Biologics CDMO Market Size and Forecast 2025 to 2034

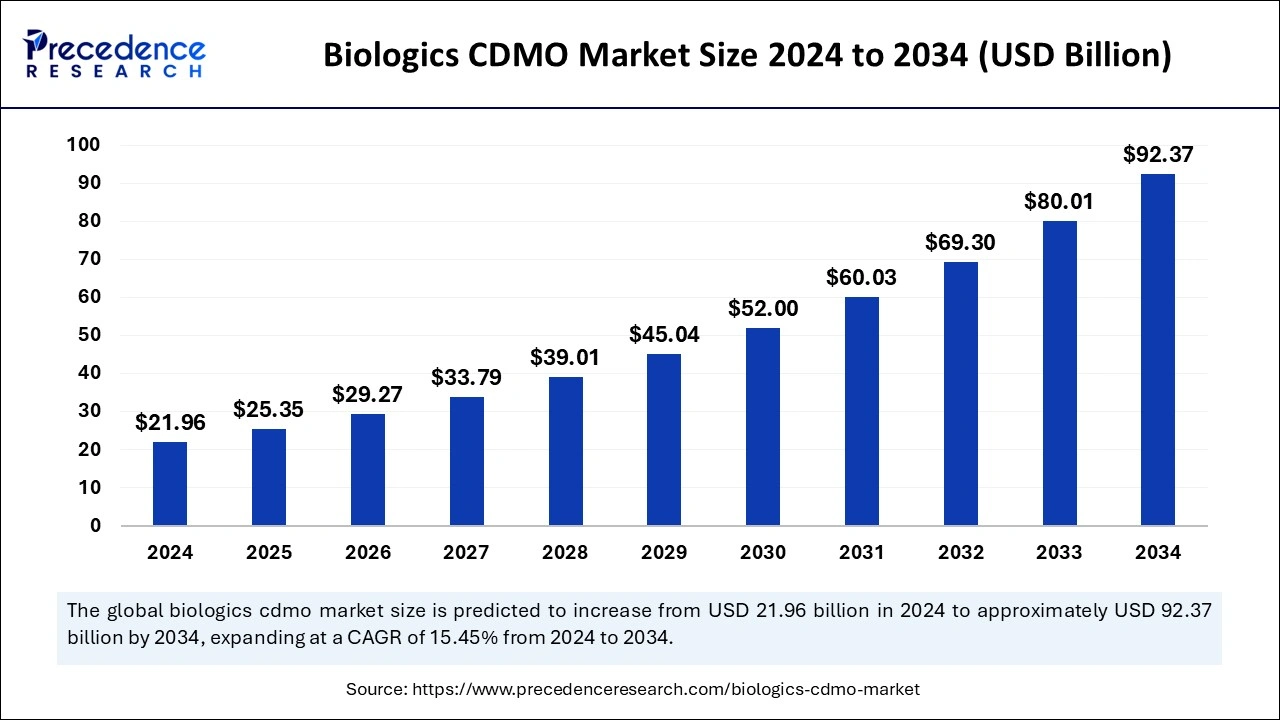

The global biologics CDMO market size was estimated at USD 21.96 billion in 2024 and is anticipated to reach around USD 92.37 billion by 2034, growing at a solid CAGR of 15.45% from 2025 to 2034.

Biologics CDMO Market Key Takeaways

- The global biologics CDMO market was valued at USD 21.96 billion in 2024.

- It is projected to reach USD 92.37 billion by 2034.

- The biologics CDMO market is expected to grow at a CAGR of 15.45% from 2025 to 2034.

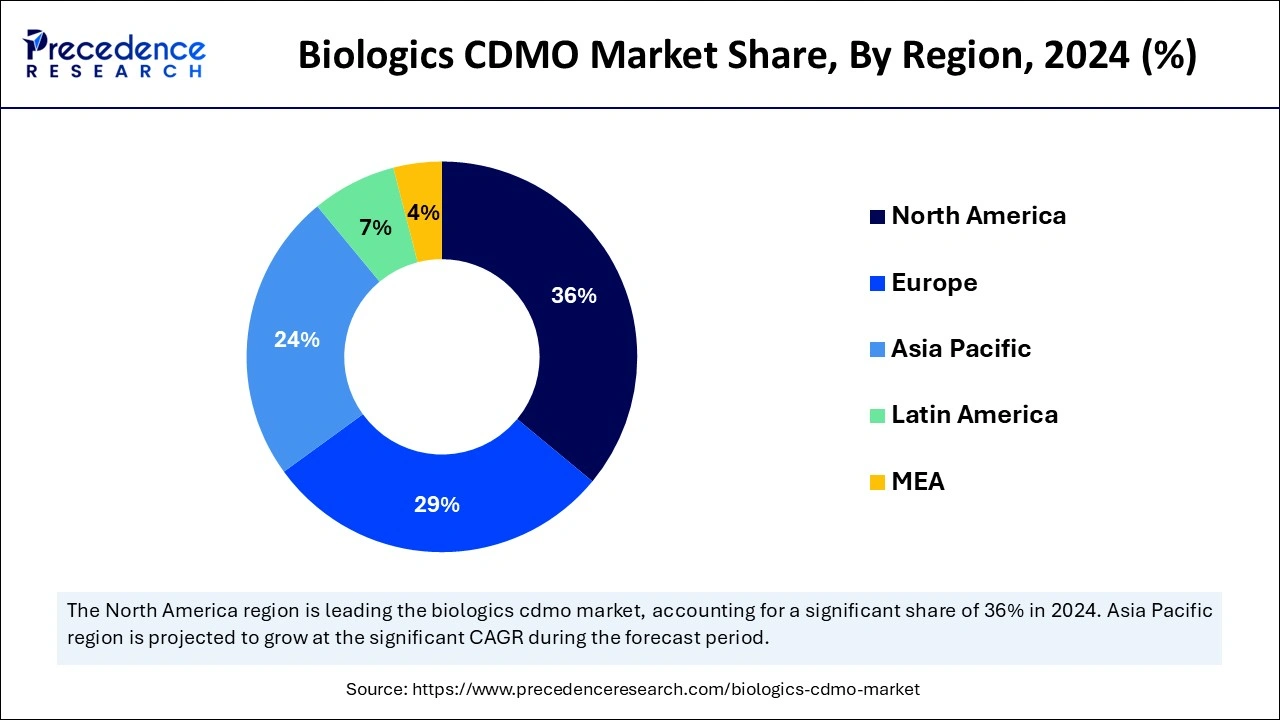

- North America dominated the biologics CDMO market with the largest market share of 36% in 2024.

- Asia-Pacific is observed to be the fastest-growing in the biologics CDMO market during the forecast period.

- By type, the mammalian segment dominated the market in 2024.

- By type, the microbial segment is observed to be the fastest growing in the biologics CDMO market during the forecast period.

- By molecule type, the monoclonal antibodies segment dominated the biologics CDMO market in 2024.

- By molecule type, the recombinant protein segment is observed to be the fastest growing in the biologics CDMO market during the forecast period.

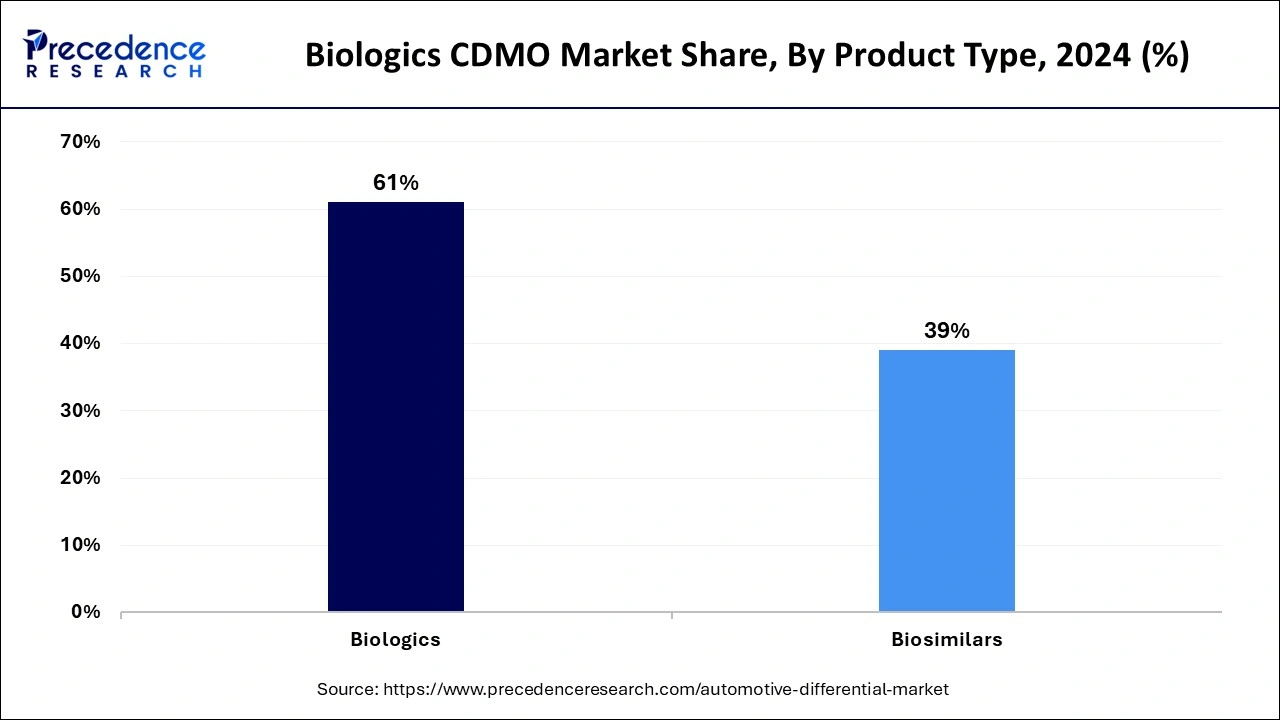

- By product type, the biologics segment contributed the biggest market share of 61% in 2024.

- By indication, the oncology segment dominated the biologics CDMO market in 2024.

- By indication, the auto-immune diseases segment grows at a notable rate in the market during the forecast period.

How Artificial Intelligence is Transforming the Biologics CDMO Market?

Artificial intelligenceis changing the landscape ofdrug discovery, quality control efficiency,supply chain management, and optimizing manufacturing performance.Generative AIassists with designing of visual, textual, and molecular content by synthesizing a vast amount of data obtained from the pharmaceutical industries. The integration of AI in biological and chemical processing through autonomous robots eases handling of multiple complex tasks, problem-solving and precise system modelling and control. The incorporation of AI helps in thepersonalized medicine, tailoring appropriate healthcare solutions and ensuring the safety of patient's personal health information.

- In June 2024, Bionova Scientific, the U.S. Biologics CDMO announced the establishment of new business facility in Texas for the process development and good manufacturing practices-based manufacturing of plasmids that will benefit to the pharmaceutical and biotechnology plasmid DNA research.

U.S. Biologics CDMO Market Size and Growth 2025 to 2034

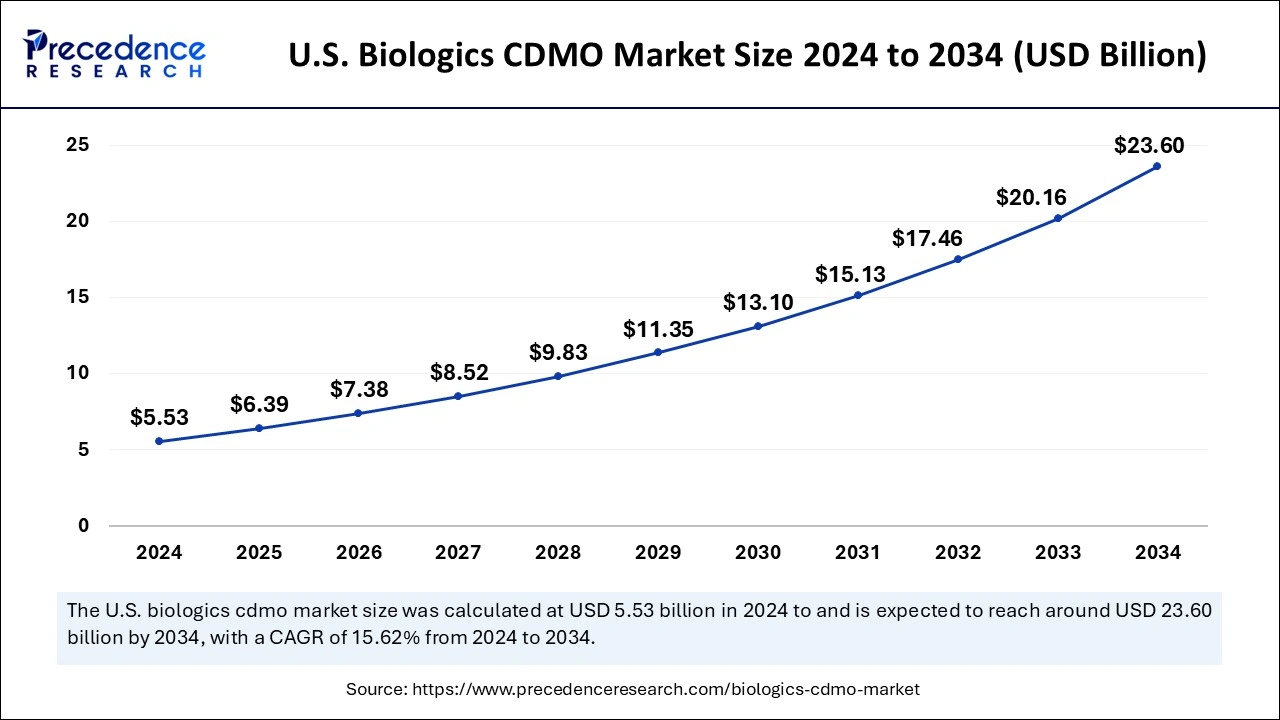

The U.S. biologics CDMO market size was exhibited at USD 5.53 billion in 2024 and is projected to be worth around USD 23.60 billion by 2034, poised to grow at a CAGR of 15.62% from 2025 to 2034.

North America had dominated in the biologics CDMO market in 2024. Many of the world's top pharmaceutical and biotechnology companies are based in North America, especially in the United States. Pfizer, Amgen, and Johnson & Johnson headquarters are located nearby, offering a solid foundation for biologics CDMO operations. The Food and Drug Administration (FDA) of the United States has established clear rules for authorizing and regulating biologics. This regulatory clarity stimulates investment in biologics and innovation.

- In June 2023, Enzene Biosciences, a division of Alkem Laboratories in India, announced plans to build a $50 million manufacturing plant near Princeton, New Jersey. The CDMO anticipates adding up to 300 more employees to help with facility operations.

Asia-Pacific is observed to be the fastest growing in the biologics CDMO market during the forecast period. The region is seeing an increase in foreign direct investment, especially in the biopharmaceutical industry. Global corporations are establishing manufacturing and research and development (R&D) centers to take advantage of the lower costs and access to trained personnel in the area. The region's biologics manufacturing costs are generally less than those of North America and Europe. Due to its reduced labor, raw materials, and overall operating costs, it is a desirable location for CDMO services.

- In September 2023, Prestige Biologics Co., a biopharmaceutical contract development and manufacturing organization (CDO) based in South Korea, collaborates with a top pharmaceutical company in India to grow its CDMO business.

Market Overview

Pharmaceutical businesses can obtain services for developing and producing biological medicinal products from a biologics contract development and manufacturing organization (CDMO). This kind of CDMO may provide the same services for small molecule medications in addition to biologics, or they may focus exclusively on developing and producing biologics.

Pharmaceutical businesses can benefit greatly from the experience that biologics CDMOs have in handling pre-formulation, clinical trials, and commercial production. Biologics CDMO businesses offer the knowledge and expertise to be first to market when it matters. With their cutting-edge treatments for a variety of illnesses, such as cancer, autoimmune and other genetic disorders, and infectious diseases, biologics have entirely changed the way drugs are delivered.

- In November 2023, Boehringer Ingelheim has extended its use of the Genedata platform to include the Drug Metabolism and Pharmacokinetics (DMPK) group in the United States, according to a statement released by Genedata. The DMPK US operations use Genedata Biologics as part of their crucial reagent life-cycle management approach for non-clinical and clinical bioanalytical activities related to potential novel biopharmaceutical medications.

Biologics CDMO Market Trends

- In July 2023, Leading biopharmaceuticals-focused contract development and manufacturing organization (CDMO), Biovian recently revealed a significant investment of more than 50 million euros to expand its operations in Finland.

- In June 2023, Samsung Biologics inked two long-term production contracts valued at $897 million for Pfizer's portfolio of multiproduct biosimilars.

- The advancement of advanced therapeutics (ATs) and biologics is driving a fundamental transformation in the pharmaceutical industry. The therapeutic landscape is changing due to this change, which also brings new potential and difficulties for the drug development and manufacturing value chain. This drives the growth of the biologics CDMO market.

- In May 2023, Aurigene Pharmaceutical Services declared that a cutting-edge facility for developing and producing medicinal proteins, antibodies, and viral vectors is being built. Aurigene is spending $40 million on an R&D and pilot-scale facility at Genome Valley, a renowned Biotechnology Park in Hyderabad, as the initial leg of the investment plan. This facility will satisfy international biotech enterprises' process development and clinical supply demands.

- The full-service biologics CDMO Bionova Scientific, a U.S. subsidiary of Asahi Kasei Medical, has decided to open a new business line utilizing plasmid DNA and build a specialized facility in Texas.

Biologics CDMO Market Growth Factors

- Biologics are sophisticated medications made from living organisms, and demand for them is being driven by the rising incidence of chronic diseases like diabetes, cancer, and autoimmune disorders.

- Chronic diseases are more common in the elderly, which increases the need for biologics and CDMO services. Due to financial constraints and the requirement for experience in creating biologics, pharmaceutical companies are outsourcing research and development more and more, which is advantageous for CDMOs with robust R&D capacities. This drives the growth of the biologics CDMO market.

- Biopharmaceutical companies are collaborating with CDMOs to develop and produce innovative biologics by utilizing their knowledge and resources.

- Technological innovations such as disposable/single-use systems increase the flexibility, economy, and efficiency of biologics manufacturing, making CDMOs more desirable business partners. This drives the growth of the biologics CDMO market.

- Drug research expenses are rising, and globalization is driving a major expansion in the broader pharmaceutical CDMO business. This rising tide lifts all boats, benefiting biologics CDMOs as well.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 92.37 Billion |

| Market Size in 2024 | USD 21.96 Billion |

| Market Size in 2025 | USD 25.35 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.45% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Molecule Type, Product Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for biological medicinal products and small-molecule drugs

Even with the rise of biologicals, small-molecule medications are still crucial for treating a wide range of illnesses. CDMOs are essential for maximizing and scaling up the manufacture of these medications. Their proficiency in process optimization, synthetic chemistry, and regulatory compliance aids pharmaceutical companies in effectively introducing these medications to the market.

The pharmaceutical industry's shift towards personalized treatment and targeted therapy further fueled the need for specialized biologics and small-molecule medications. CDMOs with strong manufacturing skills and the ability to quickly adjust to changing market conditions are well-positioned for expansion. This drives the growth of the biologics CDMO market.

Increasing adoption of automation and Internet of Things (IoT) technologies

In biologics production, automation enables streamlined procedures that lower human error and unpredictability. Through real-time parameter monitoring, IoT-enabled equipment can guarantee constant quality and regulatory compliance throughout the production process. IoT sensors gather large volumes of data while production is taking place. Analyzing this data can increase overall operating efficiency through process optimization, predictive maintenance, and continuous improvement.

Restraint

Shortage of skilled professionals in bioprocessing and biomanufacturing

A thorough understanding of bioprocess engineering, cell culture techniques, purification processes, and regulatory compliance is required by the biologics CDMO industry. Not only do proficient experts need to carry out these procedures, but they must also be continuously innovated and optimized. Lack of such knowledge may make it more difficult for CDMOs to remain competitive in a market that is expanding quickly and to satisfy the changing needs of their biopharmaceutical clients. This limits the growth of the biologics CDMO market.

Opportunities

Advantages of investments in contract manufacturing facilities

Manufacturing biologics calls for specific resources and knowledge. Pharmaceutical businesses can avoid the high initial capital expenditures of establishing and maintaining these facilities by investing in contract manufacturing facilities. Alternatively, by using CDMOs' already-existing infrastructure and obtaining economies of scale, companies can outsource production to them. This opens an opportunity for the growth of the biologics CDMO market.

Potential for additional CDMOs and big pharma alliances

CDMOs possess deep technical expertise in cell culture, fermentation, purification, and analytical testing. They invest in state-of-the-art infrastructure and technology to fulfill the unique requirements of biologic production. CDMOs are skilled at negotiating intricate regulatory procedures, guaranteeing that goods meet international standards. These procedures require specific equipment and knowledge because they involve living cells. Strict regulatory requirements are in place for biologics to ensure their efficacy and safety.

Type Insights

The mammalian segment dominated the biologics CDMO market in 2024. Mammalian cell-based biologics are frequently more sophisticated than those created with other systems, such as yeast or bacterial cells. Because of their complexity, therapeutic proteins may be produced structurally and functionally in ways that are very similar to human proteins. This makes them excellent treatments for various illnesses like cancer, autoimmune diseases, and chronic illnesses. Due to their improved efficacy, the increased demand for these biologics has also increased the demand for CDMO services based on mammalian cell culture.

The microbial segment is observed to be the fastest growing in the biologics CDMO market during the forecast period. The market for biosimilars has expanded due to the expiring patents for some popular biologics. Because microbial systems are efficient and affordable, many biosimilars are made there. A growing pipeline of new biologics is being generated using microbial systems, including novel therapeutic proteins and peptides.

Molecule Type Insights

The monoclonal antibodies segment dominated the biologics CDMO market in 2024. The industry has grown due to large investments made by venture capital firms into biotech businesses, creating mAbs. Government subsidies and funding for monoclonal antibody research, particularly during pandemics, have supported the market. Advancements in upstream and downstream bioprocessing have increased the efficiency and yield of mAb synthesis. The usage of single-use systems has improved manufacturing flexibility and decreased the possibility of cross-contamination. The characterization of mAbs has been enhanced by sophisticated analytical techniques, guaranteeing increased quality and consistency in production.

- In October 2023, to provide the biopharmaceutical industry with its knowledge and expertise, Tanvex BioPharma USA Inc., a programmer and manufacturer of biopharmaceuticals, created Tanvex CDMO, a comprehensive biologic contract development and manufacturing service.

The recombinant proteins segment is observed to be the fastest growing in the biologics CDMO market during the forecast period. Improvements in expression methods, including insect, bacterial, yeast, and mammalian cell lines, have significantly increased the yield and productivity of recombinant protein synthesis. Advances in cell-free protein synthesis, continuous manufacturing, and single-use bioreactors have simplified production procedures, cutting expenses and time.

- In December 2023, ProteoNic Biosciences BV and Abzena, a bioconjugate and complex biologics CDMO, collaborated to license 2G UNic, their protein expression technology. This cutting-edge vector technique is intended to greatly enhance the generation of high-yielding CHO cell lines for Abzena's clients.

Product Type Insights

The biologics segment has a significant share in the biologics CDMO market in 2024. Treatments for complicated diseases like cancer, autoimmune disorders, and hereditary problems have shown greater efficacy and specificity when using biologics, which include vaccines, recombinant proteins, cell and gene treatments, and monoclonal antibodies. Biologics, frequently customized to unique patient profiles, are in more demand due to the trend toward personalized therapy.

Indication Insights

The oncology segment dominated the biologics CDMO market in 2024. Millions of new cases of cancer are identified annually, indicating a rising global prevalence of the disease. This has led to a significant need for novel and efficient biologic medicines. The need for cutting-edge oncology therapies is further fueled by the fact that an aging global population is more vulnerable to cancer.

Biologic medications that target different types of cancer are rapidly emerging from the pipeline because of significant investments made by pharmaceutical and biotech businesses in oncology research and development. Research into cancer, clinical trials, and the creation of biologic treatments are all greatly aided by substantial funding from public agencies, nonprofit groups, and private investors.

- The National Library of Medicine projects that in 2023, there will be 609,820 cancer-related fatalities and 1,958,310 new cases of cancer in the US.

- In December 2023, to improve the treatment of pediatric cancer, ViroCell Biologics, a viral vector CDMO located in London that conducts clinical trials for gene and cell therapies, teamed up with University College London (UCL).

The auto-immune diseases segment grows at a notable rate in the biologics CDMO market during the forecast period. The frequency and prevalence of autoimmune illnesses, including lupus, rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease, have increased significantly. This increase is driving the need for efficient biologic medicines. The need for biologic therapy has been fueled partly by increased awareness of autoimmune disorders and their earlier and more accurate detection due to developments in diagnostic procedures.

The trend toward personalized medicine and precision therapeutics is driving the need for biologics that cater to each patient's specific requirements. Biologics are ideally adapted to fulfill the individualized therapeutic needs associated with autoimmune disorders.

- In May 2024, with €16 million in seed funding, Commit Biologics came out stealth to use its bispecific complement engaging (BiCE) technology to create antibody therapeutics for treating autoimmune disorders and cancer.

Biologics CDMO Market Companies

- 3P BIOPHARMACEUTICALS S.L.U

- AGC Biologics

- Binex Co. Ltd.

- Boehringer Ingelheim International GmbH

- Bora Pharmaceuticals Co. Ltd

- Catalent Inc.

- Evonik Industries AG

- FUJIFILM Corp.

- Rentschler Biopharma SE

- Samsung Electronics Co. Ltd.

Recent Developments

- In May 2023, the healthcare-specialized acquisition firm EureKING, which focuses on bioproduction, offered to purchase Skyepharma, a contract development and manufacturing organization (CDMO) engaged in medication development and oral technology delivery innovation.

- In April 2023, Eurofins CDMO Alphora Inc. started the Biologics project to expand and diversify within North America's contract development and manufacturing sector. The multi-phase project intends to build a facility in the Sheridan Research Park campus in Mississauga, Ontario, Canada's 2070 Hadwen site.

- In January 2023, Richard Won-jik Lee, CEO of Lotte Biologics, unveiled a plan to advance the company's status as a worldwide contract development and manufacturing organization (CDMO). The company intends to build three mega plants in Korea with a combined manufacturing capacity of 360,000 liters of antibody therapeutics by investing $3 billion (about KRW 3 trillion) by 2030.

Segments Covered in the Report

By Type

- Mammalian

- Microbial

By Molecule Type

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Hormones

- Others

By Product Type

- Biologics

- Biosimilars

By Indication

- Oncology

- Auto-Immune Diseases

- Infectious Diseases

- Neurology

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content