What is the Industrial Diesel Turbocharger Market Size?

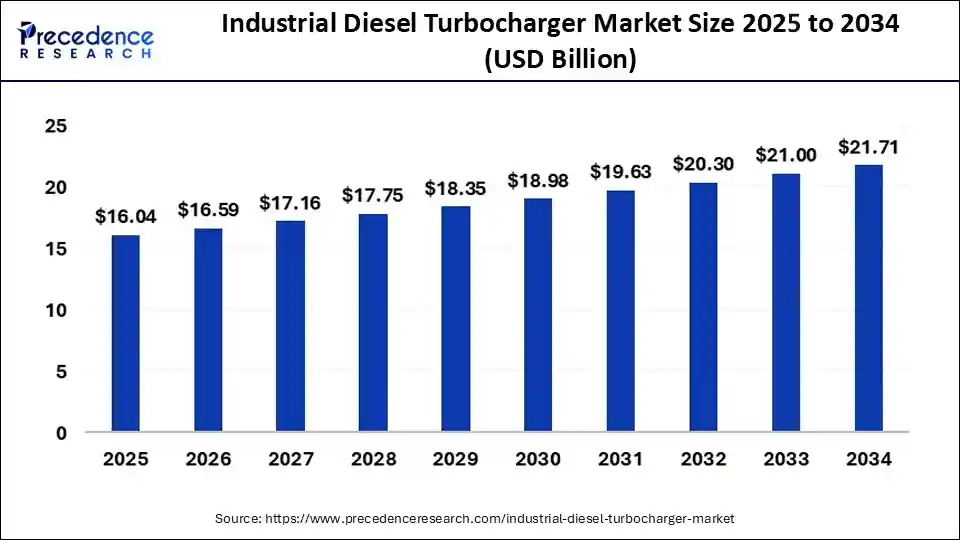

The global industrial diesel turbocharger market size is valued at USD 16.04 billion in 2025 and is predicted to increase from USD 16.59 billion in 2026 to approximately USD 21.71 billion by 2034, expanding at a CAGR of 3.42% from 2025 to 2034. The key factor driving market growth is the increasing focus on sustainable operations. Also, the increasing need for fuel efficiency coupled with the stringent emission regulations across many sectors can fuel market growth further.

Industrial Diesel Turbocharger Market Key Takeaways

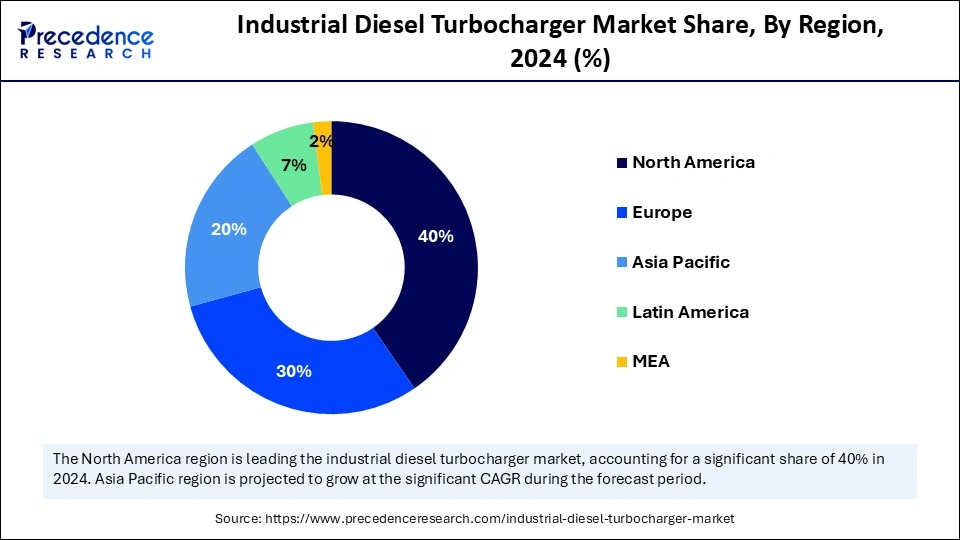

- Asia Pacific dominated the industrial diesel turbocharger market with the largest share of 40% in 2024.

- North America is expected to grow at a significant rate over the forecast period.

- By engine type, the diesel engines segment led the global market in 2024.

- By engine type, the internal combustion engine segment is estimated to grow fastest over the forecast period.

- By sales channel, the OEM sales segment held the largest market share in 2024.

- By sales channel, the direct sales segment is expected to grow at the fastest rate over the forecast period.

- By component type, the compressors segment dominated the market in 2024.

- By component type, the turbine segment is expected to grow rapidly over the projected period.

- By application, the power generation segment dominated the market in 2024.

- By application, the marine application segment is expected to grow at a significant rate over the forecast period.

Role of Artificial Intelligence (AI) in the Industrial Diesel Turbocharger Market

The impact of artificial intelligence in the industrial diesel turbocharger market goes beyond efficiency, boosting innovation and creating new business avenues. AI-powered algorithms can facilitate resource allocation, individualize user experiences, and improve cybersecurity measures. Furthermore, AI integration in the industry is changing customer interactions through individualized suggestions, automated support systems, and intelligent chatbots.

Market Overview

Industrial turbochargers play a crucial role in improving engine performance and efficiency. They are essential in fulfilling stringent environmental standards and meeting the increasing demand for fuel-convenient diesel engines across different industries. Market players are emphasizing creating smart solutions that enable better control and management of turbocharger performance, which improves efficiency and also helps in predictive maintenance.

Industrial Diesel Turbocharger Market Growth Factors

- Shifting consumer preferences and technological advancements are expected to boost industrial diesel turbocharger market growth soon.

- The drive towards sustainability and the global shift towards electric engines can propel market growth shortly.

- Ongoing investments in research and development will likely contribute to the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.71 Billion |

| Market Size in 2025 | USD 16.04 Billion |

| Market Size in 2026 | USD 16.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.42% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Engine Type, Component Type, application, Sales Channel and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for fuel efficiency

The major factor driving the growth of the market is the increasing need for fuel economy across many industrial applications. Turbochargers serve a substantial purpose with respect to enhancing the efficiency of these engines. In addition, these features become important to the likes of the agricultural sector and construction industry, which depend on heavy machinery.

- In January 2025, Global power and technology leader Cummins Inc. announced the launch of its new turbocharger designed specifically for hydrogen internal combustion engines (H2 ICE). This advancement in turbocharging technology marks a significant milestone for heavy-duty commercial on-highway applications in Europe.

Restraint

Complexity of turbocharger systems

The high cost and technological challenges of turbocharger systems create a substantial hurdle to the market. Innovative turbocharger technologies like twin-scroll systems and variable geometry turbochargers (VGT) necessitate high-grade materials and accurate engineering to ensure performance and durability under harsh conditions.

Opportunity

Increasing demand for electric turbocharger

The automotive industry is rapidly embracing electric vehicle technology, and more advanced models are anticipated to emerge in the market. Government regulations to safeguard the environment are a key factor in revolutionizing the automobile sector. Furthermore, automotive manufacturers are substantially investing in hybrid vehicle technology, creating opportunities in the industrial diesel turbocharger market.

- In April 2023, Garrett Motion Inc., a differentiated technology leader in the automotive industry, presented at Auto Shanghai 2023 a portfolio of advanced technologies geared toward turbocharging, electrification, and software connectivity. Garrett's range of variable nozzle turbines (VNT), double-axle VNTs (DAVNT), and wastegate turbo technologies intensify power density and increase fuel economy for both gasoline and diesel applications of passenger and commercial vehicles.

Engine Type Insights

The diesel engines segment led the global industrial diesel turbocharger market in 2024. The dominance of the segment can be linked to the high-power output and enhanced efficiency of diesel engines, which makes them suitable for heavy-duty applications. Also, these engines offer better towing, acceleration, and hauling potential than gasoline engines, impacting the segment's growth positively further.

- In September 2024, PHINIA Inc., a leader in premium fuel systems and electrical systems, launched the first electronically-controlled, low-pressure common rail injection system for compact diesel engines used in off-highway applications with Kohler Engines. This partnership marks a significant step forward in industry efforts to improve fuel economy and comply with evolving emissions standards.

The internal combustion engine segment is estimated to grow fastest over the forecast period. The growth of the segment is owing to the extensive utilization of these engines in various industrial sectors. However, internal combustion engines offer outstanding durability and drivability. They can also use renewable or alternative fuels such as propane and biodiesel etc.

Component Type Insights

In 2024, the compressors segment dominated the industrial diesel turbocharger market. The dominance of the segment is due to the essential role of compressors to improve air intake, directly affecting engine power output. Compressors also reduce the risk of electrical shocks better than electrically powered tools also are safe to work in areas with high temperatures and combustive gases.

The turbine segment is expected to grow rapidly over the projected period. The growth of the segment can be credited to the energy recovery ability of turbines, which makes them crucial in enhancing overall fuel efficiency. Furthermore, turbines give electricity without polluting the air or burning any fuel.

Application Insights

The power generation segment dominated the industrial diesel turbocharger market in 2024. The dominance of the segment can be attributed to the increasing need for efficient energy generation solutions due to raised emphasis on sustainable power generation practices and renewable energy transitions. Additionally, sustainable power sources are also gaining traction because of their requirements on a global scale.

The marine application segment is expected to grow at a significant rate over the forecast period. The growth of the segment can be credited to the surge in global trade and the growth of shipping fleets globally, along with the need for efficient power propulsion systems. Moreover, turbocharges are important in marine engines as they have high fuel efficiency and high power output.

Sales Channel Insights

The OEM sales segment held the largest industrial diesel turbocharger market share in 2024. The dominance of the segment is owing to the increasing need for original equipment from manufacturers who require turbochargers for their diesel engines.OEMs play an essential role in combining turbochargers into diesel engines during manufacturing, ensuring compliance and performance optimization.

The direct sales segment is expected to grow at the fastest rate over the forecast period. The growth of the segment is owning to its provision of direct access to consumers via manufacturers, ensuring strong relationships and better communication. Direct sales also build strong relationships with customers, which leads to a better understanding of their preferences and needs.

Regional Insights

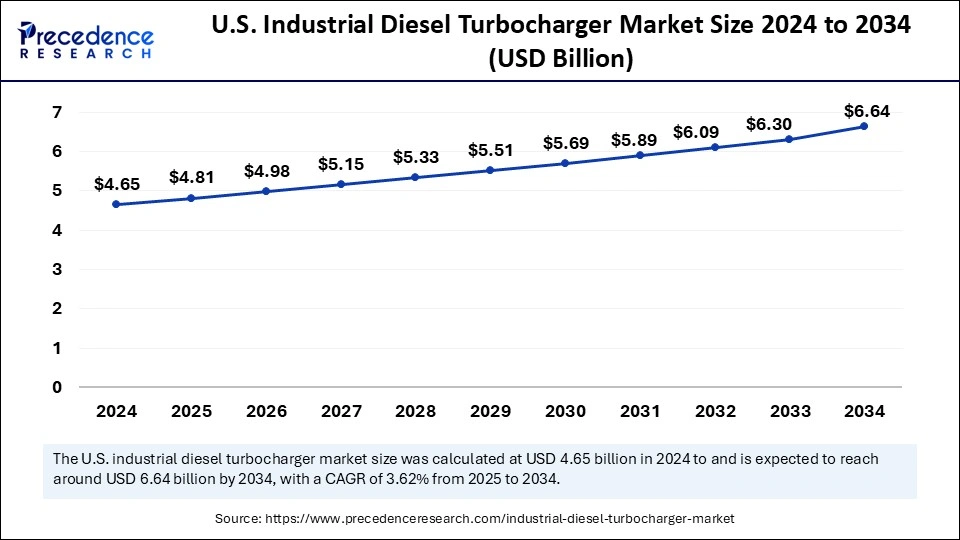

U.S. Industrial Diesel Turbocharger Market Size and Growth 2025 to 2034

The U.S. industrial diesel turbocharger market size is exhibited at USD 4.81 billion in 2025 and is projected to be worth around USD 6.64 billion by 2034, growing at a CAGR of 3.62% from 2025 to 2034.

Asia Pacific dominated the industrial diesel turbocharger market in 2024. The growth of the region can be credited to the ongoing urbanization, industrialization, and infrastructure development in emerging economies such as China and India. Furthermore, the growing need for emission-compliant and fuel-efficient engines in the mining, construction, and shipping sectors offers added impetus for market growth.

In Asia Pacific, China dominated the market due to the increasing adoption of innovative turbocharging because of the export of heavy-duty and regulations on the manufacture. The government in China is also implementing new policies to streamline the manufacturing process in the industrial landscapes.

- In April 2023, Garrett Motion launched new products during the Auto Shanghai 2023 event, focusing on the latest turbocharging solutions both for gasoline and diesel engines. These innovations target better performance and efficiency of industrial diesel turbochargers supporting industries requiring high-powered engine solutions.

North America is expected to grow at a significant rate over the forecast period. The dominance of the region can be attributed to the increasing demand for efficient turbocharger systems coupled with the region's substantial industrial base. Moreover, growing investments in marine industries and shipbuilding facilities will likely contribute to the market expansion in the region further.

In North America, the U.S. led the market. The dominance of the country is owing to the presence of major organizations such as BorgWarner and Garrett Motion who are expanding their product range with innovative turbocharging technologies, particularly for heavy-duty applications.

China Industrial Diesel Turbocharger Market Trends

In the Asia Pacific, China dominated the market due to the increasing adoption of innovative turbocharging because of the export of heavy-duty vehicles and regulations on manufacturing. The government in China is also implementing new policies to streamline the manufacturing process in the industrial landscapes.

U.S. Industrial Diesel Turbocharger Market Trends

In North America, the U.S. led the market. The dominance of the country is owing to the presence of major organizations such as BorgWarner and Garrett Motion, which are expanding their product range with innovative turbocharging technologies, particularly for heavy-duty applications.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by strict emission regulations like Euro VI, which enforces engine downsizing for enhanced fuel efficiency and lower emissions. Furthermore, growing demand for high-performance, reliable equipment in these sectors boosts the need for turbochargers.

Germany Industrial Diesel Turbocharger Market Trends

The growth of the market in Germany can be boosted by the rapid push towards more fuel-efficient and powerful engines, along with the stringent emission regulations. Advancements such as variable geometry turbochargers lead to a greater adoption of industrial diesel in the country.

Industrial Diesel Turbocharger Market Value Chain Analysis

- Raw material suppliers

This stage involves the sourcing of essential raw materials used in the manufacturing of turbochargers, including metals like cast iron, aluminium, and steel alloys. - Turbocharger manufacturing

This is the main production stage when raw materials are transformed into finished turbochargers through complex engineering processes. - Distribution channels

This stage involves delivering the finished products from producers to end-users, which can include both original equipment manufacturers (OEMs) and the aftermarket. - End-user industries

This is the final stage where industrial diesel turbochargers are combined into various equipment and applications.

Key Players' Offering

- ABB Ltd. (Accelleron): Offers advanced turbocharger technologies for low-speed and medium-speed diesel engines used in marine, power generation, and other heavy-duty applications.

- BorgWarner Inc.: The company offers technologies such as regulated two-stage (R2S) turbocharging systems and variable turbine geometry (VTG) turbochargers.

Market Outlook

- Industry Growth Overview: Shifting consumer preferences and technological advancements are expected to boost the industrial diesel turbocharger market growth soon.

- Global Expansion: Asia-Pacific is currently the dominant and fastest-growing market, while North America and Europe also maintain substantial market shares due to specific regional drivers.

- Major investors: Major investors and companies in the industrial diesel turbocharger market include BorgWarner Inc., Cummins Inc., Mitsubishi Heavy Industries, and IHI Corporation. These companies are dominating the market through acquisitions, direct investments, and the development of new technologies.

- Startup Ecosystem: The market does not have its "startup ecosystem" in the traditional sense of new, disruptive tech companies, but rather a competitive landscape driven by established advancements within existing large firms and a network of supporting organizations.

Industrial Diesel Turbocharger Market Companies

- Cummins

- Turbo Energy

- KTT

- Kangyue

- BorgWarner

- K turbocharger

- Weichai Power

- Mitsubishi Heavy Industries

- IHI Corporation

- MHI Turbocharger

- Honeywell

- General Electric

Latest Announcement by Market Leaders

- In March 2025, COLUMBUS, Ind. global power and technology leader Cummins Inc. announced an update to the legendary B-Series engine platform, unveiling the new Cummins B7.2 diesel engine at NTEA Work Truck Week in Indianapolis, IN."The B7.2 brings the latest technology and advancements to one of our most proven platforms.

- In October 2024, Engine manufacturer General Electric announced that its LM2500 marine engines had been chosen to power the Indian Navy's Next Generation Missile Vessels (NGMV) being built by Cochin Shipyard Limited. Additionally, GE Aerospace will be supplying its composite base and enclosure, and full complement of gas turbine auxiliary systems, GE said in a statement.

Recent Developments

- In September 2024, A Cummins-powered Ram had on display a 2700 HP triple-turbo setup in a high-performance demo accompanied by a slow explosion that underlined the immense capabilities of industrial diesel turbochargers. It gave credence to the awesome capacity and efficiency of today's turbocharging systems- much more so for that designed by Cummins.

- In May 2023, Mitsubishi Heavy Industries (MHI) introduced MGS3100R, a turbocharger for high efficiency in the diesel engine. It marked a monumental technological advancement in turbochargers in increasing fuel efficiency and further cutting industrial emission levels.

In February 2023, BorgWarner announced the acquisition of Delphi Technologies' turbocharger business. The acquisition will strengthen BorgWarner's position in the global turbocharger market and expand its product portfolio.

Segments Covered in the Report

By Engine Type

- Internal Combustion Engine

- Diesel Engine

- Natural Gas Engine

- Dual Fuel Engine

- Heavy Fuel Engine

By Component Type

- Bearing Systems

- Compressor

- Turbine

- Wastegate

- Actuators

By Application

- Marine

- Power Generation

- Construction Equipment

- Mining

- Agricultural Equipment

By Sales Channel

- Direct Sales

- Distributor Sales

- Online Sales

- OEM Sales

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting