What is the Packaging Inks and Coatings Market Size?

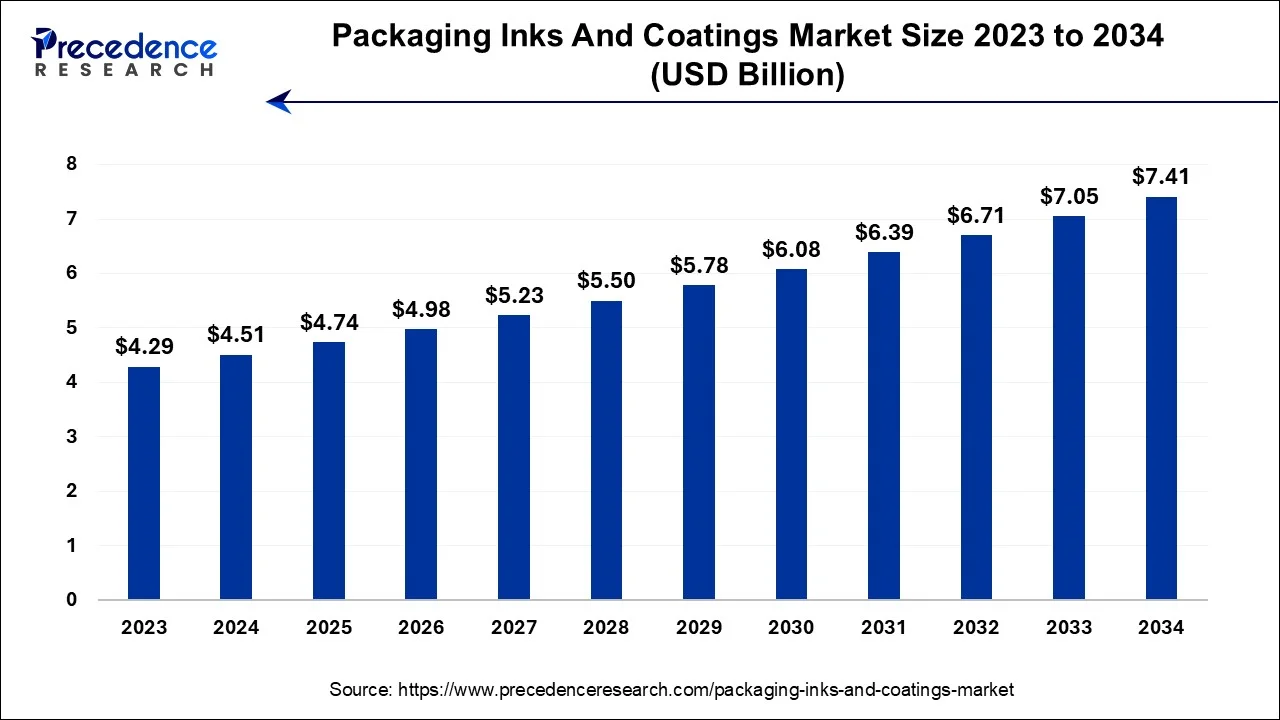

The global packaging inks and coatings market size is calculated at USD 4.74billion in 2025and is predicted to increase from USD 4.98 billion in 2026 to approximately USD 7.76billion by 2035, registering a CAGR of 5.05% during the forecast period from 2026 to 2035.

Packaging Inks And Coatings Market Key Takeaways

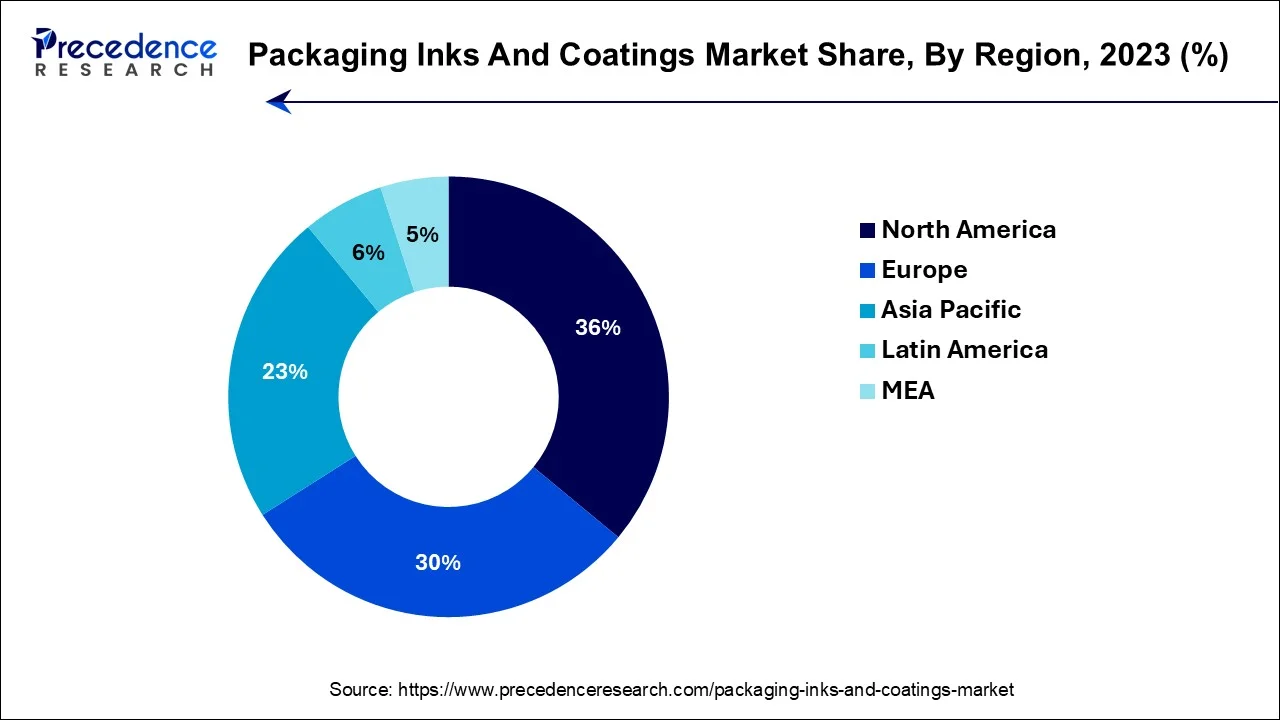

- North America led the market with the biggest market share of 36% in 2025.

- Asia-Pacific is projected to expand at the fastest CAGR during the forecast period.

- By Type, the flexible plastic segment is recorded more than 38% of revenue share in 2025.

- By Type, the paper segment is expected to grow at a noteworthy CAGR of 8.1% during the forecast period.

- By Application, the advertising segment registered the maximum market share of 39% in 2025.

- By Application, the retail segment is estimated to expand at the fastest CAGR over the projected period.

Market Overview

Packaging inks and coatings are specialized materials applied to various packaging substrates, such as paper, plastic, or metal, to enhance both aesthetics and functionality. Inks provide color and graphic elements for branding, product information, and visual appeal. Coatings, on the other hand, offer protective layers that can enhance durability, barrier properties, and tactile qualities.

They serve vital functions like preserving product freshness, preventing moisture or gas intrusion, and ensuring label and package integrity. Additionally, these inks and coatings play a crucial role in meeting regulatory requirements, especially for food andpharmaceutical packaging, by ensuring safety and compliance with industry standards.

Packaging Inks and Coatings Market Growth Factors

The packaging inks and coatings market is experiencing robust growth, driven by several key factors. Firstly, the increasing demand for attractive and informative packaging across various industries, including food, beverages, pharmaceuticals, and cosmetics, has fueled the need for high-quality printing inks and protective coatings.

The emphasis on branding and visual appeal is a significant growth driver. Moreover, the growing consumer preference for eco-friendly and sustainable packaging materials has led to innovations in environmentally friendly inks and coatings. This aligns with the industry's trend toward greater sustainability. However, the market faces challenges such as volatile raw material prices, stringent regulatory requirements related to food safety and labeling, and the need to keep pace with rapidly evolving printing technologies.

In terms of opportunities, the packaging inks and coatings sector can explore advancements in digital printing technologies, enabling shorter print runs, customization, and reduced waste. Additionally, catering to the surging e-commerce market by developing inks and coatings that are resilient during shipping and handling presents a lucrative prospect. The packaging inks and coatings market is thriving due to increased demand for visually appealing and sustainable packaging solutions, but it must navigate challenges related to regulations and technological advancements while capitalizing on emerging opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 7.76 Billion |

| Market Size in 2026 | USD 4.98 Billion |

| Market Size in 2025 | USD 4.74 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Branding, product information and transparency

In today's highly competitive consumer market, packaging is often the first point of interaction between a product and a potential customer. Eye-catching packaging with vibrant colors, intricate designs, and high-resolution graphics can significantly influence purchasing decisions. Brands are leveraging packaging inks and coatings to create visually appealing and memorable packaging that stands out on crowded store shelves or in online marketplaces. As a result, the demand for premium printing inks and coatings has surged, driving growth in the packaging industry.

Moreover, Consumers are becoming increasingly conscious of what they consume, demanding clear and comprehensive product information. Packaging inks and coatings play a pivotal role in conveying essential details such as nutritional facts, ingredient lists, and product origin. Additionally, they enable QR codes and augmented reality features, allowing consumers to access additional information and interactive content.

As transparency and information-sharing become industry standards, the packaging inks and coatings market experiences growth due to the need for accurate and informative packaging that fosters trust between brands and consumers. This shift is particularly evident in the food and pharmaceutical sectors, where safety and transparency are paramount.

Restraints

Raw material price volatility, health, and safety concerns

One of the significant restraints in the packaging inks and coatings market is the volatility in raw material prices. The industry heavily relies on various chemicals, solvents, and pigments. Price fluctuations of raw materials can disrupt production costs, diminishing profit margins and impeding competitive pricing.

Manufacturers may find it challenging to absorb abrupt cost surges, potentially resulting in elevated prices for end-users. This scenario could curtail market demand, particularly within cost-sensitive sectors like packaging. Health and safety regulations are stringent in the packaging inks and coatings industry due to the potential risks associated with chemical exposure. Compliance with these regulations often necessitates costly investments in safety measures, training, and equipment.

Additionally, concerns about the environmental impact of certain chemicals used in inks and coatings can lead to regulatory changes and increased scrutiny, which may further constrain market growth. The packaging inks and coatings market faces challenges related to raw material price volatility, which affects pricing and profitability, as well as health and safety concerns, which demand ongoing investments in compliance and sustainability, potentially impacting market demand, especially among companies unable to adapt to these challenges.

Opportunities

Digital printing advancements and anti-counterfeiting features

Digital printing technologies have revolutionized the packaging industry by offering greater flexibility and customization. Brands can now create unique and eye-catching packaging with shorter print runs and reduced setup times. Small and medium-sized enterprises (SMEs) have notably leveraged digital printing advancements, enhancing their competitiveness.

Furthermore, the market has experienced heightened demand due to the rising concern over counterfeit products. To safeguard consumer safety and brand integrity, companies are now integrating anti-counterfeiting features into their packaging. These security features necessitate specialized inks and coatings that are challenging to replicate, reinforcing their significance in the packaging industry. Such security measures include holograms, QR codes, tamper-evident seals, and invisible inks, which have become essential for pharmaceuticals, cosmetics, and high-value consumer goods.

This heightened focus on product security has created a substantial demand for specialized inks and coatings with anti-counterfeiting properties. In combination, these advancements and security features are driving a strong demand for innovative and specialized packaging inks and coatings, making them indispensable components of modern packaging solutions.

Segment Insights

Type Insights

The flexible plastic segment has held 38% revenue share in 2023. Flexible plastics, often defined by their cost-effectiveness, versatility, and durability, are widely used in packaging. They encompass materials like polyethylene and polypropylene, offering malleability and resistance to external factors, making them ideal for various packaging applications. In the packaging inks and coatings market, the trend is toward sustainable solutions, with water-based and UV-curable coatings gaining popularity.

These eco-friendly options reduce emissions and waste, aligning with the growing demand for environmentally responsible packaging. Additionally, the market is witnessing increased investments in digital printing technologies, enabling customized and vibrant packaging designs at competitive costs.

The paper segment is anticipated to expand at a significant CAGR of 8.1% during the projected period Paper in the packaging inks and coatings market refers to the substrate used for various packaging applications. It offers a cost-effective option compared to other materials, making it a preferred choice for eco-conscious consumers and businesses.

As sustainability gains prominence, there's a growing trend towards using paper-based packaging, which is recyclable and biodegradable. Brands are increasingly seeking water-based and eco-friendly inks and coatings compatible with paper packaging to align with these trends and meet consumer demands for environmentally responsible packaging solutions.

Application Insights

The advertising segment held the largest market share of 39% in 2023. In the packaging inks and coatings market, advertising refers to the use of printed visuals and information on packaging to communicate brand identity, product features, and marketing messages. A key trend in this area involves the growing importance of eye-catching packaging that stands out on crowded shelves, driving brand recognition.

Additionally, there is a rising demand for interactive packaging, such as QR codes or augmented reality features, which engage consumers digitally. These trends underscore the significance of packaging inks and coatings in facilitating effective advertising and consumer engagement.

The retail segment is projected to grow at the fastest rate over the projected period. In the retail sector, packaging inks and coatings play a vital role in enhancing product presentation and consumer appeal. Key trends include a growing emphasis on sustainable packaging solutions, with eco-friendly inks and coatings gaining traction.

Additionally, customization and personalization are on the rise to create unique and eye-catching retail packaging. Brands are also incorporating anti-counterfeiting features to ensure product authenticity and safety. Overall, the retail segment is witnessing a shift towards innovative, sustainable, and visually appealing packaging solutions to capture consumer attention and loyalty.

Regional Insights

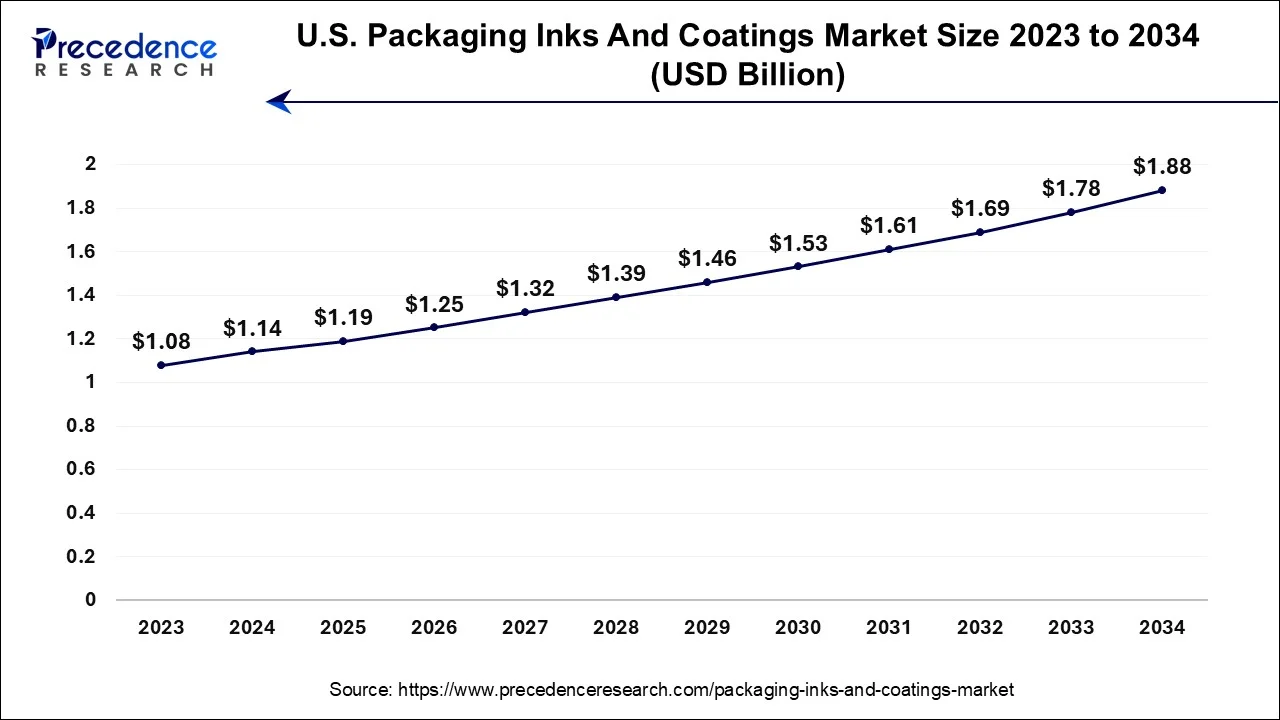

U.S. Packaging Inks and Coatings Market Size?

The U.S. packaging Inks and coatings market size is exhibited at USD 1.19 billion in 2025 and is projected to be worth around USD 1.97 billion by 2035, growing at a CAGR of 5.17% from 2026 to 2035.

How is the Transformative Growth of North America in the Packaging Inks and Coatings Market in 2025?

North America has held the largest revenue share 36% in 2023. In North America, the packaging inks and coatings market is characterized by several notable trends. There's a growing emphasis on sustainable and eco-friendly solutions, driven by consumer awareness and regulatory pressures. Secondly, the adoption of advanced digital printing technologies is on the rise, allowing for greater customization and shorter print runs.

Additionally, heightened concerns about product safety and counterfeit prevention are driving the incorporation of anti-counterfeiting features into packaging. Lastly, the COVID-19 pandemic accelerated the demand for e-commerce-friendly packaging in the region, necessitating durable and protective coatings for online sales.

U.S. Packaging Inks and Coatings Market Analysis

The U.S. industry is driven by the huge adoption of digital printing, the expansion of e-commerce, sustainability, and regulatory compliance. In January 2025, the U.S. Department of Commerce (DoE) announced $1.4 billion in final awards to support and advance the next-generation of semiconductor advanced packaging in the U.S.

How does Asia Pacific Expand Rapidly in the Packaging Inks and Coatings Market?

Asia-Pacific is estimated to observe the fastest expansionIn the Asia-Pacific region, the packaging inks and coatings market is witnessing notable trends. The growing e-commerce sector is driving demand for high-quality, durable inks and coatings that can withstand the rigors of transportation.

Additionally, the emphasis on sustainable packaging solutions is pushing manufacturers to develop eco-friendly inks and coatings to align with the region's environmental concerns. As brands prioritize unique packaging designs, digital printing technologies are gaining prominence, further boosting the market's growth in the Asia-Pacific region.

India Packaging Inks and Coatings Market Analysis

The Indian market is witnessing booming e-commerce, a surge in FMCG and food processing, and an eco-friendly shift. In July 2025, Uflex secured an Indian patent for waterborne heat seal coating for food and consumer goods packaging.

- In September 2024, Siegwerk India launched a cleanliness initiative in Bhiwadi.

What will be the Noteworthy Growth of Europe in the Packaging Inks and Coatings Market?

In Europe, the packaging inks and coatings market is witnessing notable trends. There is a growing emphasis on sustainability, with increased demand for eco-friendly inks and coatings to align with the region's strong environmental awareness. Furthermore, stringent regulations related to food safety and labeling have fueled the need for compliant and safe packaging solutions. Digital printing technologies are gaining traction for their customization capabilities. The European market is also seeing a rising interest in anti-counterfeiting features to protect brands and consumers.

How is the Pivotal Growth of the Packaging Inks and Coatings Market within South America?

South America is expected to experience significant growth during the forecast period, driven by the rise of flexible packaging and the growth of the food and beverage sector. The major regulatory shifts are seen in Brazil, and regional programs in Chile, Colombia, and Argentina.

How is the Middle East and Africa Gaining Momentum in the Packaging Inks and Coatings Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by stringent environmental regulations favoring sustainable solutions, expanding e-commerce, and rapid urbanization. The government programs and incentives in Saudi Arabia, Egypt, and the UAE support the regional market's growth.

Value Chain Analysis

- Raw Material Sourcing (Plastic, Paper, Glass, etc.)

This stage includes bio-based feedstocks, transition to water-based systems, recycled and recovered materials, and elimination of harmful substances.

Key Players: BASF SE, Arkema S.A., Sun Chemical, Flint Group, Siegwerk Druckfarben, Sakata INX. - Logistics and Distribution

The rising trends in this stage are regional hub expansion, sustainable material logistics, automation, and digitalization.

Key Players: Sun Chemical, PPG Industries, AkzoNobel N.V., BASF SE, Flint Group. - Recycling and Waste Management

This stage includes digital waste sorting, direct-to-object printing, and refill and reuse systems.

Key Players: BASF SE, Arkema S.A., Sun Chemical, Flint Group, Siegwerk Druckfarben, Sakata INX.

Packaging Inks and Coatings Market Companies

- Sun Chemical Corporation

- Flint Group

- Toyo Ink Group

- Siegwerk Druckfarben AG & Co. KGaA

- DIC Corporation

- ALTANA AG

- Hubergroup Deutschland GmbH

- Sakata INX Corporation

- T&K TOKA Co., Ltd.

- Wikoff Color Corporation

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Zeller+Gmelin GmbH & Co. KG

- INX International Ink Co.

- Tokyo Printing Ink Mfg. Co., Ltd.

- Pulse Roll Label Products Ltd.

Recent Developments

- In August 2025, Sun Chemical launched innovative packaging solutions at FACHPACK 2025. (Source: https://www.sunchemical.com/ )

- In November 2025, BASF Coatings launched a new automotive OEM coatings plant in Germany. (Source: https://www.basf.com/ )

- In 2023, The Toyo Ink Group entered a share purchase agreement to acquire Thai Eurocoat, with the goal of becoming the leading metal coatings producer in the ASEAN canned food market, enhancing its position and capabilities in the region's packaging industry.

- In 2022, Clariant successfully completed the acquisition of BASF's U.S. Attapulgite business assets, strengthening its portfolio and presence in the specialty chemicals industry, particularly in the area of Attapulgite-based additives and minerals.

- Sun Chemical acquire Flint Group's European publication gravure ink business. This strategic move will bolster Sun Chemical's presence and capabilities in the publication and commercial printing ink market across Europe, enhancing its product offerings and market reach.

- BASF successfully acquired Albemarle's global surface treatment business, Chemetall. This move broadens BASF's Coatings division's offerings, positioning it as a comprehensive solutions provider in the surface treatment industry, and further strengthening its market presence and capabilities.

Segments Covered in the Report

By Type

- Flexible Plastic

- Rigid Plastic

- Metal

- Paper

By Application

- Advertising

- Electronic

- Retail

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting