Oral Contraceptive Pills Market Size and Forecast 2025 to 2034

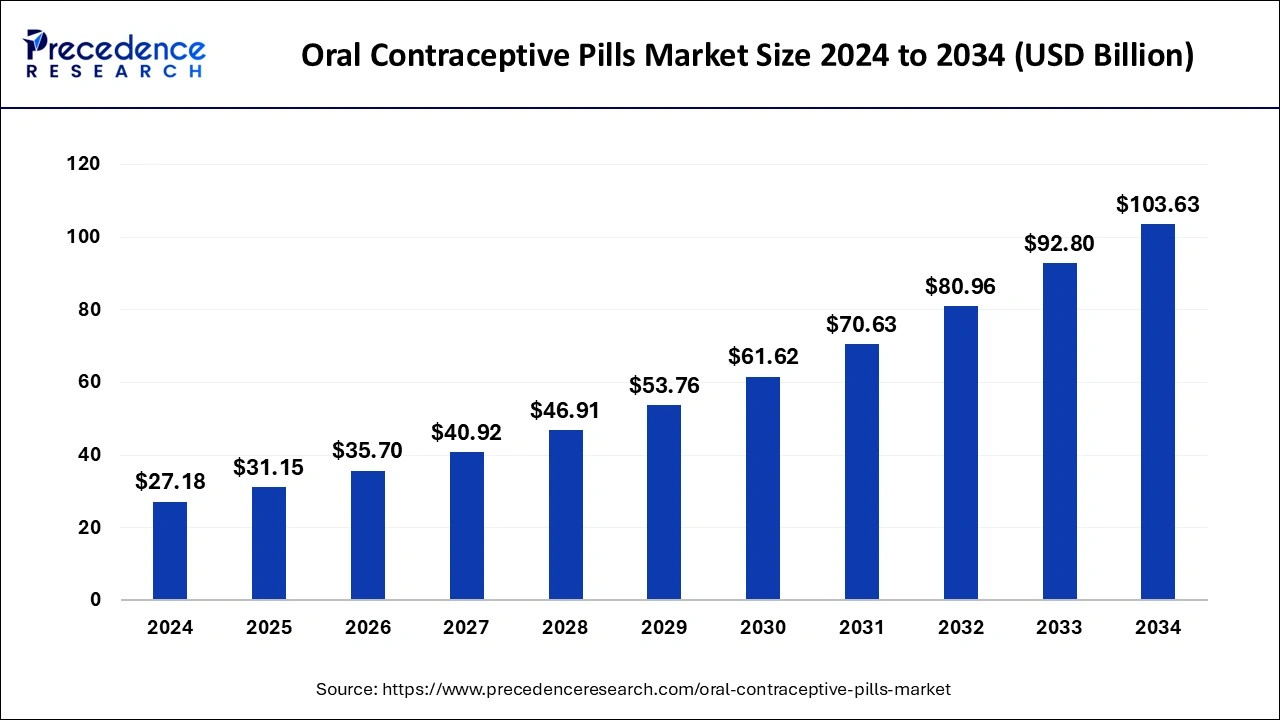

The global oral contraceptive pills market size accounted for USD 27.18 billion in 2024 and is predicted to increase from USD 31.15 billion in 2025 to approximately USD 103.63 billion by 2034, expanding at a CAGR of 14.32% from 2025 to 2034. The oral contraceptive pills market is driven by the increasing number of unintended pregnancies.

Oral Contraceptive Pills Market Key Takeaways

- The global oral contraceptive pills market was valued at USD 27.18 billion in 2024.

- It is projected to reach USD 103.63 billion by 2034.

- The oral contraceptive pills market is expected to grow at a CAGR of 14.32% from 2025 to 2034.

- North America dominated the oral contraceptive pills market in 2024.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By type, the progestin only segment held a significant share of the market in 2024.

- By category, the branded segment dominated the oral contraceptive pills market.

- By distribution channel, the retail pharmacy segment dominated the market in 2024.

Market Overview

Oral contraceptive pills (OCPs) are prescription medications used orally to prevent pregnancy. They usually contain progestin and estrogen, two synthetic hormones. These medications function by inhibiting ovulation, thickening cervical mucus to impede sperm motility, and weakening the uterus lining to stop a fertilized egg from implanting.

With the dependable and reversible birth control approach that OCPs offer, women have more autonomy over their family planning choices and reproductive health. Oral contraceptives are essential for population management in areas with rapid population expansion because they help moderate demographic trends and reduce demand on infrastructure and resources.

Oral Contraceptive Pills Market Trends

- According to the World Health Organization data 2024, in developing nations, an estimated 21 million females between the ages group 15 and 19 become pregnant each year, and about 12 million of them give birth.

- In November 2023, for residents of Ontario, the New Democratic Party (NDP) suggested starting a free contraceptive program.

- In November 2022, The US health authorities gave medicine manufacturer Lupin permission to sell Drospirenone tablets, which are intended to avoid pregnancy, in the US market. The US Food and Drug Administration (FDA) has tentatively approved the company's abbreviated new drug application (ANDA) for 4 mg strength Drospirenone Tablets.

Oral Contraceptive Pills Market Growth Factors

- The industry is being driven by growing concerns about unintended pregnancies and a focus on family planning.

- The business expansion is facilitated by government initiatives that support women's health and access to contraception.

- There is an increasing demand for control over reproduction due to rising female labor force participation and educational achievement.

- Improvements in pill formulations that have fewer adverse effects, and more health advantages may draw new users in.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.32% |

| Market Size in 2025 | USD 31.15 Billion |

| Market Size in 2024 | USD 27.18 Billion |

| Market Size by 2034 | USD 103.63 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Category, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The growing rate of unintended pregnancies

Unwanted pregnancies have a negative impact on women's and children's health and welfare, especially when the mothers are young and susceptible. Understanding unwanted pregnancy contributes to our understanding of population fertility and the unfulfilled demand for family planning and contraception. Most unwanted births are caused by either not using contraception at all or not utilizing it correctly or consistently.

- A startling 45,557 adolescent pregnancies were recorded in Karnataka between January 2020 and June 2023.

Restraints

Risk of complications associated with oral contraceptives

Although oral contraceptive pills are generally safe for most women, some people may experience adverse side effects. Mood swings, headaches, breast discomfort, and nausea are typical side effects. The degree of these adverse effects varies, and some women may decide to stop taking OCPs entirely or to minimize their use. Regulation bodies carefully monitor their effectiveness and safety because of the severe health risks connected to OCPs. Any hint of elevated risk or unfavorable occurrences may trigger regulatory examination involving label modifications, limitations, or removal from distribution. Furthermore, the regulatory environment is further expanded by the possibility of lawsuits linked to unfavorable health consequences, which may also affect market dynamics.

Lack of awareness or education about contraception

Many places may have little or no access to comprehensive sexual education and knowledge regarding contraception, especially in developing nations or communities with traditional cultural values. People are unable to understand the range of contraceptive methods that are accessible to them, including oral contraceptives, due to this lack of access, especially to young adults. Healthcare professionals might not be adequately trained or knowledgeable about contraceptive techniques, including OCPs, even in areas where contraception is widely accessible. This may lead to insufficient guidance and counseling for those looking for contraception, which could result in OCPs being used less effectively or stopped altogether because of worries or misunderstandings.

Opportunities

Increased awareness about hormonal health

The prevalence of digital health influencers and social media platforms has made conversations regarding hormonal health more commonplace. Millions of followers are drawn to the personal stories, advice, and knowledge that celebrities, health experts, and influencers provide on hormonal balancing. The rising prominence of this topic normalizes discussions about hormonal health and motivates people to look for trustworthy information and take charge of their hormonal well-being. When it comes to educating people about hormonal health and contraceptive alternatives, healthcare providers are essential. Such rising awareness about hormonal health is observed to offer lucrative opportunities for the oral contraceptive pills market.

Healthcare professionals are more likely to bring up hormonal health during routine visits and provide tailored contraceptive advice because of patient demand and increasing awareness. Patients and healthcare professionals create a supportive environment supporting proactive hormonal management and educated decision-making.

Rise of telemedicine and e-commerce platforms provides easier access to contraceptive pills

Internet sites are essential for educating people about contraceptive alternatives and sharing information. Individuals can educate themselves on the various forms of oral contraceptives that are available, their benefits and adverse effects, and how to use them properly through educational articles, interactive tools, and community forums. People are now better equipped to make decisions about their reproductive health. Telemedicine platforms allow users to receive continuous support and allow for remote monitoring of contraceptive use.

Healthcare practitioners can monitor and manage side effects and patient adherence using digital health tracking technologies and virtual follow-up appointments. The usage of oral contraceptives is safer and more effective overall because of this proactive strategy.

Type Insights

The progestin only segment held a significant share of the oral contraceptive pills market in 2024. Globally, women's knowledge and acceptability of hormonal contraceptives have significantly increased in the past few years. Educational campaigns, more accessible access to healthcare, and shifting public perceptions of family planning are some of the reasons for this increase. In general, progestin-only pills have fewer adverse effects than oral contraceptives that are combined.

This includes a lowered chance of generating headaches or nausea, a lessened impact on blood pressure, and a decreased risk of blood clots. Progestin-only pills are a desirable alternative for women looking for minimally invasive forms of contraception due to their increased tolerability.

- In July 2023, Opill (norgestrel) tablets are now approved for nonprescription use as a pregnancy preventive by the US Food and Drug Administration. This is the first over-the-counter daily oral contraceptive that has been authorized for use in the United States. With the approval of this progestin-only oral contraceptive pill, consumers now have the option to buy oral contraceptives online, at pharmacies, convenience stores, and grocery stores without a prescription.

The combination segment shows a notable growth in the oral contraceptive pills market during the forecast period. When used as prescribed, combination oral contraceptives, which contain both progestin and estrogen, are highly effective at preventing pregnancy. The rise can be primarily attributed to its effectiveness, instilling confidence in healthcare providers and patients. Pharmaceutical companies are always coming up with novel ways to combine oral contraceptives, like low-dose or extended-cycle formulations that are more tolerable and have fewer adverse effects. These developments meet women's changing requirements and interests.

Category Insights

The branded segment held the dominating share of the oral contraceptive pills market in 2024. Pharmaceutical companies are constantly developing new ways to differentiate branded drugs from their generic counterparts. They make research and development investments to provide cutting-edge formulations, delivery systems, and other features catering to customers' wants and preferences. These developments give branded contraceptives a competitive edge and draw in customers looking for the newest developments in the field of contraception.

When choosing oral contraceptives, some people place a higher value on brand reputation, perceived quality, and familiarity. They choose well-known brands that provide better advantages and peace of mind. Brand loyalty and favorable experiences with branded products further reinforce consumer preference for these contraceptives, supporting demand and growth.

The generic segment is observed to show a notable growth in the oral contraceptive pills market during the forecast period. When comparing generic oral contraceptives to name-brand alternatives, the former are usually less expensive. Because of their cost, a wider range of women who might otherwise be unable to buy branded drugs or who do not have sufficient insurance coverage can use them. Therefore, people concerned about costs are more likely to choose generic substitutes, which is fueling the growth.

Distribution Channel Insights

The retail pharmacy segment dominated the oral contraceptive pills market in 2024. Pharmacists are essential for in-patient education and consulting regarding oral contraceptive tablets. In confidential consultation areas found in many retail pharmacies, patients can speak with qualified pharmacists about their requirements, concerns, and medical history regarding contraception. In addition to increasing patient pleasure, this individualized approach builds the pharmacy's reputation for trust and loyalty. To help patients make educated decisions regarding their contraceptive options, pharmacists can offer important information on dose, side effects, drug interactions, and other pertinent topics.

The online segment is the fastest growing oral contraceptive pills market during the forecast period. Confidentiality and discretion are possible when buying oral contraceptives online, which may not be available at conventional brick-and-mortar pharmacies. Many people prefer the privacy that comes with internet purchasing, particularly regarding delicate medical items like contraception. People in younger demographics and others who might feel awkward disclosing their need for contraception in person will find this privacy feature especially appealing.

Regional Insights

North America had the largest market share in 2024 in the oral contraceptive pills market and the region is observed to sustain the position throughout the predicted timeframe. Oral contraceptive pill adoption among women of reproductive age is relatively high in the US and Canada. This broad acceptability stems from several variables, including comprehensive sex education programs, cultural acceptance of contraception, and ease of access to healthcare facilities. Oral contraceptive tablets are now more economical and available to more significant portions of the population in North America because many health insurance programs cover them. Furthermore, low-income people frequently receive free or heavily discounted contraceptives through government-sponsored healthcare programs and initiatives, which increases the usage of these drugs.

United States

- In April 2023, Julie, a progestin-only emergency contraceptive, was introduced at 4,500 Walmart locations across the country as a one-step tablet that contained Levonorgestrel, the essential component of the well-known Plan B emergency contraceptive that the FDA approved in the late 1990s without a prescription.

Canada

- In March 2024, Canada announced to pay for women's contraception up front. The administration emphasized the initial segment of a noteworthy healthcare reform. For the nine million Canadian women of reproductive age, the government will cover the cost of the most popular contraceptive methods (IUDs, tablets, hormonal implants, or the day-after pill).

Asia-Pacific is observed to be the fastest growing oral contraceptive pills market during the forecast period. In the last few years, there has been a notable surge in the region's knowledge of family planning and contraception. Oral contraceptive pill use has been extensively promoted by governments, non-governmental organizations, and healthcare organizations as a secure and reliable way of birth control. Women in the area are now more accepting of and likely to use oral contraceptives because of this raised awareness. Convenient, dependable, and reversible contraceptive techniques are in growing demand as more women pursue higher education and employment. Women can manage their fertility and other facets of their lives with the freedom that oral contraceptive tablets provide.

India

- The government-initiated Mission Parivar Vikas to significantly improve access to family planning services and contraceptives in 146 high-fertility districts with a Total Fertility Rate (TFR) of three or above. Seven high-focus states comprise the 146 districts that have been identified.

- In August 2022, the Odisha government was prepared to provide newlyweds in the state with contraceptive tablets and condoms. The decision was based on the Mission Parivar Vikas program of the central government. ASHA workers will distribute the 'Nayi Pahal' or 'Nabadampati kit,' a wedding kit, along with pamphlets about the significance of family planning, safe sex, and spacing out births.

Japan

- In November 2023, Japan began selling emergency contraceptive pills without a prescription in a trial program, bringing the country closer to the over 90 nations that already permit the over-the-counter sale of these medications at pharmacies.

Recent Developments

- In March 2024, the over-the-counter birth control drug Perrigo Opill has been dispatched to major retailers and pharmacies in the United States and will be available in shops and online later. Opill is scheduled to hit store shelves that focus on consumer self-care items.

- In December 2023, a ground-breaking step toward shared responsibility in contraception, UK researchers launched the first stage of testing for a novel non-hormonal birth control tablet for men.

- In April 2023, in an open letter signed on Monday, executives from over 300 biotech and pharmaceutical companies, including Pfizer and Biogen, called for the reversal of a federal judge's order to halt the sale of the abortion drug mifepristone.

Oral Contraceptive Pills Market Companies

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis AG

- AbbVie Inc.

- Bayer AG

- Sanofi S.A.

- GlaxoSmithKline PLC

- Zydus Lifesciences Ltd

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd.

- Church & Dwight Co Inc.

- Aurobindo Pharma Limited

- Cipla Inc.

- Dr. Reddy's Laboratories Ltd

- Ferring B.V

- Amneal Pharmaceuticals LLC

- Lupin Pharmaceuticals Inc.

- Vardhaman Lifecare Pvt. Ltd

- Glenmark Pharmaceuticals

- Piramal Enterprises Ltd.

- Mankind Pharma Ltd.

- Sopharma AD

- Mayne Pharma

- HLL Lifecare Limited

- Famy Care Ltd

- Syzygy Healthcare

- V Care Pharma

- Actavis PLC

- Mylan N.V.

Segments Covered in the Report

By Type

- Combination

- Monophasic

- Triphasic

- Others

- Progestin Only

- Others

By Category

- Generic

- Branded

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Clinics

- Online

- Public Channel And NGO

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting