What is the Oral Clinical Nutrition Market Size?

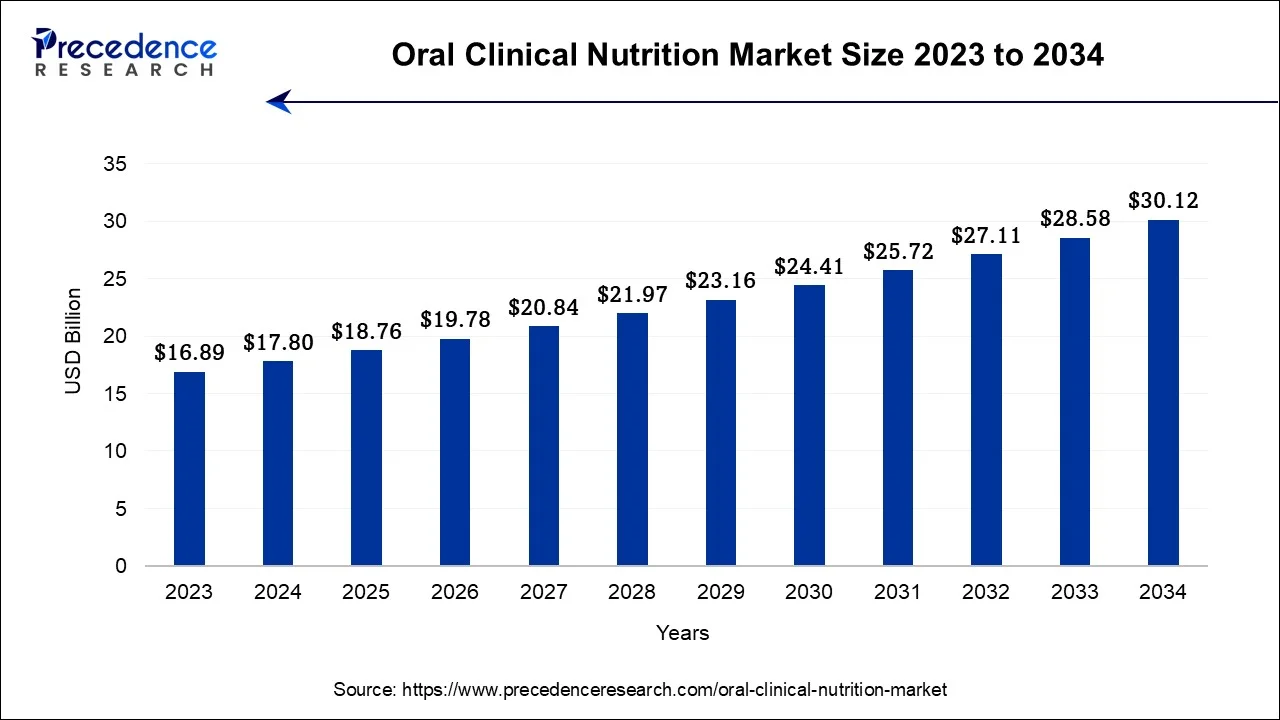

The global oral clinical nutrition market size is calculated at USD 18.76 billion in 2025 and is predicted to increase from USD 19.78 billion in 2026 to approximately USD 31.61 billion by 2035, expanding at a CAGR of 5.36% from 2026 to 2035.

Key Takeaways

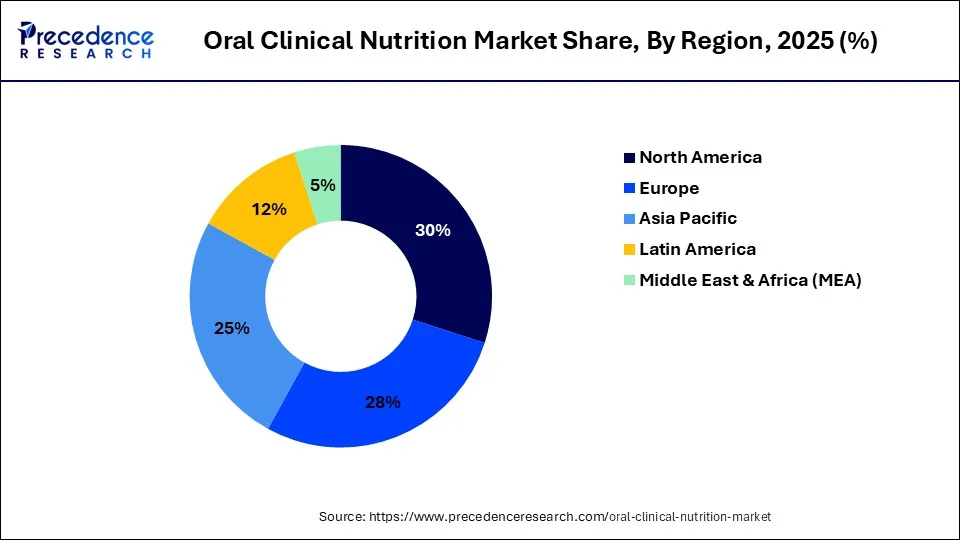

- North America led the global market with the highest market share of 30% in 2025.

- Asia-Pacific is predicted to expand at the fastest CAGR during the forecast period.

- By Stage, the adult segment captured more than 86% of revenue share in 2025.

- By Stage, the pediatrics segment?is estimated to grow at a notable CAGR of 6.7% during the projected period.

- By Indication, the cancer care segment had the biggest market share of 17% in 2025.

- By Sales Channel, the institutional sales segment contributed around 42.5% of revenue share in 2025.

- By Sales Channel, the online sales segment is anticipated to expand at a noteworthy CAGR of 8.9% over the predicted period.

Market Overview

The oral clinical nutrition sector pertains to the healthcare industry's domain specializing in delivering crucial nutrients, vitamins, and minerals to individuals unable to ingest food orally due to medical conditions or surgical procedures. It encompasses a broad spectrum of offerings, including oral nutritional supplements, enteral feeding solutions, and specialized dietary items.

Recent years have seen substantial expansion in this sector, primarily fueled by the growing prevalence of chronic ailments, an aging demographic, and an increased emphasis on personalized nutritional strategies. Prominent stakeholders in this field encompass pharmaceutical firms, nutrition experts, and healthcare institutions, all collaboratively striving to enhance patient well-being through customized nutritional interventions.

What is the Role of AI in the Oral Clinical Nutrition Market?

AI has played a vital role in shaping the oral clinical nutrition market. The integration of AI in oral clinical nutrition helps in personalizing patient care by analyzing large sets of data and supports clinicians by providing real-time insights about patient health. Additionally, AI-based platforms are used for creating diet plans for patients suffering from chronic diseases such as Cancer, CVDs, Arthritis and some others.

- In October 2025, Order AI launched an AI-enabled smart diet tracking app. This tracking app is designed for consumers in the U.S. region.(Source: https://www.nutritioninsight.com )

Oral Clinical Nutrition Market Growth Factors

The oral clinical nutrition market holds a pivotal role in tending to the dietary requirements of individuals incapable of oral food intake due to various medical conditions or surgical interventions. This domain encompasses a diverse array of products, encompassing oral nutritional supplements, enteral feeding solutions, and specialized dietary provisions. Recent years have witnessed substantial market growth, largely influenced by several notable industry trends and catalysts for expansion.

A significant trend is the escalating prevalence of chronic ailments, which has propelled the demand for oral clinical nutrition offerings. With the global populace aging, there is an escalating necessity for tailored nutritional solutions to manage conditions like diabetes, cancer, and gastrointestinal disorders. Furthermore, heightened awareness regarding the pivotal role of nutrition in healthcare has encouraged healthcare professionals to increasingly advocate for oral clinical nutrition as an integral facet of patient care.

Additionally, the trend toward personalized nutrition has catalyzed innovation in this sphere. Companies are pioneering customized nutritional products and formulations tailored to meet the distinctive dietary prerequisites of individual patients. This trend harmonizes with the broader shift toward personalized medicine and healthcare, presenting avenues for market expansion.

The oral clinical nutrition sector contends with specific challenges. One notable challenge pertains to regulatory scrutiny and adherence. The industry must navigate intricate regulations and exacting quality standards to ensure the safety and effectiveness of their offerings, a task compounded when dealing with specialized dietary items and enteral feeding solutions.

Another challenge emerges from the competitive landscape within the market. The sector has experienced an influx of both established pharmaceutical conglomerates and startups, intensifying competition. Differentiation through innovative product development, quality assurance, and strategic marketing becomes imperative for maintaining a competitive edge.

Despite the challenges, the oral clinical nutrition market presents lucrative business opportunities. One promising avenue is global expansion. As healthcare awareness increases across the globe, there exists potential for market penetration in emerging economies characterized by evolving healthcare infrastructures.

Furthermore, substantial investment in research and development stands as a catalyst for breakthroughs in nutritional science and product innovation, thereby opening new avenues for business ventures. Companies that commit to pioneering research and collaborate closely with healthcare providers to address unmet patient needs are poised for enduring success.

In summation, the oral clinical nutrition market stands as a dynamic and evolving sector marked by substantial growth potential. Industry trends such as the surge in chronic diseases and the advent of personalized nutrition, coupled with opportunities for global outreach and research-driven innovation, are shaping the trajectory of this indispensable healthcare field. Nevertheless, adeptly navigating regulatory hurdles and fierce market competition remains imperative for sustained prosperity.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.36% |

| Market Size in 2025 | USD 18.76Billion |

| Market Size in 2026 | USD 19.78 Billion |

| Market Size by 2035 | USD 31.61 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Stage, By Indication, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increase in prevalence of chronic diseases

The increasing prevalence of chronic diseases is a potent driver of market growth in the oral clinical nutrition sector. As chronic conditions like diabetes, cardiovascular diseases, cancer, and gastrointestinal disorders become more widespread globally, the demand for specialized nutritional support is escalating. These ailments often require tailored dietary interventions to manage symptoms, improve quality of life, and support recovery. Patients diagnosed with chronic diseases are increasingly turning to oral clinical nutrition products as an integral part of their treatment regimens.

Healthcare providers recognize the importance of nutrition in managing and preventing these conditions, thus driving the prescription and recommendation of these specialized products. Moreover, as the aging population grows, the incidence of age-related chronic diseases also rises, further bolstering the market. In response to this demand, manufacturers are continually innovating to develop nutritionally advanced and condition-specific products. This convergence of increasing chronic disease prevalence, healthcare provider endorsement, and product innovation creates a robust growth trajectory for the oral clinical nutrition market, positioning it as a pivotal player in modern healthcare solutions.

Restraints

Complex patient needs

The complexity of addressing diverse patient needs poses a significant restraint on the growth of the oral clinical nutrition market. Patients with various medical conditions require tailored nutritional solutions, which can be challenging for manufacturers to develop and market effectively. Each medical condition may necessitate specific formulations with precise nutrient ratios, which increases research and development costs. Ensuring palatability and ease of consumption for patients with different taste preferences and dietary restrictions further complicates product development. This complexity can result in a slower rate of product innovation and longer time-to-market.

Moreover, healthcare professionals must carefully assess and prescribe the right oral clinical nutrition products for individual patients, considering their unique medical history and nutritional needs. This process can be time-consuming and may lead to variations in product selection, hindering standardization and widespread adoption. As a result, the intricate task of catering to complex patient needs can act as a barrier to market growth, particularly in terms of scalability and reaching a broader patient population.

Opportunities

Innovation in product development

Innovation in product development is a transformative force within the oral clinical nutrition market, ushering in numerous opportunities for growth and advancement. Continuous research and development efforts are driving the creation of novel and highly specialized nutritional products, addressing the unique needs of patients with various medical conditions. These innovations not only improve the effectiveness of oral clinical nutrition but also enhance the overall patient experience by focusing on factors like taste, texture, and ease of consumption. Furthermore, emerging technologies and scientific insights enable the formulation of cutting-edge nutritional solutions that cater to specific health conditions, such as personalized nutrition approaches.

Companies that invest in these advancements are poised to meet the evolving demands of healthcare providers and patients, positioning themselves as leaders in a market that increasingly values evidence-based, high-quality products. This opens up opportunities for market expansion, increased adoption, and the potential to revolutionize the way oral clinical nutrition contributes to patient well-being and healthcare outcomes.

Impact of COVID-19

The COVID-19 pandemic had both positive and negative impacts on the oral clinical nutrition industry.

On the positive side, there was a heightened awareness of the importance of nutrition in bolstering immunity and overall health, driving demand for nutritional supplements. However, supply chain disruptions and healthcare system strain affected product availability and distribution. Elective surgeries, often a key driver for clinical nutrition demand, were delayed, dampening market growth.

Despite challenges, the pandemic underscored the significance of oral clinical nutrition, potentially leading to sustained interest in preventive healthcare and nutritional interventions in the post-pandemic era.

Segment Insights

Stage Insights

According to the stage, the adult segment has held 86% revenue share in 2025. The dominance of the adult segment in the oral clinical nutrition market can be attributed to several key factors. Firstly, the worldwide demographic landscape is witnessing a notable expansion of the elderly population, leading to a surge in chronic ailments and age-related health issues that necessitate specialized nutritional intervention.

Moreover, adults typically exhibit a broader range of intricate medical requirements, making them a primary demographic for tailored oral clinical nutrition solutions. Additionally, a growing awareness surrounding the pivotal role of nutrition in sustaining adult well-being has amplified the demand for these products, solidifying the adult segment's prominent position within the market landscape.

The pediatrics segment is anticipated to expand at a significantly CAGR of 6.7% during the projected period. The pediatrics segment holds a significant growth in the oral clinical nutrition market primarily due to the vulnerability of children to nutritional deficiencies and medical conditions that require specialized dietary support. Pediatric patients, including premature infants and those with congenital disorders or developmental issues, often rely on oral clinical nutrition products for healthy growth and development.

Additionally, parents and healthcare providers are increasingly recognizing the importance of early nutritional intervention to address child health concerns. This heightened awareness, coupled with a growing emphasis on child nutrition, has contributed to the prominent market growth of the pediatrics segment.

Indication Insights

In 2025, the cancer care sector had the highest market share of 16.8% on the basis of the indication. The cancer care segment commands a significant share in the oral clinical nutrition market due to the unique nutritional needs of cancer patients. Cancer and its treatments often lead to appetite loss, weight loss, and malnutrition, making specialized nutrition crucial. Oral clinical nutrition products are tailored to provide essential nutrients, support immune function, and manage side effects like nausea. As cancer diagnoses rise globally, the demand for these products has surged. Additionally, ongoing research in oncology and nutrition has led to advanced, condition-specific formulations, further cementing the cancer care segment's dominance in the market.

The malabsorption/gi disorder/diarrhea is anticipated to expand at the fastest rate over the projected period. The Malabsorption/GI Disorder/Diarrhea segment holds a substantial growth in the oral clinical nutrition market due to several factors. Patients suffering from gastrointestinal disorders, malabsorption issues, or chronic diarrhea often face challenges in absorbing essential nutrients from regular diets. Therefore, they rely heavily on specialized oral clinical nutrition products to meet their nutritional needs. Additionally, the prevalence of such conditions is relatively high, driving sustained demand. As a result, healthcare providers frequently prescribe oral clinical nutrition solutions, making this segment a significant contributor to the market's overall share and growth.

Sales Channel Insights

The institutional sales segment held the largest revenue share of 42.5% in 2023. The institutional sales segment commands a significant share in the oral clinical nutrition market primarily due to its extensive reach within healthcare settings like hospitals, nursing homes, and long-term care facilities. Healthcare professionals play a pivotal role in recommending and prescribing oral clinical nutrition products to patients with specific medical needs.

Additionally, these institutions often purchase these products in bulk, contributing to substantial revenue generation. Moreover, the institutional segment benefits from the trust factor associated with healthcare institutions, which enhances the adoption and utilization of oral clinical nutrition products among patients under medical care.

The online sales sector is anticipated to grow at a significantly faster rate, registering a CAGR of 8.9% over the predicted period. Online sales hold a significant growth in the oral clinical nutrition market due to several key factors. Firstly, the convenience of online shopping appeals to consumers, especially those with limited mobility or specific dietary needs. Secondly, the extensive product variety and availability online allow customers to access a wide range of oral clinical nutrition options.

Additionally, online platforms offer valuable information, reviews, and customer feedback, aiding informed purchasing decisions. Lastly, the COVID-19 pandemic accelerated the shift towards online shopping for healthcare products, further boosting the prominence growth of this sales channel in the oral clinical nutrition market.

Regional Insights

What is the U.S. Oral Clinical Nutrition Market Size?

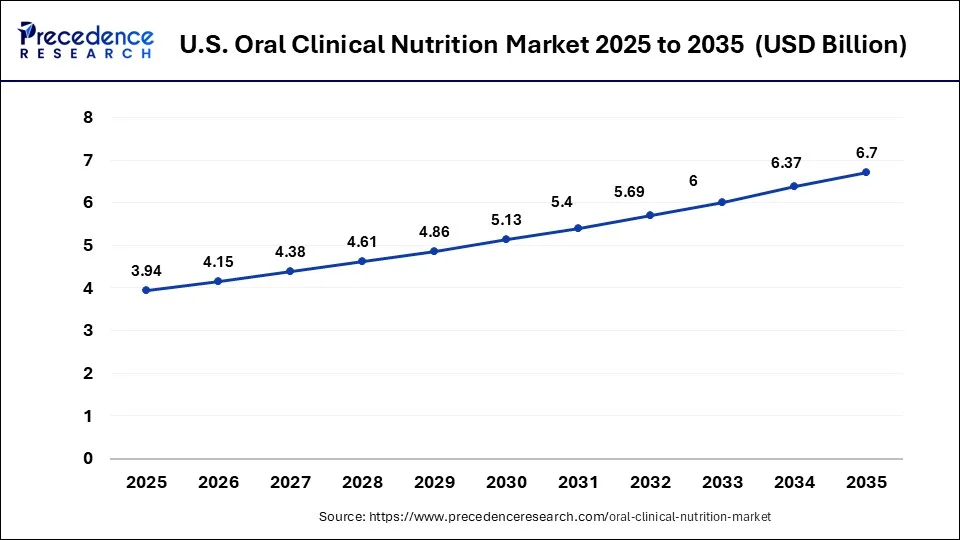

The U.S. oral clinical nutrition market size accounted for USD 3.94 billion in 2025 and is estimated to reach around USD 6.70 billion by 2035, growing at a CAGR of 5.45% from 2026 to 2035.

North America has held the largest revenue share of 30% in 2023. North America's dominant share in the oral clinical nutrition market can be attributed to several key factors. Firstly, the region boasts a substantial aging population with a higher prevalence of chronic diseases, driving demand for specialized nutritional products. Secondly, a well-established healthcare infrastructure and a robust pharmaceutical industry contribute to widespread access to oral clinical nutrition products. Additionally, a strong focus on wellness, coupled with increasing healthcare expenditure, encourages product adoption. Lastly, a culture of preventive healthcare and awareness of the importance of nutrition further solidify North America's position as a major player in the oral clinical nutrition market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands significant growth in the oral clinical nutrition market due to a convergence of factors. A burgeoning aging population with increasing healthcare needs, rising awareness about the importance of nutrition, and a surge in chronic diseases have driven demand. Additionally, improving healthcare infrastructure, expanding middle-class populations, and growing disposable incomes have fueled market growth. Furthermore, multinational companies are focusing on market expansion in Asia-Pacific, introducing a diverse range of oral clinical nutrition products tailored to regional preferences and dietary requirements. These factors collectively contribute to the region's substantial growth in the oral clinical nutrition market.

What Drives the European Oral Clinical Nutrition Market?

The market in Europe is expected to expand at a significant rate over the projection period. This is mainly due to the surging cases of lung cancer, which is boosting the demand for oral formulations. Germany, the UK, France, Italy, and Sweden are major contributors to the European market. Numerous government initiatives aimed at developing pediatric hospitals are expected to contribute to the market in this region.

How is the Opportunistic Rise of Latin America in the Oral Clinical Nutrition Market?

Latin America is expected to grow at a notable CAGR during the forecast period. The growing demand for oral nutrition products from patients suffering from dementia is boosting the market. Additionally, the increasing prevalence of diabetes and chronic kidney diseases is positively contributing to the market in this region.

What Potentiates the Middle East & Africa Oral Clinical Nutrition Market?

The Middle East & Africa (MEA) is expected to expand at a significant CAGR during the forecast period. The rising prevalence of dysphagia in numerous countries, including the UAE, South Africa, and Qatar, is increasing the demand for oral nutrition products. Moreover, the surging preference of consumers to purchase nutritional products from online platforms is expected to accelerate the growth of the market in this region.

Value Chain Analysis

- Raw Materials Sourcing: Raw materials used in the production of oral clinical nutrition comprise macronutrients, micronutrients, and others. Key Companies: Mosaic, Yara, and Nutrien.

- Regulatory Approvals: Regulatory approvals for oral clinical nutrition is an advanced framework that enables a company to launch any dietary substances in the market.

Key Companies: FDA, EDE, and MDR. - Distribution Channel: The distribution channels for oral clinical nutrition consist of hospitals, nursing homes, retail/online pharmacies, and e-commerce.

Key Companies: Netmeds, eBay, and Amazon.

Oral Clinical Nutrition Market Companies

- Abbott Laboratories

- Pfizer Inc.

- Bayer AG

- Nestle S.A.

- GlaxoSmithKline plc

- Baxter International Inc.

- Otsuka Holdings Co., Ltd.

- Mead Johnson & Company, LLC

- Danone Nutricia, Victus, Inc.

Recent Developments

- In April 2025, Arla Foods Ingredients launched the Lacprodan MicelPure. Lacprodan MicelPure is an oral clinical nutrition solution designed for global consumers.

(Source: https://www.arlafoodsingredients.com ) - In January 2025, Stratum Nutrition launched the Ovolux ingredient. Ovulux is a premium, upcycled, USDA-sourced eggshell membrane ingredient that improves hair, skin, and nails in human beings.

(Source: https://www.nutritionaloutlook.com ) - In January 2025, Novo Nordisk launched Wegovy Pill. Wegovy Pill is an oral formulation designed for treating obesity.

(Source: https://www.businesswire.com ) - In 2022: Hologram Sciences and Maeil Health Nutrition forged a strategic alliance to introduce tailor-made nutritional solutions to the Korean market.

- In 2022:Glanbia Nutritionals introduced TechVantage, an innovative nutrient technology platform designed to deliver optimized functional nutrients to its customers.

- In 2021, Abbott revitalized its PediaSure Harvest and Ensure Harvest product lines, infusing them with plant-based protein and organic ingredients. These products can serve as a comprehensive nutrition source or a supplementary option to fulfill daily dietary needs.

- In 2019, Nestle Health Science completed the acquisition of Persona, a company specializing in personalized vitamin solutions. This strategic move aimed to bolster Nestlé's presence in the personalized nutrition sector and expand its portfolio of offerings.

Segments Covered in the Report

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer's

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting