Automotive VVT System Market Size and Forecast 2025 to 2034

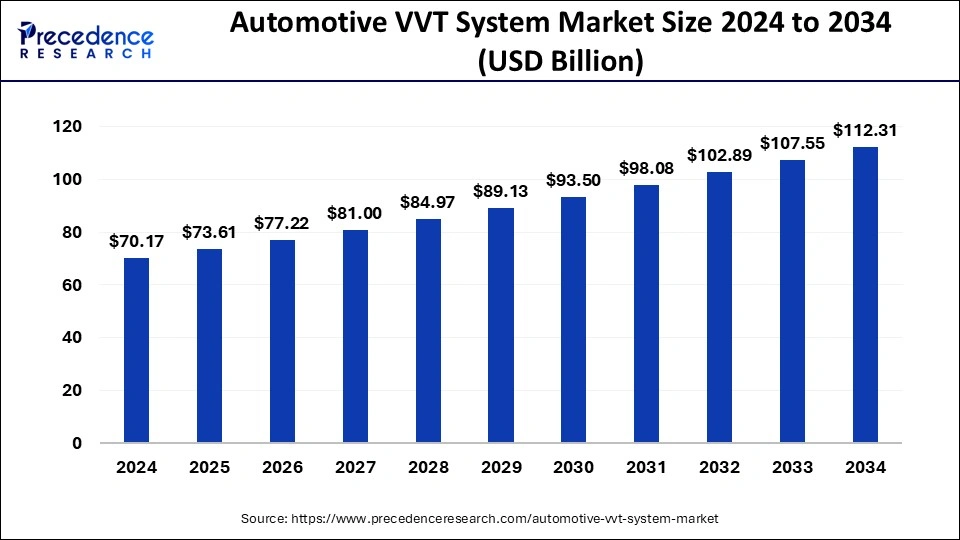

The global automotive VVT system market size accounted for USD 70.17 billion in 2024 and is predicted to increase from USD 73.61 billion in 2025 to approximately USD 112.31 billion by 2034, expanding at a CAGR of 4.82%.

Automotive VVT System Market Key Takeaways

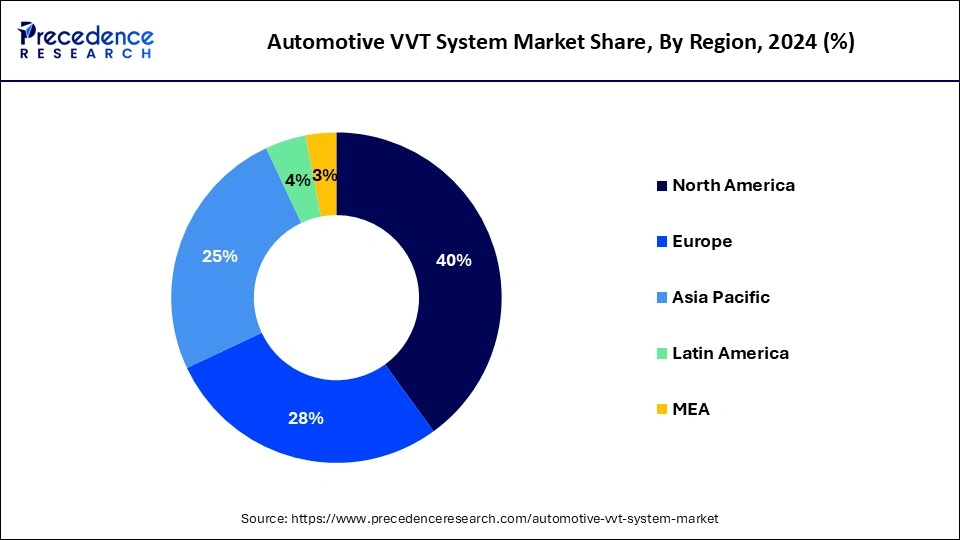

- Asia Pacific led the market with the biggest market share in 2024.

- By Valve Train, the Double Overhead Cam(DOHC) segment has held the largest market share in 2024.

- By Vehicle Type, the Passenger vehicle segment generated over 65% of revenue share in 2024.

AI in the Automotive VVT System Market

The global VVT system market is undergoing dramatic changes through AI. Refined designs and intelligent maintenance keep system performance and reliability high while keeping efficiency on the better side. Through adaptive control, an AI system dynamically adjusts valve timing to achieve optimum engine operations under different conditions. It also promoted fuel economy while suppressing emissions for greater sustainability. AI also offers predictive maintenance by recognizing anomalies, thus avoiding costly breakdowns and extending component life. On a larger scale, the innovation in VVT systems, such as those for hybrid and electric vehicles, is another area of AI. AI equips supply chains with intelligent demand forecasting and logistics. AI-enriched customer experiences render unique data-based vehicle designs, features, and marketing strategies. Hence, their integration yields smarter, cleaner, and more efficient automotive solutions.

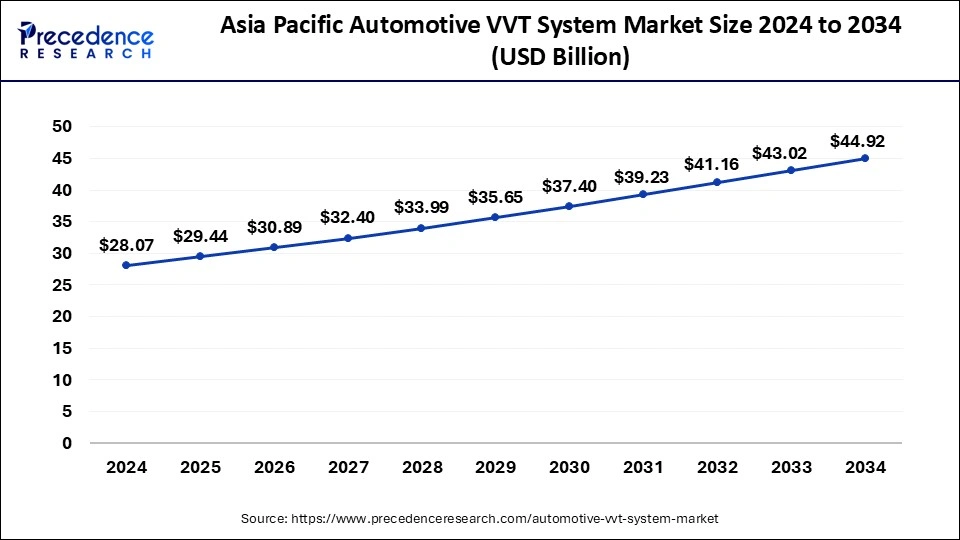

Asia Pacific Automotive VVT System Market Size and Growth 2025 to 2034

The Asia Pacific automotive VVT system market size was exhibited at USD 28.07 billion in 2024 and is projected to be worth around USD 44.92 billion by 2034, growing at a CAGR of 5.00%.

In 2024, the Asia Pacific held a considerable market value share and expected to exhibit substantial growth over the forecast period. Rapid growth in sale of passenger vehicles is one of the prime factors that boost the market growth. Furthermore, rising price of gasoline and petrol evoke demand for fuel-efficient engine, thereby propelling the growth of VVT systems. Besides this, government encouragement to consumers for adopting battery-powered vehicles to curb the environment degradation analyzed to hamper the growth of VVT systems in the region.

On the other hand, Europe and North America are the other major regions for the automotive VVT system market as they encounter significant sale of passenger as well as commercial vehicles in the region. Moreover, the regions have adopted several measures to cut down the fuel consumption, thereby improving the fuel efficiency of the vehicle.

Automotive VVT System Market Growth Factors

- Emission regulations are pushing automotive VVT systems, which in turn reduce harmful gas emissions and the resultant environmental impact.

- With the increasing demand for efficiency and durability in engines offered by VVT systems, vehicle manufacturers have been prompted to install these in high numbers across vehicle types.

- Increasing consumer purchasing power for passenger vehicles is allowing the growth of advanced engine technologies.

- Keeping the engine design advanced, high-performance, and low in fuel consumption is instigating greater acceptance of VVT systems.

- Consumers are opting for sustainability and performance, and so VVT systems are becoming an integral part of market fulfillment

MarketScope

| Report Coverage | Details |

| Market Size by 2034 | USD 112.31 Billion |

| Market Size in 2025 | USD 73.61 Billion |

| Market Size in 2024 | USD 70.17 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Methods, System, Number of Valves, Valve Train, Technology, Vehicle Type, Actuation Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Value Cain Analysis

- Raw Material Sourcing: It involves acquiring and managing inputs for manufacturing VVT system components, including metals for gears and actuators, polymers for seals, and semiconductors for electronic controls.

Key Players: Sumitomo Electric, TEXA METALS AND ALLOYS

- Component Manufacturing (Engines, Transmissions, etc.): Involves precision machining and assembly of VVT phasers, actuators, and electronic control units installed into a vehicle engine.

Key Players: Robert Bosch GmbH, Continental AG, Denso Corporation

- Vehicle Assembly and Integration: Concerned with the actual installation of the fully assembled VVT system during vehicle manufacturing into the engine, verifying its functioning and integration with other vehicle systems.

Key Players: Valeo, BorgWarner, and Hitachi

- Testing and Quality Control: Used to ensure that the VVT system is operating correctly, testing for performance, durability, and emissions compliance through simulation and physical tests.

Key Players: Bosch, Continental AG, Denso, Aisin, and BorgWarner

- Distribution to Dealers and OEMs: Concerns itself with getting the completed VVT system to OEMs for use in new vehicle production or to dealers as replacement parts.

Key Players: Robert Bosch, Denso Corporation, BorgWarner, Continental AG

Valve Train Insights

Double Over Head Cam valve train design enables broader angle among exhaust valve and intake valve compared to Over Head Valve (OHV) and Single Over Head Cam (SOHC). In consequence to this, DOHC valve train design holds the maximum share in the automotive VVT system market and anticipated to grow at a significant rate over the analysis period. DOHC consists of two cam shafts located overhead for operating different intake and exhaust valves. The DOHC has double inlet and exhaust valves compared to SOHC that makes the engine cooler. This helps the engine to make less noise, run smoothly, and provide superior performance. Increasing demand for high fuel efficiency, on-going research & development in engine management systems, constant rise in sales of vehicles, and rise in demand for high power engines are further predicted to flourish the demand for DOHC in the global automotive variable valve timing (VVT) market during the analysis period.

Vehicle Type Insights

Based on vehicle type, the global automotive VVT system market is bifurcated into passenger vehicles, electric vehicles, and commercial vehicle. Passenger vehicle expected to dominate the global automotive VVT market and accounted to more than 65% value share. The continuous rise in demand for passenger vehicles along with their upgradation has prompted the international automobile manufacturers to extend their production capacities.

As specified by the International Organization of Motor Vehicle Manufacturers (OICA), in 2018, the overall production of passenger cars surpassed 70 Million units. Rising per capita income, increase in purchasing power of consumers, rising demand for comfort in travelling, and growth in economy of developing countries are some of the prominent factors that drives the market growth of passenger vehicles.

Key Companies & Market Share Insights

The global automotive VVT system market has few major players operating in the market due to expensive and complicated manufacturing process of VVT systems. Major market players are strategically adopting merger & acquisition strategy of regional players to extend their portfolio in the fabrication of different components of VVT system to develop their business. In addition, they also emphasize on R&D to improve their efficiency and functionality of the VVT systems.

Automotive VVT System Market Companies

- Mikuni American Corporation

- Johnson Controls, Inc.

- Federal-Mogul LLC

- Camcraft, Inc.

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Eaton Corporation

- Mitsubishi Electric Corporation

- DENSO Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

Recent Developments

- In April 2025, Maruti Suzuki introduced the 2025 WagonR hatchback with 6 airbags, three-point seatbelts, rear parking sensors, ABS, EBD, and a central locking system, using the same petrol engines.

https://www.indiacarnews.com - In November 2024, Ducati introduces its lightweight V2 engine, the lightest twin-cylinder in its history, featuring advanced features like IVT and DLC treatment, and available in 120 and 115 hp configurations.

https://www.autocarpro.in

Segments Covered in the Report

By Fuel Type

- Diesel

- Gasoline

By Methods

- Cam Changing

- Cam Phasing

- Variable Valve

- Cam Phasing & Changing

By System

- Continuous

- Discrete

By Number of Valves

- More than 24

- Between 17 to 23

- 16

- Less Than 12

By Valve Train

- Over Head Valve(OHV)

- Double Overhead Cam(DOHC)

- Single Overhead Cam (SOHC)

By Technology

- Dual VVT-I

- VVT-I

- VVT-iW

- VVT-iE

By Vehicle Type

- Passenger Vehicles

- Electrical Vehicles

- Commercial Vehicles

By Actuation Type

- Type V

- Type IV

- Type III

- Type II

- Type I

By End-use

- Aftermarket

- OEMs

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting