What is the API Security and Management Market Size?

The global API security and management market includes platforms that monitor, analyze, and defend APIs from misuse or data exposure. With APIs becoming core to digital business, security and management are now critical priorities.The API security and management market is experiencing robust growth, fueled by the accelerating adoption of APIs, rising cybersecurity threats, and the increasing enterprise emphasis on governance, visibility, and regulatory compliance.

API Security and Management Market Key Takeaways

- North America led the API security & management market with around 45% share in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By component, the solutions segment held the major market share of 50% in 2024.

- By component, the API security solutions sub-segment is expected to grow at the fastest CAGR between 2025 and 2034.

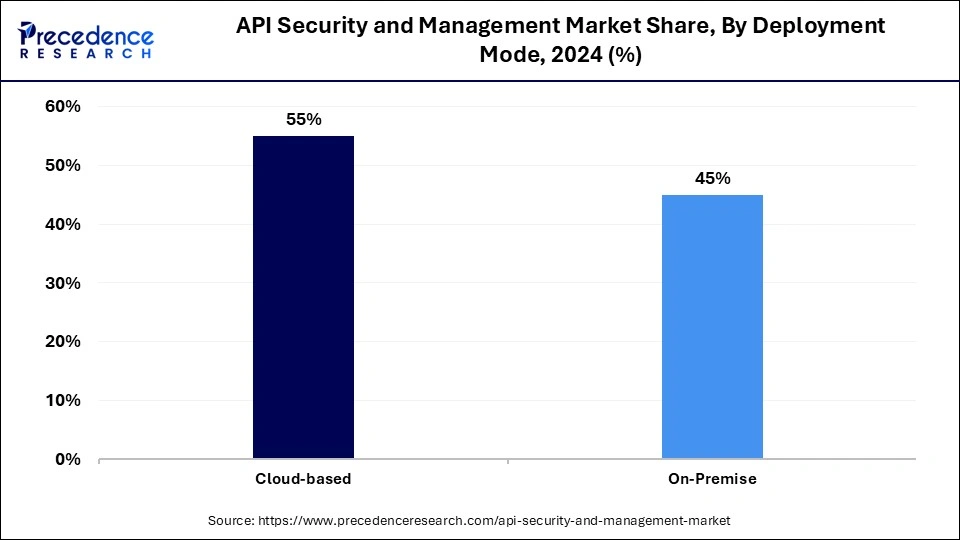

- By deployment mode, the cloud-based segment captured the largest market share of 55% in 2024.

- By deployment mode, the on-premise segment is expected to expand at a notable CAGR from 2025 to 2034.

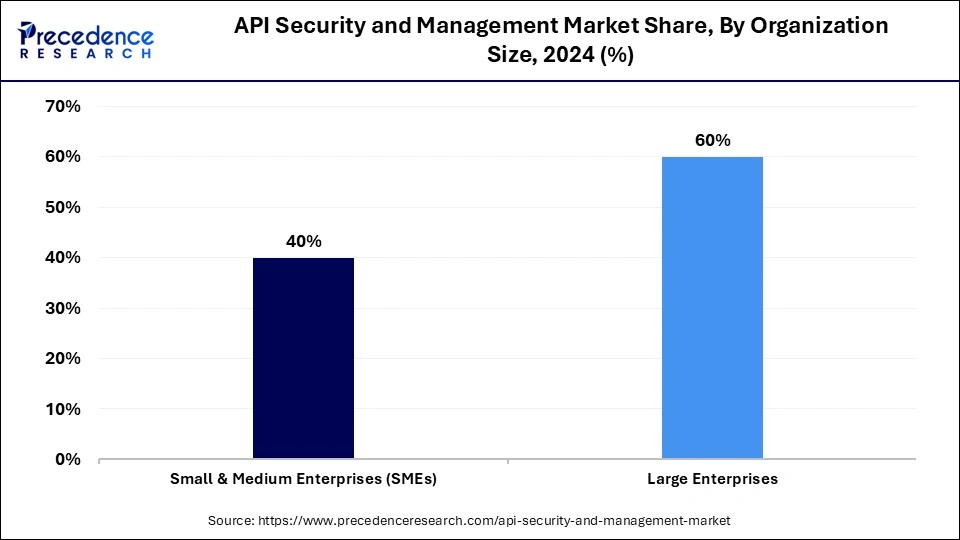

- By organization size, the large enterprises segment accounted for the biggest market share of 60% in 2024.

- By organization size, the SMEs segment is expected to expand at a notable CAGR from 2025 to 2034.

- By end-user industry, the BFSI segment held approximately 40% market share in 2024.

- By end-user industry, the IT & telecom segment is expected to expand at a notable CAGR over the projected period.

What Potentiates the Growth of the API Security and Management Market?

The proliferation of digital transformation, widespread cloud adoption, and the growing reliance on API-centric integrations across industries are key drivers propelling the growth of the API security & management market. This market focuses on safeguarding and optimizing APIs that connect disparate applications and systems, serving as critical enablers of modern digital ecosystems.

API security and management solutions ensure the secure exchange of data between applications by enforcing access controls, managing authentication, and monitoring traffic using advanced encryption and analytics tools. As cybersecurity threats rise and multi-cloud environments become more complex, organizations are increasingly prioritizing robust API governance frameworks to ensure operational reliability, scalability, and regulatory compliance. As such, API security and management have become an indispensable pillar of the modern enterprise IT infrastructure.

Impact of Artificial Intelligence on the API Security and Management Market

Artificial intelligence is reshaping the API security & management landscape through advanced automation, intelligent threat detection, and contextual monitoring. In April 2025, Salt Security launched a groundbreaking AI-enabled feature that allows enterprise teams to interact with their API infrastructure via natural language interfaces, significantly simplifying complex security management workflows.

Leveraging generative AI, this feature can identify vulnerabilities, analyze real-time traffic patterns, and proactively alert organizations to potential exploits, often before they occur. As automated bots and AI-powered cyberattacks become more prevalent, the market is shifting decisively toward AI-driven API security frameworks. Enterprises are increasingly adopting machine learning–based anomaly detection and behavioral analytics to safeguard their API environments. These developments mark a critical transition from reactive security models to proactive and adaptive API defense strategies, enabling faster and smarter responses to evolving cyber threats.

API Security and Management Market Outlook

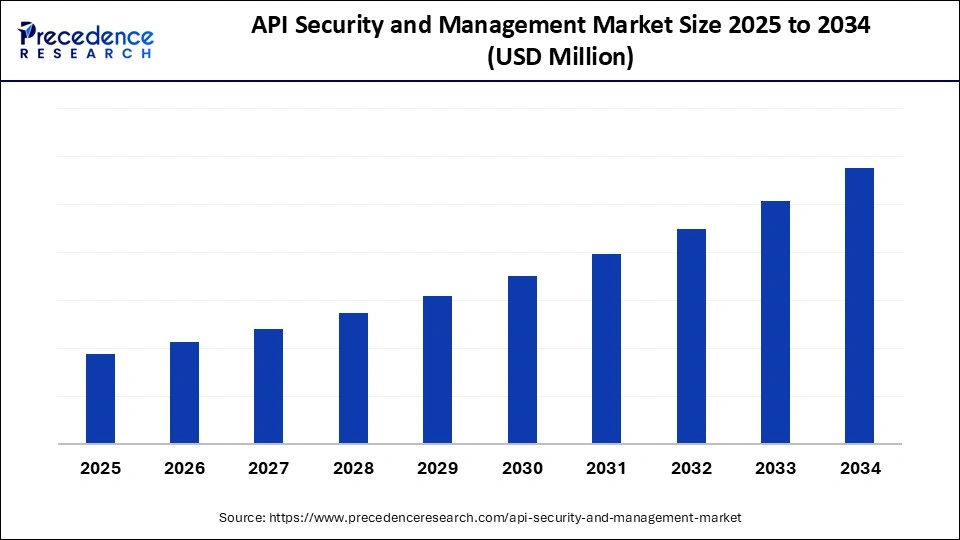

The API Security & Management market is projected to grow at a significant rate between 2025 and 2034, driven by enterprises' increasing reliance on APIs for digital operations. Regulatory and standards bodies are now responding to the growing threat landscape, notably, NIST has published SP-800-228, which elevates the priority of implementing API-specific controls, such as discovery and runtime protection across industries.

Regulatory scrutiny and cybersecurity alerts from organizations such as ENISA and CISA are catalyzing API security mandates beyond traditional tech hubs. As a result, sectors such as government, public services, and other regulated industries are expected to adopt API protection strategies at scale, accelerating global demand for policy enforcement, compliance, and API hardening capabilities.

Investment activity is shifting toward platforms that align with NIST-recommended controls, including automated API inventory, authentication and authorization hardening, and runtime threat detection and mitigation. These focus areas are now recognized as high-priority components in national and international cybersecurity frameworks.

The surging demand for API security and management is primarily driven by a sharp rise in API-targeted cyberattacks, which have increasingly made APIs the primary entry point for malicious actors. In 2025 alone, there were over 40,000 API-related security incidents across more than 4,000 environments, highlighting APIs as a dominant attack vector in the modern threat landscape. Further compounding the issue, DDoS attacks on APIs surged by 3,000% compared to traditional web assets, signaling a dramatic shift in attacker focus. As organizations continue to expose critical business logic and sensitive data via APIs, the need to secure and manage these interfaces becomes not just a best practice, but a strategic imperative. This growing threat surface is driving sustained investment in advanced API security solutions, tooling, and full lifecycle API protection frameworks.

A primary barrier to advancing API security lies in the lack of visibility and governance across the increasingly complex API ecosystem. Many organizations face difficulties in maintaining a complete and accurate inventory of their active and shadow APIs, leaving numerous endpoints unmonitored and highly susceptible to exploitation. According to recent research, 58% of companies monitor their APIs less than once per day and express low confidence in the accuracy of their API inventories. This visibility gap creates opportunities for attackers to exploit outdated, undocumented, or misconfigured interfaces, often resulting in severe data breaches and compliance risks.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Organization Size, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

API Security and Management MarketSegment Insights

Component Insights

The solutions segment dominated the API Security & Management market in 2024, with API management platforms accounting for approximately 50% of the segment's revenue share. These platforms are increasingly viewed as essential for streamlining API integration, traffic control, and analytics across diverse digital ecosystems. As enterprises adopt multi-cloud environments and microservices architectures, API management platforms have become critical enablers of scalability, governance, and full lifecycle API management. Their ability to support compliance, enhance developer productivity, and provide centralized visibility is driving widespread adoption across industries.

The API security solutions sub-segment is expected to grow at the fastest CAGR during the projection period, as organizations are experiencing a surge in cyberattacks targeting exposed application program interfaces. Concerns about data breaches and meeting compliance initiatives, such as GDPR and CCPA frameworks, have driven adoption. Organizations are now spending heavily on AI-based security applications and threat-detection environments to secure APIs from real-time vulnerabilities and unauthorized access.

Deployment Mode Insights

The cloud-based segment led the API security and management market with about 55% share in 2024, mainly because of its flexibility, scalability, and overall cost-effectiveness. Organizations prefer cloud technology because it allows for easier integration, faster deployment, and better accessibility options. The strong position of cloud-based API security and management solutions is only reinforced by the rise of remote work due to get-the-job-done capitalism, digital transformation initiatives, and hybrid IT infrastructures.

The on-premise segment is expected to grow rapidly in the near future as organizations in highly regulated industries prioritize data control and security. Companies that handle private data, especially in banking, healthcare, and government, prefer on-premise solutions because of the compliance they offer, but they also want the added benefit of a customization layer that protects them from external threats or hacks. Overall, higher costs associated with this solution do not prevent its adoption.

Organization Size Insights

The large enterprises segment dominated the API security & management market by capturing approximately 60% market share in 2024. This is mainly due to their wide API ecosystems and complex digital infrastructures. They invest heavily in successful API management systems that provide security, governance, and scalability across multiple applications, all of which are essential in industries such as BFSI, IT, and manufacturing.

The SME segment is expected to grow the fastest during the forecast period. The quick adoption of API security and management solutions among small and medium-sized enterprises (SMEs) is happening as these businesses aim to expand and secure data integration across different systems. The rise of affordable cloud platforms and growing cybersecurity focus enables SMEs to increase efficiency, enhance connectivity, protect their digital assets, and do so cost-effectively.

End User Industry Insights

The BFSI segment held nearly 40% of the market share in 2024 due to its high use of APIs related to digital banking, payment gateways, and open banking frameworks. For financial institutions, managing and securing APIs is essential for protecting customer information, ensuring regulatory compliance, and enhancing access across digital service platforms.

The IT & telecom segment is expected to grow rapidly in the coming years due to the industry's high adoption of APIs to support cloud, IoT, and 5G connectivity. API security and management are driven by the need for secure data sharing, automation, and interoperability. This enables service providers to enhance reliability, reduce latency, and improve the user experience.

API Security and Management MarketRegional Insights

North America led the API Security & Management market in 2024, accounting for approximately 45% of the global market share. This dominance is driven by the region's advanced API adoption, fueled by major cloud providers, fintech companies, and hyperscalers, creating a strong demand for robust API management and mature security frameworks. Enterprises in the region are prioritizing unified API posture management, accelerating the adoption of advanced tooling, and consolidating vendors. These factors favor U.S.-based specialist providers and integrated platform solutions.

In October 2025, Akamai Technologies, a U.S.-based company, announced an expanded partnership with Apiiro, a leading agentic application security platform. This collaboration aims to deliver the most comprehensive API security platform in the industry, integrating full API inventory and discovery, visibility across environments, posture management, and real-time protection through Akamai's API Security and App & API Protector. This move further solidifies North America's leadership position in shaping the future of API security.

The U.S. maintains a dominant position in the North American API security & management market, supported by widespread cloud-native enterprise adoption, advanced DevOps practices, and a highly competitive vendor ecosystem, including major players such as Salt Security, Kong, Microsoft, and AWS. These firms are at the forefront of accelerating product innovation and driving large-scale enterprise deployments. Moreover, the U.S. market continues to strengthen through strategic partnerships and AI-focused product launches, positioning itself to remain both highly resilient under scale and proactive in addressing emerging API threats.

Asia Pacific is experiencing rapid growth due to extensive digital transformation, cloud migrations, and a quickly expanding fintech ecosystem. The rising adoption of digital payments, open banking, and super apps has caused an exponential rise in API usage and introduced new security challenges. The surge in API-related cyber incidents and breaches has led organizations to adopt advanced API management and security solutions.

India is emerging as a growth epicenter, thanks to its extensive digital ecosystem and expanding fintech and e-commerce sectors. APIs have become the most vulnerable attack vector, often putting sensitive data and third-party integrations at risk. Incidents of API attacks increased by 126%, and Distributed Denial of Service (DDoS) attacks on APIs rose by 388%, making India the biggest target in the region. In response, enterprises in India are implementing AI-powered API gateways, runtime protection, and observability tools to bolster their API security posture and new compliance standards.

API security and management market Value Chain

Enterprises in the market are investing time and money in advanced threat detection algorithms, improved encryption methods, and AI-driven tools to better protect APIs and ensure compliance with new cybersecurity guidelines.

Vendors develop, code, and integrate security tools, including API gateways, authentication protocols, and traffic monitoring systems to safeguard communications between applications and external interfaces.

Vendors deploy solutions in cloud, on-premises, and hybrid environments, integrating them into the enterprise IT environment to ensure seamless monitoring, policy management, and incident response.

Products are sold through direct sales, technology partners, and managed security service providers (MSSPs), allowing products to be offered globally with solutions tailored to various industries and enterprise sizes.

Vendors offer customer support, continuous security updates, and real-time API activity dashboards to prevent breaches, enhance activity monitoring, and maximize system uptime.

API security and management market Companies

| Tier | Companies | Rationale / Roles | Estimated Cumulative Share |

| Tier I Major Players | Google (Apigee), Microsoft (Azure), Amazon Web Services (API Gateway), Akamai Technologies, Salt Security | These companies are consistently recognized as market leaders due to their comprehensive API management or security platforms, broad enterprise adoption, global reach, and integration with large-scale cloud environments. They drive the market through innovation, strategic partnerships, and massive deployments in regulated sectors. | 45-50% |

| Tier II Established Players | Axway, Broadcom (Layer7), Noname Security, Imperva, MuleSoft (Salesforce) | These firms offer competitive API security and/or management platforms with solid enterprise penetration. While not as globally dominant as Tier I, they are respected for deep product capabilities in API gateways, posture management, integration services, and threat mitigation. Many are expanding their cloud-native and AI security offerings. | 25-30% |

| Tier III Emerging/Niche Players | Cequence Security, 42Crunch, Tyk Technologies, WSO2, Gravitee, Kong, DreamFactory, Curity | These are specialist or open-source-oriented vendors focused on particular niches such as API discovery, contract security, open-source gateways, developer-first tools, or regional presence. While they represent smaller portions of revenue individually, their collective market contribution is growing, especially in SMBs and innovation-driven use cases. | 20-25% |

Recent Developments

- In April 2025, Salt Security, the leader in API security, launched the Salt Model Context Protocol (MCP) Server, a novel access point of interaction with their API infrastructure, leveraging natural language and artificial intelligence (AI). This empowers enterprises to interact with their APIs using natural language, delivering real-time insights, posture gap analysis, and AI-driven remediation guidance.(Source: https://www.prnewswire.com)

- In February 2025, Boomi™, the intelligent integration and automation leader, launched its API Management (APIM) solution to deliver cloud-scale APIM alongside market-leading integration and automation, data management, and AI capabilities. (Source: https://boomi.com)

Exclusive Analysis

The API security & management market is undergoing a paradigmatic shift, driven by the exponential proliferation of APIs as the foundational fabric of digital ecosystems. As enterprises scale microservices architectures, embrace hybrid and multi-cloud deployments, and orchestrate real-time data exchange across distributed systems, APIs have emerged as critical enablers of innovation, and correspondingly, high-value attack surfaces.

This evolution has catalyzed a demand inflection for unified API governance, lifecycle management, and zero-trust-aligned security frameworks. The market is being redefined by a convergence of API discovery, posture management, traffic analytics, and runtime protection into intelligent platforms capable of preemptive threat detection, compliance enforcement, and adaptive access control.

Emerging investment opportunities lie in AI-augmented threat modeling, behavior-driven anomaly detection, and posture management solutions capable of continuously securing APIs across dev, staging, and production environments. Strategic traction is particularly strong in regulated sectors, such as BFSI, healthcare, and public services, where APIs serve as conduits for sensitive data exchange and require immutable auditability, robust authentication, and real-time remediation mechanisms.

Furthermore, as global regulatory frameworks (e.g., NIST SP 800-204, ENISA guidelines) increasingly codify API-specific security mandates, demand for composable, policy-driven API security infrastructure is expected to accelerate. Tier I cloud and security vendors are consolidating capabilities through M&A and partnerships, but there is still room for innovative players offering precision tooling in API posture hardening, contract-level protection, and federated identity enforcement.

Overall, the API security & management market presents a compelling growth trajectory, underpinned by structural shifts in enterprise architecture, rising cyber threat complexity, and the imperative for resilient, observable, and governable API layers in the modern software delivery lifecycle.

API security and management marketSegments Covered in the Report

By Component

- Solutions

- API Security Solutions

- API Management Platforms

- Services

- Consulting & Implementation

- Managed Services

- Training & Support

By Deployment Mode

- Cloud-based

- On-Premise

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End User Industry

- BFSI (Banking, Financial Services, Insurance)

- IT & Telecom

- Healthcare & Life Sciences

- Retail & e-Commerce

- Government & Public Sector

- Manufacturing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting