Monorail System Market Size and Forecast 2025 to 2034

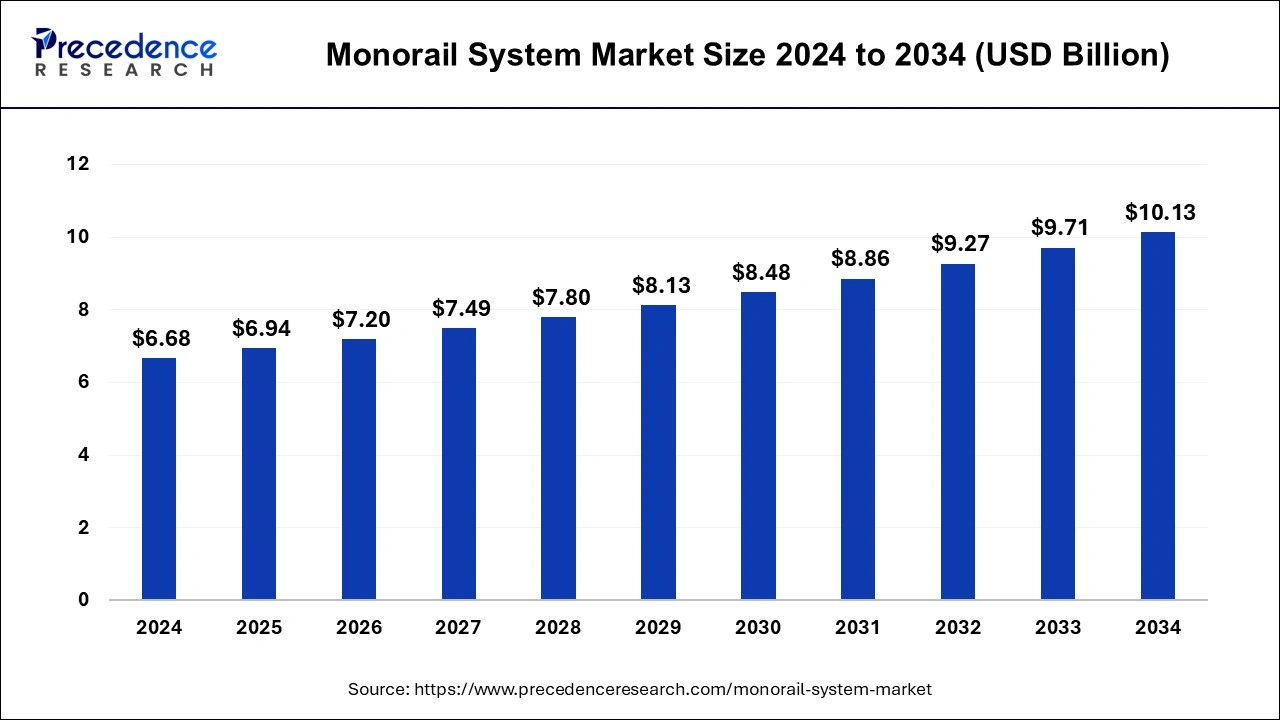

The global monorail system market size was accounted for USD 6.68 billion in 2024 and is anticipated to reach around USD 10.13 billion by 2034, growing at a CAGR of 4.25% from 2025 to 2034. The increasing demand for public transport, environmental sustainability, and increasing investments are the major growth factors of the monorail system market.

Monorail System Market Key Takeaways

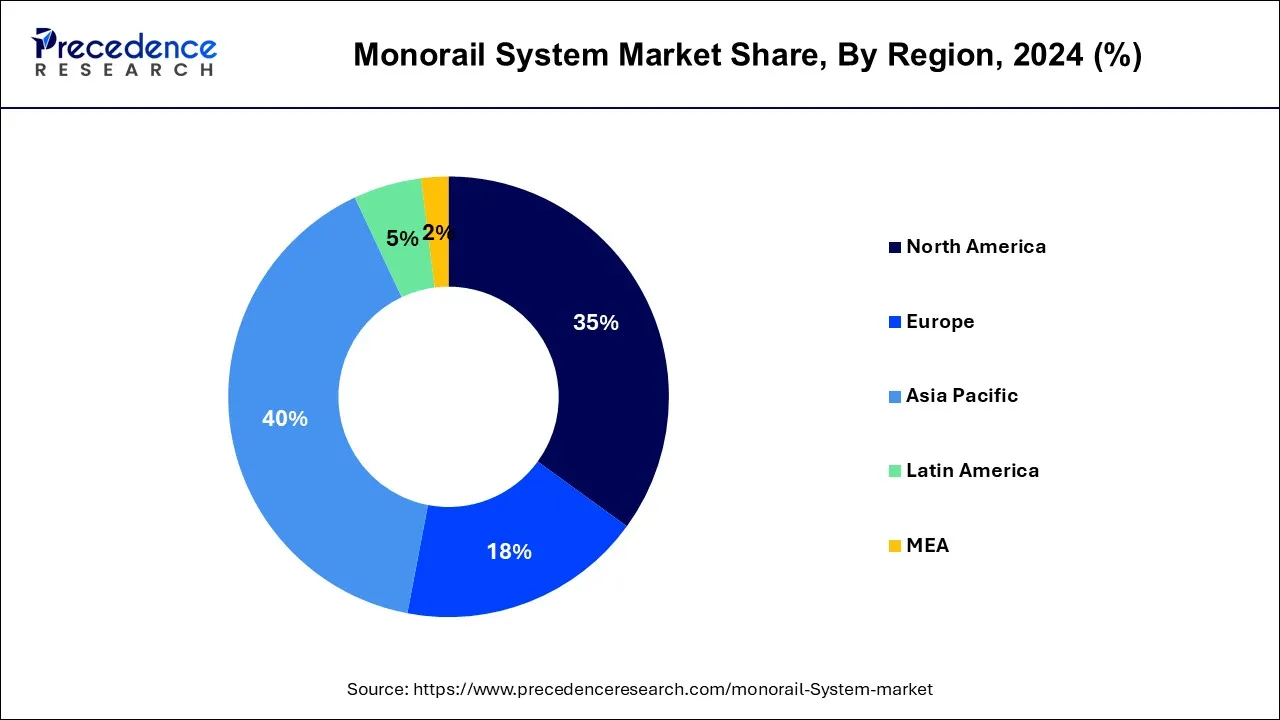

- Asia Pacific led the global market with the highest market share of 40% in 2024.

- By Type, the straddle monorail segment has held the largest revenue share in 2024.

- By Autonomy, the completely autonomous segment had the biggest market share in 2024.

- By Propulsion Type, the electric monorail segment is estimated to hold the highest market share in 2024.

Impact of AI on the Monorail System Market

Artificial intelligence (AI) revolutionizes the railways and transportation systems driven by advanced features. AI and the Internet of Things (IoT) implement digitalization in railways and overcome several challenges conventional rail systems face. Integrating AI in monorail systems allows loco pilots to detect obstacles, recognize signals, and automate log analysis. These capabilities allow operators to take real-time corrective and maintenance action. AI-enabled predictive maintenance detects potential errors in monorails and mitigates operational issues, ensuring reliability. Thus, AI and IoT reduce operational costs while improving availability, allowing the rail industry to manage traffic volumes effectively. Moreover, AI can also examine track conditions, notify operators of any safety-affecting abnormalities, and avert potential derailments.

Asia Pacific Monorail System Market Size and Growth 2025 to 2034

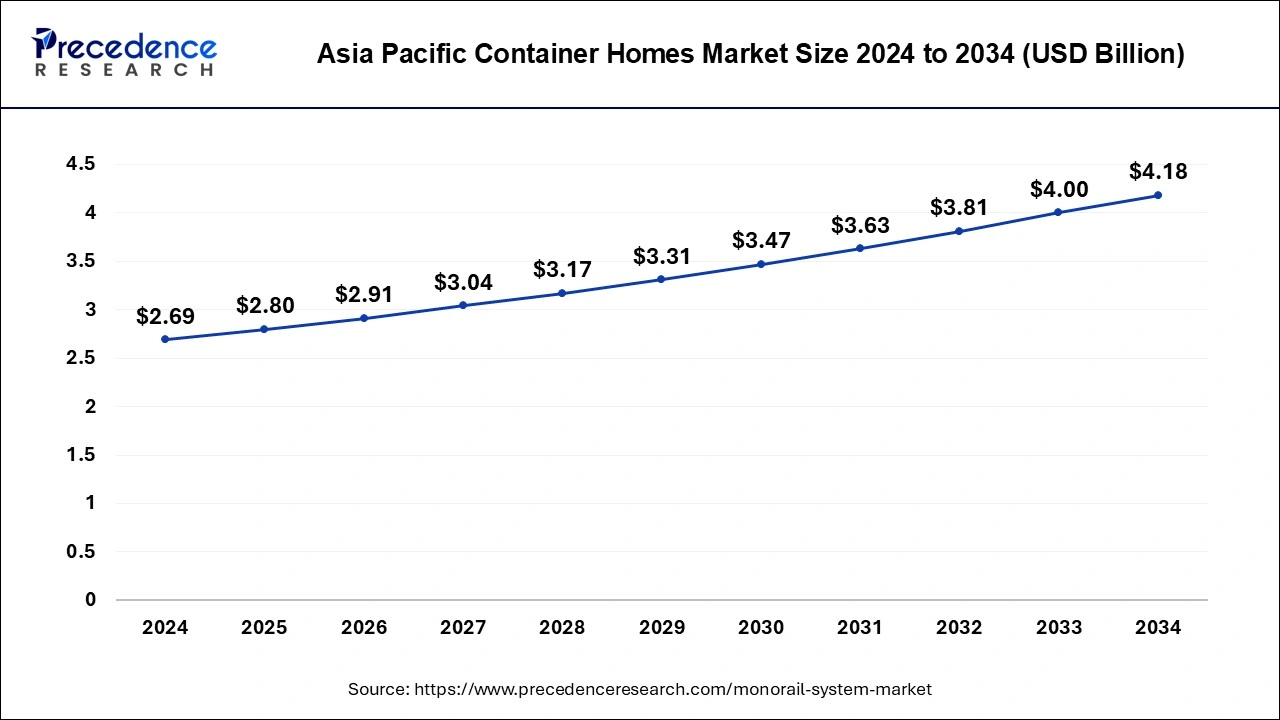

The Asia Pacific monorail system market size was exhibited at USD 2.69 billion in 2024 and is projected to be worth around USD 4.18 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034.

Asia Pacific contributed more than 40% of revenue share in 2024. Most of the under-construction projects are based in India, China, and ASEAN countries. In March 2019, India completed its first monorail project in Mumbai with an estimated investment of USD 5019 Mn on the project. In addition, rapid urbanization, rising traffic congestion, along with ever increasing population expected to propel the market growth in the region significantly.

Governments are preferring monorail systems due to rapid urbanization, an increase in the number of daily commuters, increased road traffic congestion, and the availability of tiny places. As a result of the enormous number of projected monorail system projects in Asia Pacific, the region is likely to provide profitable possibilities for monorail system manufacturers.

China Monorail System Market Trends

China is a major contributor to the monorail system market. The growing population and rapid urbanization increase demand for public transportation systems like monorails. The strong government support for the development of monorail systems helps the market growth. The growing investment in monorail systems increases the development of monorail systems. The technological advancements, like smart technologies integration, and magnetic levitation, help the market growth. The growing investment in advanced infrastructure development and integration with existing metro lines drives the market growth.

India Monorail System Market Trends

India is significantly growing in the monorail system market. The growing population and increasing traffic congestion problems fuel demand for monorail systems. The strong government investment in infrastructure development and focus on urban mobility increases the focus on the development of the monorail system. The growing demand for a sustainable transportation system and advancements in the monorail system support the overall growth of the market.

Rest of the world is another most opportunistic region that offers significant revenue growth in the coming years. The factors attributed to the market growth are increased per capita income, enhanced education quality, and the rising number of daily commuters are fueling the demand of monorail systems in the region.

North America is anticipated to grow at the fastest rate in the market during the forecast period. The rising adoption of monorail systems, technological advancements, and increasing investments drive the market. The increasing public-private partnership also supports market growth. The U.S. and Canadian governments collaborate with private organizations by providing funding and other necessary support in developing monorails for the country. As of September 2023, 16 monorail systems in use in the U.S. While, there are currently 6 monorail systems in Canada. The growing demand for public transport also contributes to the market growth. Approximately 6,800 organizations provide public transportation in the U.S. The increasing investments in modernizing public transportation infrastructure boosts market growth in North America.

United States Monorail System Market Trends

The United States is a key contributor to the monorail system market. The high investment in the public transportation system increases the adoption of monorail systems. The growing focus on the expansion of the urban transportation system increases the development of monorail systems. The growing adoption of advanced monorail technologies like predictive maintenance capabilities, automated control systems, and efficient propulsion systems helps the market growth. The increasing investment in smart city projects and focus on sustainable transportation solutions increases the adoption of the monorail system. The higher disposable income and focus on eco-friendly transportation support the overall growth of the market.

Europe is growing at a notable rate in the monorail system market. The increasing demand for efficient public transportation and the growing problems of traffic congestion are increasing the adoption of the monorail system. The focus on reducing carbon emissions and the adoption of sustainable transportation solutions help the market growth. The ongoing innovations in the monorail system, like IoT-based monitoring, an automated control system, and advanced propulsion systems, help the market growth. The strong investment in smart city projects and investment in infrastructure development drives the overall growth of the market.

Market Overview

Monorail is a type of elevated transportation system that is supported by a single track and is frequently referred to as a beam way. From airport transit to medium-capacity metros, monorail has a wide range of applications. Furthermore, companies now provide mass transit planners. Furthermore, the industry's growth is expected to be hampered by low market penetration, speed, and the availability of alternative options. Furthermore, over the forecast period, traffic congestion, technology advancements, and environmental compatibility are expected to provide profitable prospects for the market.

Monorails are capable of carrying only four to six cars at a time and sometimes up to eight cars. This is the prime factor why governments of several developing nations prefer rapid transit systems or metros over monorails. Nonetheless, its environment-friendly feature as it runs on electric and magnetic energy may make it a preferred choice for the intra-city transport system in the coming years.

Monorail System Market Growth Factors

- Growing Demand for Public Transport: The growing demand for public demand facilitates government organizations to install monorails, boosting market growth.

- Increasing Investments: Government organizations release funding and budget annually to advance infrastructure in their respective countries.

- Rapid Urbanization: The need for rapid urbanization, especially in developing countries, increases the demand for monorail systems.

- Growing Demand for Sustainability: Monorail systems are based on either electric or magnetic systems. Unlike conventional rails, they do not emit carbon or greenhouse gases.

- Favorable Government Support: The government supports the monorail system market by providing funding and releasing guidelines about environmental sustainability.

- Rising Traffic Congestion: The rising traffic congestion has triggered the demand for a clean and voluminous transport system.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 6.94 Billion |

| Market Size by 2034 | USD 10.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.25% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Autonomy, Propulsion Type, Autonomous, Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Surge in demand for electric monorails

Individually motorized carriers in electric monorail systems are powered by a track-mounted bus bar. Production areas or supply systems that require accumulation are typical applications. This system allows for a wide range of conveyor speeds, ranging from 8 to 400 fpm, permitting the carrier to fast-track, sneak into a meticulous location for automaticworkspaces, converse travel, travel on clear production hubs, travel at extremely high rates, accumulate, and so on. Furthermore, the electric monorail system can be equipped with an onboard computer that allows for decision-making for alternative routes without relying on the selected centralized conveyor system. Thus, the demand for electric monorail systems is driving the growth of the market.

Growing adoption of urban transportation

As urban areas across the globe expand and progress, the popularity of monorails as a cost-efficient, effective, and environmentally friendly transportation option is on the rise.

- According to the world bank, approximately 6% of the global population, which accounts for 4.4 billion people, resides in urban areas. This trend is projected to continue to exist; by 2050, the urban population is anticipated to more than double its current size. At that point, nearly 70% of the world's population will reside in cities.

- Moreover, according to the high road foundation organization, monorail systems around the world transport millions of people daily, with nearly 50 such systems in operation. For instance, in Chongqing, China, the monorail system efficiently serves an impressive daily ridership of approximately 1.3 million passengers.

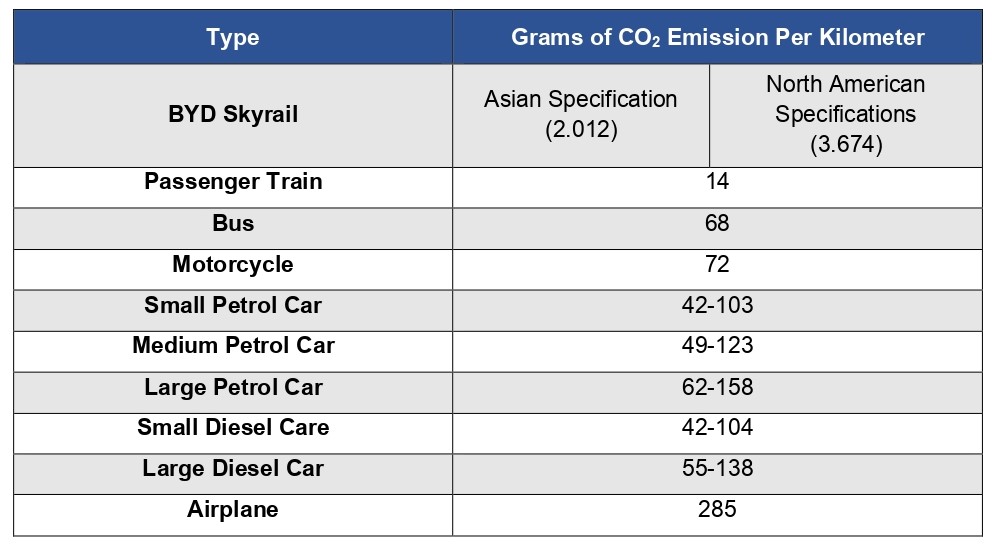

Also, the monorail has the lowest carbon footprint. Monorails cause fewer disruptions during construction and operation compared to other transportation alternatives.

Grams of CO2 Emissions Per Kilometer

They have a small footprint, requiring only 36 square feet for every 100 feet of elevated track, which reduces ground disturbance during and after construction. Furthermore, the monorail systems have the benefit of having the lowest operational and maintenance costs compared to other mass transit systems. Since monorail cars are elevated, they are less prone to vandalism and generally stay cleaner than ground-based rail systems. The important components like engines and guide rails have a longer lifespan than those in buses and trains, leading to lower long-term operating costs. Also, there are 42 urban monorail systems in operation across the globe, covering over 269 miles and serving more than 400 stations. These systems transport millions of passengers every day reliably.

Number of people transported per hour in an urban environment

| Car | Bus | Tram | Monorail | Metro |

| 2000 | 9000 | 22000 | 48000 | 50000+ |

Restraints

High installation cost of maglev

The high installation cost of maglev compared to electric railway systems is one of the major constraints limiting its progress. In emerging markets, these cars have a low adoption rate. One of the greatest barriers to manufacturers joining the market, especially in developing and developed countries, is the increased installation costs.

Opportunity

Growing Utilization in Emerging Economies

The future of the monorail system market is promising, driven by the growing utilization of monorail systems in emerging economies. Developing countries like India, Saudi Arabia, Malaysia, Singapore, Thailand, etc. are actively installing monorail systems as part of their infrastructure projects. The government of such countries launches several infrastructure projects to improve the lifestyle of people. They also contribute by providing funding to accelerate the development and utilization of monorail systems. Some governments also emphasize domestic manufacturing, promoting a circular economy in a nation. The Indian Government allocated a budget of Rs 3 lakh crore for FY2025, an increase of 15-20% from the previous year.

Challenges

Lack of innovation

In the monorail systems market, there is a dearth of innovation and research, and development. Companies must invest extensively in research and development to improve the capability of monorail systems, as well as their speed, reliability, and efficiency, in order to cut turnaround times. Thus, this is a major challenge for market growth.

Type Insights

Monorails are normally employed to support manufacturing undertakings. Straddle design of monorail system utilizes extremely effectual guideway design. The guideway's narrow beam is fashioned offsite in a way that route corridor can stay highly reachable to the general public during production. The accomplished guideway is considerably thinner and permits more light through compared to widespread bridge structures requisite by other transit vehicle designs, whereas employing suggestively fewer construction material. As a result, it has significantly lower construction costs.

Straddle type monorail led the global monorail system market in 2023 owing to its higher capacity of carrying passengers than suspended type. Thus, straddle type monorail are a preferred choice over for crowded and high-frequency transportation. However, suspended type is most used at zoos, parks, and other small areas where the number of passengers is less.

Straddle monorail, which uses rubber wheels and precast concrete track beams, is a unique urban rail transit system with great climbing capabilities, a small turning radius, minimal land use, low noise, moderate volume, and low cost.

Autonomy Insights

In terms of autonomy, the completely autonomous segment held the major market share in 2023. The segment is experiencing growth due to its features, such as high reliability and safety, increased availability, short system delivery, seamless integration, and growing installation.

- For instance, In March 2021, a fully automated driverless monorail was launched in Wuhu in eastern China. The monorail uses an Automatic Train Operation system called ATO GoA 4, which means it can run entirely on its own. The monorail was developed through a partnership between Alstom and CRRC with a total project investment of more than 8 billion yuan. The newly constructed Wuhu Line 1 features an elevated monorail that operates at a speed of 80 kilometer per hour. It is equipped with the most advanced level of automatic train operation, known as ATO GoA4. This state-of-the-art technology allows the monorail to operate without a driver and runs fully without supervision.

Propulsion Type Insights

Electric monorails dominated the global monorail systems market in 2023. Electric monorails require less manufacturing time and cost as compared to maglev trains thus they captured most of the revenue share nearly 80% of the global market. In addition, Maglev trains are not suitable for short distance run such as intra-city transportation or within urban city travel as they have very high speed compared to electric monorails. Speed range of electric monorails is between 80 to 100 kilometers per hour on the other hand, maglev train speed is above 500 kilometers per hour. A rail-bound mode of transportation with separately operated vehicles that move independently on the rail system is known as an electric monorail. With the help of switch points, branch points can be implemented on a line.

Automation Insights

The grade of automation is decided on the basis of a number of automated components in the train. Based on automation the global monorail system market is classified into GoA0, GoA1, GoA2, GoA3, and GoA4. GoA3 and GoA4 grade are considered as fully automated mass transport system and they possess highly level of punctuality and safety. They are mostly preferred in mass transits. However, GoA2 monorails are more preferred across the globe as they are more effective in reducing accidents along with enhancing the overall train performance. GoA2 trains are incorporated with Automatic Train Protection (ATP) and Automatic Train Operation (ATO) systems, and operated under surveillance. These are some of the important factors that drive the growth of the electric monorail systems market.

Monorail System MarketCompanies

- Bombardier Corporation

- CRRC Corporation Limited

- Hitachi Rail

- Ansaldo STS

- BYD Company ltd

- General Electric

- Alstom S.A.

- Thales Group

- SIEMENS AG

- Mitsubishi Electric

- ABB

Latest Announcement by Industry Leaders

- Stephen Thomas, Chief Operations Officer, KAFD DMC, commented that by launching a monorail system in Riyadh, they are enhancing the quality of life for citizens and visitors and contributing to the long-term sustainability of Riyadh. He also said that this project is a part of Saudi Arabia's Vision 2030.

Recent Developments

- In February 2023, the first medium-capacity monorail train manufactured by CRRC Changchun was introduced in Chongqing, China, on February 10th. This multi-adaptive straddle-type monorail offers excellent climbing ability, a small turning radius, and high environmental adaptability. With a maximum speed of 80km/h, each car can accommodate 136 passengers. The flexible configuration meets different passenger traffic demands, and its lightweight construction and low running noise have a minimal environmental impact.

- In October 2024, KAFD launched a monorail system in Riyadh to enhance urban connectivity with a sustainable, driverless design. The system consists of 6 autonomous trains running on a circular track and spans 3.6 kilometers.

- In September 2024, trains manufactured by Alstom were successfully tested before the launch of a new Egyptian monorail system. The new trains were constructed under a £2.3 billion contract and are part of 61 mile-long monorail network in the Egyptian capital.

- In April 2024, the Mumbai Metropolitan Region Development Authority (MMRDA) announced the trial of the first domestically manufactured monorail system at the Vadala depot. The train was developed by Medha SMH Rail and will be put into operation after dynamic testing in Mumbai.

Segments Covered in the Report

By Type

- Straddle Monorail

- Suspended Monorail

By Autonomy

- Semi-autonomous

- Completely Autonomous

- Manual

By Propulsion Type

- Electric Monorail

- Maglev Monorail

By Autonomous

- GoA0

- GoA1

- GoA2

- GoA3

- GoA4

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting