Orthodontic Supplies Market Size and Forecast 2025 to 2034

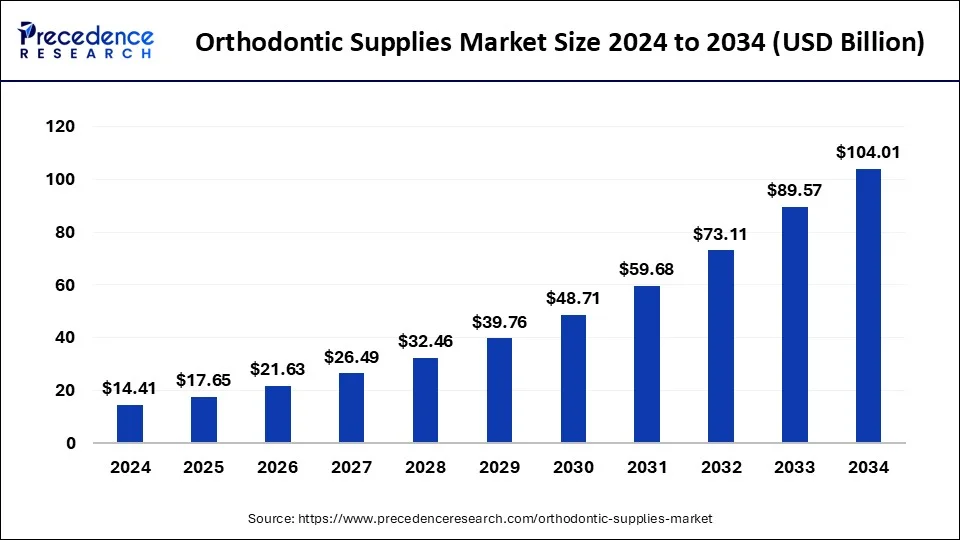

The global orthodontic supplies market size accounted for USD 14.41 billion in 2024 and is predicted to increase from USD 17.65 billion in 2025 to approximately USD 104.01 billion by 2034, expanding at a CAGR of 21.85% from 2025 to 2034. The orthodontic supplies market is driven by an expanding market for clear aligners

Orthodontic Supplies Market Key Takeaways

- In terms of revenue, the market is valued at $17.65 billion in 2025.

- It is projected to reach $ 104.01 billion by 2034.

- The market is expected to grow at a CAGR of 21.85% from 2025 to 2034.

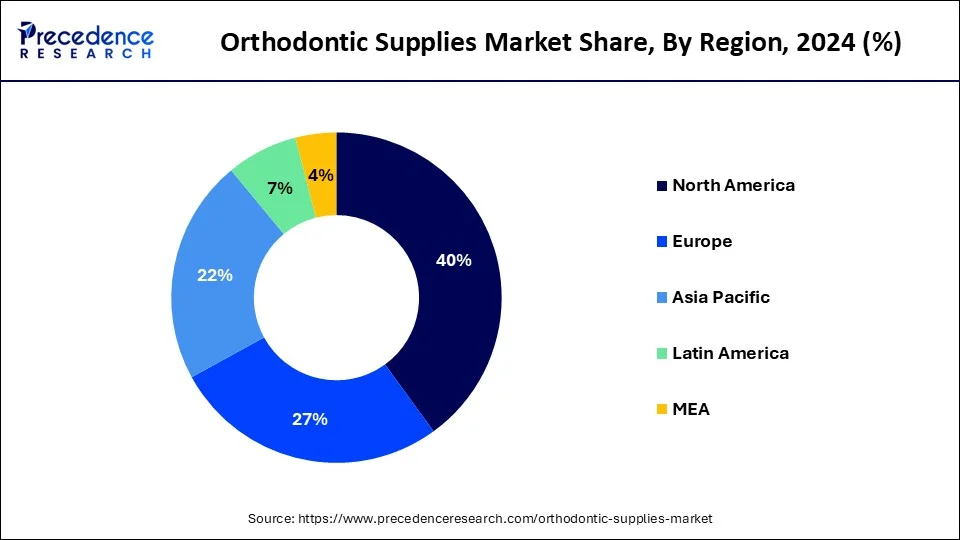

- North America dominated the global market with the largest market share of 40% in 2024.

- By product, the removable braces segment has contributed more than 71% of revenue share in 2024.

- By product, the fixed braces segment is observed to grow at a notable rate during the forecast period.

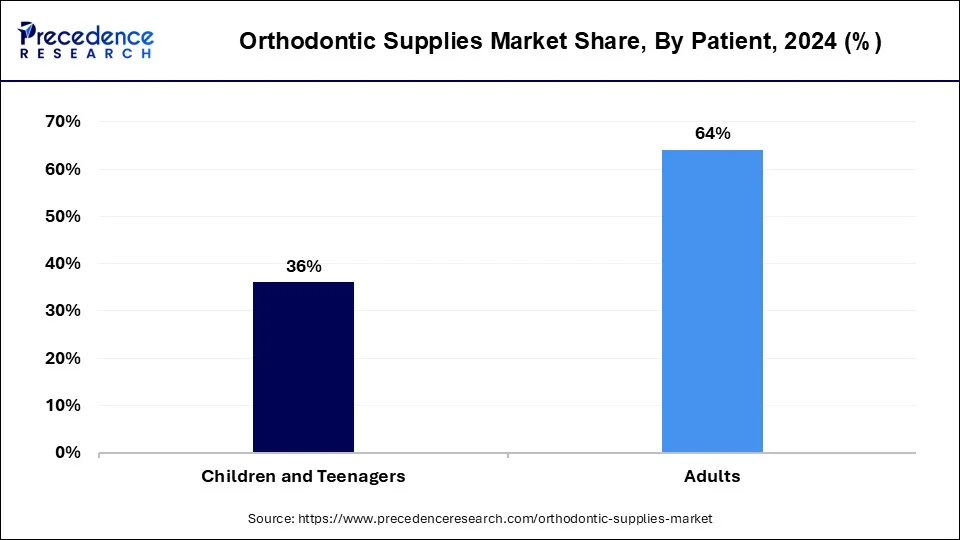

- By patient, the adults segment has held the biggest revenue share of 64% in 2024.

- By end-user, the hospital and dental clinics segment dominated the market share in 2024

U.S. Orthodontic Supplies Market Size and Growth 2025 to 2034

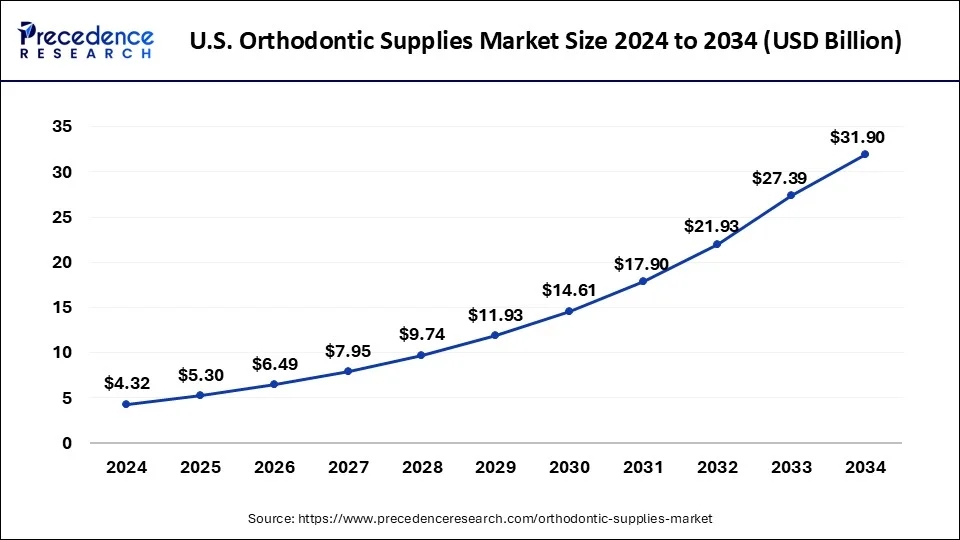

The U.S. orthodontic supplies market size was estimated at USD 4.32 billion in 2024 and is predicted to be worth around USD 31.90 billion by 2034, with a CAGR of 22.13% from 2025 to 2034.

North America held the largest share in 2024 in the orthodontic supplies market. The region is observed to sustain the position throughout the predicted timeframe. Its populace is comparatively well-off, with significant levels of discretionary income. Financially stable people can afford orthodontic procedures, which may be categorized as cosmetic or elective. Because of this, there is a constant need for orthodontic materials in this area. It makes significant investments in R&D, which results in the release of cutting-edge goods like 3D imaging technologies, digital orthodontic equipment, and clear aligners.

In North America, many people have access to dental insurance or healthcare plans that partially pay for orthodontic treatments. People are encouraged to get orthodontic procedures done thanks to this coverage, which raises the need for orthodontic materials such as braces, wires, retainers, and related accessories.

Europe holds a significant share in the orthodontic supplies market. It has led the way in technological advancements for the dental and medical fields. This covers developments in orthodontic tools, supplies, and methods. For example, renowned dental technology businesses in Germany, Switzerland, and the Netherlands are always developing state-of-the-art orthodontic materials. Because of this, more people are pursuing orthodontic procedures to straighten their teeth, make their smiles seem better, and improve their general oral health. The general European populace has become considerably more conscious about dental health and beauty.

Asia-Pacific is observed to be the fastest growing in the orthodontic supplies market during the forecast period. Throughout the region, there is a growing awareness of and desire for cosmetic dentistry procedures. More and more patients are pursuing orthodontic treatments for reasons other than only functional ones, including straightening their teeth or getting the ideal smile. Spending on healthcare is rising in sync with the region's economies' continued expansion. Governments and businesses in the private sector are funding initiatives to advance orthodontic treatments, encourage preventative dental care, and upgrade the healthcare system. Patients seeking affordable, top-notch dental care, including orthodontic operations, frequently travel from wealthy nations to these nations.

Market Overview

The area of the healthcare industry that handles the production, marketing, and distribution of goods used in orthodontic treatments is known as the orthodontic supplies market. The specialty area of dentistry known as orthodontics is devoted to identifying, stopping, and treating abnormalities in the alignment of teeth and jaws. By correctly aligning teeth and jaws, orthodontic treatments aim to improve the patient's oral health, functionality, and appearance.

The most popular orthodontic device for straightening teeth and fixing bite problems is a brace. They are made up of wires that exert pressure on the teeth to realign them and brackets that are cemented to the teeth. Clear aligners, like those made by firms like Invisalign, are a popular substitute for traditional braces because they give patients a more discrete and removable choice. For orthodontic diagnosis, treatment planning, and progress monitoring during treatment, X-ray machines, intraoral scanners, and 3D imaging technology are essential tools.

During orthodontic treatment, brackets are bonded to the teeth using adhesives. The successful and secure use of orthodontic appliances depends on additional materials such as cement, bonding agents, and imprint compounds.

Orthodontic Supplies Market Data and Statistics

- It is estimated that oral problems cost US$ 387 billion in direct costs each year, and that this global burden also results in US$ 323 billion in indirect costs.

- In January 2024, Align Technology successfully acquired Cubicure for €79 million. We will be able to grow our 3D printing operations through the acquisition of Cubicure, eventually creating millions of personalized appliances daily on-site.

- According to estimates from the WHO Global Oral Health Status Report (2022), oral illnesses afflict around 3.5 billion people globally, with middle-income countries dealing with three out of every four cases.

Orthodontic Supplies Market Growth Factors

- More people are seeking orthodontic treatment due to increased awareness of malocclusion (misaligned teeth) and jaw issues.

- The use of self-ligating braces and clear aligners, among other new technologies, is improving the comfort, effectiveness, and aesthetics of orthodontic treatment.

- A bigger middle class with greater disposable income can afford orthodontic procedures, especially in developing nations.

- The benefits of orthodontic treatment for general dental health and aesthetics are becoming more widely known because of public health initiatives and media attention.

Technological Advancements in Orthodontic Supplies Market

Modern technology has introduced strong innovations into orthodontic supplies production that generate superior functional results with better patient comfort and enhanced cosmetic design. The major advancement in orthodontic care involves digital imaging and 3D scanning technology that produces personalized and accurate treatment plans. Technological mapping tools enable dental professionals to develop accurate care programs that produce personalized treatment strategies.

Most importantly, the combination of 3D printing technology allows the production of aligners and orthodontic devices with faster production speeds and cheaper costs while promoting individual patient treatments. Patients increasingly prefer clear aligners made from modern materials instead of traditional metal braces because these products provide a more pleasant experience.

Strategic Initiatives for Orthodontic Supplies:

The National Oral Health Programme, presented by the Government of India, aims to enhance oral health requirements throughout the region. The program strives to boost oral health determinants, reduce disease morbidity, align health services with medical care, and PPPs for improved service delivery. The program aims to provide complete oral health care services while increasing public awareness and ensuring better access to preventive and treatment services, which help achieve improved public health results.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.85% |

| Market Size in 2024 | USD 14.41 Billion |

| Market Size in 2025 | USD 17.65 Billion |

| Market Size by 2034 | USD 104.01 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Patient, End-user, and regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in the number of people with malocclusions and jaw illnesses

The public is more conscious of dental health issues and the significance of malocclusion correction. The number of persons seeking orthodontic treatments has increased as a result. Malocclusions and related jaw problems are more common in modern society due to dietary practices, changes in jaw development brought on by things like mouth breathing and thumb-sucking.

The "orthodontic tourism" trend, which is driving the market growth in some areas, involves people traveling to other nations for orthodontic procedures that are less expensive.

Expanding oral health awareness

The need for orthodontic treatments is rising in tandem with people's growing awareness of the significance of dental health. This covers the appliances used in orthodontic operations, such as braces, aligners, retainers, and other supplies. Persons aware of oral health issues are more likely to seek early preventative care, resulting in more people requesting orthodontic consultations and procedures at a younger age. Patients who are more informed about the advantages of orthodontic treatments and are willing to make financial investments in their dental health and appearance are the results of awareness campaigns and educational initiatives.

Restraint

High cost associated with advanced orthodontic technologies and materials

High-tech orthodontic tools like digital scanners, 3D imaging systems, and personalized treatment planning software come with a hefty upfront cost. Because consumers, including orthodontists and dental clinics, often bear this cost, smaller practices find it difficult to purchase these devices. It can take a lot of time and money to train orthodontic professionals to implement modern technologies. The continuous costs associated with maintaining and updating this technology further raise the total cost of orthodontic services.

In the end, some patients may decide not to seek orthodontic treatment or to choose less sophisticated solutions due to the high cost of advanced orthodontic technology and materials, which could have an impact on total market demand and growth potential.

Opportunity

Growing emphasis on aesthetic dentistry

People are spending more money on dental aesthetics and overall appearance because of lifestyle trends that emphasize wellness and self-care. More appealing and straighter teeth are viewed as a component of a total grooming and self-esteem-boosting endeavor. Cosmetic dentistry operations are in greater demand as more people look to enhance the appearance of their smiles and teeth. This covers procedures including veneers, tooth whitening, and clear aligners.

Due to the developments in orthodontic technology, more visually acceptable options like tooth-colored braces and clear aligners (like Invisalign) have been made available. Patients who prefer effective orthodontic treatment without the noticeable appearance of traditional metal braces will find these solutions appealing.

Product Insights

The removable braces segment dominated in the orthodontic supplies market in 2024. Compared to traditional fixed braces, removable braces, such as clear aligners like Invisalign, offer a greater degree of comfort and convenience. Patients can take them out for eating and brushing, which loosens dietary limitations and facilitates maintaining good oral hygiene. For adults and teenagers who are self-conscious about their appearance in social situations, this feature is very intriguing. They are quite adaptable to meet each patient's unique needs.

Based on variables like the degree of misalignment, patient compliance, and the intended length of therapy, orthodontists can customize the treatment plan. This degree of personalization is appealing to clinicians as well as patients, which helps the product dominate the market.

The fixed braces segment is expected to grow at a notable growth rate in the orthodontic supplies market during the forecast period. An increasing number of people may now be able to afford orthodontic procedures, including fixed braces, due to rising disposable income levels in many areas. The demand for fixed braces and related supplies has increased due to the expansion of the possible client base for orthodontic services and suppliers. There are now more options for patients to receive orthodontic treatments, including fixed braces, thanks to the growth of orthodontic clinics and practices in both metropolitan and rural settings.

Smaller brackets, less apparent brackets made of ceramic or clear materials, and advanced archwire materials that provide gentler stresses to teeth to minimize discomfort and treatment duration are all features of contemporary fixed braces.

The adhesives segment shows a significant growth in the orthodontic supplies market during the predicted period. Globally, the number of orthodontic procedures has been steadily rising. This trend is explained by rising awareness of the value of aesthetic dentistry, rising disposable wealth in developing nations, and improvements in orthodontic treatment methods that facilitate more convenient and effective orthodontic care. The need for premium adhesives used in orthodontic treatments, like braces and aligners, is anticipated to increase in tandem with the number of persons seeking these treatments.

The performance, robustness, and usability of adhesive technologies have been greatly increased due to technological advancements. The risk of enamel damage during orthodontic treatments is decreased because of the development of modern adhesives, which are developed to give strong bond strength without being harsh on the teeth. Thanks to these technological developments, adhesive-based orthodontic treatments are now more widely accepted by practitioners as well as patients.

Patient Insights

The adults segment held the largest share in the orthodontic supplies market in 2024. Adults' awareness of the advantages of orthodontic treatments has significantly increased over the last several decades. This covers both functional advantages like better bite alignment and general oral health as well as aesthetic ones. More discrete and comfortable treatment solutions were developed due to technological improvements in orthodontics. For instance, people are using clear aligner systems like Invisalign more frequently because of how almost undetectable they are and how easily they can be taken out.

Because of this, more individuals are pursuing orthodontic procedures to take care of concerns including bite abnormalities, misalignment, and crooked teeth that may not have been addressed in their early years.

End-user Insights

The dental clinics segment dominated in the orthodontic supplies market in 2024. The specialist infrastructure and equipment needed for orthodontic procedures are usually found in hospitals and dental clinics. This comprises sterilizing units, X-ray machines, dental chairs, and other necessary equipment unique to orthodontic treatments. They have a competitive advantage in providing complete orthodontic services because of this infrastructure. It frequently works with other medical professionals, such as orthodontic specialists. The interdisciplinary care and seamless referrals made possible by this network improve treatment outcomes and the patient experience.

Orthodontic Supplies Market Companies

- Align Technology, Inc.

- 3M Company

- American Orthodontics, Inc.

- Aster Orthodontics, Inc.

- DB Orthodontics Ltd

- Dentaurum

- Dental Morelli

- Great Lakes Orthodontics Inc.

- G&H Orthodontics Inc

- Orthodontic Supply & Equipment Company

- Rocky Mountain Orthodontics

- Oswell Dental

- Straumann

- Ultradent Products Inc.

Recent Developments

- In April 2024, KLOwen Orthodontics launched a new custom metal self-ligating (SL) option, which they aspire to change the world of orthodontic treatment. This product has the benefits of low-friction and non-fatiguing ligation from a handful of conventional SL alternatives and the efficiency with custom control from the custom prescription.

- In April 2023, OrthoFX, surgical dental +aligner clinical company, announced that it received 510 (k) clearance from the U.S. Food and Drug Administration (FDA). OrthoFX NiTime Aligners were an unprecedented development as the first aligner system designed exclusively for overnight use.

- In March 2023, FORESTADENT signed an agreement with Graphy Inc. to distribute their exciting Tera Harz TC-85 resin engineered for direct aligner printing. This product allows the creation of fully custom aligners with shape memory characteristics, allowing consistent light forces to improve treatment outcomes. They are also working with UNIZ Technology regarding compatible 3D printers to promote digital orthodontics globally.

- In September 2023, Align Technology declared the launch of its patented and exclusive Invisalign palatal expander technology. The direct 3D-printed apparatus offers quick skeletal and dental narrow maxilla (upper jaw) enlargement and retention. It makes primary, mixed, or permanent dentition possible for patients who are still growing.

- In May 2023, for a purchase price of $70 million, depending on closing and additional adjustments, 3M announced that it has entered contracts to sell some of the assets related to its dental local anesthetic collection, centered in Germany, to Pierrel S.p.A., the world's leading supplier of services for the pharmaceutical industry.

Segments covered in the Report

By Product

- Fixed Braces

- Brackets, By Type

- Conventional Brackets

- Self-ligating Brackets

- Lingual Brackets

- Brackets, By Material

- Metal/Traditional Brackets

- Ceramic/ Aesthetic Brackets

- Archwires

- Beta Titanium Archwires

- Nickel Titanium Archwires

- Stainless Steel Archwires

- Anchorage Appliances

- Bands and Buccal Tubes

- Miniscrews

- Ligatures

- Elastomeric Ligatures

- Wire Ligatures

- Brackets, By Type

- Removable Braces

- Adhesives

- Accessories

By Patient

- Adults

- Children and Teenagers

By End-user

- Dental Clinics

- E- Commerce Platforms

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting