What is the Location Based Services Market Size?

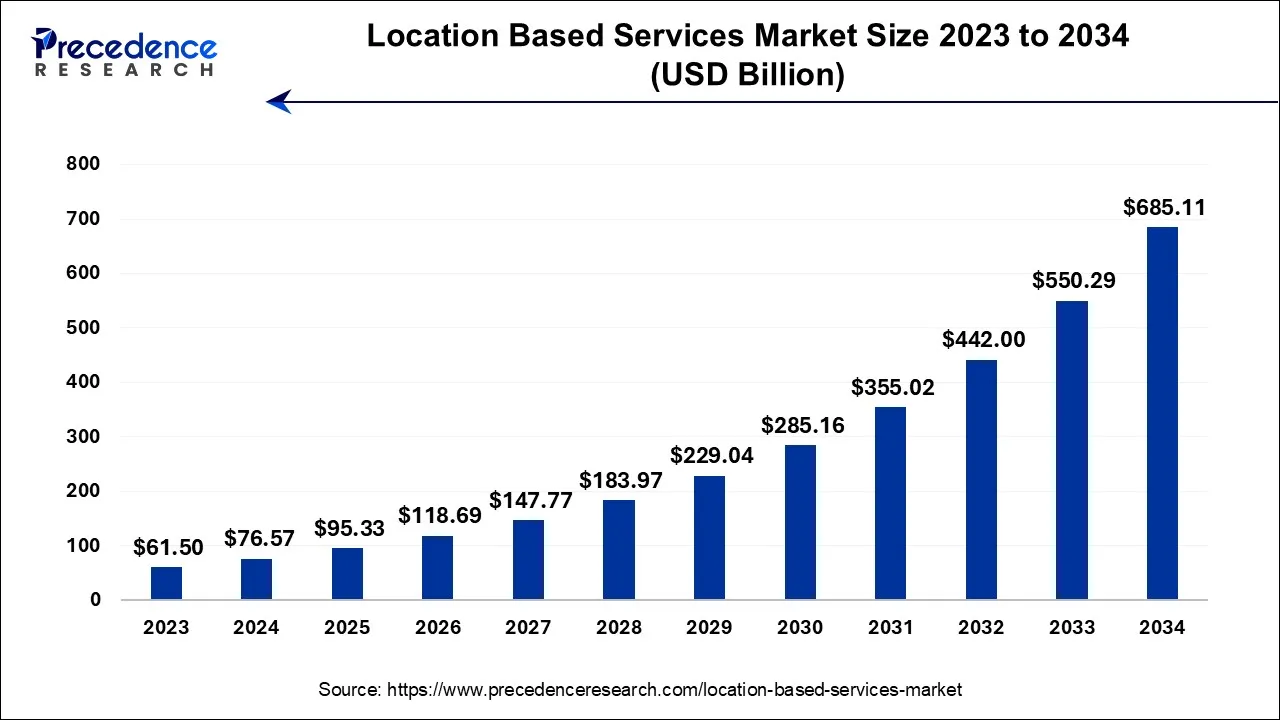

The global location based services market size accounted for USD 95.33 billion in 2025 and is projected to be worth around USD 685.11 billion by 2034, expanding at a CAGR of 24.5% from 2025 to 2034.

Market Highlights

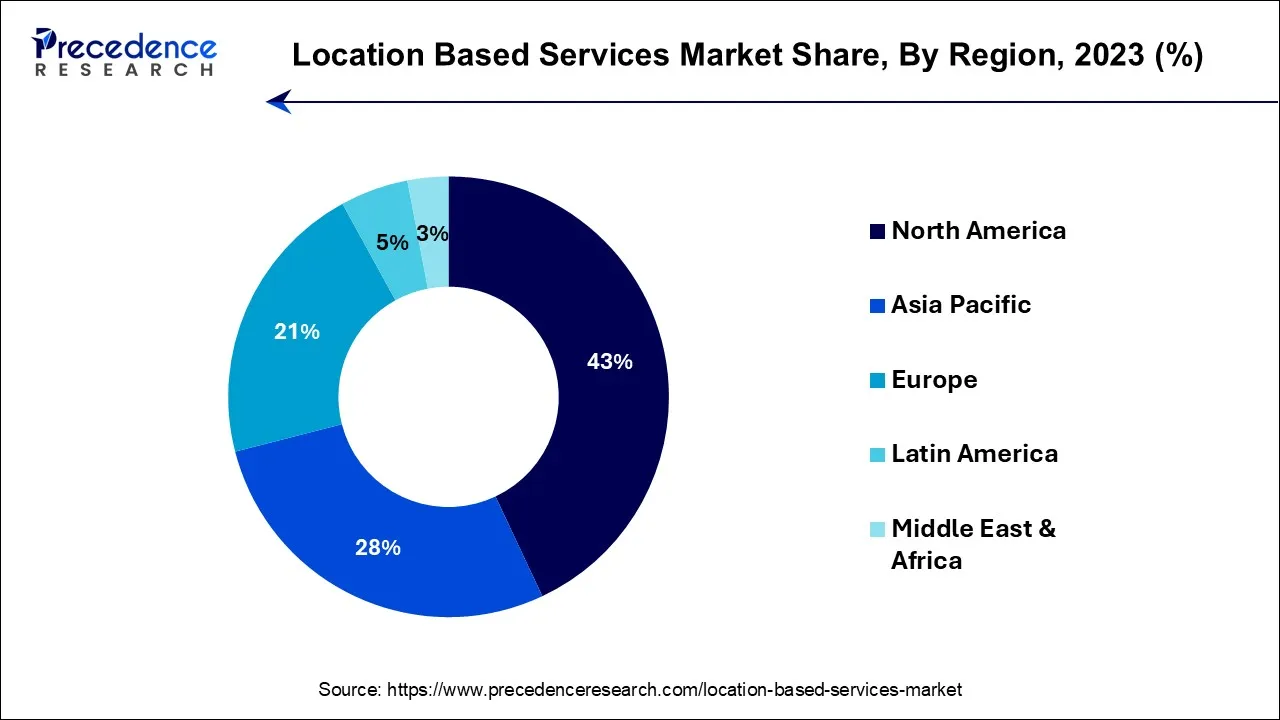

- North America contributed more than 43% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the hardware segment has held the largest market share of 45% in 2025.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 26.2% between 2025 and 2034.

- By technology, the GPS segment generated over 31% of revenue share in 2025.

- By technology, the Wi-Fi segment is expected to expand at the fastest CAGR over the projected period.

- By application, the mapping and navigation segment generated over 35% of the revenue share in 2025.

- By application, the asset tracking segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the transportation and logistics segment generated over 33% of revenue share in 2025.

- By industry vertical, the hospitality segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 95.33 Billion

- Market Size in 2026: USD 118.69 Billion

- Forecasted Market Size by 2034: USD 685.11 Billion

- CAGR (2025-2034): 24.5%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Location based services (LBS) represent sophisticated technology and applications that harness a user's precise geographic coordinates to furnish individualized information and support. These services draw upon data from multiple sources, including GPS, Wi-Fi, cellular networks, and smartphone sensors, to pinpoint a user's exact position. LBS serves a wide spectrum of functions, encompassing navigation, mapping, personalized marketing, social networking, and indispensable emergency services.

LBS can elevate user experiences by furnishing tailored recommendations and directions tailored to their present location. They empower enterprises to target consumers with location-specific promotions and advertising, amplifying the efficacy of marketing endeavors. Furthermore, LBS assumes a critical role in emergency response, facilitating the swift identification of individuals in distress.

However, LBS also provokes pertinent concerns related to privacy and data security, as they necessitate access to location data. Achieving a harmonious equilibrium between convenience and privacy constitutes a notable challenge in the evolution and deployment of location-based services.

- In 2022 Cisco Systems, Inc. made a revenue of $52.28 B an increase over the year 2021 revenue that was of $50.78 B. The revenue is the total amount of income that a company generates by the sale of goods or services.

Location Based Services Market Growth Factors

- The growing prevalence of smartphones worldwide expands the user base for location-based services. IoT devices and sensors contribute to the proliferation of location data, driving LBS demand.

- Advancements in GPS and positioning technologies improve the precision of location-based services. LBS enables businesses to deliver highly targeted ads based on a user's real-time location, boosting marketing effectiveness.

- Location-based services facilitate location-specific e-commerce recommendations and promotions. LBS continues to be integral for navigation and map-based applications.

- The growth of ride-sharing, food delivery, and other on-demand services relies on LBS for efficient operations.

- LBS play a vital role in emergency response systems, aiding rapid location identification.

- Government and urban development projects utilize LBS to improve city planning and services. Social networks utilize location data for check-ins, location sharing, and friend recommendations.

- LBS are expanding into indoor environments, enhancing in-building navigation and wayfinding. AR apps rely on LBS to overlay digital information onto the physical world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.33 Billion |

| Market Size in 2026 | USD 118.69 Billion |

| Market Size by 2034 | USD 685.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 24.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in GPS and positioning technologies

The progression of GPS and positioning technologies is a driving force behind the burgeoning location-based services (LBS) market. These advancements are ushering in a host of crucial advantages. First and foremost, the enhanced accuracy and precision of these technologies enables LBS to furnish more dependable and real-time location data. This precision is vital for applications like navigation, emergency services, and location-based advertising, where pinpointing a user's exact location is paramount.

Furthermore, these advancements have led to the emergence of hybrid positioning systems that amalgamate GPS with other positioning techniques, such as Wi-Fi, Bluetooth, and sensor data. This hybrid approach ensures that LBS can operate effectively in various settings, including densely populated urban areas and indoor environments, where conventional GPS signals may be compromised.

Additionally, the reduced power consumption of contemporary positioning technologies prolongs the battery life of mobile devices, allowing users to harness the benefits of LBS without causing excessive drain on their devices. Collectively, ongoing improvements in GPS and positioning technologies enrich the user experience and broaden the horizons of potential LBS applications, fuelling the market's expansion and adoption across diverse sectors.

Restraint

Competition and saturation

Competition and saturation are significant factors restraining the growth of the location-based services (LBS) market. The abundance of established players in the market intensifies competition, making it challenging for new entrants to gain a foothold. Existing market leaders have already captured substantial market share, leaving limited room for newcomers to thrive.

Furthermore, market saturation occurs as numerous LBS applications and solutions saturate the market, resulting in redundancy and competition for user attention. This oversaturation can dilute the impact of individual LBS offerings and can lead to a lack of innovation, as established players may focus more on maintaining their positions than on introducing groundbreaking features. As a result, while competition can drive innovation, excessive rivalry and market saturation can restrict the growth prospects for LBS providers, compelling them to seek niches or differentiate their services to remain competitive in the market.

Opportunity

Indoor mapping and navigation

Indoor mapping and navigation are creating exciting opportunities in the location-based services (LBS) market by revolutionizing the way we navigate and engage within indoor environments. As businesses and venues recognize the potential for enhancing user experiences, LBS providers are capitalizing on this demand. Indoor LBS is facilitating efficient navigation within complex indoor spaces such as shopping malls, airports, hospitals, and stadiums, offering turn-by-turn guidance, location-specific information, and interactive maps. These solutions empower businesses to engage customers with location-based marketing and services, providing tailored promotions, and simplifying product discovery.

Moreover, in a post-pandemic world, indoor LBS can aid in crowd management and social distancing measures. The growth of this segment not only enhances convenience for consumers but also opens new revenue streams for LBS providers, making indoor mapping and navigation a dynamic frontier within the LBS market.

Segments Insights

Component Insights

The hardware segment has held a 45% revenue share in 2025. The hardware segment holds a substantial share in the location-based services (LBS) market primarily due to the critical role of hardware components like GPS receivers, beacons, sensors, and mobile devices in enabling location data acquisition. Hardware serves as the foundation for LBS functionality, ensuring accurate positioning and data collection.

The proliferation of smartphones and the increasing use of IoT devices further boost the demand for hardware components. While software and services are essential, the hardware's foundational nature in providing reliable and precise location information makes it a major contributor to the LBS market's overall value and growth.

The services segment is anticipated to expand at a significant CAGR of 26.2% during the projected period. The services segment holds a substantial growth in the location-based services (LBS) market due to its pivotal role in delivering customized solutions to diverse industries. LBS services encompass software development, implementation, and ongoing support, ensuring seamless integration and functionality.

Businesses often require specialized LBS expertise to tailor location-based applications to their unique needs, driving the demand for these services. Service providers also offer maintenance, updates, and data analytics, enhancing the long-term value of LBS solutions. As a result, the services segment is integral to the success of LBS implementations, accounting for a significant growth in the market.

Technology Insights

The GPS segment had the highest market share of 31% in 2025.GPS holds a major share in the location-based services market due to its widespread adoption and reliability. Global Positioning System (GPS) technology is well-established, offering high accuracy in outdoor environments. It is widely integrated into smartphones and a variety of devices, ensuring broad accessibility for users.

GPS's reliability and real-time capabilities make it a preferred choice for navigation, emergency services, and location-specific applications. While other technologies like Wi-Fi and Bluetooth contribute to location accuracy, GPS remains the primary source for outdoor positioning, cementing its dominant position in the location-based services market.

The Wi-Fi segment is anticipated to expand fastest over the projected period. The Wi-Fi segment holds a major growth in the location-based services (LBS) market due to its versatility and widespread availability. Wi-Fi technology offers precise indoor positioning and location-based services, making it invaluable in areas like retail, hospitality, and healthcare, where GPS signals may be unreliable. Wi-Fi's dense network infrastructure and compatibility with a wide range of devices enable seamless location tracking and user engagement. This technology also supports cost-effective LBS implementations, further driving its adoption. As indoor LBS applications continue to grow, Wi-Fi remains a dominant and accessible choice for accurate and reliable indoor positioning.

Application Insights

The mapping and navigation segment had the highest market share of 35% in 2025. The mapping and navigation segment holds a major growth in the location-based services market due to its widespread and essential applications. Navigation and mapping services are integral to various industries, including transportation, logistics, and tourism, where precise location information is paramount. Additionally, with the increasing adoption of smartphones, users rely on mapping and navigation apps for real-time directions.

Furthermore, the continuous development of indoor mapping and navigation solutions for complex indoor environments, such as malls and airports, has expanded the segment's relevance, making it a dominant growth in the LBS market.

The asset tracking segment is anticipated to expand fastest over the projected period. The asset tracking segment holds a significant growth in the location-based services (LBS) market due to its widespread adoption across various industries. Businesses increasingly rely on LBS for real-time tracking and management of valuable assets, such as vehicles, equipment, and inventory.

This technology improves operational efficiency, reduces theft and loss, and enhances supply chain management. The growth of e-commerce, logistics, and transportation sectors has further fueled the demand for asset tracking solutions, making it a major contributor to the LBS market, with its practical and cost-saving applications across diverse sectors.

Industry Vertical Insights

The transportation and logistics segment had the highest market share of 33% in 2025. The transportation and logistics segment holds a significant share in the location-based services (LBS) market due to its inherent need for precise location data. LBS enables real-time tracking of vehicles, optimizing routes, improving fleet management, and enhancing delivery efficiency. It offers critical tools for monitoring cargo, reducing fuel consumption, and enhancing overall operational effectiveness.

Additionally, the integration of LBS helps logistics companies meet increasing customer demands for accurate delivery information. These factors have driven strong adoption in the transportation and logistics sector, solidifying its major share in the LBS market and highlighting its role in streamlining operations and cost savings.

The hospitality segment is anticipated to expand fastest over the projected period. The hospitality segment commands a significant growth in the location-based services (LBS) market due to its critical role in enhancing guest experiences. LBS technologies enable hotels, resorts, and restaurants to offer personalized services, including check-in and check-out services, room customization, and location-based recommendations for dining and entertainment.

Moreover, LBS facilitates staff efficiency, asset tracking, and security in hospitality settings. The integration of indoor navigation and mobile apps has become a norm, creating a seamless and tailored experience for guests, which, in turn, drives the hospitality industry's substantial adoption of LBS solutions.

Regional Insights

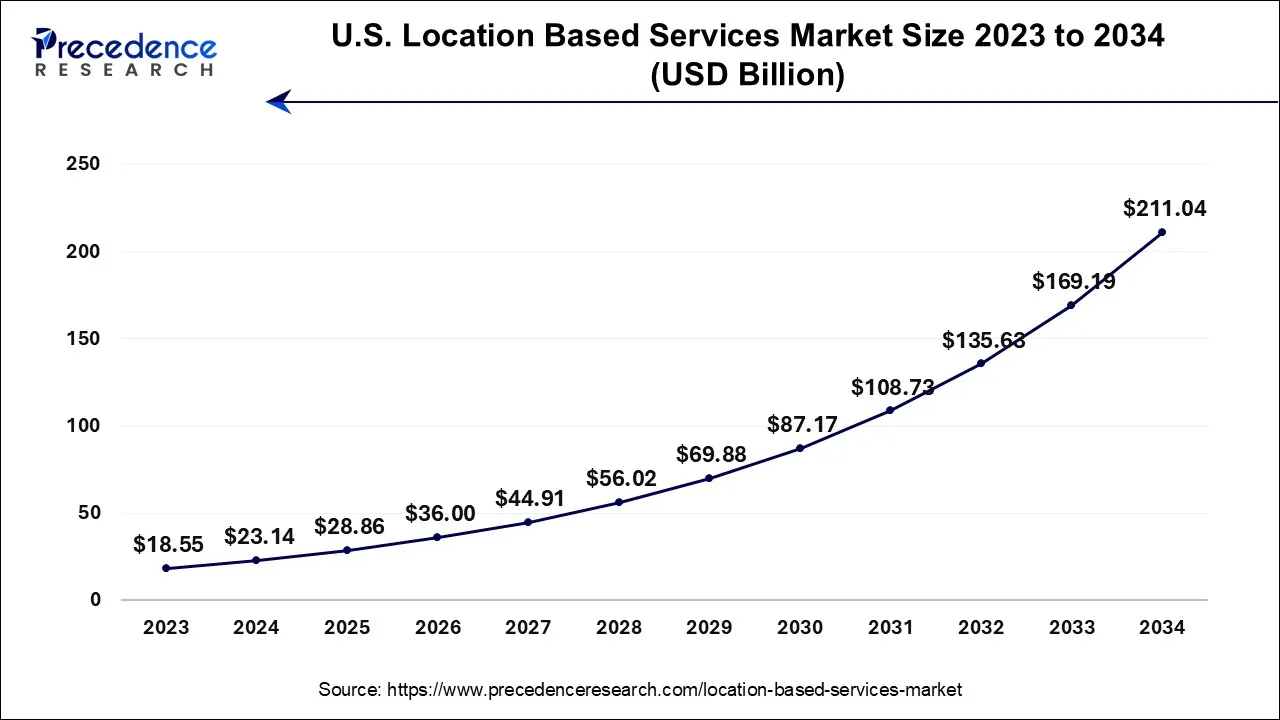

Location Based Services Market Size and Growth 2025 to 2034

The U.S. location based services market size is exhibited at USD 95.33 billion in 2025 and is projected to be worth around USD 211.04 billion by 2034, growing at a CAGR of 24.7% from 2025 to 2034.

North America has held largest revenue share of 43% in 2025. North America dominates the location-based services (LBS) market due to a combination of factors. The region boasts a mature digital infrastructure, high smartphone penetration, and a tech-savvy population, driving widespread LBS adoption. Furthermore, a robust business ecosystem, coupled with a thriving startup culture, fosters innovation and development in LBS technologies.

Major players in the LBS industry are headquartered in North America, reinforcing its market leadership. Additionally, a diverse range of applications, from navigation to geo-targeted advertising and IoT integration, finds strong demand in sectors like retail, healthcare, and transportation, further solidifying North America's dominant position.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands substantial growth in the location-based services (LBS) market for several key reasons. The region boasts a large population with a significant smartphone user base. Urbanization and the implementation of smart city initiatives, particularly in countries like China and India, fuel the demand for LBS across various sectors, from transportation to healthcare.

The region's economic diversity, spanning developed and emerging markets, presents a wide array of opportunities for LBS providers. Moreover, the increasing prevalence of mobile commerce and the growing need for location-specific services contribute to the prominent growth market presence enjoyed by Asia Pacific.

Location Based Services Market Companies

- Apple

- Microsoft

- IBM

- Cisco Systems

- Oracle

- Qualcomm

- Samsung Electronics

- TomTom

- Huawei Technologies

- HERE Technologies

- Ericsson

- Zebra Technologies

- Foursquare

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Technology

- GPS

- Assisted GPS (A-GPS)

- Enhanced GPS (E-GPS)

- Enhanced Observed Time Difference

- Observed Time Difference

- Cell ID

- Wi-Fi

- Others

By Application

- Social Networking and Entertainment

- Proximity Marketing

- Asset Tracking

- Mapping and Navigation

- Business Intelligence and Analytics

- Fleet Management

- Location-based Advertising

- Local Search and Information

- Others

By Industry Vertical

- Transportation and Logistics

- Manufacturing

- Government and Public Utilities

- Retail

- Healthcare and Life Sciences

- Media and Entertainment

- IT and Telecom

- BFSI

- Hospitality

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting