What is Men Skin Care Products Market Size?

The global men skin care products market size is estimated at USD 17.96 billion in 2025 and is projected to hit around USD 31.40 billion by 2034, growing at a CAGR of 6.37% from 2025 to 2034. The men skin care products market is driven by changing societal standards and growing concern for personal grooming amongst men.

Market Highlights

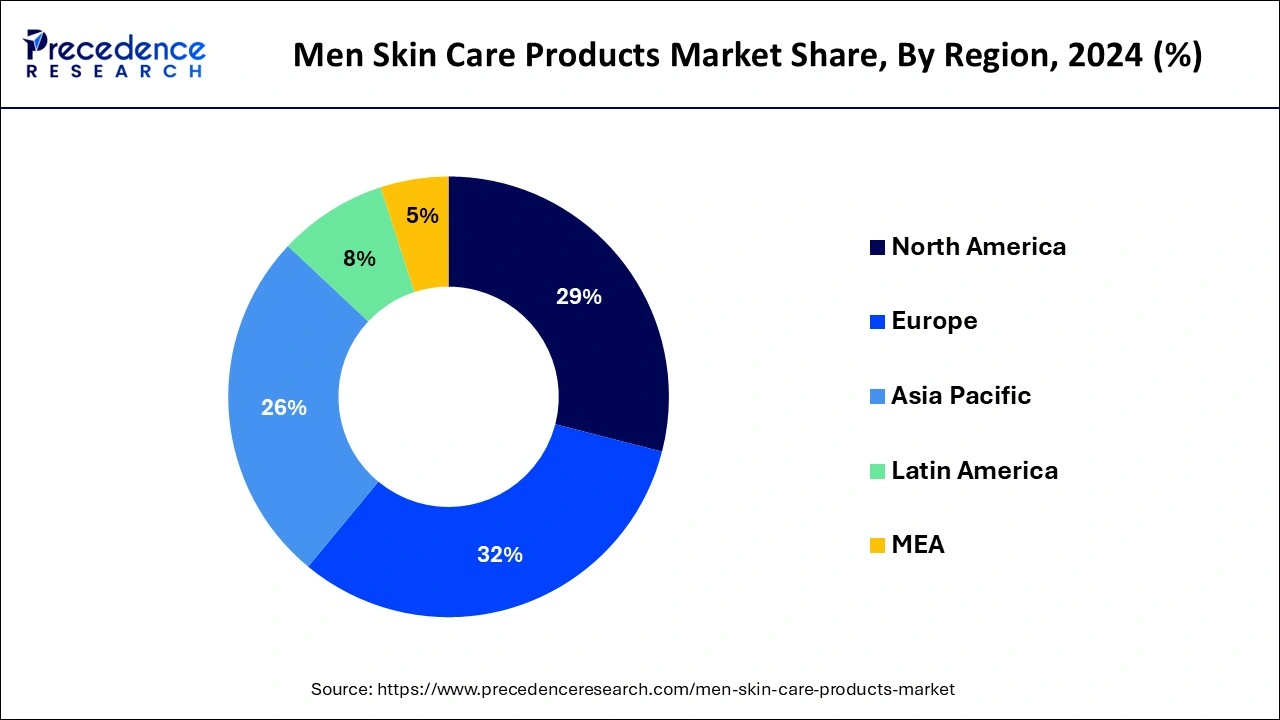

- Europe contributed more than 32% of market share in 2024.

- Asia-Pacific is observed to witness the fastest expansion during the forecast period of 2025 to 2034.

- By type, the synthetic segment held the dominating share of the market in 2024.

- By product, the cream & moisturizers segment dominated the men skin care products market in 2024.

- By age group, the 19 to 35 segment dominated the market in 2024.

- By distribution channel, the supermarket & hypermarket segment held the largest share of the market in 2024.

- By distribution channel, the e-commerce segment is expected to expand at the fastest rate during the forecast period.

Men Skin Care Products Market Overview: Redefining Men's Beauty

The men's skincare products market refers to the industry that produces and sells various skincare and grooming products specifically designed for men. This market has been experiencing growth and evolution in response to changing societal attitudes toward grooming and self-care for men. Men are becoming more interested in learning about skin health as we enter an era of skincare enlightenment.

Additionally, they are learning more about the issues with modern skincare brought on by aggressors outside the body and the abuse of active chemicals, which can occasionally be more harmful than beneficial. The growing understanding of the significance of skin health is one of the factors behind the men's skincare revolution. A young appearance is increasingly in demand for social interactions, dating, the workplace, and meetings., the recent change in perspective regarding physical appearance is observed to act as a major growth factor for the market.

Men Skin Care Products Market Growth Factors

- The market for skin nutrition products has grown as worries about skin nourishment due to acne, black spots, wounds, dullness, and sunburn have grown. Younger people demand more skin-brightening creams, toners, and scrubs.

- Men are becoming more at ease with expressing who they are and prioritizing skincare and other forms of self-care.

- Through influencer marketing, media coverage, and educational programs, men realize how vital skin health is. The desire for solutions that target skin issues like acne, sun damage, and ageing is fueled by this awareness.

- Innovative products catered to men's skin types and concerns are increasing in the market. Examples include sunscreens with anti-ageing properties, oil-free moisturizers, and creams for maintaining beards.

- Men can purchase skincare products more quietly and privately due to the convenience of online platforms and increased product choice.

Men Skin Care Products Market Outlook: A Look Towards the Trends

- Industry Growth Overview: The growing skin health awareness, online platforms, and shift toward premium natural and multifunctional products are responsible for industry growth.

- Major Investors: Large multinational consumer goods corporations, private equity, and venture capital firms are the major investors.

- Startup Ecosystem: The development of direct-to-consumer brands, personalized solutions with natural ingredients, and sustainable packaging is the focus of the startup ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.96 Billion |

| Market Size in 2026 | USD 19.06 Billion |

| Market Size by 2034 | USD 31.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Product, By Age Group, and By Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Focus on health and wellness

Men are increasingly prioritizing their health and general well-being more and more as society's views on hygiene and self-care change. Due to this change, there is an enormous requirement for skincare products made especially for males that not only help with skin health issues but also address cosmetic concerns. Customers are becoming more aware of the value of good skin and understand that skincare promotes general wellbeing and looks. Men seek products that complement their health-conscious lifestyle and provide practical solutions. This has forced the skincare sector to adapt and create goods that address the particular requirements of men's skin while fusing advantages related to appearance and health.

Restraints

Limited product knowledge

This constraint arises from men's need for more awareness and understanding regarding the variety of skincare products available and their specific benefits. Many men traditionally need to be actively engaged in skincare routines, leading to a gap in knowledge about the diverse range of products catering to different skin types and concerns.

As a result, men may need help making informed decisions about which skincare products suit their needs. Limited awareness can hinder the adoption of skincare practices among men and impede market growth. Efforts to educate and raise awareness about the benefits and usage of skincare products tailored for men are crucial in overcoming this restraint and expanding the market.

Pricing and value perception

Men have historically been less interested in skincare regimens than women and are more cost-conscious. Higher prices could put off prospective buyers, mainly if they think the goods are novel or unnecessary for skincare. The perceived worth of a brand significantly influences the acceptance of pricing. While new entrants might require a track record to support premium pricing, well-known businesses with a strong reputation might command higher rates. Men's lack of knowledge and comprehension of the advantages of skincare products might result in items being undervalued. To explain skincare's benefits and defend its cost, marketing and education campaigns must be successful.

Opportunity

Emergence of personalized products

Personalized skincare products that suit people's skin types, issues, and lifestyles are in high demand. Brands may create customized products and routines by analyzing client data through advanced technologies like artificial intelligence (AI) and data analytics. Customizing formulas for skin issues like ageing, sensitivity, or acne increases client happiness and retention. Niche goods provide tailored solutions for demands, targeting specific market segments within the men's skincare industry. Niche products might focus on new trends or specific tastes, including natural materials, eco-friendly packaging, or skincare practices particular to a specific culture.

Segment Insights

Type Insights

The synthetic segment dominated the men skin care products market in 2024. For businesses aiming for mass production, producing a synthetic product is frequently less expensive and quicker. Petrochemicals, artificial scents, PEG, harsh sulphates, and synthetic preservatives with a low concentration of skin-beneficial active ingredients are typically found in these products.

The natural/ organic/ herbal segment is the fastest growing in the men skin care products market during the forecast period. The main factor driving the desire for natural skincare options is growing awareness of the damaging effects of chemical-based products on the skin. Businesses in the men's personal care sector are concentrating on providing customers with an increasing number of goods made with natural ingredients. In addition, men are choosing natural ingredients for personal care products over the chemicals found in conventional goods.

Product Insights

The cream & moisturizers segment held the largest share of the market in 2024. The segment's dominance can be ascribed to rising consumer knowledge, the need for specialized solutions, formulation developments, and changing social perceptions of men's grooming. For instance, in April 2022, German cosmetics giant Beiersdorf introduced the first cosmetic product of recycled CO2 and owns many well-known beauty brands, including Nivea. This is accomplished by technology that captures and recycles carbon dioxide, which is then utilized to make the Nivea Men Climate Care Moisturizer.

The cleansers & face wash segment is the fastest growing in the men skin care products market during the forecast period. A profound change in society that acknowledges the value of skincare in preserving young, healthy skin. The need for specialized goods has increased due to the shift in views around grooming and self-care. One can feel confident knowing that more and more guys are joining the growing trend of taking better care of their skin. You may efficiently remove oil, grime, and pollutants from the skin using cleansers and facial wash products made just for guys. These products are specially designed to address the qualities of men's skin, namely higher oil production and thicker texture. Manufacturers have made it easy for men to integrate skincare into their everyday lives by developing a wide choice of cleansers and face wash products.

Age Group Insights

The 19 to 35 segment held the largest market share in 2024. The importance of outward appearance has grown in the modern world with the rise of social media. Beyond social media, physical appearance matters in real life as well. In today's world, people value and accept well-groomed individuals. The younger generation increasingly focuses on aesthetics in life, fashion, and physical attractiveness. The demand for men's skincare products has increased due to the growing emphasis on physical appearance, the growth of social media, rising disposable income, and improved self-care knowledge.

Distribution Channel Insights

The supermarket & hypermarket segment held the dominating share in 2024. Skincare products are usually available in a wide variety of products at supermarkets and hypermarkets. Many customers can easily access men's skincare products by integrating them into the current beauty and personal care areas. Stores like supermarkets and hypermarkets offer a convenient setting for buying various items, including beauty products, and men may prefer one-stop shopping experiences.

The prominence of these retail channels is partly due to their accessibility and convenience. Discounts, sales, and advertising campaigns are common strategies supermarkets and hypermarkets use to draw in customers. Sales of men's skincare products can be significantly increased by such promotional efforts, mainly if there are appealing discounts or packaged offers.

The e-commerce segment is the fastest growing in the men skin care products market throughout the forecast period. Customers prefer online shopping due to its convenient availability and accessibility. Online sales are increasing as a result of the work. The usage of smartphones for online shopping and the rise in internet penetration are the primary motivators. This allows manufacturers to build shopping portals and partner with other e-retailers to expand their distribution networks. It is noteworthy that South Korea has the most significant rate of smartphone ownership, the highest broadband penetration rate, and the fastest average internet speed. South Korean customers' use of e-commerce platforms to buy cosmetics is growing in popularity.

Regional Insights

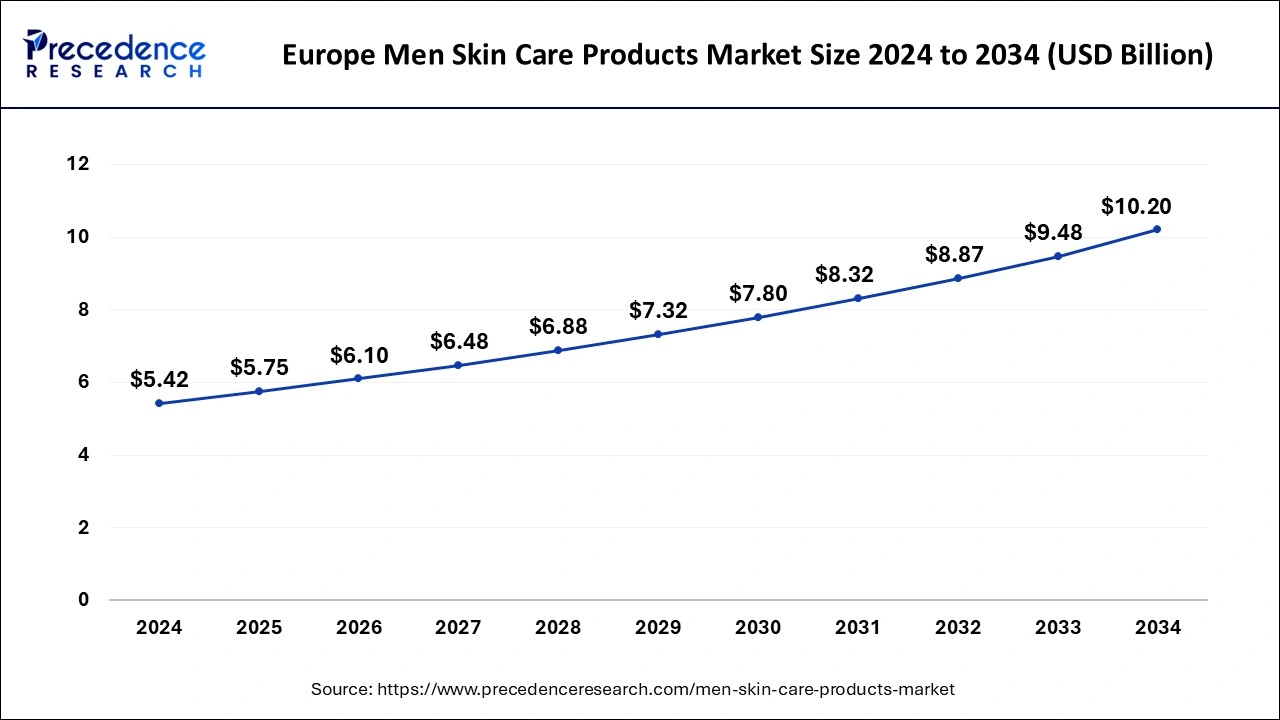

Europe Men Skin Care Products Market Size and Growth 2025 to 2034

The Europe men skin care products market size is valued at USD 5.75 billion in 2025 and is expected to reach around USD 10.20 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034.

Europe Driven by Growth in Men's Skin Products Consumption

Europe held the largest share of 32% in men skin care products market. This was brought on by men's high consumption of high-end skincare and shave care products in Germany, Italy, and the United Kingdom. There has been a noticeable change in European attitudes regarding men's care and grooming. The idea that skincare is essential to general wellness and self-care is becoming more widely accepted. Men are willing to spend money on skincare and other grooming goods as they become increasingly self-conscious about their appearance. In the men's skincare sector, there is an increasing tendency toward premiumization, where consumers are ready to pay more for upscale, high-quality goods. European companies have effectively capitalized on this trend by positioning themselves as premium and drawing in customers searching for high-end, efficient skin care products.

Rapid Urbanization Boosts the Asia Pacific

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. The region's fast urbanization has changed men's lifestyles; more of them include skincare regimens in their everyday grooming routines. In response to consumer demand, the beauty industry has launched an extensive array of customized skincare products designed to meet the specific requirements of males. This includes male-specific cleansers, moisturizers, anti-ageing treatments, and sunscreens. Customers now have easier access to skincare goods because of the growth of e-commerce platforms. Men in Asian countries are increasingly buying skincare goods online, fueling the market's explosive expansion.

- For instance, the Korean cosmetics market is booming. As K-Drama and K-pop, sometimes called K-wave, became more popular. This led to the phrase "K-Beauty," reflecting Korean products' expanding renown. Associated businesses expanded and diversified their product lines and brands, exporting to North America and Europe nations. With the highest smartphone ownership percentage in the world, Korea has seen an increase in internet marketing in recent years.

Growth in Young Male Stimulates China

China is experiencing a rise in the young male population, which is increasing the use of men's skin care products. The growing awareness through online platforms is also increasing their demand. This is increasing the development of acne solutions, skin brightening products, and anti-aging creams.

Growing Skincare Awareness Fuels the UK

The growing skincare awareness is increasing the demand for men's skin care products. This is driving the expansion in the development of natural or organic products, which is attracting consumers. Additionally, the growing retail ecosystem is also increasing their accessibility, increasing their adoption rates.

Increasing Social Media Influence Propels North America

North America is expected to grow significantly in the men's skin care products market during the forecast period, due to growing social media influence. This is increasing the acceptance rates of various men's skin care products, promoting their innovations. The growing e-commerce platforms and demand for natural skin care products are also contributing to the market growth.

Men's Grooming Culture Facilitates U.S.

Increasing men's grooming culture in the U.S. is increasing the demand for men's skin care products. The growing awareness through social media is also increasing its demand. Additionally, the presence of well-developed retail channels and companies is increasing their use and development, respectively.

Value Chain Analysis: Behind the Men's Grooming

- Product Conceptualization and Design

The development of simple, multifunctional, and effective solutions is the focus of the product conceptualization and design for men's skin care products.

Key players: Nivea Men, Lumin, Jack Black - Raw Material Procurement

Raw material procurement of men's skin care products involves the sourcing of emollients, active agents, and packaging components from major suppliers.

Key players: Givaudan, Corda, BASF. - End-of-Life Management

End-of-life management of men's skin care products involves initiatives for recycling and refilling packaging to reduce landfill waste.

Key players: L'Oreal S.A., Kiehl's

Key Players in Men Skin Care Products Market and Their Offerings

- Procter & Gamble plc: Gillette double duty face moisturizer SPF 20 and Gillette pro after shave splash icy cool are provided by the company.

- L'Oreal S.A: The company provides Vita Life anti-wrinkle & firming moisturizer, shave care products, and hydra energetic Extreme Cleanser infused with charcoal.

- Unilever PLC: Dove men+care products, Axe, Glow & Handsome, etc, are provided by the company.

- Clinique Laboratories: The company offers Clinique for men broad-spectrum SPF 21 moisturizers, charcoal face wash, anti-age moisturizer, etc.

- Emani Limited: Products like Fair & Handsome Instant Radiance Face Wash, Smart and Handsome 100% oil-clear face wash, and brightening cream for men are provided by the company.

Segments Covered in the Report

By Type

- Synthetic

- Natural/ Organic/ Herbal

- Others

By Product

- Shave Care

- Cream & Moisturizers

- Sunscreen

- Cleansers & Face Wash

- Others

By Age Group

- Below 18

- 19 to 35

- 36 to 50

- Above 50

By Distribution Channel

- Supermarkets And Hypermarkets

- Convenience Stores

- Pharmacies

- E-Commerce

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting