What is Packaging Robots Market Size?

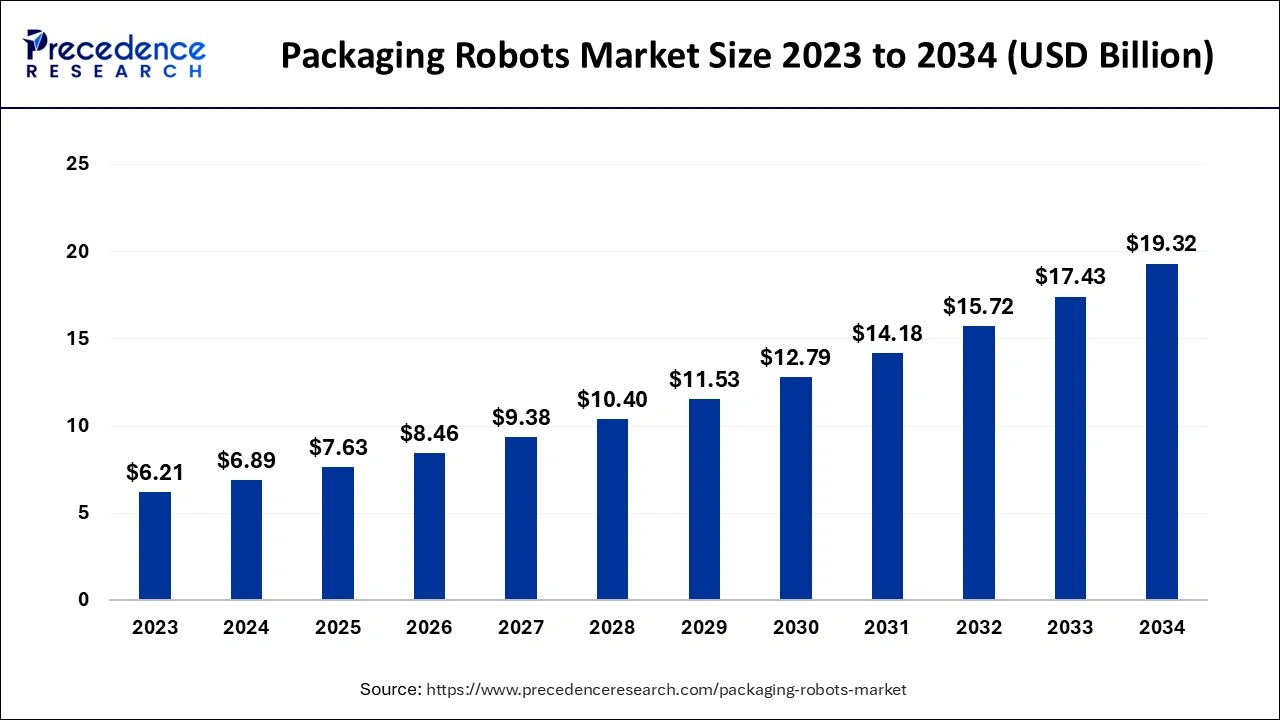

The global packaging robots market size is estimated at USD 7.63 billion in 2025 and is anticipated to reach around USD 21.09 billion by 2035, exapnding at a CAGR of 10.7% between 2026 and 2035.

Market Highlights

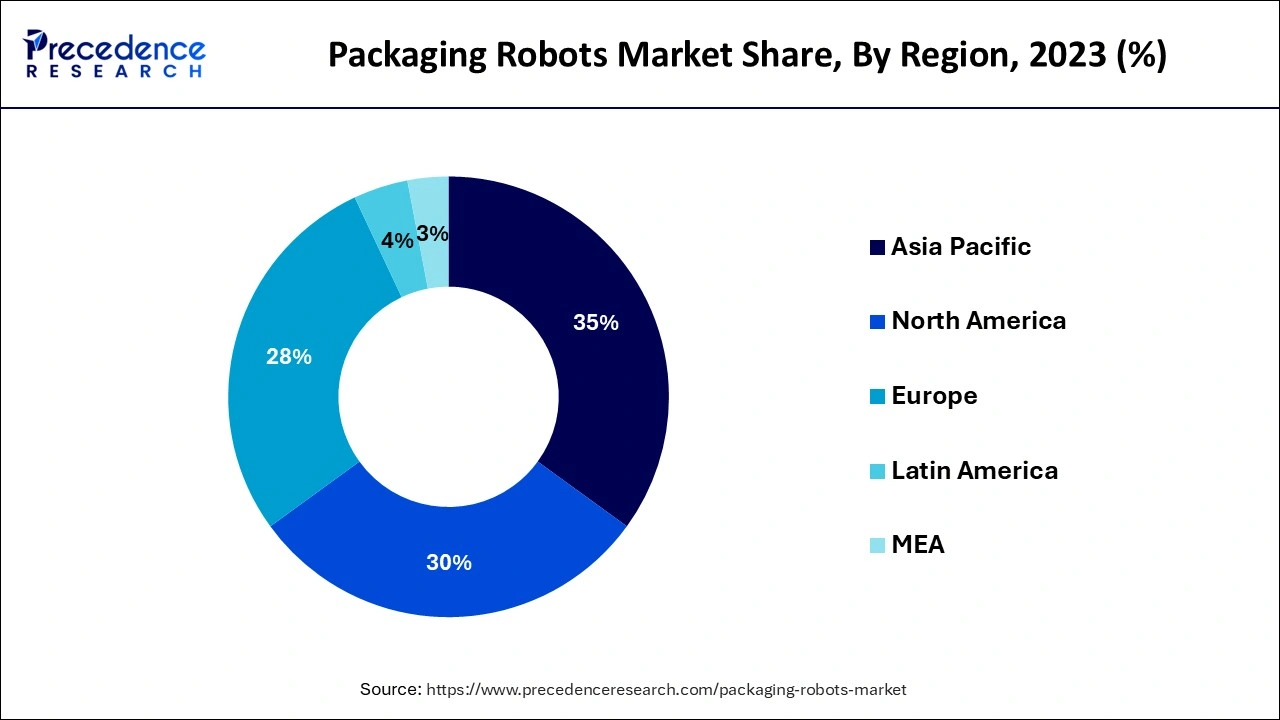

- Asia Pacific region generated more than 35% revenue share in 2025

- By gripper type, the clamp and clows segment led the global market in terms of revenue.

- By service, the pick & place segment is expected to expand at the greatest CAGR from 2026 to 2035.

- By end user, the food and beverage segment contributed the maximum market share in 2025

Packaging Robots Market Growth Factors

The flexibility, precision, and consistency of robots in packaging are its major advantages. Robots are capable of a wide range of tasks in the packaging industry, including picking and placing, boxing, palletizing, depinning, detesting, and warehousing. Robot packaging is preferred by many firms due to its enhanced supply chain efficiency, higher packaging effectiveness, and decreased operating costs. To finish any kind of packing operation, they employ the right end of arm tooling. They come in different robot sizes, payloads, reaches, and mounting configurations. The integration of packaging robots into any type of workstation is simpler.

With an automated production line, there is no concern about contamination as hygiene in the food business improves. The use of robotic packaging gives you the chance to make the most of your workforce while maintaining or raising productivity. Producers and industry leaders are creating new software and technology to emulate human activities.

- Growing demand for high-quality goods has increased the need to lower overall operational costs throughout the packaging sector and to develop production technologies.

- The market benefits from the attractive growth potential offered by the e-commerce sector's fast expansion.

- The market for packaging robots is expected to increase as a result of factors such quick industrialization, continuous R&D projects, supportive governmental regulations, and product advancements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.63 Billion |

| Market Size in 2026 | USD 6.89 Billion |

| Market Size by 2035 | USD 21.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.7% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Gripper Type, By Service and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Packaging robots benefits.

Reliable packaging robots provide excellent branding information on labels. An individual identifying code is produced once items are packed to help with supply chain tracing. Robotics' biggest advantage in the packaging industry is without a doubt their versatility. Because of their narrow arms with a broad reach, great repeatability, and precision tooling, robotic packaging systems, like pick-and-place robots, may also be very accurate and exact. They are excellent for a range of packaging and supply chain jobs because to their high level of accuracy. Additionally, product quality and cycle time may be increased with the utilization of robot packaging equipment.

The quality of the packaging is increased since robotic activities are controlled and the outputs are constantly consistent. The packing procedures can run smoothly because to this precision. The advantages of robotic packaging have been the primary driving force behind market development. These robots can operate at a high pace for at least 70,000 hours without needing any maintenance. Entrepreneurs are increasingly conscious about their time, money, and sales. A competitive product needs to be developed in order to flourish on the market. Automation of manufacturing lines enables companies to maximize innovation without compromising productivity or quality.

There is an increasing need for highly automated packaging processes.

In manufacturing facilities, especially those that create goods for the consumer market, the packing process is crucial. The addition of a robotic packaging system increases flexibility and raises the overall production of the packaging line. Packaging robots can work at a range of temperatures and use significantly less floor space than humans. Robotic packaging is commonly used in the food, beverage, and pharmaceutical sectors for both primary and secondary packaging applications. In consequence, it is projected that this would hasten the worldwide market for packaging robots in the near future.

Key Market Challenges

Automation of the packaging process is more costly than conventional packaging.

The high development and maintenance expenses of these devices are impeding the expansion of the packaging automation market. Due to the use of cutting-edge technology and the need for skilled labor, the overall cost of these machines will increase. The machines must also have proper and consistent maintenance in order for them to continue operating as intended, which raises the expense. Furthermore, severe government regulations relating to worker safety when automated packaging methods are utilized are impeding the industry's growth.

Key Market Opportunities

Technological advancements.

The need for packaging equipment connected to IoT as well as smart embedded technologies is increasing due to the field's accelerating rate of technological development. With such advanced technology, desktop PCs, mobile devices, and laptops can easily monitor packaging equipment from any place. Thanks to these cutting-edge technology, production line workers can now evaluate the efficiency and consistency of such automated systems more easily. They also assist in locating and correcting flaws by enabling remote control, which transmits essential instructions to activate or deactivate a machine's function from a distance.

The pharmaceutical business is expected to expand significantly.

The pharmaceutical industry's tremendous growth in the future years will increase the demand for sustainable packaging solutions. The International Federation of Pharmaceutical Manufacturers and Association estimates that by 2020, the global pharmaceutical market would be worth USD 1,430 billion (IFPMA). As the industry grows, more sophisticated packaging will be required to protect drugs from the elements and prevent changes in their chemical properties.

Packaging using automated machines reduces human error, improves product quality, and increases patient safety for tiny plastic parts such as catheters, inhalers, bottles, caps & closures, disposables, syringes, and other medical devices. The market will become more in need of packaging automation as a result of these factors.

Segment Insights

Gripper Type Insights

On the basis of gripper type, the market is classified into vacuum, clamp, claw, and others. The clamp and clows segment dominated the global packaging robot market in terms of revenue and is expected to expand at the fastest CAGR during the forecast timeframe. The segment is growing rapidly due to a growing demand from food & beverage and pharmaceutical sectors.

Service Insights

During the projection period, Pick & Place is anticipated to see the greatest CAGR growth. The e-commerce sector's explosive growth and the need for packaging robots from this sector are credited with driving the market's expansion. Picking robots are increasingly preferred by e-commerce firms for the order fulfillment process over manual item picking. The efficiency and cost of item picking have improved because to automation. Robot automation enables simple integration, enhanced flexibility, and excellent dependability throughout the packing phase of the packaging process.

Top loading of boxes, unloading and mixing, and feeding of materials to end loaders or film wraps are all tasks that a robot that is developed and optimized for packaging applications can do with ease. Packaging robots are frequently used for the optimization of packing applications such race track packing and monitoring of moving conveyors because they have a broad variety of robots, controller equipment, vision technology, and software.

End User Insights

The food and beverage segment captured the largest market share in 2022 because to the rise in demand for fresh food and beverage items, is the end-user that uses packaging robots the most. The need for automation solutions is rising as a result of the various governments taking action to ensure the safety of the food supply. The food processing and production sectors need the assistance of packaging robot technology to maintain consistency in the quality of their output. Automation systems like articulated, parallel, SCARA, and cylindrical are being developed as a result of the industry's need for operational efficiency and rapid technological advancement.

Regional Insights

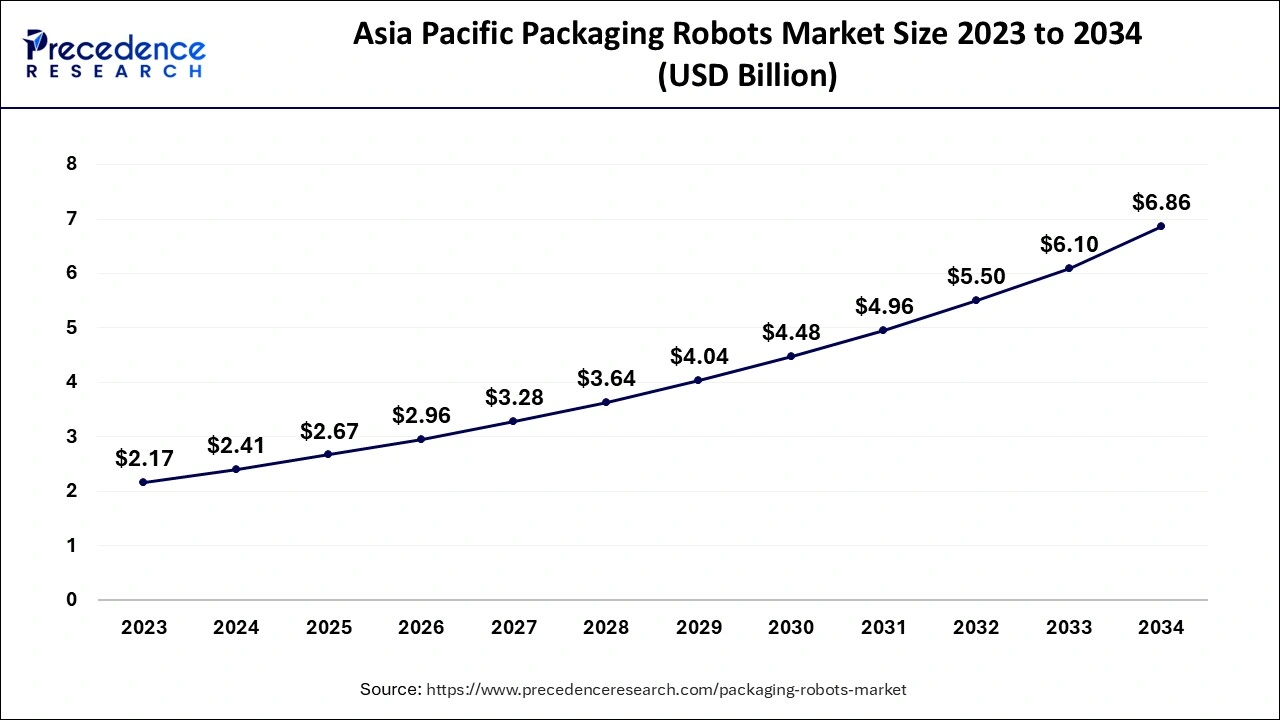

Asia Pacific Packaging Robots Market Size and Growth 2026 to 2035

The Asia Pacific packaging robots market size accounted for USD 2.67 billion in 2025 and is expected to be worth around USD 7.51 billion by 2035, growing at a CAGR of 10.9% from 2026 to 2035

Asia Pacific region has held a 35% revenue share in 2025. In manufacturing facilities, especially those that create goods for the consumer market, the packing process is crucial. The addition of a robotic packaging system increases flexibility and raises the overall production of the packaging line. Packaging robots can work at a range of temperatures and use significantly less floor space than humans. Robotic packaging is commonly used in the food, beverage, andpharmaceutical sectors for both primary and secondary packaging applications.

In consequence, it is projected that this would hasten the worldwide market for packaging robots in the near future. The following, planned operations, and transportation portion is relied upon to acquire from, while food and drink sections will acquire from changing way of life of the metropolitan populace. Despite the late but extremely clear entrance of web-based business in the arising economies in the Asia Pacific, for example, India, which houses an enormous population.

The research divides the global market for packaging robots by application into picking, pressing, which includes plate and case pressing, and palletizing, which includes sack palletizing, case palletizing, and de-palletizing. As a result of changing lifestyles among the urban population, the picking packaging robot segment accounted for 39% of interest in 2020, reflecting the growing usage of consumer goods, food, and beverages.

The packaging sector in Japan is consistently growing. The popularity of packaged foods and beverages has led to a rise in the demand for ridged packaging throughout the nation. The growing processed food industry in Japan is predicted to be a major growth factor for the packaging automation market.

Additionally, the Industrial Internet of Things (IIoT) is being more and more widely used in the local packaging business. Through new options for improved equipment, machine infrastructure, and operators, this advancement may not only boost the efficiency of packing lines but also pave the way for such a digital future of packaging equipment over the next 10 years.

North America at the Forefront: Dominance in the Packaging Robots Market Powered by Automation Leadership

North America is a mature yet innovation-driven packaging robot market, supported by advanced manufacturing infrastructure and high automation penetration. Strong demand from food, beverage, pharmaceutical, and consumer goods industries, along with labor shortages and strict quality standards, is encouraging investments in robotic packaging, inspection, and palletizing solutions.

U.S. Packaging Robots Market Trends

The U.S. leads regional growth owing to widespread adoption of robotics in large-scale packaging operations and distribution centers. Increasing focus on efficiency, traceability, and customization in packaging, combined with the strong presence of robot OEMs and integrators, is driving demand across food processing, pharmaceuticals, and logistics-driven packaging applications.

Europe Accelerates Ahead: Fastest Growth in the Packaging Robots Market Driven by Industry 4.0 Adoption

Europe exhibits steady growth in the packaging robot market, supported by stringent quality regulations, sustainability goals, and advanced automation standards. Strong emphasis on precision packaging, reduced material waste, and energy-efficient production systems is boosting adoption across the food, beverage, cosmetics, and pharmaceutical industries throughout the region.

Germany Packaging Robots Market Trends

Germany remains a key contributor due to its leadership in industrial robotics and engineering excellence. High adoption of robotic packaging systems in food processing, automotive components, and industrial goods manufacturing, along with strong domestic robot manufacturers, supports continued market expansion focused on speed, accuracy, and system integration.

Packaging Robots Market Companies

- ABB Limited

- AFAST Robotics

- BluePrint Automation

- Bosch Packaging Technology

- Brenton Engineering

- Epson Robots

- Fanuc Corporation

- Fuji Yusoki Kogyo

- Intelligent Actuator

- Krones AG

- Kuka Roboter GmbH

- Mitsubishi Electric Corporation

- Reis Robotics

- Remtec Automation LLC

- Schneider Electric SE

- Yaskawa Electric Corporation

- Yamaha Robotics

Recent Development

- In October 2025, Chef Robotics and ILPRA formed a strategic partnership to provide an AI-driven, end-to-end automation solution for food packaging. This collaboration combines Chef's AI-enabled meal assembly robots with ILPRA's packaging technology to help address labor shortages in food manufacturing.

- In February 2025,ABB Robotics introduced AppStudio, a no-code software tool launched in early 2025 to simplify creating custom robotic user interfaces across its robot portfolio. Compatible with the OmniCore controller platform, AppStudio enables users to create customized interfaces for various devices using drag-and-drop functionality.

- In January 2025, Net Zero Foods introduced ROBOT Kombucha, its primary drink, offered in completely recyclable aluminum cans, prioritizing environmental sustainability. The brand highlights "better-for-you" ingredients and strives for a net-zero carbon footprint, targeting consumers focused on health and the environment.

- May 2022: The R-2000id robot with cable-integrated technology was revealed by Fanuc Corporation, one of the biggest robot manufacturers. This robot is capable of advanced tasks including choosing, placing, and auto-checking in addition to packaging.

- Maxpack Machinery LLC introduced Leap by Max pack in August 2022, a revolutionary piece of packaging machinery that enables the client to pay overtime. Leap is Maxpack's solution to the rapidly expanding Buy Now, Pay Later sector. The automation equipment is available in premium packages with 18 interest-free, credit-free installments over 18 months.

- The LR-10iA/10 robot was introduced in November 2021 by FANUC Corporation, a Japanese maker of automation products such as robotics and computer numerical control wireless systems, and ROBOMACHINE. It is intended for machine tending and a variety of picking applications.

Segments Covered in the Report

By Gripper Type

- Vacuum

- Clamp

- Claw

- Others

By Service

- Pick & place

- Packing

- Case packing

- Tray packing

- Filling

- Others

- Palletizing

- Case palletizing

- Bag palletizing

- De-palletizing

By End User

- Manufacturing

- Food & beverage

- Logistics

- Pharmaceutical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting