What is the Mouse TNF-α Kit Market Size?

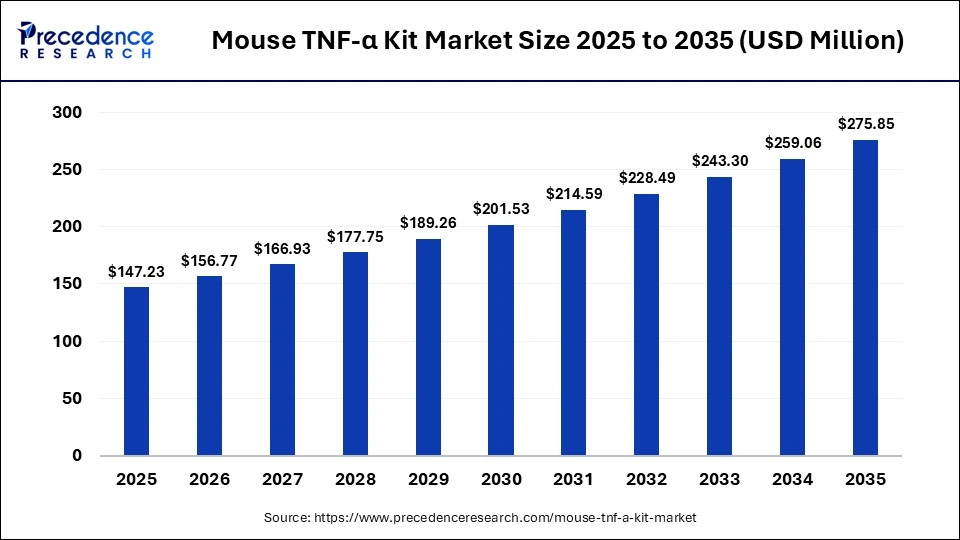

The global mouse TNF-α kit market size was estimated at USD 147.23 million in 2025 and is predicted to increase from USD 156.77 million in 2026 to approximately USD 275.85 million by 2035, expanding at a CAGR of 6.48% from 2026 to 2035. The market growth is attributed to increasing preclinical research on inflammatory and autoimmune diseases, driving demand for precise TNF-α quantification in mouse models.

Market Highlights

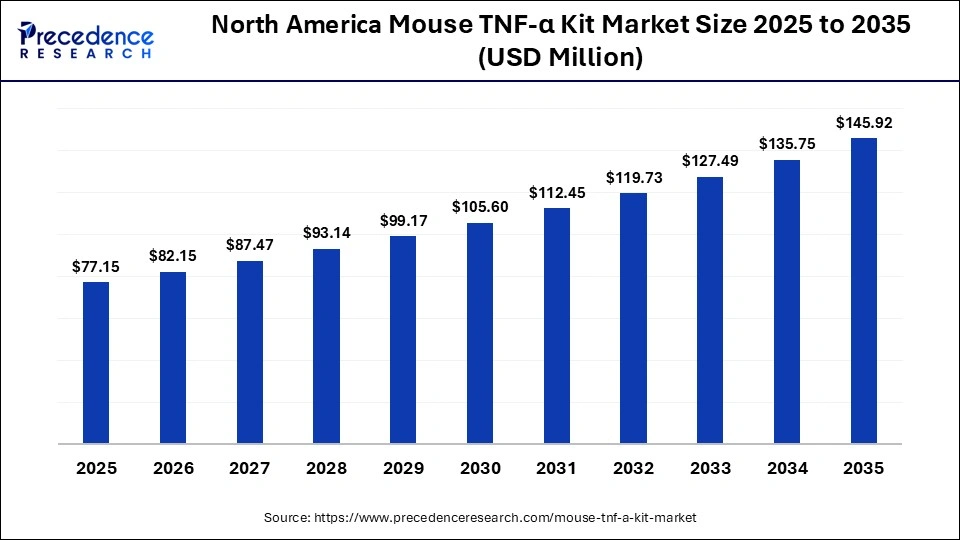

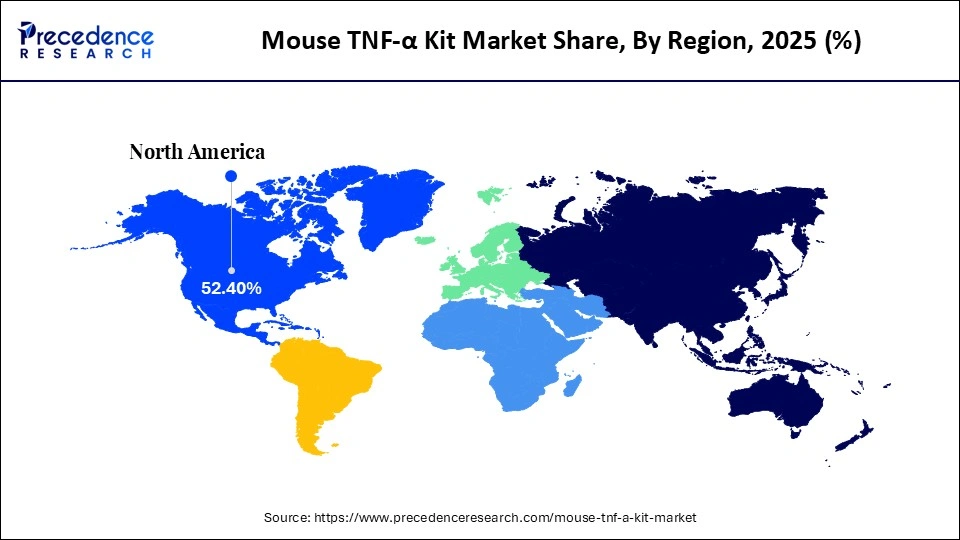

- North America dominated the market with 52.4% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7% between 2026 and 2035.

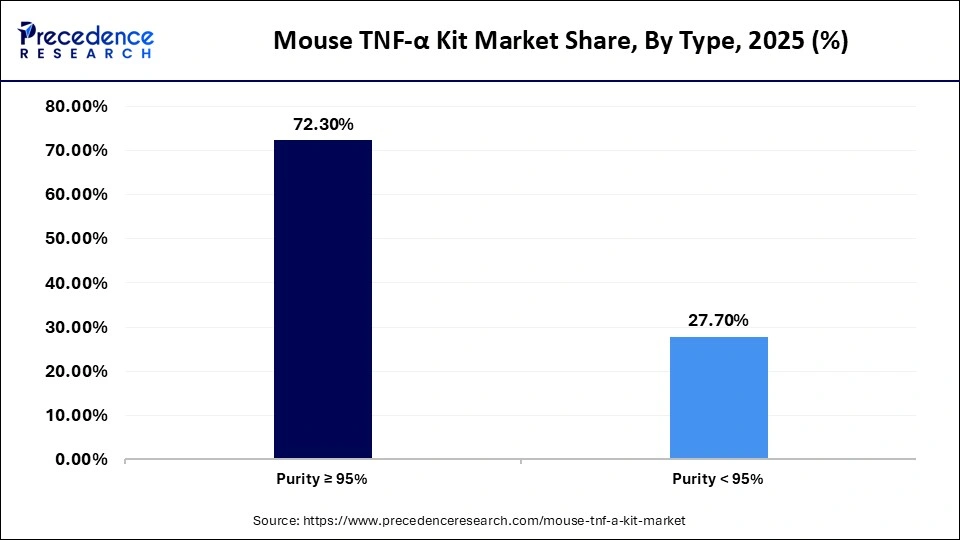

- By type, the purity ≥95% dominated the market in 2025 and is expected to sustain the position during the forecast period with a 6.2% CAGR.

- By detection method, the colorimetric ELISA segment held a major market share of 45.4% in 2025.

- By detection method, the chemiluminescent/fluorescent ELISA segment is expected to expand at a notable CAGR of 5.9% from 2026 to 2035.

- By application, the research centers segment captured the highest market share of 56.8% in 2025.

- By application, the universities segment is poised to grow at a healthy CAGR of 6% between 2026 and 2035.

- By end-user, the academic & government research labs segment generated the biggest market share of 54.7% in 2025.

- By end-user, the biotech/pharma R&D segment is expanding at the fastest CAGR of 6.1% between 2026 and 2035.

- By distribution channel, the direct sales/distributions segment accounted for the largest market share of 53.4% in 2025.

- By distribution channel, the e-commerce platforms segment is projected to grow at a solid CAGR of 6.2% between 2026 and 2035.

Mouse TNF-α Kit Market Overview

The inflammation studies are one of the major factors that drive the market demand for mouse TNF-α kits. Owing to the central role of tumor necrosis factor alpha (TNF-α) in innate immune signalling, its measurement is critical in the study of disease pathogenesis in approved preclinical models. In 2024-2025, TNF-α profiling in models of autoimmune pathophysiology and metabolic inflammation can be found in the NIH report, indicating the scope of using the assay.

TNF-α is a master controller of inflammatory cascades, which are involved in vasodilation, leukocyte recruitment, and oxidative stress. These activities render it a vital biomarker in autoimmune disease, infection, and tissue injury investigations. Furthermore, the continued investment in analytical technology, assay standardization, and cross-institutional data comparability remains a major driver pushing adoption and innovation in mouse TNF α detection tools.

Impact of Artificial Intelligence on the Mouse TNF-α Kit Market

The market of the mouse TNF α Kit is changing with the emergence of AI. These technologies are designed to improve the efficiency of the experiment and the reliability of data in preclinical research. The algorithms of the machine learning process assay results to determine weak patterns in cytokine expression. This enables researchers to evaluate inflammatory responses more precisely and forecast the results of treatment in mouse models. There are also AI-based tools that support high-throughput screening and experimental design, enabling the lab to perform more studies of higher complexity and lessen reproducibility loss.

Mouse TNF-α Kit Market Growth Factors

- Rising Preclinical Immunotherapy Programs: Expanding research in cancer and autoimmune immunotherapies is driving demand for high-precision TNF α kits in mouse models.

- Growing Adoption of Multiplex Cytokine Profiling: Integration of TNF α measurement with other cytokines is boosting the use of advanced assay kits in translational research.

- Technological Advancements in ELISA and Chemiluminescence: The development of higher sensitivity and reproducibility kits is fuelling adoption among biotech and pharmaceutical R&D centers.

- Expansion of Biotech and Pharma Pipelines: Growth in preclinical drug discovery programs is propelling demand for standardized TNF α quantification assays.

- Rising Collaborations Between Academia and Industry: Partnerships for translational studies are boosting the utilization of TNF α kits in multi-site experiments.

Mouse TNF Alpha Kit Landscape Evidence-Based Usage and Innovation Metrics 2024 2025

- CRO standardization amplifies export pull-through, as a single platform selection by a top-tier CRO can trigger deployment across 5-10 countries within one trial network, significantly accelerating cross-border kit penetration.

- Sepsis and acute inflammation studies display a broader phase spread, with 45-50% of usage in preclinical/Phase I and 30-35% extending into Phase II, as TNF-α remains a core translational biomarker across dose-finding and proof-of-concept stages.

- The Abcam Mouse TNF α ELISA Kit (ab100747) shows 89 scientific publications indexed on PubMed/related databases as of the latest count, covering studies involving mouse cytokine measurement and inflammation research in 2024-2025. This is a product-specific citation count from Abcam's own listing, a direct, verifiable usage indicator in scientific literature

- A bibliometric analysis of TNF α research in pulmonary tuberculosis (1990-2024) included 1,200 articles, with the United States contributing the most publications, followed by China and India-showing real country-level productivity in TNF α science. This is not mouse ELISA specific, but it is factual evidence of where TNF α research (which would include or lead to mouse model studies) is most prolific.

- Mouse TNF α ELISA (Proteintech KE10002) is referenced in ≥465 scientific publications, making sandwich ELISA the most widely adopted modality for TNF α quantification in mouse samples in 2024-2025. This extensive adoption directly drives high commercial demand for Proteintech ELISA kits, reinforcing their market leadership in preclinical TNF α assays

- Rheumatoid arthritis clinical responses to TNF antagonists, in a multicentered U.S. cohort (n=465), patients meeting trial eligibility criteria achieved a 52.3-63.6% rate of 20% improvement and a 30.8-45.5% rate of 50% improvement, showing how many real patients demonstrate measurable clinical benefit with TNF α-targeted therapy. These response rates illustrate patient engagement and effectiveness patterns relevant to real-world TNF α-targeted treatments, influencing demand for cytokine measurement tools like TNF α kits

Mouse TNF-α kit Market Outlook

- Industry Growth Overview: The mouse TNF α kit market continues to expand as preclinical research on inflammation, immuno-oncology, and autoimmune diseases intensifies globally, driving demand for precise cytokine quantification tools. TNF-α is a major immune activation biomarker or inflammatory control element. These specific ELISA, CLIA, and multiplex assay kits are highly essential in laboratory research on therapeutic activity and safety.

- Sustainability Trends: The concept of sustainability in Mouse TNF, a kit business, is becoming more in line with resource efficiency and operational reproducibility. The automated systems that reduce the hands-on time and sample/reagent consumption are beneficial in the reduction of costs. This also contributes to the reduction of wastage, especially in the high-volume research environments where repeated immunoassays are widespread. Moreover, operations become even more efficient with the transition to digital data capture, which minimizes the utilization of paper and manual records.

- Global Expansion: The market structure of the mouse TNF-α kit geographically is recording significant growth in various research centers. North America continues to be a base area by virtue of its set up biomedical research facilities and huge investment in immunology and therapeutic development. On the other hand, Asia Pacific nations are rapidly growing their preclinical research potential. This is reinforced by the heavy investment in biotechnology and medical research and development.

- Major Investors: Research funding agencies, academic grants, and strategic alliances are major contributors to investment activity in the mouse-α a kit ecosystem. The governmental funding of research and institutional funds indirectly drives the demand for advanced TNFα detection technologies. Furthermore, the strategic partnerships between assay developers and contract research organizations (CROs) serve as a form of investment in technology validation and adoption in the coming years.

- Startup Ecosystem: Although the mouse TNF-α kit market is dominated by large established market players. There is also a parallel ecosystem of innovation that is present in smaller research-based projects that are developing next-generation assay formats. New platforms, such as the development of microfluidic ELISA systems and high-throughput immunosensing chips indicates strong future in which new formats can be explored. Additionally, the broader trend toward integrative and intelligent biomarker measurement systems may influence future generations of TNF α quantification tools.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 147.23 Million |

| Market Size in 2026 | USD 156.77 Million |

| Market Size by 2035 | USD 275.85 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.48% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Detection Method, Application, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Is Purity ≥95% Driving Dominance in the Mouse TNF-α Kit Market?

The purity ≥95% segment dominated the market in 2025 with a 72.3% market share and is expected to sustain the position during the forecast period, accounting for an estimated 6.2% CAGR, due to the need to obtain accurate cytokine measurements and minimize background interference in ELISA and multiplex assays. TNF-α reagents of high purity give stability in binding and a high signal-to-noise ratio, thus being vital in preclinical research in inflammation and immunotherapy. Moreover, the growth of the purity ≥95% segment is also attributed to increasing adoption in regulated preclinical pipelines.

Detection Method Insights

Why Is Colorimetric ELISA Dominating TNF-α Detection in Mouse Studies?

Colorimetric ELISA segment held the largest revenue share in the mouse TNF-α kit market in 2025, holding a market share of about 45.4%. This technique of detection is preferred by laboratories due to its simplicity, low cost, and easy interpretation. The colorimetric result enables the researcher to measure the level of TNF reliably using a basic plate reader without the need to use special equipment. Furthermore, the manufacturers emphasize reproducibility and robust kit validation, thus positioning colorimetric ELISA as the foundational detection method for routine mouse TNF-α research.

Chemiluminescent/fluorescent ELISA segment is expected to grow at the fastest rate in the coming years, accounting for 5.9% CAGR, owing to the rising demand for high-sensitivity, premium detection solutions. These methods are also being demanded by researchers to identify low-abundance TNF-α in complex murine extracts. Additionally, the use of chemiluminescent and fluorescent kits is being encouraged by emerging preclinical uses in immunotherapy and inflammation research.

Application Insights

Why Are Research Centers Leading TNF-α Kit Usage in Preclinical Studies?

Research centers segment dominated the mouse TNF-α kit market in 2025, accounting for an estimated 56.8% market share. These centers focus heavily on immunology, inflammation, and translational medicine studies, which require accurate TNF-α quantification in mouse models.

The researchers also incorporate TNF-α kits in mechanistic projects on immune modulation and evaluation of therapeutic response. This propels their status as the primary consumers of high specificity assay perceptions. Moreover, the research centers usually publish in high-impact journals in which quantitative data of cytokines, such as TNF-α, need to be rigorously validated with data on TNF-α quantification using defined ELISA kits.

Universities segment is expected to grow at the fastest CAGR in the coming years, accounting for 6% of CAGR, owing to the increasing academic research in immunology and inflammatory disease models. Furthermore, the growing popularity of multi-cytokine panels that incorporate TNF-α is showcasing a trend toward more extensive immune profiling in the portfolio of university research.

End-User Insights

Why Are Academic and Government Research Labs Driving TNF-α Kit Adoption?

Academic & government research labs segment held the largest revenue share in the mouse TNF-α kit market in 2025, holding a market share of about 54.7%, as they generate significant amounts of TNF-α-related scientific literature. These institutions in 2025 alone published several mouse and human TNF-α profiling studies that investigate cytokine activation thresholds and immune cell responses. The publication of TNF-α and type I interferon crosstalk on dendritic cell fate by the NIH 2025 report showed that the basic research on understanding cytokine biology is still dependent on accurate TNF-α measurement platforms. These findings imply that validated kits are in demand in laboratories that have a large data set. Researchers need to be able to depend on the consistency of the assays to make high-impact papers. Additionally, the multicenter also engages in research studies whereby TNF-α is studied with other immune markers in a complex disease setting, including dermatitis and malaria immune responses.

Biotech/pharma R&D segment is expected to grow at the fastest rate in the coming years, accounting for 6.1% CAGR, as preclinical drug discovery increasingly depends on detailed cytokine profiles that include TNF-α. TNF-α measurements are described in immunology and inflammation programs in murine models to validate the therapeutic mechanisms. They predict the immune reactions in increasing reference to cytokine data and broader immune signatures. Additionally, the TNF-α data is also used in biotech programs to facilitate candidate selection and optimization in immune-modulating therapies via iteration.

Distribution Channel Insights

Why Are Direct Sales and Distributors Dominating TNF-α Kit Delivery?

Direct sales/distributors segment dominated the mouse TNF-α kit market in 2025, accounting for an estimated 53.4% market share. The major suppliers, such as Thermo Fisher Scientific, Bio-Techne, and R&D Systems, use direct contact with research laboratories, universities, and pharmaceutical firms. They were able to offer personalized management of the orders, technical assistance, and prompt delivery.

These channels were used in North America, Europe, and East Asia, as they guaranteed the availability of high-purity kits needed in large-scale preclinical trials. Moreover, the dominance of these channels was also strengthened as manufacturers increased training initiatives, packaged kits with reagents and consumables, and provided on-hand technical support.

The e-commerce platforms segment is expected to grow at the fastest CAGR in the coming years, accounting for 6.2% of CAGR, owing to the rapid demand for TNF-α kits, which are in demand by universities, startups, and boutique research labs. Newer labs relied on e-commerce to purchase the high-quality chemiluminescent and fluorescent TNF-α kits. Additionally, the Asia-Pacific region, in particular China, Japan, and South Korea, recorded an increase in online purchases of TNF-α kits in 2025, as shown by a more rapid uptake in digitally mature research settings.

Regional Insights

How Big is the North America Mouse TNF-α Kit Market Size?

The North America mouse TNF-α kit market size is estimated at USD 77.15 million in 2025 and is projected to reach approximately USD 145.92 million by 2035, with a 6.58% CAGR from 2026 to 2035.

Why is North America Leading the Mouse TNF α Kit Market?

North America led the mouse TNF-α kit market, capturing the largest revenue share in 2025, accounting for an estimated 52.4% market share. Driven by regions' concentration of advanced immunology and inflammatory disease research. The high research base of North America facilitates the quick adoption of ultra-sensitive kits capable of detecting TNF-α at subpicogram concentration (<1 pg/mL). They provide insight into deep mechanisms needed in immuno oncology and autoimmune disease models. Furthermore, the Multiplexing trends to quantify TNF-α in combination with IL-6, IL-1β, and other cytokines in individual workflows continue to increase the use of the kits in the U.S.

What is the Size of the U.S.Mouse TNF-α Kit Market?

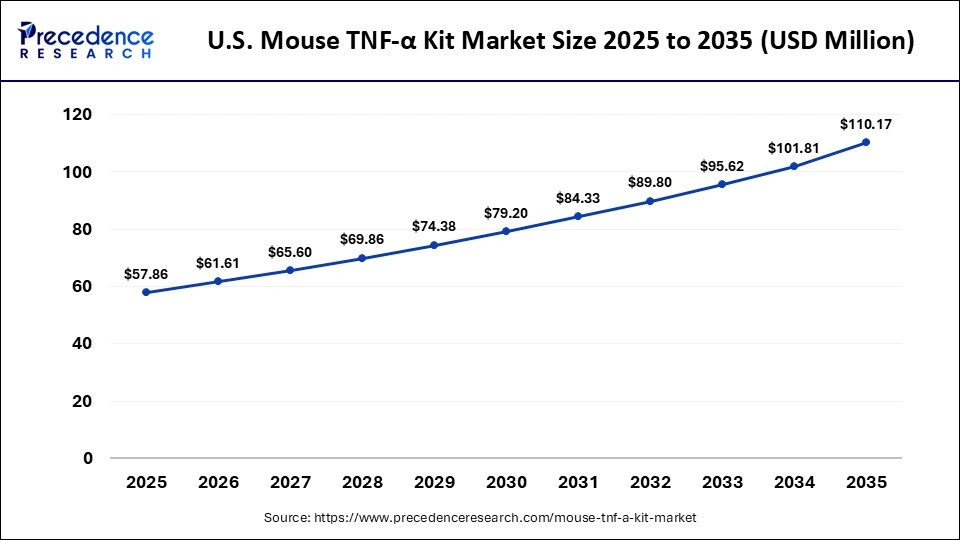

The U.S. mouse TNF-α kit market size is calculated at USD 57.86 million in 2025 and is expected to reach nearly USD 110.17 million in 2035, accelerating at a strong CAGR of 6.65% between 2026 and 2035.

U.S. at the Forefront of TNF α Research and Innovation

The U.S. is a major player in the regional North American market, as the country has a very large biomedical research facility, and immunology laboratories are concentrated. ELISA kits like the R&D Systems Quantikine Mouse TNF-α Kit have been cited more than 1,300 times. This indicates that U.S. institutions count on these tools in the determination of cytokines in different preclinical models. Moreover, the major grants, such as those provided by the NIH and the USDA, facilitate mouse TNF-α profiling in autoimmune and cancer immunotherapy studies, continuing to provide high institutional adoption of mouse TNF-α profiling.

Why is the Asia Pacific Compounded in Rapid Growth in TNF-α Kit Adoption?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, holding a market share of about 7%, owing to the growing research potential in China, Japan, South Korea, and Singapore. Such nations indicate more productive publications on immunology by 2025 and reinforce their research interests in inflammation and immune regulation. Additionally, the Asia Pacific scientists are adopting high-performance ELISA assays more in 2025 in translational investigations of inflammatory disease and metabolic disorders. This demonstrates the ample application of TNF-α beyond traditional immunology, thus boosting the market growth.

China's Rapid Rise in Mouse TNF α Kit Applications

China is leading the charge in the Asia Pacific market, as its mouse TNF-α kit usage is growing fast as the government invests more in immunology and precision medicine. The growing CRO and biotech industries in China propel high-performance kit adoption in this region. Furthermore, the international partnerships with the global agents increase the presence of Chinese TNF-α data in the global literature, which also increases the demand for the assays in the regions.

Why is Europe registering significant growth in TNF-α Kit Adoption?

The Europe region is expected to hold a notable revenue share of the market, due to the coordinated funding initiatives and strong collaborative research networks spanning the EU. European research centers also invest in kits with strong performance characteristics, sensitivity limits in low pg/mL ranges, to accommodate a variety of disease progression and treatment response models. Furthermore, the EU funding schemes encourage laboratories to maintain cutting-edge assay inventories, further boosting TNF α kit adoption, thus expanding the regional market segment.

Germany Driving Precision and Standardization in TNF α Profiling

Germany leads the market, owing to the presence of strong, powerful biotechnology and academic research institutes. Multicenter European projects to measure TNF-α using inflammatory biomarkers often use groups of German researchers, which supports the importance of standardized measures of TNF-α in murine models. The stringent regulatory nature of the assay quality in Germany also adds to confidence in the performance of the reagents, which encourages cross-border research undertakings that entail the TNF-α profiling.

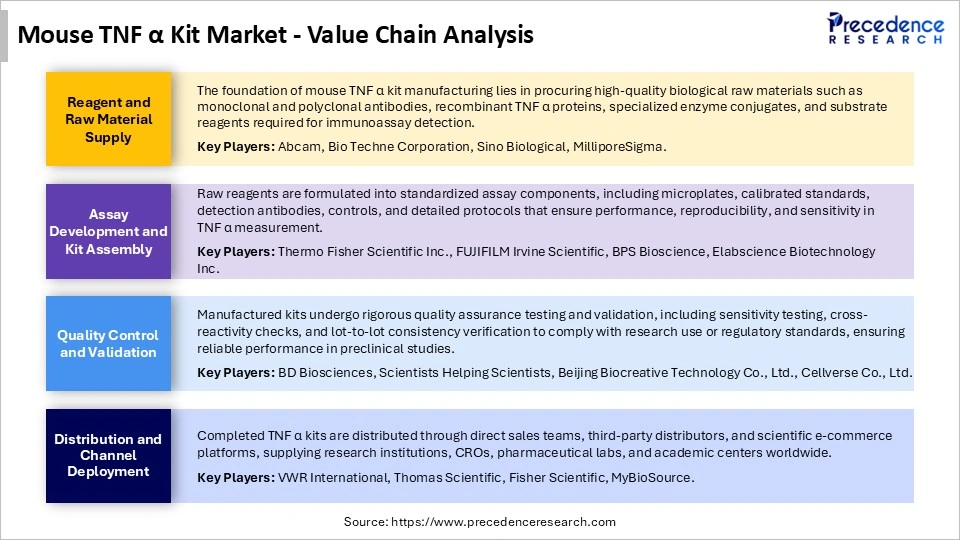

Mouse TNF α Kit Market Value Chain Analysis

Who are the Major Players in the Global Mouse TNF-α Kit Market?

The major players in the mouse TNF-α kit market include Thermo Fisher Scientific Inc., Bio-Techne Corporation, MilliporeSigma, Scientists Helping Scientists, FUJIFILM Irvine Scientific, BD Biosciences, Sino Biological, Inc., BPS Bioscience, Inc., Elabscience Biotechnology Inc., Yisheng Biotechnology (Shanghai) Co., Ltd., Abbkine, Beijing Biocreative Technology Co., Ltd., Shanghai Yaji Biotechnology Co., Ltd., Cellverse Co., Ltd., and Dalian Meilun Biotech Co., Ltd.

Recent Developments

- In December 2025, Creative Diagnostics, a leading manufacturer of antibodies, antigens, and assay kits, announced the launch of its new CDJCV Anti-polyomavirus JC (JCV) IgG ELISA Kit (Cat. No. DEIASL160). The kit enables laboratory researchers to detect IgG antibodies against JC polyomavirus in human serum with high sensitivity. This tool is expected to support investigations into diseases caused by or associated with JCV, enhancing diagnostic research capabilities.(Source:https://www.einpresswire.com)

- In December 2025, TNF Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company focused on oral therapies for autoimmune and inflammatory conditions, announced the successful completion of a pivotal safety study for its TNF-alpha inhibitor, isomyosamine. The FDA-recommended 13-week study demonstrated clinical safety across all evaluated dose levels, supporting the expansion of longer-term clinical trials across multiple indications.(Source: https://tnfpharma.com)

- In March 2025, Celltrion announced the U.S. launch of STEQEYMA (ustekinumab-stba), a biosimilar to STELARA (ustekinumab), following FDA approval in December 2024. STEQEYMA is indicated for the treatment of plaque psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis in adult and pediatric patients, offering consistency in treatment options. The product is available in both subcutaneous injection and intravenous infusion formats, providing flexibility for healthcare providers and patients.(Source:https://www.prnewswire.com)

Segments Covered in the Report

By Type

- Purity ≥95%

- Purity < 95%

By Detection Method

- Colorimetric ELISA

- Fluorescent ELISA

- Chemiluminescent ELISA

- CLIA / Other immunodetection platforms

By Application

- Research Centers

- Universities

- Pharmaceutical & Biotech Firms

By End-User

- Academic & Government Research Labs

- Biotech/Pharma R&D

- Contract Research Organizations (CROs)

- Diagnostics & Clinical Research

By Distribution Channel

- Direct Sales

- Distributors

- E-commerce Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting