What is the Marine Propulsion Engines Market Size?

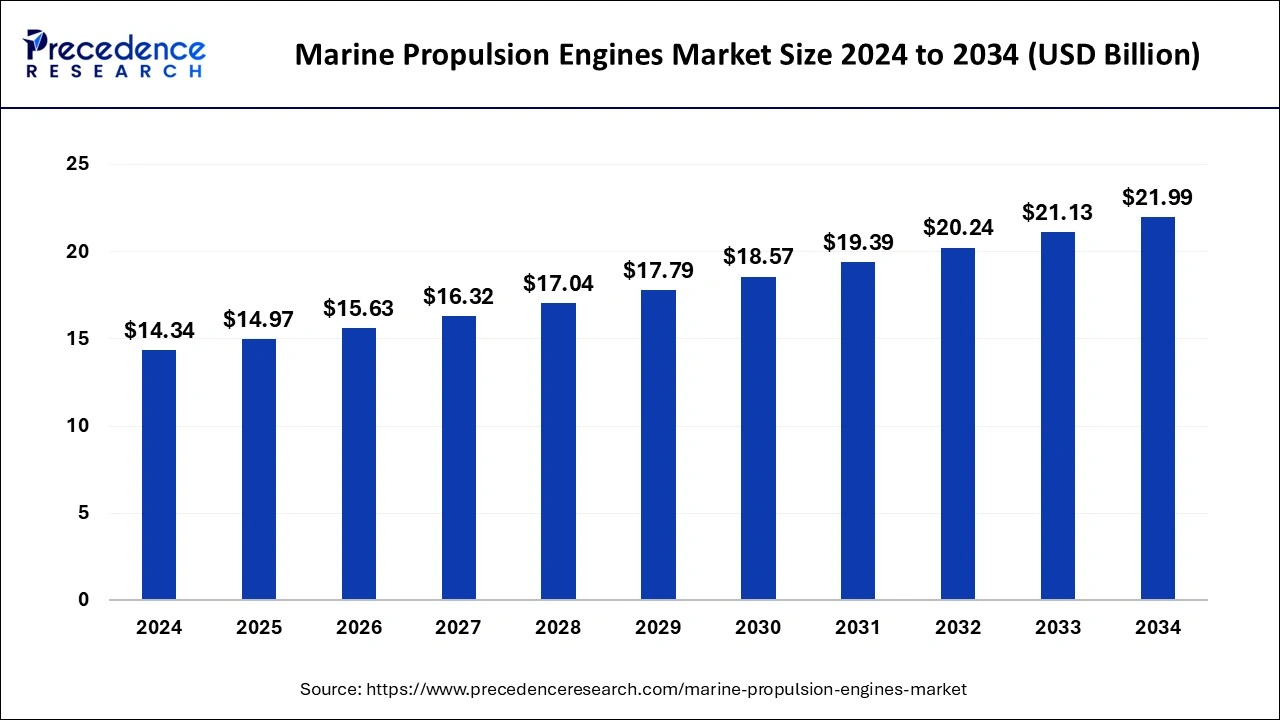

The global marine propulsion engines market size is valued at USD 14.97 billion in 2025 and is predicted to increase from USD 15.63 billion in 2026 to approximately USD 22.85 billion by 2035, growing at a CAGR of 4.37% from 2026 to 2035.

Marine Propulsion Engines Market Key Takeaways

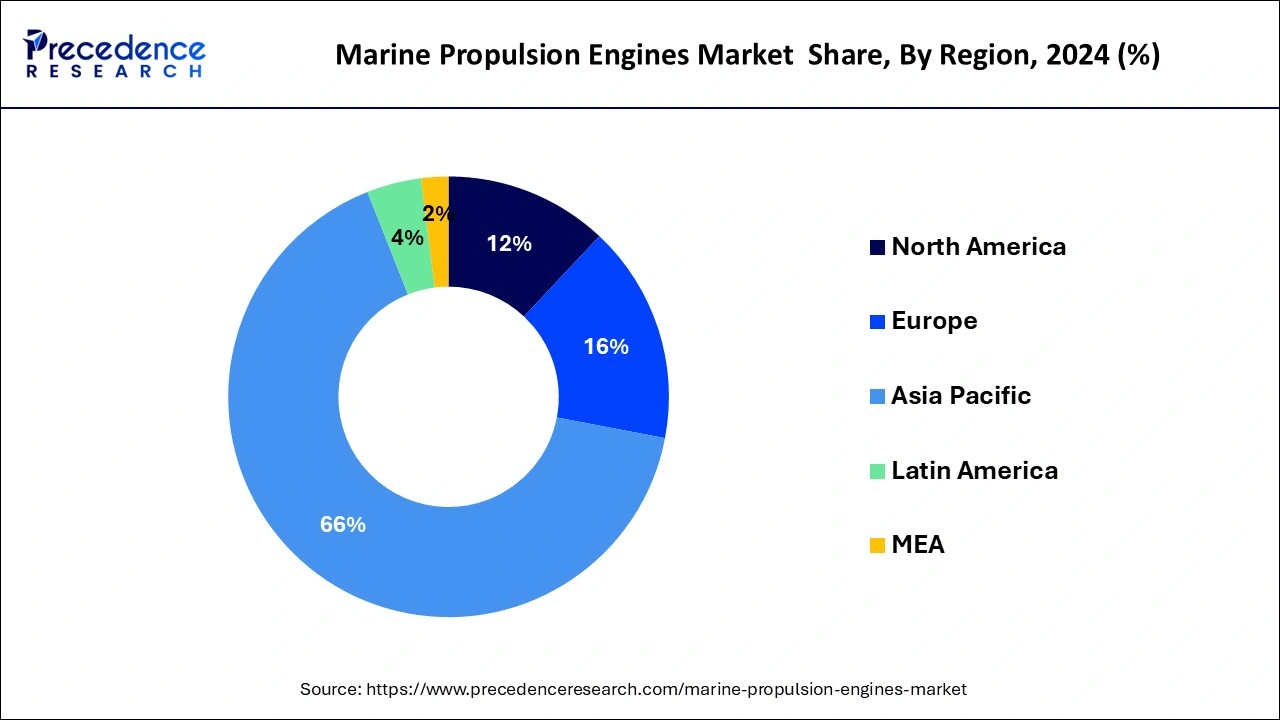

- Asia Pacific held a market share of 65.14% in 2025.

- North America region is estimated to expand the fastest CAGR between 2026 and 2035.

- By product, the diesel propulsion engine segment is expected to capture the biggest revenue share in 2025.

AI in the Market

The marine propulsion engine industry is witnessing a radical transition thanks to AI, which is enhancing practicality, dependability, and eco-friendliness. It makes predictive maintenance possible by examining real-time engine data, which in turn diminishes the duration of maintenance and boosts the lifespan of the machines. AI further refines the fuel consumption by changing the parameters according to the ship's speed, climate, and water conditions. Performance and routing optimization solutions apply AI models and digital twins to discover the best-performing engine operating conditions. AI-powered analytics contribute to the creation of smart engines, which will eventually lead to the development of next-generation propulsion systems with automatic control of navigation and energy use as their characteristics.

Marine Propulsion Engines Market Growth Factors

Marine propulsion engines market is about to register a steady growth rate during the forthcoming years because of the rise in demand for operationally dependable and financially efficient ships. Shipping industry plays a significant role in the global trade. Cross-border trade is largely dependent on the shipping industry for importing and exporting heavy goods to various countries owing to easy and affordable cost of transportation. Some of the countries lack the abundance of natural resources, in order to fulfill the requirements, they import rest of the quantity from other countries in bulk, this also triggers the trend for shipping transportation and thus drives the growth of marine propulsion engines market.

The increasing import and export activities across the globe has put a greater emphasis on enhancing the capacity of diesel propulsion engines to prosper the growth of new-generation tankers with higher cargo holding capacity. Further, rapid depletion of conventional and shale gas reserves has prominently boosted the demand for LPG gas in marine fuel. Previously, steam turbine systems were largely preferred for marine propulsion, whereas for increasing the utilization of natural gas, the dual-fuel diesel (DFD) propulsion engines were introduced on LNG carriers.

- The demand in international trade and shipping increased the demand for efficient marine propulsion systems with the best power, and hence, the demand for the shipbuilding industry that has advanced technology-driven installation of such engines.

- The shift towards eco-friendly fuels is being made due to the public concern about the environment and the imposition of tighter pollution regulations.

- The expansion of offshore drilling and mining has come along with the demand for good-quality and powerful marine engines that can stand the tough conditions.

- One of the main benefits of propulsion technologies is technological advancements that make the system more reliable, less costly, and at the same time, open up the possibility for sustainable maritime operations.

Market Outlook of the Marine Propulsion Engines Market:

- Industry Growth Overview: The ship propulsion engine sector is booming, mainly because of the increase in global seaborne trade. The strategies used by naval fleets to modernize their vessels and the requirement for high-efficiency ship propulsion engine options for both commercial and defence-related vessels.

- Sustainability Trends: The increasing enforcement of stricter regulations by the International Maritime Organisation (IMO) regarding greenhouse gas emissions is contributing to the rapid growth of hybrid, liquefied natural gas (LNG), and methanol with ready propulsion systems and encouraging engine manufacturers to develop engines with improved fuel flexibility, reduced carbon emissions, and energy-efficient engine layouts.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.97 Billion |

| Market Size in 2026 | USD 15.63 Billion |

| Market Size by 2035 | USD 22.85 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.37% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Product Insights

Based on product, the marine propulsion engines market is classified into the wind & solar propulsion engine, diesel propulsion engine, fuel cell propulsion engine, gas turbine propulsion engine, natural gas propulsion engine, steam turbine propulsion engine, and others. In the past decade, diesel propulsion engine has emerged as the prominent source of propulsion in the shipping industry. With the rising advancements in the technology and increasing preference for sustainable propulsion system alternate energy sources for example renewable energy that has minimal emission rate has garnered significant penetration in the shipping industry. This in turn accelerates the market growth for wind and solar marine propulsion engine.

Although solar and wind marine propulsion engine has gained importance as the auxiliary propulsion engine, they are insufficient to meet the power requirement for primary marine propulsion purpose. Wind propulsion systems are limited for propulsion augmentation applications if full sail propulsion method is adopted that gives rise to adverse commercial and financial implications in terms of voyage time taken and number of ships required. In addition, wind-based propulsion is dependent on the speed of wind that should be uniform and effective to sail a ship coupled with the installation of suitable control system technology in the ship. Hence, wind and solar propulsion engines witness magnificent growth as the auxiliary system as they are environment friendly and do not emit harmful substance in the environment.

Apart from the shift for renewable energy in marine propulsion system, developments in fuel injection technology, firing pressure, brake mean effective pressure, and turbo-charging efficiency have drastically reduced the fuel consumption in marine industry. This has significantly triggered the adoption of natural gas and diesel propulsion engines in the marine industry.

Key Companies & Market Share Insights

The global marine propulsion engines market is moving towards consolation owing to increasing number of merger & acquisition activities between market players. For instance, on 8th March 2019, Hyundai Heavy Industries acquired its local rival company Daewoo Shipbuilding and Marine Engineering that benefited it in increasing its stake in the global marine market by 21%. As per the acquisition deal, Hyundai Heavy Industries was likely to create a holding company under which it manages the ship building unit along with the Daewoo's Shipbuilding.

Regional Analysis

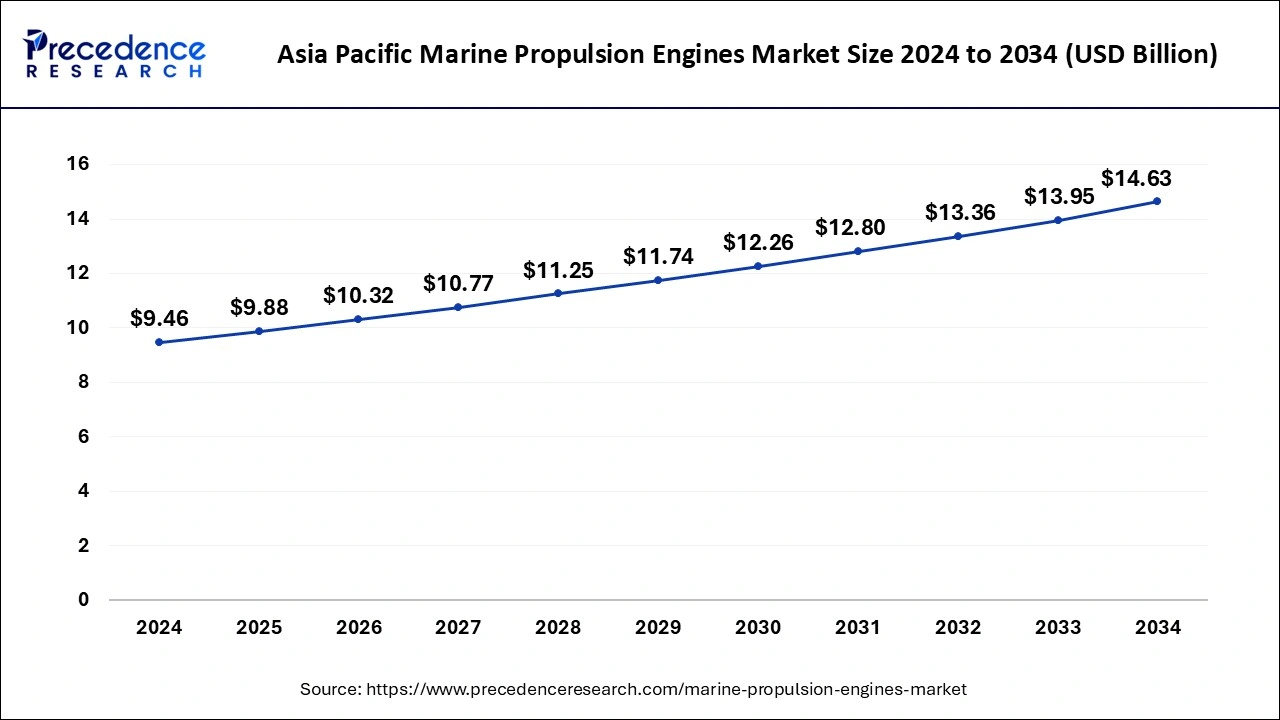

Asia Pacific Marine Propulsion Engines Market Size and Growth 2026 to 2035

The Asia Pacific marine propulsion engines market size is evaluated at USD 9.88 billion in 2025 and is projected to be worth around USD 15.31 billion by 2035, growing at a CAGR of 4.46% from 2026 to 2035.

The Asia Pacific has emerged as the market leader in the global marine propulsion engines market in the year 2025. Diesel production in the region has experienced high growth in the last five years and hence the market for diesel propulsion engine. Further, diesel propelled machineries are developed in prominent amount for the marine industry owing to various benefits such as reliable and widely accepted primary propulsion engine across the shipping industry. Further, the diesel propulsion engine is also used as an auxiliary propulsion engine owing to various technology advancements and wide usage of diesel propelled engines for the demand of high range of power.

On the other hand, North America witnessed a slow growth rate in the global marine propulsion engines market during the forthcoming years. This is mainly attributed to the stringent emission regulations imposed by the government of the region in order to control the alarming rate of pollution.

How is Asia-Pacific leading the Marine Propulsion Engines Market?

The Asia Pacific region leads the market owing to its robust shipbuilding industry, massive industrial exports, and increased commercial shipping activities. The regional maritime infrastructure development and the use of modern propulsion systems based on advanced technologies are making the area stronger in the market. The countries such as China, India, and Singapore are pushing the demand through their commitment to energy-efficient and green marine engines.

China Marine Propulsion Engines Market Trends:

The Asia Pacific market is dominated by China, which boasts a huge shipbuilding industry and a strong export-driven economy. The country's push for energy-saving propulsion systems and technological self-reliance are key factors in the quick market development. The integration of hybrid and LNG-based solutions is not only empowering China's maritime sector but also securing its position as a worldwide center for marine propulsion manufacturing and technological innovation.

How is North America performing in the Marine Propulsion Engines Market?

North America stands out as a key market while being backed up by a strong shipping and defense industry. More and more offshore exploration, as well as upgrades of naval fleets, are driving the need for—say—high-efficiency propulsion systems. The regional intent to have marine tech that is both fuel-efficient and environmentally friendly helps the market further, with the U.S., Canada, and Mexico being the main forces behind this technological progress.

United States Marine Propulsion Engines Market Trends:

Strong military, commercial, and offshore shipping sectors provide the U.S. market with considerable advantages. The increasing concern for energy-efficient and emission-compliant propulsion systems is a major driver for modernization. The U.S. is now seen as a technological leader in marine propulsion innovation due to its strategic investments in AI-enabled maintenance and hybrid engine solutions that enhance operational performance and environmental sustainability.

What are the driving factors of the Marine Propulsion Engines Market in Europe?

Europe is the holder of a significant portion of the market, which is mainly due to the extensive fleet of commercial and passenger ships, as well as the growth of sea tourism. The stricter environmental regulations and the focus on cutting down carbon emissions are prompting the use of hybrid and LNG-based power systems. Germany, the U.K., Denmark, and Sweden are among the major contributors to this sector because of their cutting-edge maritime technologies and green shipbuilding practices.

Germany Marine Propulsion Engines Market Trends

Germany is still a top European market with sophisticated engineering resources and a strong shipbuilding industry. The country's focus on technical innovation and sustainability helps the development of high-performance propagation systems. The combination of Germany's powerful industrial sector and environmental standards compliance becomes a major factor for the country's leadership in marine propulsion research and production.

Latin American Market: Increasing Ocean Transportation Trade:

Marine propulsion engines for commercial and patrol vessels will see increased utilization due to increased use of offshore oil resources, increased coastal shipping networks (especially in Mexico and Brazil), and modernization of ports through the introduction of the so-called new generation of marine propulsion engines. Brazil.

The demand for marine propulsion engines in Brazil has been growing as a result of major expenditures by oil and gas companies to develop offshore oil fields and to upgrade and expand their naval fleets.

Brazil Marine Propulsion Engines Market Trends

Brazil's market is expanding as the country's shipping, offshore oil & gas, and inland waterways sectors increase activity, driving demand for robust and efficient propulsion systems. Rising investment in port infrastructure, coastal trade, and offshore support vessels is encouraging the adoption of advanced engines with higher performance and reliability.

East Africa and the Middle East (MEA) Market: Marine Transportation Routes And Naval Spending

MEA has continued to grow as a result of the growth of strategic commercial sea lanes, increased spending on naval defence, and the development of offshore energy sources in the Gulf Cooperation Council (GCC) and Africa regions, generating high demand for marine propulsion engines from cargo vessels, oil tankers, and security fleets within those nations.

The UAE Marine Propulsion Engines Market Trends

The UAE market is primarily growing due to the continued enhancement of existing port infrastructures, new shipbuilding programs, and sophisticated naval procurement initiatives. The growing investment in port modernization, offshore support vessels, and tourism-related marine assets (including cruise and leisure boats) is further stimulating demand across diverse vessel categories.

Value Chain Analysis of the Marine Propulsion Engines Market:

- Raw Material & Component Suppliers: Suppliers provide high-quality components such as high-grade steel, crankshafts, turbochargers, and fuel injection systems to support the engine manufacturing process, and these suppliers are focused on providing high durability and emissions compliance.

Key Players: Nippon Steel, Thyssenkrupp, and Bosch. - Engine Manufacturing & Assembly: By combining new technologies, digital monitoring, and modular engine designs, manufacturers have developed new and additional ways to increase fuel efficiency and development throughout the engine lifecycle.

Key Players: MAN Energy Solutions and Hyundai Heavy Industries. - Distribution, Integration & Aftermarket Services: Shipyards, marine integrators and service providers install, maintain and optimise engines during their lifecycles with the support of growing numbers of predictive maintenance software.

Key Players: ABB Marine, Rolls-Royce Power Systems, and Caterpillar Marine.

Marine Propulsion Engines Market Companies

- BP Shipping

- Yamaha

- Aegean

- Caterpillar

- Cummins

- Chevron

- Hydraulic Marine Systems

- Exxon Mobil Corp. (XOM)

- Hydrosta BV

- Ingeteam

- Idemitsu

- MAN Diesel & Turbo

- Lukoil

- Masson Marine

- Petronas

- Mercury Marine

- Shell

- Total

- Sinopec

- SCANA

- Rolls Royce

- Volvo Penta

- Siemens

- Wartsila

Recent Developments

- In October 2025, WinGD will introduce the first ethanol-fuelled two-stroke marine engine next year, with deliveries for newbuild and retrofit projects commencing in 2027. This announcement follows ten years of research into ethanol fuel and prior methanol engine development.

https://splash247.com - In September 2025, Japan Engine Corporation (J-ENG) launched the world's first ammonia-powered ship engine, the 7UEC50LSJA-HPSCR, aimed at transforming maritime transport and reducing greenhouse gas emissions, unveiled on August 30.

https://interestingengineering.com

Value Chain Analysis

- Raw Material Sourcing: It is the process of obtaining high-quality metals, electronics, and composites to guarantee their resistance to corrosion, along with strength and reliability in performance.

Key Players: Caterpillar and Mitsubishi Heavy Industries. - Component Fabrication and Machining: This is the manufacturing stage where the raw materials are accurately machined to make things like pistons and propellers, which are the engine components.

Key Players: Shandong Heavy Industry, a Weichai Company, and Baudouin - Testing and Certification: This includes the execution of comprehensive manufacturer trials and rigorous sea trials to ascertain performance, emissions compliance, and safety standards.

Key Players: DNV GL, Lloyd's Register, and American Bureau of Shipping (ABS) - Installation and Commissioning: The process of installing engines in ships, integrating auxiliary systems, and conducting operational tests to verify the functionality.

Key Players: D M Ship Repairs and Royal Tech Marine Engineers - Distribution and Sales: Global marketing, sales, and delivery networks to provide propulsion engines to various marine customers are taken care of by this department.

Key players: MAN Energy Solutions, Wärtsilä, Caterpillar, and Cummins Inc. - Maintenance and After-Sales Service: The company supports the customers through inspections, repairs, spare parts, and technical support that promote engine longevity and performance.

Key players: Caterpillar - Product Lifecycle Management: The complete lifecycle of the engine from design, production, and service to end-of-life disposal is managed by the department.

Key players: Siemens, Oracle

Segments Covered in the Report

By Product Outlook

- Diesel Propulsion Engine

- Gas Turbine Propulsion

- Wind & Solar Propulsion

- Steam Turbine Propulsion

- Fuel Cell Propulsion

- Natural Gas Propulsion

- Others

Regional Outlook

- North America

- Europe

- Asia Pacific

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting