What is Linear Voltage Regulators Market Size?

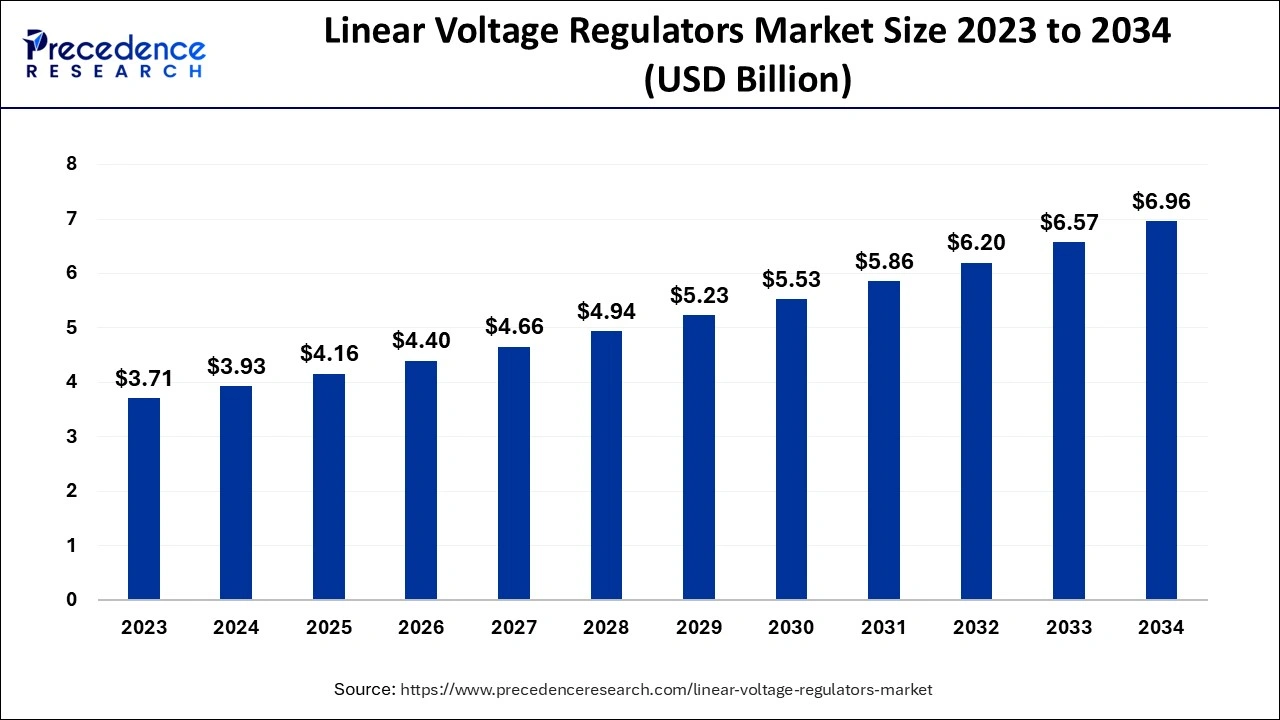

The global linear voltage regulators market size accounted for USD 4.16 billion in 2025 and is anticipated to reach around USD 7.33 billion by 2035, expanding at a CAGR of 5.83% between 2026 to 2035. A mechanism used to keep a constant voltage is called a linear voltage regulator. A constant output voltage is achieved by the regulator's resistance, which fluctuates with the load. This regulating component functions as a variable resistor and continually modifies the voltage divider network to maintain a constant output voltage.

Market Highlights

- The automotive sector had the largest market share, accounting for 32% revenue share in 2025.

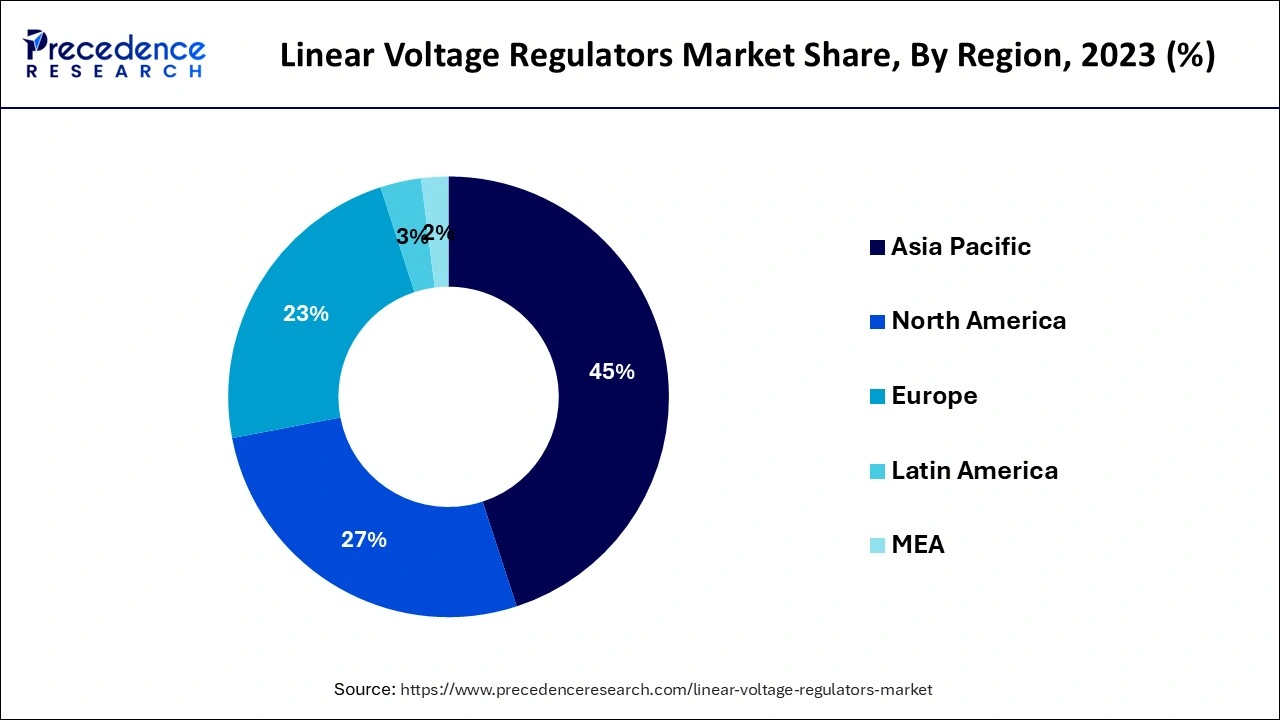

- The Asia pacific region has generated more than 45% of the revenue share in 2025.

- The Europe region is expected to expand at a CAGR of 4.8% from 2026 to 2035.

Linear Voltage Regulators Market Growth Factors

The need for more efficient devices to provide an appropriate voltage and current supply to industries is growing quickly as a result of the continuous advances in electronic components and enormous industrialization. Today, the manufacturing of electronic parts is rising quite quickly, and linear voltage regulators are one of such parts. The need for linear voltage regulators that can deliver a consistent DC output voltage is growing throughout sectors. The use of linear voltage regulators in industrial applications is also anticipated to grow, as these regulators have circuitry that keeps the output voltage constant despite variations in load current or input voltage.

For the purpose of maintaining constant voltage levels, a linear voltage regulator is employed. Linear voltage regulators produce a constant output voltage by varying their resistance in response to changes in the load. The linear voltage regulators change the voltage divider network by serving as a variable resistor, which aids in stabilizing the output voltage. The usage of linear voltage regulators in electronic devices and the widespread use of linear regulators in integrated circuit (IC) form are both a result of these advantages.

One major driver of the global market for linear voltage regulators is the quick rise in the production of electronic components. For the purpose of maintaining constant voltage levels, a linear voltage regulator is employed. Linear voltage regulators produce a constant output voltage by varying their resistance in response to changes in the load.

The linear voltage regulators change the voltage divider network by serving as a variable resistor, which aids in stabilizing the output voltage. The usage of linear voltage regulators in electronic devices and the widespread use of linear regulators in integrated circuit (IC) form are both a result of these advantages. One major driver of the global market for linear voltage regulators is the quick rise in the production of electronic components. Another key element contributing to the growing use of linear voltage regulators across several business verticals.

- The need for voltage regulators is rising in the automobile sector to fulfill the strict pollution and fuel economy rules.

- Increasing demand from the telecommunications industry for voltage regulators to meet rising data traffic and network reliability standards.

- The increasing use of UPSs, which need voltage regulators as a backup power source during power outages or brownouts.

- The growth of smart grid technologies, which require effective voltage management to provide a steady supply of electricity to both consumers and businesses.

- Growing demand from developing nations as a result of population growth and quick industrialization.

Market Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 4.16 Billion |

| Market Size in 2026 | USD 4.4 Billion |

| Market Size by 2035 | USD 7.33 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.83% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By End User and By Administration Analysis, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing needs for electricity and power.

The primary forces propelling the market's expansion are rapid industrialization, particularly in developing nations, and the rising demand for energy and power from the residential and commercial sectors. To maintain a constant voltage and guarantee an unbroken supply of electricity, voltage regulators are installed in distribution lines and substations. Additionally, the market is expanding due to the rising demand for consumer electronics and vehicles that require voltage regulators in smart electronic devices.

Electronic variations include extra circuits for safety against short circuits, thermal shutdowns, and overvoltage in addition to a steady voltage supply that suppresses ripple voltage. It is projected that further factors, including the construction of new and upgraded energy transmission and distribution (T&D) networks and the adoption of supportive government policies for voltage control, would further propel the industry.

Increasing usage of linear voltage regulators in multiple applications.

Due to the increased urbanization and rising spending power of consumers, there is a growth in demand for smart electronic items such as laptops, coffee makers, grillers, toasters, and PCs. This is one of the key drivers supporting the market expansion, along with the booming electronics industry. Additionally, the need for voltage regulators is being fueled by the increased use of energy in residential, commercial, and industrial settings. Additionally, it might be ascribed to the rising number of HVAC (heating, ventilation, and air conditioning) system installations.

Furthermore, the governments of various nations are funding the creation of smart cities, which is bolstering the expansion of the industry. Voltage regulators are also utilized in the main parts of passenger and commercial vehicles. The market is being favorably impacted by this as well as the growing emphasis on enhancing passenger and driver safety.

Additionally, it is projected that the incorporation of electronic voltage regulators, which may assist in supplying a steady voltage source and contain extra circuits for protection against short circuits, thermal shutdowns, and overvoltage, would generate a favorable picture for the market.

A significant driver of market expansion is the rising demand for LDO in the consumer electronics and communications end-use sectors. The need for microcontrollers to deliver power to linked devices has expanded as a result of the rising number of smartphones, tablets, laptops, notebooks, and other electronic devices. Additionally, growing awareness of the need to safeguard the environment from dangerous gases released by the batteries used in these goods will support industry expansion throughout the projection period.Government restrictions on the use of lead and mercury in PSEs, like as the RoHS directive established by the European Commission, continue to favor linear regulators since they are non-toxic when disposed of once the product life cycle is complete.

Market Challenges

Low efficiency

The poor efficiency of voltage regulators in comparison to switching voltage regulators is one of the issues limiting their expansion. Additionally, linear voltage regulators are difficult to operate since their parts need to be replaced and maintained on a regular basis.

Other significant constraints limiting the growth of the market for linear voltage regulators are the need for space created by the heat sink and the fact that these regulators cannot raise the voltage above the input.

Key Market Opportunities

Lucrative opportunities in the automotive sector.

Organizations from all over the world are now enticed to invest in the automobile business. Because many manufacturers of linear voltage regulators are concentrating on include features like watchdog, reset, and early warning in their products, employing linear voltage regulators in autos is beneficial in difficult situations.Linear voltage regulators are also advantageous for usage in autos since they produce steady output voltage for all automotive applications.

Thus, throughout the forecast period, the worldwide market for linear voltage regulators is anticipated to benefit from a rise in the usage of linear voltage regulators in the automotive industry.

Segment Insights

End User Insights

In 2025, the automotive sector had the highest market share of around 32%. The automotive industry has grown to be a popular investment target for businesses all around the world. Since many linear voltage regulator manufacturers are concentrating on providing features like watchdog, reset, and early warning, the use of linear voltage regulators in vehicles is advantageous under challenging settings. Additionally, because they generate steady output voltage for all automotive applications, linear voltage regulators in autos are desirable.

Thus, during the course of the forecast period, the global market for linear voltage regulators is projected to benefit greatly from the increase in the usage of linear voltage regulators in the automotive industry. Since the electrical and electronics (E&E) sector needs a steady and ripple-free power supply, linear voltage regulators are widely utilized in this sector. The ability to change greater input voltage to lower output voltage is another feature of linear voltage regulators.

Furthermore, since the linear voltage regulator lacks a switching device, it has incredibly low output ripple and spectrum noise. Linear voltage regulators are therefore widely employed in both wired and wireless communication systems.

Additionally, by maintaining a consistent output voltage regardless of changes in the load delivered to the system, linear voltage regulators are employed in power distribution systems to reduce the likelihood of short-circuit current. These benefits are driving up demand for linear voltage regulators in the electrical and electronics industries. During the forecast period, this is anticipated to boost the worldwide market for linear voltage regulators.

Administration Analysis Insights

The market is divided into low dropout and standard segments according on the type. Market share for low-drop outline linear voltage regulators is sizable. Even when the supply voltage is close to the output voltage, the low drop out linear voltage regulator can control the output voltage. The absence of switching noise, reduced device size, and higher design simplicity are further benefits of employing this regulator.

Regional Insights

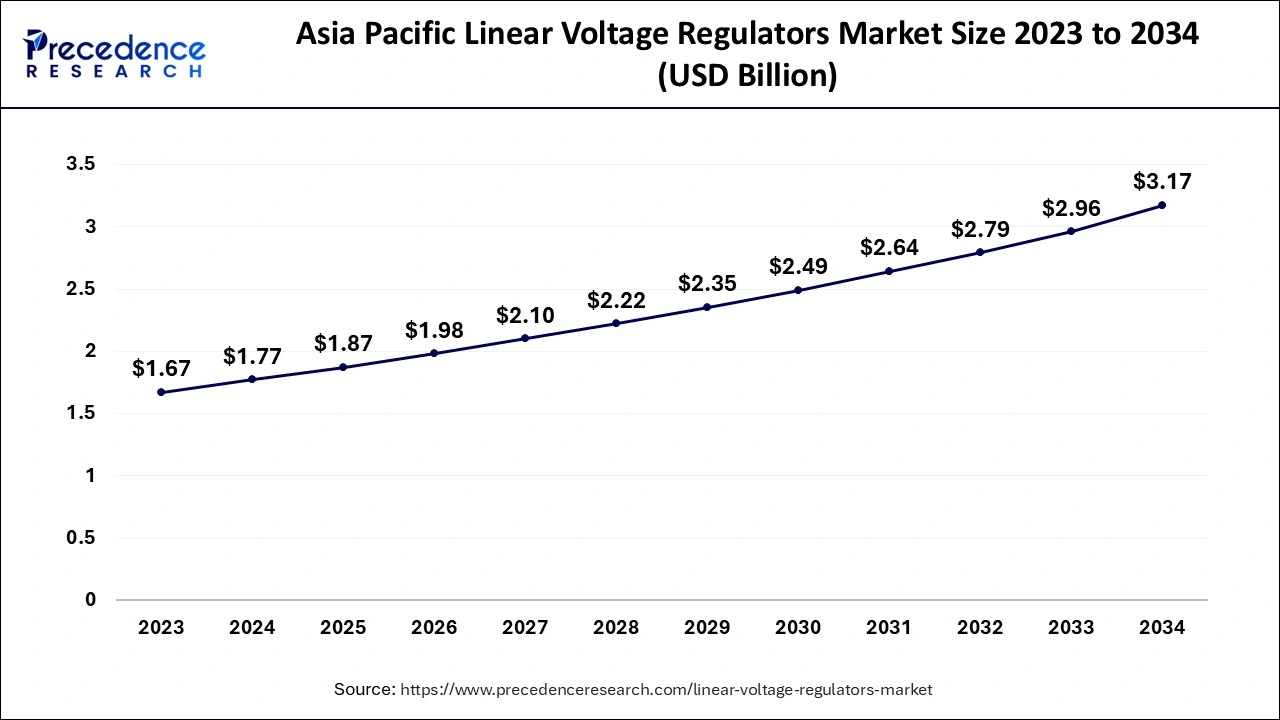

Asia Pacific Linear Voltage Regulators Market Size and Growth 2026 to 2035

The Asia Pacific linear voltage regulators market size is estimatd at USD 1.87 billion in 2025 and is expected to be worth around USD 3.35 billion by 2035, growing at a CAGR of 6.00% between 2026 to 2035

Asia Pacific: China Linear Voltage Regulators Market Trends

China's market is experiencing robust growth as demand rises from key electronics and industrial sectors, driven by the rapid expansion of consumer electronics, electric vehicles, industrial automation, and smart manufacturing. China is one of the largest regional markets globally, supported by its strong electronics manufacturing base and rising need for precise voltage regulation in devices with sensitive power requirements.

The Asia Pacific region has accounted for 45% of the revenue share in 2023.Due to the rising manufacturing of consumer electronic gadgets in emerging nations like China, India, and others, APEJ maintains a significant market share in terms of revenue creation from the sales of linear voltage regulators. The availability of inexpensive raw materials and reduced labor costs in these nations is the main factor driving the growth in the manufacturing of linear voltage regulators.

Given that this area has the biggest need for voltage maintenance technology, North America and Europe are the second-largest markets for linear voltage regulators. As a result of the presence of multiple manufacturers of linear voltage regulators in Europe and their ongoing investments in the field of voltage regulators, Europe is predicted to dominate the global linear voltage regulator market during the projection period. However, throughout the projected period, the demand for linear voltage regulators is anticipated to expand at a modest CAGR in the MEA region.

North America: U.S. Linear Voltage Regulators Market Trends

The U.S. market benefits from a strong semiconductor design ecosystem, extensive R&D investment, and widespread adoption of advanced electronics across healthcare, defense, data centers, and automotive sectors. Increasing integration of precision power regulation in IoT devices, EV platforms, and industrial automation systems supports sustained demand for high-performance linear voltage regulators.

Europe: Germany Linear Voltage Regulators Market Trends

Germany serves as a key contributor within Europe, supported by its advanced automotive, industrial automation, and engineering sectors. High demand for reliable power management components in electric vehicles, industrial machinery, and precision electronics fuels market growth, alongside strong collaboration between semiconductor suppliers and OEMs focused on high-efficiency electronic systems.

Linear Voltage Regulators Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

North America (USA & Canada) |

Federal Communications Commission (FCC); U.S. EPA; Occupational Safety and Health Administration (OSHA); Industry Canada |

• FCC Part 15 (EMC/EMI limits) |

• Electromagnetic compatibility |

Linear regulators used in electronics must comply with EMC/EMI limits; efficiency isn't mandated for all, but often tied to Energy Star or incentive programs for power supplies. |

|

Europe |

European Commission; ETSI; European Committee for Electrotechnical Standardization (CENELEC); National agencies |

• CE Marking (Low Voltage Directive, EMC Directive) |

• Electrical safety and EMC |

Linear regulators integrated on PCBs must meet CE marking requirements. RoHS heavily influences component supply chains (lead, cadmium, and certain brominated flame retardants are restricted). |

|

Asia Pacific |

China MIIT / CQC; Japan TELEC / METI; South Korea KC Certification; India BIS/TEC |

• China CCC & GB/T EMC standards |

• EMC compliance |

Many APAC countries are aligning their EMC and safety standards with IEC equivalents; emerging efficiency labeling schemes impact regulator expectations. |

|

Latin America |

ANATEL (Brazil); SCT/IFT (Mexico) |

• National EMC & telecom component standards |

• Component safety and interference control |

Latin American markets often reference US/EU EMC standards; local agency certification may be required for imports. RoHS-style controls are emerging in some countries. |

|

Middle East & Africa |

GSO (Gulf Standardization Organization); NTRA (Egypt); ARASIA |

• GSO/ESMA/KSA EMC & electrical safety standards |

• EMC and safety compliance |

Gulf and African nations are increasingly adopting IEC/CISPR norms; conformity certification is often required before market entry. |

Linear Voltage Regulators Market Companies

- Texas Instruments

- ROHM Semiconductor

- Intersil

- Richtek Technology

- Maxim Integrated

- Anaren

- Analog Devices Inc.

- NXP

- ON Semiconductor

- TE Connectivity

- Parallax

- Skyworks

- Semtech

- Diodes Incorporated

- Exar

- Seiko Instrument

- Microchip Technology

Recent Developments

- In August 2025, the Indian Space Research Organisation (ISRO), in partnership with the Semiconductor Laboratory (SCL) in Chandigarh. The partnership is developing four new indigenous integrated circuits (ICs) aimed at improving the self-reliance and performance of its launch vehicles. (Source: https://economictimes.indiatimes.com)

- In October 2025, STMicroelectronics expanded its STDRIVE family with half-bridge gate drivers optimized for Gallium Nitride (GaN) and Silicon MOSFET applications in industrial and consumer systems. The devices are designed for systems powered from industrial or telecom bus voltages. (Source: https://www.newelectronics.co.uk)

- In November 2024, Orca Semiconductor launched its OS2000 IO-Link communications transceiver, specifically designed to improve Industry 4.0 applications in smart factories. The device enables bi-directional communication between sensors, control systems, and actuators.

- A Texas device known as the TPS7A02 low dropout linear regulator was released in September 2019 and coupled a very low IQ with a quick transient response. Quiescent current of less than 25nA according to Texas Instruments. Faster wake-up times are made possible by its quick transient reaction, which is said to be the fastest in class. This enhances application response time and dynamic performance.

Segments Covered in the Report

By End User

- Commercial

- Residential

- Industrial

- Automotive

By Administration Analysis

- Standard

- LDO

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting