What is the Microinsurance Market Size?

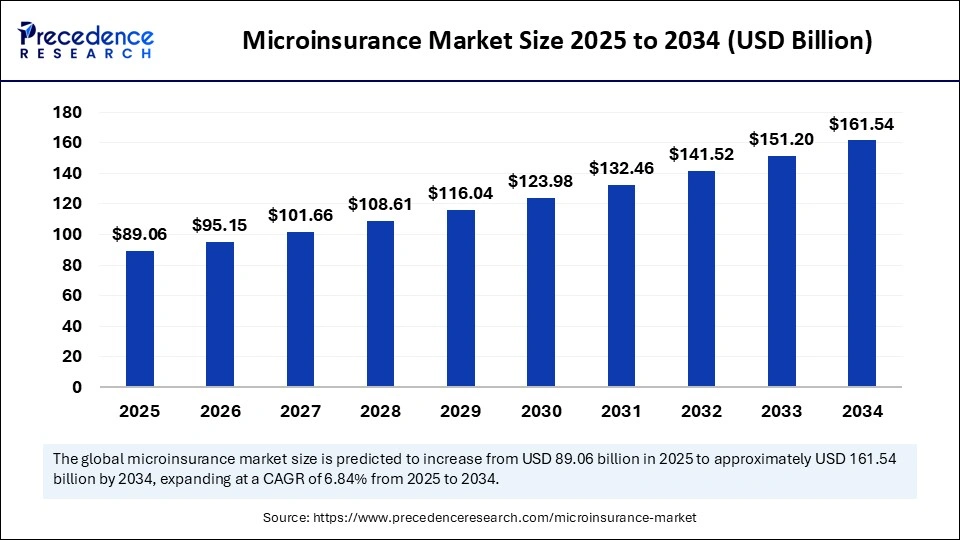

The global microinsurance market size accounted for USD 89.06 billion in 2025 and is predicted to increase from USD 95.15 billion in 2026 to approximately USD 161.54 billion by 2034, expanding at a CAGR of 6.84% from 2025 to 2034. The market growth is attributed to increasing smartphone penetration, mobile money adoption, which enables efficient, low-cost, and accessible insurance solutions for underserved populations.

Market Highlights

- The Asia Pacific accounted for the largest market share of 37% in 2024.

- The North America is expected to grow at the fastest CAGR from 2025 to 2034.

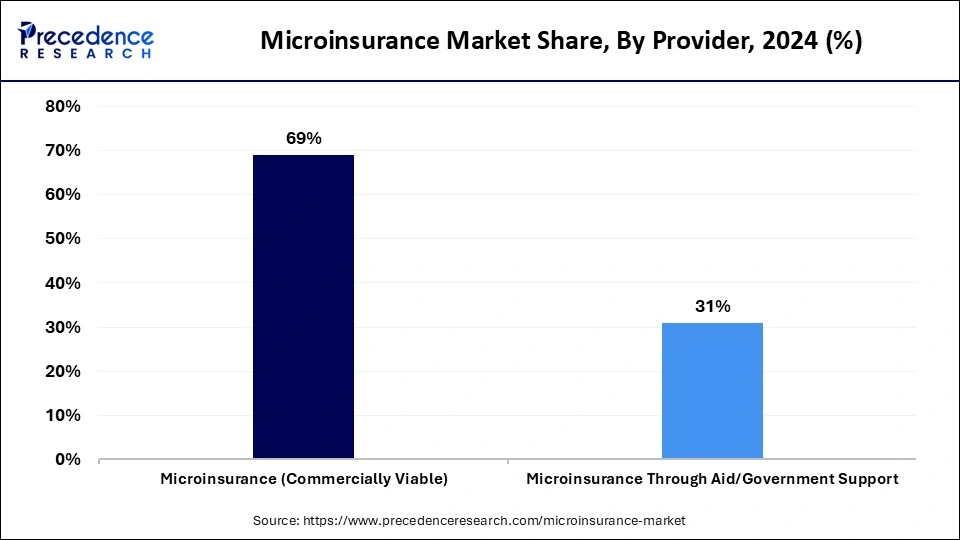

- By provider, the microinsurance segment held the highest market share of 69% in 2024.

- By provider, the microinsurance through aid/government support segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By model type, the partner agent model segment led the microinsurance market.

- By model type, the full-service model segment is growing at a notable CAGR from 2025 to 2034.

- By product type, the life insurance segment domianted the market in 2024.

- By product type, the health insurance segment is anticipated to grow with the highest CAGR between 2025 and 2034.

- By distribution channel, the financial institutions segment held the biggest market share in 2024.

- By distribution channel, the digital channel segment growing at a strong CAGR from 2025 to 2034.

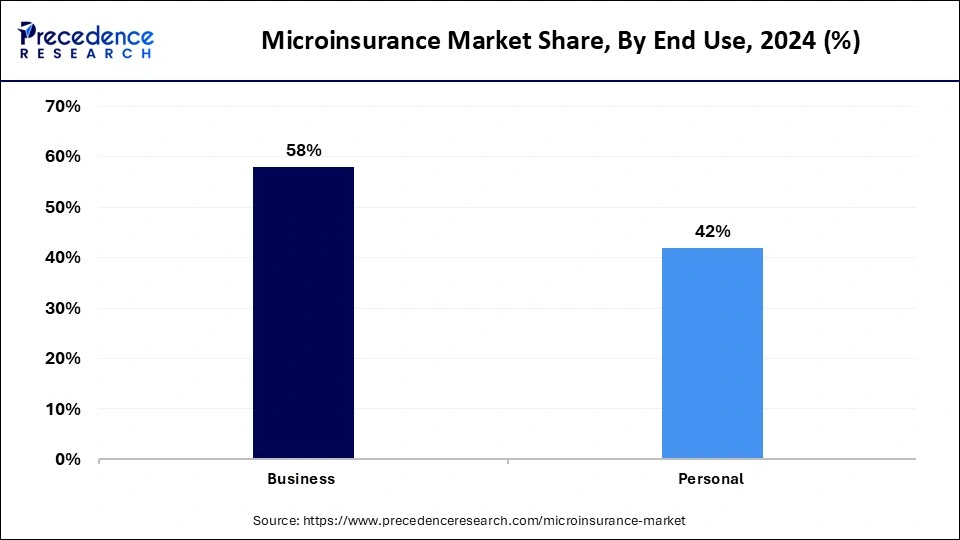

- By end-use insight, the business segment maintained a leading position in the market in 2024.

- By end-use insight, the personal segment is predicted to witness significant CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 89.06 Billion

- Market Size in 2026: USD 95.15 Billion

- Forecasted Market Size by 2034: USD 161.54 Billion

- CAGR (2025-2034): 6.84%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Microinsurance?

Digital innovation has become the source of growth in the micro-insurance sector as more people access smartphones and use mobile money technology. This allows populations with limited access to purchase and track their policies using applications and USSD codes. Governments and international development agencies report that in 37 countries in 2023, the number of people covered by micro-insurance has increased to 344 million people.

However, it is estimated that the target population of 88% is still not covered, which explains the size of the challenge as well as the growth potential. This technological change reduces the operating expense, allows low-premium policies to be viable, and allows a wider range of informal employment areas to be covered. Furthermore, the increased infrastructure, in turn, indicates that the presence of affordable, accessible micro-insurance policies on its own is a market growth driver for last-mile populations.

Impact of Artificial Intelligence on the Microinsurance Market

By causing insurers to increase coverage, improve efficiency, and provide individualized protection to low-income and underserved communities, artificial intelligence (AI) is changing the microinsurance industry. AI-driven analytics is applied to alternative data in mobile usage, digital wallets, and agricultural sensors. Further enabling the insurers to determine the risk in markets where conventional credit or medical histories tend to be unavailable. Additionally, the intelligence facilitates the development of policies that are flexible and usage-based, which can be adjusted to the needs and payment abilities of customers.

Microinsurance Market Outlook

Government programs and NGO efforts are driving the adoption of microinsurance through mobile banking and fintech platforms, expanding access to underserved populations.

Increasing natural disasters and climate-related events are boosting demand for crop, weather, and parametric insurance solutions in vulnerable regions.

Enhanced risk assessment, automated underwriting, and fraud detection are fueling efficiency and faster policy issuance, making microinsurance more scalable.

Collaborations between insurers, microfinance institutions, and development agencies are growing the reach and penetration of microinsurance in low-income communities.

Expanding mobile money and e-wallet platforms are enabling convenient premium collection and claims processing, propelling market growth.

Global Microinsurance Coverage and Market Insights (2024–2025)

- India Leads in Microinsurance Policy Distribution: India accounts for nearly 35% of global microinsurance enrolments in 2024, driven by government-backed schemes like PMJJBY and PMSBY. The total annual premium collected in India exceeds USD 1.6 billion, reflecting strong demand among rural and low-income populations.

- Kenya and Ghana Drive Africa's Microinsurance Growth: These countries represent the largest microinsurance adoption in Africa, with coverage increasing between 2021 and 2024. Mobile-based policies for health, agriculture, and life insurance dominate, supported by fintech partnerships and NGOs.

- Latin America's Microinsurance Market Expands Through Reinsurance and Cross-Border Partnerships: Mexico, Brazil, and Colombia lead the region, with total premium income reaching USD 279.8 billion in 2024, a 14.2% year-on-year increase. Reinsurers like Swiss Re and Munich Re support local insurers to manage risk and scale coverage for agriculture and disaster protection.

- Bangladesh Demonstrates Effective Microinsurance Models: Bangladesh has successfully implemented microinsurance programs, covering approximately 10 million individuals in 2024. Community-based models and NGO collaborations play a significant role in reaching underserved populations.

- Vietnam's Microinsurance Market Expands with Mobile Integration: Vietnam's microinsurance sector is growing rapidly, with over 3 million policies issued in 2024. Mobile integration and partnerships with fintech companies are enhancing accessibility for low-income individuals.

- Global Coverage Increase: Between 2021 and 2024, the number of people covered by microinsurance products increased by 70%, reaching 344 million individuals across 37 countries in Africa, Asia, and Latin America.

- Product Type Coverage: In 2024, the median number of customers per microinsurance product exceeded 10,000, generating nearly $120,000 in annual premiums per product.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 89.06 Billion |

| Market Size in 2026 | USD 95.15 Billion |

| Market Size by 2034 | USD 161.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Provider, Model Type, Product Type, Distribution Channel, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Microinsurance MarketSegmental Insights

Provider Insights

The microinsurance (commercially viable) segment dominated the microinsurance market in 2024. Due to the rising popularity of digital platforms and mobile technology, which have offered massive cost reduction in distribution and a greater reach. Its ability to provide affordable, scalable insurance services to the low-income groups whilst remaining profitable to those providing microinsurance. Furthermore, the increased trust and adoption by underserved communities are expected to fuel the segment.

The microinsurance through aid/government support segment is expected to grow at the fastest rate in the coming years, as governments all over the world are focusing on social protection and financial inclusion. India (Pradhan Mantri Suraksha Bima Yojana) and other similar programs in Africa and Latin America have seen a significant rise in the insurance that is available to vulnerable populations.

- In 2024, government-supported microinsurance plans increased by 70% people around the world, which is much higher as compared to previous years, and it represents the overall intention to commit to financial inclusion. Additionally, this segment is expected to expand at a faster rate as governments proceed to invest in these programs and educate more people on the benefits of microinsurance.

Model Type Insights

The partner agent model segment held the largest revenue share in the microinsurance market in 2024, due to its cost-effectiveness, which requires insurers to have expansive distribution channels. Moreover, the Partner-Agent Model enables the reception of insurance products to the unique requirements of the local community, which increases the interest in products and their adoption.

The full-service model segment is expected to grow at the fastest CAGR in the coming years. The emergence of digital technologies and mobile platforms has promoted the application of the Full-Service Model. Moreover, the trend of growing demand for fully encompassing insurance products, which cover a wide range of risks, is fostering the implementation of the model.

Product Type Insights

The life insurance segment dominated the microinsurance market in 2024, due to the growing focus of the low-income population on the need for financial security against risks in life. In addition, the introduction of digital technologies has facilitated the issuance of policies and payment of claims, which also makes life microinsurance products more attractive.

The health insurance segment is expected to grow at the fastest rate in the coming years, owing to the inaccessibility of quality health services by most of the population in most of the developing countries. In the 2024 report by the Swiss Re Foundation, it is noted that health microinsurance products have been key in enhancing access to healthcare for the marginalized members of the population.

Hence, leading to the overall well-being and health of the community. Additionally, the growing acceptance of health insurance as a key factor in the realization of sustainable development objectives will most likely be an impetus to investment and policy incentives for health microinsurance schemes.

Distribution Channel Insights

The financial institutions segment held the largest revenue share in the microinsurance market in 2024, as banks and microfinance institutions (MFIs) were the most common 2024 channels of distribution of microinsurance products. Furthermore, their intense penetration into the underserved markets also enabled the rampant adoption of microinsurance, especially in such areas as the Asia-Pacific and Sub-Saharan Africa.

The online channel segment is expected to grow at the fastest CAGR in the coming years in the market for microinsurance, owing to the development of mobile technology and higher internet penetration. Additionally, the ease and access of online channels will continue to drive the use of microinsurance products, thus becoming more affordable to the poor.

End User Insights

The business segment dominated the microinsurance market in 2024, due to the growing awareness of small and medium-sized enterprises (SMEs) about the financial risks. They encounter issues such as property damage, health problems of the employees, and business disruptions. Moreover, the government initiatives and regulatory frameworks that encouraged financial inclusion also helped in increasing the uptake of microinsurance solutions by companies.

The personal segment is expected to grow at the fastest rate in the coming years, owing to the increasing awareness among individuals of the need to protect themselves financially against health, life, and accident risks. Additionally, the collaboration of microfinance institutions and non-governmental organizations has been critical in accessing the remote and marginalized communities so that personal microinsurance provision is both inclusive and extensive.

Microinsurance Market Regional Insights

The Asia Pacific microinsurance market size is exhibited at USD 32.97 billion in 2025 and is projected to be worth around USD 60.58 billion by 2034, growing at a CAGR of 6.98% from 2025 to 2034.

Why Did Asia Pacific Dominate the Microinsurance Market in 2024?

Asia Pacific led the microinsurance market, capturing the largest revenue share in 2024, owing to the high number of unbanked individuals, the growing smartphone coverage, and the financial inclusion programs supported by the government. Programs, such as Pradhan Mantri Suraksha Bima Yojana in India, rural cooperative insurance schemes in China, and national health insurance initiatives in Indonesia, were among the many programs that substantially boosted the enrolment in microinsurance.

As of April 2025, over 510 million people have enrolled in the Pradhan Mantri Suraksha Bima Yojana (PMSBY). More than 157,000 claims, totaling ₹31.21 billion, have been settled under this scheme. Notably, there is significant female enrolment, with 238.7 million women participating, and the rural enrolment rate stands at 71%.

In 2024, India became a major growth-booster in the microinsurance market of the Asia Pacific, with a large portion of the local market. The online platform, such as mobile wallets such as GoPay, M-Pesa, and Airtel Money, made the enrollment and claim processing easy, especially in rural areas. Furthermore, the Regulatory support, incorporation of technology, and high public awareness campaigns put India at the center of microinsurance growth in the Asian Pacific in the year 2024.

North America is anticipated to grow at the fastest rate in the market during the forecast period, due to the developed financial infrastructure, the level of insurance literacy, and the existence of well-developed insurers. Banks and financial institutions actively embraced microinsurance in their books, and the low-income groups were able to purchase personalized life, health, and accident cover.

In 2024, the United States strengthened its role as a market leader in the microinsurance market, with nearly a quarter of the global market share. Such a superiority is explained by a strong financial base, strong digitalization, and novel collaboration between insurers and technology companies.

To improve policy management and expedite claims processing, companies, including MetLife, Prudential, and AIG, joined forces with technology giants, including Google Cloud and AWS. Furthermore, the inclusion of AI-based risk assessment tools, underwriting, and fraud prevention became quicker, thus further facilitating the region's growth.

The Middle East and Africa region is expected to hold a notable revenue share of the market. Due to the availability of microinsurance products was also improved by efforts of the government, such as the financial inclusion programs administered by the government. Furthermore, the reinsurers launched microinsurance-based risk cover, which allowed them to penetrate the markets more broadly and allowed them to support small businesses and community-based coverage.

Microinsurance Market Value Chain

The foundation of microinsurance lies in accurately identifying target populations and assessing their specific risk profiles through comprehensive data analysis. This process involves gathering demographic, behavioral, health, agricultural, and climatic data to understand the vulnerabilities and insurance needs of low-income groups. Advanced data collection tools, mobile platforms, and remote sensing technologies are increasingly being used to capture localized and real-time information, particularly in rural and underserved areas.

Key Players: Microinsurance Network, FSD Africa, CGAP, UNDP, local microfinance institutions, mobile network operators.

In the microinsurance ecosystem, product design and development focus on creating insurance solutions that are affordable, flexible, and easily understandable for low-income and vulnerable populations. Insurers design a range of tailored products, including health, life, crop, livestock, and disaster insurance, each aligned with the specific risks and livelihood patterns of target communities.

Key Players: BIMA, Pula, Jubilee Insurance, Allianz X, MAPFRE.

In the microinsurance framework, underwriting and pricing are pivotal stages that determine both the financial sustainability of insurance products and their accessibility to low-income clients. Insurers employ actuarial models, enhanced by AI-driven analytics and big data insights, to accurately evaluate individual and community-level risks.

Key Players: Swiss Re, Munich Re, Hannover Re, and local insurance providers.

The success of microinsurance largely depends on efficient policy distribution and enrollment mechanisms that ensure accessibility and trust among low-income communities. To achieve last-mile connectivity, insurers leverage a multi-channel distribution model involving mobile platforms, agent networks, microfinance institutions (MFIs), cooperatives, NGOs, and fintech partnerships. Mobile-based enrollment and premium payment systems have revolutionized reach, allowing customers in remote areas to register, pay, and receive policy updates seamlessly through their phones.

Key Players: MTN Mobile Money, Airtel, M-Pesa, BIMA, MicroEnsure.

Microinsurance Market Companies

The Hollard Insurance Company is one of the leading microinsurance providers in Africa, offering accessible insurance solutions for low-income individuals and small businesses. Its microinsurance products cover health, life, and asset protection, tailored to meet the needs of underserved communities. Hollard’s inclusive approach supports financial resilience and social impact across emerging markets.

AFPGen (Armed Forces and Police General Insurance Corporation) provides microinsurance and protection products in the Philippines. Its offerings focus on affordable life, accident, and property insurance for military personnel, their families, and low-income individuals, contributing to financial inclusion and community security.

AIG offers microinsurance solutions in developing markets, focusing on life, health, and agricultural coverage. Its global reach and digital distribution strategies enable scalable, low-cost protection for vulnerable populations. AIG’s involvement in public-private partnerships supports financial inclusion initiatives worldwide.

Bharti AXA provides microinsurance and protection plans designed to make life and health insurance affordable for low-income and rural populations in India. It's simple, transparent policy structures promote financial literacy and easy claim processes.

SBI Life offers microinsurance products such as Sampoorn Suraksha and Grameen Bima, aimed at improving rural financial protection. Backed by the State Bank of India’s extensive distribution network, the company ensures accessibility to insurance in remote regions.

ICICI Prudential delivers microinsurance plans focused on low-income households, emphasizing affordable premiums and simplified claim settlements. Its partnerships with microfinance institutions and NGOs enhance outreach across India’s rural sectors.

Banco do Nordeste provides microinsurance and microfinance solutions tailored to small businesses and rural entrepreneurs in Brazil. Its integrated model promotes financial inclusion and risk protection for marginalized communities.

CLIMBS Life and General Insurance Cooperative is a leading microinsurance provider in the Philippines, offering affordable cooperative-based insurance for low-income individuals. Its community-driven approach fosters sustainable protection and mutual growth among cooperatives.

Allianz SE delivers microinsurance products across Asia, Africa, and Latin America, offering life, health, and property coverage through partnerships with NGOs and local microfinance institutions. Its focus on digital distribution and scalable models drives inclusion and affordability in emerging markets.

Bajaj Allianz provides microinsurance plans targeting rural and low-income groups, emphasizing accessibility through simplified products and minimal documentation. Its digital platforms and local partnerships enhance reach and efficiency in underserved areas.

Recent Developments

- In October 2025, the Life Insurance Corporation of India (LIC) introduced two new plans: Jan Suraksha and Bima Lakshmi. These plans offer guaranteed additions and financial protection features tailored to meet the needs of diverse customer segments.

- In October 2025, CoverSure, a consumer-focused insurtech platform, launched a short-term Firecracker Insurance plan priced at just ₹5. This low-cost policy provides financial protection against accidental death and fire-related burns, aiming to ensure safety during the high-risk festive period.

- In October 2025, AXA and Egypt Post partnered to launch Egypt's first microinsurance company. This initiative, made possible by the new Unified Insurance Law, is designed to provide affordable insurance to low-income citizens, furthering Egypt's recent efforts toward financial inclusion.

(Source: https://www.thehindu.com)

(Source: https://www.angelone.in)

Microinsurance MarketSegments Covered in the Report

By Provider

- Microinsurance

- Microinsurance Through Aid/Government Support

By Model Type

- Partner Agent Model

- Full Service Model

- Provider Driven Model

- Others

By Product Type

- Life Insurance

- Health Insurance

- Property Insurance

- Others

By Distribution Channel

- Direct Sales

- Financial Institutions

- Digital Channels

- Others

By End Use

- Business

- Personal

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting