitors, especially in critical care and situations needing immediate therapeutic effects. Ongoing developments include long-acting injectable formulations and nanoparticle-based delivery systems, which enhance their effectiveness and therapeutic range.

Enzyme Inhibitor Market Companies

- Pfizer Inc.

- Novartis AG

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Roche Holding AG

- AstraZeneca PLC

- Boehringer Ingelheim

- AbbVie Inc.

- Eli Lilly and Company

- Johnson & Johnson

- Bristol-Myers Squibb

- Amgen Inc.

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Gilead Sciences, Inc.

- Astellas Pharma Inc.

- Viiv Healthcare

- Eisai Co., Ltd

Recent Developments

- In January 2025, Vertex Pharmaceuticals announced that the U.S. FDA approved JOURNAVX (suzetrigine), an oral, non-opioid, highly selective NaV1.8 pain signal inhibitor for treating adults with moderate-to-severe acute pain. JOURNAVX proves to be an effective and well-tolerated medication, with no evidence of addictive potential, and it is indicated for all types of moderate-to-severe acute pain.

(Source: https://news.vrtx.com) - In June 2024, Verona Pharma plc announced that the U.S. FDA approved Ohtuvayre (ensifentrine) for maintenance treatment of chronic obstructive pulmonary disease (COPD) in adult patients. Ohtuvayre is the first inhaled product with a novel mechanism of action delivered directly to the lungs via a standard jet nebulizer, eliminating the need for high inspiratory flow rates or complex hand-breath coordination.

(Source: https://www.veronapharma.com) - In May 2024, Roche announced that the U.S. FDA granted Breakthrough Therapy Designation for inavolisib, an investigational oral therapy, in combination with palbociclib (Ibrance) and fulvestrant. This combination is intended for treating adult patients with PIK3CA-mutated, hormone receptor-positive, human epidermal growth factor receptor 2-negative, locally advanced or metastatic breast cancer, following recurrence within 12 months of completing adjuvant endocrine treatment.

(Source: https://www.roche.com)

Segments Covered in the Report

By Type of Inhibitor

- Protease Inhibitors

- Reverse Transcriptase Inhibitors

- Kinase Inhibitors

- Neuraminidase Inhibitors

- Aromatase Inhibitors

- Acetylcholinesterase Inhibitors

- Phosphodiesterase Inhibitors

- Others (e.g., COX, HDAC, Topoisomerase, DPP-4)

By Source

- Natural Enzyme Inhibitors (e.g., from plants, fungi, microbes)

- Synthetic Enzyme Inhibitors

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Neurological Disorders

- Infectious Diseases

- Metabolic Disorders (e.g., Diabetes)

- Respiratory Disorders

- Others (e.g., inflammation, gastrointestinal, autoimmune)

By Mechanism of Action

- Competitive Inhibitors

- Non-competitive Inhibitors

- Uncompetitive Inhibitors

- Irreversible Inhibitors

- Allosteric Inhibitors

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals and Clinics

- Contract Research Organizations (CROs)

By Route of Administration

- Oral

- Injectable

- Others (Topical, Inhalation)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting