What is the Intravascular Lithotripsy Market Size?

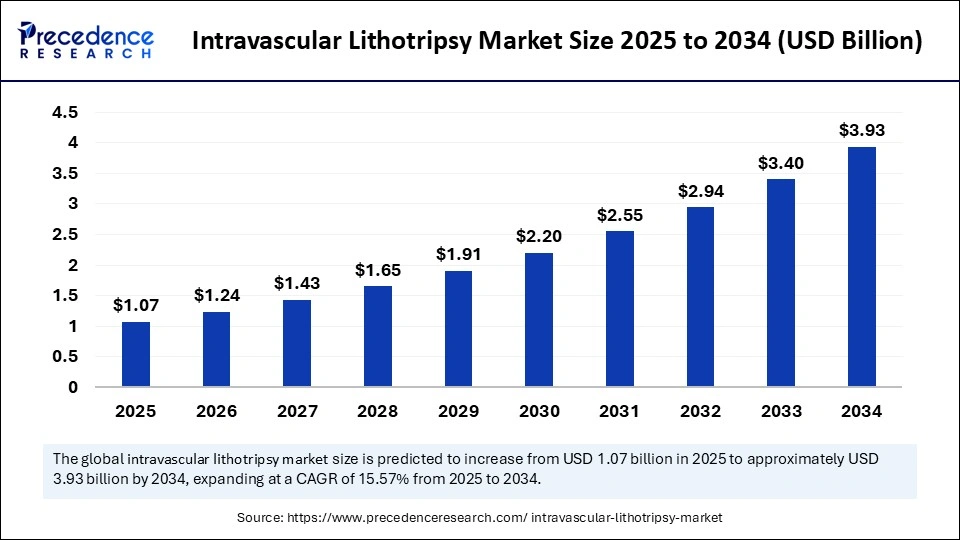

The global intravascular lithotripsy market size was calculated at USD 0.93 billion in 2024 and is predicted to increase from USD 1.07 billion in 2025 to approximately USD 3.93 billion by 2034, expanding at a CAGR of 15.57% from 2025 to 2034. The AAV gene therapy market is driven by rising approvals, expanding therapeutic applications, and increasing investments in advanced genetic treatment innovations.

Market Highlights

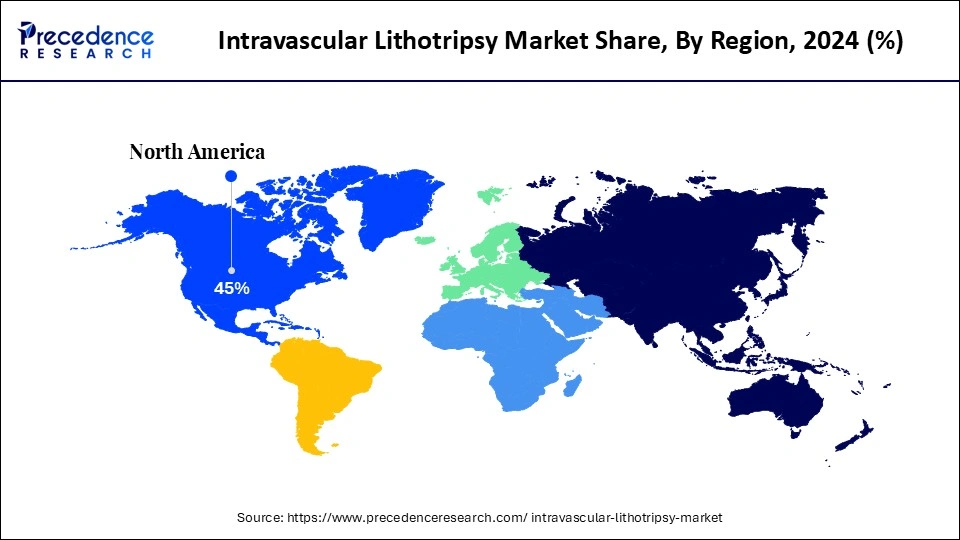

- North America dominated the intravascular lithotripsy market with the largest market share of 45% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR of 12% between 2025 and 2034.

- By procedure/application, the coronary artery disease (CAD) segment held the biggest market share of 60% in 2024.

- By procedure/application, the other vascular applications segment is anticipated to grow at a fastest CAGR between 2025 and 2034.

- By product/device type, the IVL catheters segment contributed the highest market share of 85% in 2024.

- By product/device type, the IVL generators segment is expected to expand at a notable CAGR over the projected period.

- By end user/hospital type, the cardiac and cath labs segment generated the major market share of 70% in 2024.

- By end user/hospital type, the others segment is expected to expand at a notable CAGR over the projected period.

Market Size and Forecast

- Market Size in 2024: USD 0.93 Billion

- Market Size in 2025: USD 1.07 Billion

- Forecasted Market Size by 2034: USD 3.93 Billion

- CAGR (2025-2034): 15.57%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The global intravascular lithotripsy market is experiencing rapid growth, driven by the rising prevalence of cardiovascular diseases and the advantages over traditional treatments for calcified arteries. The market refers to the segment of cardiovascular medical devices that utilize acoustic shockwave technology to treat calcified coronary and peripheral arterial lesions. IVL devices fragment calcium deposits within blood vessels, facilitating stent expansion and improving vessel compliance without causing significant vascular trauma. IVL is increasingly used for patients with severe calcified atherosclerosis, where traditional balloon angioplasty or atherectomy may be challenging.

Is Artificial Intelligence Changing the Landscape of Intravascular Lithotripsy?

Artificial intelligence is facilitating greater precision in the intravascular lithotripsy market through its ability to improve intravascular imaging interpretation and case selection. Promising deep-learning models for OCT and IVUS are currently running and overcoming traditional challenges of detecting and quantifying calcified plaque features and assisting operators in determining IVL or alternative calcium-modification tools.

Late-breaking clinical presentations and platform updates from leading IVL developers have engaged everyone's attention with potential integration of AI-assisted workflows in procedure planning and intraprocedural guidance. Academic narrative and ongoing trials, as well, are demonstrating AI's contribution to automation in calcium scoring, segmentation, and real-time decision support, and early work has proposed faster image review and selective stent preparation.

Intravascular Lithotripsy Market Growth Factors

- Rising Incidence of Vascular Calcification: The increased incidence of dreaded peripheral and coronary artery diseases with significant calcification is raising the utilization of intravascular lithotripsy due to its inherent safety and efficacy compared to standard angioplasty procedures.

- Advances in Minimally-Invasive Methods: Ongoing advancements in catheter-based devices have increased intravascular lithotripsy's adoption as physicians become able to be more precise with less risk and shorter recovery times than conventional methods.

- World-Wide Increase in Geriatric Population: An ageing population that defines a high risk for atherosclerosis and other cardiovascular complications mitigates the need for improved vascular therapies, like intravascular lithotripsy, in order to improve outcomes while reducing risk.

- Positive Clinical Efficacy and Approvals: Strong clinical data confirming the efficacy of intravascular lithotripsy for complex calcified lesions, along with wider approvals by health systems around the world, are supporting its usage and its adoption into the daily practice of interventional cardiology.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 0.93 Billion |

| Market Size in 2025 | USD 1.07 Billion |

| Market Size by 2034 | USD 3.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Procedure/Application, Product/Device Type, End User/Hospital Type, adn Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing burden of cardiovascular diseases

The increasing prevalence of cardiovascular diseases around the world is a major factor in the global intravascular lithotripsy market. Cardiac and vascular diseases remain the number one cause of morbidity and mortality globally, leading to 17.9 million deaths according to the World Health Organization. (Source:https://www.who.int)

- In the CDC's 2023 report, 919,032 deaths in the United States were attributed to cardiovascular disease, 1 in every three deaths. (Source: https://www.cdc.gov)

With patients increasingly presenting with complex calcified coronary and peripheral arterial occlusion, intravascular lithotripsy has yet again demonstrated to be a safer and more effective alternative to traditional atherectomy or stenting procedures, while also reducing complications and improving long-term outcomes. This growing burden of disease is directly contributing to the need for vascular treatment solutions globally.

Restraint

What significant obstacle is hindering the broader adoption of intravascular lithotripsy?

One of the most significant limiting factors for global uptake of IVL has to do with limited effectiveness for more calcified, eccentric, or nodular lesions, which often leads interventional cardiologists to use complementary, or even completely different, calcium-modification techniques. In March 2024, MDPI analysis, for example, it was noted that in cases of heavily calcified vessel walls or nodular substantial calcium, IVL may not completely fracture the plaque and that there will be incomplete lesion preparation and increased risk of complications like perforation. (Source: https://www.mdpi.com)

Real-world studies likewise featuring 500+ IVL use, which took place across Europe, also confirmed that while procedures are typically safe, many of the trials excluded high-risk cases, which thereby did not demonstrate their performance when presented with more difficult scenarios. These technical limitations are detrimental to confidence and especially when plaque morphology is considerably complicated, and are limiting in general use; this is especially true in emerging markets where operators do not have sophisticated imaging modalities or backup atherectomy tools either.

Opportunity

How does expansion into complex lesions represent a large opportunity for intravascular lithotripsy?

One of the strongest growth vectors for intravascular lithotripsy (IVL) resides in its expansion for use in highly complex coronary lesions, including lesion length, bifurcations, in-stent restenosis (ISR), undilatable stents, or under-expanded stents. Recent data demonstrate that in the REPLICA-EPIC registry, nearly half (≈ 49%) of all calcified lesions in the registry were considered “undilatable,” but IVL was able to successfully deliver in 99% of lesions and provide strong solutions when dividing specific high-risk subsets of lesions.

In European ad hoc or real-world studies, IVL has been reported to have a procedural success rate of up to 99% with low short and mid-term complication rates. By addressing such difficult lesion types where a traditional balloon, scoring/cutting balloon, or atherectomy is not possible, IVL opens up a large opportunity to become the solution of choice in complex percutaneous coronary intervention scenarios.

Segment Insights

Procedure/Application Insight

Which procedure/application has a higher share of the intravascular lithotripsy market?

The coronary artery disease (CAD) segment leads the way in the intravascular lithotripsy market, mainly due to the success in treating severe coronary calcifications. IVL enables percutaneous coronary intervention to be safer and more streamlined by modifying rigid plaques, along with better stent expansion and reduced procedural burden to patients with complex coronary artery disease.

The other vascular applications segment, including renal and carotid artery disease, in addition to multi-vessel calcifications, is very quickly emerging as the next most rapidly expanding area, as many physicians have established its use in non-coronary indications, thanks to its minimally invasive nature and good patient outcomes, which are making way for its use to expand beyond coronary treatment.

Product/Device Type Insights

Why are IVL catheters leading in the intravascular lithotripsy market?

The IVL catheters segment holds the leading position in the intravascular lithotripsy market as these are the first devices used to provide shockwaves directly to calcified lesions. Their widespread use for coronary and peripheral procedures regularly reinforces their importance in the treatment, producing a consistent demand in hospitals and cath labs.

The IVL generators segment, which acts as the energy source for the catheters, is growing at a faster pace. Although they are typically sold with the catheters, the growing use in new clinical applications and advancements in smaller designs are increasing the demand and becoming a more significant part of IVL procedures.

End User/Hospital Type Insights

Which end user/hospital type has a larger share of the intravascular lithotripsy market?

The cardiac and cath labs segment captured around 70% of the intravascular lithotripsy market share in 2024, as most percutaneous coronary interventions are performed in these settings. Their specialized infrastructure, trained personnel, and large patient volume for coronary procedures contribute to the fact that labs are the primary end user of intravascular lithotripsy systems.

The others segment is expected to expand at a notable CAGR over the projected period. Hybrid operating rooms and outpatient cardiovascular centers represent the rapidly growing end user. Overall, rising interest in minimally invasive therapies, more rapid recoveries, and the expansion of advanced technologies to outpatient care are opportunities to increase intravascular lithotripsy to alternative care platforms.

Regional Insights

U.S. Intravascular Lithotripsy Market Size and Growth 2025 to 2034

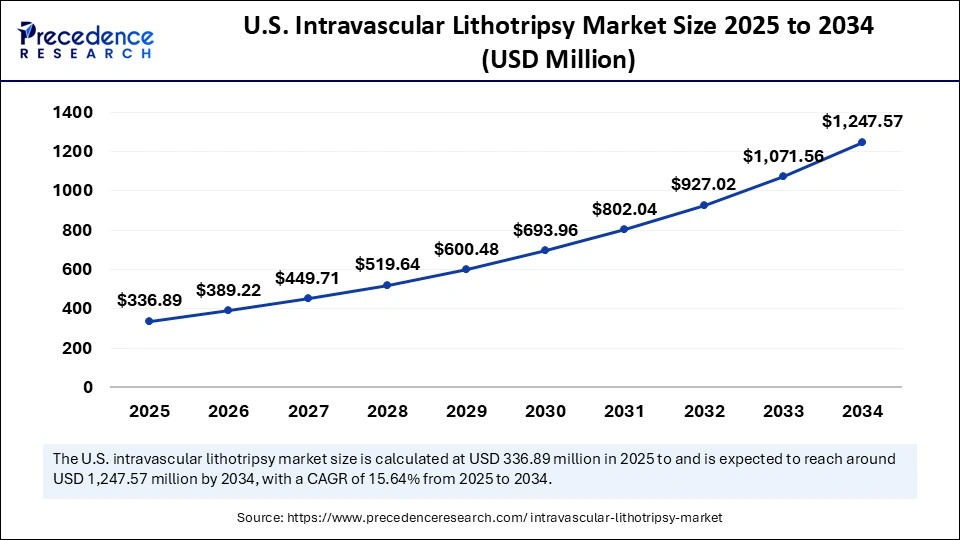

The U.S. intravascular lithotripsy market size was exhibited at USD 291.61 million in 2024 and is projected to be worth around USD 1,247.57 million by 2034, growing at a CAGR of 15.64% from 2025 to 2034.

What accounts for North America's dominance of the intravascular lithotripsy market?

The leadership of North America is supported by a well-established ecosystem for cardiovascular interventions: strong clinical trial activity, adoption of new devices into hospitals, and clear regulatory and reimbursement pathways. FDA clearances of devices, along with real-world, post-approval registries, have created a breadth of clinical evidence to lower clinician ambiguity and shorten procurement timelines.

The United States provides a combination of high procedural volume, state-of-the-art payer coverage pathways for newly implemented cardiac technologies, and centers of excellence where new technologies are rapidly adopted. FDA pre-market approvals and active IDE/registrational studies provide hospitals with constant outcomes-based data to drive capital and formulary decisions.

- In March 2025, Shockwave Medical, Inc., a subsidiary of Johnson and Johnson MedTech, announced the U.S. launch of its Shockwave Javelin Peripheral IVL Catheter, a novel intravascular lithotripsy (IVL) platform intended to modify calcium in patients with peripheral artery disease (PAD).(Source: https://www.jnj.com)

What is driving Asia Pacific to be the fastest-growing space of adoption for intravascular lithotripsy?

Asia Pacific's rapid growth demonstrates increasing rates of cardiovascular disease, along with the development of its tertiary care system, and increasing regulatory pathways that approve advanced interventional devices. The manufacturers have established regional partnerships and distribution agreements to expand access across hospitals in China, India, Japan, and Southeast Asia. Clinical presentations and registries establishing safety in peripheral and coronary indications have helped the payers and clinicians in these areas evaluate IVL adoption.

China's market performance is supported by a large patient population, regulatory approvals for IVL systems, and commercialization partnerships, which reduce time-to-market. With hospitals expanding complex PCI services and peripheral vascular services, IVL device suppliers are investing in training, local clinical evidence, and supply chains, establishing China as an early commercial region with regional impact in IVL.

- In February 2024, MicroPort RotaPace received market approval in China for the TomaHawk Integrated Coronary Intravascular Lithotripsy System (TomaHawk), which includes a disposable coronary intravascular lithotripsy (IVL) balloon catheter and treatment device.(Source: https://microport.com)

Recruiting Clinical Trials for Intravascular Lithotripsy (IVL)

| Study Start Date | Study Title | Brief Summary of Study | Sponsor |

| 9/1/2025 | Super High-pressure Balloon Versus Intravascular Lithotripsy to Prepare Severely Calcified Coronary Lesions. | To evaluate the stent expansion through optical coherence tomography (OCT) and compare the efficacy and safety of super high-pressure balloon to IVL in severely calcified lesions. | Nanjing First Hospital, Nanjing Medical University |

| 4/4/2025 | FORWARD CAD IDE Study | The Study was conducted to assess the safety and effectiveness of the Shockwave Intravascular Lithotripsy (IVL) System with the Javelin Coronary IVL Catheter for the treatment of calcified, stenotic de novo coronary artery lesions prior to stenting. | Shockwave Medical, Inc. |

| 4/1/2025 | TECTONIC CAD IVL IDE Study | A prospective, single-arm, open-label, multi-center IDE study with up to 55 US sites | Abbott Medical Devices |

| 12/17/2024 | DEBSCAN-IVL. Drug-Eluting Balloon or Drug-Eluting Stent to Treat Calcified Nodules After IntraVascular Lithotripsy. | International, investigator-driven, multicenter, open-label, prospective randomized controlled trial on patients with de novo lesions. | Fundación EPIC |

| 7/1/2024 | Intracoronary Stenting and Additional Results Achieved by ShockWAVE Coronary Lithotripsy | The clinical trial is intended to evaluate the efficacy, safety, and economic benefit of coronary lithotripsy compared to other additional procedures (cutting or super high-pressure balloon angioplasty, ablative procedures) in lesion preparation and interventional treatment of severely calcified coronary stenoses. | Deutsches Herzzentrum Muenchen |

(Source: https://www.clinicaltrials.gov)

Intravascular Lithotripsy Market Companies

- Shockwave Medical

- Boston Scientific

- Medtronic

- Abbott Laboratories

- Philips Healthcare

- Terumo Corporation

- Becton Dickinson (BD)

- Penumbra, Inc.

- Cook Medical

- Cardinal Health

- Teleflex Incorporated

- Asahi Intecc

- Siemens Healthineers

- Abiomed

- OrbusNeich

- Volcano Corporation

- Avinger Inc.

- Spectranetics (Philips)

- Merit Medical Systems

- C.R. Bard (now BD)

Recent Developments

- In January 2025, Boston Scientific Corporation collaborated with Bolt Medical, Inc., an intravascular lithotripsy (IVL) advanced laser-based platform developer for the treatment of coronary and peripheral artery disease. The Bolt IVL™ system is designed with a novel application of lithotripsy to fracture calcium by creating acoustic pressure waves inside a balloon catheter. (Source: https://news.bostonscientific.com)

- In March 2025, Abbott launches an intravascular lithotripsy trial that aims to fracture hardened calcium within the heart's coronary arteries. According to the company, its approach will employ high-energy sound pressure waves to crack obstructive deposits within the blood vessel, before the placement of a stent.

(Source: https://www.fiercebiotech.com)

Segments Covered in the Report

By Procedure/Application

- Coronary Artery Disease (CAD)

- Peripheral Artery Disease (PAD)

- Other Vascular Applications (~15%)

By Product/Device Type

- IVL Catheters

- IVL Generators

By End User/Hospital Type

- Cardiac and Cath Labs

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting