What is the Online Books Market Size?

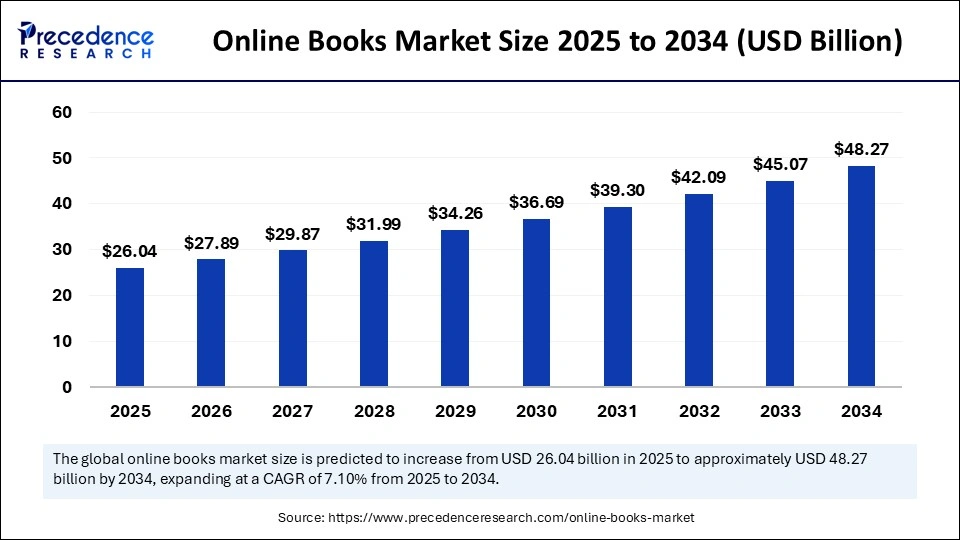

The global online books market size is valued at USD 26.04 billion in 2025 and is predicted to increase from USD 27.89 billion in 2026 to approximately USD 48.27 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The growth of the market is driven by the rise of e-books and growing digitization.

Online Books Market Key Takeaways

- In terms of revenue, the online books market is valued at $ $26.04 billion in 2025.

- It is projected to reach $48.27 billion by 2034.

- The market is expected to grow at a CAGR of 7.10% from 2025 to 2034.

- North America led the online books market with the largest share in 2024.

- Asia pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By product type, the e-books segment held the largest market share in 2024.

- By product type, the audiobooks segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By genre, the fiction segment held the largest market share in 2024.

- By genre, the non-fiction segment is projected to grow at the highest CAGR in the coming years.

- By distribution channel, the online retailers segment held the largest market share in 2024.

- By distribution channel, the subscription services segment is anticipated to grow at a rapid pace in the coming years.

- By device compatibility, the smartphones segment dominated the market in 2024.

- By device compatibility, the tablet segment is expected to expand at a significant CAGR during the forecast period.

Is AI turning the page of the online books market?

Artificial Intelligence is significantly reshaping the online books market, enhancing both user experience and operational efficiency. Artificial intelligence (AI) enables personalized books to be recommended through advanced algorithms, improving customer engagement and boosting sales. It also streamlines content creation with AI-driven editing, proofreading, and even automated writing tools, empowering authors and publishers to produce high-quality content more efficiently. Additionally, AI expands the reach of audiobooks and e-books to global audiences, creating new growth opportunities in the market.

- In 2024, major platforms like Amazon Kindle and Apple Books integrated AI chat assistants to provide real-time book suggestions and interactive reading experiences, further ameliorating the digital landscape.

Market Overview

Online books offer a vast selection of digital and print books through e-commerce platforms and subscription-based services. The rise of e-books, audiobooks, and on-demand publishing has transformed the way readers assess content. The online books market has been witnessing significant growth due to the increasing popularity of e-books and audiobooks, along with the widespread use of smartphones, tablets, and e-readers. Consumers now prefer the convince and accessibility of digital formats, which allow them to read or listen to books anytime and anywhere. Moreover, the rise of subscription-based models and online platforms, such as Amazon Kindle, Audible, Google Books, has expanded the availability of diverse content. The growing demand for educational and professional e-books and advancements in digital publishing technologies continue to shape the market's dynamics.

Online Books Market Growth Factors

- Increasing internet penetration and smartphone adoption: With the widespread availability of high-speed internet and the growing use of smartphones and tablets, online books have become easier and more convenient for readers worldwide.

- Rising popularity of e-books and audiobooks: The demand for e-books and audiobooks is on the rise due to their portability, affordability, and user-friendly formats, appealing to both leisure readers and professionals.

- Growth of subscription-based models: Platforms like Amazon Kindle Unlimited, Audible, and Scribd offer vast content libraries through affordable subscription plans, making digital reading more accessible and cost-effective.

- Sustainability and environmental concerns: Growing awareness of environmental conservation encourages readers to shift from physical books to digital alternatives, reducing paper consumption and carbon footprints.

- Advancements in AI and personalization: AI-driven recommendation engines and personalized content delivery enhance user experiences, increasing engagement and customer retention on digital platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 48.27 Billion |

| Market Size in 2025 | USD 26.04 Billion |

| Market Size in 2026 | USD 27.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Genre, Distribution Channel,Device Compatibility and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for E-books

The increasing demand for e-books and audiobooks is a major factor driving the growth of the online books market. Consumers are shifting toward digital formats due to their convenience, affordability, and instant accessibility. With the rise of portable devices like e-readers, tablets, and smartphones, readers can access a vast library of books anytime and anywhere. Recent developments, such as voice-enabled technologies, have further enhanced user experience, boosting the popularity of audiobooks globally. Voice assistants and smart devices now offer seamless audiobook integration, while augmented reality is being explored for children's books and educational content. Moreover, several publishers have begun using audiobooks narrated by synthetic voices, increasing the availability of audiobook content.

Restraint

Digital Piracy Challenges

Despite several opportunities, the online books market faces numerous challenges. Digital piracy is one of the significant factors hindering the growth of the market. Unauthorized distribution of e-books and audiobooks through illegal platforms undermines publishers' and authors' revenues. Privacy continues to pose a threat to intellectual property rights and profitability. In addition, the rising distribution of unauthorized content limits the growth of the market. To curb these challenges, publishers and digital platforms need to strengthen their digital rights management (DRM) protocols.In 2024, several leading publishers and digital platforms, including Amazon and Google Books, have strengthened their digital rights management protocols. Advanced AI-driven anti-piracy technologies are being deployed to monitor and detect unauthorized content distribution.

Opportunity

Innovation in Content Creation and Delivery

The online books market is witnessing significant opportunities through innovative content creation and delivery methods. Publishers and authors are leveraging AI and machine learning technologies to create personalized reading experiences, such as adaptive storytelling, interactive e-books, and AI-narrated audiobooks. These technologies allow customized content recommendations, enhancing reader engagement and expanding market reach. Additionally, blockchain-based copyright protection solutions are emerging, offering transparent and tamperproof tracking of digital book ownership and distribution, aiming to curb piracy more effectively. These technologies are changing the way readers consume and interact with digital literature, opening new revenue streams for publishers and creators.

- In 2024, Amazon Kindle and Audible introduced AI-powered personalized reading and listening experiences, offering tailored recommendations based on user preferences and reading history. Additionally, Google Books expanded its AI translation services, enabling access to a broader range of international titles in multiple languages.

Product Type Insights

The e-books segment dominated the online books market with the largest share in 2024. This is mainly due to their widespread accessibility, affordability, and ease of distribution. With the vast range of genres available across various platforms like Amazon Kindle and Google Books, e-books are the preferred format for readers seeking convince and probability. Educational institutions and professionals also favor e-books for their searchability and annotation features.

On the other hand, the audiobooks segment is anticipated to grow at a remarkable CAGR during the projection period. The growth of the segment is attributed to the increasing availability of audiobooks through mobile apps and smart devices. The convenience of listening and the rising popularity of podcast-style storytelling are driving the growth of the segment.

Genre Insights

The fiction segment led the online books market with the largest share in 2024. Popular genres like romance, mystery, fantasy, and science fiction cater to diverse reader interests. A vast selection of fiction genres is available, enabling readers to easily assess content according to their interests. Major platforms such as Amazon Kindle and Wattpad consistently report high engagement and sales in fiction categories.

Meanwhile, the non-fiction segment is expected to witness the fastest growth in the coming years. The growth of the segment is attributed to the increasing interest in self-help, personal development, biographies, and business books. Readers are seeking knowledge-driven content for both professional and personal growth. The rise of audiobooks has also contributed to this trend, as non-fiction titles are consumed in audio formats for convince.

Distribution Channel Insights

The online retailers segment dominated the online books market in 2024, capturing a major share. This is mainly due to the ease of access to books through online retailers, expanding reach to a broader readership. Online retailers such as Amazon Kindle, Apple Books, and Google Play Books offer a wide selection of e-books and audiobooks, with one-time purchase options and frequent discounts, making them a preferred choice for readers worldwide.

On the other hand, the subscription services segment is projected to expand at a rapid pace during the forecast period. Subscription services provide access to a large library of books for a fixed monthly fee. These services provide access to books anytime. Subscription-based models are cheaper than purchasing individual books. Subscription services provide unlimited access to books for a particular time, making it a convenient option, especially for avid readers.

Device Compatibility Insights

The smartphone segment dominated the online books market by holding the largest share in 2024. This is mainly due to their portability and convenience. With mobile apps and improved screen technology, readers can access content on-the-go, making smartphones the primary device for e-book consumption.

Meanwhile, the tablets segment is expected to expand at a significant CAGR during the forecast period. Tablets are preferred for their larger screen size, enhancing the reading experience, especially for graphic novels, textbooks, and illustrated content. Tablets have the ability to handle various e-book formats like PDF and multimedia files, offering more flexibility than e-readers.

Regional Insights

North America held the largest share of the online books market in 2024. This is mainly due to high internet penetration, advanced digital infrastructure, and a tech-savvy consumer base. The U.S., in particular, has a large consumer base of e-books and audiobooks. The region is home to major players like Amazon, Apple, and Google. The early adoption of digital publishing platforms and subscription-based models further contributed to the region's dominance. The region is likely to sustain its position in the market. This is mainly due to the presence of well-developed online retail and digital distribution platforms. In addition, higher disposable income is likely to drive the growth of the market.

Asia Pacific is projected to witness the fastest growth, primarily due to the rising use of smartphones and access to high-speed internet. The younger population, especially Gen Z, is increasingly preferring online books. Countries like India and China are key contributors, with consumers embracing regional language content and AI-driven reading platforms. The growing popularity of subscription services and audio content is accelerating the market's growth.

India stands out as the major market. A surge in smartphone penetration and an expanding middle-class population are expected to support the growth of the market. Popular platforms like Storytel, Amazon Kindle, and Audible have gained massive user bases from India. The rising tech-savvy population further contributes to market expansion.In 2024, Storytel announced partnerships with Indian publishers to release regional language audiobooks.

Online Books Market Companies

- Amazon Kindle

- Apple Books

- Barnes & Noble Nook

- Google Play Books

- Kobo Books

- Scribd

- OverDrive

- Bookmate

- Wattpad

- Smashwords

- Project Gutenberg

- Open Library

- Libby

- Hoopla Digital

- Audible

- Thalia

- Tolino

- Storytel

- Rakuten Books

- 24symbols

Recent Developments

- In August 2024, Scribd, Inc. introduced a beta version of its AI-powered tool, ‘Ask AI,' which has been developed to elevate customer experience for its Scribd and Everand brands. This feature enables users to rapidly gather vital information from documents on Scribd, avoiding spending excessive time on research. Meanwhile, on Everand, Ask AI recommends audiobook and e-book titles based on user preferences, creating a highly personalized reading experience.

- In May 2023, the International Council on Systems Engineering (INCOSE) launched the eBook “Realizing Relevance: Stories for Our Digital Era: The Business Value of Thinking in Systems.” This eBook is a guide for maximizing business and client value by unleashing the relevance and performance of digital solutions, products, and services with fit-for-use systems engineering and thinking.

Segments Covered in the Report

By Product Type

- E-books

- Audiobooks

- Interactive Books

By Genre

- Fiction

- Non-Fiction

- Educational

- Children's Books

- Others

By Distribution Channel

- Online Retailers

- Subscription Services

- Direct Sales

- Others

By Device Compatibility

- Smartphones

- Tablets

- E-readers

- Computers

- Others

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting