What is the Micro Irrigation Systems Market Size?

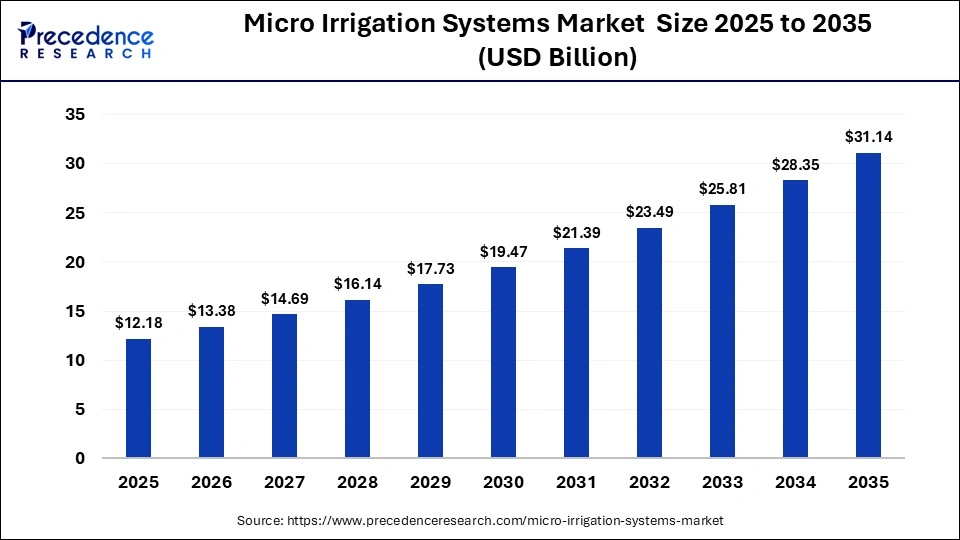

The global micro irrigation systems market size was calculated at USD 12.18 billion in 2025 and is predicted to increase from USD 13.38 billion in 2026 to approximately USD 31.14 billion by 2035, expanding at a CAGR of 9.84% from 2026 to 2035.The market is driven by the rising demand for precision agriculture and water conservation.

Market Highlights

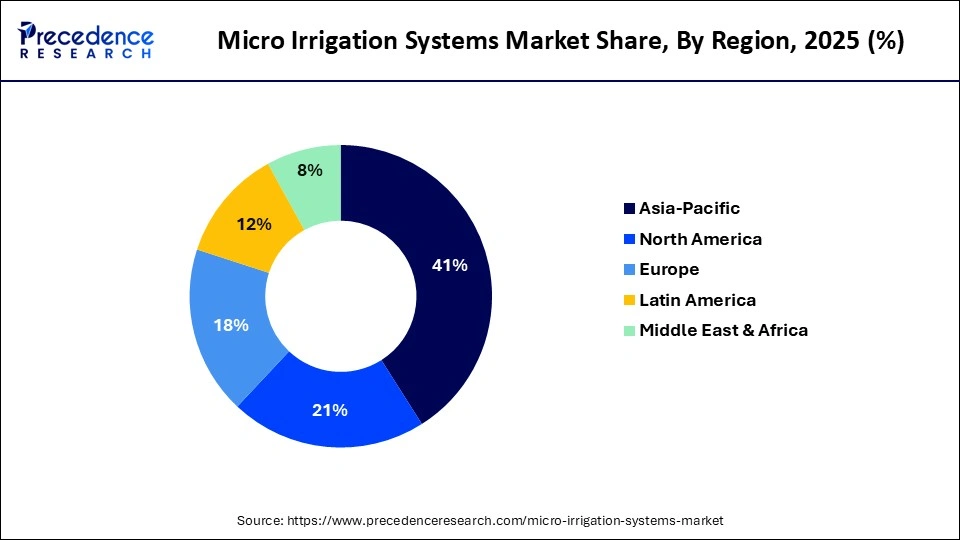

- Asia Pacific led the global market with the highest share of approximately 41% in 2025.

- Latin America is expected to grow at the fastest CAGR between 2026 and 2035.

- By system type, the drip irrigation systems segment led the market with the highest share of approximately 58% in 2025.

- By system type, the micro sprinkler irrigation systems segment is expected to expand at the highest CAGR between 2026 and 2035.

- By component type, the pipes & tubes segment led the market with a major share of approximately 28% in 2025.

- By component type, the controllers & automation units segment is expected to grow at a significant rate between 2026 and 2035.

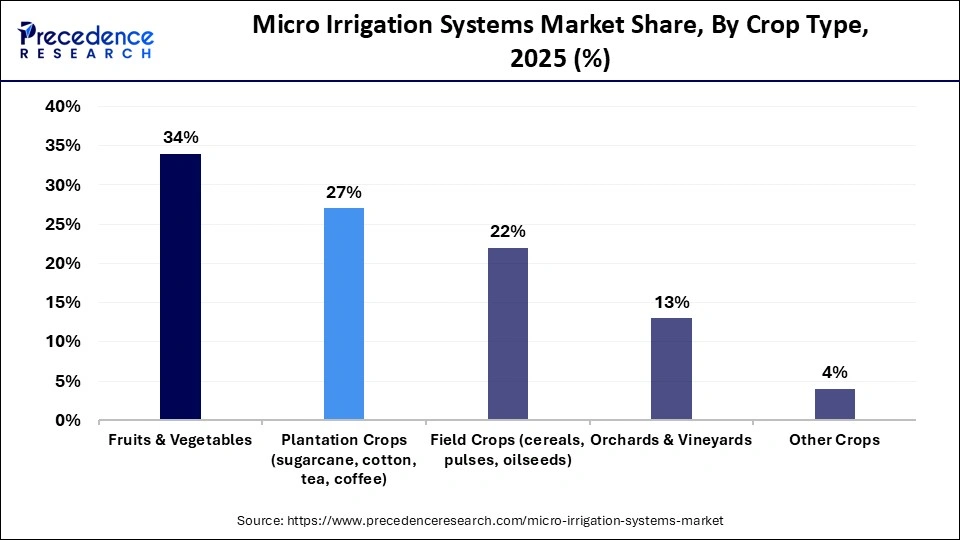

- By crop type, the fruits & vegetables segment led the market with the largest share of approximately 34% in 2025.

- By crop type, the plantation crops segment is expected to grow at the highest CAGR between 2026 and 2035.

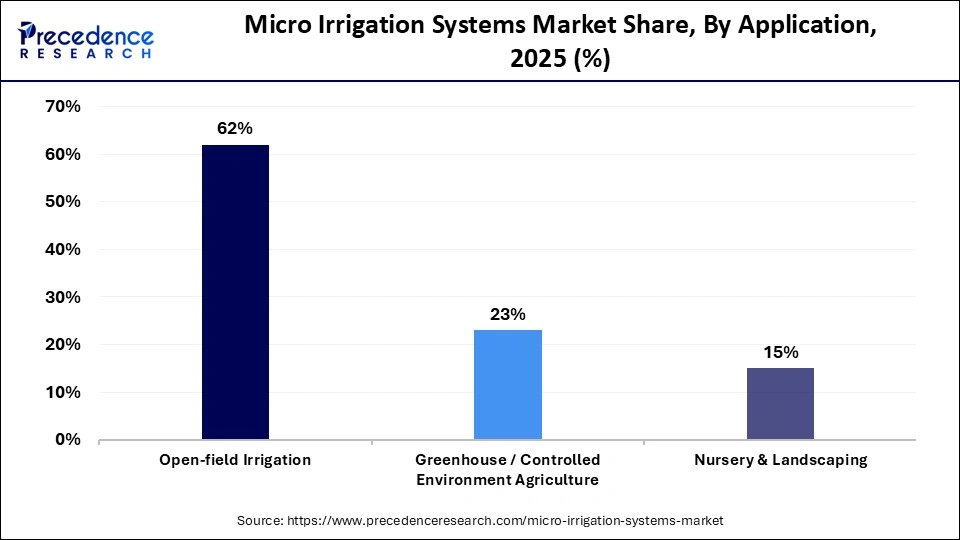

- By application, the open-field irrigation segment led the market with the highest share of approximately 62% in 2025.

- By application, the greenhouse / controlled environment agriculture segment is expected to grow at the fastest rate from 2026 to 2035.

What is the Micro Irrigation Systems Market?

The global micro irrigation systems market includes water-efficient irrigation technologies that deliver water directly to the root zone of crops in controlled volumes, minimizing evaporation and runoff losses. The market spans drip irrigation, sprinkler-based micro systems, micro-sprayers, emitters, tubing, filtration, fertigation units, valves, and automation-enabled controllers deployed across field crops, horticulture, orchards, greenhouses, and plantations. Growth is driven by rising water scarcity, adoption of precision farming, government subsidies for efficient irrigation, and increasing emphasis on higher yield per unit water.

How is AI contributing to the Micro Irrigation Systems Market?

AI is revolutionizing the micro irrigation systems market. AI estimates irrigation water requirements based on the data provided by soil and weather sensors. It also adjusts the irrigation water supply according to predictions. AI prevents water wastage and helps to increase crop yield value. AI systems also track the condition of the irrigation system and identify leaks in the pipeline. It also facilitates water irrigation systems to be monitored remotely using advanced algorithms.

What are the Major Trends Influencing the Market?

- Collaborations & Partnerships: Manufacturers are increasingly partnering with agritech companies and research institutions to develop automated and smart irrigation systems. Such partnerships enhance water-use efficiency, optimize farm yields, and enable precision irrigation. For instance, Netafim partnered with CropX to integrate drip irrigation systems with soil moisture sensors.

- Government Initiatives: Governments worldwide are promoting the adoption of micro irrigation systems to conserve water and improve agricultural sustainability. Farmers benefit from subsidies, incentive programs, and supportive policies, enabling wider adoption of efficient irrigation methods. In Spain, for instance, funding programs have been introduced to support micro irrigation suppliers such as Rivulis and Toro.

- Business Expansions: Key players operating in the market are expanding their manufacturing facilities and distribution networks to meet rising demand in major agricultural regions. By increasing irrigation capacities and streamlining delivery, companies are able to provide faster service and better support to farmers. For example, Netafim expanded operations in Mexico, while Rivulis strengthened its presence in Latin America.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.18Billion |

| Market Size in 2026 | USD 9.84 Billion |

| Market Size by 2035 | USD 31.14Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type , Component, Crop Type , Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

System Type Insights

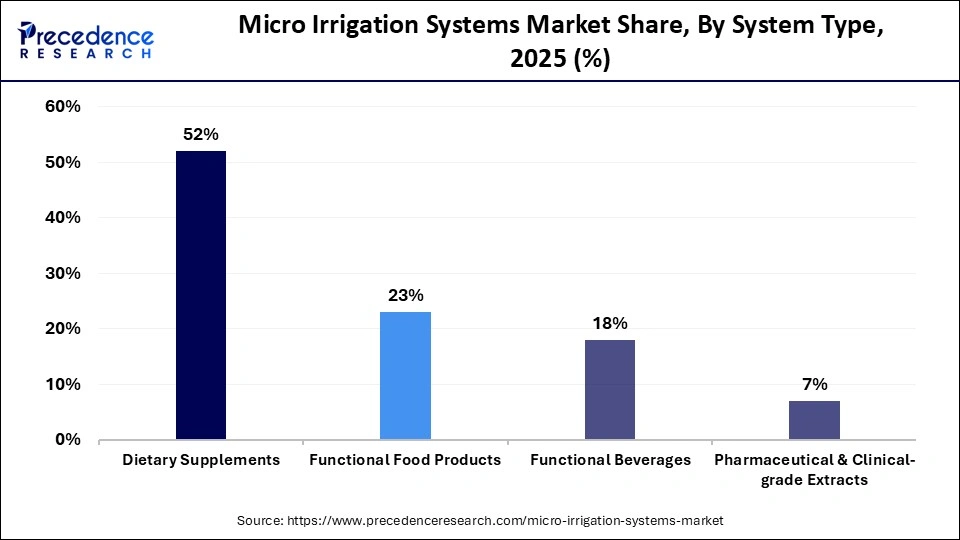

Why Did the Drip Irrigation Systems Segment Dominate the Micro Irrigation Systems Market?

The drip irrigation systems segment dominated the market with the highest share of around 58% in 2025. This is mainly due to their optimized operational efficiency. Drip irrigation systems deliver water directly to the root of the crop, which minimizes water evaporation. These systems improve yields as well as soil conservation. The amount of fertilizer usage is reduced because of controlled, precise fertilizer delivery to crops. These systems are heavily used in horticulture and commercial plantations due to government subsidies and scarcity of water, further solidifying the segment's dominance.

The micro sprinkler irrigation systems segment is expected to grow at the fastest rate during the projection period due to its ability to uniformly distribute water over large areas while minimizing waste, making it ideal for orchards, vineyards, and high-value crops. This type of irrigation system is most suitable for orchards, plantations, and uneven farmlands. It is ideal for areas where water needs to be evenly spread over a large area. This type of irrigation is cheaper than drip irrigation. Micro sprinklers are used for frost protection and cooling. The increasing usage of these systems in vegetable cultivation further supports segmental growth.

Component Type Insights

What Made Pipes & Tubes the Leading Segment in the Micro Irrigation Systems Market?

The pipes & tubes segment led the market with a 28% share in 2025 because they are the core infrastructure of every irrigation setup. They carry water from the source to emitters and sprinklers without loss. These components are required in large volumes across all farm sizes. Regular wear and tear also drives replacement demand. Their widespread use across drip irrigation and micro sprinkler systems ensures the long-term growth of the segment.

The controllers & automation units segment is expected to expand at the highest CAGR in the upcoming period. This segment's growth is driven by the increasing focus on precision and smart irrigation systems. Controllers and automation units facilitate real-time management of water flow location as well as duration. These systems decrease wastage of water and increase uniformity. Automation saves labor and increases operational efficiency. The combination of sensors and mobile application systems results in improved irrigation practices.

Crop Type Insights

Why Did the Fruits & Vegetables Segment Dominate the Micro Irrigation Systems Market?

The fruits & vegetables segment dominated the market while holding a 34% share in 2025. This is mainly due to the high water sensitivity of these crops, which necessitates precise irrigation to maximize yield. Farmers are increasingly adopting drip and micro sprinkler systems to address water wastage and storage challenges while ensuring optimal growth. The growing focus on improved crop quality and higher productivity has further driven the adoption of micro irrigation systems in this segment, resulting in the largest revenue contribution in the market.

The plantation crops segment is expected to grow at the fastest CAGR over the forecast period. This is because plantation crops, such as coffee, tea, cotton, cocoa, and spices, require meticulous water control over a large area of land. Micro irrigation systems ensure better yield, quality, and robust vegetation with less water waste. The demand for plantation crops is increasing globally, driving the adoption of micro irrigation practices.

Application Insights

Why Did the Open-Field Irrigation Segment Lead the Micro Irrigation Systems Market?

The open-field irrigation segment led the global market with the highest market share of approximately 62% in 2025 due to its flexibility and affordability in mass agricultural applications. This system enables equal irrigation of water across a widespread land area. Open-field systems enable efficient water distribution and reduced wastage compared to traditional flood irrigation methods. This results in enhanced crop productivity and resource conservation. The ease of installation and applicability of these systems drives their adoption.

The greenhouse / controlled environment agriculture segment is expected to grow at the highest CAGR throughout the projection period, as these setups require highly accurate water and nutrient management to achieve improved productivity. Micro irrigation systems facilitate the precise delivery of water and reduce waste. It provides support for high-density and high-value crops throughout the year. The increasing focus on sustainable, efficient, and climate-resilient farming drives the demand for micro irrigation systems.

Regional Insights

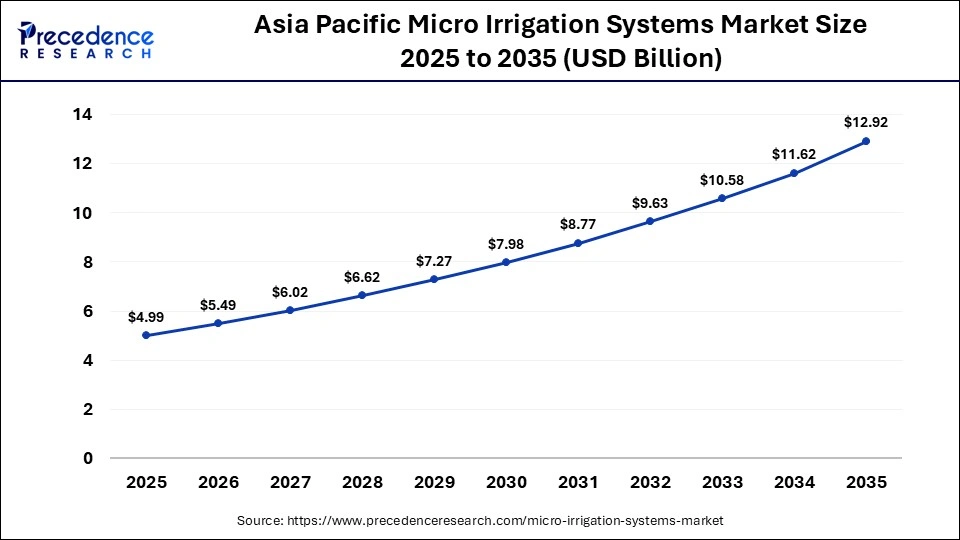

What is the Asia Pacific Micro Irrigation Systems Market Size?

The Asia Pacific micro irrigation systems market size is expected to be worth USD 12.92 billion by 2035, increasing from USD 4.99 billion by 2025, growing at a CAGR of 9.98% from 2026 to 2035.

What Made Asia Pacific the Leading Region in the Micro Irrigation Systems Market?

Asia Pacific led the micro irrigation systems market with the largest share of approximately 41% in 2025. This is mainly due to the increased adoption of micro irrigation agriculture practices, driven by the increasing water scarcity. Governments around the region are supporting water conservation and encouraging the use of efficient irrigation systems through subsidies and programs. The increased adoption of horticultural crops, plantations, and a strong focus on crop protection are further ensuring the long-term growth of the market.

India Micro Irrigation Agriculture Market Trends

India is the major contributor to the market within Asia Pacific due to a high adoption of micro irrigation agricultural practices. The rising water scarcity and the country's economic dependence on agriculture are accelerating the adoption of micro irrigation systems. Government initiatives, including subsidies and irrigation support programs, are encouraging farmers to transition to micro irrigation practices. Techniques such as drip and sprinkler irrigation are increasingly being used to deliver precise amounts of water and fertilizer, optimizing crop yield.

Why is Latin America Considered the Fastest-Growing Region in the Micro Irrigation Systems Market?

Latin America is expected to grow at the fastest CAGR throughout the forecast period, driven by the rapid growth of commercial agriculture and export-oriented farming. The cultivation of high-value fruits, vegetables, and plantation crops to meet export demand places significant pressure on water and soil resources, prompting farmers to adopt micro irrigation methods for precise water management without compromising crop quality. Additionally, climate change and global warming have increased the need for precision irrigation solutions, while rising private investments and gradual government policy support are further accelerating the adoption of micro irrigation practices across the region.

Brazil Micro Irrigation Systems Market Trends

Brazil plays a significant role in the Latin American market, driven by growing demand for export-oriented crops such as fruits, sugarcane, and coffee, which require efficient irrigation solutions. Climate change and periodic droughts have further accelerated the adoption of judicious water management practices in agriculture. Additionally, government initiatives encouraging farmers to implement micro irrigation techniques aim to optimize the nation's agricultural output while conserving water resources, reinforcing Brazil's leadership in the regional market.

Micro Irrigation Systems Market Value Chain Analysis

- R&D and Manufacturing: R&D operations focus on improving the efficiency of the emitter, clog resistance, pressure regulation, and longevity of the system. The manufacturing process involves drip lines, pipes, filters, valves, and smart controllers.

Key Players: Netafim, Rivulis, Rain Bird, and Metzer. - System Integration and Distribution: Various manufacturers assemble parts into irrigating systems, which vary based on crop and farmland size. Irrigation systems are distributed through dealers, agricultural retailers, and direct selling in the case of bigger farms.

Companies include Netafim, Rivulis, and Chinadrip. - Installation and Farmer Support: The installation stage covers system design, on-field installation, and routine maintenance services. Companies also provide training, digital guidance, and technical support.

Key Players: Netafim, Toro, Rain Bird, and Hunter Industries.

Who are the Major Players in the Global Micro Irrigation Systems Market?

The major players in the micro irrigation systems market include Netafim Limited, The Toro Company, Rain Bird Corporation, Hunter Industries, Jain Irrigation Systems, Rivulis Irrigation, Valmont Industries, Finolex Plasson, Antelco, Chinadrip Irrigation Equipment, Lindsay Corporation.

Recent Developments

- In February 2025, Netafim, the precision agriculture arm of Orbia, has launched its patented Hybrid Dripline system, the world's first integral dripline with a built-in outlet. The technology combines the advantages of integral and on-line dripper systems, offering growers a leak-free, clog-resistant, and labor-saving irrigation solution globally.(Source: https://www.netafim.com)

- In November 2025, Nelson Irrigation launched the R7 rotator sprinkler, which provides better water coverage and easier maintenance. R7 rotator sprinklers use quick clean technology and a modular design, which decreases system maintenance time. This sprinkler facilitates uniform irrigation and reduces operational costs.(Source: https://farmersreviewafrica.com)

Segments Covered in the Report

By System Type

- Drip Irrigation Systems

- Inline drip systems

- Online drip systems

- Subsurface drip irrigation (SDI)

- Micro Sprinkler Irrigation Systems

- Micro-sprayers

- Micro-jets

- Other Micro Irrigation Systems

By Component

- Drippers / Emitters

- Pipes & Tubes

- Filters & Filtration Units

- Valves & Fittings

- Sprinklers / Micro-sprayers

- Controllers & Automation Units

By Crop Type

- Fruits & Vegetables

- Plantation Crops (sugarcane, cotton, tea, coffee)

- Field Crops (cereals, pulses, oilseeds)

- Orchards & Vineyards

- Other Crops

By Application

- Open-field Irrigation

- Greenhouse / Controlled Environment Agriculture

- Nursery & Landscaping

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content