What is the Oil and Gas Analytics Market Size?

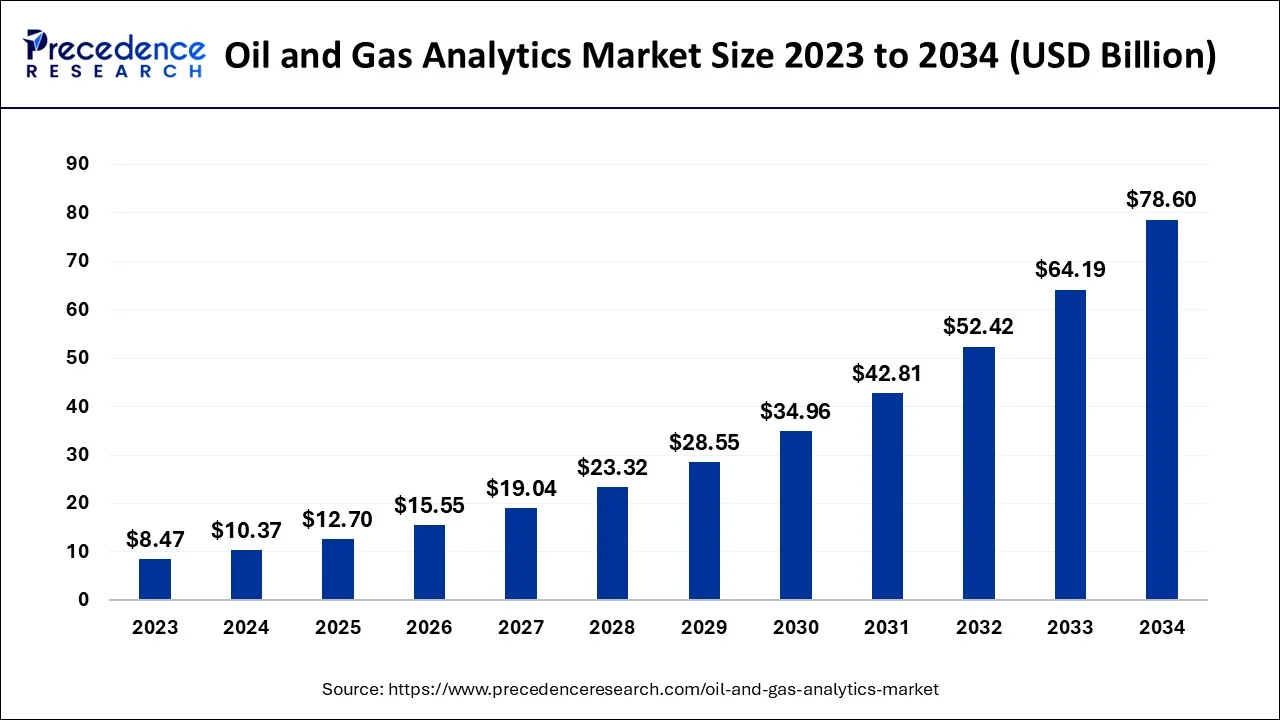

The globaloil and gas analytics market size is exhibited at USD 12.70 billion in 2025 and is predicted to surpass around USD 91.25 billion by 2035, growing at a CAGR of 21.80% from 2026 to 2035. Boost in the transportation and travel industry across the globe fuels the growth of the oil and gas analytics market.

Key Takeaways

- By geography, North America contributed the maximum revenue share in 2025.

- By offering, the software segment captured the largest revenue share of the market in 2025.

- By deployment platform, the cloud segment dominates the global market in 2025.

- By application, the upstream segment is predicted to boost the market from 2026 to 2035.

- By use, the large enterprise segment is dominating the global market.

Strategic Overview of the Global Oil and Gas Analytics Industry

Oil and gas analytics is a statistical method to enable predictive analysis. The oil and gas analytics is done to reduce the risk in the market, maximizing the yield and accelerating the performance. The oil and gas industry analytics provides a set of techniques to extract trends and patterns of the current demand from the data to assist the decision-making process or optimization. Descriptive analytics, predictive analytics, diagnostic and perspective are a few pillars of analytics. Many oil and gas companies have employed oil and gas analytics (predictive type) to reduce downtime and maintenance costs to improve asset management.

Oil and gas analytics offers multiple advantages to the oil and gas company, such as improved occupational safety and proper optimization of drilling operations. Companies that have adopted oil and gas analytics are likely to develop rapidly. The analytics process for oil and gas companies is done using a large amount of field data and machine learning algorithms. The collected data helps optimize business performance, forecast the future and understand consumer behaviour. Highly complex and variable data from the oil and gas industry have forced companies to adopt oil and gas analytics in recent years.

Artificial Intelligence: The Next Growth Catalyst in Oil and Gas Analytics

AI is fundamentally impacting the oil and gas analytics industry by driving a shift from traditional data analysis to predictive and prescriptive insights across the entire value chain. It is enabling companies like Shell and BP to leverage machine learning algorithms that analyze vast datasets from sensors for predictive maintenance, significantly reducing unplanned downtime and operational costs by up to 30-50%.

In exploration, AI enhances seismic data interpretation to pinpoint potential drilling sites with higher accuracy, thus minimizing environmental disruption and improving success rates. Furthermore, AI optimizes supply chain management and helps forecast volatile market prices by analyzing global economic indicators, providing a strategic edge in decision-making.

Market Outlook

- Market Growth Overview: The oil and gas analytics market is expected to grow significantly between 2025 and 2034, driven by operational efficiency and cost reduction, regulatory compliance and ESG focus, and data-driven exploration and production.

- Sustainability Trends: Sustainability trends involve AI and analytics for emission monitoring and detection, operational efficiency and energy optimization, and carbon capture, utilization, and storage data management.

- Major Investors: Major investors in the market include Exxon Mobil Corporation & Chevron Corporation, Shell plc & BP p.l.c., Microsoft Corporation & Amazon Web Services (AWS), and SAP SE.

- Startup Economy: The startup economy is focused on leveraging cutting-edge technology, particularly AI/ML, IoT, and cloud computing, to disrupt traditional practices.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.70 Billion |

| Market Size in 2026 | USD 15.55 Billion |

| Market Size by 2035 | USD 91.25 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 21.80% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Offering, By Deployment Platform, By Application, and By User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

MarketDynamics

The increasing demand for energy all across the globe is seen as a significant driving factor for the market. The growth of the oil and gas analytics market is attributed to the growing awareness of security during operations in the oil and gas industry. The demand for oil and gas analytics is boosted as several companies have started investing in digitization. The deployment of artificial intelligence and the Internet of Things (IoT) in the global oil and gas analytics market is considered a significant driver for the market's growth. Many oil and gas companies are focused on increasing efficiency and performance with proper data insight. All these requirements are fulfilled by the oil and gas analytics. This factor fuels the growth of the global oil and gas analytics market.

The overall advancements in the travel and transportation industry result in increased oil consumption. Oil and gas analytics provide data to oil and gas companies that offer visionary solutions to the companies. Thus, increased oil consumption across the globe is seen as another driving factor for the growth of the global oil and gas analytics market. The greater oil demand has forced oil companies to explore new oil reserves to fulfil the demand. Companies require cost optimization during such processes. This acts as the market driver for oil &gas analytics. Furthermore, the significant growth of the global oil and gas analytics market is driven by advancements in process automation and growing demand for the implementation of big data analytics.

The uncertainty or volatility in crude oil prices stands as a restraining factor for the growth of the global oil and gas analytics market. Unpredictable events such as war and natural or human-made disasters hamper the market's growth. For instance, the Russia-Ukraine war in 2022 showed adverse impacts on the oil and gas market. Russia is one of the largest producers of oil and natural gas. The war affected the energy market globally, directly affecting the growth of the global oil and gas analytics market. Moreover, the stringent policies and regulations on the oil and gas industry hamper the growth of the market and act as a restraint for market growth.

Segment Insights

Offering Insights

Based on the offering, the software segment acquires the largest share of the market. Rapidly growing demand for machine learning and artificial intelligence for compelling market predictions is driving the software segment's growth. Technological advancements in the market, such as the use of robotics and sensor networks in the upcoming years, are prone to grow in the software segment during the forecast period of 2024-2034.

The service segment of the oil and gas analytics market is further divided into professional, integrated and maintained. The service segment offers secure storage and maintenance of generated data. It also ensures the data protection and authentication of the user before accessing the data. Considering the advantages provided by the service, the segment is expected to grow at a good rate during the forecast period.

Deployment Platform Insights

Based on the deployment platform, the global oil and gas analytics market is segmented into on-premises and cloud. Many companies have adopted the cloud platform to analyze their business performance. The cloud service segment is the dominating global oil and gas analytics market.

Cloud-based services allow better reliability and lower downtime. Also, managing big data has become easier with cloud services. Cloud services also offer remote and connected operations, which is convenient for oil and gas companies. With such super flexible options of operations for oil and gas industries, the cloud segment is expected to witness noticeable growth during the forecast period.

Application Insights

Based on the application, the global oil and gas analytics market is segmented into upstream, midstream and downstream. The upstream segment is expected to boost during the forecast period owing to the increased exploration of crude oil sources. The midstream segment refers to the transportation and storage of crude oil and natural gas.

To avoid the potential risks associated with the logistical or transport process, oil and gas companies deploy analytics. In contrast, the downstream segment shows potential for growth in the upcoming years. This segment holds the distribution and sale process to the consumers. Oil and gas companies use predictive oil and gas analytics for the distribution and sale process.

User Insights

Based on the user, the global oil and gas analytics market is segmented into small & medium enterprises and large enterprises. Large enterprise is the dominating segment of the market. The capabilities of large enterprises to invest in oil and gas analytics are higher. Along with this, the data that is required to be handled during the analytics is enormous for large enterprises. In the case of small & medium enterprises, the volume of data is small, and such enterprises are not capable of investing huge capital in the market.

Regional Insights

North America acquires the largest revenue share of the global oil and gas analytics market. Growing investments in the energy and power sector in North America are considered the major driving factor for the market's growth. The rapid adoption of cloud services in the region has boosted the market's growth. Increased operational activities in the oil and gas industry have surged the region's demand for data management services. This factor is contributing to the development of the market. The oil and gas analytics market in Europe is anticipated to show a significant increase during the forecast period owing to the rapid digitization in the region. Multiple oil companies in Germany and France have already deployed cloud services for data analytics. Thus, the increasing deployment of cloud-based services in the oil and gas industry in Europe is seen as a significant driver for the growth of the market.

U.S. Oil and Gas Analytics Market Trend

The U.S. market, the upstream sector, and characterized by aggressive adoption of AI/ML for applications like predictive maintenance and real-time drilling analytics. The shift toward scalable cloud-based platforms (55.8% market share) is a major trend, improving data integration and operational efficiency. Driven by environmental regulations, sustainability, and emissions management are growing application areas, with companies utilizing AI for methane leak detection.

Asia Pacific is considered the fastest-growing region and is projected to hold the highest revenue share during the forecast period in the global oil and gas analytics market. The growing demand for data analysis required during the exploration of oil sources in the region is contributing to the growth of the market. The increasing number of software companies that provide analytics platforms for oil and gas companies is another factor propelling the growth of the oil and gas analytics market in Asia Pacific.

China Oil and Gas Analytics Market Trend

China's market is experiencing robust growth driven by a dominant upstream sector focus on maximizing domestic production and achieving energy security. The rapid integration of AI for enhanced efficiency, safety, and production optimization often occurs in collaboration with tech giants like Huawei. Government-led digitalization initiatives and stringent sustainability regulations are accelerating the adoption of analytics for emissions monitoring and environmental compliance.

How did Europe gain a notable share in the Oil and Gas Analytics Market?

Europe's need to optimize production from mature North Sea fields and comply with strict environmental regulations like the EU Green Deal. The region leverages deep technological expertise in AI and digital twins to boost operational efficiency and manage costs effectively. Furthermore, analytics play a crucial role in integrating traditional energy infrastructure with emerging renewable sources.

Germany Oil and Gas Analytics Market Trends

Germany's market is the nation's ambitious Energiewende and a focus on the dominant downstream sector. The market leverages AI and data-driven solutions to optimize refinery operations, enhance efficiency, and ensure stringent environmental compliance and emissions monitoring.

Increasing local and foreign investment in the oil and gas market in the Middle East is likely to grow the market revenue share of the region during the forecast period. The higher rate of oil production in the area is supplementing the uptake of new oil industry projects, mainly in the gulf countries. This factor is fueling the growth of the oil and gas analytics market in the Middle East. Middle East and Africa are prone to augment the global market for oil and gas analytics.

Value Chain Analysis of the Oil and Gas Analytics Market

- Data Acquisition and Sensor Technology:

This foundational stage involves capturing vast amounts of data from physical assets, such as seismic surveys, wellhead sensors, pipelines, and refinery equipment.

Key Players: Schlumberger Limited, Halliburton Company, Baker Hughes Company, and Honeywell International Inc. - Data Management and Infrastructure:

This stage focuses on storing, managing, and integrating the massive volume of collected data, often using cloud-based platforms and robust data lakes.

Key Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Oracle Corporation, and SAP SE. - Analytics Software and Solution Development:

This crucial stage involves developing the specialized software, algorithms (AI/ML), and platforms that process raw data into actionable insights for applications like predictive maintenance, reservoir modeling, and supply chain optimization.

Key Players: IBM Corporation, SAP SE, Microsoft, and Palantir Technologies Inc. - Consulting and Integration Services:

Third-party service providers and consultancies help oil and gas companies implement, integrate, and customize analytics platforms to meet their specific needs and comply with regulations.

Key Players: Accenture, Deloitte, IBM Global Services, and Capgemini. - End-User Application and Value Creation:

The final stage involves the deployment and application of analytical insights across the upstream, midstream, and downstream sectors to drive decision-making and achieve business outcomes.

Key Players: Exxon Mobil Corporation, Shell plc, BP p.l.c., and Chevron Corporation.

Oil and Gas Analytics Market Companies

- Hitachi: Hitachi contributes to the oil & gas analytics market through its expertise in IT infrastructure, operational technology (OT), and AI-driven predictive maintenance solutions that optimize asset performance and ensure reliability across the energy value chain.

- IBM Corporation: IBM provides hybrid cloud and AI-powered analytics platforms (like Maximo and Watson) that enable oil & gas companies to manage complex data, optimize production, perform predictive maintenance, and enhance decision-making across their operations.

- TIBCO Software: TIBCO contributes by offering data integration and visual analytics platforms that help oil & gas companies connect disparate data sources and visualize complex data patterns for real-time decision support and operational intelligence.

- Tableau Software (now part of Salesforce): Tableau provides powerful, user-friendly business intelligence and data visualization software that allows analysts and engineers to easily explore and share insights from large datasets in the oil & gas sector.

- Northwest Analyst: (Note: Information about Northwest Analyst's specific contributions to the oil & gas analytics market is limited.)

- Teradata: Teradata contributes enterprise-grade data warehousing and analytics solutions, helping major oil & gas companies manage massive data volumes and run complex analytical queries to optimize exploration, production, and supply chain logistics.

Recent Developments

- In January 2023, a leading work-site intelligence platform for the oil and gas industry, Eyrus, launched a new and advanced platform, ' Eyrus Evolved'. This platform is an end-to-end solution for the oil and gas industry and contractors to make better decisions related to progress, risk and safety.

- In October 2022, Texas A&M University and Peloton announced a collaboration of content for two courses in the Petroleum Engineering Curriculum of the university to empower future petroleum engineers. The partnership between Texas A&M University and Peloton aims to teach petroleum engineering students data management and analytics.

- In August 2022, multinational oil and gas company Shell announced that the company had built a new integrated data platform to accelerate the energy transition. Databricks has formed the basis of Shell's new unified data analytics platform. Databricks is a software company headquartered in the United States.

- In September 2022, a global provider of well-site services to the oil, gas and other energy industries, Geolog International, announced a strategic partnership with Petro.ai, an artificial intelligence company. The strategic partnership aims to provide machine learning and artificial intelligence-based data science, predictive products and services to the global energy industry.

- In July 2022, Cairn Oil &Gas decided to increase its cloud footprint by moving 80% of its workloads to the cloud. This decision aims to improve the company's processes, efficiency and cost optimization.

Segments Covered in the Report

By Offering

- Hardware

- Software

- Service

By Deployment Platform

- On-premises

- Cloud

By Application

- Upstream

- Midstream

- Downstream

By User

- Small & medium Enterprises

- Large Enterprises

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting