What is the Ophthalmoscopes Market Size?

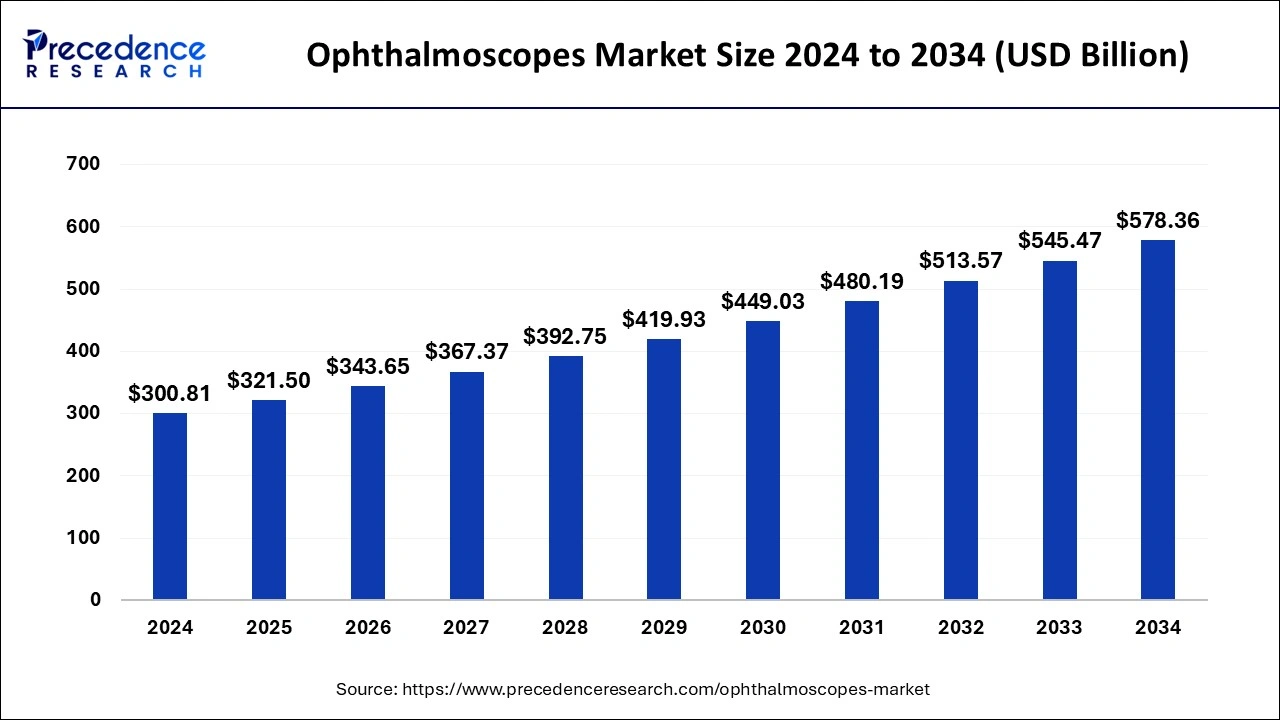

The global ophthalmoscopes market size is valued at USD 321.50 billion in 2025 and is predicted to increase from USD 343.65 billion in 2026 to approximately USD 610.59 billion by 2035, expanding at a CAGR of 6.62% from 2026 to 2035.

Ophthalmoscopes MarketKey Takeaways

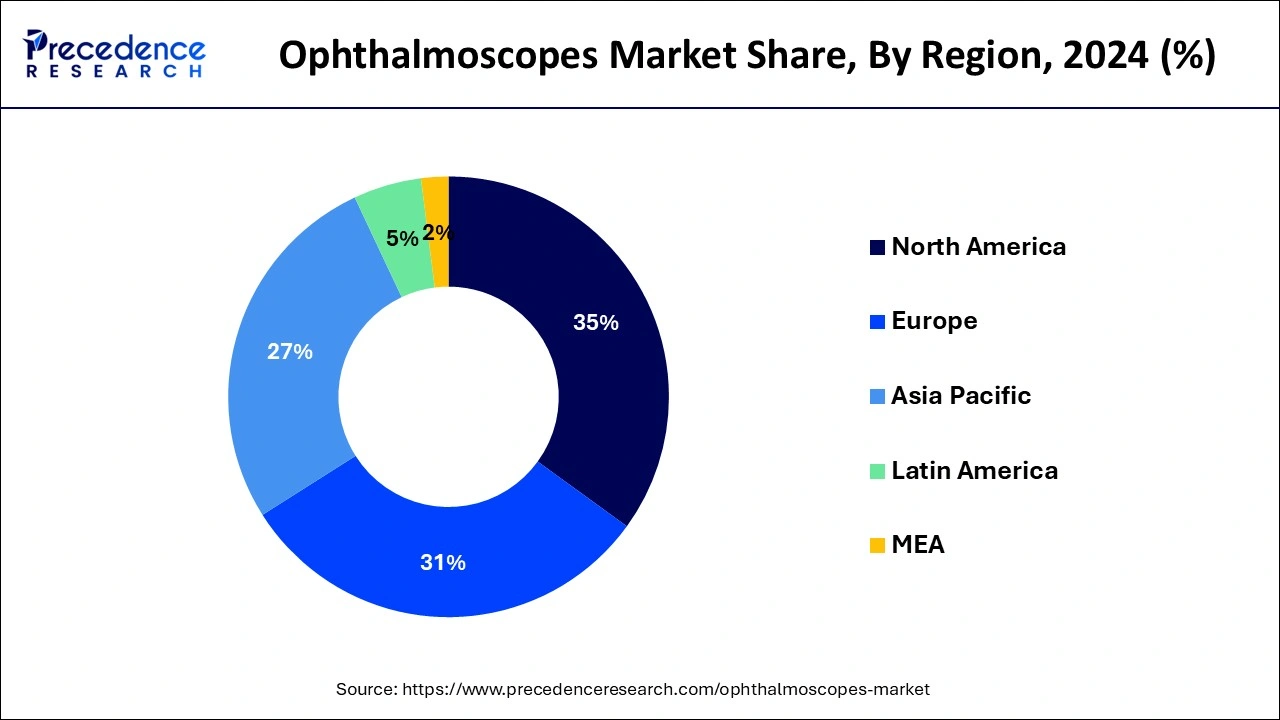

- North America led the global market with the largest market share of 35% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Type, the direct segment has held the largest revenue share in 2025.

- By Type, the indirect segment is anticipated to grow at the fastest CAGR during the projected period.

- By Application, the glaucoma dominated the global market in 2025.

- By Application, the diabetic retinopathy segment is projected to expand at the fastest CAGR over the projected period.

- By End-use, the hospitals segment had the biggest market share in 2025.

- By End-use, the ophthalmic clinics segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

The ophthalmoscopes market includes the distribution, production, and sale of ophthalmoscopes, which are vital medical devices utilize by eye care professionals to inspect the internal structures of the eye. It allows the imaging or visualization of the optic nerve, retina, and other important eye structures, aiding in the monitoring and diagnosis of several eye diseases and problems. The market comprises a range of ophthalmoscope types, including direct, indirect, and digital models.

Furthermore, Digital ophthalmoscopes incorporate advanced imaging technology, allowing for image capture and storage, aiding in documentation and telemedicine applications. Factors driving the growth of the ophthalmoscopes market are the rising occurrence of eye disorders, technological advancements in ophthalmoscope design, surging awareness of eye health, and mounting healthcare infrastructure, making it a vital component of the broader healthcare sector.

Artificial Intelligence: The Next Growth Catalyst in Ophthalmoscopes

AI is the technology that enhances the precision of images, automates the analysis of the retina, and helps doctors detect minute abnormalities quickly. It is also a strong support to predictive diagnosis, cutting down manual errors, and connecting with tele-ophthalmology platforms that make eye care services available worldwide, thus facilitating the making of decisions and interventions sooner.

Ophthalmoscopes Market Growth Factors

The growth of the ophthalmoscopes market attributed to several factors such as increasing awareness of eye health, rising occurrence of eye diseases, aging population, and surging telemedicine & remote diagnostics. These factors contribute to the constant demand for ophthalmoscopes in the healthcare industry, as they address the growing need for accurate and efficient eye examinations and diagnostics, ultimately supporting better patient outcomes and eye health.

Furthermore, with surging digital ophthalmoscopes, smartphone-compatible devices, and more sophisticated optics offering improved diagnostic capabilities and ease of use for healthcare professionals, this further help in creating demand for ophthalmoscope technology continues to advance. For instance, in April 2021, Hillrom launched innovative tools designed to help clinicians make earlier and more accurate diagnoses of eye conditions Welch Allyn PanOptic plus Ophthalmoscope.

In addition, surging occurrence of eye conditions such as macular degeneration, glaucoma, diabetic retinopathy, and cataracts driving demand for ophthalmic examinations led to greater adoption of ophthalmoscopes and further creating demand across the market. For instance, in July 2020, researchers at the University of Bonn and Sankara Eye Hospital, Bengaluru introduced smartphone-based ophthalmoscope tool can be effectively turned into an eye-examination device and could help diagnose diabetic retinopathy from miles away.

Market Outlook

- Industry Growth Overview: The demand for efficient eye care technologies in the global market is increasing, and the market is evolving through digital imaging and diagnostic precision innovations.

- Sustainability Trends: The use of portable, AI-enabled imaging systems is making eye diagnosis accessibility easier, encouraging tele-ophthalmology, and lessening diagnostic disparities.

- Global Expansion: Innovation in the ophthalmic field is the main driver in global healthcare problem-solving by the introduction of efficient, technology-based, and affordable diagnostic solutions in developing areas.

- Major Investors: The global leaders and innovators are investing significantly in the devices that focus on connectivity and precision diagnostics.

- Startup Ecosystem: Emerging companies are changing the face of early eye diagnosis through mobile-compatible, AI-assisted screening solutions for point-of-care availability.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.84% |

| Market Size in 2025 | USD 321.50 Billion |

| Market Size in 2026 | USD 343.65 Billion |

| Market Size by 2035 | USD 610.59 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By End-Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Rising awareness of eyes related disorders

Surging awareness about eye-related disorders helps in providing more people seeking preventive eye care, early diagnosis and treatment of eye diseases. According to the World Health Organization (WHO) in 2022, about 2.2 billion people worldwide have vision impairment, of which at least 1 billion have a vision impairment that could have been prevented or treated.

The ophthalmoscopes helps healthcare professional in analyzing vital tool for eye doctors to inspect the inside of the eye and identify eye diseases. Moreover, the emphasis on early detection and diagnosis of eye disorders encourages individuals to consult healthcare providers at the slightest signs of visual disturbances or discomfort. Ophthalmoscopes, being indispensable tools for diagnosing and monitoring various eye conditions, become instrumental in facilitating early intervention and enhancing treatment outcomes.

Public health campaigns, educational initiatives, and media awareness programs are also instrumental in shedding light on eye health, eye safety, and the crucial role of routine eye exams. These efforts underscore the significance of ophthalmoscopes in detecting eye diseases, thereby fueling the demand for these diagnostic devices.

Furthermore, the trend toward preventive eye care gains momentum as awareness grows. Individuals are proactively seeking eye examinations to identify potential issues before they escalate, which, in turn, drives demand for ophthalmoscopes in primary care and eye clinics. The rise in telemedicine and remote consultations is another notable outcome of heightened awareness. Ophthalmoscopes equipped with digital imaging capabilities are facilitating remote eye examinations, democratizing access to eye care and expanding the market's reach.

In addition, awareness campaigns may stimulate educational institutions and research centers to invest in ophthalmoscope equipment. This investment serves a dual purpose by training future eye care professionals in the proper use of ophthalmoscopes and supporting eye-related research endeavors. Thus, the burgeoning awareness of eye-related disorders and the significance of maintaining good eye health are fundamental forces that significantly boost the demand for ophthalmoscopes.

Restraints

High cost and limited access to eye care services

The high cost of ophthalmoscopes can pose a substantial barrier to their acquisition, particularly for smaller healthcare facilities, individual practitioners, and healthcare systems with limited budgets. Advanced digital ophthalmoscopes, which offer enhanced diagnostic capabilities, tend to be particularly expensive. This pricing barrier can limit the accessibility of these crucial diagnostic tools in resource-constrained regions, where affordable and cost-effective solutions are often sought.

Moreover, the limited access to eye care services in certain geographic areas or underserved communities impedes the demand for ophthalmoscopes. In regions with a shortage of specialized eye care professionals and clinics, the requirement for ophthalmic equipment is diminished, as there may not be sufficient patient demand for these services.

Furthermore, in areas where access to healthcare infrastructure is lacking or where patients face geographical and financial constraints, the utilization of ophthalmoscopes becomes challenging. Patients may not have the means to access eye care services, thereby reducing the demand for ophthalmic examinations and diagnostic equipment. Thus, the combination of high costs and limited access to eye care services creates a formidable restraint for the ophthalmoscopes market.

Opportunities

Adoption of AI in ophthalmoscopes

Digital ophthalmoscopes fitted with innovative telehealth and imaging abilities, are poised to play a vital role in the remote diagnosis and monitoring of eye conditions. Moreover, teleophthalmology, a branch of telemedicine, allows eye care professionals to conduct remote eye examinations and consultations with patients in real-time. Digital ophthalmoscopes capture excellent videos and images of the eye's interior, which may be transmitted strongly to healthcare providers for analysis. This overcomes geographical barriers, and make eye care available to patients in underserved or rural areas where access to specific eye care is restricted.

Furthermore, the expansion of telemedicine enables early detection and timely intervention in eye diseases, contributing to improved patient outcomes and reduced healthcare costs. Patients can receive timely advice, prescriptions, and referrals, preventing the progression of conditions that might otherwise lead to irreversible vision loss. For ophthalmoscope manufacturers, this trend presents an opportunity to develop and market specialized digital ophthalmoscopes tailored for teleophthalmology applications.

These devices can include features such as integrated data sharing, telehealth platform compatibility, and remote diagnostics support. Collaborations between ophthalmoscope manufacturers and telemedicine service providers can further enhance the synergy between these technologies. Thus, the growth of telemedicine and remote healthcare services revolutionizes the way eye care is delivered, creating a substantial opportunity for the ophthalmoscopes market.

Segment Insights

Type Insights

According to the type, the direct segment technology has held highest revenue share in 2025. Direct ophthalmoscopes are handheld devices used for inspecting the eye's inner directly through the pupil. They usually have a built-in light source and optics that enable healthcare professionals to look at the optic nerve, retina, and other structures in the back of the eye. It provides a narrow but extremely magnified view of the eye, which is beneficial for detailed examination of precise areas. It is normally used in routine eye examinations and are comparatively portable and easy to use.

The Indirect ophthalmoscopes type is anticipated to expand at a significantly CAGR during the projected period. because Indirect ophthalmoscopes are larger, binocular devices that provide a wider field of view. They don't rely on direct examination through the pupil; instead, they project an inverted image of the eye onto a lens or mirror, allowing the examiner to view the retina and other structures indirectly. Indirect ophthalmoscopes are particularly valuable for comprehensive examinations and are often used for assessing the peripheral retina. They offer a broader view of the eye's interior but can be bulkier and require more skill to use effectively.

Application Insights

Based on the application, Glaucoma is anticipated to hold the largest market share in 2025. Early detection and monitoring of glaucoma are essential to prevent vision loss, making ophthalmoscopes a valuable tool in glaucoma management. Ophthalmoscopes are used to inspect the optic nerve head, where damage can indicate the presence of glaucoma.

On the other hand, the Diabetic retinopathy is projected to grow at the fastest rate over the projected period. Diabetic retinopathy is a substantial application area for ophthalmoscopes during the forecast period. It is instrumental in monitoring and detecting retinal fluctuations affected by diabetes, aiding healthcare professionals detect the disease's progression and improve appropriate treatment plans.

End-use Insights

In 2025, the Hospitals segment had the highest market share of on the basis of the end-use industry. Ophthalmoscopes are vital diagnostic tools in hospital settings, where they are utilized by ophthalmologists, optometrists, and other healthcare professionals to examine patients with a wide range of eye conditions and diseases. Hospitals often have specialized eye care departments or ophthalmology clinics where ophthalmoscopes are routinely used for diagnosis, treatment, and monitoring of patients.

The Ophthalmic clinics are anticipated to expand at the fastest rate over the projected period. Ophthalmic clinics, including standalone eye clinics and specialized eye care centers, are dedicated facilities for the diagnosis and treatment of eye-related issues. Ophthalmoscopes are a primary tool in these clinics, used by ophthalmologists and optometrists to provide specialized eye care services. These clinics may offer a more focused and comprehensive approach to eye care compared to general hospitals.

Regional Insights

What is the U.S. Ophthalmoscopes Market Size?

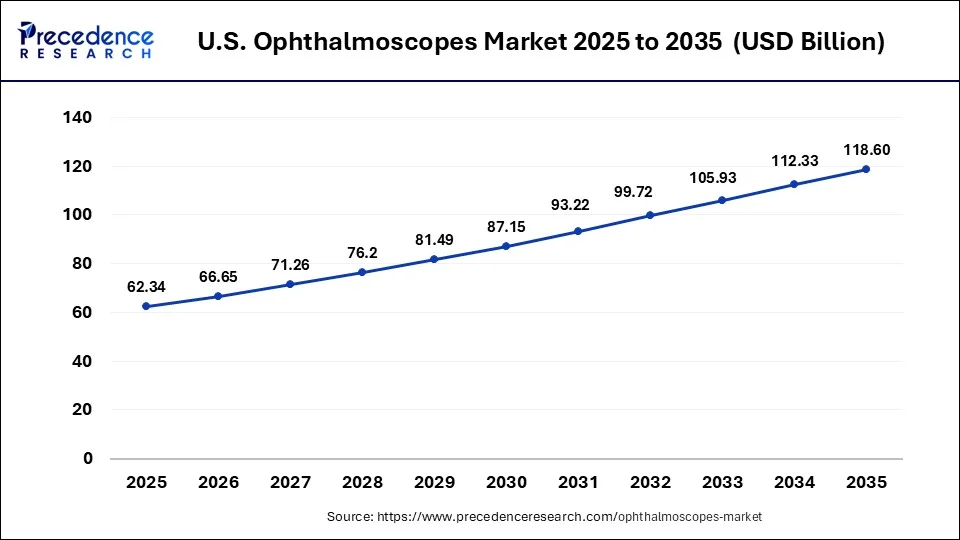

The U.S. ophthalmoscopes market size is valued at USD 62.34 billion in 2025 and is estimated to reach around USD 118.60 billion by 2035, growing at a CAGR of 6.64% from 2026 to 2035.

North America has held largest revenue share in 2025. This is due to the region's aging population and a higher occurrence of eye-related disorders. Technological advancements, such as digital ophthalmoscopes with telemedicine capabilities, are gaining traction in the North American Ophthalmoscopes market. Prominent healthcare institutions, ophthalmology clinics, and hospitals in the region trust on ophthalmoscopes for precise and accurate eye examinations and disease diagnosis. In addition, robust support from government healthcare policies and research activities in the field of eye care further fuel the market's growth.

United States Ophthalmoscopes Market Trends

The U.S. regionally holds the top position mainly due to the large-scale adoption of AI-based diagnostics and the high level of patient awareness. The healthcare stakeholders in the U.S. are very much focused on both efficiency and innovation, thus allowing for the fast integration of the smart and connected ophthalmoscopic solutions for better eye examination accuracy.

Canada Ophthalmoscopes Market Trends

Canada's market, which includes tools like ophthalmoscopes, is growing steadily as demand for comprehensive eye care rises with the country's aging population and increasing prevalence of vision disorders. The broader ophthalmic equipment and diagnostic segment is expanding, supported by investments in advanced technologies such as high-resolution imaging and portable diagnostic tools that enhance early disease detection.

Asia-Pacific estimated to observe the fastest expansion.The region, which includes countries such as India, Japan, China, and others, anticipated a mounting demand for ophthalmic equipment due to its large and aging population, along with a surging incidence of eye-related disorders. Government initiatives, increased healthcare spending, and a growing awareness of eye health are also driving market expansion. The Asia-Pacific region offers substantial opportunities for ophthalmoscope manufacturers and providers of eye care services.

India Ophthalmoscopes Market Trends

India's market is growing steadily as the rising prevalence of eye disorders, including those linked to aging, diabetes, and increased screen time, drives demand for regular eye examinations and early diagnosis. Expansion of healthcare facilities, including more hospitals, specialty eye clinics, and diagnostic centers in both urban and rural areas, is enhancing access to ophthalmic diagnostic tools like ophthalmoscopes.

China Ophthalmoscopes Market Trends:

China's technological advances in the market and the growth of its health care infrastructure are the two major factors that are driving the expansion of its market. There is a rising trend towards preventive eye care in the country, and local innovation is helping make diagnostic tools more affordable, thereby reinforcing the country's position as a key player in the region.

The European ophthalmoscopes market is a prominent segment of the medical device industry in the European continent. It comprises countries like Germany, the United Kingdom, France, and others. The market is driven by the region's aging population and the increasing prevalence of eye diseases and disorders. Technological advancements, particularly in digital ophthalmoscopes and telemedicine, are shaping the landscape of eye care, enabling more accessible and efficient diagnosis and treatment. Robust healthcare infrastructure, government support for eye care initiatives, and a strong emphasis on patient well-being contribute to the growth of the European Ophthalmoscopes Market. These factors position Europe as a key hub for eye care innovation and medical device development.

Germany Ophthalmoscopes Market Trends:

Germany's ophthalmic diagnostic market is showing significant growth, mostly due to its constant medical device innovation and hospitals' adoption of modern diagnostic tools. The country's high focus on quality care, along with continuous R&D investments, is very supportive of the growth of ophthalmic diagnostics.

Value Chain Analysis

- R&D: Emphasis is placed on innovation, compound optimization, and the development of new devices for the advancement of the pipeline.

Key Players: Carl Zeiss Meditec AG, Topcon Corporation, NIDEK Co., Ltd. - Clinical Trials and Regulatory Approvals: Validation, safety compliance, and product availability are ensured at a fast pace and in a cost-efficient manner.

Key Players: Ora, Inc., PPD (Thermo Fisher Scientific), ICON plc, and Syneos Health - Formulation and Final Dosage Preparation: The process of changing raw materials into quality, effective diagnostic tools is evaluated.

Key Players: Carl Zeiss Meditec AG, Johnson & Johnson, and Haag-Streit Group - Packaging and Serialization: The study of safe and secure packaging, product traceability, and counterfeit prevention is conducted.

Key Players: Amcor plc, Gerresheimer AG, and Schott AG - Distribution to Hospitals, Pharmacies of Ophthalmoscopes: The analysis of logistics, inventory, and timely supply to end-users is performed.

Key Players: Alcon, Carl Zeiss

Ophthalmoscopes Market Companies

- Welch Allyn (Baxter): The company dominates the market with its PanOptic Plus series, which features a 20X larger viewing area and QuickEye alignment technology for easier optic disc captures.

- Keeler Ltd.: A major player in the indirect ophthalmoscope segment, Keeler offers the Vantage Plus LED Digital, which features built-in video capture for documentation and training.

- Zumax Medical Co. Ltd.: This company provides a diverse range of cost-effective diagnostic tools, including the BM800 indirect ophthalmoscope, catering to both specialized and general medical practices.

- Albert Waeschle (Opticlar): Through its Opticlar Vision brand, the company contributes high-performance handheld instruments that utilize miniaturized optics and precision engineering to set new diagnostic benchmarks.

- Neitz Instruments Co., Ltd.: Neitz significantly enhances the market with its

BXa LED ophthalmoscope, which includes a unique "boost mode" for increased brightness during screenings in well-lit environments. - US Ophthalmic: Acting as a major distributor and manufacturer in the North American market, this company provides a wide selection of both direct and indirect ophthalmoscopes to hospitals and clinics.

- Heine USA Ltd.: Heine is a leader in premium diagnostic tools, particularly with the

Omega 600 indirect ophthalmoscope, which utilizes visionBOOST technology to improve illumination through dense cataracts.

Other Major Key Players

- HONSUN Group

- Rudolf Riester GmbH

- Dino-Lite Europe

- Iridex Corporation

Recent Developments

- July 2023: International charity for visually impaired, Christian Blind Mission (CBM) announced that it has donated eye treatment equipment worth $100 million to the Jigawa State government. It includes 5 A-scans, 10 Retinoscopes, 10 Ophthalmoscopes, 15 visual acuity charts (electronic), 5 slit lamps with an applanation tonometer, 5 auto keratometers, 5 surgical microscopes, an IOL master, and 5 I-care Tonometers.

- January 2023: Department of Ophthalmology at Stanford University Researchers developed a low-latency monocular pupil tracker by means of hybrid FPGA-CPU computing.

- August 2022: Orbis International Ghana donated eye care equipment to 5 health facilities in the Ashanti Region worth $73,000. This include ophthalmoscopes, operating microscopes,cataract sets, chalazion sets, pediatric trial frames, adult trial frames, focimeters, minor surgery and visual acuity charts.

- In January 2025, Norlase announced the launch of Norlase LYNX™, the first pattern scanning laser indirect ophthalmoscope, featuring a battery-powered, ergonomic design, wireless interface, and multilingual voice control for enhanced surgical efficiency and flexibility.

https://www.prnewswire.com - In January 2025, Nidek Inc. launched the Mirante Scanning Laser Ophthalmoscope in the U.S. market, enhancing its portfolio of ophthalmic diagnostic equipment and lasers for treating various vision-impairing diseases.

https://glance.eyesoneyecare.com

Segments Covered in the Report

By Type

- Direct

- Indirect

By Application

- Diabetic Retinopathy

- Macular Degeneration

- Retinal Repair

- Glaucoma

- Others

By End-Use Industry

- Hospitals

- Ophthalmic Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting