Industrial Gases Market Size and Forecast 2025 to 2034

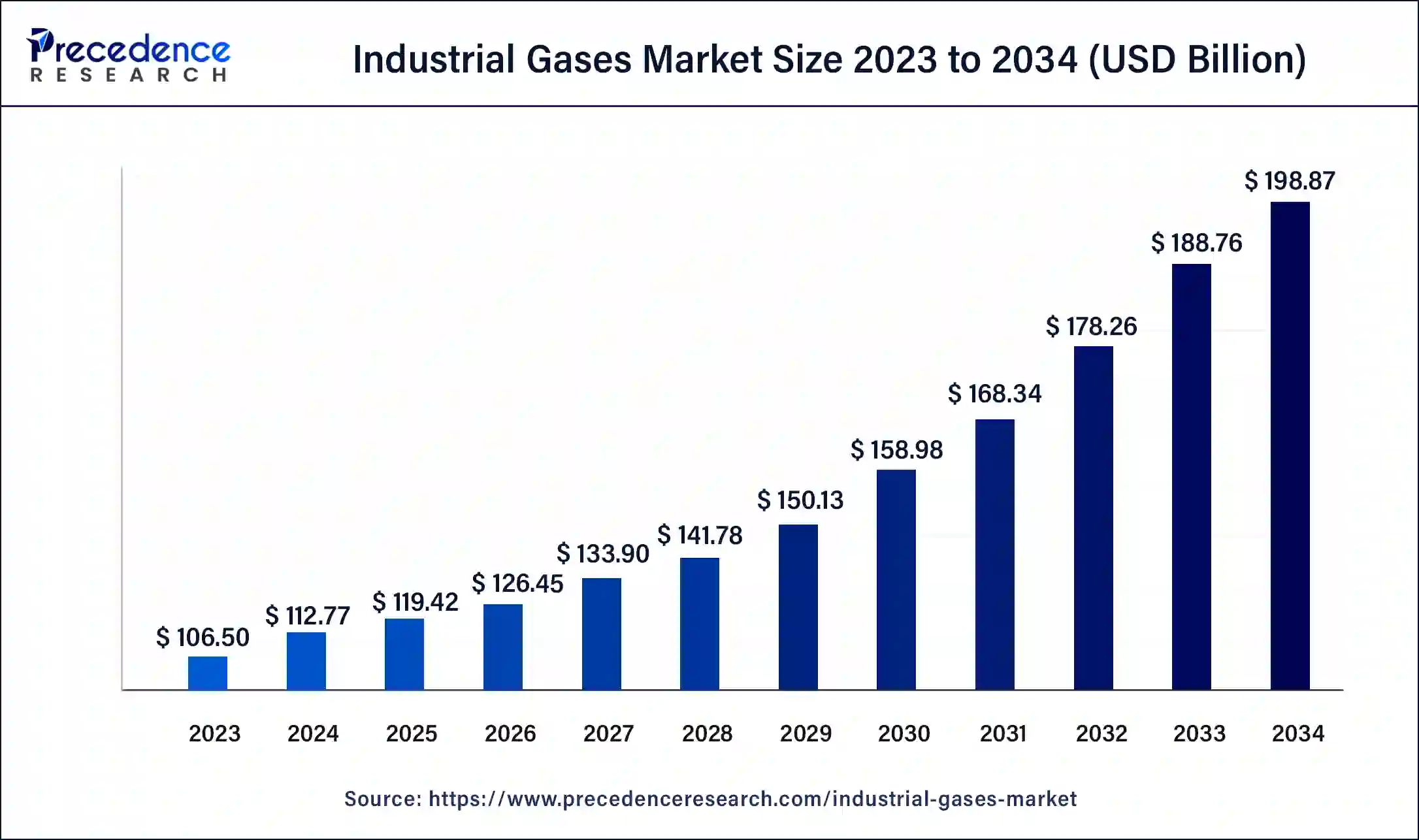

The global industrial gases market size accounted at USD 112.77 billion in 2024 and is predicted to reach around USD 198.87 billion by 2034,growing at a CAGR of 5.84% from 2025 to 2034.

Industrial Gases Market Key Takeaways

- In terms of revenue, the industrial gases market is valued at $119.42 billion in 2025.

- It is projected to reach $198.87 billion by 2034.

- The industrial gases market is expected to grow at a CAGR of 5.84% from 2025 to 2034.

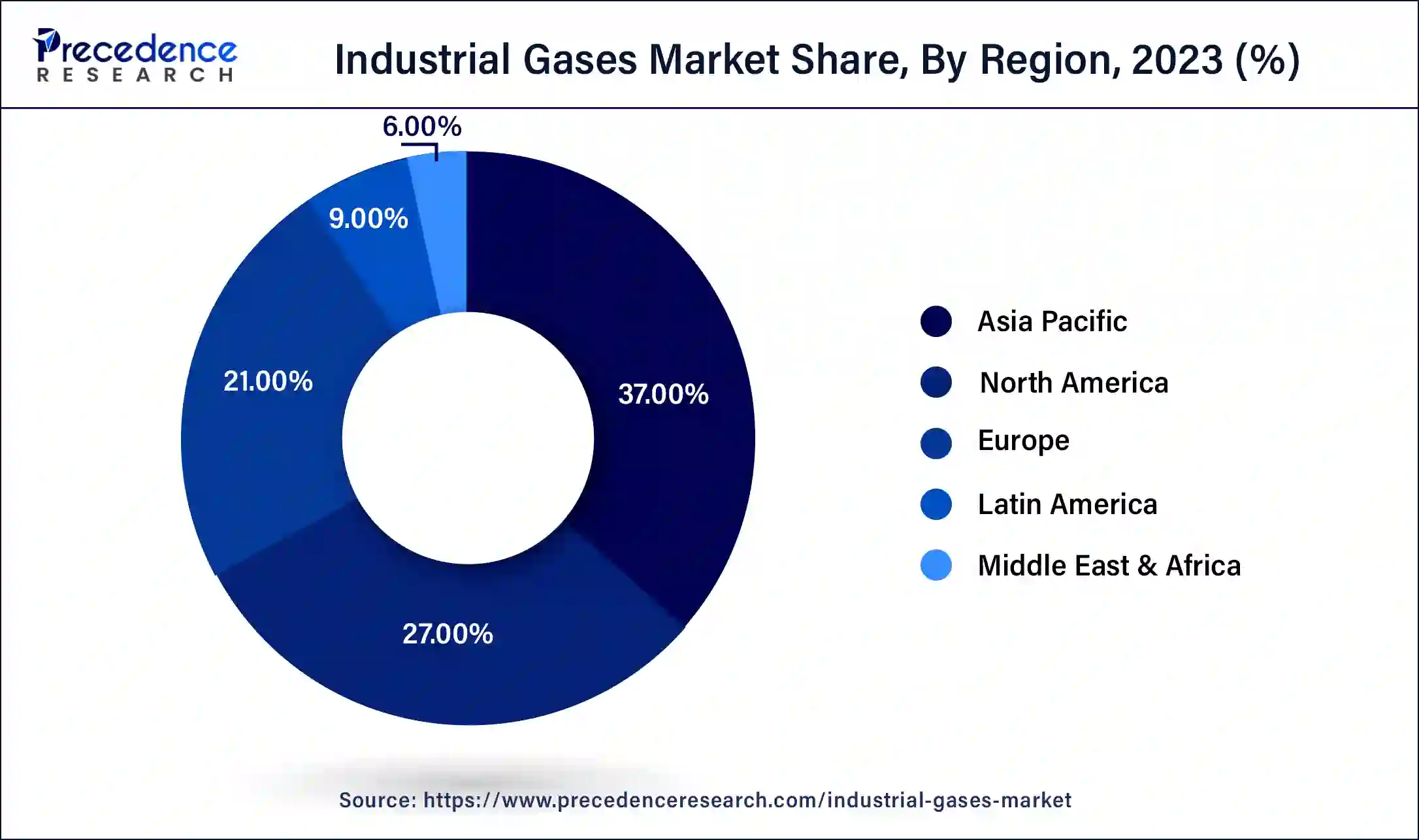

- The Asia Pacific region has held the highest revenue share of around 37% in 2024.

- By product type, the oxygen segment has captured a market share of around 28.10% in 2024.

- By distribution, the cylinder (Merchant) segment had the biggest revenue share in 2023 at 37.20%.

- The on-site segment is anticipated to increase at the fastest rate from 2025 to 2034.

- By application, the manufacturing segment has contributed a market share of around 27.50% in 2024.

Asia Pacific Industrial Gases Market Size and Growth 2025 To 2034

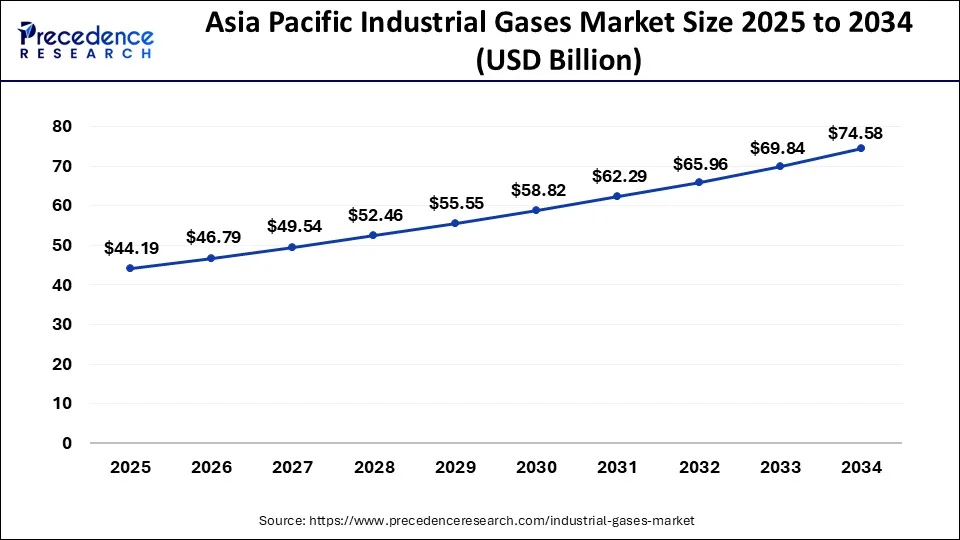

The Asia Pacific industrial gases market size reached USD 41.72 billion in 2024 and is anticipated to be worth around USD 74.58 billion by 2034, poised to grow at a CAGR of 5.98% from 2025 to 2034.

Asia Pacifi dominated the market with the largest market share of 37 % in 2024. The development and expansion of end-use sectors in China, India, South Korea, and Japan can be linked to the rising demand for industrial gases in the Asia Pacific region. These nations serve as both the major international and Asian Pacific markets for industrial gases.

China became the largest market at the national level. Because the aerospace industry is increasingly in need of high-quality gas solutions, Asia Pacific had the highest demand for industrial gases in 2023. Additionally, it is anticipated that throughout the projection period, there will be plenty of chances for market expansion due to the huge growth of the food, beverage, and pharmaceutical sectors in emerging economies like China and India. The U.S. had the greatest revenue share in the North American market in 2023, and it is anticipated that it would have the highest CAGR throughout the forecast period. The region's expanding healthcare and electronic sectors are probably going to help the North American market expand. Additionally, it is projected that the market would develop due to the rise of the industrial sector in the area.

Market Overview

The manufacturing sector's expansion in Asia Pacific's emerging economies is mostly to blame for the market's expansion. Additionally, rising industrialization and urbanization along with an increase in the use of industrial gases in several sectors, including healthcare, metal and mining, and beverages and food manufacturing, are anticipated to have an impact on market expansion in the years to come.

The growth prospects for this market are compelled due to the usage of industrial gas in the electronics (photovoltaic) industry for the production of semiconductors, solar, screens, LED solid-state lighting, wafers, and polysilicon. Solar photovoltaic energy, in particular, is becoming a leading source of sustainable energy generation and drawing in investments on a worldwide scale. These gases significantly lower production costs, which bodes well for a rise in their use throughout the anticipated period. Global industrial production has been increasing, and this trend is projected to continue. There is a rising need for industrial gases in the mining, metals, and aerospace industries, where they are used extensively. Additionally, a number of opportunities for market growth exist as a result of the pharmaceutical, food, and beverage industries' continued expansion in North America, Europe, and Asia-Pacific.

Due to the shutdown of industrial operations in areas severely impacted by COVID-19, the desire for industrial-grade co 2 has also been on the lower side. However, because it is used in firefighting and medicine, consumption of carbon dioxide has been more than usual. The demand for medical-grade carbon dioxide has increased recently as a result of the need for several COVID care facilities around the nation and a few medical uses of carbon dioxide.

Industrial Gases MarketGrowth Factors

Increased use of industrial gases in a variety of industries, including construction, metallurgy, mining, and food service, as well as increased demand for alternative sources of energy are some of the factors predicted to propel the expansion of the industrial gases market over the course of the projected period.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 112.77 Billion |

| Market Size in 2024 | USD 119.42 Billion |

| Market Size by 2034 | USD 198.87 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Distribution, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Growing Investment in the manufacturing and processing sectors - Expanding governmental and private spending, particularly in emerging countries, to explore new frontiers in a variety of industrial sectors, including metallurgy, food and beverage, mining, and meta is anticipated to increase the size of the global industrial market. For instance, according to the World Investment Report 2020 issued by the United Nations Conference on Trade and Development in June 2020, the overall FDI influx throughout the Asia Pacific region in 2019 was $474 billion, or more than 30% of the total FDI movement worldwide. The group also stated that South East Asian nations, like Singapore and Malaysia, are expected to have some of the region's strongest economies going forward, creating significant chances for industrial development.

- Significant growth in the food and beverage and healthcare sectors - During the projection period, the demand for gases will be driven by the rising investment in the food and beverages and healthcare sectors. Europe produces the most food, and Germany has the fourth-largest food and beverage sector in the world. It is also the third-largest exporter of food and beverage products, with sales of processed foods as well as agricultural commodities totaling $84.31 billion in 2018. Several gases used in the food and beverage sector will see an increase in demand as a result of this trend, which is anticipated to continue over the forecast period.

Challenges

- Falling demand for gas as a result of national lockdowns - The unexpected spread of the COVID-19 pandemic had a detrimental effect on every industry, causing a global health disaster. The investment that was made for gases in the fiscal year 2020 has decreased as a result of the loss in operational time caused by the lack of workers and the lower demand from end-use sectors as a result of the national lockdown to stop the spread of the virus. The disease's spread has also significantly changed the need for crude oil, which has even caused oil prices to hit new records. For instance, in May 2020, the price of a barrel of oil plummeted to $20.37. The lowest level since February 2002. Production has been disrupted in numerous industries as a result of the low demand period, the suspension of operations, and international travel restrictions. The demand for various gases across demand from various end-use industries has decreased as a direct result of this.

Opportunities

- The growing use of industrial gases in the oil and gas industry - Increasing demand for crude oil and the requirement for refining have raised the price of gases on the international market. Industrial gases are widely utilized in the upstream and downstream processes of the oil and gas sector for tasks including well hoisting, pipe inserting and cooling, coiled tubing drilling, inspection, offshore vessels, leak testing, gas analysis, and other tasks. The need for these gases for numerous applications would be leveraged by the expansion of the oil and gas industry, which would further fuel market growth.

- Increasing urbanization and industrialization - Both developing and emerging markets have seen a sharp increase in the pace of urbanization and industrialization, which will influence market trends for industrial gases over the next years. Urbanization's rapid development, which includes the construction of new facilities for the manufacturing and processing industries, is projected to benefit this industry.

Product Type Insights

With a 28.10% revenue share in 2024, the oxygen product type had the most contribution. This is well known that it raises the thermal effectiveness of fuel. For the gasification of coal and the treatment of dangerous wastes and contaminated water, oxygen is employed. The healthcare sector also uses oxygen very extensively. Therefore, it is anticipated that the demand for oxygen used in industries will grow in the future years due to the extensive usage of oxygen in several sectors. In terms of revenue share, nitrogen gas came in second place in 2024, and from 2025 to 2034, it is expected to rise at the fastest rate. Due to the expanding medical and pharmaceutical industries in North America and Asia Pacific, nitrogen gas is widely employed in the healthcare sector. This is anticipated to fuel the segment's expansion during the ensuing years.

Due to a rise in the use of carbon dioxide for gas-based enhanced oil recovery in countries including the United States, Canada, Mexico, Brazil, and oil-producing nations in the Middle East, carbon dioxide is predicted to see considerable growth throughout the projection period. Additionally, there will be a considerable increase in the use of enhanced oil recovery to boost the effectiveness of oil production from oil wells due to fluctuations in crude oil prices and a growth in the number of mature wells throughout the world.

Supply Mode Insights

The on-site/pipeline segment held the largest share of 36.40% in the 2024 industrial gases market. The on-site/pipeline segment includes either supplying or generating gases. The supply of gases through an expanding pipeline network to the vast industrial consumers, such as steel mills and petrochemical plants. Whereas the generating gases are deliverable directly to the customer's site. The dedicated pipeline system enables on-site delivery for industrial gases, according to the pipeline. The on-site generation unit delivers gases such as nitrogen, hydrogen, and oxygen at a customer's facility via a dedicated pipeline, discarding the need for transportation expenses.

The tonnage supply agreements segment is expected to grow at a CAGR of 7.90% during the forecast period. The segment in the industrial gas space promises long-term contracts. Following the contract, the gas suppliers are the sole owner, operator, and former of its on-site production facilities providing a massive quantity of gases such as nitrogen and hydrogen to main industrial customers, mainly steel plants and refineries. The agreement is significant for fueling growth and contributing to the industrial expansion.

Distribution Insights

The cylinder category had the biggest revenue share in 2024 at 37.20%. The section demonstrates the use of packed cylinders for the delivery of gases. But only clients with a moderate requirement for industrial gases can use this delivery technique. Gases including argon, nitrogen, helium, oxygen, and hydrogen can all be compressed into cylinders with ease for cylinder distribution at pressures of up to 300 bars. A number of gases are also present in liquid form at room temperature.

Over the projected period, the on-site category is anticipated to increase at the quickest rate. The setting up of the filling station at the firm facility or another location is included in the on-site section. For the provision of huge amounts of gases at various pressures and states, this technique of distribution is utilised. Since various issues related to the transportation and distribution of hydrogen is eliminated by on-site generation, the market is anticipated to expand significantly. Due to new technologies becoming available at lower prices than provided distribution routes, on-site hydrogen production in small-scale companies has grown in favor.

Application Insights

The metal production and fabrication segment held the largest share of 24.20% in the 2024 global industrial gases market. The segment involves processes such as steelmaking, heat treatment, welding, and cutting of metals to ensure high-quality metal production and fabrication. The gases such as nitrogen, hydrogen, argon, and oxygen are major for heating, steelmaking, and welding, cutting processes. The development is fueled by the growing demand for smart metal alloys that promote low-carbon processes and sustainability.

The healthcare/medical segment is expected to grow at a CAGR of 8.70% during the forecast period. In the healthcare sector, the use of gases for creating medical oxygen is increasing due to a growing patient population that requires nebulizers and other therapeutics. The industrial gases, like nitrogen, carbon dioxide, helium, and oxygen, are pivotal in the healthcare industry. For respiratory therapy, the constant need for industrial oxygen bolsters the industrial gases company globally. For critical operations/surgery, the anesthesia gases are prominent.

Gas Type Insights

The oxygen segment held the largest share of 28.60% in the 2024 industrial gases market. The industrial oxygen is the oxygen used to contribute to the industrial process, like chemical production, wastewater treatment, cutting and welding, and steel and glass manufacturing. The industrial gas company is expanding with rapid oxygen gas demand. The rising demand has led to the adoption of technologies such as pressure swing adsorption (PSA) and cryogenic air separation.

The hydrogen segment is expected to grow at a CAGR of 8.90% during the forecast period. The hydrogen is a critical industrial gas mainly used in metal treatment, petroleum refining, and ammonia and methanol production, promoting clean green hydrogen as a sustainable approach. The purpose is to decarbonize these areas and provide their useful aspects for energy storage, transportation, and. Also, integrating it into new applications, such as hydrogen-fired power generation.

Production Technology Insights

The cryogenic air separation segment peaked with the largest share of 41.30% in the 2024 industrial gases market. The cryogenic air separation generates purified industrial gases such as nitrogen, argon (by distilling air and liquifying) play a pivotal role in industries like healthcare, metallurgy, and more. The segment's development has always concentrated on integrated processes and enhanced energy efficiency to meet the recent trends involving novel column designs such as TVR ASU, AI-powered predictive maintenance, and technologies like self-heat recuperation to diminish energy consumption.

The electrolysis segment is expected to accelerate at a CAGR of 9.50% during the forecast period. The electrolysis produces the prioritized gas purity, hydrogen, using electricity to divide water into oxygen and hydrogen. It's a crucial technology for a low-carbon future, promoting sustainable clean energy and providing feedstock for industries such as chemicals. Further, the development is aiming for efficiency, diminishing the high capital costs of electrolyzers.

Distribution Channel Insights

The direct supply (industrial contracts) segment held the largest share of 47.50% in the 2024 global industrial gases market. The direct supply via industrial contracts is a fundamental model for distributing huge volumes of industrial gases, with companies such as Air Liquide and INOX Air Products forming critical gas yards to satisfy customer needs mainly in areas such as petrochemicals, steel, and popular high-tech industries like semiconductors. The contract-based supply underscores efficiency and reliability via storage, delivery network, and production. The segment is emerging and expanding the industrial gases company globally.

The e-commerce/online platforms segment is expected to grow at a CAGR of 10.10% during the forecast period. E-commerce platforms are trending and have gained significant space in the industrial gases market. The segment streamlines procurement and has saved costs for businesses and unlocking new sales opportunities for suppliers. The online platforms link suppliers and buyers, providing various features such as informative specifications, delivery alternatives, and product filters to ease complicated transactions. The segment is steadily rising with the profit in the industrial gases company globally.

Companies Info

Linde plc:Linde plc is a global industrial gas company with a primary focus on the oxygen, nitrogen, and hydrogen markets. Through its combination with Praxair, Linde has expanded its services and supported efficiency and innovation. Linde is dedicated to carbon capture and clean energy as a means to help drive global decarbonization efforts.

Air Liquide: Air Liquide S.A. is another important player in the industrial and medical gases field; it operates in over 80 countries, offers nitrogen, oxygen, and hydrogen, and serves important industries such as healthcare, electronics, and energy. Its established distribution network and recent acquisition activity continue to support its market position, which is only going to accelerate its consistent growth.

Messer Group: Messer Group is a leading and independent primary supplier of industrial gases focused on the food, pharmaceuticals, and metal fabrication sectors with a market presence in Europe, Asia, and the Americas. Messer takes a customer-centric approach to everything it does and has established a reputation aligned with safety, innovation, and environmentally responsible solutions, including COâ‚‚ recovery technologies.

Industrial Gases Market Companies

- Yingde Gases Group Company Limited

- Air Liquide S.A

- Linde Group

- Airgas Inc.

- Messer Group

- Buzwair Industrial Gases Factories

- Air Products and Chemicals Inc.

- Taiyo Nippon Sanso Corporation

- Air Water Incorporation

- BASF SE

Recent Developments

- In April 2025, Air Liquide claimed first occupancy as the registered provider of renewable hydrogen certified by the RFNBO. This process is a vital yet underdeveloped area of sustainable energy solutions for the world. Air Liquide increased nitrogen supply in Tianjin, China, to support growth and research, solidifying their business operation in the Asia Pacific.

- In January 2024, Linde announced that it will be supplying oxygen, nitrogen, and argon from two on-site air separation units (ASUs) to SAIL's Rourkela steel plant in Odisha, Eastern India, at full capacity. Linde's energy-efficient ASU supplies oxygen, nitrogen, and argon to sustain SAIL's Expansion and Modernization Program in Rourkela.

- In October 2023, Irish chemical company Linde signed a contract to supply industrial gases to IndianOil Corporation Limited's (IOCL) refinery in Bahol, Panipat, Haryana, India. The capacity of the refinery will increase from 15 million tons per plant per year (mtpa) to 25 million tons per year. Linde's Indian units will under long-term contracts, will build/own/operate a new plant in Panipat to supply.

- Echo Energy Plc obtained two additional contracts in March 2021 to sell industrial gases at significant markups. The duration of each contract is 12 months, and the business will start selling gases in May 2021.

- 11 new contracts were signed by Air Liquide and its industrial merchant clients in April 2020. It would provide its consumers with hydrogen, oxygen, and nitrogen for ten years. The business will be able to compete in the market in this manner.

Segments Covered in the Report

By Gas Type (US$ Billion & Tons)

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide (COâ‚‚)

- Argon

- Helium

- Acetylene

- Specialty Gases

- Calibration Gases

- Ultra-high-purity Gases

- Noble Gases

- Neon

- Xenon

- Krypton

- Halogenated Gases

- Others (Ammonia, etc.)

By Application / End-Use Industry

- Healthcare / Medical

- Medical Oxygen

- Anesthesia Gases

- Respiratory Therapy

- Metal Production & Fabrication

- Welding & Cutting

- Steelmaking

- Heat Treatment

- Chemical & Petrochemicals

- Ammonia Production

- Hydrogenation

- Inerting & Purging

- Electronics

- Semiconductor Manufacturing

- LED / LCD / OLED Fabrication

- Solar PV Cell Manufacturing

- Food & Beverage

- Freezing & Chilling

- Carbonation

- Modified Atmosphere Packaging (MAP)

- Energy & Power

- Enhanced Oil Recovery (EOR)

- Gas Turbine Cooling

- Hydrogen Fuel Applications

- Water & Wastewater Treatment

- Pharmaceutical & Biotechnology

- Cell Culture

- Fermentation

- Inert Packaging

- Automotive & Transportation

- Pulp & Paper

- Glass & Ceramics

- Aerospace & Defense

- Others (Research Labs, etc.)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting