What is Nuclear Medicine Software Market Size?

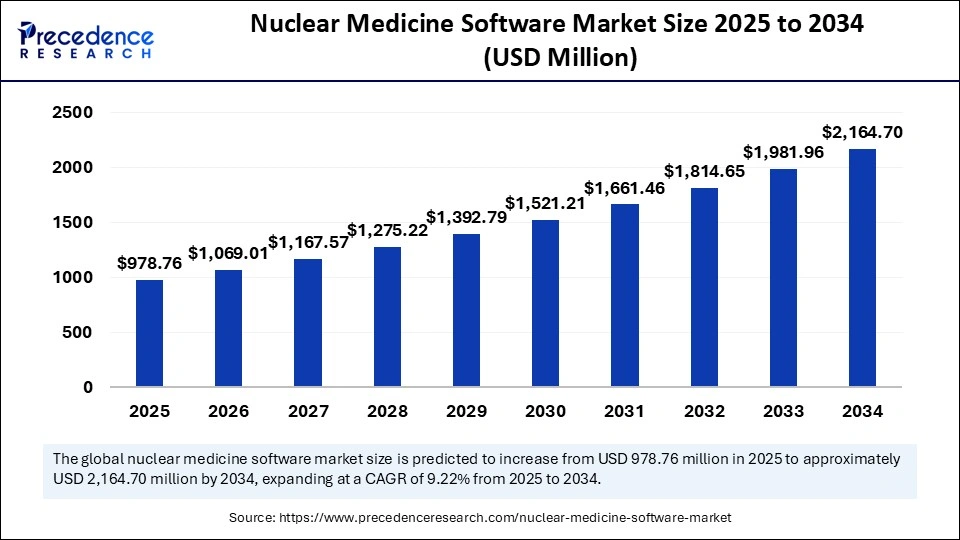

The global nuclear medicine software market size is calculated at USD 978.76 million in 2025 and is predicted to increase from USD 1069.01 million in 2026 to approximately USD 2164.70 million by 2034, expanding at a CAGR of 9.22% from 2025 to 2034. The rising prevalence of chronic and life-threatening diseases such as cardiovascular disorders (CVDs) and cancer is driving the demand for advanced diagnostic tools. This, in turn, is propelling market growth through the integration of AI and machine learning technologies with nuclear medicine software.

Market Highlights

- North America held the largest market share of 38% in 2024.

- Asia Pacific is expected to register the fastest CAGR of 11.60% between 2025 and 2034.

- By product type, the image processing & analysis software segment contributed the biggest market share of 32% in 2024.

- By product type, the quantification & analytics software segment is expected to grow at the fastest CAGR of 10.80% from 2025 to 2034.

- By modality, the SPECT segment recorded the largest market share of 46% in 2024.

- By modality, the PET segment is growing at a notable CAGR of 10.60% between 2025 and 2034.

- By deployment mode, the on-premises segment held the major market share of 41% in 2024.

- By deployment mode, the cloud-based segment is expanding at the fastest CAGR of 11.20% from 2025 to 2034.

- By application, the oncology segment generated the biggest market share of 44% in 2024.

- By application, the neurology segment is expected to register the fastest CAGR of 10.50% between 2025 and 2034.

- By end user, the hospitals segment held the largest market share of 47% in 2024.

- By end user, the diagnostics imaging centers segment is expected to witness the fastest CAGR of 10.30% during the foreseeable period.

Market Size and Forecast

- Market Size in 2025: USD 978.76 Million

- Market Size in 2026: USD 1069.01 Million

- Forecasted Market Size by 2034: USD 2164.70 Million

- CAGR (2025-2034): 9.22%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Nuclear Medicine Software Market?

The nuclear medicine software market is the segment of the healthcare industry focused on the development, distribution, and support of specialized software used in nuclear medicine procedures. These software solutions provide critical functionalities such as image processing, patient data management, and therapy planning involving radiopharmaceuticals.

Advanced imaging techniques, such as positron emission tomography (PET) and single photon emission computed tomography (SPECT), require accurate analysis, which is facilitated by nuclear medicine software. In addition to diagnostic precision, these systems enhance clinical workflow efficiency and support comprehensive patient record management.

Nuclear Medicine Software Market Outlook

- Industry Growth Overview: The nuclear medicine software industry is expected to experience rapid growth between 2025 and 2034, driven by ongoing technological advancements, strategic investments from key industry players, and supportive government initiatives. A primary growth catalyst is the increasing demand for early and accurate diagnostics, particularly for chronic and life-threatening conditions such as cardiovascular diseases (CVDs) and cancer.

- Global Expansion: The market is witnessing global expansion, with early technology adoption in regions like North America acting as a growth benchmark. Meanwhile, the Asia-Pacific region is emerging as a key growth engine, supported by a strong industrial base, expanding healthcare infrastructure, and rising government-backed healthcare initiatives. Strategic partnerships and cross-border collaborations are further amplifying market opportunities on a global scale.

- Major Investors:Industry leaders such as GE Healthcare, Siemens Healthineers, and Hermes Medical Solutions are making significant R&D investments to drive innovation in areas like AI-enabled imaging and workflow automation. Additionally, pharmaceutical giants like Eli Lilly and Sanofi are actively investing in radiopharmaceutical development, which in turn increases demand for specialized nuclear medicine software to support precision therapies.

Key Technological Shifts in the Nuclear Medicine Software Market

The integration of artificial intelligence (AI) into nuclear medicine software is significantly transforming the market by enhancing image analysis, automating workflows, enabling personalized medicine, and accelerating drug discovery. AI-driven tools improve the speed and accuracy of nuclear imaging interpretation through automation and deep learning techniques.

Advanced models such as convolutional neural networks (CNNs) and generative adversarial networks (GANs) are particularly recognized for their ability to improve image reconstruction quality while minimizing noise-related errors. In addition, AI is increasingly being leveraged to optimize pharmacodynamics by aiding in the design of radiopharmaceuticals, thereby improving their safety and therapeutic efficacy.

Value Chain Analysis of the Nuclear Medicine Software Market

- Research and Development

It is an initial stage that involves conceptualization, designing, and prototyping of nuclear medicine software solutions. It focuses on AI integration to achieve sophisticated image reconstruction using algorithms for improved diagnostics and clinical workflow.

Key Players: GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., DOSIsoft SA, and Miranda Medical.

- Manufacturing and Development

This stage involves software activities that are crucial for the development of medicine, such as coding, testing, and production. It ensures regulatory compliance and seamless integration with several hospitals' information systems, medical devices, and picture archiving and communication systems.

Key Players: Hermes Medical Solutions, Mediso Ltd., Siemens Healthineers, and GE Healthcare.

- Sales and Distribution

This stage involves marketing strategies, selling, and distributing software to hospitals, imaging centers, and research facilities. Companies are leveraging partnerships and agreements for deeper market penetration, while larger firms leverage the skills of their sales teams and establish relationships with local healthcare providers.

Key Players: Canon Medical Systems, Hermes Medical Solutions, GE Healthcare.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 978.76 Million |

| Market Size in 2026 | USD 1069.01 Million |

| Market Size by 2034 | USD 2164.70 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Lightsource,Detection Technique, Aplication, End User, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Product Type Insights

Why Did the Image Processing & Analysis Software Segment Dominate the Market?

The image processing & analysis software segment dominated the nuclear medicine software market by holding the largest share of 32% in 2024. This is mainly due to its crucial role in transforming raw imaging data into precise and actionable clinical steps. This software is essential to improve diagnostic precision, treatment planning, and managing complex datasets generated by nuclear medicine scanners like PET and SPECT. The integration of AI/ML has further reinforced the dominance of image processing and analysis.

The quantification & analytic software segment is expected to grow at the fastest CAGR of 10.80% during the foreseeable period. The segment is expanding due to the rise of personalized medicine. It is essential in oncology, which needs advanced software for treatment planning. The growing prevalence of chronic diseases further propels the segment's growth.

Modality Insights

How Does SPECT Modality Lead the Nuclear Medicine Software Market?

The single photon emission computed tomography (SPECT) segment led the market with a 46% share in 2024. The segment's dominance is attributed to its widespread use and cost-effective SPECT/CT systems, which utilize both functional and anatomical imaging for enhanced diagnostic accuracy. This synergy further allows for better lesion detection, staging, and therapy planning. This modality is also widely used and supported by the long-standing history of procedures like general nuclear medicine and cardiology.

The positron emission tomography (PET) segment is expected to grow at the fastest CAGR of 10.60% during the foreseeable period. The segment's growth is largely attributed to the increasing cases of cancer across the globe, which drives the demand for PET's functional capabilities. The development of advanced tracers and hybrid imaging, like PET/CT and PET/MR, offers greater diagnostic accuracy and escalates the personalized medicine demand.

Deployment Mode Insights

What Made On-Premise the Dominant Segment in the Nuclear Medicine Software Market?

The on-premises segment dominated the market, holding the largest share of 41% in 2024. The segment's dominance is attributed to the increasing focus on data control, privacy, and regulatory compliance with data safety by healthcare institutions. On-premises deployment offers complete authority of patient data to the hospital, which is crucial for nuclear medicine software, while managing highly sensitive data about patient health issues.

The cloud-based segment is expected to expand at the fastest CAGR of 11.20% during the foreseeable period. The segment's growth is attributed to its ability to offer cost-effective data management, high scalability, flexibility, and the ability to manage remote access and team collaboration while working on time-sensitive projects. The model provides seamless integration of AI and easy software updates.

Application Insights

Why Did the Oncology Segment Dominate the Nuclear Medicine Software Market?

The oncology segment held the largest market share of 44% in 2024. The segment's dominance is attributed to the increasing incidence of cancer among every age group, which drives the demand for early detection of such a fatal health condition to plan further treatment for better outcomes. The growing use of targeted radioligand therapies mandates the need for specialized software. Also, factors like regulatory support for therapeutics and increased reimbursement for cancer are fueling the segment's growth.

The neurology segment is expected to witness the fastest CAGR of 10.50% during the foreseeable period. The segment is growing due to the increasing cases of neurological disorders, which need precise diagnostic tools. Also, the advanced radiotracers and software that support personalized treatment plans and AI-based image analysis further fuel the market's growth.

End User Insights

Why Did Hospitals Lead the Nuclear Medicine Software Market?

The hospitals segment led the market while holding the largest share of 47% in 2024. The segment's dominance is attributed to its comprehensive infrastructure, volume of complex procedures, and major role in early diagnosis and treatment planning. The increasing incidences of chronic life-threatening diseases like CVDs and cancer, combined with advanced hybrid imaging modalities, highlight the compulsion for comprehensive software to handle huge healthcare datasets.

The diagnostic imaging centers segment is expected to grow at the fastest CAGR of 10.30% during the foreseeable period. The segment is growing due to the huge demand for outpatient services driven by cost-effective solutions and convenience, along with the emergence of AI-backed interpretation and 3D/4D imaging. Diagnostics centers are expanding their presence to cater to this explosive demand across the globe.

Regional Analysis

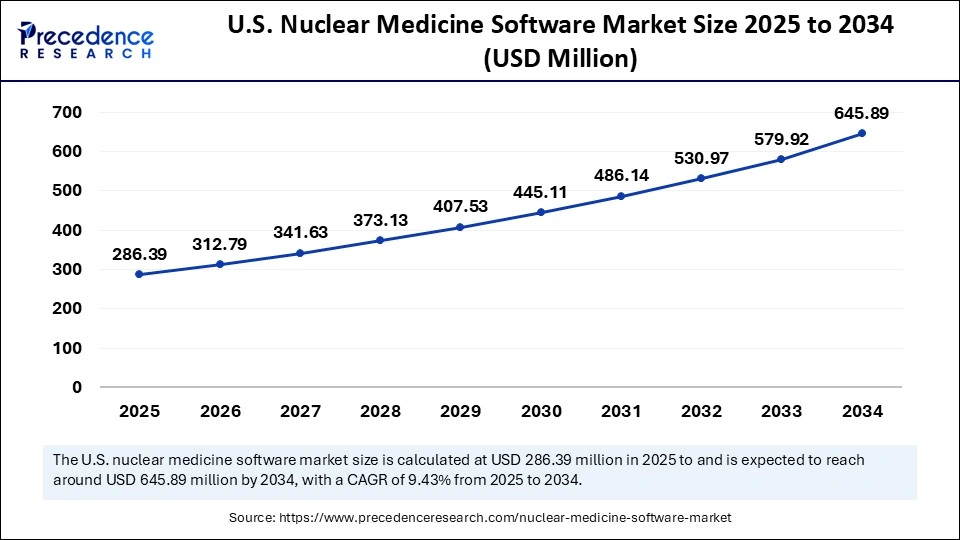

U.S. Nuclear Medicine Software Market Size and Growth 2025 to 2034

The U.S. nuclear medicine software market size is exhibited at USD 286.39 million in 2025 and is projected to be worth around USD 645.89 million by 2034, growing at a CAGR of 9.43% from 2025 to 2034.

North America

What Made North America a Dominant Force in the Nuclear Medicine Software Market?

North America dominated the market with the largest share of 38% in 2024. The region's dominance is driven by various factors like well-established healthcare infrastructure, early adoption of advanced technologies in the healthcare sector, and supportive government regulations with huge spending on the healthcare industry by both the private and government healthcare sectors.

The active involvement of leading healthcare industrialists like GE Healthcare and Siemens Healthineers has further mobilized market growth in North America. The integration of AI and ML into the diagnostic workflow, with extensive clinical research initiatives, has also reinforced the assertion of North America and its presence on a global scale.

U.S. Nuclear Medicine Software Market Analysis

The U.S. is a major contributor to the North American nuclear medicine software market, with substantial contributions from domestic and international firms. The U.S. benefits from a well-developed regulatory system under the FDA that ensures strict compliance while supporting innovation. Advanced research and introduction of innovative platforms for cutting-edge software, useful for the healthcare industry, is another key driver of the region.

How is the Asia Pacific Nuclear Medicine Software Market Expanding?

Asia Pacific is expected to register the fastest CAGR of 11.60% during the foreseeable period of 2025-2034. The region's growth is propelled significantly due to the increasing healthcare spending by governments of leading Asian countries, growing awareness for proactive healthcare facilities, growing nuclear medicine procedures, and developing hospital infrastructure.

The progressive regulatory reforms followed by leading countries like China, India, and Japan, along with growing awareness about nuclear medicine diagnostics and its easy accessibility, are key drivers of the region. The convergence of local and international key players like Canon Medical Systems and Fujifilm Holdings has fueled competitive market dynamics and innovative launches of software solutions designed for the healthcare industry in the Asia Pacific.

India Nuclear Medicine Software Market Trends

The Indian nuclear medicine software market is steadily growing owing to the increasing healthcare awareness and the government's initiatives aimed at improving the diagnostics infrastructure, along with cost-effective solutions, coupled with increasing nuclear medicine centers. The private and government sectors are also collaborating to introduce innovative healthcare solutions; facilities are further fueling the market's growth.

For instance, in March 2025, AIIMS New Delhi and SAMEER signed an MOU to support innovation in medical electronics and healthcare technology. This collaboration helps India's healthcare sector by using advanced MRI, NMR, and RF/Microwave technology.

How is the Opportunistic Rise of Europe in the Nuclear Medicine Software Market?

Europe is expected to experience notable growth in the upcoming years. The region's growth is driven by factors like the rise in precision medicine, the growing adoption of AI with advanced imaging technologies, and stringent regulations for health and overall safety. Also, Europe is highly focused on digital sovereignty and has a strong hold on GDPR compliance, driving the need for secure software solutions.

Germany Nuclear Medicine Software Trend

Germany is considered a leader in the European region for the nuclear medicine software market. The country hosts various leading healthcare companies, like Siemens Healthineers, which are key players in the market. Reimbursement policies and strong healthcare infrastructure further drive the market's growth.

Top Companies in the Nuclear Medicine Software Market

Tier I – Major Players

| Company | Rationale / Roles | Approximate Contribution |

| GE Healthcare | Cited as one of the leading players in nuclear medicine software. major medtech presence, large installed base, broad software portfolio. | 2025% |

| Siemens Healthineer | Another dominant player in nuclear medicine software; strong global presence and portfolio in imaging and software. | 1520% |

| Koninklijke Philips NV | Significant software offerings in nuclear medicine workflow, analytics, and hospital integration. | 810% |

Tier II – Established Players

| Company | Rationale / Roles | Approximate Contribution |

| Lantheus Hondlings Inc. | Focuses on imaging diagnostics and related software, including niche applications in nuclear medicine. | 57% |

| Hermes Medical Solutions | Software specialist in imaging/dosimetry in nuclear medicine; more specialised but globally recognised. | 46% |

| Bracco Group | Involved in imaging and software segments; smaller than Tier I but with meaningful niche presence. | 35% |

| Others midplayers (e.g. Mirion Technilogy) | These firms support regional/functional segments (dosimetry, workflow, analytics) in nuclear medicine software. | 1015% combined |

Tier III – Emerging / Niche Players

This tier includes smaller, more specialised or regional software vendors whose individual contributions are modest but collectively add up. Examples

- DOSIsoft SA(France)

- Mirada Medical (UK)

- LabLogic System Ltd. (UK)

- COMERCE (Italy)

- Others niche vendors mentioned in nuclear medicine software market report.

Recent Developments

- In August 2025, the society of nuclear medicine and molecular imaging introduced a comprehensive digital platform, AI-powered Trail Finder, which is constructed to access patients' data for clinical trials of radiopharmaceuticals. (Source: https://interhospi.com)

- In May 2025, a global leader, Hermes Medical solutions, unveiled its updates to Hermia multimodality software, designed for nuclear medical imaging and dosimetry. This updated version will offer new CE-market functionalities for showing and analyzing nuclear medicine imaging across various modalities.

Expert Analysis

The global nuclear medicine software market is positioned at the intersection of diagnostic precision, clinical workflow automation, and digital healthcare transformation. Amidst the accelerating convergence of advanced imaging technologies and artificial intelligence, the sector is undergoing a structural evolution, transitioning from legacy, hardware-dependent platforms to integrated, cloud-enabled and AI-augmented ecosystems.

The market's forward momentum is underpinned by a confluence of macro and microeconomic vectors: the rising global disease burden of oncology and cardiology, expanding procedural volumes in PET and SPECT imaging, and policy-level shifts emphasizing value-based care and early-stage diagnostics. These dynamics are catalyzing downstream demand for software platforms capable of delivering multimodal imaging analytics, real-time decision support, and scalable data interoperability across radiology and nuclear medicine departments.

Strategically, the integration of machine learning algorithms into image reconstruction, dosimetry planning, and radiopharmaceutical optimization presents a high-yield opportunity space. Vendors with advanced AI capabilities and FDA/CE-cleared software modules are well-positioned to capture premium market segments, particularly within academic medical centers and high-throughput diagnostic hubs. Furthermore, the shift toward cloud-native deployment models is creating recurring revenue opportunities through SaaS frameworks and subscription-based licensing, fostering long-term client lock-in and enhancing margins.

Regionally, while North America remains the technological bellwether, Asia-Pacific is emerging as a high-growth corridor, fueled by increasing healthcare investments, expanding imaging infrastructure, and a growing volume of public-private partnerships. Simultaneously, the European Union's policy emphasis on data transparency, radiological safety, and cross-border digital health integration is expected to drive a wave of procurement linked to compliance-driven software upgrades.

Segments Covered in the Report

By Product Type

- Image Processing & Analysis Software

- SPECT Image Analysis

- PET Image Analysis

- Hybrid Imaging (PET/CT, SPECT/CT, PET/MRI)

- Workflow Management Software

- Scheduling & Patient Management

- Dose Management & Tracking

- Reporting & Data Management

- Quantification & Analytics Software

- SUV Calculation & Quantitative Assessment Tools

- Kinetic Modeling & Parametric Imaging

- Radiomics & AI-based Quantification Tools

- Radiopharmacy Management Software

- Isotope Inventory Management

- Quality Control & Regulatory Compliance Modules

- Order Tracking & Dispensing Management

- Other Software Solutions

- PACS Integration Tools

- Cloud-based Data Sharing Platforms

- Interoperability & Communication Software

By Modality

- Positron Emission Tomography (PET)

- PET/CT

- PET/MRI

- Single Photon Emission Computed Tomography (SPECT)

- SPECT/CT

- Planar Scintigraphy

By Deployment Mode

- On-Premises

- Cloud-Based / Web-Based

- Hybrid

By Application

- Oncology

- Cardiology

- Neurology

- Endocrinology

- Orthopaedics

- Other Clinical Applications (e.g., Gastroenterology, Nephrology)

By End User

- Hospitals

- Diagnostic Imaging Centers

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Radio pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting