What is the Checkpoint Inhibitor Biologics CDMO Market Size?

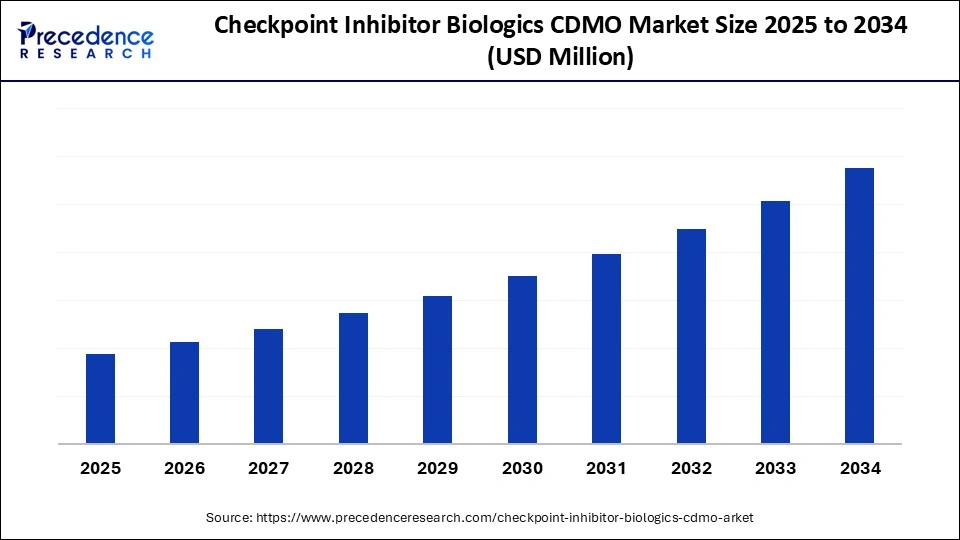

The global checkpoint inhibitor biologics CDMO market is witnessing strong growth as pharmaceutical firms outsource biologics development to enhance efficiency and reduce time-to-market.The market for checkpoint inhibitor biologics CDMOs is witnessing remarkable growth, fueled by advancements in cancer treatment and a rising demand for personalized therapies. As the landscape of biologics continues to evolve, this market is poised for significant expansion, reflecting the increasing importance of checkpoint inhibitors in modern medicine.

Checkpoint Inhibitor Biologics CDMO Market Key Takeaways

- By region, North America dominated the market, holding the largest market share of 45% in 2024.

- By region, Asia Pacific is expected to expand at the highest CAGR in the market between 2025 and 2034.

- By service type, the commercial manufacturing segment held the largest share, accounting for 40% of the checkpoint inhibitor biologics CDMO market in 2024.

- By service type, fill-finish services is expected to grow at a remarkable CAGR between 2025 and 2034.

- By technology platform, the mammalian cell culture segments held the largest share of 60% in the market for checkpoint inhibitor biologics CDMOs during 2024.

- By technology platform type, microbial fermentation is expected to grow at a remarkable CAGR between 2025 and 2034.

- By drug class, the monoclonal antibodies segment held the largest share, accounting for 70% of the checkpoint inhibitor biologics CDMO market in 2024.

- By drug class, the bispecific antibodies segment is set to grow at a remarkable CAGR between 2025 and 2034.

- By end-user type, the pharmaceutical companies segment held the largest share of 50% in the checkpoint inhibitor biologics CDMO market during 2024.

- By end-user type, biotechnology firms grow at a remarkable CAGR between 2025 and 2034.

What is the Checkpoint Inhibitor Biologics CDMO Market?

The checkpoint inhibitor biologics contract development and manufacturing organization (CDMO) market focuses on the outsourcing of development and manufacturing services for biologic drugs that target immune checkpoints, such as PD-1, PD-L1, and CTLA-4 inhibitors. These inhibitors play a crucial role in cancer immunotherapy by enhancing the body's immune response against tumour cells. The CDMO sector provides specialized services, including cell line development, process optimization, and large-scale production, to support the commercialization of these biologic therapeutics.

The checkpoint inhibitor biologics CDMO market is witnessing significant growth, driven by innovations in cancer treatments and a rising demand for personalized therapies. This sector focuses on the outsourcing of development and manufacturing services for biologic drugs that target immune checkpoints, which play a crucial role in cancer immunotherapy. North America currently leads the market, while the Asia Pacific region is expected to experience the fastest growth in the coming years. Commercial manufacturing services are pivotal in this market, reflecting the need for efficient production processes. Additionally, monoclonal antibodies are a key component of the drug classes in demand, underscoring their importance in immunotherapy. Overall, the market is poised for expansion as checkpoint inhibitors continue to make significant contributions to modern cancer treatment strategies.

Key Technological Shift in the Checkpoint Inhibitor Biologics CDMO Market

A tectonic technological shift is evident in the transition from large stainless-steel batches to modular, single-use, and continuous bioprocessing platforms that prioritize agility over economies of scale. Advanced analytics, real-time PAT, multivariate data analysis, and AI-driven process control are being embedded to enable predictive maintenance and ensure batch-to-batch comparability. Downstream innovations such as simulated moving bed chromatography and membrane chromatography are reducing resin costs and shortening cycle times. Moreover, the rise of platformed cell-line development, including transposon and site-specific integration systems, has compressed timelines from cell-line development to GMP batches. Digital twins of production processes are gaining traction for risk-free process optimization and regulatory documentation. Collectively, these technologies metamorphose CDMOs from mere manufacturers into high-value process partners.

Impact of AI in the Checkpoint Inhibitor Biologics CDMO Market

Artificial intelligence is revolutionizing the checkpoint inhibitor biologics CDMO market by streamlining development, enhancing production efficiency, and ensuring consistent quality in complex biologic manufacturing. In the early stages of process development, AI-powered predictive models are helping scientists identify optimal cell lines, media compositions, and process conditions to maximize yield and maintain desired protein structures, such as glycosylation profiles, which are critical for checkpoint inhibitors.

During scale-up, AI-driven digital twins simulate bioreactor conditions, enabling manufacturers to predict the impact of variable changes, such as pH, temperature, or oxygen transfer, on output, thereby significantly reducing experimental cycles and time-to-market. In real-time production, machine learning algorithms analyze sensor data from bioreactors and purification systems to detect deviations early, enabling automated adjustments that prevent batch failures and maintain process consistency. AI is also playing a key role in predictive maintenance of critical equipment, ensuring minimal downtime and improved operational reliability.

Checkpoint Inhibitor Biologics CDMO Market Outlook

- Industry Growth Overview: The industry growth trajectory is being propelled by a confluence of robust oncology pipelines, maturing biologics platforms, and sponsor preference for outsourcing non-core manufacturing competencies. Growth rates vary by service tier, with fill-finish and commercial-scale bioreactors commanding premium valuation multiples. Regulatory harmonization across major markets eases multi-jurisdictional supply but simultaneously raises the bar for quality systems and batch record traceability. Capital expenditures are being rechannelled into single-use technologies and modular facilities that reduce time-to-market and mitigate cross-contamination risks. As biosimilars and next-generation checkpoint inhibitors proliferate, CDMOs that can pivot between modalities will capture a disproportionate market share. Inelastic demand for sterilisable, high-integrity cold-chain logistics ensures ancillary services remain lucrative.

- Sustainability trends: Sustainability efforts are shifting from rhetoric to operations, with water and energy footprints being quantified, and facilities adopting steam-reduction strategies and solvent-recycling systems. Single-use technologies, while reducing cleaning validation burdens, raise concerns about plastic waste, prompting pilots for recyclable polymers and vendor take-back schemes. Carbon accounting is increasingly integrated into client contracts, with some sponsors stipulating reductions in Scope 1–3 emissions as part of long-term engagements. Process intensification not only improves volumetric productivity but also reduces resource consumption per gram of drug substance. Green chemistry principles are being applied to chromatography and formulation steps to minimize solvent use and hazardous-waste generation. These initiatives are becoming differentiators in tender evaluations and investor ESG assessments.

- Major investors: Private equity and strategic pharmaceutical acquirers remain the principal financiers, attracted by predictable cash flows and high switching costs for sponsors. Sovereign and government-backed funds are selectively underwriting facility buildouts in regions seeking onshoring of critical biologics capacity. Venture capital flows are directed more toward platform technologies and niche CDMOs that service complex modalities rather than into commodity manufacturing. Co-investment vehicles that bundle capacity with offtake agreements are emerging as a pragmatic model to de-risk both construction and early commercial ramp. Debt financing with long tenors is common for brownfield expansions that promise immediate revenue accretion. Investors are increasingly insisting on demonstrable quality metrics and validated client pipelines before committing capital.

- Startup economy: A vibrant cohort of nimble CDMO startups is carving out blue ocean niches specializing in bispecific, ADC payload conjugation, or viral-vector compatible operations. These smaller players leverage agility and bespoke service models to attract mid-sized biotech sponsors seeking bespoke attention and speed. Startups often partner with contract development labs and academic spinouts to feed a pipeline of tech-transfers and to de-risk scale-up challenges. However, the maturation curve is steep: many require strategic partnerships or acquisitions to secure the capital necessary for commercial-scale bioreactors. Talent acquisition is both an existential challenge and an opportunity: startups that cultivate deep domain expertise can command premium pricing. The startup ecosystem is thus a crucible for technological experimentation and the development of differentiated service propositions.

Market Key Trends

- Integration of development, analytics, and supply chain under a single contractual umbrella.

- Shift to single-use and modular facilities for faster scale-up and expansion.

- Increasing role of biosimilar and combination-immunotherapy manufacturing.

- Outsourced sterile fill-finish and lyophilization capacity as chokepoints.

- Investor preference for platform-specialist CDMOs over generalists.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Technology Platform, Drug Class, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Pipeline Proliferation: The Irresistible Engine

The primary driver of the checkpoint inhibitor biologics CDMO market is the significant expansion of oncology pipelines, particularly in areas such as checkpoint inhibitors and combination regimens, which necessitate complex biologics manufacturing. Sponsors are increasingly eschewing in-house scale-up, preferring CDMOs that can rapidly and reliably translate lab-scale proofs into GMP-grade material. The high regulatory bar for oncology therapies compels development partners to outsource to organizations with established quality systems and regulatory dossiers. Furthermore, the trend toward personalized and niche oncology indications creates episodic, high-value manufacturing demand rather than steady commodity throughput. This dynamism rewards CDMOs that can offer both small-batch flexibility and the option to scale to multi-tonne outputs. Ultimately, the pipeline itself and its insatiable need for GMP supply underwrite the CDMO value proposition.

Restraint

Capacity Constriction: The Invisible Hand Brake

A salient restraint is the asymmetry between demand and immediately available GMP capacity, particularly for aseptic fill-finish and specialized downstream operations. Lead times for building validated large-scale facilities are long and capital-intensive, creating bottlenecks that can delay clinical programs and commercialization. Regulatory complexities and the costs of maintaining multi-jurisdictional approvals further impede nimble response to sudden demand surges. Additionally, margin compression from competitive tendering and pricing pressures from payers can erode profitability unless process efficiencies are realized. Talent shortages in specialized biomanufacturing skill sets exacerbate operational constraints and can impact overall equipment effectiveness (OEE). This confluence of capacity, regulatory, and human-resource limits functions as a brake on otherwise robust market expansion.

Opportunity

Adjacency Alchemy from Manufacture to Mission

The most compelling opportunity in the checkpoint inhibitor biologics CDMO market lies in their expansion into adjacent services, including comparability studies, regulatory filing support, analytics-as-a-service, and supply-chain orchestration, thereby capturing more value per client engagement. Opportunities also exist in geographically underserved regions where onshoring incentives and biosecurity concerns are prompting sponsors to diversify manufacturing locations. Investment in modular, rapidly deployable facilities can unlock new revenue streams by offering short-term campaign-based production for niche indications. Another fertile domain is the manufacture of combination therapies, such as checkpoint inhibitors paired with cell therapies or ADCs, which require cross-modal expertise. Finally, CDMOs that can demonstrate reduced time-to-market through platformed workflows and tight integration with sponsor R&D will attract premium partnerships. These adjacent expansions transform CDMOs into strategic allies rather than transactional vendors.

Segmental Insights

Service Type Insights

Why is Commercial Manufacturing Dominating the Checkpoint Inhibitor Biologics CDMO Market?

The commercial manufacturing segment dominates the checkpoint inhibitor biologics CDMO market, holding a 40% share due to these clinical candidates maturing into late-stage approved products and sponsors increasingly entrusting CDMOs with large-scale production that adheres to the rigorous requirements of GMP compliance. The inherent complexity of biologics, especially checkpoint inhibitors, necessitates specialized expertise, scale-up, validation, and comparability assessments. CDMOs equipped with advanced bioreactor suites, automation, and validated analytical infrastructure are thus indispensable allies in ensuring supply continuity. Long-term contracts and dedicated capacity agreements have become defining traits of this segment. Ultimately, commercial manufacturing represents the nexus of industrial precision, regulatory credibility, and scientific integrity.

As product pipelines proliferate and biosimilar entrants loom, commercial manufacturing will remain a bastion of reliability for biopharma clients. The emphasis will shift toward flexible, single-use facilities capable of multiproduct campaigns, thereby increasing efficiency without compromising quality. Regional diversification of production is also expected to mitigate geopolitical and supply chain risks. Furthermore, real-time analytics and digital batch recording systems will enhance traceability, driving both confidence and compliance. The future belongs to those CDMOs that can transform manufacturing from a cost centre into a strategic differentiator.

The fill-finish services are the fastest-growing in the checkpoint inhibitor biologics CDMO market, expected to clock in a CAGR between 20-25%. As checkpoint biologics progress toward commercialization, the precision and sterility of final drug product handling have become mission-critical. CDMOs are responding with investments in advanced isolator technology, robotics-driven aseptic lines, and lyophilisation systems for improved stability and shelf life. The surging demand for multi-dose vials, prefilled syringes, and on-demand packaging formats further amplifies the importance of this service tier. Moreover, the fill-finish phase now integrates sophisticated analytical control, ensuring particulate-free, contamination-resistant, and dosage-consistent outcomes.

In the future, digital twin simulations and AI-guided quality monitoring will redefine excellence in fill-finish operations. CDMOs that can balance throughput with sterility assurance will dominate client rosters. The expansion of biologic modalities, including antibody-drug conjugates and fusion proteins, will demand versatile filling systems that are adaptable to diverse viscosity and stability profiles. This segment's rapid ascent mirrors the industry's growing appreciation for the precision artistry behind the final dosage form.

Technology Platform Insights

Why Is Mammalian Cell Culture Leading the Checkpoint Inhibitor Biologics CDMO Market?

The mammalian cell culture segment is leading the market, commanding nearly 60% of the checkpoint inhibitor biologics CDMO market because of the cells' unique ability to produce complex, glycosylated antibodies that mirror human biological activity and therapeutic efficacy. CDMOs have mastered high-titre CHO cell lines, perfusion bioprocessing, and serum-free media to enhance productivity while reducing contamination risk. This platform's versatility accommodates monoclonal, bispecific, and fusion protein architectures, making it indispensable to the realm of checkpoint biologics. Robust scalability from bench-scale to 10,000-litre reactors ensures seamless progression from clinical to commercial supply. The convergence of process intensification and analytical validation continues to solidify this platform's centrality.

Future advances in mammalian systems are likely to focus on continuous processing, PAT-enabled control, and modular bioreactors for enhanced multiproduct agility. Genetic engineering of cell lines for higher expression stability and improved post-translational fidelity will also accelerate innovation. CDMOs that combine upstream dexterity with downstream efficiency will command enduring partnerships with global sponsors. In essence, mammalian cell culture is not merely a technique; it is the living backbone of checkpoint biologic production.

Microbial fermentation is experiencing a renaissance, expanding at a CAGR of roughly 15-20% as cost pressures and innovation in expression systems converge. While traditionally limited to simpler proteins, modern engineering has enabled microbial systems to produce antibody fragments and therapeutic scaffolds at high yields. This platform's advantages, including shorter cycle times, reduced media costs, and a compact facility footprint, make it a compelling alternative for emerging markets and niche indications. CDMOs leveraging advanced fermentation control and hybrid purification pipelines are redefining their commercial viability.

Going forward, innovations such as synthetic biology-based strain optimization and AI-driven bioprocess tuning will further push microbial systems into mainstream biologics. Their ecological efficiency reduces water and energy consumption, aligning with sustainability imperatives. The shift toward hybrid manufacturing, which combines microbial and mammalian outputs within a unified CDMO infrastructure, is likely to become a hallmark of next-generation facilities.

Drug Class Insights

Why Are Monoclonal Antibodies Leading the Checkpoint Inhibitor Biologics CDMO Market?

The monoclonal antibodies segment remains the undisputed heavyweight of the checkpoint biologics CDMO market, constituting approximately 70% of all activity. Their clinical versatility, ranging from PD-1 and CTLA-4 inhibitors to emerging co-stimulatory modulators, has driven continuous demand for large-scale, high-fidelity manufacturing. CDMOs have refined processes for titer optimisation, aggregation control, and glycosylation consistency, ensuring regulatory compliance and therapeutic reliability. The global appetite for mAbs reflects not only their scientific merit but also their entrenched position in oncology pipelines and combination therapies.

Yet, as pipelines expand and global competition intensifies, CDMOs must innovate to remain indispensable. The rise of next-generation monoclonals engineered for enhanced affinity, reduced immunogenicity, and improved tissue penetration demands precision bioprocessing. Integration of real-time release testing, automation, and digital quality systems will underpin scalability and cost efficiency. In sum, monoclonal antibody manufacturing remains the gold standard of biologic craftsmanship.

The bispecific antibodies segment is emerging as the vanguard of therapeutic innovation, expected to advance at a CAGR between 25–30%. Their ability to bind two distinct targets simultaneously opens new frontiers in immune modulation and tumour specificity. For CDMOs, however, their structural complexity introduces fresh challenges in correct chain pairing, stability optimisation, and purification of heterogeneous forms. Those with the expertise to navigate these intricacies will become the preferred partners for a new generation of checkpoint drugs.

In the coming decade, bispecifics will redefine the boundaries of therapeutic design, necessitating tailored manufacturing workflows and analytics to support their development. CDMOs investing in modular bioprocess lines, adaptive chromatography, and structural validation will seize disproportionate market advantage. The segment's trajectory is emblematic of the industry's evolution, from replication to orchestration of biological intelligence.

End-User Insights

Why are Pharmaceutical Companies Dominating the Checkpoint Inhibitor Biologics CDMO Market?

The pharmaceutical companies segment accounted for approximately 50% of the market because of their reliance on outsourced expertise to accelerate production while maintaining capital prudence. Many have adopted hybrid models, retained limited internal capacity, and leveraged CDMOs for flexibility and surge manufacturing. The growing complexity of immuno-oncology portfolios, coupled with global distribution needs, makes CDMO partnerships a strategic imperative. Regulatory alignment and proven GMP compliance remain key selection criteria for such collaborations.

Going forward, pharmaceutical clients will increasingly demand end-to-end services encompassing analytics, formulation, and fill-finish under unified quality systems. CDMOs offering dual-site redundancy and data transparency will become the preferred long-term allies. This collaboration between industrial giants and manufacturing specialists epitomizes the modern biopharma ecosystem, cooperative, capital-light, and innovation-oriented.

The biotechnology firms segment represents the most dynamic clientele, expected to grow at a CAGR of 20–25% as research and development pipelines surge globally. These companies often lack in-house capacity, relying on CDMOs for development, process transfer, and clinical batch production. Their agility and scientific creativity demand manufacturing partners capable of parallel innovation and rapid response. CDMOs, in turn, benefit from early-stage collaborations that mature into long-term commercial relationships.

Regional Insights

How Is North America the Rising Star in Checkpoint Inhibitor Biologics CDMO Market?

North America dominated the checkpoint inhibitor biologics CDMO market in 2024 with a 45% share due to its deep concentration of immune-oncology sponsors, advanced regulatory frameworks, and mature GMP infrastructure. The region hosts a dense ecosystem of pioneering biotechs, leading academic translational centres, and established CDMOs with proven track records in antibody therapeutics and complex biologic modalities.

Will the United States Continue to Chart the Course of Checkpoint Inhibitors?

The U.S. maintains a strong pipeline of innovative biologic drugs, particularly monoclonal antibodies. Investors and strategic partners are plentiful, enabling rapid capital deployment for capacity and analytical upgrades. The region's regulatory and payer sophistication facilitates early commercialization strategies and premium pricing for differentiated therapies. Consequently, the U.S. is both the principal demand generator and the source of many best-practice manufacturing paradigms.

How Is Asia Pacific the Fastest Growing in the Checkpoint Inhibitor Biologics CDMO Market?

The Asia Pacific is the fastest-growing regional market, driven by expanding biotech ecosystems, increasing domestic capital, and strategic investments in manufacturing capacity for oligonucleotides and LNPs. Governments and private sponsors in the region are prioritizing life sciences clusters, enabling the rapid scale-up of GMP facilities and clinical trial networks. Lower manufacturing costs and growing CDMO sophistication make the region attractive both for global supply diversification and cost-sensitive market entry. Local innovators focus on niche indications and affordable delivery solutions tailored to regional disease burdens. With regulatory pathways maturing and cross-border collaborations increasing, the Asia Pacific is poised to evolve from a manufacturing hub to a clinical innovation centre.

Can India translate Scale, Capital, and policy support into Global CDMO leadership for Checkpoint Biologics?

India is emerging as a key player due to its growing biotechnology sector and increasing outsourcing of biologics manufacturing. It offers a cost advantage in biomanufacturing, making it an attractive destination for outsourcing from global pharmaceutical companies. A large pool of skilled scientists and engineers is driving innovations in biomanufacturing processes, particularly in microbial fermentation and mammalian cell culture technologies.

Checkpoint Inhibitor Biologics CDMO Market Value Chain Analysis

- Raw Material Sources: Primary inputs include modified nucleotides, phosphoramidites for oligo synthesis, lipids for nanoparticle formulations, and ligands for receptor targeting. Secure sourcing of high-purity reagents and single-use consumables is crucial to ensure GMP consistency and supply chain resilience.

- Technology Used: Core technologies include solid-phase oligonucleotide synthesis, lipid nanoparticle microfluidic assembly, receptor-targeted conjugation chemistries, and analytical platforms such as mass spectrometry and next-generation sequencing for biodistribution analysis. Complementary tools include formulation screening, robotics, and advanced in vitro organoid models for translational assessment.

- Investment by Investors: Investors favor platform companies with differentiated delivery IP, established CMC pathways, and early clinical proof-of-concept; CDMOs with scalable LNP and oligo capabilities also attract infrastructure capital. Strategic biopharma partnerships remain the common exit and commercialization route.

- AI Advancements: AI accelerates sequence selection, predicts off-target interactions, optimizes conjugation linkers, and models biodistribution based on physicochemical properties, thereby shortening lead discovery times and enhancing safety profiling. Machine learning also streamlines manufacturing yield optimization and predictive quality control.

Top Checkpoint Inhibitor Biologics CDMO Market Companies

- Lonza Group: Lonza is a global leader in biopharmaceutical manufacturing and CDMO services, offering fully integrated solutions from cell line development to commercial biologics and cell/gene therapy production. The company's global facilities in Switzerland, the U.S., and Asia make it a preferred partner for biologics manufacturing, biosimilars, and mRNA vaccine components.

- WuXi AppTec: WuXi AppTec provides comprehensive R&D, manufacturing, and testing services across small molecules, biologics, and advanced therapies. With its “follow the molecule” business model, the company supports clients throughout the entire drug development cycle, accelerating timelines for global pharmaceutical firms.

- Samsung Biologics: Samsung Biologics is one of the largest biologics CDMOs in the world, offering large-scale monoclonal antibody and recombinant protein manufacturing. Its state-of-the-art Bio Campus in Incheon provides unmatched production capacity, speed, and digitalized quality systems for global biotech and pharma clients.

- WuXi Biologics: WuXi Biologics delivers end-to-end biologics development and manufacturing through its proprietary WuXiBody™ platform, enhancing antibody design and expression. The company's global expansion includes facilities in the U.S., Ireland, and Singapore, supporting clinical to commercial-scale biologics production.

- Boehringer Ingelheim: Boehringer Ingelheim's BioXcellence™ division offers world-class biologics CDMO services, including mammalian and microbial cell culture systems. With over 35 years of experience, the company supports biopharma partners from early development through to large-scale commercial manufacturing.

Other Companies in the Checkpoint Inhibitor Biologics CDMO Space

Recent Developments

- In October 2025, Eli Lilly and Company announced that it plans to spend over $1 billion in the next few years to grow its contract manufacturing business in India. This will help local companies that make drugs, suppliers, and technology partners, and it will make India a stronger player in the global pharmaceutical industry. The investment will enhance Lilly's manufacturing and supply processes, making it easier for people worldwide to access its medicines. A new Manufacturing and Quality Center will be established in Hyderabad to oversee Lilly's contract manufacturing operations in India.

(Source: https://www.businesstoday.in) - In March 2025, mAbTree Biologics AG entered into a development and commercialization agreement with Shilpa Biologicals for a novel checkpoint inhibitor, wherein Shilpa will provide GMP manufacturing, formulation, and global supply support under its emerging “hybrid CDMO” model.

(Source: https://pharmasource.global)

Segment Covered in the Report

By Service Type

- Cell Line Development

- Process Development

- Analytical and Quality Control

- Commercial Manufacturing

- Fill-Finish Services

By Technology Platform

- Mammalian Cell Culture

- Microbial Fermentation

- Cell-Free Systems

- Others

By Drug Class

- Monoclonal Antibodies

- Bispecific Antibodies

- Fusion Proteins

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Firms

- Academic and Research Institutions

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting