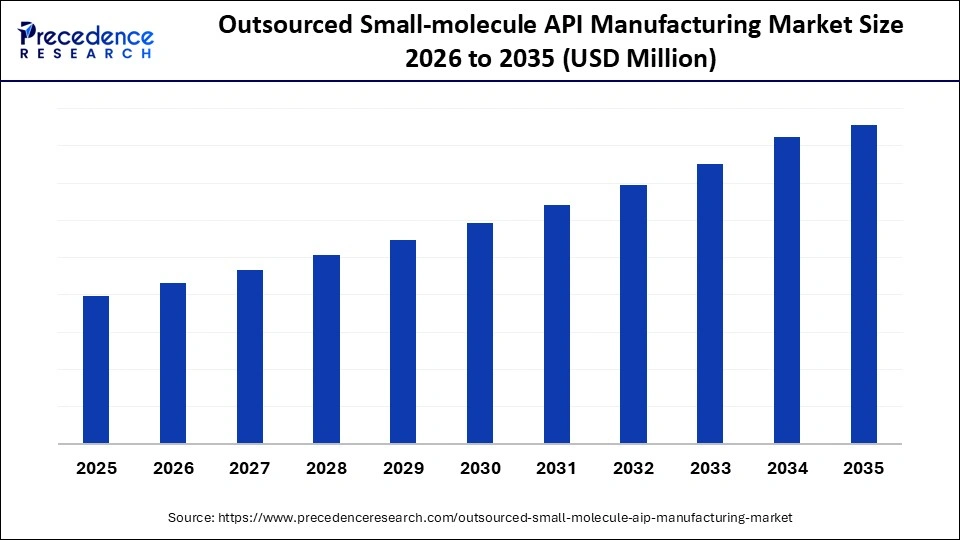

What is the Outsourced Small-Molecule API Manufacturing Market Size?

The global outsourced small-molecule API manufacturing market is expanding as pharma companies rely on CDMOs for scalable, cost-efficient, and high-quality API production.The market is largely influenced by the increasing prevalence of chronic diseases, which has resulted in a huge demand for APIs, the growing shift of the pharma industry to outsource API production and commercialization while following strict safety guidelines, and governments' huge investment in R&D across leading sectors, helping the market grow exponentially.

Market Highlights

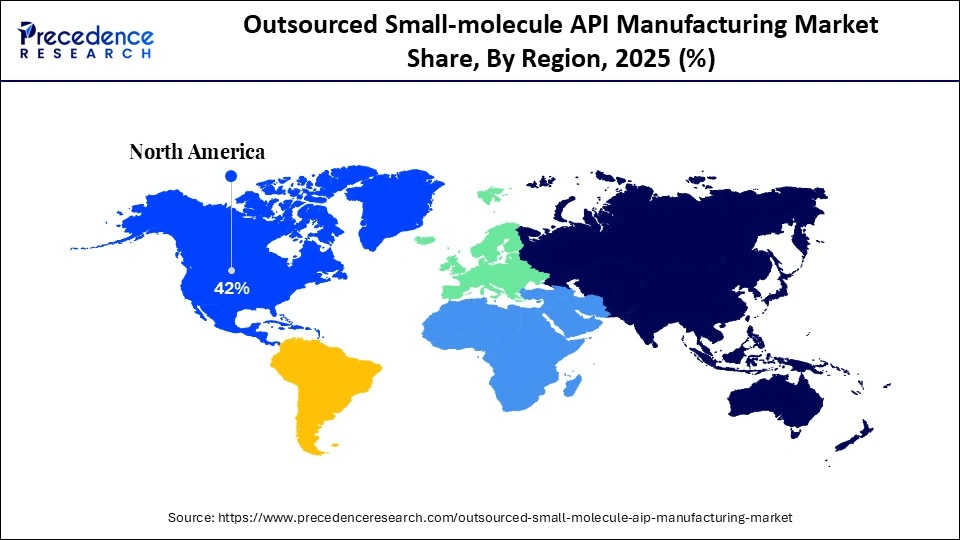

- North America accounted for the largest market share of 42% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 9% from 2026 to 2035.

- By service type, the commercial scale API manufacturing segment contributed the biggest market share of 34% in 2025.

- By service type, the process development & optimization segment is growing at the fastest CAGR of 8.80% from 2026 to 2035.

- By synthesis type, the synthetic/chemical APIs segment held the highest market share of 68% in 2025.

- By synthesis type, the biocatalysis/Enzyme-mediated synthesis segment is expanding at a strong CAGR of 9% from 2026 to 2035.

- By therapeutic area, the oncology segment accounted for the major market share of 32% in 2025.

- By end user, the pharmaceutical companies segment recoded the highest market share of 56% in 2025.

- By end user, the virtual/emerging pharma companies' segment is expected to expand at the fastest CAGR of 9.20% from 2026 to 2035.

Outsourced Small-molecule API Manufacturing Market: Offerings & its Expansion

The market refers to the sector where pharmaceutical companies deal with third-party specialized companies that offer development and manufacturing of Active Pharmaceutical ingredients for drugs. These companies are popularly known as contract development and manufacturing organizations (CDMOs), provide cost-effective solutions with high-skilled expertise and help achieve scalable production without the need for substantial investment in building their own facilities.

Small and mid-size companies often invest in CDMOs due to a lack of their own facilities for developing APIs and their mass production. They mainly depend on outsourcing this work. In some cases, large firms like Pfizer and Novartis also outsourced their API production to focus on core operations and gain flexibility, which is a major driver of the market.

AI Shifts in Outsourced Small-Molecule API Manufacturing Market

The pharmaceutical industry is transforming due to digital integration and API manufacturing, where drug development can be accelerated using AI/ML technologies to optimize processes and achieve higher yield with quality, resulting in a competitive advantage. AI has evolved from being only a future concept to todays cutting-edge technology readily applicable to various domains.

AI can detect data loopholes that are hindering the manufacturing process, offer possible solutions, and even allow changes to operational processes in real time while optimizing batch scheduling to minimize downtime. It can further affect quality assurance by predicting deviations before they occur, using past data analysis to reduce potential product recalls and avoid human errors.

Outsourced Small-Molecule API Manufacturing Market Trends

- Integration of Advanced Technologies:Advanced technologies such as process analytical technology and automation are significantly influencing the small-molecule APIs manufacturing sector. PAT offers real-time manufacturing, while automation and digitalization streamline critical operations, mitigating errors that lead to higher-quality products.

- Growing Focus on Sustainability:Sustainability is a crucial aspect of many sectors, including outsourced small-molecule API manufacturing. Various enterprises are prioritizing eco-friendly manufacturing processes, energy efficiency, and proper waste disposal methods to avoid harming the environment.

- Quality Compliance:Stringent quality regulation is another trend the market is witnessing, aimed at delivering high-quality products and earning certifications from authorities. CDMOs are following strict regulations set by the US FDA, GMP, and the EMA for drug development and pharmaceutical product launches to reduce the risk of regulatory setbacks.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Synthesis Type, Therapeutic Area, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outsourced Small-Molecule API Manufacturing Market Segmental Insights

Service Type Insights

The commercial-scale API manufacturing segment held the largest market share, at 34%, in 2025. The segment is dominating due to ongoing demand for innovative drugs to curb chronic diseases, cost-effective large-scale production, and specialized infrastructure requirements. Manufacturing APIs at scale enable enterprises to lower overall production costs and achieve significant margins.

The process development & optimization segment is expected to witness the fastest CAGR of 8.80% during the foreseeable period. The segment is growing due to increasing demand for drugs, advanced AI technology integration, and flow chemistry, along with the unmatched benefits of outsourcing. The complex nature of new drugs and the need to comply with regulatory standards are key drivers.

Synthesis Type Insights

The synthetic/chemical APIs segment held the largest market share, at 68%, in 2025. The segment is dominating due to the long-standing nature of synthetic APIs and their less reactivity to temperature, light, moisture, and other sudden environmental changes. This allows a wide range of administration routes, such as common oral forms, including tablets and capsules, which are not possible for complex biologics.

The biocatalysis/Enzyme-mediated synthesis segment is expected to witness the fastest CAGR of 9% during the foreseeable period. The segment is growing due to its high specificity and route simplification. Enzymes exhibit chemo-, regio-, and stereo-selectivity to produce chiral compounds that are crucial for the synthesis of many APIs.

Therapeutic Area Insights

The oncology segment held the largest market share of 32% in 2025 and is expected to witness the fastest CAGR of 9% over the foreseeable period. The segment is largely dominating due to the increasing prevalence of cancer and huge investments by governments to develop highly potent and complex nature of drugs to cure various cancers. This can be achieved by outsourcing API manufacturing to a specialized facility, as many modern small-molecule cancer drugs work effectively at lower doses but pose health risks if not handled properly.

Segment is further expanding, as a dedicated team and robust infrastructure are needed to build and maintain the efficacy of oncology drugs, with enormous investment, which is possible through outsourcing small-molecule APIs manufacturing, even given the complex nature of oncology API development.

End User Insights

The pharmaceutical companies segment held the largest market share, at 56%, in 2025. The segment is largely dominated by cost efficiency and reduced capital investment in API development, leveraging CDMOs from leading pharmaceutical companies. Outsourcing offers immediate access to highly skilled engineers and scientists and state-of-the-art facilities, along with technologies such as continuous flow chemistry and biocatalysis.

The virtual/emerging pharma companies' segment is expected to witness the fastest CAGR of 9.20% during the foreseeable period. The segment is growing because CDMOs can offer emerging pharma companies deep technical expertise and scalable solutions to meet fluctuating demand, from small clinical batches to large commercial batches, helping manage costs effectively.

Outsourced Small-Molecule API Manufacturing Market Regional Insights

North America held the largest market share, at 42% in 2025. The region is dominating due to the increasing rate of chronic diseases across the region, which includes conditions like diabetes, CVDs, cancer, and other neurological disorders that require highly effective drug solutions with active pharmaceutical ingredients. For example, the Centers for Disease Control and Prevention has reported on the major death reasons that include chronic diseases as a major factor, fueling the demand for new medications to target these healthcare issues.

The ongoing surge in a chronic condition has mandated a continuous and reliable supply of APIs to fulfill the growing demand for newly developed and effective medications across the North American region. In response to these market shifts, leading pharmaceutical players are investing heavily in developing APIs and outsourcing production to meet regulatory standards and commercialize at a rapid pace.

The U.S. is a frontier in the Outsourced small-molecule API manufacturing market, holding the largest regional market share. The regions dominance is attributed to factors such as the presence of top players in the pharma industry, including AbbVie, Viatris, Inc., and Pfizer, which are heavily influencing APIs innovation, production, and commercialization across the region, significantly fueling the market's growth.

Additionally, the U.S. government is actively contributing to the market's growth by introducing several initiatives to raise healthcare awareness, improve medical reimbursement, and fund robust infrastructure equipped with hi-tech healthcare instruments, thereby propelling the markets growth.

Asia Pacific is expected to witness the fastest CAGR of 9% during the foreseeable period of 2026 to 2035. The market is driven primarily by the growing demand for high-quality, low-cost API supplies from leading pharmaceutical companies and contract manufacturers. The increasing rate of an ageing population that is highly prone to chronic diseases is further boosting demand for generic drugs with active APIs to curb the diseases effectively.

Moreover, many global-level pharma companies are shifting the APIs supply chain to Asia-Pacific regions distributors to gain cost efficiency and faster time-to-market, while managing regulatory hurdles. Lower manufacturing costs, a large pool of skilled workforce, and well-developed chemical and bioprocessing infrastructure in the Asia Pacific region are a leading force behind increased API production by pharmaceutical firms across many areas.

China Outsourced Small-Molecule API Manufacturing Market Trends

The country is witnessing major trends in the outsourced small-molecule API manufacturing market, including expanding manufacturing capabilities due to significant investment in building robust infrastructure, backed by favorable government policies and funding, a strong base for R&D in the healthcare and life sciences domain, and technological integration with the research sectors of leading domains.

The Europe outsourced small-molecule API manufacturing market is experiencing steady yet profound growth due to the EU's strict regulations for the pharma and healthcare sector amid increasing demand for high-quality medications and the optimization of APIs, essential pharmaceutical solutions. Focusing on innovation and sustainability, fostering a thriving environment of collaboration among leading pharma players in Europe, is one of the major drivers of the market's growth in the region.The market's growth is further supported by the growing demand for biosimilars and personalized medications, encouraging the mass production of APIs.

For instance, in May 2025, the European Union held a public hearing aiming to resolve excessive dependency on export production of APIs and finished medicines, as the majority of the drugs are currently imported from Asian countries, especially from China and India.

Germany Outsourced Small-Molecule API Manufacturing Market Trends

The market is witnessing significant trends, including an increasing focus on high-quality medicine production, an expanding R&D base, and an emphasis on sustainability and adherence to regulatory standards for high-quality medicine manufacturing and its commercialization nationwide. Moreover, Germany is a leader in AI integration and automation in the API manufacturing process, aiming to reduce production costs while maintaining quality and efficiency.

The region is notably growing due to the growing demand for innovative and generic APIs to manage the increasing chronic diseases like diabetes, CVDs conditions and fatal conditions like cancer across the region. Expanding healthcare infrastructure and strategies developed by local manufacturers, along with supportive regulatory environments, are fueling the markets growth in the area.

Specifically, the MEA small-molecule API manufacturing market is expanding due to the growing adoption of biologics and specialty APIs formulated with small molecules, reflecting the increasing need for advanced therapeutics and medications in healthcare domains such as oncology, autoimmune disorders, and rare health conditions.

For instance, in August 2025, the Deputy Prime Minister and Minister of Health of Egypt held a meeting with the Representatives of ACDIMA, aiming to build strong coherence among leading players of the pharma sector under the strategy of Egypt named Egypts Vision 2030.

South Africa Outsourced Small-Molecule API Manufacturing Market Trends

At the country level, South Africa is a major contributor to the MEA outsourced small-molecule API manufacturing market, propelled by a highly developed pharmaceutical manufacturing base and by local manufacturers increasingly launching new APIs, ensuring supply chain security and providing cost-effective treatment options. The increasing focus on curing and offering constant support for growing chronic diseases like cancer, CVDs, and diabetes is a key driver for the market's growth.

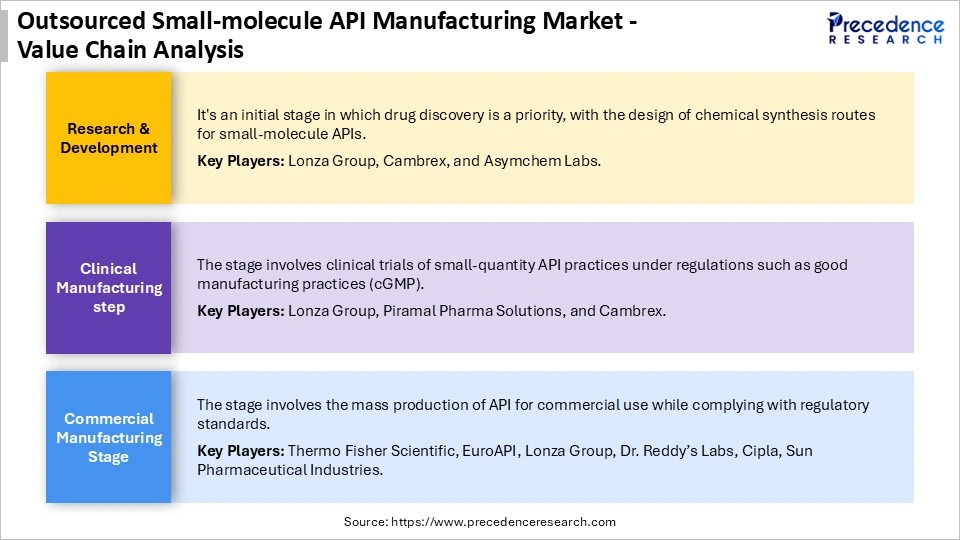

Outsourced Small-Molecule API Manufacturing Market Value Chain

Top Companies in Outsourced Small-molecule API Manufacturing Market & their Offerings

- Lonza

- Catalent, Inc.

- Siegfried AG

- Piramal Pharma Solutions

- Pfizer Inc

- 6S Pharma

- Merck KGaA

- Novartis

- Cambrex

- Johnson Matthey

- Teva

- Euroapi

- Boehringer Ingelheim GmbH

- Gland Pharma Ltd

Recent Developments

- In November 2025, A CDMO and out-licensing services will be launched by Grindeks Group as the company has found unused capacity at its manufacturing sites that will now be available for development, analytical, and GMP manufacturing as a support for APIs and developed dosage forms.

(Source: https://pharmasource.global) - In October 2025, the U.S.-based CDMO specialty firm, Wilmington PharmaTech, collaborated with an LA-based private equity firm, Curewell Capital, to expand the manufacturing capacity of Wilmington PharmaTech.

Outsourced Small-Molecule API Manufacturing MarketSegments Covered in the Report

By Service Type

- API Manufacturing

- Clinical-Stage API Manufacturing

- Phase I

- Phase II

- Phase III

- Commercial-Scale API Manufacturing

- Clinical-Stage API Manufacturing

- Process Development & Optimization

- Route Scouting

- Process Chemistry Optimization

- Scale-up & Tech Transfer

- Analytical & QC Services

- Method Development

- Method Validation

- Batch Release Testing

- Stability Studies

- Regulatory Support Services

- DMF/CMC Documentation

- Regulatory Filing Support

- Packaging & Distribution Services

- API Packaging

- Logistics & Supply Chain Support

By Synthesis Type

- Synthetic/Chemical APIs

- High-potency APIs

- Highly complex APIs

- Chiral & Asymmetric Synthesis APIs

- Controlled Substances

- Biocatalysis/Enzyme-mediated Synthesis APIs

- Fermentation-based Small Molecules

- Antibiotics

- Amino acids & intermediates

- Specialty metabolites

By Therapeutic Area

- Oncology

- Cardiology

- Central Nervous System (CNS) Disorders

- Infectious Diseases

- Endocrine & Metabolic Disorders

- Respiratory Diseases

- Gastrointestinal Disorders

- Pain Management

- Autoimmune & Inflammatory Diseases

- Others

By End User

- Pharmaceutical Companies

- Big Pharma

- Specialty Pharma

- Biotechnology Companies

- Generics Manufacturers

- Virtual/Emerging Pharma Companies

- Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting