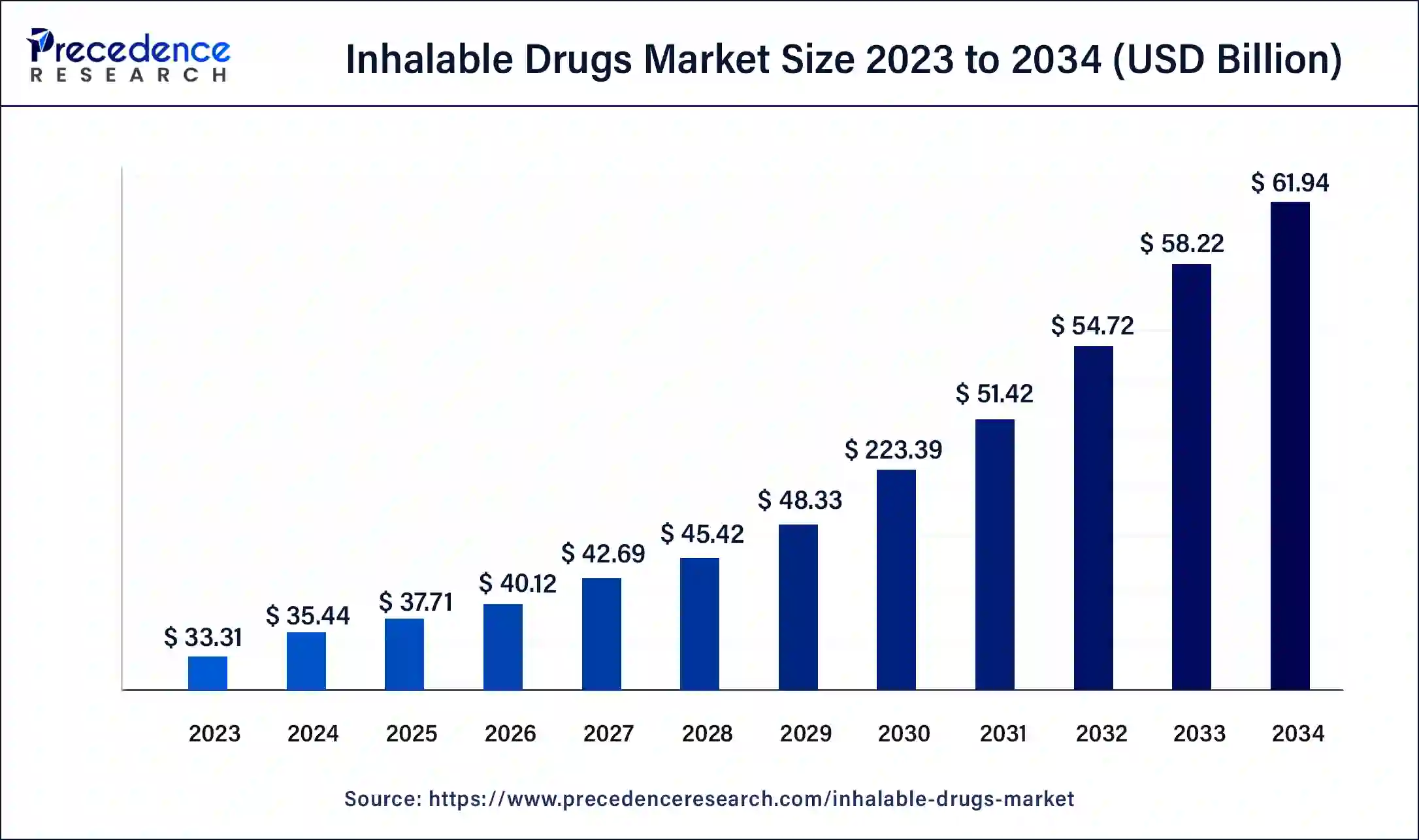

Inhalable Drugs Market Size and Forecast 2025 to 2034

The global inhalable drugs market size accounted at USD 35.44 billion in 2024 and is predicted to reach around USD 65.51 billion by 2034, growing at a CAGR of 5.57% from 2025 to 2034.

Inhalable Drugs MarketKey Takeaways

- The global inhalable drugs market was valued at USD 35.44 billion in 2024.

- It is projected to reach USD 65.51 billion by 2034.

- The inhalable drugs market is expected to grow at a CAGR of 5.57% from 2025 to 2034.

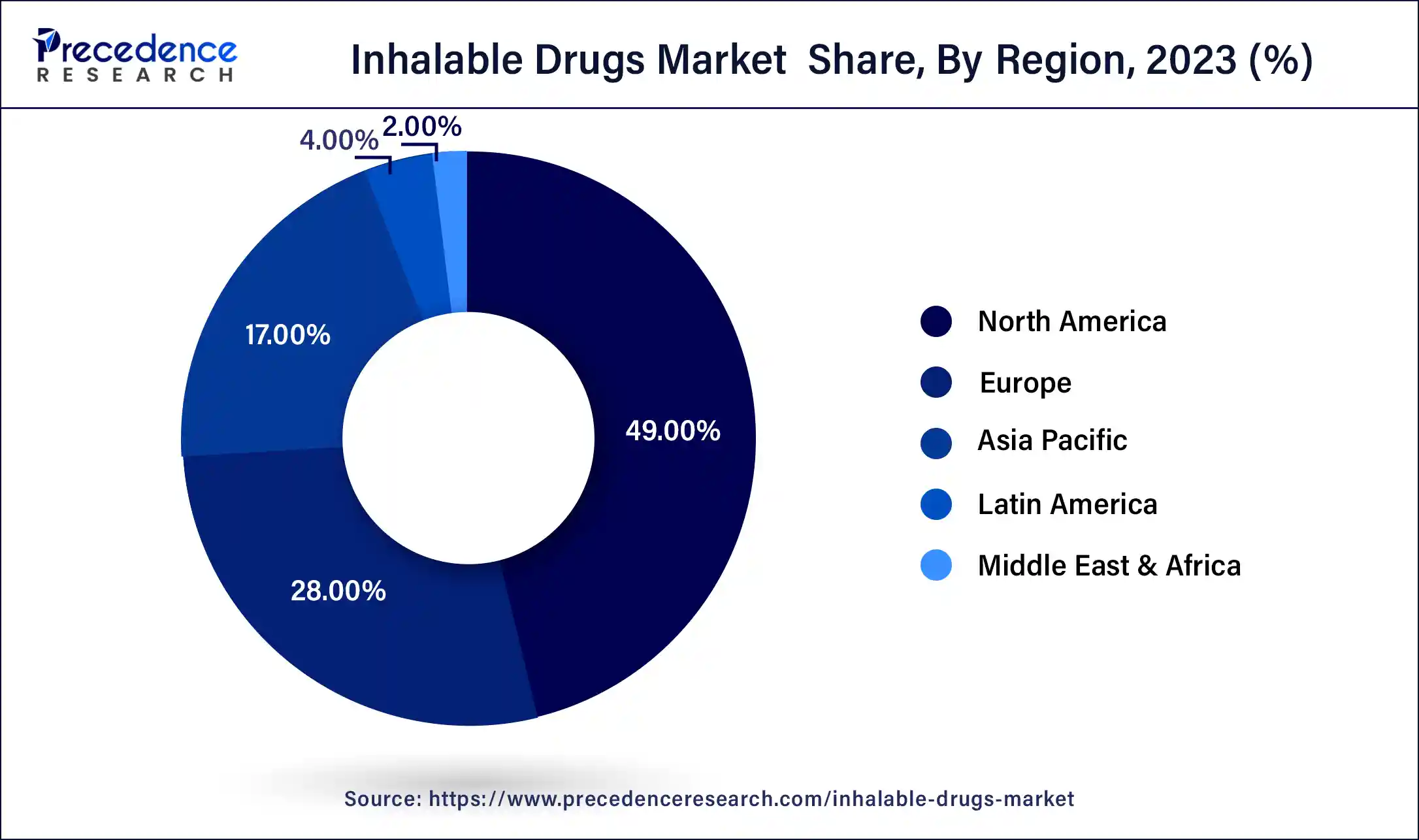

- North America contributed more than 49% of revenue share in 2024.

- The Asia-Pacific is estimated to witness the fastest CAGR between 2025 and 2034.

- By drug class, the dry powder formulation segment held the largest market share of 46% in 2024.

- By drug class, the spray segment is anticipated to grow at a remarkable CAGR of 7.8% between 2025 and 2034.

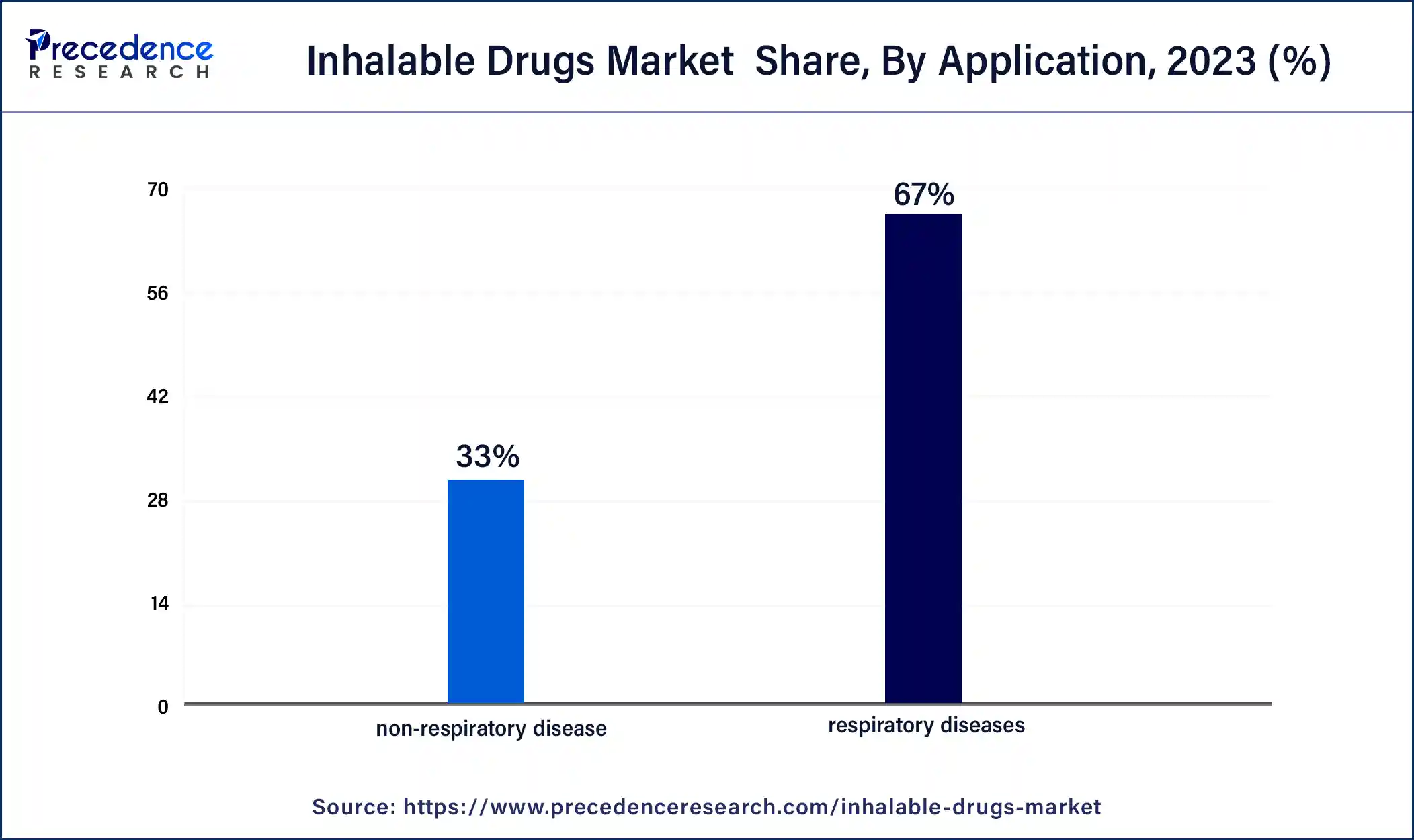

- By application, the respiratory diseases segment generated over 67% of revenue share in 2024.

- By application, the non-respiratory diseases segment is expected to expand at the fastest CAGR over the projected period.

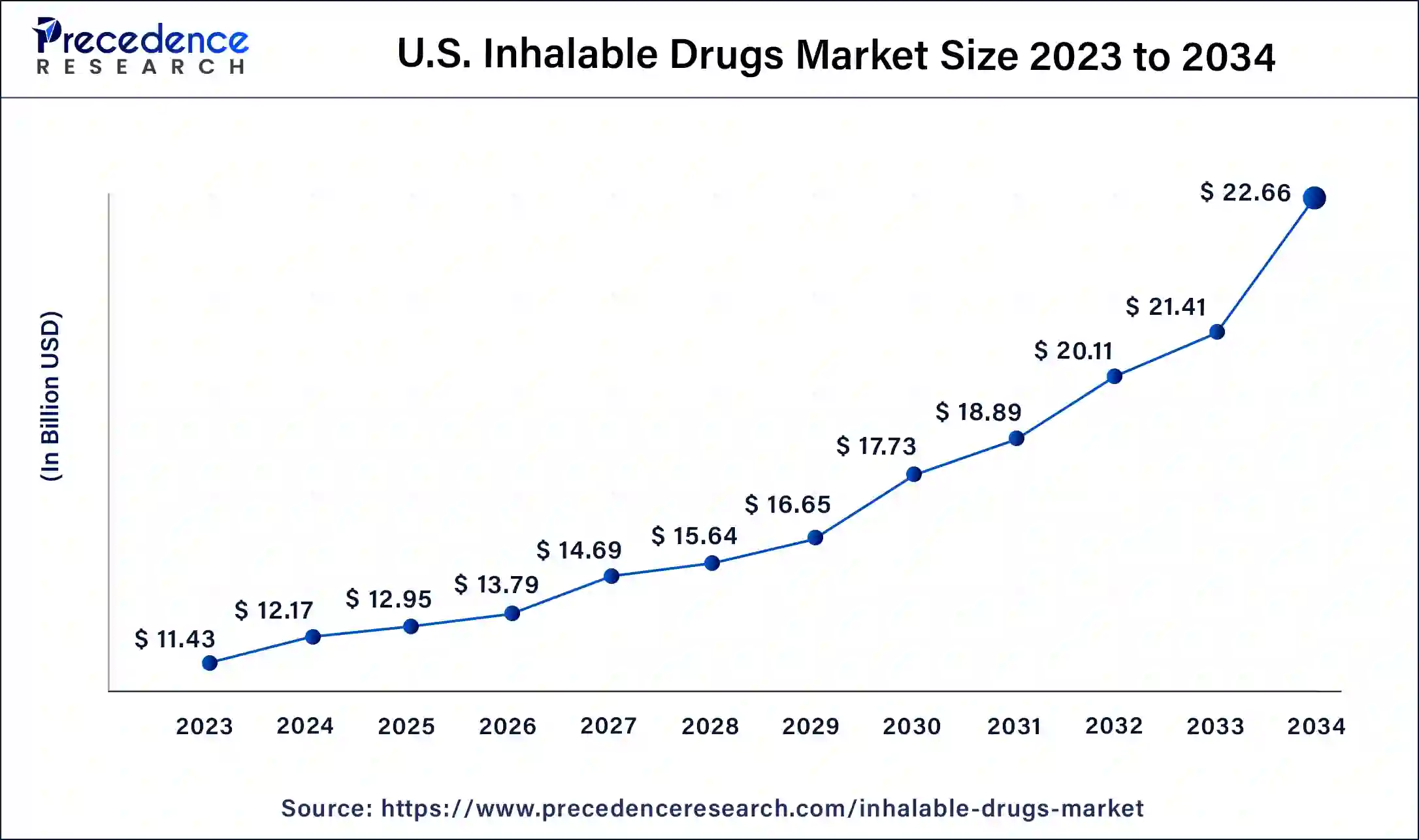

U.S. Inhalable Drugs Market Size and Growth 2025 To 2034

The U.S. inhalable drugs market size was valued at USD 12.17 billion in 2024 and is expected to be worth around USD 22.66 billion by 2034, at a CAGR of 6.41% from 2025 to 2034.

North America held the largest revenue share of 49% in 2024. North America holds a significant share in the inhalable drugs market due to advanced healthcare infrastructure, a well-established pharmaceutical industry, and high adoption of innovative medical technologies. The region benefits from a robust regulatory framework supporting the development and commercialization of inhalable drugs. Moreover, a rising prevalence of respiratory diseases, increasing healthcare expenditure, and a growing aging population contribute to the market's prominence. The presence of key pharmaceutical players and ongoing research activities further solidify North America's leadership in driving advancements and market growth within the inhalable drugs sector.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the inhalable drugs market due to several factors. The region's large population, coupled with a rising prevalence of respiratory diseases and a growing aging demographic, contributes to increased demand for inhalable therapies. Additionally, expanding healthcare infrastructure, favorable government initiatives, and a surge in pharmaceutical research and development activities in countries like China and India further propel the market. The Asia-Pacific region's robust economic growth and increasing awareness of advanced medical treatments position it as a major contributor to the inhalable drugs market.

Market Overview

Inhalable drugs represent pharmaceutical compounds meticulously designed for delivery through inhalation, a precise method that directs the medication straight to the respiratory system. This mode of drug administration proves especially advantageous in managing lung-related conditions like asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections. The primary objective is to facilitate the efficient delivery of active drug components to lung tissues, ensuring swift absorption and localized therapeutic impact.

A diverse array of inhalation devices, including metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers, are employed to administer these drugs. Inhalable medications offer a spectrum of advantages, encompassing rapid onset of action, minimized systemic side effects, and heightened adherence among patients. The pharmaceutical industry directs substantial efforts toward refining inhalable formulations, aiming to enhance treatment outcomes, elevate patient convenience, and effectively address respiratory complexities. The ongoing evolution of drug formulations and inhalation technologies plays a pivotal role in shaping the landscape of inhalable drugs, providing individuals with more targeted and efficient solutions for their respiratory well-being.

Inhalable Drugs Market Growth Factors

- A rising prevalence of respiratory conditions, such as asthma and COPD, is a significant growth factor for the inhalable drugs market, driving the demand for effective respiratory therapies.

- Ongoing innovations in inhalation device technology contribute to improved drug delivery methods, enhancing the overall efficacy of inhalable drugs and stimulating market growth.

- Growing preference among patients for non-invasive treatment options, like inhalable drugs, fosters market expansion by addressing convenience and ease of use.

- Continuous research and development efforts focused on enhancing inhalable drug formulations contribute to the market's growth, providing more effective and targeted therapeutic solutions.

- The increasing elderly population, prone to respiratory ailments, is a key demographic factor propelling the demand for inhalable drugs, as these formulations cater to the unique needs of older individuals.

- Escalating levels of air pollution globally contribute to a higher incidence of respiratory disorders, bolstering the demand for inhalable drugs as an essential means of managing related health issues.

- Supportive government initiatives and regulatory frameworks promoting the development and adoption of inhalable drugs positively impact market growth, ensuring compliance with quality and safety standards.

- Increasing awareness among healthcare professionals and patients regarding the benefits of inhalation therapy fosters market growth, driving the adoption of inhalable drugs.

- Collaborations between pharmaceutical companies and research institutions facilitate the development of innovative inhalable drugs, fostering market expansion through shared expertise and resources.

- Diversification of indications for inhalable drugs beyond respiratory conditions, such as diabetes and pain management, broadens the market scope and attracts a wider patient base.

- Lessons learned from the COVID-19 pandemic underscore the importance of respiratory health, leading to increased research and investment in inhalable drug solutions for respiratory viral infections.

- Urbanization, coupled with lifestyle changes, contributes to an increased risk of respiratory diseases, creating a substantial market opportunity for inhalable drug manufacturers.

- Growing trends in personalized medicine drive the development of tailored inhalable drug therapies, catering to individual patient needs and preferences.

- The overall rise in healthcare spending globally supports investments in advanced treatment modalities, including inhalable drugs, contributing to market growth.

- Patent expirations of conventional inhalable drugs create opportunities for generic alternatives, fostering market competition and affordability.

- Expanding Biopharmaceutical Pipeline: An expanding pipeline of biopharmaceutical inhalable drugs, including monoclonal antibodies and gene therapies, drives market growth by introducing novel and advanced treatment options.

- Continuous investments in R&D activities focused on inhalable drug development contribute to a pipeline of innovative therapies, sustaining market growth.

- The focus on environmentally friendly inhalation devices and formulations aligns with sustainability goals, attracting environmentally conscious consumers and driving market expansion.

- Improvements in healthcare infrastructure, particularly in emerging economies, contribute to better accessibility to inhalable drugs, fostering market growth in previously underserved regions.

Inhalable Drugs Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 65.51 Billion |

| Market Size in 2025 | USD 37.71 Billion |

| Market Size in 2024 | USD 35.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drug Class and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancements in drug formulations and expanding applications beyond respiratory conditions

Advancements in drug formulations significantly boost the demand for inhalable drugs by fostering the development of more effective and targeted therapeutic solutions. Continuous research and development efforts focus on refining the formulation of inhalable drugs, enhancing their pharmacokinetics, and optimizing their therapeutic efficacy. These advancements contribute to improved patient outcomes, reduced side effects, and increased patient compliance, thereby driving the market demand for inhalable drugs.

Moreover, the expanding applications of inhalable drugs beyond respiratory conditions play a pivotal role in surging market demand. As these drugs demonstrate efficacy in treating ailments beyond traditional respiratory disorders, such as diabetes and pain management, the market scope widens considerably. This diversification attracts a broader patient base, encouraging pharmaceutical companies to invest in the development of inhalable drugs for multifaceted therapeutic applications. The versatility of inhalable drugs in addressing diverse health issues contributes to their growing acceptance and increased demand in the healthcare landscape.

Restraint

Limited drug compatibility and insurance coverage challenges

Limited drug compatibility poses a significant restraint on the inhalable drugs market as not all medications are suitable for inhalation delivery. This limitation restricts the range of drugs that can be formulated as inhalable, potentially excluding crucial therapeutic options. Pharmaceutical companies face challenges in adapting diverse medications to inhalable formulations, hindering the development of a comprehensive portfolio of inhalable drugs.

The constraint of limited drug compatibility thus narrows the scope of inhalable drug applications and may impact the overall market demand. Insurance coverage challenges further impede the market demand for inhalable drugs. Insufficient reimbursement and insurance coverage for certain inhalable medications can limit patient accessibility, particularly in regions with less comprehensive healthcare coverage.

Patients may face higher out-of-pocket costs, deterring them from choosing inhalable drug therapies even when they are clinically advantageous. Overcoming these challenges requires collaborative efforts among stakeholders, including pharmaceutical companies, insurers, and regulatory bodies, to address reimbursement issues and ensure broader access to inhalable drug treatments.

Opportunity

Regulatory support for innovation and personalized medicine

Regulatory support for innovation in the inhalable drugs market is a key catalyst for opportunities. Favorable regulatory environments that encourage and facilitate the development of novel inhalable drug therapies foster innovation and streamline approval processes. This support allows pharmaceutical companies to navigate regulatory pathways more efficiently, bringing advanced inhalable drugs to market sooner. Regulatory backing not only ensures the safety and efficacy of these innovative treatments but also stimulates research and development investment, creating a conducive environment for market growth and expansion.

The trend towards personalized medicine further amplifies opportunities in the inhalable drugs market. Tailoring inhalable drug therapies to individual patient characteristics enhances treatment precision and efficacy. With advancements in diagnostics and genetic profiling, inhalable drugs can be customized to address specific patient needs, optimizing therapeutic outcomes. This personalized approach aligns with evolving healthcare trends, creating a unique market niche and positioning inhalable drugs as a forefront solution in the era of precision medicine.

Drug Class Insights

In 2024, the dry powder formulations segment held the highest market share of 46% based on the drug class. Dry powder formulations represent a drug class in the inhalable drugs market, characterized by medications formulated in powder form for inhalation. This segment has witnessed a growing preference due to its convenience, stability, and ease of administration. Recent trends indicate increased research and development efforts focusing on enhancing the performance and efficacy of dry powder formulations. Advancements in inhalation device technology and innovations in particle engineering contribute to the evolving landscape of dry powder inhalable drugs, offering patients and healthcare providers efficient and patient-friendly respiratory treatments.

The spray segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The spray segment in the inhalable drugs market encompasses drugs administered through aerosolized sprays, typically delivered via metered-dose inhalers (MDIs) or nebulizers. This drug class is witnessing a growing trend with advancements in spray technology, offering precise and convenient delivery of medications to the respiratory system. Innovations in formulations and devices, such as breath-actuated inhalers, are enhancing patient compliance. The spray segment is gaining prominence due to its effectiveness in treating respiratory conditions, contributing to the overall expansion of the inhalable drugs market.

Application Insights

According to the application, the respiratory diseases segment held 67% revenue share in 2024. The respiratory diseases segment in the inhalable drugs market focuses on addressing conditions such as asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections. This segment involves the development of inhalable drugs specifically designed to provide targeted and efficient treatment for respiratory ailments. Current trends include the continuous advancement of inhalable drug formulations and delivery devices, as well as ongoing research efforts to expand the range of respiratory diseases addressed. The segment reflects a commitment to improving patient outcomes and enhancing the management of various respiratory conditions through innovative inhalable drug therapies.

The non-respiratory disease segment is anticipated to expand fastest over the projected period. The non-respiratory disease segment in the inhalable drugs market refers to the application of inhalable formulations for treating conditions beyond the respiratory system. This includes diverse therapeutic areas such as diabetes, pain management, and systemic infections.

A notable trend in this segment involves the expansion of inhalable drugs into novel medical domains, driven by advancements in drug formulations and a growing recognition of the potential benefits of inhalation therapy for a broader spectrum of health issues. This diversification reflects a shift toward the development of inhalable drugs as versatile solutions for various non-respiratory diseases.

Inhalable Drugs Market Players

- GlaxoSmithKline plc

- AstraZeneca plc

- Novartis International AG

- Boehringer Ingelheim

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi

- Cipla Ltd.

- Vectura Group plc

- Mylan N.V. (now part of Viatris)

- Sunovion Pharmaceuticals Inc.

- MannKind Corporation

- Insmed Incorporated

- Theravance Biopharma

Recent Developments

- In January 2023, the U.S. Food and Drug Administration granted approval to AstraZeneca for Airsupra (albuterol and budesonide) inhalation aerosol. This inhalable medication, a collaborative effort between AstraZeneca and Avillion, aims to reduce the likelihood of asthma exacerbations in individuals aged 18 years and older.

- In March 2022,Viatris Inc. and Kindeva Drug Delivery L.P. garnered FDA approval for Breyna, a cutting-edge drug-device combination therapy tailored for patients grappling with asthma or chronic obstructive pulmonary disease (COPD). This regulatory green light underscores the ongoing strides in pharmaceutical advancements aimed at providing innovative solutions for respiratory health challenges.

Segments Covered in the Report

By Drug Class

- Aerosol

- Dry powder formulation

- Spray

By Application

- Respiratory diseases

- Non-respiratory disease

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting