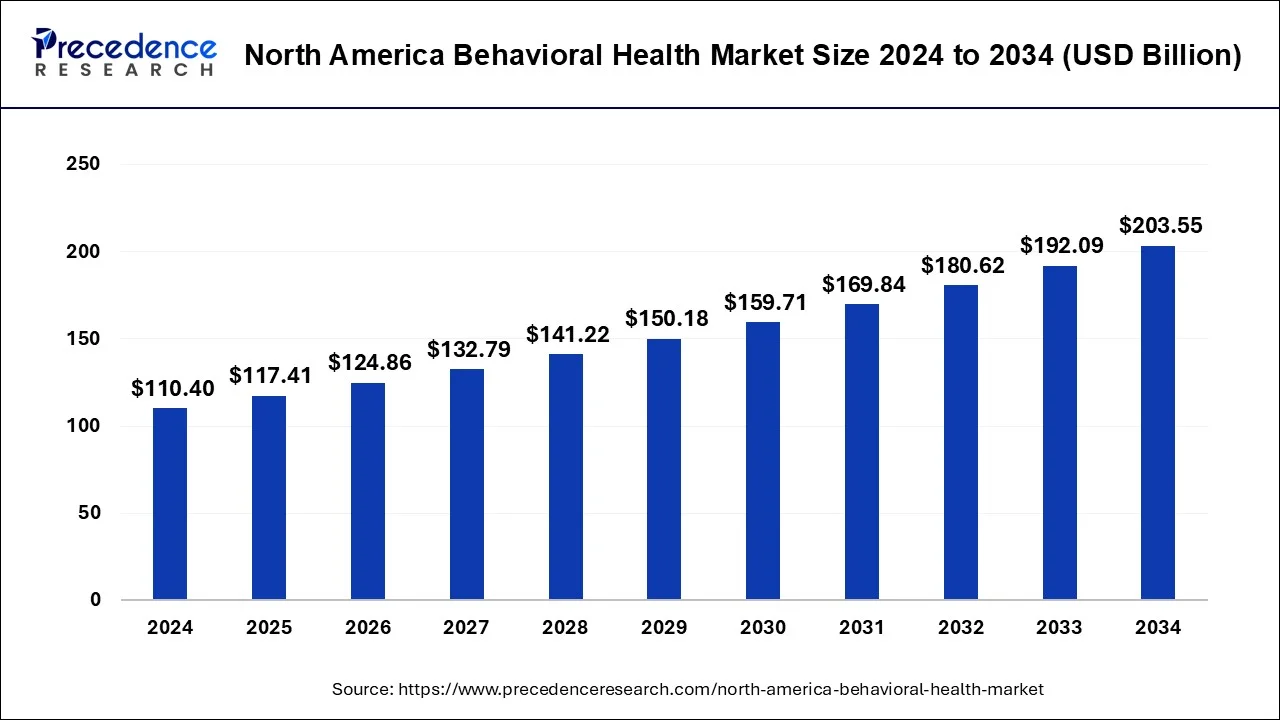

What is the North America Behavioral Health Market Size?

The North America behavioral health market size was valued at USD 117.41 billion in 2025 and is predicted to surpass around USD 203.55 billion by 2034, growing at a CAGR of 6.30% from 2025 to 2034. The North America behavioral health market is driven by rising rates of mental illness.

Market Highlights

- The United States dominated the market with the largest market share of 80.70% in 2024.

- By service type, the outpatient counseling segment has contributed more than 34.05% of the market share in 2024.

- By disorder type, the anxiety disorder segment has accounted for over 47.41% of the market share in 2024.

- By end-user, the outpatient clinics segment has generated more than 36.85% of the market share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 117.41 Billion

- Market Size in 2026: USD 124.86 Billion

- Forecasted Market Size by 2034: USD 203.55 Billion

- CAGR (2025-2034): 6.30%

- Largest Market in 2024: United States

Market Overview

The North America behavioral health market is the healthcare area dealing with mental health and drug abuse diseases in the geographical area. This covers treatments, including counseling, therapy, psychiatric care, addiction treatment, and other therapies meant to enhance people's psychological health.

The stigma around addiction and mental health issues has been lessened, which has inspired more people to get treatment. More people are willing to seek out behavioral health care when stigma declines. There is an increasing need for behavioral health services due to several factors, including trauma, socioeconomic inequality, increased stress from modern lives, and societal changes. As governments and healthcare systems devote more funds to treating mental health and addiction concerns, economic reasons also come into play.

- In February 2024, The Mental Health Services Administration (SAMHSA) and the Substance Abuse and Human Services (HHS) of the U.S. Department of Health released notices of funding opportunities totaling $36.9 million to support award programs that provide behavioral health services around the country.

North America Behavioral Health Market Data and Statistics

According to the State Mental Health in America report 2023-

- Approximately 50 million Americans, or 21% of adults, suffer from a mental disorder.

- Of the adult population, 4.8% have reported having severe suicidal thoughts, or about 12.1 million.

- Over 2.7 million young people suffer from serious depression.

- Twenty-three percent of persons who report at least 14 days a month of mental illness were unable to see a doctor because of financial constraints.

North America Behavioral Health Market Growth Factors

- An increased prevalence of anxiety, depression, and substance addiction disorders is being attributed to factors such as social media and economic stress.

- Behavioral health treatments are becoming more accessible because of telehealth and online therapy choices, particularly in distant places. Additionally, governments and individuals in North America are willing to allocate greater funds for mental health care.

- The higher likelihood of mental health concerns among seniors drives the demand for specialist care, while promoting the growth of the North America behavioral health market.

- North America has a robust network of clinics, hospitals, and mental health providers.

Market Scope

| Report Coverage | Details |

| North America Market Size in 2025 | USD 117.41 Billion |

| North America Market Size in 2026 | USD 124.86 Billion |

| North America Market Size by 2034 | USD 203.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.90% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Disorder Type, End-users, and Region |

| Country Covered | U.S., Canada, and Mexico |

Market Dynamics

Drivers

Rising prevalence of depression and other mental illnesses

Alternative therapies such as digital therapeutics, neurostimulation techniques, personalized medicine, and holistic interventions have advanced in the mental health industry. These cutting-edge methods open new treatment and management options for a range of mental health issues, drawing investors and patients to the behavioral health industry. The writing prevalence of depression and other mental illnesses create a significant driver for the North America behavioral health market.

Investing in programs that improve school culture

Investing in initiatives that support a pleasant school climate frequently includes early detection and preventive methods for behavioral health problems. Schools can detect and manage mental health issues early on and keep them from developing into more serious issues by fostering a supportive and inclusive environment. Its emphasis on mental health has long-term effects on the community. In the educational system, we can cultivate resilient, emotionally intelligent, and mentally healthy individuals who will be better able to face life's challenges, make positive contributions to society, and lessen the strain behavioral health issues will place on healthcare systems. Such investments in school programs for better mental health promotes the expansion of the North America behavioral health market.

Restraint

Lack of trained professionals across the world

In North America, there is a lack of mental health specialists, including psychologists, counselors, psychiatrists, and therapists. This shortage is a pervasive problem affecting urban and rural communities, not simply one place. Long wait periods for consultations are a result of the shortage of mental health experts, which can worsen mental health issues for individuals who need prompt assistance. Innovative approaches in behavioral healthcare, like digital treatments, telemedicine platforms, and tailored treatment models, may face obstacles due to a shortage of qualified specialists.

Opportunity

Expanding access towards Medicaid-covered school-based mental health services

Various interventions, such as counseling, therapy, assessment, and crisis intervention, are included in school-based mental health services. Due to this diversity in service offerings, there are now more opportunities for all kinds of providers in the behavioral health industry. Psychologists, social workers, counselors, and psychiatrists are examples of mental health specialists who can work with schools to provide holistic care, thus broadening their scope and influence. More students will have access to Medicaid-covered services in schools, allowing for collecting and analyzing a vast amount of data on mental health trends, service usage patterns, and results.

Making decisions based on data becomes crucial for maximizing care delivery, pinpointing improvement areas, and proving the efficacy of interventions. This focus on data and analytics in the behavioral health industry opens doors for researchers, data analysts, and technology vendors.

Segments Insights

Service Insights

The outpatient counselling segment led the North America behavioral health market with the largest share in 2024. The outpatient counselling services generally offer sessions without actually admitting patients in the hospitals or at any other centers. This brings convenient for patients who don't require round-the clock administration. While traditional mental health services act as ‘not one size fits all', the outpatient counselling brings appropriate solutions for patients. The outpatient counselling is observed to be even more cost-effective than inpatient services. Along with this, the rising popularity of online counselling services bring a lucrative opportunity for the segment to expand.

The inpatient hospital treatment segment is observed to be another lucrative segment in the North America behavioral health market. Mental health care has a long history involving inpatient hospital treatment. In the past, people with severe mental illnesses were frequently institutionalized for protracted periods, and mental health diseases were often stigmatized. This resulted in the groundwork for inpatient mental health care being laid by the establishment of specialty psychiatric hospitals and units inside general hospitals. Behavioral health diseases range significantly in severity, from moderate anxiety disorders to severe conditions like psychosis or suicidal thoughts.

When patients need systematic interventions, intense monitoring, and stabilization that cannot be given in an outpatient setting, inpatient hospital therapy becomes necessary. The round-the-clock care and monitoring offered in inpatient settings are frequently beneficial for patients with severe symptoms, those who pose a risk to themselves or others, or those going through a mental health crisis.

The home-based treatment services segment is the fastest growing North America behavioral health market during the forecast period. Standard in-person therapies might not be as convenient or accessible as home-based treatment programs. Patients prefer to get care conveniently in their homes, especially if they have limited mobility, transportation difficulties, or hectic schedules. Convenience plays a significant role in the rise of home-based services as more people look for easily accessible solutions for their mental health requirements. It makes it possible to give care in a way that is more individualized, and patient centered. By considering the patient's lifestyle, support network, and home environment, clinicians can customize treatment strategies to meet their specific needs.

Disorder Insights

The anxiety disorder segment led the market with the largest share in 2024. Research and development in the field of mental health have led to advancements in the treatment of anxiety disorders. This includes the development of effective psychotherapeutic approaches, such as cognitive-behavioral therapy (CBT), as well as pharmacological treatments like selective serotonin reuptake inhibitors (SSRIs) and other medications. The availability of these treatments has expanded the options for individuals with anxiety disorders, further driving market growth. There has been a greater emphasis on mental health awareness and education, including anxiety disorders, through campaigns, public health initiatives, and media coverage. Increased awareness has led to more individuals recognizing symptoms of anxiety disorders and seeking appropriate care.

The depression segment is observed to expand at a notable rate during the forecast period. One of the most prevalent mental health conditions in the world, depression affects millions of individuals annually. Over time, the prevalence of depression has been rising in North America. The number of people having depressive symptoms is on the rise, and factors that may contribute to this include changes in lifestyle, stress from job, social pressures, and genetic predispositions.

The depression sector's domination has also been attributed to technology use in mental healthcare. Access to care has been increased, and patient engagement with depression has improved due to telehealth services, digital platforms for self-help materials, virtual therapy sessions, and smartphone apps for mental health monitoring and support.

End-user Insights

The outpatient clinics segment dominated the North America behavioral health market in 2024. Outpatient clinics offer more access to mental health and substance abuse services compared to inpatient facilities. Patients can schedule appointments that fit into their daily lives, allowing them to receive treatment without significant disruptions to work, school, or family responsibilities. Outpatient clinics play a crucial role in the continuum of care for behavioral health. They can serve as entry points for individuals seeking help, provide ongoing support and therapy, and facilitate transitions between different levels of care as patients' needs evolve. The convenience of outpatient clinics encourages more individuals to seek help for behavioral health issues, leading to a larger patient base and increased market growth.

The homecare setting segment is the fastest growing in the North America behavioral health market during the forecast period. The healthcare business is witnessing a notable transition towards care models centered around the patient, prioritizing individualized and comprehensive treatments. Better results and patient satisfaction can be achieved in homecare settings because more individualized care plans cater to each patient's specific needs.

Home-based behavioral health interventions are becoming more valued and effective, reflected in the more favorable regulatory environment around home healthcare services. The supportive regulatory environment encourages healthcare providers and other stakeholders to invest in growing homecare services and incorporating behavioral health into home health programs.

Regional Inights

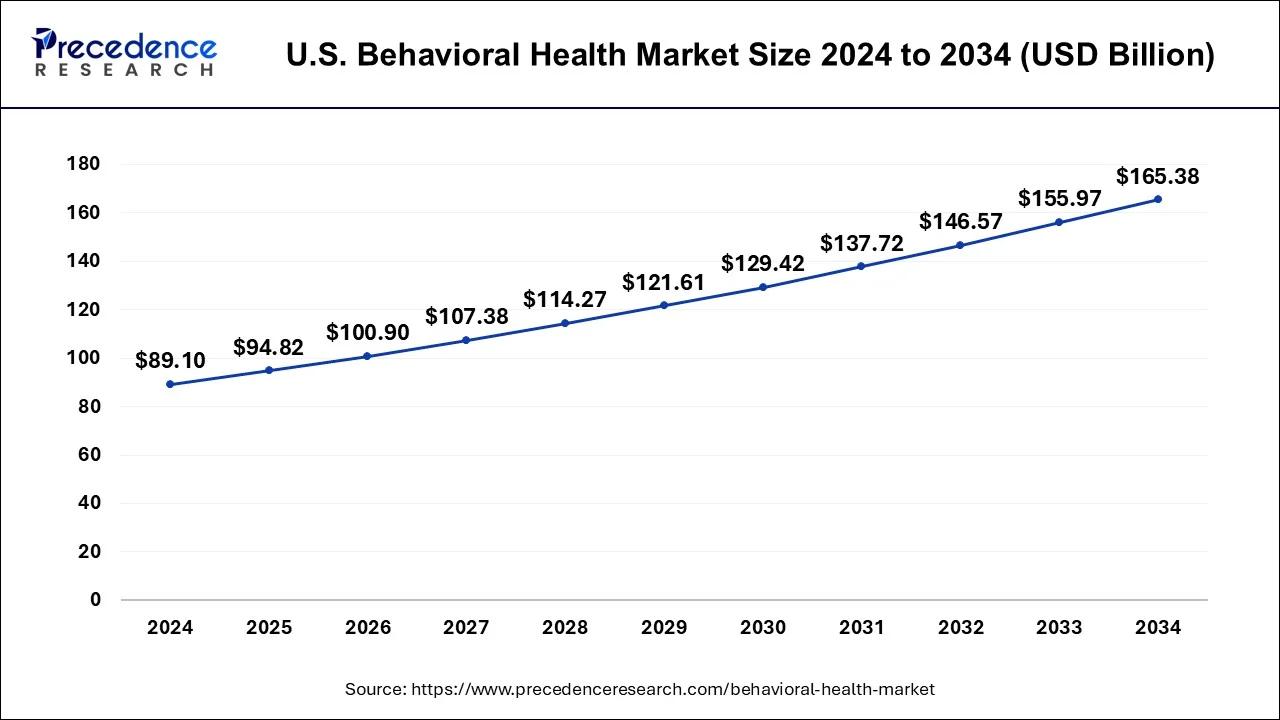

U.S. Behavioral Health Market Size and Growth 2025 to 2034

The U.S. behavioral health market size was estimated at USD 94.82 billion in 2025 and is predicted to be worth around USD 165.38 billion by 2034, at a CAGR of 6.40% from 2025 to 2034.

The United States has its largest market share of80.70% in 2024in the North America behavioral health market, the country is observed to sustain the dominance throughout the predicted timeframe. The United States consistently implements and advances evidence-based treatment modalities for mental health disorders. This covers developments in cognitive-behavioral therapies (CBT), medication, psychotherapy, and integrative therapeutic approaches. The need for specialized and customized therapies is rising as our understanding of mental health issues deepens.

Millions of Americans access behavioral health services due to government initiatives, including the medicaid expansion, the Affordable Care Act (ACA), and mental health parity laws. These regulations promote insurance coverage for drug addiction and mental health care, which raises consumer demand for services and increases market revenue.

Canada shows a significant growth in the North America behavioral health market during the forecast period.The Canadian government has sponsored behavioral health programs and raised public awareness of mental health issues. More financing for mental health services, public health campaigns, and educational programs have enhanced Canadians' access to behavioral health options. As a result of this support, the need for mental health services has increased, propelling the behavioral health market's expansion.

- According to an article published by the Canadian Institute for Health Information, every year, almost 1 in 5 Canadians have a mental disorder. Many people must wait to receive the treatment they require. In contrast, others receive insufficient or no care, with young people disproportionately affected by a lack of resources.

North America Behavioral Health Market Companies

- Acadia Healthcare Co.

- Universal Health Services, Inc.

- Magellan Health Inc.

- National Mentor Holdings Inc.

- Behavioural Health Services Inc.

- Behavioural Health Network Inc.

- North Range Behavioural Health

- Seton Healthcare Family (Ascension Health)

- Ocean Mental Health Services

- Beacon Health Strategies

Recent Developments

- In February 2024, The U.S. Department of Health and Human Services (HHS), via the Medicaid Services (CMS) & Centers for Medicare, accepted New Mexico's request for community-based mobile crisis response teams to offer Medicaid crisis services.

- In February 2024, Tennis Canada, in collaboration with the University of Ottawa, the Canadian Centre for Mental Health and Sport (CCMHS), Own The Podium, and Game Plan, designed, implemented, and evaluated a comprehensive long-term strategy to enhance the mental health and wellness of Tennis Canada athletes, coaches, parents, and staff.

Segments Covered in the Report

By Service

- Home-Based Treatment Services

- Outpatient Counselling

- Emergency Mental Health Services

- Inpatient Hospital Treatment

- Intensive Care Management

By Disorder

- Bipolar Disorder

- Anxiety Disorder

- Post-Traumatic Stress Disorder

- Eating Disorder

- Substance Abuse Disorder

- Other Disorders

By End-users

- Outpatient Clinics

- Hospitals

- Rehabilitation Centers

- Homecare Setting

By Country

- North America

- U.S.

- Canada

- Mexico

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting