The biopharmaceutical industry is at a turning point as science, regulation, and technology combine to speed up drug development and create better treatments for complex and previously hard-to-cure diseases.

The biopharmaceutical industry is undergoing a structural transformation driven by advances in molecular science, data-driven discovery, and evolving healthcare economics. Traditional linear drug development models are giving way to platform-based innovation, precision medicine, and digitally enabled value chains. This article examines the scientific, technological, and strategic forces reshaping the biopharma landscape, with emphasis on R&D productivity, manufacturing evolution, regulatory complexity, and long-term growth sustainability. The analysis highlights how leading organizations are redefining competitive advantage through the integration of biology, technology, and operational excellence.

Biopharmaceutical Shareholder Returns: Value Creation Drivers and Strategic Implications

Biopharmaceutical is a company with a consistent historical trend of achieving the strategic objectives and values of shareholders by their return. The biopharmaceutical industry presents a distinctive set of scientific risk, lengthy development cycles, and asymmetric payoff potential to define the shareholder returns. In contrast to other industries, the creation of values is strongly in the areas of successful innovation, regulatory authorizations, and management of major assets. Subsequently, returns are usually volatile yet outsized to firms that have good pipelines and execution discipline. Investors with a long-term perspective of the biopharma usually consider its sustainability in innovation and not its stability in the short term, in terms of earning.

- Key Risky Shareholder Returns: The most valuable determinant of shareholder value in biopharma is the R&D productivity. Excess returns can be high as a result of pricing power and longevity of exclusivity due to successful late-stage assets and first-in-class or best-in-class therapies. Diversification of portfolios in terms of therapeutic areas and modalities, minimizes risk and levels cash flows. Proper lifecycle management such as label expansion and formulation upgrades will increase the revenue period and returns. Shareholder returns are also affected by capital discipline in terms of R&D expenditure and acquisition.

- Merger, Acquisition and License Role: M&A and licensing deals are at the center of the process of influencing shareholder returns through expediting innovation access and de-risking internal pipelines. Late stage or commercial acquisitions can create instant revenue and valuation boost. Value can be lost, however, through overpayment or integration issues. Licensing and partnering business strategy enables businesses to spread risk in development and maintain upside. The highest level of shareholder returns occurs when deal strategy is closely linked to core scientific capabilities.

- Capital Allocation Policy and Payout Policy: Biopharma firms strike a balance between reinvestment in innovation and shareholders payouts in the form of dividends and share buybacks. Moneyed and established companies are likely to focus on regular dividend and buyback to provide stable returns. On the contrary, emerging and mfid-size biopharma firms use cash flows to fuel their pipeline. The best capital allocation activities are based on the maturity of pipeline, the cash flow visibility, and the positioning. Shareholders pay dividend to transparency and uniformity in capital deployment policies.

- Market Volatility and Risk Profile: Biopharma shareholder returns are also sensitive to the results of clinical trials, to regulatory decisions and to pricing. Dependency on single assets can greatly contribute to the downside risk. Market value can be demolished within a short time due to regulatory difficulties or safety issues. On the other hand, positive trial reports or approvals may prompt severe re-rating of valuations. Such an unequal distribution of risk and reward is characteristic of biopharma among most other sectors.

- Long-Term Return Outlook: In the long run, biopharma has shown the possibility of outperforming the wider markets in case there is high success rates in innovation. The possibilities of value creation are growing with the advent of biologics, treatments of rare diseases, and precision medicine. Firms that have both the scientific and the disciplined action and financial stewardship tend to provide higher shareholder returns over the long term. Growing investor interest in the quality of the pipeline, the transparency of data, and strategic consistency is changing valuation.

Registration of Biosimilars and Generics

The process of registering generics and biosimilars is a key regulation, aimed at providing safety, efficacy and quality of the medication and allowing easy access to the medicines at reasonable prices. The scientific and regulatory needs vary considerably, despite being both intended to establish equivalence to an accepted reference product, because of the complexity of biologics. The regulatory authorities use risk-based, step by step evaluation models, which are dependent on the product type. Consequently, biosimilar registration is data-intensive as compared to generic drug approval. These models have a check on the incentives of innovation and the cost of healthcare.

Regulatory Principle

The generic drugs are small-molecule products that are chemically identical to their reference listed drugs. Registration is done on the basis of showing pharmaceutical equivalence and bioequivalence, and does not require the repetition of full clinical efficacy trials. This method is because there are similar therapeutic results due to the same chemical composition.

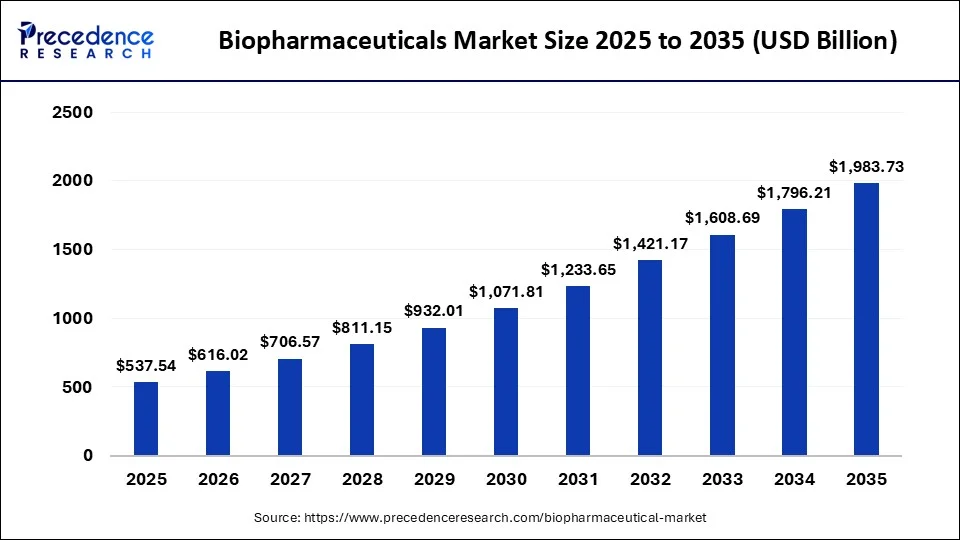

What is the Biopharmaceuticals Market Size?

The global biopharmaceuticals market size is calculated at USD 537.54 billion in 2025 and is predicted to increase from USD 616.02 billion in 2026 to approximately USD 1,983.73 billion by 2035, expanding at a CAGR of 13.95% from 2026 to 2035.

Biopharmaceuticals Market Key Takeaways

- North America dominated the global biopharmaceutical market with the highest market share of 46% in 2025.

- By type, the monoclonal antibodies segment accounted for the largest market share of 38% in 2025.

- By application, the oncology segment dominated the global market in 2025.

Major Registration Requirements.

- Proving similarity in active ingredient, dosage form, strength, and route of administration.

- Bioequivalence trials between the pharmacokinetic parameters and the reference product.

- Control and Manufacturing and Controls (CMC) documentation to guarantee reliability.

- Data of stability, impurity, and dissolution.

Adherence to Good Manufacturing Practices (GMP).

Upon approval, generics are therapeutically interchangeable with reference product. The smooth line saves both time and money that are spent on development. This allows quick market penetration and competition of prices. Generics are in the center stage of enhancing the affordability of healthcare. The time of review of the regulation is normally less than the innovative drugs. Biologic products with high similarity, but not identicality to an approved reference biologic are known as biosimilars since biological manufacturing is highly complex. Registration would be a totality-of-evidence approach in which there can be no clinically relevant difference in safety, purity, and potency. The emphasis is made on similarity instead of autonomous demonstration of effectiveness.

Stepwise Development and Registration

- Analytical Comparability Extensive structural and functional characterization to demonstrate molecular similarity.

- Nonclinical Studies Comparative in vitro and, when necessary, in vivo studies.

- Clinical Pharmacology Comparative pharmacokinetic and pharmacodynamic studies.

- Clinical Efficacy and Safety At least one confirmatory clinical study in a sensitive indication.

- Immunogenicity Assessment Evaluation of immune response risk compared to the reference product

Based on scientific rationale, approved biosimilars receive indications that might incorporate extrapolation between several applications of the reference product. The interchangeability at the designation where it applies entails extra evidence. The area of focus on post-marketing surveillance is based on long-term safety considerations. The scientifically rigorous and resource intensive approval pathway is also involved. The registration paths have a direct impact on the development schedules, costing schemes and price settings. Whereas generics will enter the market quickly by replacing products, biosimilars will need physician conviction and training. The markets need regulatory clarity to take up. The harmonization of jurisdictions is done to minimize duplication and ensure safety. Effective registration plans combine the science of regulations with manufacturing quality.

Key difference Between Generic and Biosimilar Registration

| Aspect | Generics | Biosimilar |

| Molecular structure | Identical | Highly similar |

| Clinical trials | Not required | Required |

| Development cost | Low | High |

| Regulatory approach | Bioequivalence based | Totality of evidence |

The approval of biosimilars and generics indicates two radically different scientific and regulatory issues. The generics are based on chemical identity and bioequivalence, which provide effective approval and mass replacement. Biosimilars need to have strong comparative evidence to overcome the risk of biological complexity and immunogenicity. This combination of pathways will promote the sustainability of healthcare by harmonizing the aspects of innovation, safety, and affordability.

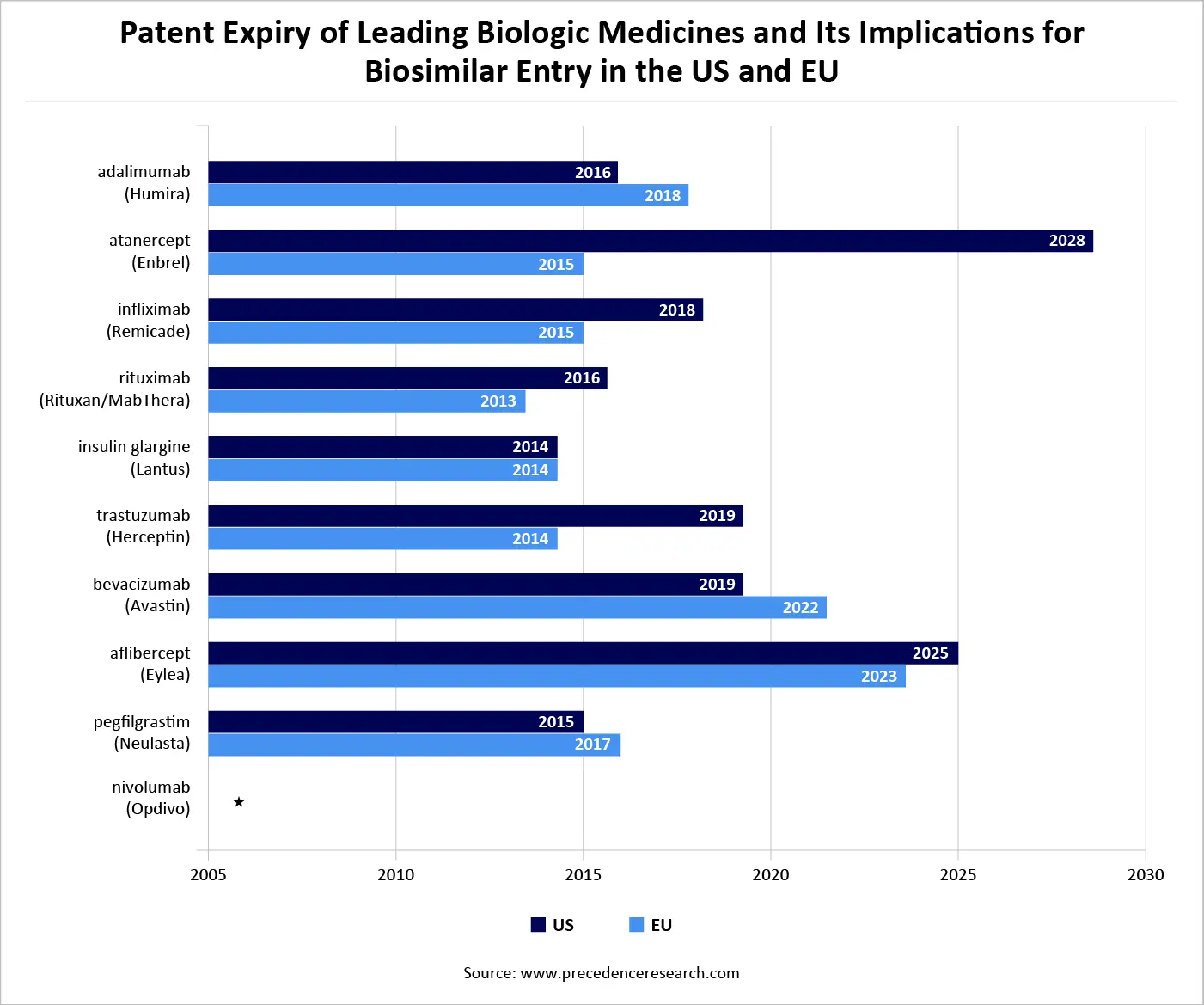

Patent Expiry of Leading Biologic Medicines and Its Implications for Biosimilar Entry in the US and EU

Cytochrome P450: The Body’s Master Chemists of Drug Metabolism

Cytochrome P450 (CYP450) enzymes play a central role in the metabolism of drugs, endogenous compounds, and environmental chemicals, acting as the body’s primary biochemical defense and processing system. Located mainly in the liver, these enzymes catalyse oxidative reactions that convert lipophilic substances into more water-soluble metabolites, facilitating their elimination from the body. CYP450 enzymes are responsible for the metabolism of a majority of clinically used drugs, influencing their bioavailability, half-life, and therapeutic efficacy.

Variability in CYP450 activity driven by genetic polymorphisms, age, disease state, and drug-drug interactions can significantly alter treatment outcomes and safety profiles. Enzyme induction or inhibition by co-administered drugs may lead to reduced efficacy or increased toxicity, making CYP450 pathways a critical consideration in drug development and clinical practice. Beyond pharmacology, CYP450 enzymes also participate in the metabolism of hormones, fatty acids, and vitamins, underscoring their broader physiological importance. Consequently, understanding CYP450 function is essential for precision medicine, dose optimization, and minimizing adverse drug reactions.

Recent Advances in Key Omics Technologies: Unravelling Complex Biology for Precision Health

The recent developments in omics technologies have revolutionarily fast-tracked our knowledge in biological systems shifting the field of research and clinical practice to more comprehensive and high-resolution knowledge. Ultra-long reads, high-precision, and single-cell resolution. Next-generation sequencing (NGS) is still developing, and allows the detailed analysis of genomic variation, structural rearrangement, and rare cell populations. The development of mass spectrometry methods, such as data-independent acquisition and top-down methods, has enabled proteomics to be used to quantify proteins further, map post-translational modifications, and profile protein interactions dynamically.

Now metabolomics and lipidomic make use of high-resolution platforms and enhanced computational deconvolution to plot metabolic states and fluxes with previously unparalleled specificity to connect phenotype with biochemical activity. New epigenomics technologies, including single-cell ATAC-seq and multi-modal chromatin profiling, are offering a glimpse into regulatory processes of both disease and development. In addition to these, spatial omics technologies bring molecular profiling together with histological context to show how cellular microenvironments determine function and pathology.

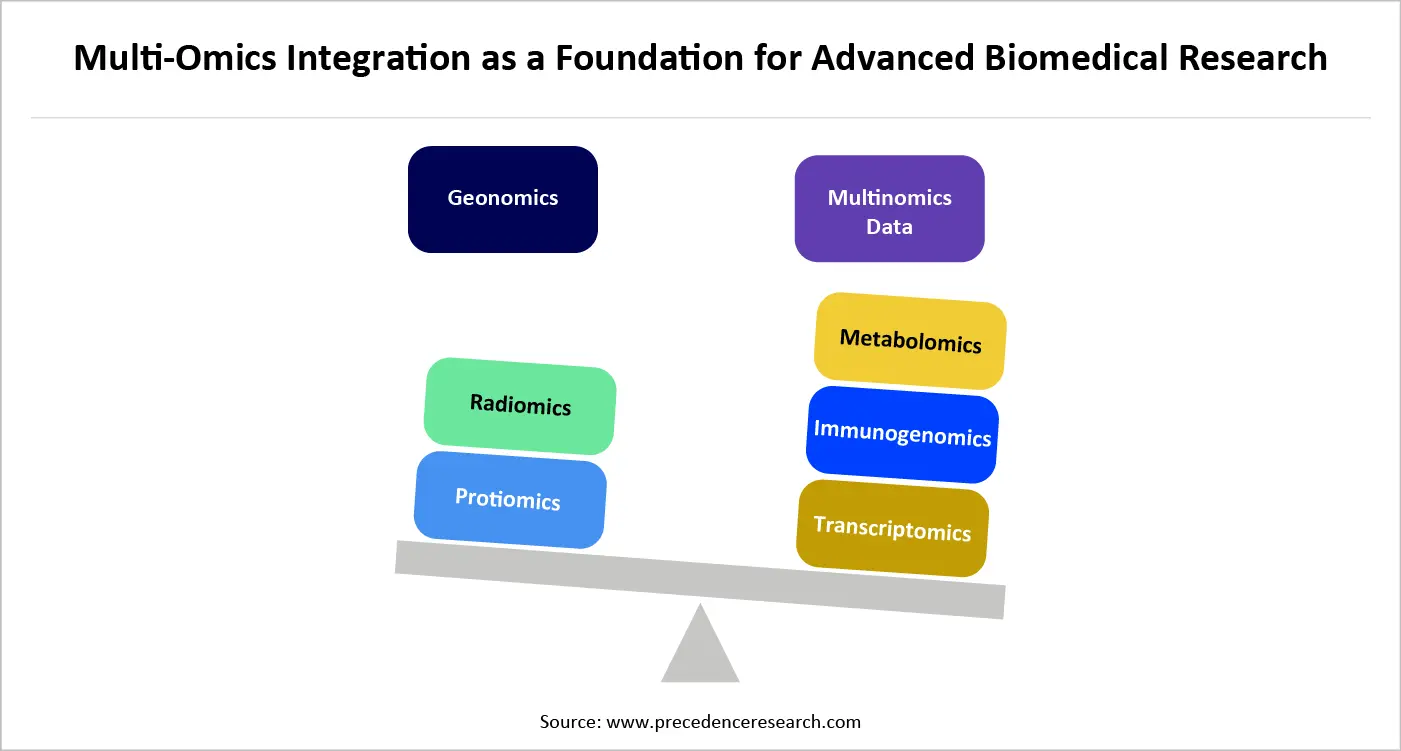

Multi-omics integration, which is driven by state-of-the-art machine learning and network biology systems, is providing predictive disease progression, therapeutic response, and biological system behavior models. Together, these developments are hastening down the path of precision medicine, increasing the discovery of biomarkers, and transforming drug development with better-informed target discovery and patient segmentation.

Multi-Omics Integration as a Foundation for Advanced Biomedical Research

Drug Screening and Discovery: From Target Insight to Therapeutic Reality

Drug screening and discovery is a very integrated and data-driven process that converts biological knowledge into viable therapeutic candidates. Initially, it starts with target identification and validation, which is progressively informed by genomics, proteomics, and systems biology to provide excellent disease relevance and clinical translatability. Large-scale screening, high-throughput screening, abbreviated as HTS systems, can now be used to screen libraries of millions of compounds at validated targets in a short time, whereas phenotypic screening covers more multicellular phenotypes than single-target phenotypes.

Computational chemistry, structure-based drug design, and AI-based virtual screening have made a major time and cost reduction by ranking high-probability lead compounds and experimentally testing them afterwards. The optimization of leads is an additional step to optimize potency, selectivity, pharmacokinetics, and safety with the help of iterative medicinal chemistry, in-vitro, and in-vivo studies.

Moreover, there is the incorporation of organ-on-chip models, 3D cells cultures, and translational biomarkers that are enhancing the predictability of human reactions at the early stages of development. A combination of these innovations is transforming drug discovery to a more accurate, efficient, and patient-focused field and is decreasing the bench-to-bedside approach.

Overview of Selected Bioinformatics Tools and Techniques

| Tool or Techniques | Purpose | Application Scope | Advantages | Potential Disadvantages and Limitations |

| ChIP-seq | Chromatin immunoprecipitation sequencing | Epigenomics | Provides high-resolution mapping of protein-dna binding sites across the entire genome | Depends on the availability of high-quality, highly specific antibodies and may contains relatively high levels of background noise |

| MaxQuant | Proteomics data analysis | Proteomics | Enables high-precision quantitative analysis of large-scale proteomic datasets and offers robust support for diverse experimental designs and mass spectrometry platforms | Requires significant computational resources for processing large datasets |

| DeepTox | Deep learning algorithms for robust toxicity prediction | Toxicity prediction | Utilizes large-scale datasets and facilitates feature sharing among related toxicity prediction tasks through multi-task learning strategies | Limited model interpretability and potential risk of overfitting, particularly with limited data |

Future of the Drug Screening and Discovery Industry

The future of the drug screening and discovery industry will be defined by convergence where biology, data science, and engineering intersect to create faster, smarter, and more predictive development pathways. Artificial intelligence and machine learning will move from supportive tools to core decision engines, enabling real-time target prioritization, de novo molecule design, and adaptive screening strategies with higher clinical success rates. Multi-omics integration and systems pharmacology will deepen disease understanding, shifting discovery from single-target approaches toward network-based and precision therapies tailored to patient subpopulations.

Experimental models will continue to evolve, with organoids, organ-on-chip platforms, and humanized in-vitro systems reducing dependence on animal testing while improving translational accuracy. Collaborative ecosystems linking pharma, biotech, academia, CROs, and cloud platforms will become the dominant innovation model, supported by secure data sharing and interoperable digital infrastructure. Ultimately, the industry will transition from a linear, high-attrition process to a continuously learning, patient-centric engine capable of delivering safer, more effective medicines at unprecedented speed

Initial QTPP Development in Biopharmaceuticals

Initial Quality Target Product Profile (QTPP) development is a foundational step in biopharmaceutical product design, defining the intended quality characteristics that ensure safety, efficacy, and patient acceptability. In biopharmaceuticals, the QTPP is established early in development by integrating clinical objectives, target patient population, route of administration, dosage form, dosing frequency, and therapeutic indication. It translates clinical expectations into measurable quality attributes such as potency, purity, stability, immunogenicity risk, and product consistency, which are especially critical for complex biologics like monoclonal antibodies, vaccines, and recombinant proteins. During early QTPP development, cross-functional input from clinical, regulatory, formulation, analytical, and manufacturing teams is essential to align product design with regulatory expectations and lifecycle management goals. Risk-based tools such as prior knowledge, platform technologies, and early comparability assessments are used to refine QTPP elements as more data becomes available. A well-defined initial QTPP ultimately serves as the strategic blueprint for critical quality attribute (CQA) identification, process development, control strategy design, and successful regulatory submissions throughout the biopharmaceutical product lifecycle.

Drug Product Attribute Comparison by Development Phase

|

Product Attribute |

Phase I/II |

Phase III/Commercial |

|

Indication |

Arthritis |

Arthritis |

|

Molecule type |

IgG1 |

IgG1 |

|

Route of administration |

Intravenous/subcutaneous |

Subcutaneous |

|

Dosage form |

Liquid, single use |

Liquid, single use |

|

Dose |

0.1–1.5 mg/kg variable dose |

150 mg fixed dose |

|

Protein content per container |

100 mg extractable |

150 mg deliverable |

|

Biocompatibility |

Acceptable toleration on infusion or injection |

Acceptable toleration on injection |

|

Drug product presentation |

25- 50 mg/mL |

150 mg/mL |

|

Primary container |

2R type 1 borosilicate glass vials, aminated stopper |

1 mL long staked needle glass type 1 pre-filled syringe |

|

Target shelf life |

≥2 years at 2 to 8 °C |

≥3 years at 2 to 8 °C |

|

Compatibility with Manufacturing |

Minimum 7 days at 25 °C plus ≥2 years at 2 to 8 °C Okay with 150 mg/mL during UF/DF |

1 month at 25 °C plus ≥3 years at 2 to 8 °C |

|

Viscosity properties |

≤ 10 cP |

< 15 cP, No Injectability issues |

|

Degradants and impurities |

Below safety threshold and cleared by process |

Below safety threshold and cleared by process |

|

Pharmacopeial compliance |

Meets pharmacopoeial requirements, colorless to slightly yellow, practically free of visible particles and meets USP<787> criteria for subvisible particles |

Meets pharmacopoeial requirements, colorless to slightly yellow, practically free of visible particles and meets USP<787> criteria for subvisible particles |

Global Biopharmaceutical Industry: A Transformative Strategic Force

The biopharmaceutical industry has become one of the strongest forces in the healthcare ecosystem of the world, moving innovation in the biologics, vaccines, cell and gene therapies, and more sophisticated recombinant technologies. The industry worldwide is typified by the intensity of research, lengthy development cycles, and significant expenditure of capital, with North America and Europe being the most innovative and Asia-Pacific gaining greater dominance in both scale of manufacturing and frequency of clinical trials.

The lightning-fast discoveries in genomics, proteomics, artificial intelligence, and platform-based drug development have changed the discovery and development paradigms, providing more specific, personalized, and faster therapeutic solutions. International harmonisation initiatives and efforts to collaborate with other countries have facilitated the accessibility of the global market, though pricing pressure, variation in reimbursements and supply chain resilience are also continuing problems in different regions.

The industry is also vital in solving the unmet medical needs, including rare genetic disorders and complicated chronic and infectious diseases, making it crucial in global preparedness against the public health. In general, the world biopharmaceutical market is changing and shifting as a strategically important, innovation-driven market with significant economic, scientific, and social consequences.

Biopharmaceutical Sector Industrial Environment

The biopharmaceutical industry is characterized by an immensely regulated, innovation-driven and capital-intensive ecosystem that combines sophisticated science and complicated production processes. Industries are regulated under strict regulatory systems that control all processes throughout the product lifecycle such as the initial research and clinical test procedures and the mass production, quality controls, and after sales follow-ups. The competitive environment is characterized by high barriers to entry, which are influenced by high costs in conducting research and development, specialized facilities, and intellectual property demand which creates a competitive environment that is dominated by large international players as well as nimble biotechnology companies and contract development and manufacturing organizations.

The industrial environment is characterized by technological sophistication, where automation and digital quality systems, advanced analytics and biologics-specific manufacturing platforms like single-use systems and continuous bioprocessing continue to be invested in. Resilience, redundancy, and supplier qualification are also key responses in the operations of the industry because it is highly integrated with international raw material, biologic input, and specialized equipment sourcing networks. At the heart of the environment is collaboration and strategic partnerships between pharma companies, academic institutions, CROs, CMOs, and technology providers enhancing innovation and reducing risk. The general state of the biopharmaceutical industrial environment can be characterized as a balance between the level of scientific progress, regulatory rigor, and operational efficiency, making the industry both a high-growth and high-complexity sector of the global economy.

GMP Drug Product (DP) Stability Monitoring and Manufacturing.

The manufacturing of GMP drug products is a well-managed procedure, which aims at producing a final pharmaceutical product that has a high consistency in terms of quality, safety, and efficacy. It starts with the drug substance, excipients and primary packaging material being received and qualified, after which the formulation, sterile/non-sterile filling and packaging under approved environmental condition is carried out. During the manufacturing process, in-process controls, equipment qualification, and batch documentation are observed to the letter as a way of ensuring traceability and regulatory compliance.

Stability surveillance is part of the GMP DP manufacturing and is carried out during the product lifecycle. The stability studies are run under the conditions proposed by the ICH to determine the changes in the quality attributes of the drug product, such as potency, purity, appearance, and sterility over time. Information prepared through stability programs are used to assign shelf-life, storage conditions and regulatory submissions, and stability studies done during the ongoing (post-approval) stability tests are used to assure the continued quality of the product in the commercial phase. Combined, GMP production and stability testing constitute a closed quality loop, which protects patient safety and regulatory trust.

Future of the Biopharmaceutical Industry

The future of the biopharmaceutical industry will be shaped by a convergence of scientific breakthroughs, digital transformation, and evolving healthcare needs. Advanced modalities such as cell and gene therapies, mRNA platforms, and RNA-based therapeutics are expected to move from niche applications to more mainstream treatment options, fundamentally changing how complex and rare diseases are managed. Artificial intelligence and machine learning will increasingly drive drug discovery, clinical trial design, and manufacturing optimization, significantly reducing development timelines and improving success rates.

Manufacturing and supply chains will become more flexible, decentralized, and technology-enabled, with greater adoption of continuous bioprocessing, single-use systems, and real-time quality monitoring. Regulatory frameworks are also likely to evolve toward more adaptive, data-driven models that support accelerated approvals while maintaining rigorous safety standards. At the same time, value-based healthcare, biosimilars, and cost-containment pressures will reshape pricing and market access strategies globally. Overall, the industry’s future points toward a more patient-centric, digitally integrated, and innovation-led ecosystem with a strong emphasis on sustainability, resilience, and global health impact.

The biopharmaceutical sector is at a crossroads where science, regulation and industrial perfection meet to transform the world of healthcare. The recent developments of biologics, digital technologies as well as precision medicine, are not only speeding up the development of drugs but also increasing the prospect of treating complex and previously incurable diseases

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation