Laparoscopy Devices Market Size and Forecast 2025 to 2034

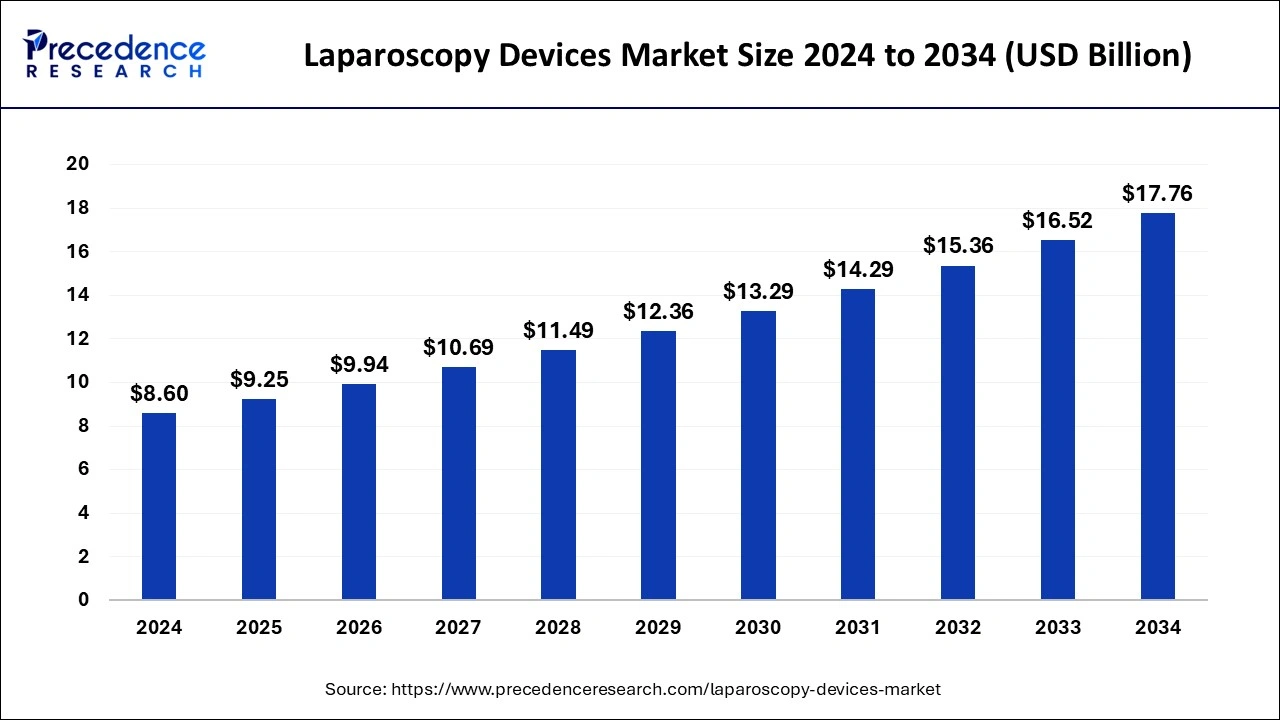

The global laparoscopy devices market size was estimated at USD 8.60 billion in 2024 and is anticipated to reach around USD 17.76 billion by 2034, expanding at a CAGR of 7.52% from 2025 to 2034.

Laparoscopy Devices Market Key Takeaways

- In terms of revenue, the laparoscopy devices market is valued at $9.25 billion in 2025.

- It is projected to reach $17.76 billion by 2034.

- The laparoscopy devices market is expected to grow at a CAGR of 7.52% from 2025 to 2034.

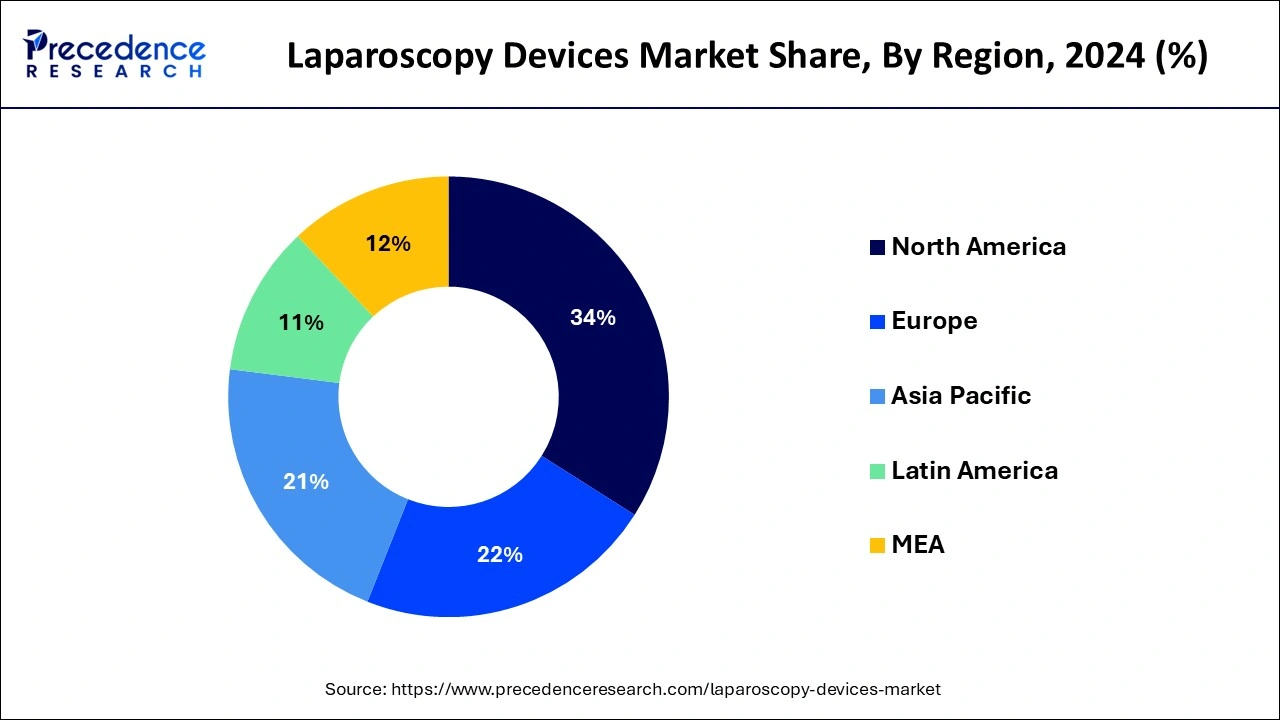

- North America dominated the global laparoscopy devices market with the largest market share of 34% in 2024.

- Asia Pacific is expected to expand at a solid CAGR of 8.02% during the forecast period.

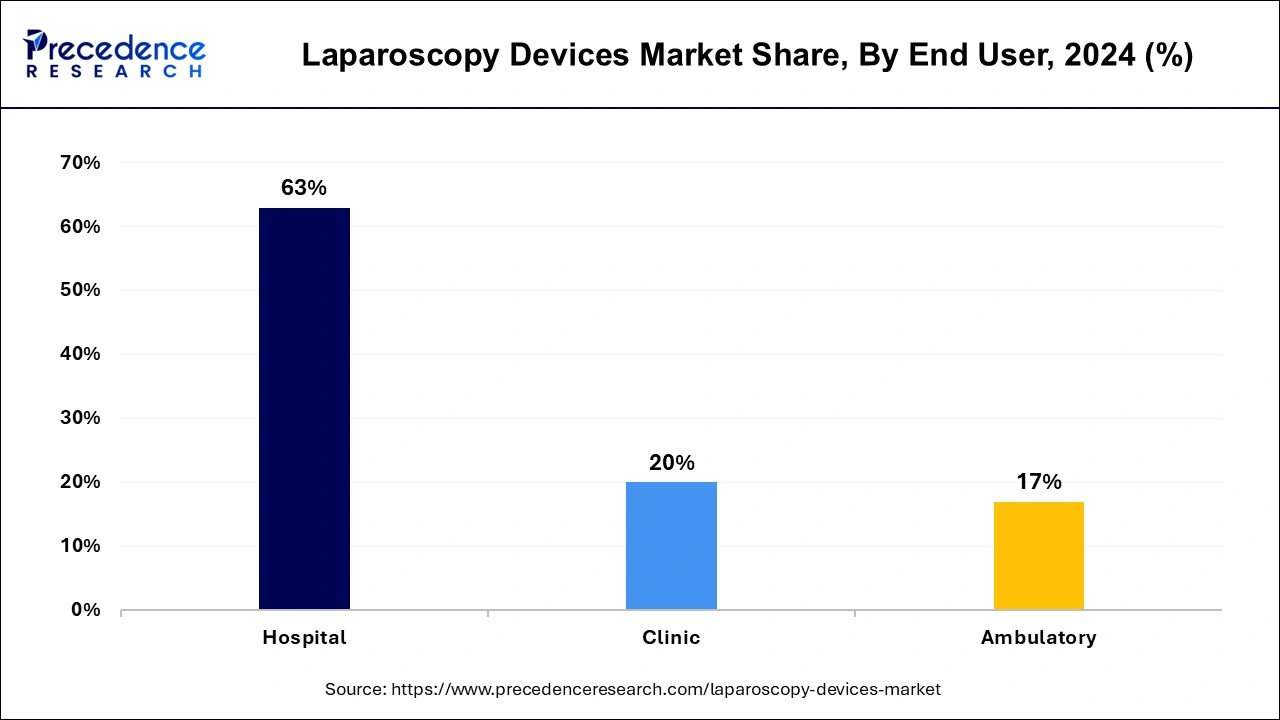

- By end user, the hospital segment contributed the highest market share of 63% in 2024.

- By end user, the ambulatory segment is projected to grow at a solid CAGR during the forecast period.

- By application, the bariatric surgery segment accounted for the highest market share of 28%% in 2024.

- By application, the general surgery segment is expected to grow at a notable CAGR during the forecast period.

U.S. Laparoscopy Devices Market Size and Growth 2025 to 2034

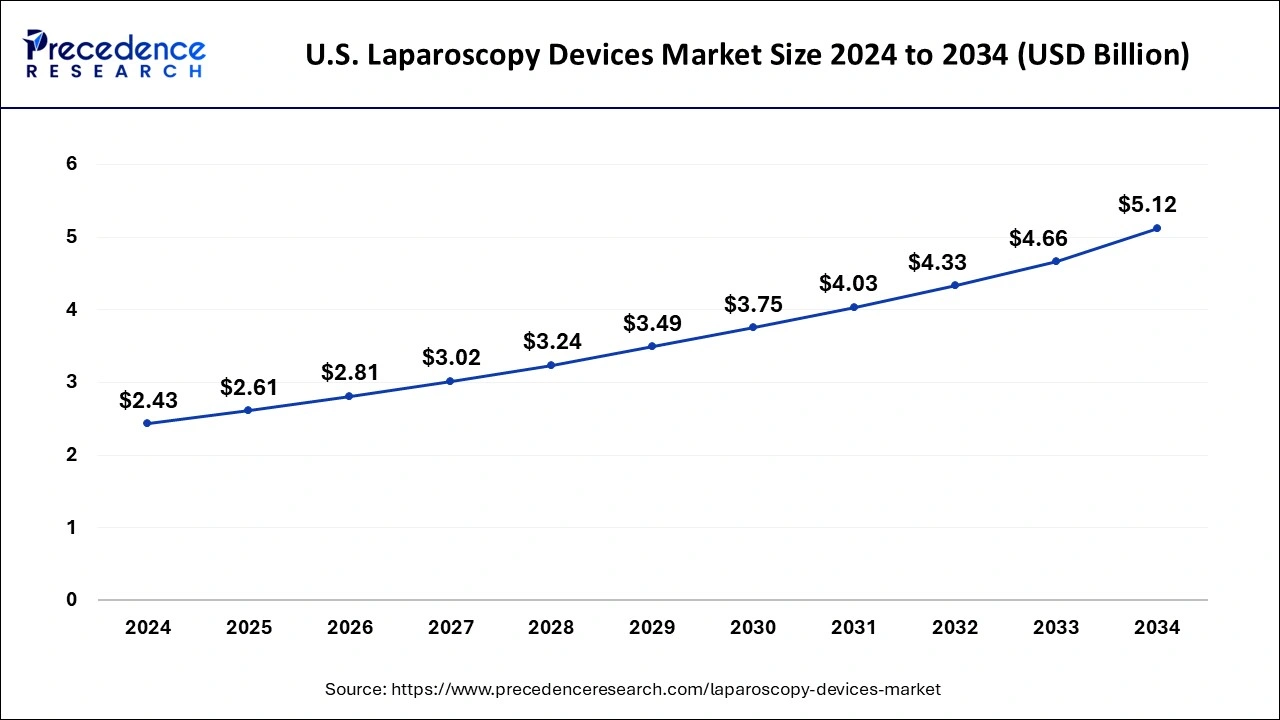

The U.S. laparoscopy devices market size was evaluated at USD 2.43 billion in 2024 and is predicted to be worth around USD 5.12 billion by 2034, rising at a CAGR of 7.74% from 2025 to 2034.

North America dominated the global laparoscopy devices market with the largest market share of 34% in 2024. The growth of laparoscopy devices market in North America is attributed to the growing prevalence of chronic disorders and rising adoption of non-invasive or minimally invasive surgical devices. As per the Centers for Disease Control and Prevention, six out of ten persons in the U.S. have at least one chronic disease, and four out of ten adults have two or more chronic diseases. Thus, the growing number of disorders and infections is driving the demand for laparoscopy devices in North America region. In addition, presence of major market players is also paving way for the expansion of laparoscopy devices market in the region.

The market for laparoscopy devices in North America is led by the United States, which has a well-developed healthcare infrastructure, significant number of key medical device manufacturers and suppliers, and an increasing preference for minimally invasive surgical procedures. According to the CDC, more than 13 million laparoscopic procedures are performed in the US every year, commonly performed procedures being primarily due to increased numbers of obesity and gynecological conditions, and numbers of laparoscopic surgeries are only expected to increase. The US has the highest number of minimum-invasive procedures in the world, as such, innovation in robotic-assisted laparoscopic surgery, and a rise in number of outpatient surgical centers will continue to demonstrate significant growth in the market.

Asia-Pacific is expected to expand at a solid CAGR of 8.02% during the forecast period. South Korea and Singapore dominates the laparoscopy devices market in Asia-Pacific region. The growing number of hospitals and healthcare centers for surgeries are driving the growth of laparoscopy devices market in the region. In addition, other factors such as growing trend ofmedical tourism, technological advancements, and enhancement of reimbursement policies are contributing towards the expansion of Asia-Pacific laparoscopy devices market.

Europe is expected to grow significantly in the laparoscopy devices market during the forecast period. The increasing prevalence of diseases in Europe is increasing the demand for the use of laparoscopy devices. At the same time, they are being preferred choice due to their minimally invasive procedure. Moreover, with the help of advanced technologies, new developments are also being made along with the use of robotic-assisted systems. This, in turn, helps in minimizing the recovery time. This increases their adoption in various hospitals. Furthermore, the policies as well as safety regulations laid by the government as well as regulatory bodies are also contributing to their increased use. Thus, all these factors enhance the market growth.

UK

The hospitals in the UK are adopting to laparoscopic devices due to their advantages. At the same time, various development is also being made in these devices to enhance their performance. Moreover, robotic assisted systems are also being developed which are improving the surgery procedures as well as recovery times.

Germany

Due to growing diseases, the utilization of laparoscopy devices is increasing. Furthermore, the use of advanced technologies new devices is also being developed. Moreover, to enhance the safety of these devices, regulations are also being implemented, which in turn is improving patient outcomes.

Japan

Japan leads the market for laparoscopy devices in the Asia-Pacific region, given Japan's aging demographic, rapid rate of adoption of medical technologies, and emphasis on precision surgery. Japan is also seeing a consistent increase in laparoscopic surgery for gastrointestinal and urological disorders, and the government initiative to promote modernization of hospitals is expected to help further the growth. The advancement of surgical robotic devices tailored for minimally invasive use by Japanese medical device manufacturers is a substantial contribution to the growth of the market. With a more proactive robtotic laparoscopy interest by surgeons engaged in ongoing medical research, we can expect Japan to contribute positively to the continued innovative advancements and demand of the APAC laparoscopy devices market.

Laparoscopy Devices Market Growth Factors

One of the key factors driving the growth of global laparoscopy devices market is rising prevalence of chronic disorders. As per the World Health Organization (WHO) statistics, cardiovascular disorders account for 17.9 million fatalities globally in 2021, followed by cancer for 9.3 million, respiratory disorders for 4.1 million, and diabetes for 1.5 million. Thus, the global laparoscopy devices market is expected to expand in coming years.

Bariatric surgery is gaining popularity in the global laparoscopy devices market. The growing obesity among people all around the world are driving the demand for bariatric surgery all around the world. The rising disposable income is also supporting the growth and development of global laparoscopy devices market. Obesity has nearly tripled in the world since 1975, as per the World Health Organization (WHO) in 2021. Obesity grew from less than 1% to 7% in the 5 to 19 age group over the same period of time. These figures emphasize the importance of adopting of laparoscopy devices for bariatric surgeries.

As per the American Congress Obstetricians and Gynecologists, the number of minimally invasive hysterectomy procedures performed in the U.S. increased from 14% in 2004 to 53% in 2013. According to the American Society of Plastic Surgeons, 20 million surgical operations were performed worldwide in 2014, with 52% of these being minimally invasive procedures. Thus, the growing demand for minimally invasive surgeries is propelling the expansion of global laparoscopy devices market. The other factors such as technological advancements and adoption of unique strategies by major market players are also supporting the growth and development of the global laparoscopy devices market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.76 Billion |

| Market Size in 2025 | USD 9.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.52% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunity

Robotic-Assisted Laparoscopy Broadens Availability in Emerging Markets

One of the most significant opportunities in the laparoscopy device market is the accelerating use of robotic-assisted surgeries in emerging economies. The recent FDA clearance of CMR Surgical's Versius system for gallbladder procedures in October 2024 highlights the global movement to compact and affordable robotic applications. While thousands of da Vinci robotic systems already exist in North America and Europe, the emerging regions are relatively underdeveloped. This offers manufacturers a chance to develop affordable scale-up robotic systems suited for their healthcare systems. The unmet need for advanced surgical care within these markets is a high potential growth area for next-generation laparoscopy technologies.

Product Insights

The energy systems segment captured maximum revenue share in 2024. As per the IFSO Global Registry Report 2019, there were 833,687 bariatric procedures conducted in 61 countries worldwide in 2019. Thus, the growing number of bariatric procedures is driving the demand for energy systems in the global laparoscopy devices market.

The insufflation device segment is projected to reach at a CAGR of 7.9% from forecast period. The growing prevalence of colorectal cancer is boosting the demand for insufflation devices. As per the World Cancer Research Fund International, colorectal malignancy or cancer was the 3rd most common cancer in both women and men in 2020, with over 1.90 million new cases reported. Thus, this factor is driving the growth of segment.

Application Insights

The bariatric surgery segment accounted for the highest market share of 28%% in 2024. The other surgeries such as colon laparoscopy, thoracic laparoscopy, prostate laparoscopy, and cholecystectomy laparoscopy are among other types of surgeries. The growing prevalence of colon laparoscopy is boosting the growth of the global laparoscopy devices market. The adoption of minimally invasive laparoscopy devices is contributing towards the growth of the segment.

The general surgery segment is expected to grow at a notable CAGR during the forecast period. The factors such as growing government initiatives for the support of bariatric surgeries are paving way for the expansion of the segment. In addition, in bariatric surgery the requirement for laparoscopy devices is quite high. According to the American Society of Metabolic and Bariatric Surgery, 252,000 bariatric procedures were performed in the U.S. alone in 2018. As a result, the segment is expected to grow in near future.

End User Insights

The hospital segment contributed the highest market share of 63% in 2024.The rising prevalence of chronic diseases is increasing the number of patients visiting hospitals. The hospitals have high patient number as compared to other type of healthcare settings. As per the American Society for Metabolic and Bariatric Surgery, weight loss surgery was performed on 256,000 persons in the U.S. in 2019. Thus, all of these factors are driving demand for laparoscopy devices in the hospitals.

The ambulatory segment is projected to grow at a solid CAGR during the forecast period. The demand for laparoscopy devices in the ambulatory surgical devices is attributed to the rise in the use of minimally invasive surgeries and a strong desire and need for outpatient surgeries. Thus, the global laparoscopy devices market is expected to grow due to rising adoption of laparoscopy devices in ambulatory surgical centers.

Laparoscopy Devices Market Companies

- B. Braun Melsungen AG

- Boston Scientific Corporation

- ConMed Corporation

- Johnson & Johnson

- Karl Storz SE & Co. KG

- Medtronic PLC

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew PLC

- Stryker Corporation

Key Developments

- In November 2025, to convert imaging in minimally invasive procedures, a new laparoscopic diagnostic surgery device was introduced by Irillic. The enhanced clarity for visualising the surgical field will be provided by this IrillicL.nm True 4K NIR laparoscopic imaging system to the surgeons.

- In May 2025, in the recently developed animal laboratory located at Madurai Medical College, the first laparoscopic procedure was performed on pigs.

(Source: https://www.msn.com)

(Source: https://www.thehindu.com) - The SIF-H190 single balloon enteroscopy system from Olympus Corporation was released in 2021 to reach deep into the small intestine.

- The USFDA approved BD's new line of Snowden-Pencer 3.0mm laparoscopic ergonomic take-apart equipment in June 2017.

- Olympus Corporation unveiled the POWERSEAL line of innovative bipolar surgical energy tools in September 2021, which provide surgeons with cutting edge sealing, dissection, and gripping capabilities in open surgery and laparoscopy while considerably lowering the force necessary to close the jaws.

- Stryker Corporation purchased K2M Group in 2018 in order to enhance and grow its arthroscopy and minimally or non-invasive spine portfolios as well as expand its additive manufacturing capabilities.

- ENDOCONTROL declared the release the launch of the JAIMY Advance, a next generation robotic device for advanced laparoscopy in February 2018.

- Seger Surgical Solutions started developing next generation laparoscopy devices for intracorporeal anastomosis in January 2022. The LAP IA 60 device aligns, seals, and staples the common intracorporeal anastomosis opening securely, quickly, and without internal fixation.

Segments Covered in the Report

By Product

- Laparoscopes

- Energy Systems

- Trocars

- Closure Devices

- Suction/Irrigation Devices

- Robot Assisted Systems

- Hand Access Instruments

By Application

- Bariatric Surgery

- Urological Surgery

- Gynecological Surgery

- General Surgery

- Colorectal Surgery

- Other Surgeries

By End User

- Hospital

- Clinic

- Ambulatory

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting