What is the Palletizing Robot Market Size?

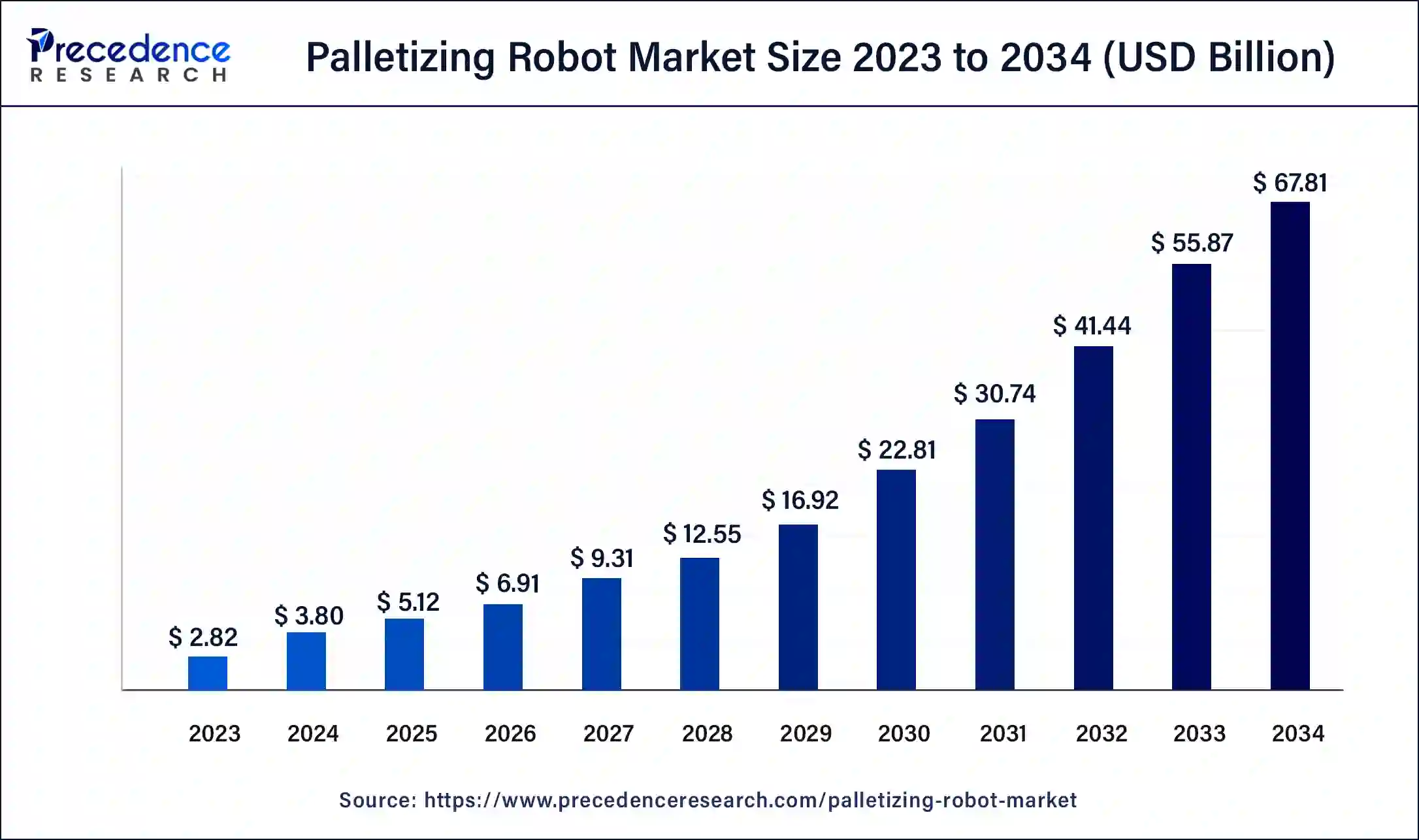

The global palletizing robot market size is calculated at USD 5.12 billion in 2025 and is predicted to increase from USD 6.91 billion in 2026 to approximately USD 31.87 billion by 2035, expanding at a CAGR of 31.87% from 2026 to 2035.

Palletizing Robot Market Key Takeaways

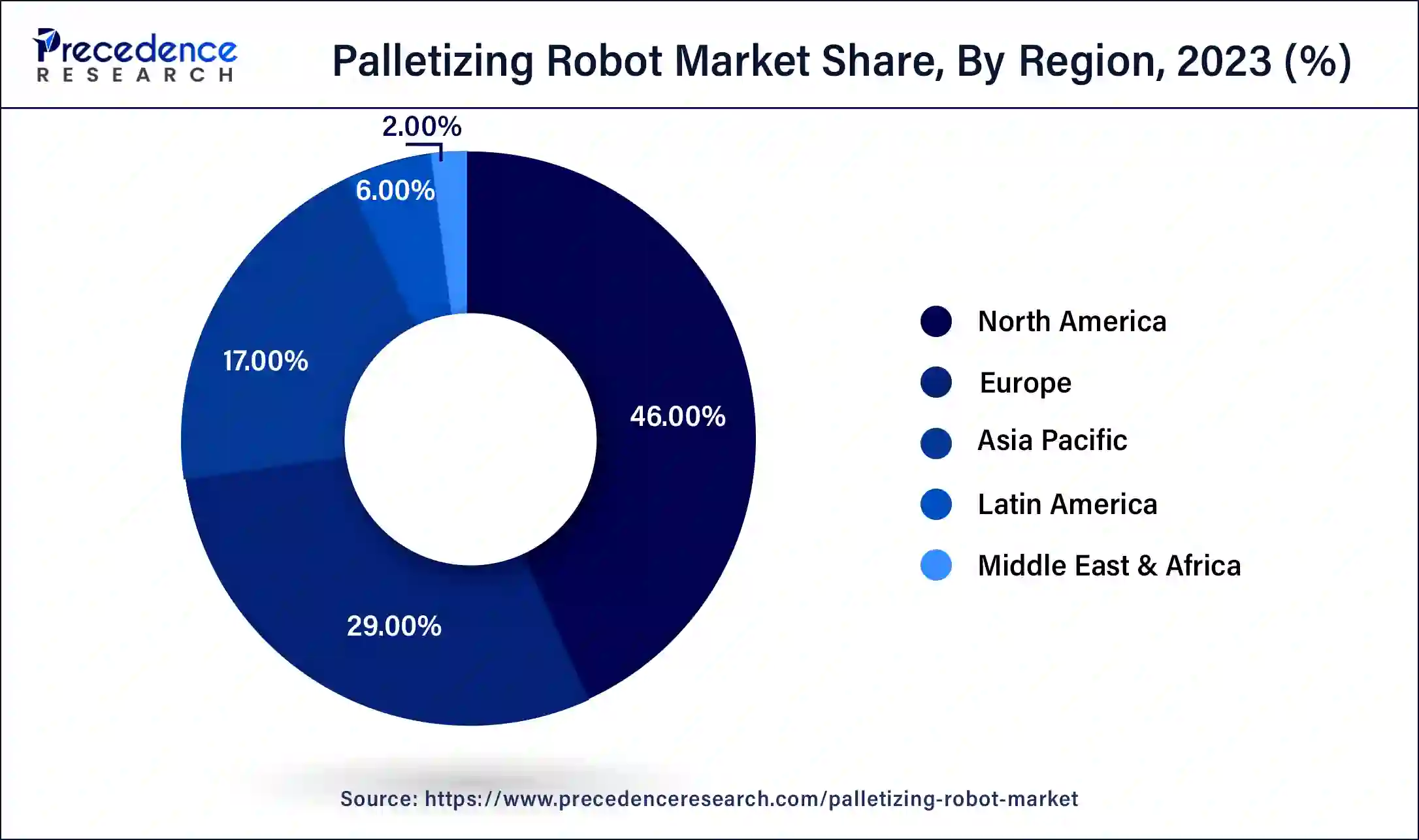

- North America contributed more than 46% of revenue share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By product, the case palletizing segment has held the largest market share of 42% in 2025.

- By product, the bag palletizing segment is anticipated to grow at a remarkable CAGR of 38.1% between 2026 to 2035.

- By range, the 1000-3000 mm segment generated over 43% of revenue share in 2025.

- By range, the above 3000mm segment is expected to expand at the fastest CAGR over the projected period.

- By payload, the 100-300kg segment had the largest market share of 42% in 2025.

- By payload, the above 500kg segment is expected to expand at the fastest CAGR over the projected period.

- By robot type, the SCARA segment generated over 44% of revenue share in 2025.

- By robot type, the cobots segment is expected to expand at the fastest CAGR over the projected period.

- By end-use industry, the discrete manufacturing segment had the largest market share of 42% in 2025.

- By end-use industry, the electrical & electronics segment is expected to expand at the fastest CAGR over the projected period.

What is the Palletizing Robot?

The palletizing robot market refers to the industry focused on robotic systems designed for palletizing applications. Palletizing robots are automated machines equipped with robotic arms and grippers, specifically tailored for stacking goods or materials on pallets. These robots enhance efficiency, reduce manual labor, and streamline the palletization process across various industries, including manufacturing and logistics. The market growth is driven by the increasing adoption of automation solutions to optimize warehouse operations, improve productivity, and meet the growing demand for efficient material handling in the global supply chain.

The palletizing robot market is witnessing robust growth as industries prioritize automation for enhanced efficiency and reduced operational costs. With advanced features like vision systems and collaborative capabilities, palletizing robots cater to diverse industrial needs, making them a pivotal component of modern material handling solutions across various sectors, including manufacturing, logistics, and e-commerce.

How is AI contributing to the Palletizing Robot Industry?

Palletizing robots are becoming smart through AI and can be made flexible. With machine learning and computer vision, it is possible to recognize products in real time, mixed SKUs, and quality inspection. AI-based algorithms optimize loading patterns, stacking, and collision-free paths. To avoid downtime, predictive analytics observes sensors. Adaptive gripper control variable force and speed, which can offer autonomous control and reduce deployment time, increase throughput, and maintain a constant end-of-line efficiency in contemporary industrial packaging plants.

Palletizing Robot Market Outlook

- Industry Growth Overview: The palletizing robot market is expected to experience significant growth from 2025 to 2034, driven by increasing demand for automation across logistics, manufacturing, and warehousing. The growth of the e-commerce and consumer goods industries is also likely to increase demand for robotic solutions to handle orders and palletize products. Labor shortages are also prompting industries to adopt robotic palletizing to keep operations continuous and efficient. Additionally, more manufacturers are adopting automation to reduce workplace injuries and improve consistency on production lines, fueling market expansion.

- Automation & Technological Innovation: Technological innovation is transforming the palletizing robot industry, emphasizing collaborative robots (cobots), AI-enabled vision systems, adaptive gripping mechanisms, and autonomous mobile robot (AMR) integration. AI-assisted vision robots are able to handle mixed SKU pallets, delicate products, and irregular shapes, reducing human contact and errors. Additionally, the growing adoption of Industry 4.0 and IoT-enabled factories is further boosting demand for smart robotic solutions, thus driving market growth.

- Global Expansion: Leading palletizing robot vendors are rapidly expanding their presence in emerging regions to stay close to customers and provide localized support and maintenance services. In the Asia-Pacific region, companies like Yaskawa and Mitsubishi Electric are establishing manufacturing plants and service centers in countries such as China, Japan, and India to meet rising demand for industrial automation. Additionally, Europe presents significant opportunities, and KUKA and ABB are strengthening their positions in Germany, France, and Eastern Europe to serve the automotive and logistics sectors.

- Major Investors: Major investors in the market include large industrial robotics manufacturers, corporate automation investors, and private equity/venture capital firms backing warehousing and logistics automation startups. Their investment fund R&D for high-speed, AI-enabled palletizing robots, expansion of manufacturing capacity, and global distribution, supporting automation to more warehouses, logistics centers, and manufacturing sites worldwide

- Startup Ecosystem: The palletizing robotics startup ecosystem is rapidly evolving, driven by advances in AI, computer vision, and robotics-as-a-service (RaaS) models. New companies target small and medium-sized businesses (SMEs) that need scalable, flexible, and cost-effective automation solutions. Projects like RightHand Robotics (U.S.), Plus One Robotics (U.S.), and Kindred AI (Canada) offer smart, adaptable robotic palletizers that are able to handle various product types with minimal human assistance. Additionally, growing interest in sustainability is significant, with robotics solutions designed to reduce energy use and waste and to optimize warehouse space.

Palletizing Robot Market Growth Factors

- Palletizing robots improve operational efficiency by automating the palletization process, reducing manual labor requirements, and increasing throughput.

- Industries adopt palletizing robots to cut labor costs and enhance overall cost-effectiveness through streamlined and efficient palletization.

- Advanced palletizing robots exhibit flexibility and adaptability to handle diverse packaging formats, sizes, and materials, providing a versatile solution for various industries.

- Continuous technological innovations, including vision systems and collaborative features, contribute to the enhanced capabilities and performance of palletizing robots.

- The rising demand for palletizing robots is particularly notable in the e-commerce and logistics sectors, where efficient palletization is crucial for order fulfillment and distribution.

- Palletizing robots are equipped with advanced safety features, making them suitable for collaborative work environments and ensuring compliance with industry safety standards.

- The increasing adoption of palletizing robots is driving market expansion, presenting business opportunities for robot manufacturers and integrators to cater to diverse industry needs.

- Palletizing robots offer customization options and seamless integration with existing production lines, providing businesses with tailored solutions for their specific requirements.

- The integration of palletizing robots aligns with the principles of Industry 4.0, fostering connectivity, data exchange, and smart automation in manufacturing processes.

- Palletizing robots contribute to global supply chain optimization by improving palletization efficiency, reducing errors, and enhancing overall supply chain management.

Trade Analysis for Palletizing Robot Market

- The number of import shipments of robotic palletizers that were tracked in trade routes globally is 4,181.

- Strong and diversified demand with 1,174 active buyers.

- There is a large international adoption of imports with a total of 73 importing countries.

- There are 1,166 exporters and suppliers in the global supply ecosystem.

- 4,181 export deliveries registered, which is equivalent to a consistent cross-border flow.

- There is a wide foundation of manufacturing in the exports of 53 exporting countries.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 31.87% |

| Market Size in 2025 | USD 5.12 Billion |

| Market Size in 2026 | USD 6.91 Billion |

| Market Size by 2035 | USD 81.41 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Range, Payload, Robot Type, End Use Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Automation demand and technological advancements

The palletizing robot market experiences a surge in demand driven by the dual forces of increasing automation needs and ongoing technological advancements. As industries across the globe seek to enhance operational efficiency and reduce manual labor, the demand for automated solutions has risen significantly. Palletizing robots, with their ability to streamline and automate the palletization process, have become pivotal in meeting these demands. This surge in automation demand is evident across various sectors, from manufacturing to logistics and e-commerce, where the need for efficient material handling is paramount.

Simultaneously, continuous technological advancements in robotics play a crucial role in propelling the palletizing robot market forward. These advancements encompass sophisticated features such as vision systems, collaborative capabilities, and enhanced safety measures. Technologically advanced palletizing robots not only improve overall performance but also offer increased flexibility in adapting to diverse manufacturing environments. As businesses embrace these cutting-edge solutions to stay competitive, the market for palletizing robots is poised for sustained growth, further solidifying their role as integral components in modern industrial and logistics processes.

Restraint

Concerns over job displacement and integration challenges

The increasing automation of tasks through palletizing robots raises concerns about potential job displacement. As companies deploy robots for palletizing, there is apprehension about the impact on human workers. Job displacement worries arise particularly in industries where manual palletizing has been a traditional job. The fear of reduced job opportunities and the need for reskilling workers to adapt to the evolving work environment contribute to hesitancy in embracing palletizing robots.

Integrating palletizing robots into existing workflows poses challenges for businesses. Many industries already have established processes, and incorporating robots seamlessly requires significant planning and investment. Integration challenges include the need for compatible software, workforce training, and adapting infrastructure. Businesses may face disruptions during the integration phase, impacting productivity. These challenges act as barriers, preventing some companies from readily adopting palletizing robots despite their potential benefits.

Opportunity

Integration with Industry 4.0 technologies and collaborative palletizing robots

The surge in demand for palletizing robots is closely linked to their integration with Industry 4.0 technologies and the emergence of collaborative robots, marking a significant shift in modern material handling processes. Integration with Industry 4.0 enables these robots to be part of smart, interconnected systems, facilitating real-time data exchange and advanced automation. Palletizing robots, equipped with sensors and IoT capabilities, contribute to the creation of intelligent warehouses where they can adapt to dynamic production requirements and communicate seamlessly with other machinery.

Collaborative palletizing robots further enhance the market demand by fostering a safe and efficient working environment. These robots can work alongside human operators, optimizing the strengths of both, and ensuring flexible and adaptable palletization processes. The collaborative nature of these robots opens up possibilities for their use in diverse industries, including manufacturing, logistics, and e-commerce, where dynamic and customizable palletizing solutions are crucial. As a result, the integration of Industry 4.0 technologies and collaborative features positions palletizing robots as essential components for businesses seeking advanced, efficient, and flexible material handling solutions.

Segment Insights

Product Insights

The case palletizing segment held a 42% revenue share in 2025. Case palletizing in the Palletizing Robot Market involves the use of robots to stack and organize individual cases of products onto pallets. This process is common in industries such as food and beverage, consumer goods, and manufacturing. A key trend in case palletizing is the adoption of vision systems and artificial intelligence to enhance accuracy in picking and placing cases on pallets, optimizing the overall efficiency of the palletizing process.

The bag palletizing segment is anticipated to expand at a significant CAGR of 38.1% during the projected period. In bag palletizing, robots are employed to handle bags of various materials, such as cement, grains, or pet food, and arrange them onto pallets. A notable trend in bag palletizing is the integration of robotic grippers and end-of-arm tools designed for precise bag manipulation. This ensures gentle handling of bags while maintaining high-speed palletizing capabilities. Additionally, advancements in machine learning algorithms enable these robots to adapt to different bag sizes and shapes, contributing to greater flexibility in bag palletizing applications.

Range Insights

The 1000-3000 mm range segment held the largest market share of 43% in 2025. Palletizing robots within the 1000-3000 mm range are characterized by their medium to high payload capacities, making them suitable for handling various-sized pallets. The trend in this range is towards increased versatility and precision, allowing these robots to efficiently palletize different products in industries such as food and beverage, logistics, and manufacturing. Their flexibility in accommodating diverse payloads and pallet sizes aligns with the growing demand for adaptable and scalable robotic solutions.

On the other hand, the above 3000 mm segment is projected to grow at the fastest rate over the projected period. Palletizing robots with a range above 3000 mm typically have higher payload capacities, catering to large and heavy palletizing tasks. The trend in this range emphasizes enhanced efficiency and speed, optimizing the handling of bulk materials and oversized pallets. These robots often feature advanced technologies such as vision systems for accurate placement, contributing to improved productivity in industries like automotive, construction materials, and large-scale manufacturing. The market demand for robots in this range reflects the need for robust and high-capacity solutions in handling substantial loads efficiently.

Payload Insights

In 2025, the 100-300kg segment had the highest market share of 42% on the basis of the payload. Palletizing robots with a payload capacity of 100-300kg are characterized by their versatility and efficiency in handling moderate to heavy loads. These robots find widespread applications in industries with diverse palletizing needs, including food and beverage, manufacturing, and logistics. The trend in this segment focuses on enhancing speed, precision, and adaptability, allowing these robots to seamlessly integrate into dynamic production environments and accommodate various packaging sizes and weights.

The above 500kg segment is anticipated to expand at the fastest rate over the projected period. Palletizing robots with a payload above 500kg are designed for heavy-duty tasks, catering to industries with substantial material handling requirements such as automotive, construction, and large-scale manufacturing. The trend in this category revolves around robustness, advanced safety features, and integration capabilities with other automation systems. These high-capacity robots are crucial for optimizing efficiency in applications where handling bulky or massive loads is a primary requirement, contributing to improved productivity and operational excellence.

Robot Type Insights

The SCARA segment held the largest market share of 44% in 2025. SCARA (Selective Compliance Assembly Robot Arm) robots are a type of industrial robot known for their horizontal reach and precision in assembly and handling tasks. In the palletizing robot market, SCARA robots excel in applications requiring high-speed and accurate palletizing, especially in industries like food and beverage and manufacturing. Their speed and accuracy contribute to efficient palletizing operations, enhancing productivity and reducing cycle times.

On the other hand, the cobots segment is projected to grow at the fastest rate over the projected period. Cobots, or collaborative robots, are designed to work alongside humans in a shared workspace. In the palletizing robot market, cobots play a pivotal role in optimizing collaborative palletizing processes. With advanced safety features and sensors, these robots can safely collaborate with human workers, offering flexibility in handling various palletizing tasks. The trend in adopting cobots for palletizing is driven by the need for adaptive and space-efficient solutions, particularly in environments where humans and robots collaborate seamlessly.

End Use Industry Insights

The discrete manufacturing segment held the largest market share of 32% in 2025. In the palletizing robot market, discrete manufacturing refers to industries that produce distinct items, such as automotive or machinery parts. The trend in this sector involves deploying palletizing robots to automate the stacking and packaging of manufactured components. Palletizing robots enhance efficiency, reduce errors, and optimize space utilization in discrete manufacturing processes, contributing to streamlined production and logistics operations.

On the other hand, the electrical and electronics segment is projected to grow at the fastest rate over the projected period. In the realm of electrical and electronics manufacturing, palletizing robots play a pivotal role in handling fragile and intricate components. The trend focuses on implementing robots equipped with advanced vision systems and grippers to delicately palletize electronic items.

Precision and speed are paramount in this sector, and palletizing robots contribute to error-free and rapid stacking of electronic products. The adoption of collaborative robots is also increasing, ensuring a seamless interaction between human workers and robots in the palletization process for improved productivity and safety.

Regional Insights

What is the U.S. Palletizing Robot Market Size?

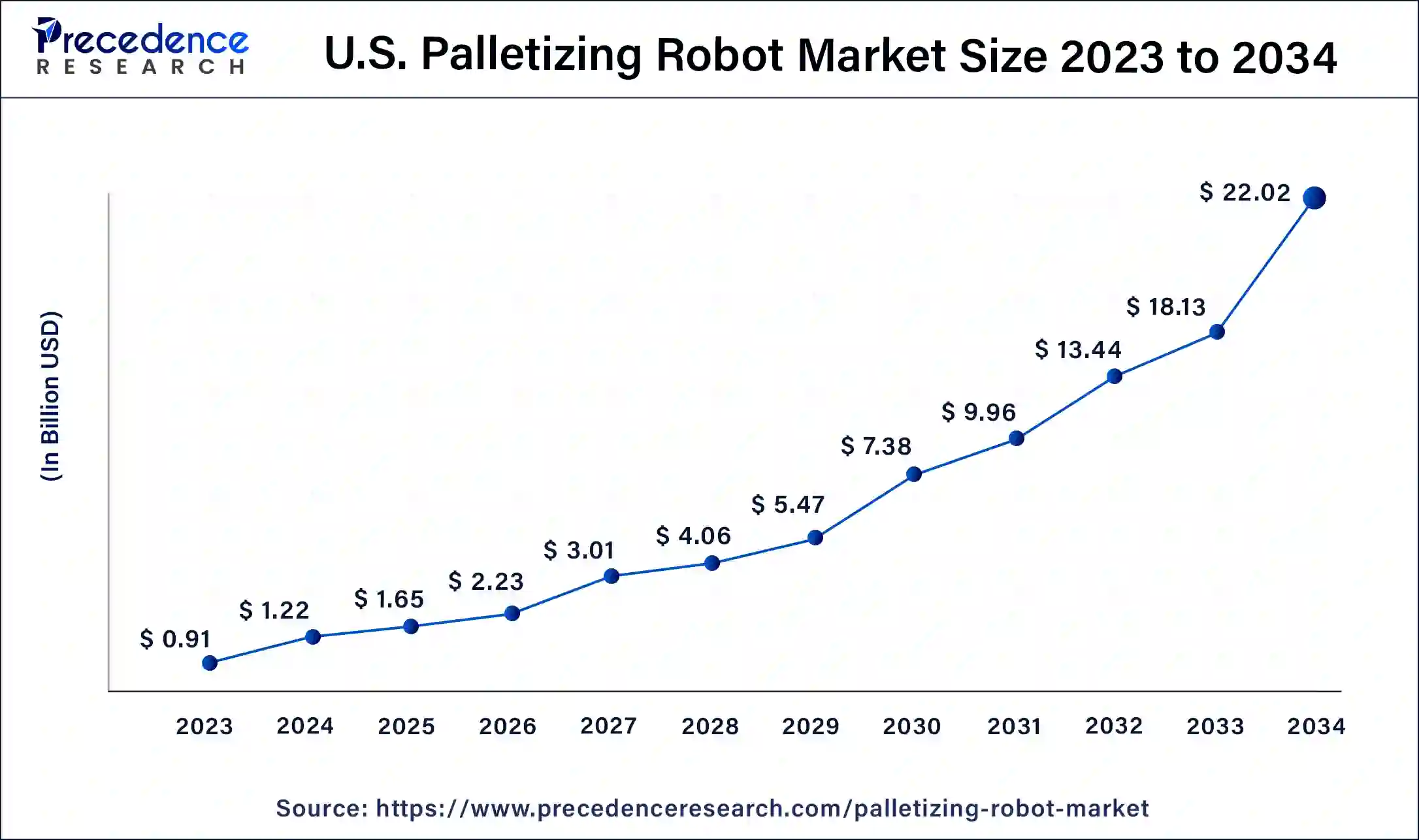

The U.S. palletizing robot market size is valued at USD 1.65 billion in 2025 and is expected to be worth around USD 26.44 billion by 2035, at a CAGR of 31.97% from 2026 to 2035.

North America has held the largest revenue share 46% in 2024. In North America, the palletizing robot market is witnessing a robust growth trajectory, driven by the increasing adoption of automation in the manufacturing and logistics sectors. The region's advanced industrial landscape and emphasis on optimizing operational efficiency contribute to the widespread deployment of palletizing robots. Moreover, the demand is fueled by the growing need for cost-effective and flexible solutions in industries like food and beverage, automotive, and e-commerce.

U.S. Palletizing Robot Market Trends

The U.S. leads the market due to high adoption of automation across e-commerce, logistics, and food & beverage industries. Robotic palletizing systems are being implemented to increase throughput, minimize errors, and enhance workplace safety. ABB, Fanuc, and Brenton are reinforcing local business activities by establishing regional business units and AI-driven palletizing systems to meet warehouse and production demand. Moreover, the country is an early adopter of robotic solutions, contributing to market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific showcases a dynamic palletizing robot market with rapid industrialization and a surge in e-commerce activities. Countries like China, Japan, and South Korea are at the forefront of adopting advanced robotic technologies for palletizing purposes. The region benefits from a strong manufacturing base, coupled with a focus on enhancing productivity through automation. The increasing demand for consumer goods, coupled with labor shortages, propels the adoption of palletizing robots across diverse industries in Asia-Pacific.

China Palletizing Robot Market Trends

China is a major contributor to the market in Asia Pacific. Rapid industrialization, high labor costs in urban areas, and government programs like “Made in China 2025” are driving widespread adoption of robotic palletizing systems. The major adoption of these robots is in the automotive, electronics, and e-commerce industries, which are pursuing high-speed, reliable pallet processing to streamline supply chains.

What Potentiates the Growth of the Market in Europe?

In Europe, the palletizing robot market is characterized by a steady adoption of robotic solutions across various industries, including manufacturing and logistics. The region emphasizes efficiency improvements and resource optimization, leading to an increased integration of palletizing robots. With a strong manufacturing tradition and a focus on automation, European countries contribute significantly to the growth and evolution of the palletizing robot industry.

Germany Palletizing Robot Market Trends

In Germany, the market is driven by the increasing adoption of automation technology across several industries to enhance precision, efficiency, and operational flexibility. Strict labor and safety regulations encourage the replacement of manual pallet handling with automated systems. Furthermore, modular end-of-arm tooling and vision-assisted robots are being used by companies to handle a wide range of products, including sensitive products, thereby boosting market growth in this country.

How is Latin America Emerging in the Palletizing Robot Market?

Latin America is expected to experience lucrative growth in the market. The rising cost of labor and workforce shortages in urban areas are compelling industries to consider using palletizing robots. The growing focus on industrial automation and modernization is also likely to support market growth.

Brazil Palletizing Robot Market Trends

Brazil is considered a major player in the market in Latin America due to operational efficiency needs and rising labor costs. ABB, KUKA, and Brenton are developing service networks and providing large-scale warehouses and production lines with individual palletizing solutions. The rising adoption of robotics and automation solutions for warehouse management and material handling in manufacturing industries further contributes to market growth.

What is Fueling the Steady Growth of the Palletizing Robot Market in the Middle East & Africa?

In the Middle East & Africa, the market is fueled by the rising demand from the logistics, food & beverage, and pharmaceutical sectors. These sectors invest heavily in automation to improve productivity and reduce operational costs. Rising infrastructure development and the expansion of industrial parks are likely to facilitate the rapid adoption of robotic palletizing systems in this region.

UAE Palletizing Robot Market Trends

In the UAE, market growth is driven by a shift in the logistics, food and beverage, and pharmaceutical industries toward integrating automation to increase operational efficiency and reduce reliance on manual labor. Additionally, government support for industrial modernization programs enhances the UAE's position as a regional leader in robotic automation, further fueling market growth.

Palletizing Robot Market – Value Chain Analysis

- Component Sourcing

The foundation of palletizing robot production begins with sourcing high-quality components such as servo motors, sensors, actuators, controllers, and industrial-grade materials for frames and joints.

Key Players: ABB, KUKA, Fanuc, Yaskawa Electric Corporation, Mitsubishi Electric. - Robot Design & Engineering

Raw components are engineered into robotic arms, end-of-arm tooling, and integrated control systems. This stage focuses on precision, payload capacity, speed, and reliability for industrial and logistics applications.

Key Players: Kawasaki Heavy Industries, Krones AG, Columbia/Okura LLC. - Robot Manufacturing & Assembly

Robotic arms and palletizing units are assembled, tested for performance, and integrated with software for motion control, safety, and automation compatibility.

Key Players: ABB, Fanuc, KUKA, Yaskawa Electric Corporation. - System Integration & Software Deployment

Palletizing robots are integrated into automated production lines, warehouses, or distribution centers with material handling systems, vision systems, and intelligent control software.

Key Players: Bastian Solutions, Wynright Corporation, Honeywell International Inc., SSI Schaefer. - Distribution & After-Sales Support

Completed robotic palletizing systems are delivered to end-users across industries such as food & beverage, e-commerce, automotive, and consumer goods, with ongoing maintenance, software updates, and technical support.

Key Players: ABB, KUKA, Brenton LLC, JBT Corporation, C&D Skilled Robotics.

Palletizing Robot Market Companies

- ABB Ltd. (Switzerland): ABB is a global leader in industrial robotics, offering advanced palletizing robots for automotive, food & beverage, and logistics industries with high precision and efficiency.

- KUKA AG (Germany): KUKA specializes in automated palletizing solutions with flexible robots that serve automotive, packaging, and warehousing applications.

- Yaskawa Electric Corporation (Japan): Yaskawa provides Motoman palletizing robots renowned for speed, payload capacity, and reliability in manufacturing and material handling.

- Fanuc Corporation (Japan): Fanuc offers a broad range of palletizing robots with integrated vision systems and AI-based motion control for factory automation.

- Kawasaki Heavy Industries, Ltd. (Japan): Kawasaki delivers robust palletizing robots with modular designs suitable for high-volume industrial and logistics applications.

- Schaefer Systems International, Inc. (U.S.): SSI integrates robotic palletizing solutions with automated storage and retrieval systems for warehousing and distribution centers.

- Columbia/Okura LLC (U.S.): Columbia/Okura focuses on robotic palletizers for food, beverage, and consumer goods industries, emphasizing reliability and hygiene standards.

- Krones AG (Germany): Krones provides palletizing robots as part of turnkey packaging solutions for the beverage and liquid food industries.

- Brenton, LLC (U.S.): Brenton specializes in high-speed robotic palletizers for the food, beverage, and bakery sectors, offering flexible automation systems.

- C&D Skilled Robotics, Inc. (U.S.): C&D Skilled Robotics develops custom palletizing solutions tailored to unique manufacturing and logistics requirements.

- KION Group AG (Germany): KION integrates robotic palletizing systems with its automated warehouse solutions and material handling equipment.

- Bastian Solutions, Inc. (U.S.): Bastian Solutions provides complete robotic palletizing systems with intelligent software for optimized warehouse operations.

- Honeywell International Inc. (U.S.): Honeywell combines robotics with automation software for palletizing and material handling in industrial and logistics applications.

- Wynright Corporation (U.S.): Wynright offers robotic palletizing solutions as part of its automated material handling systems for distribution centers.

- JBT Corporation (U.S.): JBT delivers robotic palletizing solutions mainly for the food and beverage sector, focusing on efficiency and sanitary handling standards.

Recent Developments

- In January 2026, beRobox launches STACKiT AI Vision for PALTZ palletizers, enhancing depalletizing and repalletizing via AI visual recognition. The system adapts robot movements in real-time for smarter, easier, and more efficient operations. (Source: https://www.packworld.com )

- In October 2025, the Festo FPaKit offers an affordable, ready-to-assemble solution for automated palletizing. Designed for loads up to 110 lb (50 kg) and speeds of 4 to 10 boxes per minute, it reduces engineering time and risk. Components are catalog-based, globally supported, and ensure project efficiency.

(Source: https://www.designworldonline.com ) - In July 2025, Vention launched its next-generation Rapid Series Palletizer, a versatile solution for fast deployment, debuting at Pack Expo Las Vegas from September 29 to October 1. Designed for manufacturers with labor challenges and diverse SKUs, it features a modular system with plug-and-play hardware, intuitive software, and remote support. (Source: https://www.prnewswire.com )

- In 2021, Geek+ unveiled a Smart Mixed Case palletizing solution in collaboration with WSR Solutions. Integrating Geek+'s autonomous mobile robots with WSR's intelligent palletizing algorithm, the solution enables warehouse operators to efficiently manage the processing of multiple outbound orders flexibly and securely, enhancing overall operational efficiency.

- In 2021,AAA20Group, LLC, a subscription-based robotic solutions provider, unveiled its new Robotics as a Service (RaaS) offering at PACK EXPO 2021. This service is targeted at growing companies, allowing them to leverage robotic solutions while reallocating their workforce for more strategic activities, thereby preserving valuable working capital.

Segments Covered in the Report

By Product

- Case Palletizing

- Bag Palletizing

- De-Palletizing

By Range

- Below 1,000mm

- 1000-3000 mm

- Above 3000mm

By Payload

- Less than 100kg

- 100-300kg

- 300-500kg

- Above 500kg

By Robot Type

- SCARA

- Cobots

- Deltas

- Articulated Robot

- Gantry Robot

By End Use Industry

- Discrete Manufacturing

- Chemical & Material

- Electrical & Electronics

- Food & Beverage

- Pharmaceutical & Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting