Life Insurance Market Size and Forecast 2025 to 2034

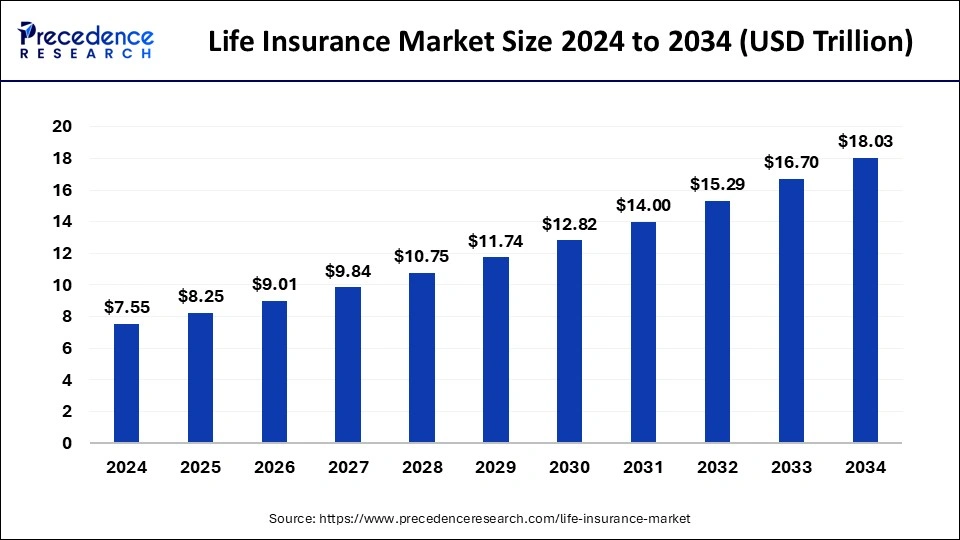

The global life insurance market size was estimated at USD 7.55 trillion in 2024 and is predicted to increase from USD 8.25 trillion in 2025 to approximately USD 18.03 trillion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034. The life insurance market is driven by the expansion of the middle class in emerging markets.

Life Insurance Market Key Takeaways

- The global life insurance market was valued at USD 7.55 trillion in 2024.

- It is projected to reach USD 18.03 trillion by 2034.

- The market is expected to grow at a CAGR of 9.10% from 2025 to 2034.

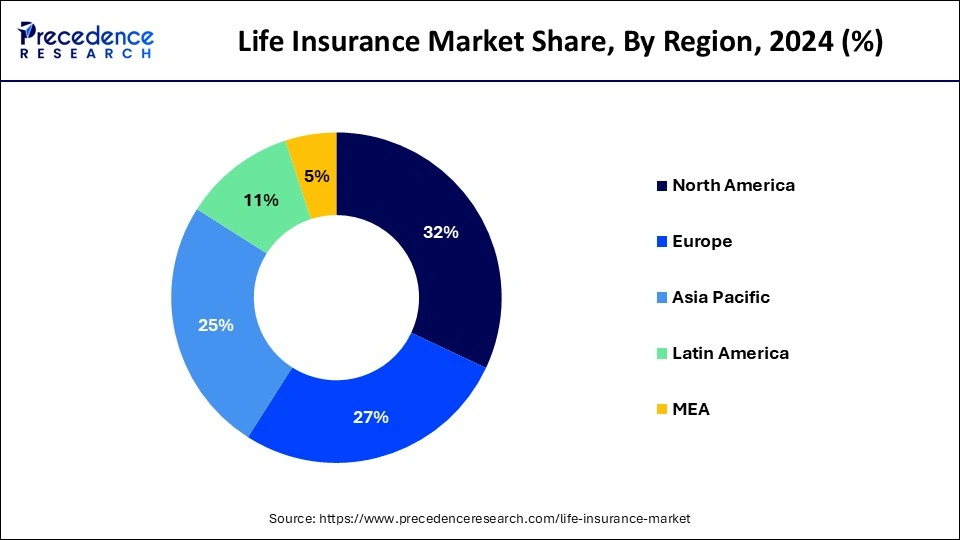

- North America dominated the market with largest revenue share of 32% in 2024.

- Asia- Pacific is the fastest growing market during the forecast period.

- By type, the annuity premiums & deposits segment dominated the market in 2024.

- By type, the accident & health premiums segment is the fastest growing market during the forecast period.

- By type, the life insurance premiums segment shows a notable growth during the forecast period.

U.S. Life Insurance Market Size and Growth 2025 to 2034

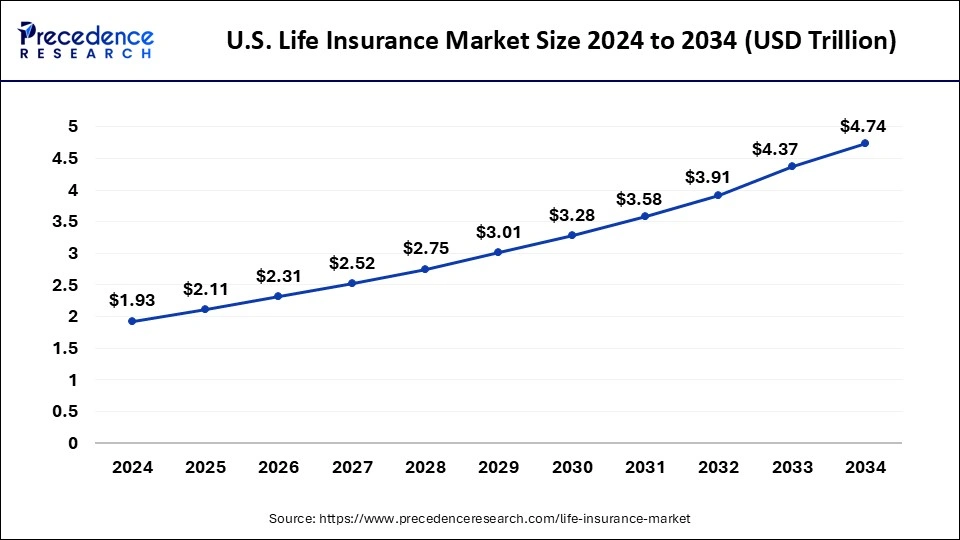

The U.S. life insurance market size was estimated at USD 1.93 trillion in 2024 and is predicted to be worth around USD 4.74 trillion by 2034 with a CAGR of 9.40% from 2025 to 2034.

North America has its largest market share in 2024 in the life insurance market. More people can purchase life insurance plans due to the region's high per capita income. The acquisition of both necessary and supplementary financial goods, such as life insurance, is made possible by this disposable money. It is deeply engrained in culture to view life insurance as a vital financial tool for safeguarding families and guaranteeing financial stability in the event of an insured person's passing. This cultural acceptance bolsters the continuous demand for life insurance products.

- In April 2025, The Guardian Life Insurance Company of America, one of America's largest life insurers and providers of employee benefits, unveiled a strategic partnership with global asset manager Janus Henderson Group. Through the collaboration, Janus Henderson will manage the USD 45 billion investment-grade public fixed income portfolio for Guardian's general account, which will include investment-grade corporates and securitized credit.

According to the American Council of Life Insurers (ACLI), there were 134,193,000 individual life insurance policies in force in 2023. There were over 118,000,000 people with group life insurance.

Because many high-yielding investment options are available, life insurance firms in North America enjoy robust investment returns. Because of their financial stability, insurers can provide customers with competitive and appealing products.

Asia- Pacific is the fastest growing market during the forecast period. The growing middle class in nations like China, India, and Indonesia fueled demand for products and services, which in turn drove demand in the retail, automobile, and technology industries. The area is rapidly becoming more urbanized, which increases demand for housing, infrastructure, and urban services. As a result, related businesses, including utilities, real estate, and construction, are growing.

The cloud, artificial intelligence, Internet of Things, and 5G technologies have enormous growth potential, and the digital economy is growing quickly. Businesses in the area are making significant investments in digital capabilities and infrastructure.

Market Overview

The life insurance market is a collection of companies and endeavors engaged in purchasing, selling, and managing life insurance policies. These policies are agreements between an insurance company and a policyholder. The insurance company agrees to pay premiums in exchange for the policyholder's beneficiary designation upon the covered person's death. Various plans on the market address distinct financial needs and objectives, including whole life, variable life, universal life, and term life insurance.

In the case of the policyholder's passing, life insurance offers beneficiaries, typically family members, financial security. To ensure that the insured's dependents are financially responsible, this can cover living expenses, debts, school tuition, and other financial commitments. Loans can be secured by life insurance policies, improving a borrower's or business's creditworthiness. This makes credit more accessible and encourages saving and investment.

The life insurance industry is a major employer, with positions in underwriting, sales, claims processing, actuarial science, and other areas. Its operations support related businesses like healthcare, finance, and legal services.

Life Insurance Market Growth Factors

- A growing middle class means more people have extra money to spend, which means they can and will buy financial protection goods like life insurance.

- The youthful population of India offers a sizable prospective market for life insurance products.

- The market for life insurance products is driven by rising financial literacy and a greater understanding of life's risks.

- The creation of novel, tailored life insurance solutions and the growing application of technology (InsurTech) are increasing the allure and accessibility of life insurance.

- A wider population can obtain life insurance by focusing on cost-effective term life plans.

- The market for life insurance can grow even faster if financial inclusion is promoted through initiatives and regulatory reforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.25 Trillion |

| Market Size by 2034 | USD 18.03 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Greater private sector participation and an improvement in distribution capabilities

Pressure from competition causes private insurers to function more effectively. They improve service delivery, cut expenses, and streamline procedures, improving the general customer experience. The involvement of the private sector facilitates the adoption of cutting-edge technology like digital platforms, artificial intelligence, and big data analytics. With these technologies, insurers may provide more individualized products, expedite the underwriting process, and better analyze risk.

Substantial improvements in operational efficiencies.

Enhancements in operational effectiveness frequently result in quicker and more precise handling of client queries, insurance claims, and policy administration. Due to automation, artificial intelligence (AI), and machine learning (ML), insurance companies may now offer more individualized services and faster response times. This increases client happiness and loyalty. Creating operational savings frees up funds that can be used for innovation and the creation of fresh insurance offerings. This enables insurance companies to meet their client's changing demands and interests by offering personalized policies, micro insurance, and digital insurance solutions.

Operational enhancements and technological breakthroughs streamline underwriting procedures. Automated underwriting systems use AI and big data to evaluate applications more rapidly and precisely, cutting down on the time it takes to issue a policy and enhancing the onboarding process for new customers. This drives the growth of the life insurance market.

Restraint

Premiums for life insurance policies can be expensive

Customers frequently compare the perceived value or advantages of a life insurance coverage with the cost of the premiums. Potential clients may believe that paying large premiums is not worth the advantages, particularly if they are young and believe they have a low chance of dying. This belief may cause people to be reluctant to get life insurance, which would limit the market's expansion. Recessions and economic downturns make the problem of high premiums worse.

Families and individuals are more prone to reduce non-essential spending during these times by tightening their budgets. When finances are tight, life insurance is sometimes viewed as a non-essential expense, maybe one of the first items to go. Customers are significantly more likely to choose not to purchase life insurance due to high rates. This limits the growth of the life insurance market.

Opportunity

Partnering with healthcare providers to offer wellness programs

Diabetes and hypertension are two examples of chronic diseases that can be prevented and managed through wellness programs, which can lower their incidence. Promoting routine health examinations and screenings can aid in the early detection of health problems, hence lowering the severity and expense of claims.

Insurance companies and healthcare providers can collaborate to obtain full health data. This information sheds light on policyholders' ongoing medical issues, lifestyle choices, and medical histories. The data makes more accurate risk assessment possible, which improves underwriting choices and precision in insurance pricing. This opens an opportunity for the growth of the life insurance market.

- In February 2025, India Post Payments Bank (IPPB) entered a bancassurance partnership with PNB MetLife India Insurance Company to boost life insurance access in India. The collaboration will leverage IPPB's network of 650 banking outlets and 110 million customers to distribute PNB MetLife's life insurance products.

Type Insights

The annuity premiums & deposits segment dominated the life insurance market in 2024. People are beginning to realize how vital retirement planning is. Annuity product demand is being driven by consumers seeking to secure a steady and predictable income throughout retirement. Many nations have regulatory frameworks that guarantee consumer safety and offer tax advantages, which contribute to the expansion of the annuity business. As a result, more people gain confidence and purchase annuities.

The accident & health premiums segment is the fastest growing in the life insurance market during the forecast period. Paying benefits to the insured for treating disease, injury, disability, accident, and health insurance shields policyholders from the financial strain and fallout from unforeseen medical expenses. Policies can be given to people, employers, workers, or association members. The coverage of these insurances varies considerably. Surgical and treatment-related costs, as well as hospital stays (including some room and board), are typically covered by basic medical coverage. Basic coverage often pays providers a certain sum based on "usual, reasonable, and customary" criteria.

The expansion of employer-sponsored health plans and government initiatives supporting health insurance plays a major role in the growth of the A&H premiums category. Employers are increasingly offering health insurance as a benefit, and numerous governments are putting laws into place to boost the prevalence of health insurance.

The life insurance premiums segment shows a notable growth in the life insurance market during the forecast period.The life insurance premium is the money that fuels your policy and keeps your coverage active while protecting your beneficiaries. Paying your premiums on time is essential to keeping your policy in effect, regardless of whether you choose a permanent plan that offers lifelong protection or a term policy with a set period. Although many insurers offer quarterly, semi-annual, or annual payment choices to accommodate varying preferences, these payments are often paid monthly. Insurance companies constantly innovate and broaden the range of products they offer to meet the needs of a wider spectrum of customers.

Products such as endowment policies, whole life, term insurance, and unit-linked insurance plans (ULIPs) offer investment possibilities and a range of advantages. The availability of such a wide range of goods draws in more clients, which increases the demand for premium collections. The growth of the life insurance business is encouraged by favorable regulatory frameworks and government incentives in several countries. A rise in policy uptake and premium payments results from advantageous policies that encourage insurance penetration and tax benefits on life insurance premiums.

Life Insurance Market Companies

- AXA Group

- China Life Insurance Company

- Chubb Limited

- Cigna

- MetLife, Inc.

- New York Life Insurance Company

- Northwestern Mutual

- United Health Group

- Prudential Financial

- Ping An Insurance Group

Recent Developments

- In January 2024, the combination of Shriram LI Holdings Private Limited (SLIH) and Shriram Life Insurance Company Limited (SLIC) was approved by the CCI.

- As announced in November 2023, With the planned acquisition of a majority stake in Kotak General Insurance, Zurich Insurance Group will become the first significant foreign investor in India's insurance industry in eight years. CCI has approved Zurich's acquisition of a 70% share in Kotak Mahindra Company.

- In February 2025, Pramerica Life Insurance, one of India's fastest-growing life insurance companies, announced the launch of its flagship campaign, #ThisIsMyClimb. The campaign aims to foster a deeper emotional connection with audiences by celebrating the resilience and selflessness of everyday individuals.

- In November 2024, AU Small Finance Bank Ltd announced a strategic partnership with the insurance company Bharti AXA Life Insurance to provide the customers of AU Small Finance Bank with comprehensive solutions of life insurance and financial security.

- In March 2025, Shriram Life Insurance, one of the leading life insurance providers in India, announced a strategic partnership with JM Financial Services. This collaboration aims to enhance the accessibility of life insurance products for JM Financial's customers and equity stakeholders. This partnership allows Shriram Life to offer its wide range of services, assisting customers to explore and access insurance plans to secure themselves and their families.

Segments Covered in the Report

By Type

- Life Insurance Premiums

- Annuity Premiums and Deposits

- Accident and Health Premiums

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting