What is the Lithotripsy Devices Market Size?

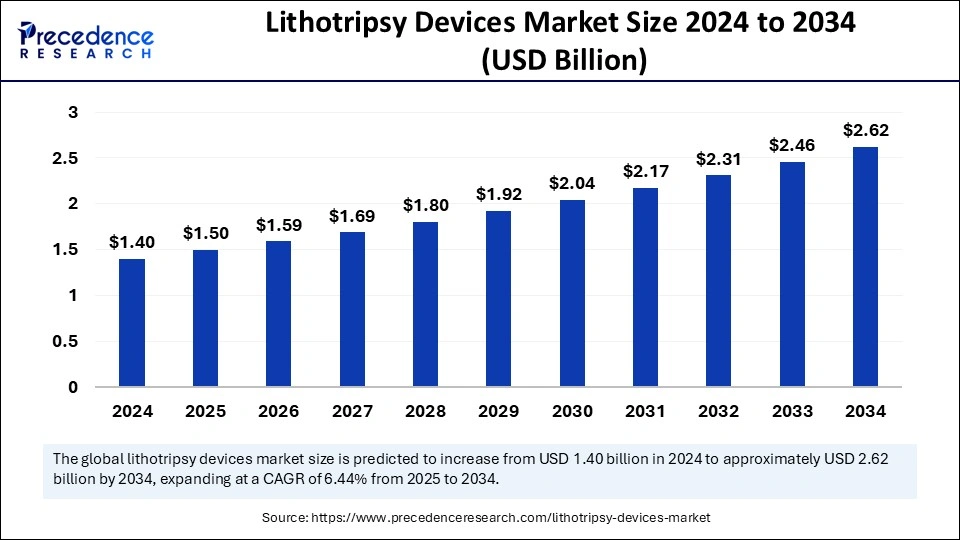

The global lithotripsy devices market size is calculated at USD 1.50 billion in 2025 and is predicted to increase from USD 1.59 billion in 2026 to approximately USD 2.78 billion by 2035, expanding at a CAGR of 6.36% from 2026 to 2035.The lithotripsy devices market is expected to grow at a rapid pace due to the rising government initiatives to boost the domestic production of medical devices.

Lithotripsy Devices Market Key Takeaways

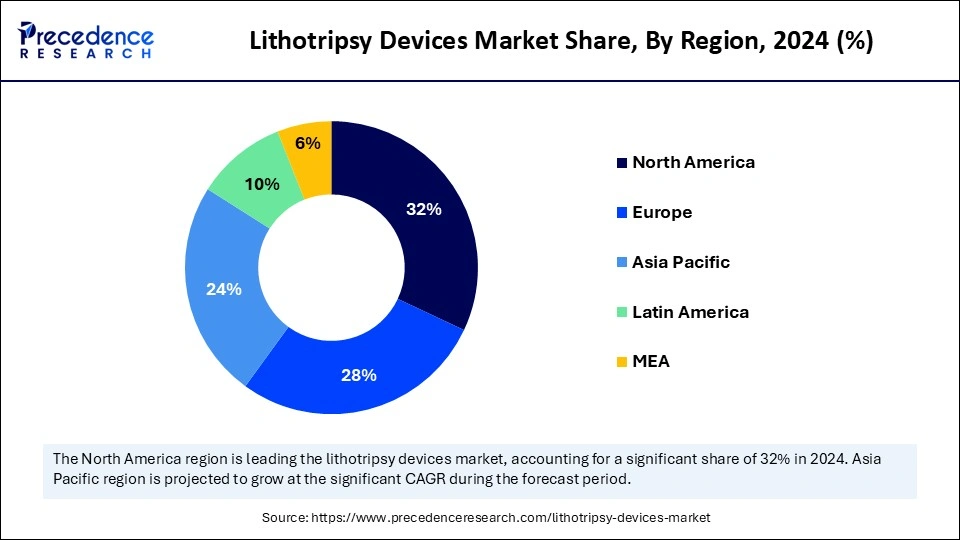

- North America dominated the lithotripsy devices market with the largest share around 32% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By type, the extracorporeal shock wave lithotripsy devices segment dominated the market in 2025.

- By type, the intracorporeal lithotripsy devices segment is projected to expand at a significant CAGR in the coming years.

- By application, the kidney stones segment held the biggest market share in 2025.

- By application, the pancreatic stones segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use, the hospitals segment led the market in 2025.

- By end-use, the ambulatory surgical centers segment is likely to expand at the fastest CAGR over the studied years.

Role of AI in Lithotripsy Devices

Artificial Intelligence integration in lithotripsy devices significantly enhances both treatment effectiveness and patient outcomes. AI-driven imaging and monitoring devices are enhancing the precision of stone removal procedures. The seamless incorporation of robotics and AI holds promises for enhancing the efficacy and efficiency of stone removal technology. AI enhances the effectiveness of kidney stone procedures, providing modern solutions for treatment planning, diagnosis, and medical intervention. By harnessing the power of AI, healthcare providers deliver more effective, efficient, and personalized care to people with kidney stones with the help of lithotripsy devices, eventually enhancing medical outcomes and the quality of life.

Market Overview

The lithotripsy devices market is witnessing rapid growth due to the increasing incidence of kidney stones and uric acid nephrolithiasis among the old age population. Lithotripsy devices use shock waves to fragment stones in the kidney and parts of the ureter. These devices reduce complications, recovery time, and trauma in the management of kidney stones. Ongoing advancements in endoscopic devices and minimally invasive solutions further contribute to market expansion. Modern lithotripters commonly deliver shock waves with lower energy, resulting in lower patient discomfort. The increasing healthcare expenditure and growing awareness about urological and kidney disorders further support market growth.

Lithotripsy Devices Market Growth Factors

- The increasing number of surgical procedures performed in ambulatory surgical centers (ASCs) is expected to boost the demand for lithotripsy devices. These devices provide patients with the convenience of surgeries and procedures done safely outside the hospital setting.

- The rising demand for disposable lithotripters boosts the growth of the market. These lithotripters reduce the risk of contamination and enhance convenience compared to reusable alternatives.

- Ongoing technological advancements in medical devices further support market expansion.

- The rising demand for minimally invasive surgeries is expected to boost market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 2.78 Billion |

| Market Size in 2025 | USD 1.50 Billion |

| Market Size in 2026 | USD 1.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.36% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing Geriatric Population

The growing geriatric population worldwide is a major factor driving the growth of the lithotripsy devices market. Kidney stone formation is common in older adults as they often experience dietary changes and dehydration, which are key causes of kidney stones and uric acid nephrolithiasis. As the global population ages, the prevalence of kidney stones is likely to increase. Moreover, older adults often face other health issues, making it complex to perform traditional surgical procedures. This, in turn, boosts the demand for lithotripsy devices. Management of urolithiasis in older adults requires a multidisciplinary approach involving urologists, nephrologists, and geriatric specialists to address age-related comorbidities and physiological considerations. As older adults often present higher surgical risk, the adoption of minimally invasive procedures, such as ureteroscopy and extracorporeal shock wave lithotripsy (ESWL), is expected to increase due to their safety, efficacy, and shorter recovery time.

Restraint

Technical Limitations and Limited Accessibility

Despite the rising adoption of lithotripsy, numerous challenges continue to restrain the growth of the market. Lithotripsy procedures often fail due to difficulties in fragmenting the stone, requiring trained surgeons to handle lithotripsy devices. Anatomical risk, especially stones located in the lower ureter or near sensitive structures, increases the risk of tissue damage and reduces the effectiveness of the procedure. This, in turn, limits the adoption of lithotripsy devices. Moreover, the high costs associated with lithotripsy procedures compelled patients to seek alternative, cost-effective procedures, limiting the growth of the market.

Opportunity

Technological Advancements in Imaging and BWL

Recent technological innovation in the field of lithotripsy creates novel opportunities for the growth of the lithotripsy devices market. New techniques like break wave lithotripsy (BWL) noninvasive ultrasound-based modality are gaining attention for their capability to effectively and safely fragment urinary stones without the need for surgical intervention or anesthesia. Furthermore, future advancement aims to merge BWL with stone-specific ultrasound imaging technologies, increasing treatment outcomes and precision. Next-generation lithotripters are also integrating real-time ultrasound monitoring with fluoroscopy, expressively lowering patient exposure to ionizing radiation.

Advances in laser lithotripsy further support market growth. Laser lithotripsy is a more effective process of stone breaking than electrohydraulic lithotripsy (EHL) for breaking hard stones. Laser lithotripsy is often performed by urologists through ureteroscopy. In this process, a flexible laser fiber is inserted through a scope into the urinary tract to fragment the stones. These modern developments enhance clinical efficiency and safety and also align with the growing demand for minimally invasive, patient-friendly solutions.

Type Insights

The extracorporeal shockwave lithotripsy devices segment dominated the lithotripsy devices market with the largest share in 2025. This is mainly due to the rise in the demand for minimally invasive procedures. Extracorporeal shockwave lithotripsy procedure is completely non-invasive and is a common treatment for kidney stones. This procedure is performed in a short period, like 60-90 minutes, and sometimes takes longer depending on the number of stones and size of stones. This procedure does not require anesthesia, significantly reducing trauma associated with surgery and enhancing patient outcomes.

The intracorporeal lithotripsy devices segment is projected to expand at a significant CAGR in the coming years. Intracorporeal lithotripsy is a powerful device based on pneumatically driven projectiles that strike a metallic probe placed endoscopically on a calculus. The probe is passed in a rigid endoscopic way and placed on the stone. This equipment works better when used with a rigid endoscope and is associated with stone migration throughout the treatment. Moreover, intracorporeal lithotripsy devices come in various types, such as ballistic, ultrasonic, and laser lithotripters, enhancing the accessibility.

Application Insights

The kidney stones segment held the largest share of the lithotripsy devices market in 2025. This is mainly due to the increased prevalence of kidney stones. Lithotripsy devices manage kidney stones by delivering shock waves or ultrasonic energy to the stone. These shock waves break stones into very small pieces, which can then pass through urine. With the heightened awareness among people about the benefits of minimally invasive procedures, the adoption of lithotripters has increased for treating kidney stones, which bolstered the growth of the segment.

The pancreatic stones segment is expected to grow at the fastest rate during the forecast period. Lithotripsy devices also find applications in treating pancreatic stones. Lithotripsy is considered the first-line treatment for complex or large stones. Pancreatic stones are sequelae of chronic pancreatitis, resulting in frequent hospitalizations, poor quality of life, and potential economic burden. Extracorporeal shock waves can be applied to pancreatic stones, enhancing surgical effectiveness and patient outcomes.

End-use Insights

The hospitals segment dominated the lithotripsy devices market in 2025. This is mainly due to the easy availability of a range of lithotripsy devices, attracting a large base of patients. Hospitals often have trained healthcare staff, encouraging patients to perform surgical procedures in these settings. Moreover, the availability of other essential devices like ultrasound or X-ray in these settings makes it easier to optimize the success rate of lithotripsy, enhancing patient outcomes. The rise in hospital admissions associated with kidney stones further bolstered the segment.

The ambulatory surgical centers segment is anticipated to register the fastest growth during the forecast period. This is mainly due to the rapid shift toward outpatient healthcare facilities for surgical procedures. Ambulatory surgical centers (ASCs) often provide personalized care, reducing the risk of complications and attracting more patients. Moreover, these settings offer cost-effective treatments than hospitals and provide same-day surgery, reducing the need for hospitalization.

Regional Insights

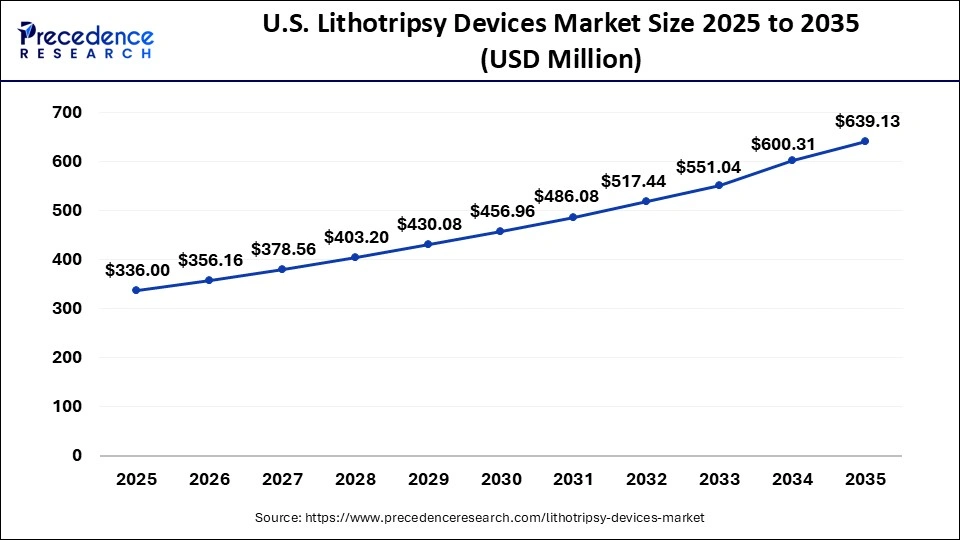

U.S. Lithotripsy Devices Market Size and Growth 2026 to 2035

The U.S. lithotripsy devices market size is exhibited at USD 336.00 million in 2025 and is projected to be worth around USD 639.13 million by 2035, growing at a CAGR of 6.64% from 2026 to 2035.

North America registered dominance in the lithotripsy devices market by holding the largest share in 2025. This is mainly due to its advanced healthcare sector, boosting the adoption of cutting-edge lithotripsy devices. There is a rapid shift toward advanced care options for various diseases, increasing the adoption of advanced technologies andmedical devices to enhance patient care and outcomes. The North American healthcare system is considered the world's best system as it offers expedient access to a highly subspecialized network of doctors.

The U.S. is a major contributor to the North American lithotripsy devices market. The increasing burden of kidney diseases in the U.S. is a major factor driving the growth of the market. For instance, according to the National Institutes of Health (NIH), the U.S. population living in high-risk zones for nephrolithiasis will grow from 40% in 2000 to 56% by 2050 and 70% by 2095. This highlights the need for lithotripsy in the country. In addition, the country is an early adopter of minimally invasive surgery, supporting market growth. Advancements in kidney disease management and increasing programs nationwide to optimize screening for kidney diseases, high demand for targeted therapies, and increasing development of advanced medical devices are expected to boost market growth.

Asia Pacific is anticipated to witness the fastest growth in the coming years. The regional market growth can be attributed to the growing aging population, which significantly boosts the need for minimally invasive surgeries, and so does the demand for lithotripsy devices. The rising prevalence of Kidney stones further supports market growth. Moreover, governments of various Asian countries are investing heavily to advance healthcare infrastructure and boost the domestic production of medical devices, contributing to market growth.

- For instance, in November 2024, the Indian government announced a ?500-crore scheme to fortify the domestic medical device sector.

India is expected to have a stronghold on the Asia Pacific lithotripsy devices market. There is a high prevalence of urolithiasis due to the scarcity of clean water resources, especially in remote or rural areas. The consumption of polluted water can lead to kidney stones, increasing the volume of patients in the country. The rising Indian government initiatives to increase the accessibility to healthcare in rural areas further support market growth.

- In May 2023, Health Minister Ma. Subramanian inaugurated an extracorporeal shock wave lithotripsy (ESWL) Treatment Center at the Government Kilpauk Medical College (KMC) and Hospital. The ESWL technology was sponsored by MOBIS India Foundation under its corporate social responsibility funding.

Shattering Stones: Europe's Lithotripsy Devices Industry Enters a New Growth Phase

Europe accounts for a substantial share of the global market, driven by well-established public healthcare systems, a rising geriatric population, and increasing prevalence of renal and ureteral stone disorders. The region emphasizes clinical effectiveness, patient safety, and cost optimization, supporting steady adoption of both extracorporeal and endoscopic lithotripsy technologies across hospitals and specialty urology clinics.

Germany Lithotripsy Devices Market Trends

Germany serves as a key contributor to the European lithotripsy devices market, supported by strong medical device manufacturing capabilities, advanced urology practices, and high healthcare spending. The country's focus on minimally invasive therapies, combined with favorable reimbursement policies and widespread availability of specialized urology centers, accelerates the adoption of advanced lithotripsy systems.

Lithotripsy Devices Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

U.S. Food and Drug Administration (FDA) |

Federal Food, Drug, and Cosmetic Act (FD&C Act) |

Device classification & clearance |

Lithotripsy devices (ESWL and related) are regulated as medical devices; clinical data may be required for novel technologies. 510(k) is common for incremental innovations; PMA for high-risk or novel systems. |

|

European Union |

European Commission; Notified Bodies; Competent National Authorities |

EU Medical Device Regulation (MDR 2017/745) |

CE marking & risk classification |

Lithotripsy devices typically fall under Class IIa/IIb under MDR; manufacturers must maintain a Technical Fileand demonstrate clinical safety/effectiveness. |

|

China |

National Medical Products Administration (NMPA) |

Regulations for Registration and Filing of Medical Devices |

Local device registration |

China's NMPA requires a formal registration process; local clinical dataor bridging studies are often required for lithotripsy devices not previously approved in China. |

|

Japan |

Pharmaceuticals and Medical Devices Agency (PMDA) / Ministry of Health, Labour and Welfare (MHLW) |

Pharmaceutical & Medical Devices Act (PMD Act) |

Marketing approval (Shonin) or certification (Ninsho) |

Japan classifies most lithotripsy systems as regulated devices requiring approval or certification depending on risk class; a robust QMS is expected. |

|

South Korea |

Ministry of Food and Drug Safety (MFDS) |

Medical Device Act & Enforcement Decrees |

Registration and safety review |

South Korea follows a structured review; local testing or documentation may be required; MFDS often references international standards. |

|

India |

Central Drugs Standard Control Organization (CDSCO) |

Medical Device Rules, 2017 (under Drugs & Cosmetics Act) |

Device registration & licensing |

Lithotripsy devices are regulated as medical devices; manufacturers must register the device, provide safety and performance evidence, and comply with labeling/quality requirements. |

|

Latin America |

Brazil ANVISA |

National medical device registration systems |

Local market authorization |

Regulatory timelines vary by country. Brazil and Mexico often rely on compliance with ISO 13485and reference approvals (FDA/CE) to expedite review. |

|

Middle East & Africa |

Saudi SFDA |

Medical device registration frameworks |

Local approvals |

Many countries adopt IMDRF/GHTFprinciples and may accept foreign certifications (FDA/CE) as part of local submissions; some require local testing/data. |

Top Companies in the Lithotripsy Devices Market & Their Offerings:

- Storz Medical AG:

Storz Medical offers advanced extracorporeal shock wave lithotripsy (ESWL) systems designed for the non-invasive fragmentation of kidney and ureteral stones. Its products are known for precision shock generation, high stone-free rates, and patient comfort. - Dornier MedTech:

Dornier is a pioneer in lithotripsy technology and provides a broad portfolio of ESWL systems widely used in urology clinics and hospitals. The company focuses on reliable performance, improved targeting, and reduced procedural time for urinary stone management. - Boston Scientific Corporation:

Boston Scientific supplies ultrasound and laser lithotripsy systems, including advanced Holmium: YAG and thulium fiber laser platforms for ureteroscopy and flexible endoscopy. Its solutions enable high efficiency, safety, and versatility in treating complex stone cases. - Olympus Corporation:

Olympus offers comprehensive endoscopic and laser lithotripsy technologies integrated with its scope systems. Its products support minimally invasive stone treatment via ureteroscopy, with laser energy delivery systems designed for precision and control. - EMS Electro Medical Systems:

EMS provides electromagnetic and piezoelectric lithotripsy systems used in urology. Its Swiss-engineered devices emphasize high-energy shock wave delivery with consistent stone fragmentation and patient safety. - Richard Wolf GmbH:

Richard Wolf develops lithotripsy equipment and accessories, including laser systems and endoscopic platforms for stone management. The company focuses on ergonomic design, workflow efficiency, and compatibility with advanced imaging.

Lithotripsy Devices Market Companies

- Zimmer MedizinSystems GmbH

- Olympus Corporation

- Richard Wolf GmbH

- Boston Scientific Corporation

- STORZ Medical AG

Recent Developments

- In March 2025, Shockwave Medical, Inc., a part of Johnson & Johnson MedTech, announced the launch of its Shockwave Javelin Peripheral IVL Catheter for the U.S. market. This novel intravascular lithotripsy (IVL) platform is designed to modify calcium and cross extremely narrow vessels in patients with peripheral artery disease (PAD).

- In January 2025, Boston Scientific Corporation announced that it had entered into a definitive agreement to acquire Bolt Medical, Inc., the developer of an intravascular lithotripsy (IVL) laser-based platform for the treatment of coronary and peripheral artery disease (PAD). Boston Scientific anticipates the transaction to be completed in the first half of 2025, subject to customary closing conditions.

- In August 2024, Amplitude Vascular Systems (AVS), a medical device company focused on safely and effectively treating severely calcified arterial disease with its Pulse Intravascular Lithotripsy platform, announced it had entered into a strategic agreement with the Jacobs Institute, a nonprofit medical device innovation center.

Segments Covered in the Report

By Type

- Extracorporeal Shock Wave Lithotripsy Devices

- Intracorporeal Lithotripsy Devices

By Application

- Kidney Stones

- Ureteral Stones

- Pancreatic Stones

- Bile Duct Stones

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting