Term Insurance Market Size and Forecast 2025 to 2034

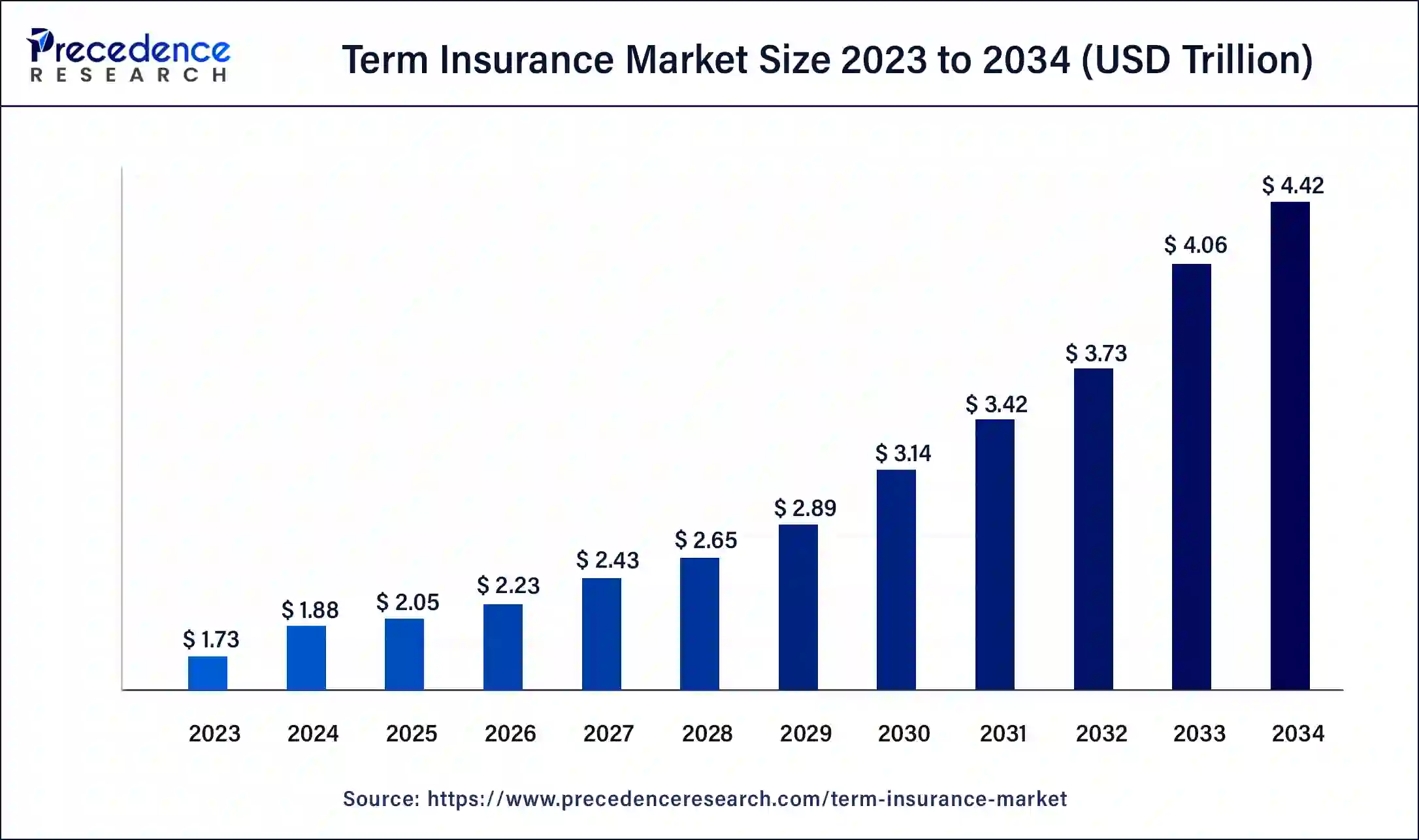

The global term insurance market size was accounted at USD 1.88 trillion in 2024, and is expected to reach around USD 4.42 trillion by 2034, expanding at a CAGR of 8.92% from 2025 to 2034.

Term Insurance Market Key Takeaways

- The global term insurance market was valued at USD 1.88 trillion in 2024.

- It is projected to reach USD 4.42 trillion by 2034.

- The term insurance market is expected to grow at a CAGR of 8.92% from 2025 to 2034.

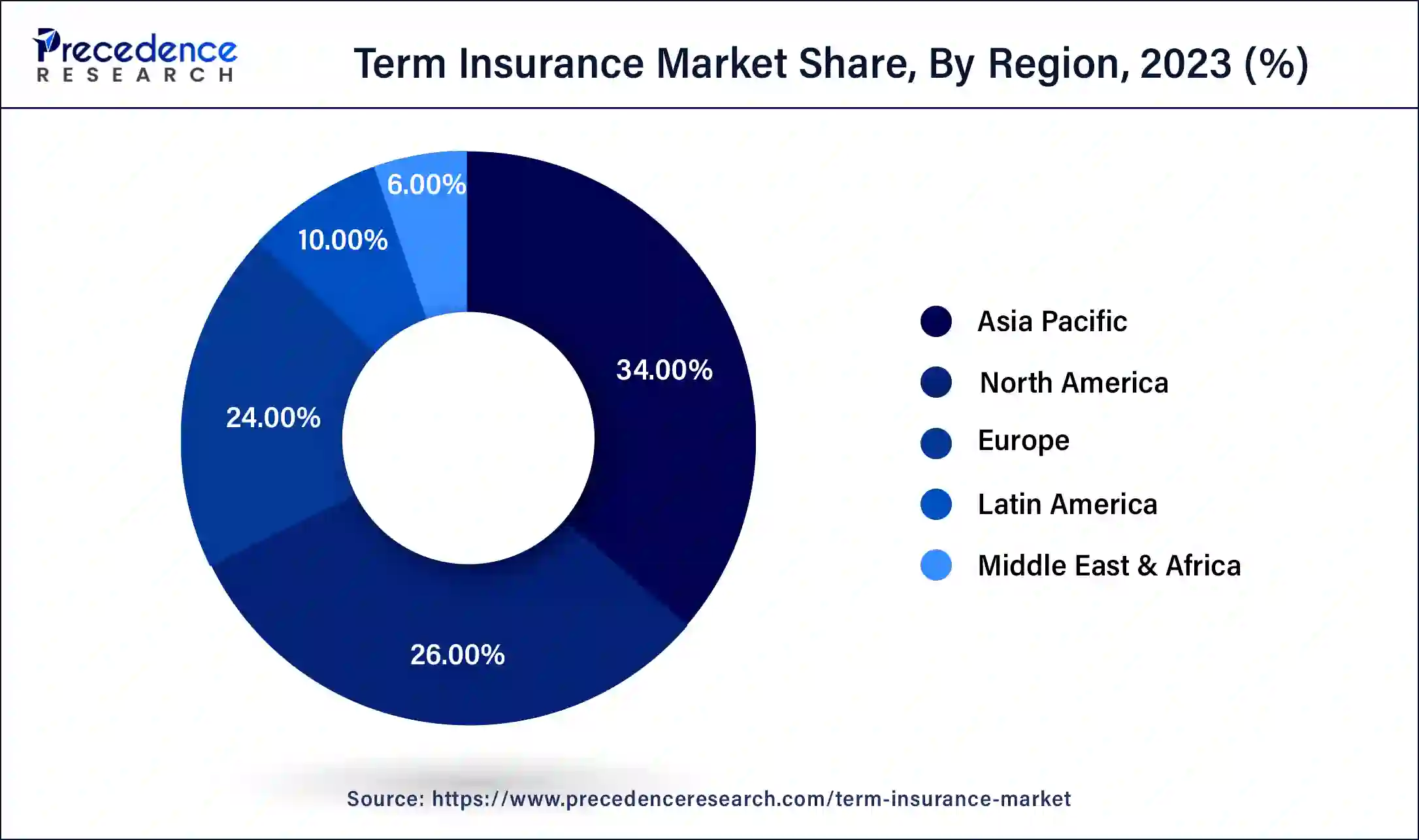

- Asia-Pacific has contributed more than 34% of market share in 2024.

- Europe is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, in 2024, the individual-level term life insurance segment held the highest market share of 76%.

- By type, the group-level term insurance segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

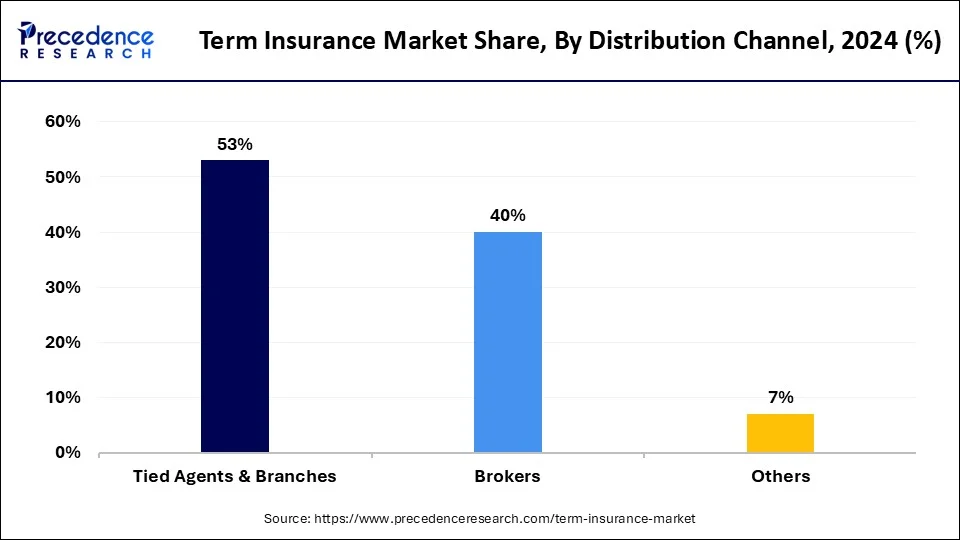

- By distribution channel, the tied agents & branches segment has held 53% market share in 2024.

- By distribution channel, the light brokers segment is anticipated to witness rapid growth over the projected period.

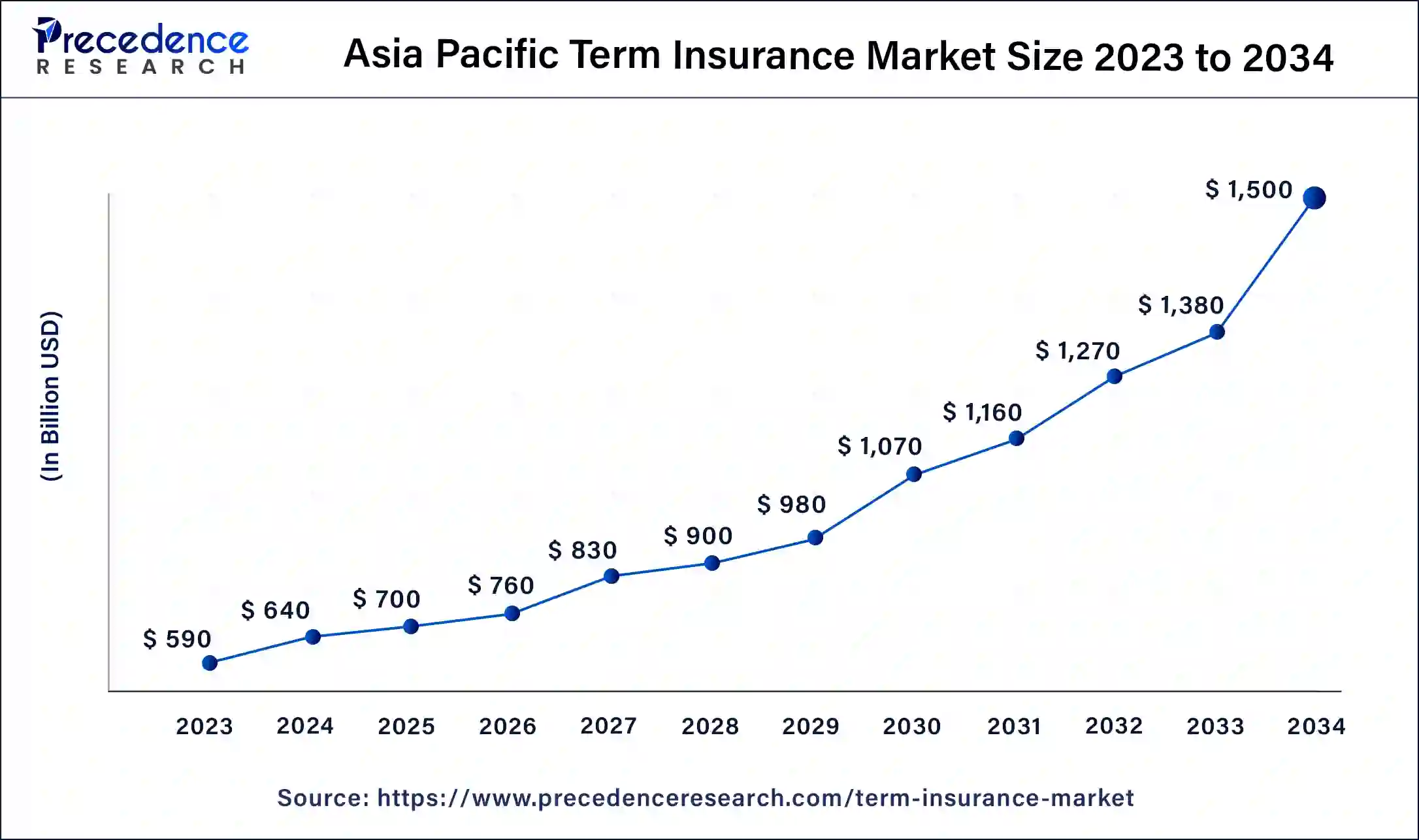

Asia Pacific Term Insurance Market Size and Growth 2025 to 2034

The Asia Pacific term insurance market size was estimated at USD 640billion in 2024 and is predicted to be worth around USD 1,520 billion by 2034, at a CAGR of 9.04% from 2025 to 2034.

Asia Pacific is indeed a dominant force in the term insurance market, accounting for more than 34% of the market's revenue share in 2024. This region is experiencing robust growth driven by several key factors. Firstly, the Asia Pacific region boasts a large and diverse population, particularly in emerging economies like India and China, where awareness of the importance of life insurance is steadily increasing.

The aging demographics further amplify the need for financial protection, spurring demand for term insurance products. Moreover, the presence of numerous life insurance companies in the Asia Pacific region, along with supportive government policies and the rapid adoption of digital technologies, creates fertile ground for new product development and industry advancement. The embrace of digital platforms facilitates easier access to insurance products, enhancing market penetration and consumer outreach.

Europe is also poised for significant growth of 9.3% CAGR in the term insurance market. Regulatory changes, economic uncertainties, and an aging population have prompted individuals across Europe to prioritize financial security, driving increased demand for term insurance coverage. Furthermore, technological advancements and heightened market competition have catalyzed the sector's expansion, offering consumers more choices and streamlined processes.

The growth witnessed in both the Asia Pacific and European regions underscores the increasing recognition of term insurance as a vital tool for financial planning and protection. As individuals become more cognizant of the risks associated with unforeseen events, term insurance emerges as a preferred option to safeguard their financial well-being, driving sustained growth and innovation in the global term insurance market.

North America is expected to grow significantly in the term insurance market during the forecast period. The citizens of North America are increasing the demand for affordable term insurance. Moreover, the growing health concerns and house ownership are increasing its use. At the same time, various companies are providing online services as well as applications, enhancing the accessibility of their term insurance schemes. This also helps the clients to compare the policies and select the best option. Thus, all these factors are promoting the market growth.

Market Overview

Term life insurance stands out in the insurance landscape for its provision of coverage for a fixed duration, typically ranging from 10 to 30 years, offering individuals a flexible and cost-effective means of protecting their loved ones financially. This type of insurance diverges from whole life insurance, which necessitates continuous premium payments throughout the insured's lifetime and often includes a cash value component. The appeal of term life insurance lies in its simplicity and affordability, making it an attractive option for individuals and families seeking straightforward protection against unforeseen events.

Commonly, term policies are selected to align with specific financial obligations or life stages, such as mortgage payments, children's education expenses, or income replacement during the prime working years. The escalating number of term life insurance policyholders globally underscores the growing recognition of its benefits, including its adaptability to evolving financial needs and its comparatively lower premium costs. As consumers become increasingly aware of the importance of financial security and risk management, term life insurance continues to gain popularity, promoting the growth of the term insurance market. This trend highlights the enduring relevance of term life insurance as a fundamental tool for providing essential protection and peace of mind to individuals and their families worldwide.

Term Insurance Market Data and Statistics

- According to current data from the American Council of Life Insurers, in contrast to cash value plans, term life insurance is the most popular option in the United States, with 48% of households reporting that they own one.

- According to a recent survey done in February 2023, 60% of respondents believe that communicating with insurance firms online will be their main method going forward. The market is anticipated to increase significantly as a result of the enthusiastic adoption of digital transformation technology by term insurers and the growing desire of consumers for digital interactions.

Term Insurance Market Growth Factors

- Term insurance policies offer flexibility in coverage duration and benefit amounts. Policyholders can tailor their coverage to match their financial needs, such as mortgage payments, children's education, or income replacement during critical life stages.

- Insurers continually innovate to meet evolving consumer needs. They introduce new features, riders, and policy options to enhance the value proposition of term insurance. Features such as return of premium riders, accelerated death benefits, and conversion options contribute to market growth.

- Technology plays a crucial role in expanding the reach and accessibility of term insurance. Online platforms, digital marketing strategies, and streamlined underwriting processes make it easier for consumers to research, compare, and purchase policies, driving market growth.

- Regulatory reforms and favorable policies can stimulate market growth by creating a conducive environment for insurance companies to operate. Government initiatives aimed at promoting insurance penetration, consumer protection, and market competitiveness contribute to the expansion of the term insurance market.

- Emerging economies represent significant growth opportunities for term insurance providers. Rising incomes, urbanization, and expanding middle-class populations in countries like India, China, and Brazil drive the demand for insurance products, including term insurance.

- Heightened awareness of financial risks and uncertainties, such as health crises, natural disasters, and economic instability, prompts individuals to seek protection through term insurance policies, fostering market growth.

- Employer-sponsored term life insurance programs often serve as an essential component of employee benefits packages. The expansion of corporate insurance offerings and group term insurance policies contributes to term insurance market's growth by increasing insurance coverage among employees and their families.

Market Scope

| Report Coverage | Details |

| Rate from 2025 to 2034 | CAGR of 8.92% |

| Market Size in 2024 | USD 1.88 Trillion |

| Market Size in 2025 | USD 2.05 Trillion |

| Market Size by 2034 | USD 4.42 Trillion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Influence of digital transformation

The influence of digital transformation in the insurance industry, particularly within the realm of term insurance, has emerged as a significant driver of market growth. The integration of digital technologies has revolutionized traditional insurance practices, fostering operational efficiency and fundamentally reshaping customer interactions. By leveraging digital tools and platforms, insurers have streamlined processes, reduced operational costs, and enhanced service delivery, ultimately benefiting both insurers and policyholders.

One of the most profound impacts of digital transformation is the elevation of operational efficiency within insurance companies. Automation of routine tasks, such as underwriting, claims processing, and policy administration, has significantly expedited workflows and minimized manual errors. Digital platforms have enabled insurers to access vast amounts of data efficiently, facilitating data-driven decision-making and risk assessment. As a result, insurers can optimize resource allocation, improve risk management practices, and enhance overall operational performance.

The results of the survey conducted in February 2023, indicating that 60% of consumers consider web-based communication as their primary means of engaging with insurance companies in the future, underscore a significant shift in consumer preferences and expectations within the insurance industry. This finding reflects the increasing reliance on digital channels for accessing information, conducting transactions, and seeking customer support across various sectors, including insurance.

Furthermore, the enthusiastic adoption of digital transformation technologies by term insurers has become a pivotal driver of term insurance market's growth, fostering operational efficiency, enhancing customer engagement, and driving innovation across the insurance value chain. As insurers continue to embrace digital transformation initiatives, the industry is poised to witness further evolution, with digital technologies serving as a cornerstone for driving sustainable growth and delivering value to both insurers and policyholders alike.

Restraint

Cybersecurity threats pose a large risk

Cybersecurity threats present a significant risk to the term insurance market, given the sensitive and personal data managed by insurance companies. The increasing digitization of insurance processes and the proliferation of online platforms have expanded the attack surface for cybercriminals, exposing insurers to potential data breaches, fraud, and financial losses. With policyholder information, financial records, and medical histories at stake, maintaining robust cybersecurity measures is paramount to safeguarding consumer trust and preserving the integrity of the insurance industry.

Navigating evolving regulations, such as GDPR and CCPA, alongside emerging cybersecurity threats, requires term insurance companies to prioritize proactive cybersecurity strategies, invest in state-of-the-art technologies, and cultivate a culture of cybersecurity awareness and compliance across the organization. By adopting a holistic approach to cybersecurity risk management, term insurance companies can mitigate threats, protect sensitive data, and uphold their commitment to consumer privacy and data security, thereby fostering long-term growth and sustainability in the dynamic insurance landscape.

Opportunity

Emphasis on technology

Insurance technology represents a transformative force within the term insurance market, leveraging cutting-edge technologies to revolutionize traditional insurance practices and enhance operational efficiency. By harnessing innovations such as the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics, Insurance Technology companies are driving fundamental changes in how term insurers conduct business and interact with customers.

One of the key opportunity where insurance technology is making a significant impact is in streamlining operations and reducing costs. Through automation and digitization of manual processes, Insurance Technology solutions enable term insurers to achieve greater operational efficiency, minimize administrative overheads, and optimize resource allocation. By eliminating paper-based workflows and manual data entry tasks, Insurance Technology platforms facilitate faster turnaround times, enhance accuracy, and improve overall productivity across the insurance value chain.

Moreover, insurance technology's impact extends beyond traditional policy issuance and pricing to encompass claims processing, contract drafting, and policy underwriting. Through AI-driven algorithms and natural language processing capabilities, Insurance Technology platforms automate claims adjudication, expedite claims settlement processes, and enhance fraud detection mechanisms, thereby improving customer satisfaction and retention.

Therefore, the rise of insurance technology companies is fundamentally reshaping the term insurance market by introducing innovative solutions that enhance operational efficiency, reduce costs, and improve the overall customer experience. As insurers embrace Insurance Technology solutions to navigate the evolving insurance landscape, they stand to gain a competitive edge and drive sustainable growth in an increasingly digital-driven industry.

Type Insights

The individual-level term life insurance segment held the highest market share of 72% in 2024. Individual-level term insurance represents a personalized approach to life insurance coverage, offering protection for a defined term, typically between 10 to 30 years. What distinguishes individual-level term insurance is its customized premium structure, which is determined based on the insured individual's health, age, lifestyle, and other risk factors. This tailored pricing model ensures that policyholders receive coverage that aligns closely with their unique circumstances, resulting in the most cost-effective and suitable insurance solution.

The growing popularity of individual-level term insurance can be attributed to several factors. Firstly, individuals increasingly recognize the importance of financial protection and risk management in safeguarding their families' futures. With individual-level term insurance, policyholders can secure comprehensive coverage tailored to their specific needs and budgetary constraints, providing peace of mind against life's uncertainties.

Furthermore, individual-level term insurance meets the evolving needs and preferences of today's consumers by offering personalized coverage, flexible customization options, and competitive pricing structures. As individuals increasingly prioritize financial security and seek tailored insurance solutions, the demand for individual-level term insurance is expected to continue driving growth and innovation in the term insurance market.

The group-level term insurance segment is anticipated to witness rapid growth at a significant CAGR of 8.9% during the projected period in the term insurance market. Group-level term insurance is indeed a specialized and cost-effective form of life insurance tailored for specific groups, such as employees within a company or members of an organization. This collective coverage arrangement provides numerous benefits for both employers and individual members.

Moreover, the growth in the group-level term insurance segment is fueled by its inherent advantages, including cost-efficiency, ease of enrollment, and employer contributions. As businesses and organizations prioritize employee benefits and seek ways to attract and retain talent, group-level term insurance remains a valuable and sought-after solution for providing essential life insurance coverage to employees and their families.

Distribution Channel Insights

The tied agents & branches segment has held a 55% market share in 2024 in the term insurance market. Tied agents represent a cornerstone in the distribution landscape of the insurance market, particularly within the domain of term insurance. Their exclusive affiliation with a single insurance company provides them with unparalleled insight into the products and services offered, fostering an environment of in-depth product knowledge and expertise. This expertise enables tied agents to guide clients through the complexities of term insurance policies, offering clarity and understanding amidst intricate details.

Moreover, the personalized customer service provided by tied agents is instrumental in building strong client relationships based on trust and loyalty. Through personalized interactions and tailored recommendations, tied agents address the individual needs and concerns of clients, cultivating enduring partnerships that extend beyond mere transactions. This level of personalization and attention to detail resonates deeply with clients, enhancing their overall satisfaction and loyalty to both the tied agent and the insurance company they represent.

Furthermore, tied agents leverage the strength of their brand association with the insurance company to instill confidence and credibility in their clients. This brand association serves as a cornerstone of trust, empowering clients to make informed decisions about their insurance needs with confidence and peace of mind. In essence, tied agents serve as invaluable allies in simplifying complex insurance options and driving the growth of the term insurance segment through their unwavering commitment to exceptional service and client satisfaction.

The light brokers segment is anticipated to witness rapid growth of 8.7% over the projected period in the term insurance market. Brokers play a pivotal role as a distribution channel in the insurance market, serving as intermediaries between insurance companies and consumers. What sets brokers apart is their ability to offer unbiased advice and access to a diverse array of insurance products from multiple providers. This impartiality enables brokers to prioritize the best interests of their clients, ensuring that they receive tailored coverage solutions that align with their specific needs and preferences.

Moreover, brokers excel in comparing options and navigating the complexities of insurance policies, empowering consumers with comprehensive insights and informed decision-making capabilities. In an era where consumers prioritize transparency, choice, and competitive pricing, brokers serve as trusted advisors who facilitate meaningful conversations and facilitate well-informed choices. The increasing demand for comprehensive coverage further underscores the significance of brokers as a preferred distribution channel.

As consumers seek holistic protection against evolving risks and uncertainties, brokers are adept at curating customized insurance portfolios that address various aspects of their clients' lives, from property and casualty to health insurance and life insurance. In essence, brokers' commitment to transparency, choice, and personalized service positions them as indispensable allies in the insurance marketplace. Their ability to deliver value-added services and cultivate long-term client relationships solidifies their role as a prominent and trusted distribution channel driving the growth of the term insurance market.

Term Insurance Market Companies

- MetLife (United States)

- AIA Group Limited (Hong Kong)

- Prudential Financial Inc. (United States)

- Manulife Financial Corporation (Canada)

- China Life Insurance Company Limited (China)

- Allianz SE (Germany)

- New York Life Insurance Company (United States)

- Japan Post Holdings Co., Ltd. (Japan)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- Northwestern Mutual Life Insurance Company (United States)

- State Farm Mutual Automobile Insurance Company (United States)

- AXA S.A. (France)

- Dai-ichi Life Holdings, Inc. (Japan)

- Zurich Insurance Group Ltd. (Switzerland)

- LIC (Life Insurance Corporation of India) (India)

Recent Developments

- In September 2025, to provide flexible coverage and permitting policyholders to adjust the amount as financial responsibilities change, the Acko flexi term life insurance plan was introduced by Unicorn Acko Tech. Thus, to become a one-stop destination for all protection needs will be their main goal for this launched scheme. The customers will be provided with financial protection by the comprehensive coverage throughout their lives. Additionally, the policy duration can be modified to long-term or short-term protection depending on their life goals, as per the company. (Source: https://inc42.com)

- In August 2025, to make insurance coverage more accessible for the netizens, a pre-approved term life insurance feature was introduced by PhonePe. The proof of income will not be necessary during the policy purchase in this initiative, as per the company. Moreover, by making the products more affordable and accessible to the Indian clients throughout various socio-economic strata, and attracting the previously underserved customers into the term life insurance net will be the main goal of this initiative, as per the CEO of PhonePe Insurance Broking Services, Vishal Gupta. Additionally, the clients who are eligible for the pre-approved term insurance process are being identified by PhonePe along with its insurance partners. (Source: https://inc42.com)

- In December 2023,The Smart Total Elite Protection Plan, a comprehensive term life insurance policy created to fit modern lifestyles, was unveiled by Max Life Insurance Company. This plan provides broad coverage that is tailored to changing customer needs.

- In June 2023,after receiving an IRDAI license in just two weeks, Go Digit Life Insurance Limited, a life insurance company supported by modern technology, started operations. In order to "Make insurance simple," the "Digit Life Group Term Insurance" plan will prioritize providing high customizability to its clients, or groups.

- In May 2023,The American mutual life insurer New York Life debuted a broad selection of affordably cost term life insurance products. These services increase the return on clients' investments in protection while preparing them for opportunities and financial uncertainty.

Segments Covered in the Report

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting