Mycoprotein Market Size and Growth 2025 to 2034

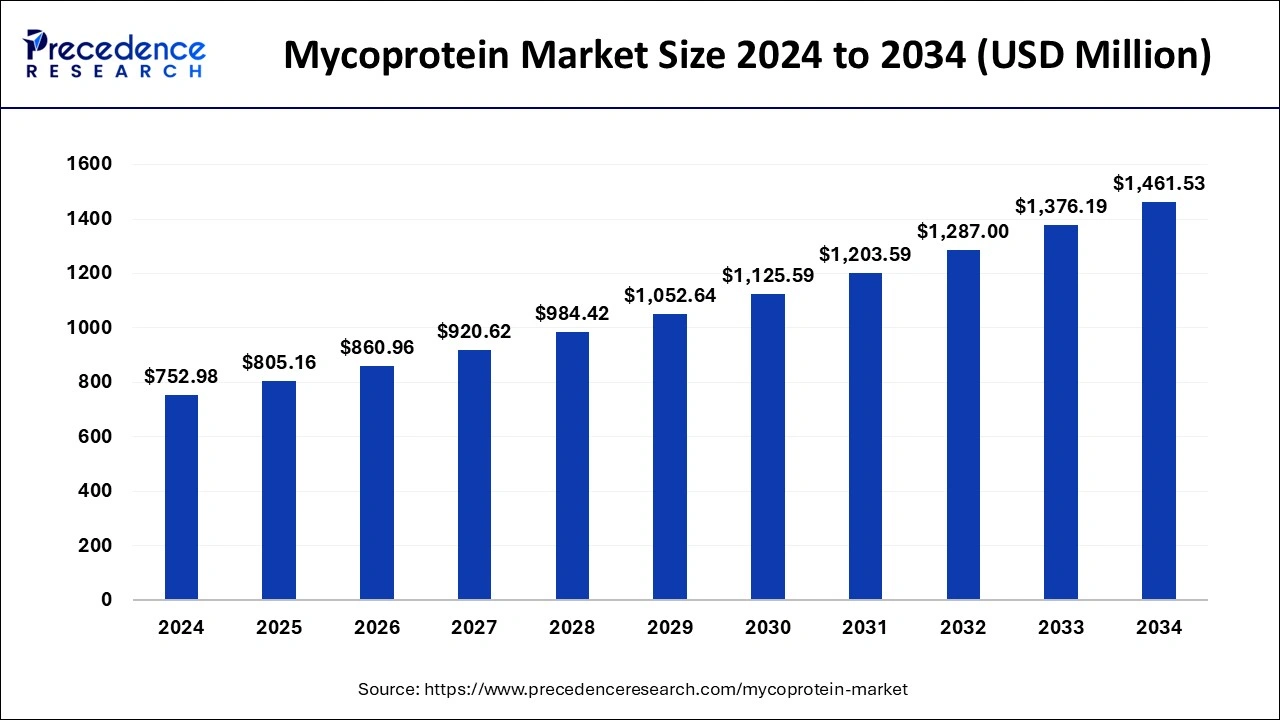

The global mycoprotein market size was estimated at USD 752.98 million in 2024 and is predicted to increase from USD 805.16 million in 2025 to approximately USD 1,461.53 million by 2034, expanding at a CAGR of 6.86% from 2025 to 2034. The rising demand for sustainable protein sources is driving the growth of the mycoprotein market.

Mycoprotein Market Key Takeaways

- The global mycoprotein market was valued at USD 752.98 million in 2024.

- It is projected to reach USD 1,461.53 million by 2034.

- The market is expected to grow at a CAGR of 6.86% from 2025 to 2034.

- Asia Pacific dominated the mycoprotein market with the largest market share in 2024.

- North America is expected to grow at the fastest pace during the forecast period.

- By type, the food-grade mycoprotein segment dominated the market with the largest share in 2024.

- By type, the feed-grade mycoprotein segment is observed to grow at a notable rate during the forecast period.

- By form, the minced segment dominated the market with the largest share in 2024.

- By sales channel, the supermarket/hyper market segment dominated the market with the largest market share in 2024.

Market Overview

Mycoprotein is a substitute to the conventional type of meat protein that are made from the Fusarium vanenatum that is naturally occurring in the fungus. Mycoprotein consists of a nutritious protein source, it is high in fiber and lower in sugar. Mycoprotein is a prominent rich source of essential amino acids, having a meat-like texture and thereby widely used as a food-grade and feed-grade product across the globe. The increasing shift in lifestyle and eating habits are driving the demand for the plant-based protein source that are driving the demand for the mycoprotein. The increasing environmental concern drives the consumption of mycoprotein due to its lower water and carbon footprint.

The mycoprotein industry is significantly emerging and strengthened by various recent funding rounds and partnership including Enough's recent 40 million funding round, and Tempty's collaboration with Marlow Foods.

Mycoprotein Market Growth Factors

- The increasing demand for sustainable protein sources and the alternatives to the environmentally friendly protein source drives the demand for the mycoprotein market.

- The recent shift towards vegetarian or vegan sources of food options has created a sustained growth factor for the market.

- People are inclined towards opting for plant-based protein sources for fulfilling the protein requirements, especially for vegetarian population. This factor also drives the market's expansion.

- Multiple technological advancements in food technology resulting in the development of plant–based products as an alternative of meat-based products create a significant growth factor for the market.

- The demand for mycoprotein based meat burgers, nuggets, and others are driving the growth of the market.

- The increasing consumer preferences towards sustainable and eco-friendly nutritional protein consumption are driving the expansion of the mycoprotein market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.86% |

| Market Size in 2025 | USD 805.16Million |

| Market Size by 2034 | USD 1,461.53 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Form, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising preferences for vegan diets

The rising shift in consumer preferences to plant-based protein for fulfilling the nutritional requirements of vegetarians and rising number of vegan population as a result of rising awareness about animal cruelty creates a driver for the mycoprotein market. The demand for a sustainable source of protein due to the rising concern about the environment is driving the expansion of the market. Plant-based protein is observed to emit lower environmental footprint as compared to the conventional production methods. The increasing concern about global warming and the consumer preferences towards reducing carbon emission are driving the expansion of the mycoprotein market.

Restraint

Lack of awareness

The limited awareness about the plant-based protein and higher cost of the plant-based protein as compared to the conventional meat or protein source are restraining the growth of the mycoprotein market. The limited or lack of awareness about such products creates a hindering factor along with a limitation regarding the product adoption. Plant-based products are comparatively newer to the market which makes them costlier as compared to conventional products. The cost factor is also observed to act as a restraint for the market's expansion.

Opportunity

Availability of wide range of products

The increasing consumer preferences towards the plant-based protein sources driving the production capacity and variety in the products such as ready-to-eat meals, snacks, and others are the driving the opportunities in the growth of the mycoprotein market. The rising demand for the different consumer segments are accelerating the demand for the market.

The rise in the export and import triads of the mycoprotein products to the countries due to the fueling demand for the plant-based protein products and the rising research and development activities in the improvement on the plant-based products, texture, flavour enhancements, and the food technologies are collectively contributing in the growth of the mycoprotein market. Additionally, the collaboration between the cultured meat industry and rising production of hybrid products integrating cultivated animal cells, and mycoprotein is also boosting the expansion of the mycoprotein market.

Type Insights

The food-grade mycoprotein segment dominated the mycoprotein market with the largest share in 2024. The growth of the segment is attributed to the awareness about the beneficial properties of the food grade mycoprotein. These types of mycoprotein do not contain any allergens like soy, nuts, and gluten that are suited for the consumption of individuals with food sensitivities. Increasing prevalence of food allergies among the population drives the demand for the anti-allergic food options.

Moreover, the rising concern about animal welfare is observed to drive the demand for the conventional meat substitute which is directly driving the demand for the food-grade mycoprotein. The increasing preference for the plant-based protein substitute like mycoprotein in the major consumer products like burgers, sausages, and others are fueling the growth of the food-grade mycoprotein segment.

The feed-grade mycoprotein segment is observed to grow at a notable rate in the mycoprotein market during the forecast period. Mycoprotein feed grade serves as an alternative protein source for animal nutrition, offering a sustainable and nutritious option for meeting the protein requirements of livestock, poultry, and aquaculture species.

Form Insights

The minced segment dominated the mycoprotein market with the largest share in 2024. The increasing demand for minced mycoprotein due to the higher demand for plant-based food substitute products like burgers, nuggets, and sausages that are driving the demand for the minced mycoprotein.

The increasing demand for meat like textured protein and ready to make vegetarian meal products in the population due to the busy lifestyle that driving the expansion of the market. The increasing concern about the environment and the people who looking for reducing the meat consumption and transitioning them to vegetarian or vegan mycoprotein is the best choice for them with having all the essential nutrition and meat like texture and taste. The increasing production of the wide range of products by using the minced mycoprotein is driving the segments expansion.

Sales Channel Insights

The supermarket/hyper market segment dominated the market with the largest market share in 2024. The easy availability of the wide range of mycoprotein products in the supermarkets and hypermarkets are driving the growth of the segment. The majority of the population prefer supermarkets for shopping for their essential supplementary products. The supermarket and hypermarket serve a variety of products with discounted prices and added offers in it.

The availability of a wide range of products with the facility to compare it with multiple other competitive products and availing products at reasonable price range creates a significant driver for the segment to grow. Multiple supermarkets and hypermarkets have availability of products along with professionals that can guide consumers regarding the product choice which offers convenience while shopping. The rising investments on the development of the supermarkets by the major industry leaders and the collaborations are driving the growth of the segment.

Regional Insights

Asia Pacific dominated the mycoprotein market with the largest market share in 2024. The growth of the market in the region is attributed to the rising number of people that are inclined towards vegetarian and vegan diet options. Along with that, the increasing consumption of plant based or dairy based products as meat substitute for fulfilling the nutritional requirement of the body acts as a growth factor for the market. The overall expansion of multiple agricultural activities in the region has already established a significance for plant-based protein sources, that promotes the market's expansion. Additionally, the rising research activities along with government initiatives for the advancements in food technology industry is observed to promote the growth of the mycoprotein market.

North America is expected to grow at a significant rate in the mycoprotein market during the forecast period. The shift in consumer preferences towards the vegetarian diet due to the rising awareness regarding health and environmental concern is driving the expansion of the market. Major food industry players are participating in the expansion and the research on the food-based mycoprotein for creating sustainable options as alternative for meat-based products is observed to act as a growth factor for the mycoprotein market in the region.

Mycoprotein Market Companies

- Enough

- Tempty Foods

- The Better Meat Co.

- Quorn Foods

- Symrise

- Mycorena AB

- An ACME Group Company

- Bright Green Partners B.V.

- KIDEMIS GmbH

- Mycovation

- MycoTechnology, Inc.

Recent Developments

- In April 2024, Edonia Parisian food tech startup raised the funding of €2 million in a pre-seed funding round for the production of sustainable, nutrient-dense, plant-based protein from microalgae.

- In May 2024, Walmart, America's 20 years largest retailers are introducing the chef-inspired, high culinary quality, free-from and plant-basednew Bettergoods brand.

- In April 2024, Rival Foods, Dutch startup are producing the whole cuts of plant-based meat without binders with the use of “Shear Cell” technology.

- In March 2024, the billionaire Amazon founder Jeff Bezos initiated the investment of US$60 million from its Bezos Earth Fund established in 2020. The investment is initiated for improving the availability and quality of alternative proteins like plant-based meat.

- In May 2024, Waitrose, a leading supermarket chain in the UK, expanded the range PlantLiving with 12 more products for catering to the increasing demand for the less processed plant-based foods.

- In May 2024, THIS, cult-favorite plant-based meat challenges brand in UK is launching the first to the market chicken thigh SKU. The product will launch in the Tesco UK's largest retailer.

- In April 2024, Plantaway, the company working on the realm of plant-based foods, announced to launch its latest range of plant-based gelatos made with the 100% of the plant-based ingredients, the flavored gelatos are completely dairy free and no added sugar.

- In April 2024, Nasoya, the developer of the plant-based foods revolution and the producers of number 1 brand in Tofu, expands its range of portfolio in new plant-based meat category with the introduction of Plantspired Plant-Based Chick'n.

- In April 2024, Alpro the Danone-owned brand has introduced the 6 SKUs including plant-based protein drinks, a yogurt substitute, and two bestselling variants, Almond No-Sugars, and Creamy Oat in a latest 500ml pack size.

Segments Covered in the Report

By Type

- Feed Grade Mycoprotein

- Food Grade Mycoprotein

By Form

- Minced

- Slices

By Sales Channel

- Supermarkets/Hyper Markets

- Convenience Stores

- Specialty Stores

- Online Stores

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting