What is the Intelligent Document Processing (IDP) Market Size?

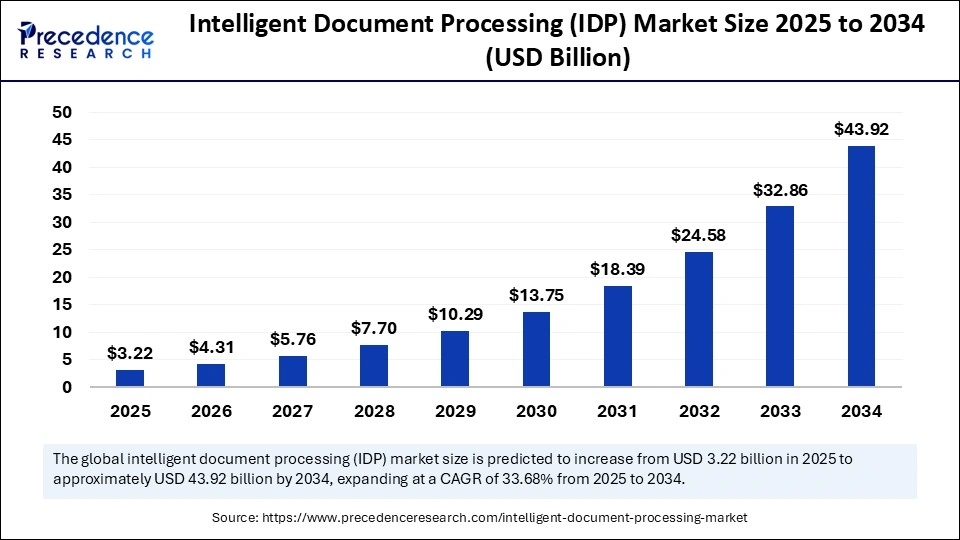

The global intelligent document processing (IDP) market size accounted for USD 3.22 billion in 2025 and is predicted to increase from USD 4.31 billion in 2026 to approximately USD 43.92 billion by 2034, expanding at a CAGR of 33.68% from 2025 to 2034. The market expansion is fueled by increasing demand for automation, AI integration, and digital transformation in the financial, healthcare, and government sectors.

Market Highlights

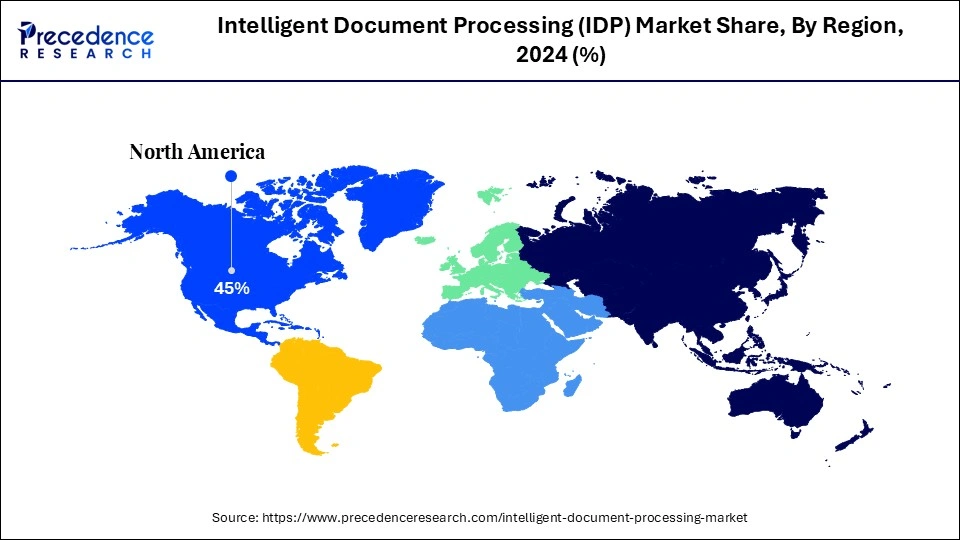

- North America led the intelligent document processing (IDP) market with around 45% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the software segment held approximately 55% market share in 2024.

- By component, the services segment growing at the fastest CAGR between 2025 and 2034.

- By deployment mode, the cloud-based IDP solutions segment captured approximately 50% market share in 2024.

- By deployment mode, the on-premise IDP solutions segment is expected to expand at a notable CAGR from 2025 to 2034.

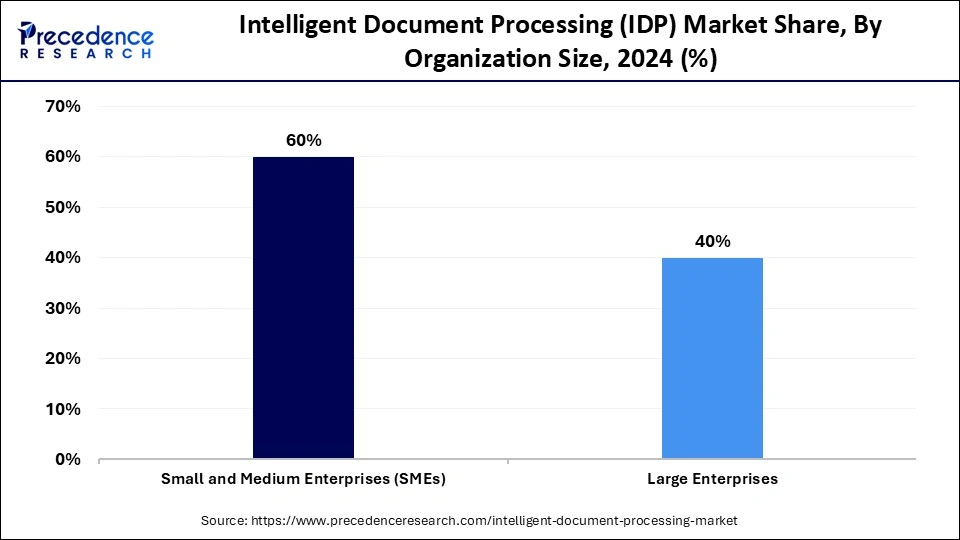

- By organization size, the large enterprises segment held the major market share of 60% in 2024.

- By organization size, the SMEs segment is expanding at the fastest CAGR between 2025 and 2034.

- By end-user industry, the BFSI segment held approximately 40% share of the market in 2024.

- By end-user industry, the healthcare & life sciences segment is expected to expand at the highest CAGR from 2025 to 2034.

What are Intelligent Document Processing Solutions?

The intelligent document processing (IDP) market is driven by the growing demand for automation and the increasing volume of unstructured data within enterprises. IDP leverages AI, machine learning, and natural language processing to automatically extract, analyze, and manage information from both structured and unstructured documents. It finds applications across banking, healthcare, legal, and other document-intensive industries, helping streamline workflows, reduce human errors, and accelerate decision-making. Organizations are adopting IDP to manage data more efficiently, ensure regulatory compliance, and integrate seamlessly with existing systems, making it a key enabler of operational efficiency and digital transformation.

The market refers to the global industry focused on software and solutions that automate the ingestion, extraction, classification, and processing of structured and unstructured data from documents. IDP combines technologies like Artificial Intelligence (AI), Machine Learning (ML), Natural Language Processing (NLP), and Optical Character Recognition (OCR) to streamline workflows, reduce manual errors, and accelerate decision-making. The market is also driven by the growing need for digital transformation, regulatory compliance, cost reduction in document-centric processes, and the increasing adoption of AI-enabled automation across industries such as BFSI, healthcare, insurance, and government.

How is Artificial Intelligence Changing the Landscape of the Intelligent Document Processing (IDP) Market?

Artificial intelligence is rapidly transforming the intelligent document processing (IDP) market by enabling the automation of complex document workflows. Leveraging machine learning and natural language processing, AI-powered IDP systems can extract, classify, and process unstructured data from invoices, contracts, forms, and other documents with minimal human intervention. By 2025, businesses are expected to widely adopt AI-based IDP solutions to manage higher document volumes efficiently, reduce errors, and free employees for strategic tasks.

For instance, Eletrobras reported a 90% reduction in manual processing, saving over 10,000 employee hours through upskilling initiatives. Similarly, a September 2025 survey by SER, a leading provider of Intelligent Content Automation, revealed that 65% of organizations are accelerating AI-driven IDP projects, underscoring the technology's critical role in boosting productivity, operational efficiency, and faster decision-making.

Intelligent Document Processing (IDP) Market Outlook

The intelligent document processing (IDP) market is expected to grow rapidly from 2025 to 2034, driven by demand for operational efficiency and faster decision-making. There is a rising adoption of IDP in industries such as finance, healthcare, legal, and logistics due to high document volumes and the high cost of manual data entry.

There is great potential for market growth worldwide. Governments globally are increasingly adopting AI-powered IDP solutions to enhance operational efficiency in the public sector. These technologies are used to improve public services, good governance, and public trust.

The IDP industry is growing rapidly with a lively startup scene featuring new players focused on innovative solutions. These companies, driven equally by investment and advances in AI and machine learning as they relate to IDP technology, are fueling the market's overall growth and diversification.

IDP solutions are increasingly used to ensure adherence to complex regulatory standards often found in finance, healthcare, and legal fields. Automating data verification and audit trails helps reduce errors, lower penalties, and enhance governance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.22 Billion |

| Market Size in 2026 | USD 4.31 Billion |

| Market Size by 2034 | USD 43.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 33.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Organization Size, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dyanamics

Drivers

One of the major factors driving the adoption of IDP is its ability to enhance accuracy and reduce errors in data extraction. Manual data entry processes are inherently prone to human error, especially at scale when handling large volumes of documents. IDP leverages the latest technologies such as Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML) to automate and streamline data extraction, significantly improve accuracy, and validate information.

Restraint

One of the main obstacles to the widespread adoption of IDP is the increasing concern about data security and privacy. Organizations are on the verge of implementing IDP technologies and reaping the workflow improvements and efficiencies they can deliver, but they are hesitant without proper security measures in place. Additional security concerns are hindering the integration of IDP into existing enterprise systems such as Enterprise Content Management (ECM), Customer Relationship Management (CRM), and Enterprise Resource Planning (ERP), due to fears of data breaches or violations of GDPR or HIPAA compliance.

Opportunity

High adoption in SMEs creates immense opportunities in the market. SMEs are able to dramatically transform operations with Intelligent Document Processing (IDP) solutions. IDP is an AI-enabled solution that automates document data extraction and structuring for invoices, contracts, and receipts, increasing efficiency while reducing manual effort and errors. According to a recent study of SMBs using IDP, at least 40% of respondents reported increased productivity or operational efficiency. Automating a specific function allows businesses to refocus existing resources from routine tasks to game-changing strategies that increase competitiveness in rapidly changing environments.

Intelligent Document Processing (IDP) MarketSegment Insights

Component Insights

The software segment led the market by holding about 55% share in 2024, under which the document capture & classification sub-segment maintaining a stronghold. This leadership is driven by the critical role these software solutions play in processing large volumes of structured and unstructured data, automating data extraction, eliminating manual errors, and optimizing document workflows. Leveraging machine learning and natural language processing (NLP), these tools understand context and enable rapid implementation across organizations, improving overall productivity and accelerating decision-making.

The services segment is expected to grow at the fastest CAGR in the upcoming period, driven by increasing demand for managed and consultancy services to deploy, integrate, and maintain IDP solutions effectively. Additionally, the need for tailored implementations and optimized document workflows is fueling growth in this segment. Emerging “IDP-as-a-service” models also allow organizations to reduce infrastructure costs, while service providers play a crucial role in supporting seamless adoption and scalable automation-first strategies.

Deployment Mode Insights

The cloud-based IDP solutions segment dominated the intelligent document processing (IDP) market in 2024, accounting for nearly 50% of the share, driven by their scalability, flexibility, and cost-effectiveness. Enterprises prefer cloud solutions for real-time access to documents, automatic software updates, and integrated AI-enabled analytical tools. This deployment also supports global collaboration and remote teams, aligning with the evolving needs of digital workplaces accelerated during the pandemic. Continuous innovations in cloud security and compliance frameworks further encourage enterprise-wide adoption.

The on-premise IDP solutions segment is expected to grow at the fastest rate over the projection period, primarily due to strict compliance requirements in government and financial sectors, which demand greater control over document and data privacy. Hybrid deployment models are also gaining traction among regulated industries, allowing organizations to balance operational agility with stringent security assurance.

Organization Size Insights

The large enterprises segment held about 60% share of the intelligent document processing (IDP) market in 2025, driven by the high volume of documents and the critical need for process optimization. Large organizations are increasingly leveraging IDP to streamline workflows, enhance compliance, and reduce operational costs across multiple departments. As digital transformation becomes a strategic imperative, these enterprises are integrating IDP solutions with ERP and customer management systems to improve accuracy, accelerate turnaround times, and enhance interdepartmental collaboration while minimizing manual intervention.

On the other hand, the small & medium enterprises (SMEs) segment is expected to expand at the highest CAGR during the forecast period, as SMEs adopt IDP to boost efficiency without extensive IT investments. Cloud-based and subscription-driven models have democratized intelligent document automation, while low-code/no-code platforms simplify deployment and reduce implementation time. As SMEs digitize key business processes across finance, HR, and operations, they are enhancing agility, scalability, and competitiveness against larger players.

End User Industry Insights

The BFSI segment dominated the market with nearly 40% share in 2024, as financial institutions increasingly leverage IDP to digitize document-intensive workflows such as loan processing, claims management, and KYC verification. The adoption of AI-powered IDP solutions enables seamless integration of unstructured data from contracts and customer records, driving faster responsiveness, fraud mitigation, and stronger compliance. Beyond operational efficiency, IDP supports enhanced data governance and fosters a paperless, secure, and scalable digital banking environment.

The healthcare & life sciences segment is expected to grow at the fastest rate, driven by the need to automate patient data processing, clinical documentation, and medical record management. Hospitals and research organizations are deploying IDP solutions to improve data accuracy, streamline workflows, and enhance patient care delivery. As electronic health record (EHR) systems gain wider adoption, IDP is becoming critical in enabling secure, compliant, and interoperable data exchange across healthcare ecosystems.

Intelligent Document Processing (IDP) MarketRegional Insights

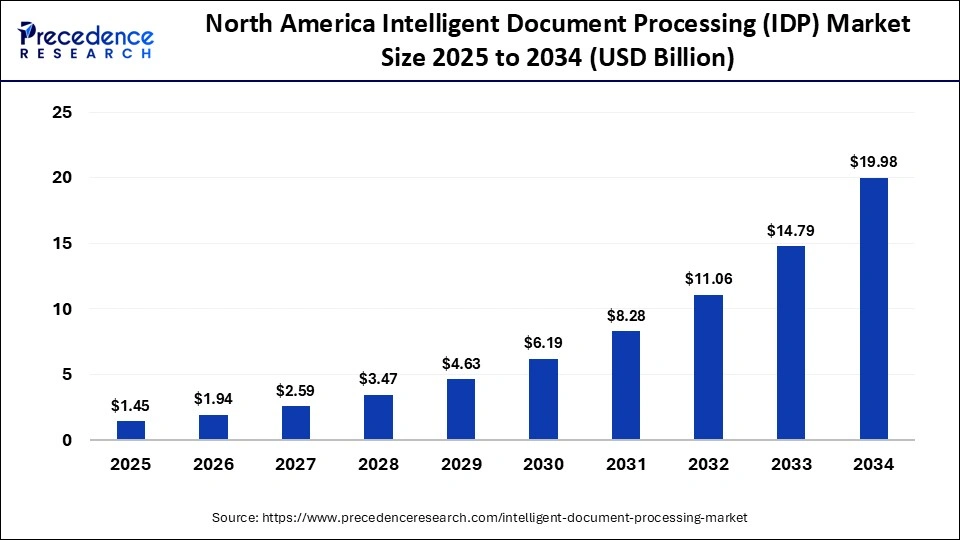

The North America intelligent document processing (IDP) market size is estimated at USD 1.45 billion in 2025 and is projected to reach approximately USD 19.98 billion by 2034, with a 33.88% CAGR from 2025 to 2034.

What Factors are Responsible for North America's Dominance in the Intelligent Document Processing (IDP) Market?

North America dominated the market with around 45% share in 2024. The region's leadership is driven by large enterprises, financial institutions, and healthcare systems that are modernizing legacy workflows into AI-first pipelines, emphasizing compliance, fraud detection, and straight-through processing. The strong ecosystem of technology vendors, cloud providers, and system integrators has shortened deployment cycles and strengthened enterprise confidence in large-scale implementations. Robust IT budgets and a thriving deal environment for document technology startups further accelerate product maturity and enterprise adoption across industries.

The U.S. intelligent document processing market size is expected to be worth USD 14.89 billion by 2034, increasing from USD 1.44 billion by 2025, growing at a CAGR of 33.96% from 2025 to 2034.

The U.S. is a major contributor to the market in North America, supported by substantial enterprise IT spending, extensive AI and cloud infrastructure, and a dynamic ISV and M&A landscape that fuels rapid innovation. U.S. banks, insurers, and service providers are scaling IDP from pilot projects to production-level deployments, standardizing on hybrid OCR + NLP + AI models that enhance scalability, governance, and vendor interoperability, positioning the U.S. as the proving ground for large-scale intelligent automation.

In May 2025, Artificio, a leader in intelligent document automation, announced launch of its new AI-powered Automation Tool for Income Summary Creation, aimed to transform mortgage processing by delivering accurate, underwriter-ready income summaries in minutes.

Asia Pacific is expected to see the fastest growth over the forecast period due to government-supported digital transformation initiatives, evolving fintech ecosystems, and the expansion of BPO and shared service industries. Enterprises are increasingly shifting from manual document workflows to AI platforms to enhance accuracy and efficiency in banking, telecom, and logistics. Widespread cloud adoption and multilingual AI language models are also improving accessibility and integration across diverse markets.

India is leading the way in Asia Pacific, driven by a vast digital public infrastructure, growth in fintech, and IT services. Major IT companies like Infosys, TCS, and Wipro are integrating IDP into enterprise automation solutions. Additionally, we expect to see further growth and maturity of IDP in 2025, with use cases such as Microsoft's Copilot integrations and Indian banks implementing AI-led KYC workflows. Government initiatives promoting paperless governance and innovation hubs for AI are also fostering a strong ecosystem for IDP adoption by both established enterprises and startups.

Europe is expected to grow at a notable rate during the forecast period due to the region's strong regulatory environment, which drives the need for automated and compliant document management solutions. The increasing adoption of AI, machine learning, and automation technologies across sectors such as banking, insurance, healthcare, and government further accelerates demand. European enterprises are prioritizing digital transformation initiatives to improve operational efficiency and reduce manual processing errors. Additionally, the rise of GDPR and other data privacy regulations has pushed organizations to adopt secure and auditable IDP systems, ensuring transparency and governance. The region's robust technology infrastructure and investments in AI innovation continue to support steady market expansion.

Latin America has emerged as a strong growth region for the IDP market, driven by a combination of increasing digitalization of business processes, rising volumes of unstructured document data (such as invoices, contracts, claims, and sales orders), and growing adoption of cloud-based automation platforms by enterprises across the region. In recent years, companies in industries like banking, insurance, retail, and government in countries such as Brazil, Mexico, and Colombia have placed greater focus on automating document-intensive workflows to improve accuracy, speed decision-making, and reduce compliance risk.

With many organizations still at early stages of digital transformation, for example, one study noted that around 38 % of Latin American enterprises remain in early stages of digital maturity, the potential for IDP uptake is significant. In addition, regional regulatory and governance trends (such as e-invoicing mandates, stronger data protection regulations, and demands for audit-readiness) are driving enterprises to adopt smarter document processing tools. Partnerships between global IDP software vendors and local system integrators have facilitated faster deployment in the region, making Latin America a region to watch in IDP expansion.

Brazil Market Analysis

In Brazil, the IDP market is showing strong momentum as both large organizations and SMEs adopt intelligent document-processing solutions to modernize back-office operations. Brazil's sizeable enterprise sector, spanning financial services, retail/e-commerce, and government, faces high document volumes and legacy manual processes, creating a compelling business case for IDP adoption. Local firms are increasingly leveraging cloud-delivered IDP platforms and integrating them with enterprise systems such as ERPs and CRMs, enabling document classification, key data extraction, and workflow automation.

Moreover, government digitalization efforts and tax administration modernization in Brazil are helping accelerate awareness and adoption of IDP within public-sector organizations as well. While challenges remain, including skill gaps, integration complexity, and price sensitivity in smaller organizations, Brazil is one of the most advanced Latin American markets for IDP, offering attractive opportunities for solution-providers looking to expand regionally.

Intelligent Document Processing (IDP) Market Companies

- Headquarters: Milpitas, California, United States (Global Headquarters: Moscow, Russia)

- Year Founded: 1989

- Ownership Type: Privately Held

History and Background

ABBYY was founded in 1989 by David Yang as a software company specializing in linguistics and document processing technologies. Initially recognized for its OCR (Optical Character Recognition) software, ABBYY has evolved into a global leader in intelligent document processing (IDP), artificial intelligence (AI), and process automation.

The company’s software enables enterprises to digitize, extract, and analyze information from complex documents, transforming unstructured data into actionable insights. ABBYY’s solutions are used across industries including banking, insurance, healthcare, and government to automate workflows and improve operational efficiency.

Key Milestones / Timeline

- 1989: Founded in Moscow, Russia as a linguistics and software development firm

- 1993: Launched ABBYY FineReader, pioneering optical character recognition (OCR) technology

- 2010: Expanded into enterprise process automation and data extraction

- 2017: Introduced ABBYY FlexiCapture for AI-driven intelligent document processing

- 2021: Established U.S. headquarters in Milpitas, California to expand global presence

- 2024: Released ABBYY Vantage 3.0 with enhanced AI model integration and cloud deployment capabilities

Business Overview

ABBYY provides intelligent automation solutions that combine OCR, machine learning, and natural language processing to help organizations automate document-intensive processes. The company’s products are used by more than 10,000 customers globally, including Fortune 500 firms, to improve document workflows and data accuracy.

Business Segments / Divisions

- Intelligent Document Processing (ABBYY Vantage)

- Process Intelligence and Analytics (ABBYY Timeline)

- OCR and Text Recognition Solutions (ABBYY FineReader Platform)

Geographic Presence

ABBYY operates in more than 40 countries with offices in the United States, Germany, the United Kingdom, Russia, Ukraine, and Japan.

Key Offerings

- ABBYY Vantage intelligent document processing platform

- ABBYY Timeline process intelligence and analytics software

- ABBYY FineReader PDF and OCR solutions

- Document capture, classification, and data extraction APIs

Financial Overview

ABBYY generates estimated annual revenues of approximately $250–300 million USD, with consistent growth driven by demand for intelligent document processing and automation solutions. The company maintains a strong presence in financial services, insurance, and public sector markets.

Key Developments and Strategic Initiatives

- March 2023: Launched ABBYY Vantage AI Skill Marketplace to support modular automation deployment

- November 2023: Expanded cloud-native IDP capabilities with AWS and Microsoft Azure integration

- April 2024: Partnered with leading automation providers to embed ABBYY Vantage into robotic process automation (RPA) ecosystems

- June 2025: Introduced ABBYY Timeline 6.0 with predictive process optimization powered by machine learning

Partnerships & Collaborations

- Strategic partnerships with UiPath, Blue Prism, and Automation Anywhere for integrated automation solutions

- Collaborations with global banks and insurers for intelligent document workflow optimization

- Alliances with major cloud providers for scalable IDP infrastructure

Product Launches / Innovations

- ABBYY Vantage 3.0 with AI skill-based architecture (2024)

- ABBYY Timeline 6.0 predictive process analytics platform (2025)

- ABBYY FineReader PDF 16 with enhanced AI-driven text recognition (2024)

Technological Capabilities / R&D Focus

- Core technologies: Artificial intelligence, OCR, NLP, process intelligence, and data extraction

- Research Infrastructure: R&D centers in Europe, North America, and Asia-Pacific

- Innovation focus: Intelligent automation, self-learning document models, and data-driven decision support

Competitive Positioning

- Strengths: Proven OCR expertise, strong AI-driven IDP platform, global partnerships

- Differentiators: AI skill-based automation and deep document analytics capabilities

SWOT Analysis

- Strengths: Robust technology stack, diverse product portfolio, global enterprise client base

- Weaknesses: Dependence on enterprise automation partnerships

- Opportunities: Growth in AI automation and process intelligence markets

- Threats: Intense competition from cloud-native automation providers

Recent News and Updates

- February 2024: ABBYY announced expansion of cloud-based IDP solutions for European customers

- July 2024: Introduced generative AI enhancements to ABBYY Vantage platform

- January 2025: Recognized as a Leader in Intelligent Document Processing by multiple industry analysts

- Headquarters: Irvine, California, United States

- Year Founded: 1985

- Ownership Type: Privately Held

History and Background

Kofax was founded in 1985 in Irvine, California, as a developer of image processing and document scanning software. Over the years, the company expanded into intelligent automation, robotic process automation (RPA), and document workflow optimization. In 2023, Kofax rebranded as Tungsten Automation, reflecting its integrated automation capabilities and the acquisition of Tungsten Network, a leading global invoicing and payments platform.

The company’s transformation into Tungsten Automation marked a strategic shift toward unifying document capture, process automation, and payment solutions under one ecosystem, helping enterprises accelerate digital transformation and achieve end-to-end workflow automation.

Key Milestones / Timeline

- 1985: Founded as a document imaging software company in Irvine, California

- 2013: Acquired by Lexmark International, expanding enterprise capture solutions

- 2017: Became an independent company backed by Thoma Bravo

- 2022: Acquired Tungsten Network, expanding into e-invoicing and payment automation

- 2023: Rebranded as Tungsten Automation to unify automation and financial workflow capabilities

- 2025: Launched Tungsten Marketplace for third-party automation extensions

Business Overview

Kofax (Tungsten Automation) delivers intelligent automation solutions combining document capture, process automation, RPA, and payment management. Its software enables enterprises to automate document workflows, manage invoices, process data, and orchestrate end-to-end digital business operations.

Business Segments / Divisions

- Intelligent Automation and RPA

- Invoice and Payment Automation (Tungsten Network)

- Document Capture and Cognitive Services

Geographic Presence

The company operates in more than 70 countries with regional offices in North America, Europe, and Asia-Pacific.

Key Offerings

- Tungsten TotalAgility intelligent automation platform

- Tungsten Network e-invoicing and payments solution

- Kofax Capture and Transformation Modules

- Kofax RPA and cognitive services suite

Financial Overview

Kofax generates estimated annual revenues of approximately $500–600 million USD, supported by strong enterprise demand for digital workflow automation and e-invoicing systems. The integration of Tungsten Network has expanded its financial automation and transaction management footprint.

Key Developments and Strategic Initiatives

- January 2023: Completed rebranding to Tungsten Automation, integrating Kofax and Tungsten product lines

- September 2023: Expanded cloud-native TotalAgility platform for document and workflow automation

- March 2024: Launched AI-powered invoice processing and payments management tools

- August 2025: Announced partnership with global ERP providers to enhance automation integration

Partnerships & Collaborations

- Partnerships with SAP, Oracle, and Microsoft for enterprise workflow integration

- Collaborations with global banks and corporations for e-invoicing automation

- Alliances with RPA and AI vendors to strengthen cognitive automation capabilities

Product Launches / Innovations

- Tungsten TotalAgility 8.0 intelligent automation suite (2024)

- AI-driven invoice and document recognition module (2024)

- Tungsten Marketplace for automation extensions and third-party integrations (2025)

Technological Capabilities / R&D Focus

- Core technologies: RPA, document capture, AI-based data extraction, e-invoicing, and workflow orchestration

- Research Infrastructure: R&D and innovation hubs in the United States, United Kingdom, and India

- Innovation focus: End-to-end intelligent automation and payment digitization

Competitive Positioning

- Strengths: Unified automation platform, strong invoice processing network, extensive enterprise client base

- Differentiators: Integration of document intelligence with financial workflow automation

SWOT Analysis

- Strengths: Broad automation capabilities, global customer footprint, proven product suite

- Weaknesses: Intense competition in RPA and IDP markets

- Opportunities: Expansion in AI-enabled payment automation and global digital invoicing

- Threats: Market consolidation and rapid technology evolution in automation software

Recent News and Updates

- February 2024: Tungsten Automation announced new AI enhancements for TotalAgility platform

- May 2024: Expanded Tungsten Network capabilities for cross-border payments

- January 2025: Launched unified automation cloud service integrating document, process, and payment workflows

Other Companies in the Market

- AntWorks: AntWorks is a pioneer in AI and Intelligent Document Processing (IDP) through its ANTstein platform, which integrates cognitive machine reading, process automation, and analytics. The company's fractal science-based engine enables structured and unstructured data extraction with exceptional accuracy. AntWorks focuses on intelligent automation solutions for banking, insurance, and healthcare sectors, emphasizing scalability and low-code deployment.

- Appian Corporation: Appian provides a leading low-code automation platform that unifies workflow automation, robotic process automation (RPA), and AI-driven decisioning. Its Appian AI Skill Designer and integrated data fabric simplify document processing and complex business process orchestration. Appian's strength lies in helping enterprises achieve digital transformation through unified process visibility and intelligent automation.

- Automation Anywhere: Automation Anywhere is one of the top global providers of RPA and intelligent automation solutions, with its Automation Success Platform integrating RPA, IDP, and generative AI capabilities. Its IQ Bot enables automated document classification, data extraction, and cognitive learning. The company focuses on enterprise-wide automation strategies across finance, healthcare, and government sectors.

- Datamatics Global Services: Datamatics offers the TruCap+ and TruBot platforms, combining AI, OCR, and machine learning for end-to-end document automation. Its IDP technology supports high-accuracy data capture across invoices, forms, and contracts. Datamatics serves industries such as BFSI, logistics, and manufacturing with strong emphasis on operational efficiency and compliance.

- EdgeVerve Systems (Infosys): EdgeVerve, a subsidiary of Infosys, provides AssistEdge, a comprehensive automation suite that combines RPA, cognitive document processing, and analytics. The platform enables digital workforce orchestration and intelligent data extraction, supporting large-scale enterprise transformation initiatives.

- Ephesoft: Ephesoft delivers AI-powered document capture and classification through its Ephesoft Transact platform. The solution automates content extraction from semi-structured and unstructured documents using supervised machine learning. Ephesoft's cloud-native architecture and API integration make it ideal for enterprise document workflows.

- HCL Technologies: HCL integrates AI, RPA, and OCR technologies into its Exacto Intelligent Document Processing platform. Exacto automates document classification, entity extraction, and validation across industries including BFSI, healthcare, and logistics. HCL's strong digital engineering expertise enhances the scalability and accuracy of its IDP offerings.

- Hyperscience: Hyperscience provides a powerful human-centered automation platform that combines machine learning and document intelligence. Its model continuously learns from human validation, ensuring high precision in data extraction. Hyperscience is known for large-scale deployments in government and financial institutions where accuracy and compliance are critical.

- IBM Corporation: IBM integrates AI and intelligent automation through its Cloud Pak for Business Automation, which includes document capture, RPA, and workflow orchestration. The IBM Datacap solution enhances document ingestion with natural language processing (NLP) and deep learning. IBM's hybrid cloud approach allows seamless scalability for enterprises across regulated sectors.

- Kofax (Tungsten Automation): Kofax, now rebranded as Tungsten Automation, offers end-to-end intelligent automation combining RPA, IDP, and process orchestration. Its flagship Kofax TotalAgility platform automates content capture, classification, and decisioning using AI and NLP. Kofax serves major industries, including finance, insurance, and government, focusing on document-heavy workflows.

- Nividous: Nividous delivers a unified Intelligent Automation Platform integrating RPA, AI, and process analytics. Its Nividous Smart Bots automate document capture, classification, and validation with built-in cognitive learning. The platform's low-code design enables quick deployment and scalability.

- OpenText Corporation: OpenText provides enterprise content management (ECM) and automation solutions through its OpenText Intelligent Capture and Documentum platforms. These tools leverage machine learning for document recognition and metadata extraction, serving highly regulated industries such as healthcare and government.

- Parascript: Parascript offers advanced handwriting and document recognition solutions powered by machine learning-based OCR. Its FormXtra.AI platform is widely used in document-intensive industries such as banking, postal services, and government. Parascript's key strength lies in unstructured document interpretation and signature verification.

- Pegasystems: Pegasystems integrates workflow automation, AI, and decision management through its Pega Platform. Its document automation features enable end-to-end processing, combining NLP and RPA for customer onboarding, claims processing, and compliance workflows. Pega's unified automation ecosystem supports large enterprise digital transformation.

- Rossum: Rossum is a fast-growing cloud-native IDP platform that uses deep learning and computer vision to automate document processing, particularly for invoices, orders, and receipts. Its Rossum AI Engine enables contextual data capture with minimal setup, reducing manual validation time.

- UiPath: UiPath is a global leader in RPA and intelligent automation, integrating AI Center, Document Understanding, and Task Mining within its platform. Its document automation tools combine OCR, NLP, and ML to extract data from unstructured documents at scale. UiPath's end-to-end automation ecosystem is widely used in finance, healthcare, and shared services.

- WorkFusion: WorkFusion specializes in AI-powered automation through its Intelligent Automation Cloud, combining digital workers, machine learning, and document analytics. Its pre-trained bots streamline high-volume document workflows in banking and insurance, especially for KYC, onboarding, and compliance processes.

Recent Developments

- In June 2025, Hyland, the pioneer of the Content Innovation Cloud, launched a next-generation agentic document processing solution, representing an innovative step in enterprise automation and a cornerstone of the company's broader agentic vision to demonstrate its Intelligent Document Processing (IDP) capabilities.(Source: https://www.prnewswire.com)

- In August 2025, Xerox Holdings Corporation launched Xerox EveryDoc IDP App, a streamlined solution built on its Intelligent Document Processing platform. It is supported by advanced AI models, the app automates data extraction and verification, streamlining document workflows and faster decision-making. (Source: https://www.news.xerox.com)

Exclusive Analysis on the Intelligent Document Processing (IDP) Market

The intelligent document processing (IDP) market is poised at a pivotal inflection point, transitioning from a niche automation enabler to a foundational pillar of enterprise digital transformation. As organizations grapple with exponentially rising volumes of unstructured and semi-structured data, the strategic imperative to convert document repositories into actionable intelligence has never been stronger. IDP, through its convergence of AI, machine learning, natural language processing, and computer vision, is redefining operational paradigms across high-compliance sectors such as BFSI, healthcare, and government, enabling data accuracy, regulatory adherence, and accelerated decision velocity.

From an investment and adoption perspective, the market demonstrates compelling scalability opportunities, particularly through the proliferation of cloud-based and low-code/no-code IDP platforms that democratize access for SMEs. Moreover, the integration of IDP into hyperautomation ecosystems and AI-driven analytics frameworks is expanding its strategic value beyond process efficiency toward enterprise intelligence and predictive insight generation.

The accelerating synergy between IDP and generative AI further unlocks next-level automation, contextual document comprehension, and adaptive learning models, positioning the sector for sustained double-digit growth through the forecast horizon. In essence, the market represents a critical juncture in the evolution of enterprise automation, one where cognitive intelligence converges with process automation to deliver transformative operational and competitive advantages.

Intelligent Document Processing (IDP) MarketSegments Covered in the Report

By Component

- Software

- Document Capture & Classification

- Data Extraction & Validation

- Workflow & Integration Tools

- Services

- Implementation & Integration

- Consulting

- Managed Services

By Deployment Mode

- Cloud-based IDP Solutions

- On-Premise IDP Solutions

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End User Industry

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Life Sciences

- Government & Public Sector

- IT & Telecom

- Manufacturing & Supply Chain

- Retail & e-Commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting