What is the Medical Device Connectivity Market Size?

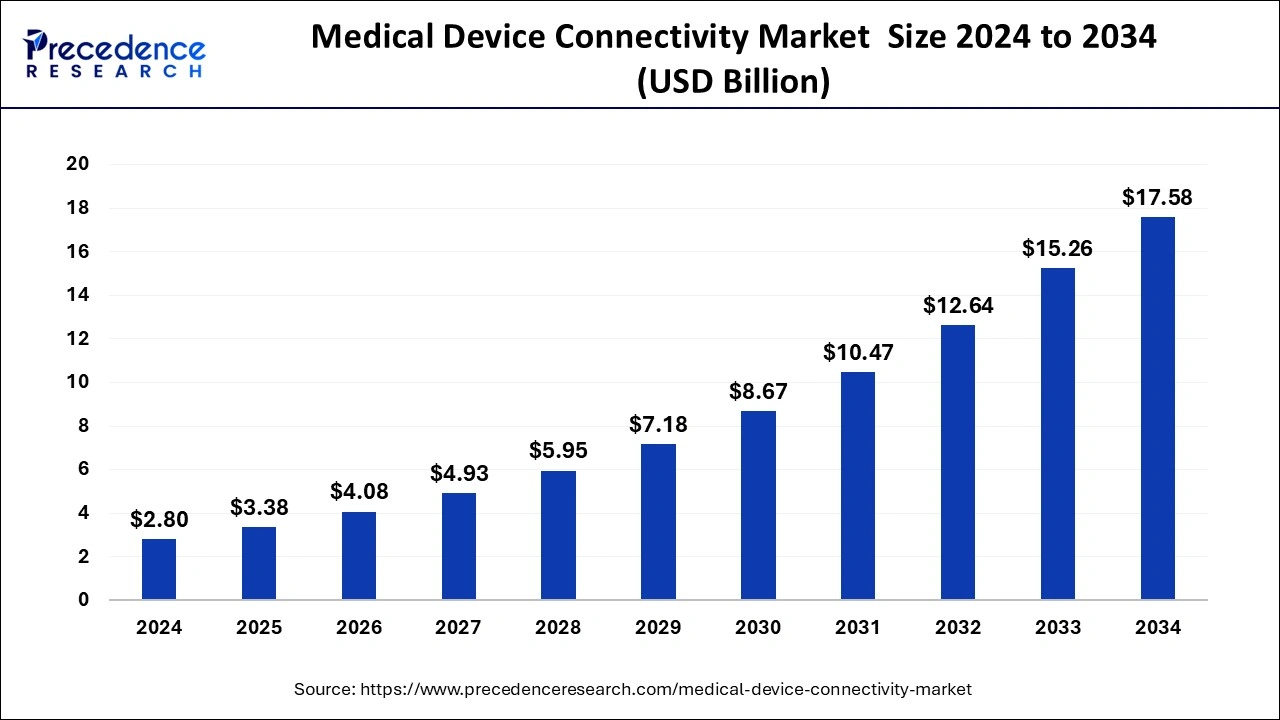

The global medical device connectivity market size is valued at USD 3.38 billion in 2025 and is predicted to increase from USD 4.08 billion in 2026 to approximately USD 20.10 billion by 2035, expanding at a CAGR of 24.96% from 2026 to 2035.

Medical Device Connectivity MarketKey Takeaways

- The global medical device connectivity market was valued at USD 3.38billion in 2025.

- It is projected to reach USD 20.10billion by 2035.

- The medical device connectivity market is expected to grow at a CAGR of 24.96% from 2026 to 2035.

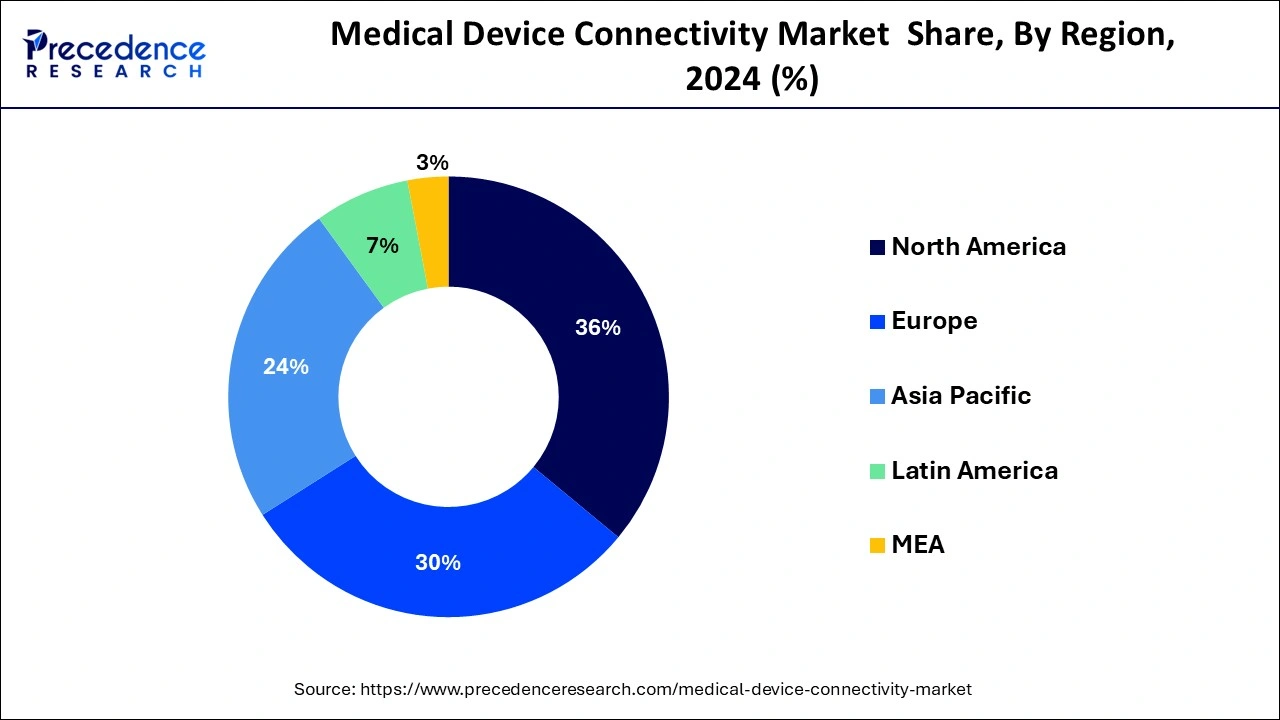

- North America has contributed 36% of market share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR of 25.7% between 2026 and 2035.

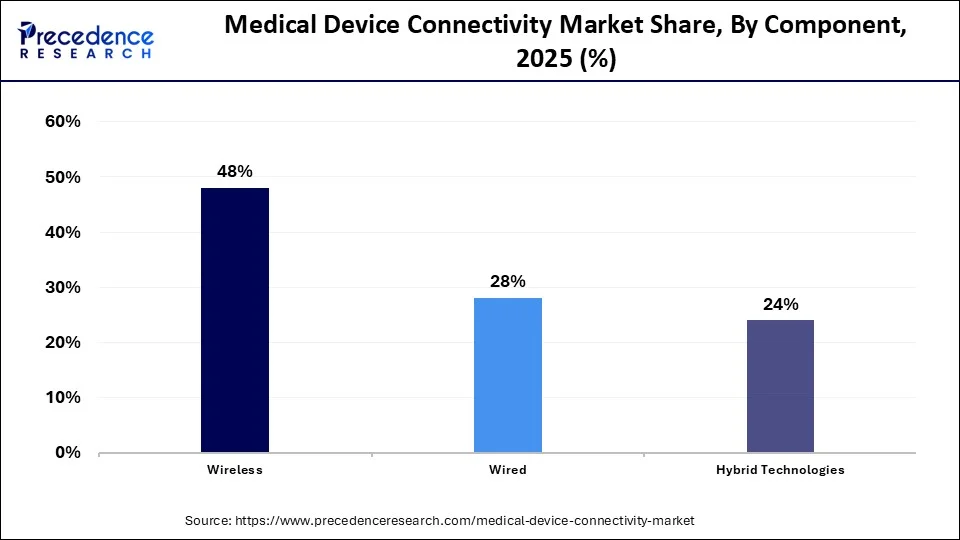

- By components, in 2023, the wireless segment held the highest market share of 48%.

- By components, the wired segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By application, the hospitals segment has held the biggest market share in 2025.

- By application, the ambulatory care centers segment is anticipated to witness significant growth over the projected period.

Market Overview

The medical device connectivity market offers an integrated system of medical equipment designed to focus on patient care by continuously monitoring and analyzing electronic health records (EHR). Through wireless network technologies, various medical devices are interconnected, allowing healthcare providers to monitor patients' vital signs and health status remotely, even when they are not physically present. Hospitals prioritize access to comprehensive, precise, and detailed medical device data to improve clinical outcomes and enhance patient safety, especially as medical device technology continues to advance rapidly. By seamlessly integrating data from multiple medical devices, MDC systems enable healthcare professionals to make informed decisions promptly, detect early signs of deterioration, and intervene promptly to prevent adverse events.

Moreover, the real-time monitoring capabilities provided by MDC systems contribute to early detection of medical emergencies, reduce response times, and improve overall patient outcomes. Furthermore, the continuous monitoring of patients' health data allows for more personalized and proactive care delivery, optimizing resource allocation and improving workflow efficiency within healthcare facilities. As a result, MDC systems play a vital role in modern healthcare settings by leveraging technology to enhance patient care, streamline clinical workflows, and promote better health outcomes for individuals under medical supervision.

Medical Device Connectivity Market Data and Statistics

- According to RFiD Discovery 2022, the U.S. FDA's Unique Device Identification (UDI) Rule mandates a unique device identification system for medical devices. Thus, every medical device utilized in the US must bear a Unique Device Identifier (UDI) readable by both humans and machines.

- In October 2021, Royal Philips introduced device drivers facilitating integration and interoperability, known as Philips Capsule Medical Device Information Platform (MDIP). Integrated into the Philips HealthSuite Platform, it's deployed across over 3,000 healthcare facilities globally. Philips Capsule MDIP captures real-time clinical data, translating it into actionable insights for patient care management. Its goal is to enhance collaboration among care teams, optimize clinical workflows, and boost productivity.

- In September 2021, CareVention HealthCare launched a remote patient monitoring service leveraging biosensors and artificial intelligence to track patients' vital signs, promptly alerting healthcare providers when necessary.

Medical Device Connectivity MarketGrowth Factors

- The increasing adoption of integrated healthcare systems that connect various medical devices to electronic health records (EHR) and hospital information systems (HIS) drives the growth of medical device connectivity. Healthcare providers seek seamless integration to streamline workflows, improve patient care, and enhance operational efficiency.

- The growing emphasis on real-time patient monitoring, especially in critical care settings, fuels the demand for medical device connectivity solutions. Connected medical devices enable healthcare professionals to remotely monitor patient data, including vital signs and clinical parameters, in real-time, facilitating timely interventions and improving patient outcomes.

- Stringent regulatory mandates and compliance requirements, such as the FDA's Unique Device Identification (UDI) Rule and data security regulations like HIPAA, drive healthcare facilities to invest in medical device connectivity solutions. Compliance with regulatory standards is essential to ensure patient safety, data security, and interoperability among medical devices and healthcare IT systems.

- Rapid advancements in healthcare technology, including wireless communication protocols, cloud computing, and IoT (Internet of Things), fuel innovation in medical device connectivity. These technological advancements enable seamless data exchange, interoperability, and data analytics, enhancing clinical decision-making and patient care delivery.

- The shift towards patient-centric care models emphasizes the importance of connected medical devices in facilitating remote monitoring, telehealth, and patient engagement initiatives. Medical device connectivity empowers patients to actively participate in their healthcare management while enabling healthcare providers to deliver personalized and proactive care, promoting the growth of the medical device connectivity market.

- Healthcare organizations are increasingly adopting medical device connectivity solutions to optimize resource utilization, reduce medical errors, and minimize healthcare costs. Connected medical devices enable predictive maintenance, remote diagnostics, and efficient resource allocation, leading to cost savings and improved operational efficiency.

Recent Trends in Medical Device Connectivity Market

- Increasing Demand for Real-Time Data:

Hospitals and clinics are rapidly adopting connected devices to enable seamless real-time data sharing and improve patient monitoring efficiency. - Rise of Wireless and IoMT Technologies:

The use of Wi-Fi, Bluetooth, and 5G is growing fast, supporting the Internet of Medical Things (IoMT) and enabling better remote healthcare solutions. - Growth in Hybrid Connectivity Systems:

Healthcare facilities are now combining wired and wireless systems to balance stability with flexibility in data transmission. - Expansion of Connectivity Services:

With more complex medical systems, hospitals are investing in integration, installation, and maintenance services to ensure smooth device connectivity. - Regulatory Push for Interoperability:

Global healthcare authorities are emphasizing standardized and secure data-sharing systems to ensure device compatibility and patient safety. - Focus on Cybersecurity:

As more devices connect digitally, protecting patient data and preventing cyber threats has become a top priority for manufacturers. - Growth in Remote and Home Monitoring:

Medical device connectivity is expanding beyond hospitals to home-based care, enabling continuous health tracking and telemedicine. - Technological Advancements in Smart Devices:

Next-generation devices are being designed with built-in connectivity features that automatically update data into digital health records.

Market Outlook

- Industry Growth Overview: The market for medical device connectivity is expanding quickly as clinics and hospitals use connected devices to enhance patient monitoring, optimize workflows, and interface with electronic health records. Global demand for interoperable medical devices is being driven by the growing emphasis on telehealth, remote monitoring, and real-time data sharing.

- Sustainability Trends: Sustainability in this market focuses on efficient resource use and extending device lifecycles. Connected platforms allow remote maintenance, predictive servicing, and reduce on-site hardware needs, lowering waste and energy consumption while improving operational efficiency.

- Global Expansion: Due to its high level of digital adoption and sophisticated healthcare infrastructure, North America currently leads the medical device connectivity market. Asia Pacific, on the other hand, is the fastest-growing region due to the expansion of hospital networks, the growing emphasis on interoperability in regulations, and the increasing demand for telehealth solutions in underserved and remote areas.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 24.96% |

| Market Size in 2025 | USD 3.38 Billion |

| Market Size in 2026 | USD 4.08 Billion |

| Market Size by 2035 | USD 20.10 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Components and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

The integration of wireless medical devices and WLAN infrastructure along with rising prevalence of cancer

The adoption of wireless medical devices and wireless local area network (WLAN) infrastructure in hospitals and healthcare facilities has significantly improved patient safety, data accuracy, and overall patient care. WLAN facilitates seamless health data transmission, communication, and patient monitoring, enabling clinicians and nurses to make informed clinical decisions and deliver timely interventions. This technology allows for the delivery of accurate patient information directly to personal digital assistants (PDAs) or smartphones, empowering healthcare professionals to provide high-quality care and improve healthcare management processes. Thereby, such integration is observed to act as a driver for the medical device connectivity market.

- The rising prevalence of cancer, as reported by the International Agency for Research on Cancer (IARC) and Global Cancer Observatory (GLOBOCAN), underscores the increasing demand for advanced technologies, including wireless medical devices and WLAN infrastructure. In Asia, countries like China, India, and Japan have witnessed a significant increase in cancer cases, contributing to the global burden of cancer. With an expected 18.1 million new cancer cases globally in 2020, there is a pressing need for enhanced patient monitoring, detailed care, and efficient healthcare management strategies.

Wireless technology plays a crucial role in addressing the complex needs of cancer patients by enabling continuous monitoring, real-time data transmission, and remote patient management. Patients undergoing cancer treatment require close monitoring of vital signs, medication adherence, and symptom management, all of which can be facilitated through wireless medical devices and WLAN infrastructure. These technologies enhance the efficiency of healthcare delivery, improve patient outcomes, and contribute to a higher quality of life for cancer patients.

The integration of wireless medical devices and WLAN infrastructure not only enhances patient care but also optimizes healthcare workflows, reduces medical errors, and enhances operational efficiency in healthcare settings. As the demand for advanced healthcare technologies continues to rise, the market for wireless medical devices and WLAN infrastructure is expected to experience significant growth, driven by the need for innovative solutions to address the evolving healthcare challenges, including the increasing burden of cancer worldwide.

Restraint

High deployment costs for small healthcare companies

The cost associated with implementing interoperability and connectivity solutions for medical devices poses a significant challenge for small-scale healthcare organizations, which is observed to act as a restraint for the medical device connectivity market. While internet connectivity has the potential to enhance patient care and streamline medical workflows, the complexities involved in implementing and maintaining these solutions can be daunting for organizations with limited resources. Small-scale healthcare providers often struggle with the technical intricacies of integrating multiple networks, wireless connectivity options, and ensuring robust security measures to safeguard sensitive patient data.

Each layer of connectivity introduces additional costs, including equipment procurement, installation, configuration, and ongoing maintenance. Moreover, the constant evolution of cybersecurity threats necessitates continuous updates and investments in security infrastructure, further adding to the financial burden. The high cost of implementing and maintaining connectivity solutions acts as a barrier to market growth, particularly for smaller healthcare organizations with constrained budgets. Many of these organizations prioritize essential healthcare services and infrastructure investments over costly connectivity solutions, resulting in limited access to advanced medical technologies and interoperability features.

Addressing the affordability and accessibility of connectivity solutions is crucial to overcoming this barrier and promoting widespread adoption of interoperable medical devices. Industry stakeholders, policymakers, and technology providers need to collaborate to develop cost-effective solutions tailored to the needs of small-scale healthcare organizations, thereby democratizing access to advanced healthcare technologies and improving patient outcomes across diverse healthcare settings.

Opportunity

Increasing organizational initiatives

The initiatives undertaken by authorized organizations, such as the United States Department of Health and Human Services (HHS) and collaborative efforts between countries like India and Japan, are instrumental in driving the growth of the medical device connectivity market. In the United States, initiatives aimed at achieving interoperability in health IT infrastructure, as advocated by HealthIT.gov, underscore the importance of seamless data exchange and connectivity across healthcare systems. By promoting interoperability standards and facilitating the integration of medical devices with electronic health records (EHRs) and health information exchange (HIE) networks, these initiatives foster a more connected and efficient healthcare ecosystem.

Additionally, the collaboration between India and Japan to manufacture medical equipment represents a significant investment in healthcare infrastructure. The substantial financial commitment, amounting to USD 42 billion over five years, reflects the growing recognition of the importance of advanced medical technologies and connectivity solutions in improving healthcare delivery and outcomes. These initiatives not only drive innovation and technological advancements in the medical device connectivity space but also create opportunities for market expansion and diversification. By fostering international partnerships and promoting the adoption of interoperable health IT solutions, authorized organizations contribute to the development of robust and interconnected healthcare systems capable of delivering high-quality care to patients worldwide.

Segment Insights

Components Insights

The wireless segment held the highest market share of 48% in 2025. The wireless technologies segment dominates the medical device connectivity market, primarily due to its ability to enhance patient care by enabling real-time updates to doctors. This facilitates prompt treatments, potentially shortening hospital stays and reducing costs through remote patient monitoring. Moreover, wireless technologies offer these benefits without compromising treatment efficacy, making them increasingly popular in the healthcare sector. As a result, the wireless technologies sector continues to expand within the industry, driven by the growing demand for efficient and effective patient care solutions.

The wired segment is anticipated to witness rapid growth at a significant CAGR of 23.9% during the projected period. Wired technologies provide stability in connectivity, ensuring consistent and reliable communication between medical devices and systems. Additionally, they offer high-speed data transmission, facilitating quick exchange of critical patient information. Moreover, wired technologies are known for their ease of access and installation, making them a preferred choice for healthcare facilities looking to implement robust connectivity solutions. These factors collectively contribute to the increasing adoption and development of wired technologies in the medical device connectivity market, driving its growth in the coming years.

Application Insights

The hospitals segment has held a 50.7% market share in 2025. The hospitals segment has emerged as the dominating segment due to several key factors. With a high volume of patients, hospitals possess substantial financial resources to invest in cutting-edge medical device connectivity solutions. Moreover, as hospitals face declining profits, there is an increased focus on delivering superior patient care and safety, prompting investments in advanced connectivity technologies. This emphasis on enhancing patient outcomes and safety drives the adoption of medical device connectivity solutions within hospitals and surgical centers, consolidating their position as leaders in the market.

The ambulatory care centers segment is anticipated to witness significant growth of 21.4% over the projected period. These centers are increasingly adopting advanced medical device connectivity solutions to streamline operations, enhance patient care delivery, and improve efficiency. With the rising demand for outpatient services and the shift towards value-based care, ambulatory care centers are investing in connectivity technologies to optimize workflows, facilitate real-time data access, and ensure seamless coordination of care. The integration of medical devices with connectivity solutions enables ambulatory care centers to improve patient outcomes, enhance clinical decision-making, and drive operational excellence, thereby fueling their growth in the medical device connectivity market.

Regional Insights

What is the U.S. Medical Device Connectivity Market Size?

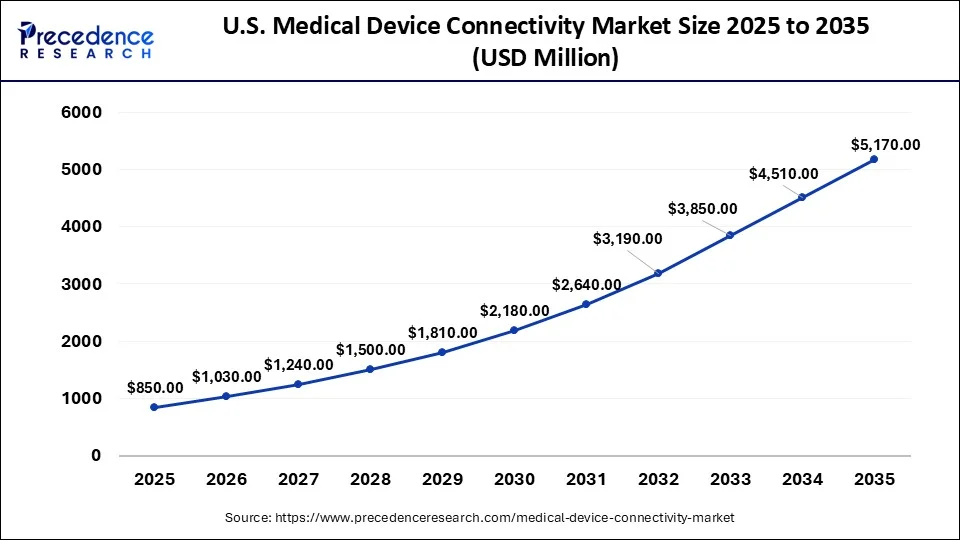

The U.S. medical device connectivity market size is estimated at USD 850 million in 2025 and is predicted to be worth around USD 5,170 million by 2035 at a CAGR of 25.32% from 2026 to 2035.

North America led the market with the biggest market share of 36% in 2025. This growth is driven by stringent regulatory standards and a strong emphasis on patient safety within the region. The implementation of robust medical device connection solutions, in compliance with regulatory requirements, is significantly contributing to the market's revenue growth trajectory in North America. As healthcare providers prioritize seamless integration and interoperability of medical devices to enhance patient care and streamline clinical workflows, the demand for advanced connectivity solutions is expected to continue rising, further fueling market expansion in the region.

Asia Pacific is estimated to expand at the fastest CAGR of 25.7% between 2026 to 2035. Rapid market expansion is fueled by escalating investments in research and development, aimed at fostering technologically advanced medical facilities. Favorable government initiatives and rising per capita income levels further propel market growth. China dominates the Asia-Pacific medical device connectivity market due to its large healthcare sector and technological advancements. Additionally, the Indian market is expected to exhibit steady growth, supported by increasing adoption of healthcare technologies and rising healthcare spending. Overall, these factors contribute to the rapid expansion of the medical device connectivity market in the Asia-Pacific region.

What are the Advancements in the Medical Device Connectivity Market in Europe?

Germany Medical Device Connectivity Market Trends: The country's market landscape consists of a mix of established firms and innovative startups, all coming up with innovative offerings in order to meet the growing demand for connected medical devices. As the region gains momentum in digital transformation, its market position is set for steady growth.

The medical device connectivity market in the Europe region has the second-highest market share. The market is witnessing significant growth in the region, driven by the widespread adoption of connection systems and services for medical equipment. Countries like Germany, with its advanced healthcare infrastructure, lead the market with substantial market share. Meanwhile, the UK is poised for substantial growth, spurred by increasing investments in healthcare technology.

What are the Key Trends in the Medical Device Connectivity Industry in Latin America?

Latin America is expected to go through substantial growth in the market. This growth is driven by advancements in technology as well as the increasing demand for integrated healthcare solutions. The region is also witnessing a shift towards digital health, with healthcare providers aiming to enhance patient care through connected devices.

The region is also supported by robust government initiatives that help to improve healthcare infrastructure and promote telemedicine. This regulatory support gives rise to investments, encouraging local manufacturers to develop advanced solutions.

Brazil Medical Device Connectivity Market Trends: The country is showcasing a strong demand for innovative healthcare solutions. It is also witnessing a heightened focus on interoperability, enabling seamless communication between various medical devices. Government initiatives and healthcare infrastructure investments are supporting enhanced connectivity adoption, while the growth of private healthcare and telehealth ecosystems further fuels market momentum.

How is the Middle East and Africa Region Growing in the Medical Device Connectivity Market?

The Middle East and Africa region is experiencing steady growth in the market and is expected to maintain this trajectory in the upcoming years. This growth is due to the fact that the region has a growing focus on healthcare modernization, driven by increasing investments in healthcare and technology. Countries like South Africa and the UAE are leading players, as there are a lot of international companies striving to establish their market position here.

Saudi Arabia Medical Device Connectivity Market Trends: The country is a hub for key players, which is fostering innovation and competition. As the region continues to actively invest in healthcare technology, growth in medical device connectivity will rise.

Value Chain Analysis

- R&D: R&D in the medical device connectivity market is focused on integrating AI, IoT, and cloud computing to enhance real-time patient monitoring and data interoperability. Companies are developing secure, plug-and-play connectivity solutions to ensure seamless communication across diverse healthcare systems.

- Clinical Trials & Regulatory Approvals: In hospitals and home care environments, clinical validations are being carried out to evaluate the dependability and cybersecurity of linked medical devices. To guarantee patient data safety and interoperability standards, regulatory bodies are releasing updated compliance frameworks.

- Patient Support and Services: To help patients use connected health devices efficiently, healthcare providers are offering remote assistance and device training programs. Mobile apps and improved telehealth integration are enhancing patient monitoring engagement and the general healthcare experience.

Medical Device Connectivity Market Companies

- Cerner Corporation (U.S.)

- Medtronic (Ireland)

- Masimo (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- General Electric (U.S.)

- Stryker (U.S.)

- iHealth Labs Inc., (U.S.)

- Cisco Systems, Inc. (U.S.)

- Lantronix Inc. (U.S.)

- Infosys Limited (India)

- Silicon & Software Systems Ltd. (Ireland)

- Hill-Rom Services Inc. (U.S.)

- Silex Technology America, Inc (Japan)

- Digi International Inc. (U.S.)

- Baxter (U.S.)

- TE Connectivity (Switzerland)

- Bridge-Tech (U.S)

- MediCollector (U.S.)

Recent Developments

- In October 2025, Medtronic launched a new cloud-based platform designed to facilitate seamless connectivity between medical devices and healthcare providers. This platform aims to streamline data sharing and enhance clinical decision-making processes. The introduction of this technology reflects Medtronic's focus on harnessing data to improve patient outcomes and operational efficiencies, positioning the company as a leader in the connectivity space.

(Source: https://www.medtronic.com) - In April 2025, Philips unveiled a new cutting-edge Elevate Platform upgrade release on the EPIQ Elite ultrasound imaging platform at UltraFest 2025 in India. This pioneering solution addresses the increasing demand for streamlined workflows and greater diagnostic efficiency, enabling clinicians to deliver timely, confident decisions for a wider range of patients.

(Source: https://www.philips.co.in) - In February 2025,Capgemini announced a report on 2025 healthcare trends, emphasizing the push for cost efficiency and the crucial role of digital tools and technology in creating a more connected and data-driven healthcare system.

(Source: https://www.capgemini.com) - In January 2025, Global Health Intelligence announced a 2025 forecast for emerging markets, predicting a rise in public-private partnerships and the expansion of health insurance, which will drive the adoption of medical device technology and connectivity.

(Source: https://globalhealthintelligence.com)

Segments Covered in the Report

By Components

- Wireless

- Wired

- Hybrid Technologies

By Application

- Hospitals

- Home Healthcare Centers

- Diagnostic Centers

- Ambulatory Care Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting